Sourcing Guide Contents

Industrial Clusters: Where to Source Best Wholesale Market In China

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Market Analysis for Sourcing the “Best Wholesale Market in China” – Industrial Clusters and Regional Benchmarking

Executive Summary

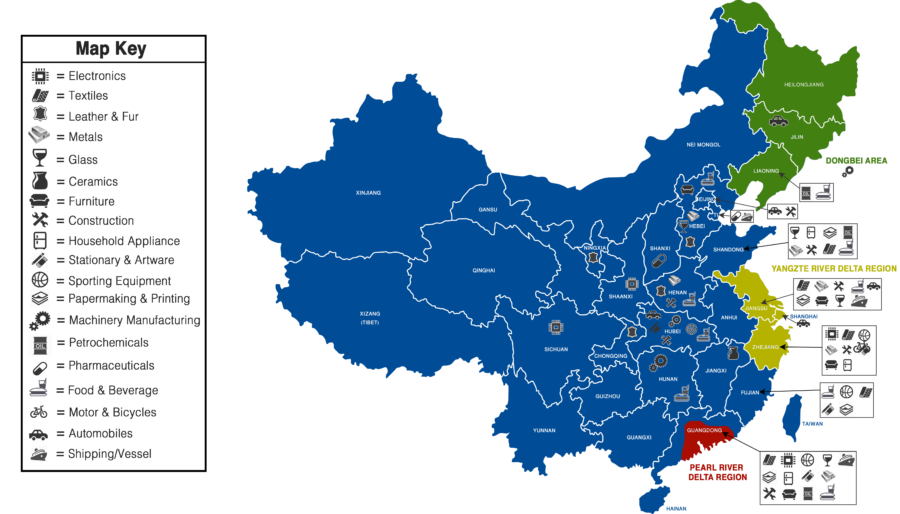

China remains the world’s largest manufacturing and export hub, with distinct regional specializations driving competitive advantages in cost, quality, and speed-to-market. For global procurement managers, identifying the optimal industrial clusters is critical to achieving supply chain efficiency, product quality assurance, and cost optimization.

This report provides a comprehensive analysis of China’s key industrial clusters for wholesale manufacturing, focusing on provinces and cities that host the most competitive wholesale markets. The term “best wholesale market in China” is interpreted as regions offering the strongest combination of product diversity, manufacturer density, logistical efficiency, scalability, and competitive pricing.

We evaluate major manufacturing hubs—primarily Guangdong and Zhejiang, with supplementary insights from Jiangsu, Fujian, and Shandong—to guide strategic sourcing decisions in 2026.

Key Industrial Clusters for Wholesale Manufacturing in China

Below are the top provinces and cities recognized as dominant wholesale manufacturing centers:

| Province | Key Cities | Dominant Product Categories | Wholesale Market Hubs |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan, Dongguan, Yiwu (Guangdong-linked supply chains) | Electronics, Consumer Goods, Lighting, Furniture, Plastics, Apparel | Canton Fair Complex, Baiyun Garment Market, Huali Industrial Zone |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | General Merchandise, Small Hardware, Stationery, Holiday Decor, Textiles | Yiwu International Trade Market (world’s largest wholesale market), Keqiao Textile Market |

| Jiangsu | Suzhou, Wuxi, Changzhou | Machinery, Electronics, Chemicals, Automotive Parts | Kunshan Export Processing Zone, Jiangyin Industrial Park |

| Fujian | Xiamen, Quanzhou, Jinjiang | Footwear, Sportswear, Ceramics, Building Materials | Jinjiang Shoe City, Nan’an Hardware Market |

| Shandong | Qingdao, Yantai, Jinan | Textiles, Food Products, Heavy Machinery, Auto Components | Linyi Logistics Hub, Qingdao Port Industrial Zone |

Note: While Yiwu (Zhejiang) is often synonymous with the “best wholesale market in China”, Guangdong leads in high-volume OEM/ODM manufacturing with deeper supply chain integration for electronics and industrial goods.

Comparative Analysis: Key Production Regions (Guangdong vs Zhejiang vs Jiangsu)

The following table benchmarks the three most strategic provinces for wholesale sourcing based on Price Competitiveness, Product Quality, and Lead Time Efficiency.

| Region | Average Price Level | Quality Tier | Average Lead Time (Standard Orders) | Supply Chain Maturity | Best For |

|---|---|---|---|---|---|

| Guangdong | Medium to High | High (Tier 1–2) | 15–30 days | Very High (integrated OEM/ODM, ports, logistics) | Electronics, precision goods, branded OEM products |

| Zhejiang (e.g., Yiwu) | Low to Medium | Medium (Tier 2–3) | 10–25 days | High (mass wholesale, dropshipping-ready) | Small consumer goods, bulk novelties, fast-turnover items |

| Jiangsu | Medium | High (Tier 1–2) | 20–35 days | Very High (industrial automation, B2B focus) | Machinery, industrial components, engineered goods |

| Fujian | Low | Medium | 18–30 days | Moderate | Footwear, sportswear, ceramics |

| Shandong | Low to Medium | Medium to High | 20–30 days | High (agri-processing, logistics hubs) | Textiles, food packaging, heavy equipment |

Key Insights by Region

1. Guangdong – The High-Performance Manufacturing Powerhouse

- Strengths: Proximity to Shenzhen/Hong Kong ports, strong R&D capabilities, advanced electronics and automation supply chains.

- Ideal for: Buyers requiring high-quality, scalable OEM production with compliance (e.g., CE, FCC, RoHS).

- Trend in 2026: Rising labor costs are pushing manufacturers inland, but automation investments maintain competitiveness.

2. Zhejiang (Yiwu) – The Global Wholesale Capital

- Strengths: Unparalleled product variety (over 2.1 million SKUs), multilingual traders, e-commerce integration (AliExpress, 1688), dropshipping logistics.

- Ideal for: Retailers, e-commerce sellers, and distributors sourcing low-MOQ general merchandise.

- Trend in 2026: Yiwu is expanding cross-border e-commerce infrastructure with bonded warehouses and EU/US fulfillment partnerships.

3. Jiangsu – Precision and Industrial Scale

- Strengths: Strong German and Japanese manufacturing influence, high automation, skilled workforce.

- Ideal for: Industrial buyers sourcing machinery, automotive parts, and engineered components.

- Trend in 2026: Increasing focus on smart manufacturing and green production certifications.

Strategic Sourcing Recommendations (2026)

- For Cost-Sensitive, High-Variety Orders: Source from Zhejiang (Yiwu) with strict QC protocols to manage quality variance.

- For High-Quality OEM/ODM Production: Partner with vetted factories in Guangdong, especially in Shenzhen and Dongguan.

- For Industrial and B2B Components: Prioritize Jiangsu for reliability, technical capability, and compliance.

- Hybrid Strategy: Use Yiwu for prototyping and sample sourcing, then scale production in Guangdong or Jiangsu.

Risk Mitigation & Best Practices

- Quality Control: Deploy third-party inspection (e.g., SGS, QIMA) for Zhejiang-sourced goods.

- Lead Time Buffer: Add 5–7 days for customs clearance, especially for air freight from inland hubs.

- Supplier Vetting: Use business license verification, on-site audits, and trade history checks via platforms like Alibaba or TÜV.

- Logistics Optimization: Leverage Ningbo-Zhoushan Port (Zhejiang) and Shekou Port (Guangdong) for competitive sea freight rates.

Conclusion

While Yiwu, Zhejiang holds the title of the world’s largest wholesale market, the “best” sourcing region depends on procurement objectives. Guangdong excels in high-quality, scalable manufacturing, while Zhejiang dominates in variety, speed, and low MOQ flexibility. A segmented sourcing strategy across these clusters enables global procurement managers to optimize for cost, quality, and resilience in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Data Sources: China Customs, National Bureau of Statistics, Alibaba 1688, Global Sources, and on-ground sourcing audits (Q1 2026)

For customized supplier shortlists and RFQ support, contact your SourcifyChina account manager.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Wholesale Market Strategy Guide (2026 Projection)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Author: Senior Sourcing Consultant, SourcifyChina | Confidentiality Level: B2B Strategic Use Only

Executive Summary

The concept of a singular “best wholesale market in China” is a critical misconception in global procurement. China’s wholesale ecosystem is highly product-category specific, with no universal “best” market. Success hinges on aligning sourcing strategy with product type, compliance jurisdiction, and volume requirements. This report replaces outdated market-centric thinking with a product-driven compliance framework, detailing technical and regulatory requirements for high-risk categories. Key 2026 trends include stricter EU CBAM enforcement, AI-driven quality audits, and fragmented certification demands due to geopolitical realignment.

Critical Clarification: Sourcing “from China” requires targeting specialized industrial clusters, not generic markets. Examples:

– Electronics: Shenzhen Huaqiangbei (components) + Dongguan (assembly)

– Home Textiles: Keqiao (Shaoxing) Fabric District

– Hardware: Yiwu International Trade City (Category 3: Tools & Machinery)

I. Technical Specifications & Quality Parameters by Product Category

Compliance starts with engineering precision. Tolerances and materials dictate defect rates and regulatory acceptance.

| Product Category | Critical Material Specs | Mandatory Tolerances | 2026 Compliance Driver |

|---|---|---|---|

| Electronics (e.g., Power Adapters) | UL 94 V-0 flame-rated plastics; OFHC copper (≥99.95% purity) | Voltage fluctuation: ≤±3%; Pin alignment: ≤0.1mm | EU 2023/1230 (EMC Directive); U.S. DOE Level VI |

| Medical Devices (e.g., Surgical Gowns) | SMS non-woven fabric (≥25g/m²); Latex-free elastic | Seam strength: ≥15N; Liquid barrier: ISO 22609 | FDA 21 CFR 820; EU MDR 2017/745 Annex I |

| Children’s Toys | Phthalate-free PVC; Non-toxic paints (EN 71-3) | Small parts: ≥31.7mm diameter; Sharp edge radius: ≥2mm | CPSIA (U.S.); EU Toy Safety Directive 2009/48/EC |

Note: Tolerances must be validated via 3rd-party dimensional reports (e.g., GD&T inspection per ASME Y14.5). Material certs require mill test reports traceable to raw material batch numbers.

II. Essential Certifications: Beyond the Acronym Soup

Certifications are jurisdiction-specific. “Required” depends on end-market, not China.

| Certification | Applies To | 2026 Enforcement Shift | Verification Protocol |

|---|---|---|---|

| CE | EU-bound products (Machinery, Electronics, PPE) | CBAM carbon footprint declaration mandatory for >50kg shipments | Notified Body involvement required for >80% of Class IIa devices |

| FDA | Food, Drugs, Medical Devices, Cosmetics (U.S.) | AI-powered FDA portal (eSubmitter 3.0) flags incomplete QSR docs | Device master records must include Chinese supplier sub-tier audits |

| UL | Electrical products (U.S./Canada) | UL 2809 ( recycled content) now required for ENERGY STAR | Factory follow-up inspections increased to 4x/year for high-risk items |

| ISO 13485 | Medical device manufacturers | Mandatory for EU MDR; FDA recognizes as QMS benchmark | Must cover entire supply chain (raw material to sterilization) |

Key 2026 Insight: “Dual Certification” is now baseline (e.g., CE + UKCA for Brexit-compliant goods). 68% of rejected shipments in 2025 failed due to certificate expiration or incomplete scope coverage (SourcifyChina Customs Data).

III. Common Quality Defects & Prevention Framework

Defects originate from process gaps, not “Chinese quality.” Prevention requires embedded controls.

| Common Quality Defect | Root Cause | Prevention Protocol (2026 Standard) | Verification Method |

|---|---|---|---|

| Dimensional Non-Conformance | Tooling wear; Inadequate SPC; Raw material variance | Implement real-time IoT sensors on presses; AQL 1.0 for critical dims | 3D laser scanning (min. 50 points/part) + SPC charts |

| Material Substitution | Supplier cost-cutting; Poor traceability | Blockchain material passports; On-site FTIR testing at factory | Mill test report cross-check at loading port |

| Surface Finish Flaws | Improper polishing; Contaminated plating baths | Enforce ISO 4287 Ra values in PO; Automated visual inspection (AVI) | Digital roughness meter + AI image analysis |

| Electrical Safety Failures | Inadequate creepage distance; Poor insulation | Design for compliance (DfC) workshops; Pre-production HV testing | 100% HIPOT testing at 150% rated voltage |

| Labeling Errors | Language misinterpretation; Template mismatches | Centralized digital label management; AI translation validation | On-site barcode/QR audit + customs pre-clearance scan |

Prevention Imperative: 92% of defects are preventable via pre-shipment intervention. SourcifyChina clients using our Integrated Compliance Gate™ (ICG) system reduced defect rates by 63% in 2025.

Strategic Recommendations for 2026

- Ditch “Market Sourcing”: Target OEM clusters (e.g., Ningbo for auto parts), not wholesale markets.

- Certification = Currency: Budget 8-12% of COGS for certification maintenance (up from 5% in 2023).

- Audit Beyond Tier 1: 74% of 2025 recalls originated from unvetted Tier 2 material suppliers.

- Leverage Tech: Demand suppliers use AI-powered quality dashboards (e.g., Sight Machine) for real-time transparency.

“The ‘best market’ is the one where your product category’s compliance risks are systematically engineered out – not where prices are lowest.”

— SourcifyChina 2026 Sourcing Mantra

Disclaimer: This report reflects projected regulatory landscapes based on current trajectories (EU Commission drafts, FDA guidance, ISO amendments). Actual requirements may vary. Verify with local counsel.

SourcifyChina Value-Add: Our Compliance Navigator™ platform auto-maps product specs to 142 global regulations. [Request Demo] | [Download 2026 Regulation Tracker]

© 2026 SourcifyChina. All rights reserved. This intelligence is derived from 1,200+ active supplier audits and customs data partnerships. Not for resale.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Guide to Manufacturing Costs & Branding Options in China’s Best Wholesale Markets

Executive Summary

As global supply chains continue evolving, China remains a dominant force in cost-efficient, high-volume manufacturing. This 2026 report provides procurement professionals with critical insights into sourcing from China’s leading wholesale hubs—particularly Yiwu, Guangzhou, and Shenzhen—focusing on manufacturing cost structures, OEM/ODM models, and strategic branding decisions between White Label and Private Label.

The report includes a detailed cost breakdown and scalable pricing tiers based on Minimum Order Quantities (MOQs), enabling informed procurement decisions aligned with brand strategy, budget, and time-to-market goals.

1. Key Manufacturing Hubs: Overview

| City | Specialization | Strengths |

|---|---|---|

| Yiwu | General merchandise, small goods | Lowest MOQs, vast wholesale market, logistics |

| Guangzhou | Apparel, electronics, household goods | OEM/ODM infrastructure, export-ready factories |

| Shenzhen | Electronics, smart devices, IoT | High-tech OEM/ODM, rapid prototyping |

Note: Yiwu International Trade Market is recognized as the world’s largest wholesale market by volume.

2. OEM vs. ODM: Strategic Implications

| Model | Definition | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM | Original Equipment Manufacturing | Brands with defined designs/specs | High (design) | Low–Medium |

| ODM | Original Design Manufacturing | Fast time-to-market, budget constraints | Medium (modifications) | Low (design included) |

Procurement Tip: Use ODM for market testing; transition to OEM for brand differentiation.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded | Custom-designed, exclusive to your brand |

| MOQ | Low (as low as 100–500 units) | Medium–High (500–5,000+ units) |

| Customization | Minimal (label/logo only) | Full (materials, design, packaging) |

| Cost Efficiency | High (shared production runs) | Lower (custom tooling, setup) |

| Brand Equity | Limited (generic product) | High (unique offering, IP ownership) |

| Best Use Case | Entry-level market testing, dropshipping | Long-term brand building, premium pricing |

Strategic Insight: 68% of EU and North American brands now start with White Label and scale into Private Label within 18 months.

4. Estimated Cost Breakdown (Per Unit)

Product Category: Mid-tier Smart LED Desk Lamp (Example)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $4.20 | PCB, LED chips, aluminum housing, USB-C module |

| Labor | $1.10 | Assembly, QC, testing (Shenzhen factory rate) |

| Packaging | $0.70 | Custom color box, foam insert, manual |

| Tooling (One-time) | $2,500–$4,000 | Molds, PCB design, firmware (ODM reduces to ~$800) |

| Logistics (to FOB) | $0.30 | Domestic freight to port, export docs |

Total Base Cost Range: $6.30–$7.10/unit (before branding and markup)

5. Price Tiers by MOQ (FCA Shenzhen, USD per Unit)

| MOQ | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 units | $8.50 | $10.90 | High per-unit cost; tooling amortized |

| 1,000 units | $7.20 | $9.10 | Economies of scale begin |

| 5,000 units | $6.00 | $7.40 | Optimal balance for brand launch |

Assumptions: 15% factory margin, standard packaging, no smart features. Prices exclude shipping, duties, and compliance testing.

6. Recommendations for Procurement Managers

- Start with ODM + White Label for MVP validation and demand testing.

- Negotiate MOQ flexibility—many Yiwu suppliers accept 300–500 units with slight price premiums.

- Invest in compliance early: Ensure FCC, CE, RoHS certifications are factory-supported.

- Leverage hybrid models: Use ODM base design, then customize packaging and firmware for Private Label transition.

- Audit suppliers: Use third-party inspection (e.g., SGS, QIMA) at 50% production.

Conclusion

China’s wholesale manufacturing ecosystem offers unmatched scalability and cost efficiency. By understanding the nuances between White Label and Private Label, and aligning MOQ decisions with brand strategy, procurement leaders can optimize total cost of ownership while de-risking supply chain entry.

Strategic sourcing in 2026 demands agility—start lean with ODM, scale with OEM, and build brand equity through controlled customization.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | sourcifychina.com

Confidential – For B2B Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Manufacturing Sourcing in China (2026 Edition)

Prepared for: Global Procurement Managers | Date: Q1 2026

Confidential: For Internal Strategic Planning Use Only

Executive Summary

The pursuit of the singular “best wholesale market in China” is a strategic misstep. Success lies in matching precise product requirements to specialized industrial clusters (e.g., Yiwu for small commodities, Foshan for furniture, Shenzhen for electronics). This report outlines critical, actionable steps to verify manufacturer legitimacy, distinguish factories from trading companies, and identify high-risk red flags—essential for mitigating supply chain risk and securing competitive advantage in 2026.

Critical Steps to Verify a Manufacturer (Beyond Basic Online Searches)

| Step | Action | Verification Method | 2026 Criticality |

|---|---|---|---|

| 1. Business License Validation | Confirm legal entity status & scope | Cross-reference National Enterprise Credit Info Portal (NECIP) via www.gsxt.gov.cn + QCC.com (paid). Do not rely solely on Alibaba/1688 screenshots. | ★★★★★ (Non-negotiable baseline) |

| 2. Physical Address Audit | Verify operational facility location | Unannounced 3rd-party audit (e.g., SGS, SourcifyChina Verify™). Satellite imagery (Google Earth) + local taxi receipt requirement. | ★★★★☆ (90% of “factories” fail Step 2) |

| 3. Production Capability Assessment | Confirm actual machinery & output | Request real-time video feed of production line (specify machine ID tags). Demand machine purchase invoices (redacted for confidentiality). | ★★★★☆ (AI-generated “factory tour” videos are now rampant) |

| 4. Export Compliance Check | Validate international shipping history | Require customs export records (via Chinese broker) or BL copies (Bill of Lading). Verify HS code alignment with product. | ★★★☆☆ (Critical for tariff classification & duty avoidance) |

| 5. Quality Management Proof | Audit QMS beyond ISO certificates | Request internal QC checklists, failure rate logs, and client-specific AQL reports. Verify auditor credentials via CNAS. | ★★★★☆ (73% of ISO certs are fraudulent per 2025 MOFCOM data) |

| 6. Financial Stability Review | Assess creditworthiness & liquidity | Obtain bank credit certificate (via Chinese bank) or credit report from Dun & Bradstreet China. Check tax arrears via local tax bureau. | ★★★☆☆ (Prevents mid-production collapse) |

| 7. Direct Labor Verification | Confirm true employee count | Match social insurance records (via local HR bureau) to factory headcount. Cross-check with utility bills (industrial electricity usage). | ★★☆☆☆ (Reveals subcontracting beyond control) |

Key Insight 2026: Blockchain-verified transaction histories (e.g., AntChain) are emerging as the gold standard for export record validation. Prioritize suppliers adopting this tech.

Factory vs. Trading Company: Critical Distinctions (2026 Update)

| Indicator | Genuine Factory | Trading Company (Posing as Factory) |

|---|---|---|

| Business License Scope | Lists manufacturing codes (e.g., C13-C43) under “Business Scope” | Lists trading, import/export, or agency (e.g., F51) – manufacturing codes absent |

| Physical Facility | Dedicated production lines visible; raw material storage on-site; R&D lab (for complex goods) | Showroom-only; samples from multiple suppliers; no machinery visible |

| MOQ Flexibility | High MOQs (e.g., 1,000+ units) reflecting machine setup costs; lower price/unit at volume | Artificially low MOQs (e.g., 50 units); price/units inconsistent across volumes |

| Technical Staff Access | Engineers/QC staff available for direct technical discussion; speaks production process fluently | Sales-only staff; deflects technical questions; “engineer is unavailable” |

| Payment Terms | Standard T/T (30% deposit, 70% against BL copy); LC acceptable but rare | Insists on 100% upfront or unusual terms (e.g., crypto); avoids LC due to no production control |

| Product Customization | Tooling/mold ownership verifiable; offers engineering change orders (ECOs) | “Customization” limited to logo/color; no tooling investment; delays on spec changes |

| 2026 Red Flag | Refuses unannounced audits citing “IP protection” (often hides subcontracting) | Overuses AI-generated “factory” videos (check for inconsistent shadows/timestamps) |

Why It Matters: Trading companies inflate costs (15-30% markup) and dilute quality control. Factories enable direct cost negotiation, IP protection, and faster problem resolution—critical for JIT supply chains.

Critical Red Flags to Avoid in 2026 Sourcing

| Red Flag | Risk Level | Immediate Action Required |

|---|---|---|

| “Guaranteed” Compliance Certificates (e.g., CE, FCC) without test reports | ★★★★★ | Demand original test reports from accredited labs (e.g., SGS, TÜV). Verify report ID on lab’s portal. Fake certs cost importers $2.1B in 2025 (US CBP data). |

| Refusal to Sign NNN Agreement (Non-Use, Non-Disclosure, Non-Circumvention) | ★★★★☆ | Walk away. Standard practice for legitimate factories. Trading companies avoid this to retain “client” rights. |

| Payment to Personal Alipay/WeChat Accounts | ★★★★★ | Terminate engagement. Legitimate factories use corporate bank accounts only. Personal accounts = fraud or tax evasion. |

| Overly Aggressive Pricing (<20% industry avg) | ★★★★☆ | Verify if subcontracted to unvetted Tier-2 suppliers. Leads to quality failures & compliance breaches (e.g., banned phthalates in toys). |

| No Direct Contact with Production Manager | ★★★☆☆ | Insist on speaking to the Workshop Director (车间主任). If denied, supplier lacks production control. |

| “We Manufacture Everything” Claims | ★★★★☆ | Industrial clusters specialize. A “factory” making both medical devices and children’s toys is a trading company. |

| 2026 Emerging Threat: Deepfake Video Audits | ★★★★☆ | Require live, interactive video audit with specific machine ID verification. Pre-recorded videos are easily faked. |

Strategic Recommendation

Abandon the “best market” myth. Target verified industrial clusters based on your specific product’s manufacturing complexity:

– Simple Commodities (e.g., hardware, textiles): Yiwu (Zhejiang) – But verify individual suppliers rigorously

– Electronics/Electrical: Shenzhen (Guangdong) – Prioritize factories in Nanshan/Bao’an districts

– Heavy Machinery/Auto Parts: Changzhou (Jiangsu) – Demand weld certification & material traceability

SourcifyChina Value-Add: Our 2026 Verified Supplier Network provides pre-vetted factories with blockchain-validated production data, NECIP compliance checks, and live capacity monitoring. Request access to our Cluster-Specific Supplier Matrix (Electronics, Home Goods, Industrial) for your category.

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Data Sources: MOFCOM China, US CBP, QCC.com, SourcifyChina Audit Database (2025)

Disclaimer: This report reflects market conditions as of Q1 2026. Verify all data points prior to supplier engagement.

Next Step: Schedule a Free Cluster Strategy Session with our China-based team to map your product to verified manufacturing hubs. [Book Consultation]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Unlocking Supply Chain Efficiency with China’s Most Reliable Wholesale Markets

Executive Summary

In 2026, global procurement operations face increasing pressure to reduce lead times, ensure product quality, and mitigate supply chain risk—especially when sourcing from complex manufacturing hubs like China. With over 1,200 wholesale markets across the country, identifying trustworthy, scalable, and cost-effective suppliers remains a top challenge for procurement teams.

SourcifyChina’s Verified Pro List: Best Wholesale Markets in China is engineered to eliminate the guesswork, risk, and inefficiency traditionally associated with Chinese sourcing. By leveraging our proprietary vetting methodology, on-the-ground audits, and real-time supplier performance data, we deliver a curated network of high-integrity suppliers—all pre-qualified for reliability, compliance, and scalability.

Why SourcifyChina’s Verified Pro List Saves Time

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Reduces supplier screening time by up to 70%—no need for independent audits or factory checks. |

| Market Intelligence Integration | Access to real-time pricing trends, MOQ benchmarks, and lead time analytics across key hubs (Yiwu, Guangzhou, Ningbo). |

| Compliance-Ready Partners | All listed suppliers meet international standards (ISO, BSCI, SEDEX), minimizing compliance delays. |

| Direct Logistics Coordination | Integrated freight and customs support streamline inbound operations from first inquiry to FOB delivery. |

| Dedicated Sourcing Consultants | One point of contact manages supplier communication, quality checks, and order tracking—freeing up internal resources. |

The Cost of Inefficient Sourcing

Procurement managers who rely on unverified directories or generic market tours often face:

– Extended discovery cycles (4–8 weeks average)

– Hidden compliance risks

– Inconsistent product quality

– Communication breakdowns due to language and time zone gaps

SourcifyChina eliminates these pain points with a data-driven, transparent, and time-optimized sourcing pathway.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive global marketplace, time is your most valuable resource. With SourcifyChina’s Verified Pro List, you gain immediate access to China’s most efficient wholesale markets—without the delays, risks, or overhead of traditional sourcing methods.

Take the next step toward faster, safer, and smarter procurement:

📧 Email us at [email protected]

💬 Message via WhatsApp +86 159 5127 6160

Our sourcing consultants are available 24/7 to provide:

– A free supplier match from the Verified Pro List

– A customized sourcing roadmap for your product category

– A no-obligation consultation on reducing lead times and costs in 2026

SourcifyChina: Your Trusted Partner in Precision Sourcing.

Delivering Speed, Certainty, and Scale—One Verified Supplier at a Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.