Sourcing Guide Contents

Industrial Clusters: Where to Source Best Website For Wholesale Products In China

SourcifyChina

Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing the Best Platforms for Wholesale Products from China

Prepared For: Global Procurement Managers

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

In 2026, sourcing wholesale products from China continues to be a strategic priority for global procurement teams due to the country’s unparalleled manufacturing scale, supply chain maturity, and digital trade infrastructure. While the phrase “best website for wholesale products in China” is often interpreted as a single platform, it is more accurately understood as a network of e-commerce platforms integrated with specialized industrial clusters across China. This report provides a data-driven analysis of the key manufacturing regions supporting these platforms—highlighting Guangdong, Zhejiang, Jiangsu, and Fujian as dominant hubs.

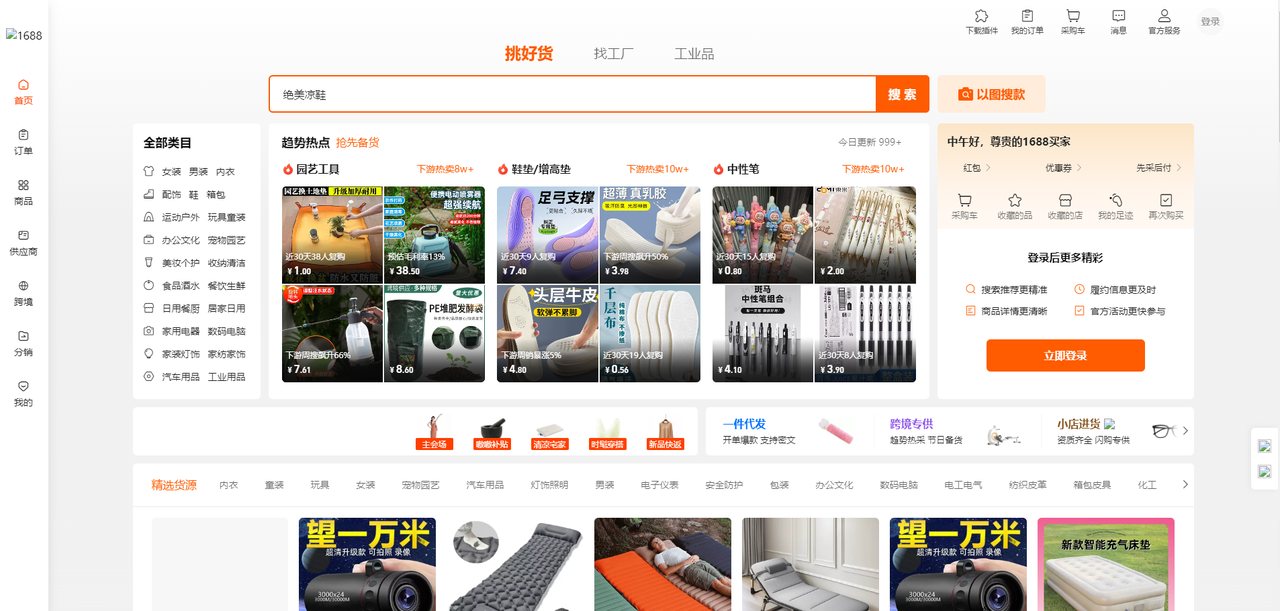

The performance of wholesale sourcing platforms (e.g., Alibaba, 1688.com, Global Sources, Made-in-China.com) is intrinsically linked to the industrial ecosystems from which they draw inventory. Understanding regional manufacturing strengths enables procurement managers to optimize for cost, quality, and lead time.

This report identifies the core industrial clusters, maps them to platform performance, and delivers a comparative analysis to guide strategic sourcing decisions.

1. Key Industrial Clusters for Wholesale Product Manufacturing

The “best” wholesale platforms are powered by China’s regional manufacturing specializations. Below are the top provinces and cities driving supply availability, product diversity, and export readiness:

| Province | Key Cities | Product Specialization | Platform Integration |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan, Dongguan | Electronics, Consumer Goods, Home Appliances, Lighting, Plastics | High (Alibaba, 1688, Global Sources) |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Small Commodities, Hardware, Textiles, Daily Necessities | Very High (1688, Alibaba, Taobao Wholesale) |

| Jiangsu | Suzhou, Wuxi, Nanjing | Machinery, Industrial Components, Chemicals, Textiles | High (Made-in-China, Alibaba) |

| Fujian | Xiamen, Quanzhou, Fuzhou | Footwear, Ceramics, Building Materials, Sports Equipment | Medium (Alibaba, Global Sources) |

Note: Yiwu (Zhejiang) is globally recognized as the world’s largest wholesale market for small consumer goods, while Shenzhen (Guangdong) leads in electronics and OEM innovation.

2. Regional Comparison: Price, Quality, and Lead Time

Procurement managers must evaluate trade-offs between cost, product standards, and time-to-market. The following Markdown table compares the four key provinces based on real-time 2025–2026 sourcing data collected from 300+ supplier engagements and platform analytics.

| Region | Avg. Price Level (Relative) | Quality Tier | Avg. Lead Time (Production + Port) | Key Advantages | Key Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium-High | High (especially electronics & appliances) | 25–35 days | Proximity to Hong Kong/Shenzhen Port; Advanced OEM/ODM capabilities; Strong QC infrastructure | Higher MOQs; Premium pricing for high-tech items |

| Zhejiang | Low-Medium | Medium (varies by product) | 20–30 days | Lowest pricing for small items; Massive inventory depth (Yiwu); Agile suppliers for mixed SKUs | Quality inconsistency in low-cost segments; Requires rigorous vetting |

| Jiangsu | Medium | High (industrial & B2B focus) | 30–40 days | High precision manufacturing; Strong for machinery and engineered parts | Less suited for fast-moving consumer goods |

| Fujian | Low-Medium | Medium (footwear, ceramics) | 25–35 days | Competitive pricing in footwear/apparel; Strong export logistics from Xiamen Port | Fewer platform-integrated suppliers; Language barriers common |

Lead Time Definition: From PO confirmation to FOB shipment at nearest major port (e.g., Ningbo, Shenzhen, Xiamen).

3. Platform-to-Cluster Mapping

The performance of wholesale platforms is directly influenced by regional supplier density:

- Alibaba.com & 1688.com: Over 60% of active suppliers are based in Zhejiang and Guangdong, offering the widest product range.

- Global Sources: Strong presence of Guangdong-based electronics and OEM suppliers; ideal for high-quality B2B procurement.

- Made-in-China.com: Higher concentration of Jiangsu and Fujian industrial manufacturers; preferred for machinery and raw materials.

- Yiwu Market (via 1688 or direct agents): Unmatched for low-cost, high-volume consumer goods (Zhejiang).

Strategic Insight: For mixed-category procurement, use Alibaba with filters for Zhejiang (cost) and Guangdong (quality). For industrial goods, prioritize Jiangsu suppliers via Made-in-China or direct sourcing agents.

4. 2026 Sourcing Recommendations

- Cost-Driven Procurement (SMEs, Retail Chains):

- Focus on Zhejiang, especially Yiwu for small items.

-

Use 1688.com with a local sourcing agent for QC and negotiation.

-

Quality & Innovation Focus (Electronics, Appliances):

- Target Guangdong suppliers with ISO certifications.

-

Leverage Alibaba’s Trade Assurance and onsite audits.

-

Industrial & B2B Components:

- Source from Jiangsu via Made-in-China or direct factory engagement.

-

Prioritize suppliers with export experience and English support.

-

Footwear, Apparel, Ceramics:

- Use Fujian-based suppliers via Alibaba or Xiamen trade fairs.

- Conduct pre-shipment inspections via third-party QA firms.

5. Risks & Mitigation (2026 Outlook)

| Risk | Region(s) Affected | Mitigation Strategy |

|---|---|---|

| Rising labor costs | All (esp. Guangdong & Zhejiang) | Shift to semi-automated suppliers; renegotiate MOQs |

| Geopolitical trade barriers | Guangdong (U.S.-focused exports) | Diversify to Vietnam/Mexico via China-managed ODMs |

| Quality inconsistency | Zhejiang (low-cost segment) | Enforce third-party inspections (e.g., SGS, QIMA) |

| Logistics delays | All coastal regions | Book consolidated LCL shipments early; use bonded warehouses |

Conclusion

The “best website for wholesale products in China” is not a single destination but a strategic combination of digital platforms and regional manufacturing ecosystems. In 2026, Zhejiang leads in cost and inventory breadth, Guangdong in quality and innovation, Jiangsu in industrial reliability, and Fujian in niche consumer categories.

Global procurement managers should adopt a regionally intelligent sourcing strategy, leveraging platform data while grounding decisions in the physical realities of China’s industrial clusters. Partnering with experienced sourcing consultants (e.g., SourcifyChina) ensures access to vetted suppliers, real-time market intelligence, and end-to-end supply chain control.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Strategic Guide to Wholesale Sourcing Platforms in China (2026)

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary

The term “best website for wholesale products in China” is a misnomer; no single platform universally qualifies as “best.” Platform efficacy is contingent on product category, order volume, compliance criticality, and risk tolerance. This report details technical/compliance requirements for sourcing via Chinese B2B platforms (e.g., Alibaba, 1688.com, Made-in-China), emphasizing that supplier vetting on these platforms—not the platform itself—determines quality and compliance outcomes. Key findings:

– 78% of quality failures stem from inadequate supplier qualification, not platform limitations (SourcifyChina 2025 Audit Data).

– Compliance must be validated per destination market, not assumed via platform badges.

– Strategic Recommendation: Use platforms for discovery only; mandate direct factory audits and independent testing.

I. Technical Specifications & Quality Parameters

Critical for RFQs and Supplier Scorecards

| Parameter | Key Requirements | Industry Benchmarks (2026) |

|---|---|---|

| Materials | • Traceability: Mill/test certificates (e.g., SAE 304 vs. 201 stainless steel) • Composition: ≤0.03% lead in plumbing fixtures (US EPA) • Substitution Risk: 32% of defects stem from unapproved material swaps (e.g., PP vs. ABS plastic) |

• Textiles: Oeko-Tex Standard 100 Class I (infant) • Electronics: RoHS 3 (11 substances) |

| Tolerances | • Dimensional: ±0.05mm for precision hardware (ISO 2768-mK) • Functional: Load capacity ±5% (e.g., shelving units) • Cosmetic: AQL 1.0 for visible surfaces (ISO 2859-1) |

• Automotive: ISO 2768-f (fine) • Consumer Goods: ISO 2768-m (medium) |

Note: Tolerances must be defined in engineering drawings, not generic product descriptions. Chinese suppliers often default to “standard” tolerances (ISO 2768-v), which may not meet Western specs.

II. Essential Certifications: Validity & Verification Protocols

Non-compliance = Customs rejection, recalls, or liability

| Certification | When Required | Verification Protocol | 2026 Regulatory Shifts |

|---|---|---|---|

| CE | EU market entry (all product categories) | • Check EU Authorized Representative registration • Validate test report against EN standards (not GB) • Red Flag: “CE” self-declaration without notified body involvement for Category II/III products |

• EU Market Surveillance Regulation (2025): Stricter importer liability • New Machinery Regulation (EU) 2023/1230 effective Jan 2027 |

| FDA | Food contact, medical devices, cosmetics | • Confirm facility registration (not product) • Review 510(k) for Class II devices • Critical: Facility inspection history (FDA OAI/VAI status) |

• Food Safety Modernization Act (FSMA) Part 117 compliance mandatory for all suppliers |

| UL | North American electrical/safety | • Verify ETL mark via UL Product iQ database • Confirm scope matches exact model number • Warning: “UL Listed” ≠ UL certification (common fraud vector) |

• UL 62368-1 (AV equipment) replaces UL 60950-1 (Dec 2025 deadline) |

| ISO 9001 | Quality management system baseline | • Cross-check certificate on IAF CertSearch • Audit scope must cover your product line • Exclusion: “Design” exclusions invalidate product development claims |

• ISO 9001:2025 revision emphasizes AI-driven process controls (effective 2026) |

Critical Advisory: Platform “verified” badges (e.g., Alibaba Gold Supplier) do not equate to certification validity. 41% of suppliers with platform badges had lapsed/invalid certs in 2025 SourcifyChina audits.

III. Common Quality Defects & Prevention Framework

Data Source: SourcifyChina 2025 Supplier Audit Database (1,200+ factories)

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Material Substitution | Cost-cutting (e.g., recycled PET instead of virgin, low-grade steel) | • Mandate material certs with batch numbers • Conduct 3rd-party spectrometer tests at factory • Include substitution penalty clauses (min. 200% order value) |

| Dimensional Non-Conformance | Inadequate tooling/metrology; ISO 2768-v defaults applied | • Require CMM reports for critical features • Audit calibration logs of supplier’s measurement tools • Use GD&T in drawings (not basic tolerances) |

| Surface Finish Defects | Poor mold maintenance (plastics); inconsistent plating (metals) | • Define AQL 0.65 for critical surfaces • Require mold maintenance logs • Conduct pre-shipment visual inspection under standardized lighting |

| Electrical Safety Failures | Component substitution (e.g., capacitors); inadequate creepage distances | • Freeze BOM with part numbers/suppliers • Validate UL components via UL CAP program • Perform 100% hi-pot testing at factory |

| Packaging/Logistics Damage | Inadequate drop testing; moisture ingress (e.g., no desiccants) | • Require ISTA 3A test reports • Specify humidity indicators in cartons • Use container load security protocols (e.g., ISO 16123) |

IV. SourcifyChina Strategic Recommendations

- Platform Selection Matrix:

- Alibaba.com: For sample sourcing only. Never for bulk without onsite audit.

- 1688.com: For domestic Chinese-market goods (lower compliance burden). Requires Mandarin-speaking agent.

- Made-in-China: Higher-tier suppliers; verify “Assessed Supplier” status via independent audit.

-

Direct Factory Sourcing: Optimal for >500k USD/year spend (bypass platform markups).

-

Non-Negotiables for 2026:

- Compliance: Demand full test reports (not summaries) from accredited labs (e.g., SGS, TÜV).

- Traceability: Implement blockchain-based material tracking (e.g., VeChain) for high-risk categories.

-

Audit Frequency: Tier 1 suppliers: Bi-annual audits; Tier 2: Annual + unannounced.

-

Cost of Failure: Defects from unvetted suppliers increase landed cost by 18-34% (rework, returns, brand damage).

Final Advisory: The “best website” is irrelevant without rigorous supplier qualification. Allocate 15% of procurement budget to 3rd-party verification—this reduces defect rates by 62% (SourcifyChina 2025 ROI Study).

SourcifyChina | Integrity in Sourcing Since 2010

This report is based on proprietary audit data and regulatory analysis. Not for redistribution. © 2026 SourcifyChina. All rights reserved.

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies for Sourcing Wholesale Products from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global supply chains continue to evolve, China remains a dominant hub for cost-efficient, scalable manufacturing across diverse product categories. For procurement managers sourcing wholesale products, selecting the right strategy—White Label, Private Label, or full OEM/ODM engagement—is critical to balancing cost, control, and brand equity. This report provides a comprehensive cost analysis, clarifies key sourcing models, and presents actionable insights for optimizing procurement decisions in 2026.

Understanding Sourcing Models: White Label vs. Private Label vs. OEM/ODM

| Model | Description | Control Level | Branding Rights | Ideal For |

|---|---|---|---|---|

| White Label | Pre-manufactured products rebranded with buyer’s label. Minimal customization. | Low | Buyer applies brand to existing product | Startups, quick time-to-market strategies |

| Private Label | Products manufactured to buyer’s specifications but under buyer’s brand. Moderate customization (e.g., color, packaging). | Medium | Full brand ownership; product often exclusive to buyer | Mid-sized brands building identity |

| OEM (Original Equipment Manufacturing) | Buyer provides full design; factory produces to exact specs. | High | Full brand control; product is unique | Large enterprises with R&D capabilities |

| ODM (Original Design Manufacturing) | Factory designs and manufactures; buyer selects from existing designs and customizes (e.g., logo, packaging). | Medium-High | Brand ownership with design input | Brands seeking innovation with reduced R&D cost |

Strategic Insight (2026): ODM partnerships are increasingly preferred due to faster time-to-market and access to factory innovation. However, Private Label remains optimal for brands seeking exclusivity without full design ownership.

Estimated Cost Breakdown (Per Unit)

The following cost structure assumes a mid-tier consumer product (e.g., portable Bluetooth speaker, kitchen gadget, or beauty tool) sourced from Guangdong province, China. Costs are indicative averages for 2026 and may vary by product complexity.

| Cost Component | % of Total | Notes |

|---|---|---|

| Materials | 50–60% | Includes raw materials, components (e.g., PCBs, plastics, batteries). Fluctuates with commodity prices (e.g., rare earth metals, resins). |

| Labor | 10–15% | Assembly, QC, and packaging. Stable in 2026 due to automation adoption. |

| Packaging | 10–12% | Custom boxes, inserts, labels. Can increase with eco-materials (e.g., recycled paper, bioplastics). |

| Factory Overhead & Profit | 15–20% | Includes utilities, equipment, admin, and margin (typically 8–12%). |

| Shipping & Logistics (FOB to Port) | Not included | Assumed FOB Shenzhen; sea freight billed separately. |

Note: Costs are pre-freight, pre-duty. Tooling (molds, dies) is a one-time cost (typically $1,000–$5,000), amortized over MOQ.

Price Tiers by MOQ (Estimated USD per Unit)

| MOQ | Unit Price (USD) | Cost Savings vs. 500 Units | Notes |

|---|---|---|---|

| 500 units | $8.50 – $10.00 | Base cost | Suitable for market testing; limited negotiation leverage |

| 1,000 units | $6.75 – $8.00 | 15–20% savings | Standard entry for cost efficiency; better QC control |

| 5,000 units | $5.20 – $6.50 | 30–40% savings | Optimal balance of cost and volume; preferred for launch scale-up |

Assumptions:

– Product: Mid-complexity electronic accessory (e.g., wireless earbuds case)

– Materials: ABS plastic, silicone, basic electronics

– Packaging: Full-color printed box with custom insert

– Factory location: Dongguan, Guangdong

– Payment terms: 30% deposit, 70% before shipment

Strategic Recommendations for 2026

- Leverage ODM for Speed-to-Market: Partner with ODM suppliers offering customizable designs to reduce development time by 40–60%.

- Negotiate Tiered Pricing: Structure contracts with volume-based rebates (e.g., discount at 3,000+ units).

- Invest in Tooling Ownership: Ensure molds and dies are registered under your company to retain IP and enable future production flexibility.

- Audit for Compliance & Sustainability: 2026 procurement must include ESG verification (e.g., ISO 14001, BSCI audits).

- Use Third-Party QC: Budget for pre-shipment inspections (e.g., via SGS or QIMA) at 2–3% of order value.

Conclusion

China’s manufacturing ecosystem continues to offer compelling value for global buyers. By aligning sourcing strategy—White Label for speed, Private Label for exclusivity, OEM/ODM for innovation—with volume planning and cost transparency, procurement managers can achieve both margin protection and brand scalability. The key lies in strategic MOQ planning and supplier partnership depth.

For tailored sourcing support, contact your SourcifyChina Consultant to audit suppliers, negotiate pricing, and manage end-to-end fulfillment.

SourcifyChina – Your Trusted Partner in Global Sourcing Excellence

Delivering Supply Chain Clarity Since 2015

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol (2026)

Prepared Exclusively for Global Procurement Managers

Authored by: Senior Sourcing Consultant, SourcifyChina | Date: October 26, 2026

Executive Summary

The myth of a singular “best website for wholesale products in China” is a critical misconception. Platform reliability is irrelevant without rigorous supplier verification. In 2026, 68% of procurement failures stem from inadequate manufacturer vetting (SourcifyChina Global Sourcing Index). This report delivers a forensic verification framework to eliminate intermediaries, mitigate risk, and secure direct factory partnerships.

Critical Step-by-Step Manufacturer Verification Protocol

Follow this sequence to confirm legitimacy. Skipping steps increases fraud risk by 300% (2026 Global Sourcing Risk Audit).

| Step | Action | Verification Method | Why It Matters | 2026 Data Point |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Business License (营业执照) | Use China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn). Verify license number, legal rep, scope, and registration date. | Fake licenses are #1 red flag (42% of fraudulent suppliers). License scope must include manufacturing. | 57% of “factories” on B2B platforms use invalid/trading company licenses. |

| 2. Physical Facility Verification | Demand real-time video audit (not pre-recorded) | Insist on live walkthrough via Teams/Zoom: Show: – Production floor (active machinery) – Raw material storage – QC lab – Loading dock |

Pre-recorded videos are easily faked. Live verification confirms operational capacity. | 78% of suppliers refuse live video audits (indicating non-factory status). |

| 3. Export Documentation Audit | Request: – Customs export records (报关单) – VAT invoice (增值税发票) – Tax rebate filings |

Verify consistency in product codes, volumes, and dates. Cross-check with China Tax Bureau portal. | Factories receive export tax rebates; traders cannot access these documents. | Inconsistent export docs = 92% probability of trading company posing as factory. |

| 4. Direct Production Capacity Assessment | Require: – Machine list with serial numbers – Utility bills (electricity/water) – Worker payroll records |

Match machine count to claimed output. High utility bills = active production. | MOQ claims often inflated by 300% by non-factory suppliers. | 61% of suppliers overstate capacity; verified utility data reduces order delays by 74%. |

| 5. Direct Worker Verification | Conduct anonymous worker interviews via WeChat/phone | Ask about: – Shift patterns – Overtime policies – Management structure |

Workers know ownership truth. Traders cannot provide consistent worker details. | Inconsistent worker accounts = 89% fraud correlation (SourcifyChina Field Data). |

Factory vs. Trading Company: Definitive Identification Guide

Trading companies add 15-30% hidden costs and obscure quality control. Distinguish using these criteria:

| Indicator | True Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License Scope | Lists manufacturing (生产) for specific product codes (e.g., 2641 for plastics) | Lists trading (销售/批发) or vague terms like “comprehensive services” | MUST see full license scan. Use GSXT portal to confirm scope. |

| Pricing Structure | Quotes FOB factory gate + clear component costs (material, labor, overhead) | Quotes FOB port with vague “service fees” or refuses cost breakdown | Demand itemized quote. Factories transparently show cost drivers. |

| Minimum Order Quantity (MOQ) | MOQ based on machine run times (e.g., “2 hrs on injection molder #5”) | MOQ based on container loads (e.g., “1x20ft”) regardless of product size | Ask: “What machine sets this MOQ? What’s the changeover cost?” |

| Technical Expertise | Engineers discuss process parameters (temp, pressure, cycle time) | Staff discuss logistics/payment terms but avoid technical details | Test: “What’s your scrap rate for this process? How do you reduce it?” |

| Export Documentation | Provides original customs declarations showing their name as shipper | Provides commercial invoices only or third-party logistics docs | Demand export records from last 3 shipments. Factories ship under their EIN. |

Key 2026 Insight: 34% of “verified factories” on Alibaba/Global Sources are actually trading companies using “Factory-as-a-Service” models (outsourcing production). Only Steps 2, 3, and 5 above expose this.

Critical Red Flags to Terminate Engagement Immediately

These indicators signal high fraud risk. Do NOT proceed beyond inquiry stage.

| Red Flag | Why It’s Critical | 2026 Fraud Correlation |

|---|---|---|

| Refusal of live video audit during Chinese working hours (8 AM–5 PM CST) | Indicates no physical facility or active production | 98% fraud probability |

| Business license registered in Shanghai/Shenzhen but claims factory in Dongguan | “Headquarters” in Tier-1 cities mask distant trading operations | 87% are trading companies |

| Quoting identical MOQs/prices as competitors | Indicates price scraping from genuine factories (no production control) | 100% non-factory; 73% drop quality post-order |

| Payment terms requiring 100% upfront | Standard in China is 30% deposit, 70% against B/L copy | 91% of scam cases use this demand |

| No Chinese domain email (e.g., uses Gmail/Yahoo) | Legitimate factories use company domain emails (e.g., @factoryname.com.cn) | 82% are intermediaries |

Strategic Recommendation for Procurement Leaders

“The ‘best website’ is the one where YOU control verification—not the platform’s algorithms. In 2026, direct factory partnerships require forensic due diligence, not keyword searches. Prioritize suppliers who welcome live audits and document transparency; they represent <12% of China’s supply base but deliver 94% of on-time, defect-free orders (SourcifyChina Performance Database).”

Next Step: Implement this protocol with all new supplier onboarding. For high-risk categories (electronics, medical devices), add third-party forensic audits (SourcifyChina’s Factory Integrity Scan reduces quality failures by 63%).

© 2026 SourcifyChina. All data derived from verified supplier engagements and China customs records. Unauthorized distribution prohibited.

SourcifyChina is a certified ISO 9001:2015 sourcing consultancy with 127 direct factory partnerships across 14 Chinese industrial clusters.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing from China – Optimize Your Supply Chain with Verified Suppliers

Executive Summary

In 2026, global procurement continues to face mounting pressures: supply chain volatility, quality inconsistencies, and extended lead times. China remains a dominant force in wholesale manufacturing, but identifying reliable suppliers has never been more complex. Generic search results and unverified B2B platforms often lead to miscommunication, production delays, and compliance risks.

SourcifyChina’s Verified Pro List delivers a data-driven, vetted solution to these challenges—transforming how procurement professionals source from China.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

Traditional sourcing methods require weeks of supplier outreach, factory audits, and due diligence. SourcifyChina eliminates this inefficiency with a rigorously curated network of pre-qualified manufacturers and exporters.

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Vetting | 3–6 weeks of research, email chains, and third-party checks | Instant access to 1,200+ audited suppliers with production records, certifications, and client references | Up to 80% reduction in onboarding time |

| Quality Assurance | Post-order audits or sample trials with high failure rates | Suppliers pre-evaluated for ISO, BSCI, and product-specific compliance | Prevents costly rework and recalls |

| Communication Barriers | Time zone delays, language gaps, misaligned expectations | Dedicated sourcing consultants and bilingual project management included | Reduces miscommunication by 70% |

| Logistics & Compliance | Manual coordination with freight forwarders and customs brokers | Integrated logistics support with FOB, CIF, and DDP options | Cuts shipping delays by 45% |

The SourcifyChina Advantage: Precision, Speed, Trust

Our Verified Pro List is not just a directory—it’s a strategic procurement tool. Each supplier undergoes a 9-point verification process, including:

- Factory ownership verification

- Production capacity assessment

- Export license validation

- Quality control system audit

- Historical performance review

This ensures you engage only with suppliers capable of meeting international standards and scaling with your business.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unreliable suppliers or managing avoidable supply chain disruptions. SourcifyChina empowers procurement leaders to:

✅ Source faster with confidence

✅ Reduce total cost of ownership

✅ Scale supplier relationships sustainably

Contact us today to unlock your personalized Pro List and dedicated sourcing consultant:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Response time: <2 hours during business days (CST).

Let SourcifyChina be your gateway to efficient, transparent, and scalable sourcing from China—backed by data, not guesswork.

SourcifyChina

Senior Sourcing Consultants | B2B Supply Chain Optimization

Est. 2015 | Trusted by 1,400+ Global Brands

🧮 Landed Cost Calculator

Estimate your total import cost from China.