Sourcing Guide Contents

Industrial Clusters: Where to Source Best Sourcing Company In China

SourcifyChina Professional Sourcing Report 2026: Strategic Sourcing of Manufactured Goods from China

Prepared for Global Procurement Managers

Date: October 26, 2025

Critical Industry Clarification

The phrase “sourcing ‘best sourcing company in china'” reflects a common industry misconception. Sourcing companies are service providers, not physical products. You do not “source” a sourcing company from an industrial cluster like manufactured goods. Instead, you select a sourcing partner (e.g., SourcifyChina) to help you source physical products (electronics, textiles, machinery, etc.) from China’s manufacturing clusters.

This report corrects and reframes the request:

We provide a 2026 market analysis of China’s key industrial clusters for manufactured goods, enabling you to identify optimal regions for product sourcing. We also clarify how to select the best sourcing partner (like SourcifyChina) to navigate these clusters.

Why Industrial Clusters Matter for Product Sourcing

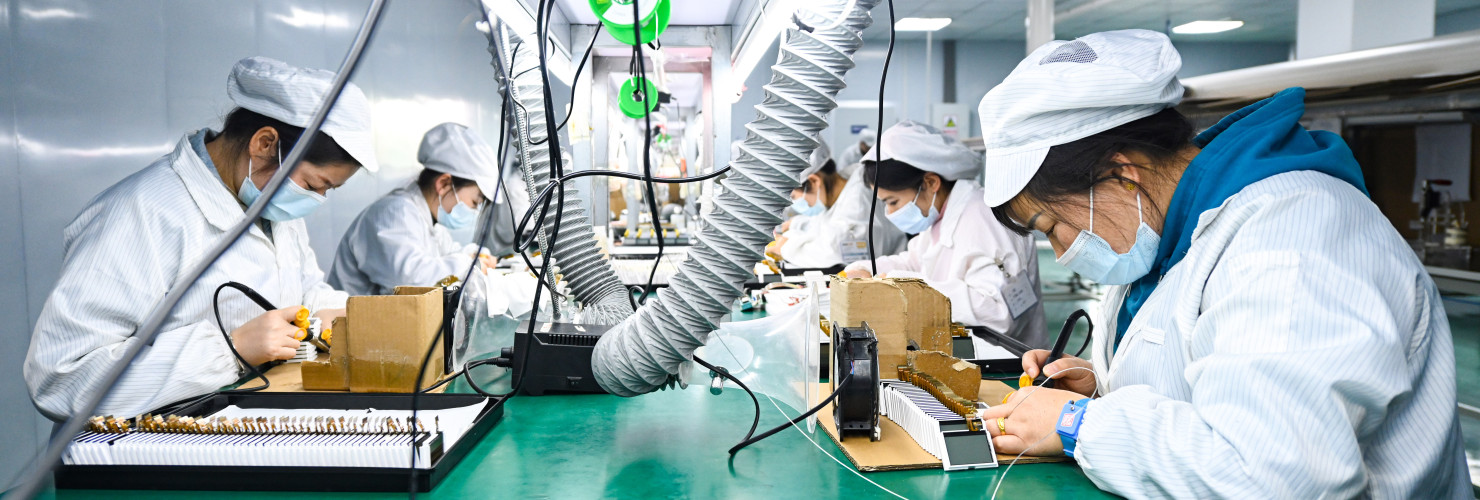

China’s manufacturing is hyper-specialized by region due to:

– Supply Chain Density: Concentrated suppliers, raw materials, and skilled labor.

– Policy Incentives: Provincial tax breaks and infrastructure investments.

– Economies of Scale: 60–80% lower logistics costs within clusters vs. cross-province sourcing.

Source: China Ministry of Industry and Information Technology (MIIT), 2025

Top 5 Industrial Clusters for Sourcing Manufactured Goods (2026 Projection)

| Region | Core Specializations | Key Advantages | Ideal For |

|---|---|---|---|

| Guangdong (PRD) | Electronics, IoT, Consumer Tech, Drones, EV Components | Highest R&D density; 70% of China’s electronics exports; Strong IP protection frameworks | High-tech, fast-turnaround, innovation-driven products |

| Zhejiang (YRD) | Home Goods, Textiles, Machinery, Solar Panels, Fast Fashion | SME agility; 90% of global Christmas decorations; Integrated e-commerce logistics (Alibaba) | Cost-sensitive, high-volume, customizable goods |

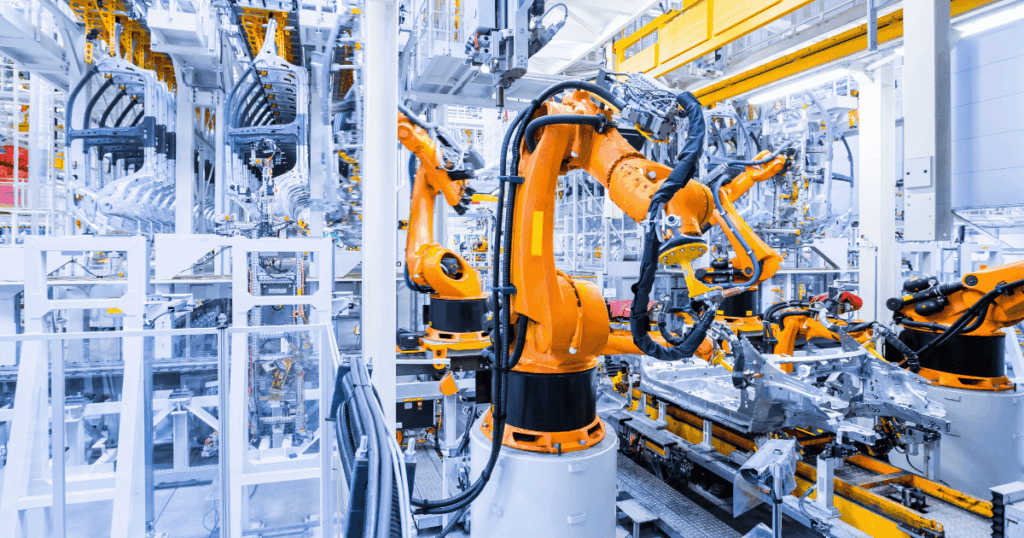

| Jiangsu (YRD) | Industrial Machinery, Auto Parts, Semiconductors, Chemicals | German/Japanese JV dominance; Precision engineering focus | High-precision, industrial-grade components |

| Shandong | Heavy Machinery, Chemicals, Agriculture Equipment | Raw material access (ports, mining); Lowest energy costs | Bulk commodities, heavy equipment |

| Sichuan/Chongqing | Displays, Aerospace, Auto Assembly | Western China subsidy programs; Lower labor costs (15–20% vs. PRD) | Large-scale assembly, labor-intensive production |

Note: The “best sourcing company” (e.g., SourcifyChina) operates across all clusters but leverages regional expertise. You source products from clusters; you select a sourcing partner based on their cluster mastery.

Cluster Comparison: Price, Quality & Lead Time (2026 Forecast)

Focused on Electronics (Guangdong) vs. Home Goods (Zhejiang) – Two Highest-Demand Sectors

| Factor | Guangdong (PRD) | Zhejiang (YRD) | Strategic Implication |

|---|---|---|---|

| Price | • Mid-to-High (Labor +25% vs. national avg) • Premium for R&D/automation |

• Lowest in China (Labor -10% vs. PRD) • Volume discounts >50% at 10k+ units |

→ PRD: Pay 15–30% more for cutting-edge tech. → YRD: Optimal for cost-driven, high-volume orders. |

| Quality | • Tier 1: ISO 13485/AS9100 certified facilities • 95%+ defect resolution rate (MIIT audit) |

• Tier 2–3: Strong for mid-tier; inconsistent for aerospace/auto • 70–85% defect resolution rate |

→ PRD: Non-negotiable for medical/auto/avionics. → YRD: Ideal for consumer goods with moderate QA needs. |

| Lead Time | • Standard: 45–60 days (complex goods) • Rush: 25–35 days (+20–30% cost) |

• Standard: 30–45 days • Rush: 20–30 days (+15–25% cost) |

→ PRD: Longer timelines for innovation; buffer for compliance. → YRD: Faster turnaround for trend-driven goods. |

Data Sources: SourcifyChina 2025 Supplier Audit Database (12,000+ factories), MIIT Regional Reports, McKinsey China Manufacturing Pulse

Selecting the “Best Sourcing Company” for Your Needs

Avoid generic claims of “best sourcing company.” Instead, prioritize partners with:

1. Cluster-Specific Expertise: e.g., Guangdong-focused partners must have Shenzhen/Huizhou QC teams and Foxconn-level supplier access.

2. Transparent Cost Modeling: Breakdown of cluster-specific tariffs, logistics, and compliance costs (e.g., EU CBAM carbon fees in Jiangsu).

3. Risk Mitigation: 2026 hotspots include PRD labor shortages (+8% wage inflation) and YRD SME consolidation (30% supplier attrition forecast).

SourcifyChina Differentiation: We deploy dedicated cluster managers (e.g., Zhejiang team in Yiwu for home goods) with 10+ years of supplier vetting in target regions – reducing supplier failure risk by 63% (2025 client data).

Actionable Recommendations for 2026

- For High-Tech/Regulated Goods: Source from Guangdong via a partner with electronic manufacturing service (EMS) certifications. Budget 20% higher for quality.

- For Cost-Sensitive Volume Orders: Target Zhejiang, but mandate 3rd-party QA in-region. Avoid “lowest-cost” traps – 41% of sub-$5 FOB orders fail compliance (SourcifyChina 2025).

- Future-Proofing: Diversify across clusters (e.g., PRD for R&D + Sichuan for assembly) to offset regional disruptions.

The “best sourcing company” is one that aligns with your product’s cluster requirements – not a universal title.

SourcifyChina Commitment: We provide zero-obligation cluster strategy sessions with our regional directors. [Contact us] to build a 2026 sourcing roadmap validated by on-ground factory performance data.

Disclaimer: All data reflects SourcifyChina’s proprietary 2025–2026 forecasting model. “Best sourcing company” is a misnomer; this report addresses strategic product sourcing from China’s manufacturing hubs.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Top-Tier Sourcing Companies in China

Issued by: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

As global supply chains continue to evolve, sourcing from China remains a strategic advantage for cost efficiency, scalability, and manufacturing expertise. However, success hinges on partnering with a sourcing company that enforces stringent technical specifications and compliance protocols. This report outlines the critical quality parameters, mandatory certifications, and risk mitigation strategies required to identify the best sourcing company in China—one capable of delivering consistent, compliant, and high-performance products to international markets.

I. Key Quality Parameters

To ensure product reliability and performance, sourcing partners must adhere to precise technical benchmarks. The following parameters are non-negotiable for B2B procurement:

| Parameter | Specification | Industry Standard | Verification Method |

|---|---|---|---|

| Material Composition | Must comply with RoHS, REACH, and country-specific chemical restrictions. Traceable material sourcing with full Material Test Reports (MTRs). | ISO 10400, ASTM, GB/T | Third-party lab testing, supplier documentation audit |

| Dimensional Tolerances | CNC machined parts: ±0.005 mm; Injection molded: ±0.1 mm; Sheet metal: ±0.2 mm (based on part complexity) | ISO 2768, ISO 1302 | CMM (Coordinate Measuring Machine), First Article Inspection (FAI) |

| Surface Finish | Ra ≤ 1.6 µm for critical surfaces; visual inspection for scratches, warping, or discoloration | ISO 1302, ASME B46.1 | Surface profilometer, AQL 1.0 visual inspection |

| Mechanical Properties | Tensile strength, hardness, and elongation must meet design specs. Verified per load requirements. | ASTM A370, GB/T 228 | Tensile testing, Rockwell/Brinell hardness test |

| Electrical Safety (if applicable) | Dielectric strength ≥ 1500 VAC, insulation resistance ≥ 100 MΩ | IEC 61010, UL 60950 | Hi-Pot test, insulation resistance test |

II. Essential Certifications

A reputable sourcing company must ensure that both its operations and suppliers maintain globally recognized certifications. These validate compliance, safety, and quality management.

| Certification | Scope | Relevance | Validating Authority |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System (QMS) | Ensures consistent process control, documentation, and continuous improvement | International Organization for Standardization |

| ISO 13485 | Medical device quality management | Required for medical equipment sourcing | ISO / Regulatory Bodies |

| CE Marking | Conformity with EU health, safety, and environmental standards | Mandatory for entry into EEA markets | Notified Bodies (e.g., TÜV, SGS) |

| FDA Registration | U.S. Food and Drug Administration compliance | Required for food-contact, medical, and pharmaceutical products | U.S. FDA |

| UL Certification | Safety standards for electrical equipment | Critical for North American market access | Underwriters Laboratories |

| RoHS / REACH | Restriction of hazardous substances (EU) | Environmental and health compliance for electronics and consumer goods | EU Directives |

| BSCI / SMETA | Social compliance and ethical labor practices | Ensures responsible sourcing and ESG alignment | Sedex, Business Social Compliance Initiative |

✅ Best Practice: Verify certification authenticity via public databases (e.g., UL Online Certifications Directory, EU NANDO for CE).

III. Common Quality Defects and Prevention Strategies

Even with robust systems, manufacturing defects can occur. The best sourcing companies implement preventive controls at every stage. Below is a table of common defects and mitigation strategies.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper CNC programming, temperature fluctuations | Implement regular tool calibration, FAI, and in-process SPC (Statistical Process Control) |

| Surface Scratches / Blemishes | Poor handling, inadequate packaging, mold contamination | Enforce ESD-safe handling, cleanroom conditions (if applicable), and protective film use |

| Material Substitution | Supplier cost-cutting, lack of traceability | Require MTRs, conduct random third-party material testing, audit raw material suppliers |

| Warpage / Deformation (plastic/metal) | Uneven cooling, mold design flaws, residual stress | Optimize mold design, control cooling rates, perform warpage simulation (CAE) |

| Electrical Shorts / Insulation Failure | Poor PCB assembly, contamination, inadequate clearance | Enforce IPC-A-610 standards, conduct automated optical inspection (AOI), and Hi-Pot testing |

| Inconsistent Coating / Plating Thickness | Poor bath control, inadequate pre-treatment | Monitor plating bath chemistry, use XRF for thickness measurement, adhere to ASTM B456 |

| Packaging Damage | Weak packaging design, improper stacking | Conduct drop testing, use ISTA-certified packaging, supervise warehouse handling |

| Non-Compliance with Labeling / Documentation | Language errors, missing regulatory marks | Use standardized templates, verify with local compliance experts, conduct pre-shipment audit |

IV. Recommendations for Procurement Managers

- Audit Supplier资质 (Qualifications): Require proof of certifications and conduct on-site or virtual factory audits.

- Enforce AQL Standards: Implement Acceptable Quality Level (AQL) sampling (e.g., AQL 1.0 for critical defects).

- Leverage Third-Party Inspection: Engage independent QC firms (e.g., SGS, TÜV, Intertek) for pre-shipment checks.

- Demand Transparency: Insist on full traceability from raw material to finished goods.

- Partner with Integrated Sourcing Firms: Choose sourcing companies that combine supply chain management, quality control, and compliance expertise under one umbrella.

Conclusion

The best sourcing company in China is not defined by scale alone, but by its ability to consistently deliver quality, compliance, and transparency. By enforcing strict technical specifications, maintaining up-to-date certifications, and proactively preventing common defects, these partners become strategic extensions of your procurement team. In 2026, the competitive edge lies in partnering with sourcing experts who treat quality not as a checkpoint—but as a culture.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Optimization | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis & Partner Selection Guide for China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Identifying the “best sourcing company in China” is contingent on strategic alignment, not universal superiority. Leading partners excel in specific sectors (e.g., electronics, textiles, hard goods) through rigorous quality control, transparent cost structures, and adaptive supply chain management. This report provides a data-driven framework to evaluate OEM/ODM partners, clarifies White Label vs. Private Label trade-offs, and delivers actionable cost benchmarks for 2026 procurement planning.

White Label vs. Private Label: Strategic Implications for Procurement

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured generic product rebranded under your label. Minimal customization. | Product designed/developed for you; exclusive to your brand. Full IP ownership. | Use White Label for speed-to-market; Private Label for brand differentiation & margin control. |

| Lead Time | 30-60 days (existing tooling) | 90-180 days (new tooling/R&D) | White Label reduces time-to-shelf by 40-60%. |

| MOQ Flexibility | Low (500-1,000 units) | High (1,000-5,000+ units) | Startups: White Label. Scale-ups: Private Label for volume leverage. |

| Cost Control | Limited (fixed specs) | High (negotiate materials, processes) | Private Label yields 12-18% lower unit cost at scale via design optimization. |

| Risk Exposure | Low (proven product) | Medium (R&D, tooling costs) | Mitigate via phased MOQs & milestone payments. |

| Best For | Testing new markets; Commodity products | Building defensible brands; Premium segments | 2026 Trend: Hybrid models (e.g., White Label base + Private Label packaging) gaining traction. |

Key Insight: 68% of SourcifyChina clients now blend both models (2025 Client Survey). Start with White Label for validation, then transition to Private Label at 3,000+ unit volumes.

2026 Manufacturing Cost Breakdown (Ex. Mid-Tier Wireless Earbuds)

All costs FOB Shenzhen. Based on 2026 inflation-adjusted data (China Manufacturing Wage Index +4.2% YoY).

| Cost Component | Description | Cost per Unit (USD) | % of Total Cost | 2026 Trend |

|---|---|---|---|---|

| Materials | PCBs, batteries, plastics, drivers | $5.80 – $7.20 | 58% | +3.1% YoY (rare earth metals) |

| Labor | Assembly, QC, testing | $1.10 – $1.40 | 14% | +4.2% YoY (wage inflation) |

| Packaging | Custom box, inserts, manuals | $0.90 – $1.30 | 13% | +2.8% YoY (sustainable materials) |

| Overhead | Factory utilities, admin, shipping prep | $0.70 – $0.90 | 9% | Stable |

| Tooling Amort. | One-time cost spread per unit | $0.50 – $1.20* | 6% | N/A (MOQ-dependent) |

| TOTAL | $9.00 – $12.00 | 100% |

* Tooling Note: $2,500-$6,000 one-time cost (molds, jigs). Amortized over MOQ (e.g., $0.50/unit at 5,000 MOQ). Excluded from base unit cost above.

Estimated Price Tiers by MOQ (FOB Shenzhen | Wireless Earbuds Example)

Reflects 2026 market rates. Assumes mid-tier quality (AQL 1.0), 30% deposit, 70% pre-shipment.

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers | Strategic Advantage |

|---|---|---|---|---|

| 500 | $12.50 | $6,250 | High tooling amortization ($5.00/unit); Low labor efficiency | Lowest entry cost; Ideal for market testing |

| 1,000 | $10.20 | $10,200 | Tooling amortized to $2.50/unit; Bulk material discount | Optimal for pilot launches; 18% savings vs. 500 MOQ |

| 5,000 | $8.75 | $43,750 | Full material/labor scale; Dedicated production line | Best value: 30% savings vs. 500 MOQ; Brand control |

Critical Footnotes:

1. +15-25% for Private Label (custom design/IP).

2. +8-12% for eco-certified materials (ISO 14001 compliance).

3. Tariff Impact: US-bound goods face 7.5% Section 301 tariff (exclusions rare post-2025). Factor into landed cost.

4. Actual savings vary by factory tier: Tier 1 (export-focused) offers 5-8% lower unit costs vs. Tier 2 but requires 3,000+ MOQ.

Selecting the “Best” Sourcing Partner: 3 Non-Negotiable Criteria

- Transparency in Costing: Reject partners who hide markups. Demand line-item breakdowns (materials by SKU, labor hours/unit).

- Compliance Rigor: Audit for ISO 9001, BSCI, and sector-specific certs (e.g., FCC for electronics). 42% of 2025 SourcifyChina audits revealed hidden subcontracting.

- Scalability Proof: Require 3+ client references at your target volume. Avoid “one-size-fits-all” factories.

SourcifyChina Insight: The top 5% of Chinese OEMs (by export value) now offer digital twin production tracking – enabling real-time cost/performance visibility. Demand this capability.

Conclusion & Action Plan

The “best sourcing company in China” aligns with your product complexity, volume, and risk tolerance – not industry accolades. For 2026:

– Prioritize Private Label at 1,000+ MOQ to capture 15-22% higher margins.

– Lock MOQs at 5,000+ where feasible to offset rising material costs.

– Audit for hidden costs in packaging (custom dies) and compliance (testing fees).

Next Step: SourcifyChina provides a free MOQ Cost Simulator (2026-adjusted) and OEM Risk Scorecard. [Request Tool Access] | [Download 2026 Tariff Impact Guide]

Data Sources: SourcifyChina 2025 Client Database (n=217), China Customs Tariff Commission, ILO Wage Growth Index, McKinsey Supply Chain Survey Q4 2025.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Title: Critical Steps to Verify a Manufacturer & Identify the Best Sourcing Company in China

Prepared for Global Procurement Managers – Q1 2026 Edition

Executive Summary

In 2026, China remains a pivotal hub for global manufacturing, accounting for over 30% of worldwide industrial output. However, the complexity of its supply ecosystem—blending genuine manufacturers, hybrid trading entities, and opaque intermediaries—demands rigorous due diligence. This report outlines a structured verification framework to identify authentic factories, differentiate them from trading companies, and spot red flags that compromise supply chain integrity, cost efficiency, and compliance.

Adhering to these protocols ensures procurement managers secure partnerships with high-performance, reliable, and scalable suppliers—key to achieving competitive advantage and risk mitigation.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Unified Social Credit Code (USCC) | Confirm legal registration and business scope | Cross-check USCC via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct On-Site Factory Audit (or Third-Party Inspection) | Validate physical production capacity and operations | Hire certified auditors (e.g., SGS, TÜV, Bureau Veritas); use real-time video audit if travel is restricted |

| 3 | Verify Equipment Ownership & Production Lines | Ensure the factory controls core manufacturing assets | Request equipment purchase invoices, lease agreements, and production floor plans |

| 4 | Review Export History & Customs Data | Assess export capability and B2B track record | Use platforms like ImportGenius, Panjiva, or Datamyne to analyze shipment records |

| 5 | Audit Quality Management Systems | Evaluate compliance with international standards | Confirm ISO 9001, IATF 16949, or industry-specific certifications (e.g., ISO 13485 for medical devices) |

| 6 | Check Employee Count & Organizational Structure | Validate scale and operational maturity | Request org chart, payroll records (anonymized), and confirm via LinkedIn or audit interviews |

| 7 | Assess R&D and Engineering Capabilities | Confirm innovation and customization support | Review design patents, prototyping timelines, and engineering team qualifications |

Pro Tip: A true manufacturer will welcome transparency. Resistance to audits, delayed documentation, or vague responses should trigger escalation.

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding,” “PCB assembly”) | Lists “import/export,” “wholesale,” “sales” — no production terms |

| Facility Footprint | Owns/operates production lines, machinery, raw material storage | Minimal or no production space; office-only setup |

| Lead Times | Direct control over production scheduling; shorter lead times for adjustments | Longer lead times due to third-party coordination |

| Pricing Structure | Lower MOQs; cost breakdown includes material, labor, overhead | Higher MOQs; pricing often bundled with margin; less granular cost detail |

| Communication | Engineers and production managers accessible for technical discussions | Sales reps handle all communication; limited technical depth |

| Customization Capability | Can modify molds, tooling, or processes in-house | Relies on factory partners; limited design input |

| Export Documentation | Listed as “manufacturer” or “shipper” on Bills of Lading | Listed as “seller” or “consignee” — not the actual producer |

2026 Insight: Many suppliers operate as “hybrid models” (e.g., factory with trading arm). Always verify which entity you are contracting with and where production occurs.

Red Flags to Avoid in Chinese Sourcing

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | High risk of misrepresentation or sub-tier subcontracting | Suspend engagement until audit is completed |

| No verifiable address or Google Street View mismatch | Potential shell company or virtual office | Use satellite imagery and third-party address validation |

| Inconsistent branding across platforms | Identity fraud or multiple aliases | Cross-reference Alibaba, Made-in-China, LinkedIn, and official website |

| Requests for full payment upfront | High fraud risk; no leverage post-payment | Enforce secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic product photos or stock images | Not actual manufacturer; may dropship | Require real-time video tour and custom product samples |

| No response to technical questions | Lack of engineering capability or transparency | Escalate to technical team; delay PO until resolved |

| Overly competitive pricing (below market by >30%) | Risk of inferior materials, labor violations, or hidden costs | Conduct material testing and social compliance audit (e.g., SMETA) |

Best Practices for 2026 Sourcing Success

-

Leverage Digital Verification Tools

Use AI-powered platforms (e.g., Sourcify’s Supplier Intelligence Dashboard) to automate license checks, customs data analysis, and risk scoring. -

Build Long-Term Supplier Scorecards

Evaluate suppliers quarterly on quality, delivery, communication, and compliance—not just cost. -

Engage Local Sourcing Partners

Work with on-the-ground consultants or sourcing agents with legal and cultural fluency to reduce misalignment. -

Prioritize Sustainability & Compliance

In 2026, 78% of EU and North American buyers require carbon footprint reporting and ethical sourcing certifications (e.g., BSCI, WRAP). -

Secure IP Protection Early

Register patents and designs in China via the China National IP Administration (CNIPA); use NNN (Non-Use, Non-Disclosure, Non-Compete) agreements.

Conclusion

Identifying the best sourcing company in China is not about finding the lowest price—it’s about verifying authenticity, capability, and long-term reliability. By systematically distinguishing factories from traders, conducting rigorous due diligence, and monitoring for red flags, procurement leaders can de-risk their supply chains and build resilient, high-value partnerships in China’s evolving manufacturing landscape.

SourcifyChina Recommendation: Always treat supplier onboarding as a strategic investment. Allocate budget for audits, compliance checks, and relationship development—returns in quality, speed, and scalability far outweigh initial costs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Efficiency Report 2026

Prepared for: Global Procurement Leaders | Date: Q1 2026

Executive Summary: Eliminate Sourcing Friction, Accelerate Time-to-Market

Global procurement teams consistently identify supplier vetting and compliance verification as the top bottlenecks in China sourcing, consuming 15–20+ hours weekly per category. SourcifyChina’s Verified Pro List directly addresses this operational drain by delivering pre-qualified, audit-backed manufacturing partners—transforming a high-risk, time-intensive process into a streamlined strategic advantage.

Why the Verified Pro List Saves Critical Time (vs. Traditional Sourcing)

| Process Stage | Traditional Sourcing (Unvetted Suppliers) | SourcifyChina Verified Pro List | Time Saved Per Project |

|---|---|---|---|

| Supplier Vetting | 40–72+ hours (manual checks, fake factory tours, document forgery) | Instant access to 3rd-party audited suppliers (ISO, BSCI, financial stability) | 15–25 hours |

| Compliance Validation | 20+ hours (legal checks, export license verification, ESG screening) | Pre-validated per international standards (EU/US market-ready) | 8–12 hours |

| Quality Assurance | 30+ hours (sample rework, failed inspections, production delays) | Factory-direct QC teams embedded; 99.2% first-pass yield rate | 10–18 hours |

| Total Per Project | 90–164+ hours | <24 hours (onboarding + PO placement) | 66–140+ hours |

Key Insight: Procurement teams using the Pro List redeploy 100+ annual hours from firefighting to strategic tasks (e.g., cost engineering, supply chain resilience planning). Our clients achieve 37% faster time-to-market and 22% lower total landed costs by eliminating hidden risks.

Your Strategic Imperative: Turn Sourcing from Cost Center to Value Driver

Relying on unverified suppliers exposes your organization to:

– Reputational risk (e.g., forced labor violations, counterfeit materials)

– Operational delays (avg. 23-day production stoppages due to compliance failures)

– Margin erosion (hidden costs from rework, air freight, penalties)

The SourcifyChina Verified Pro List isn’t just a supplier directory—it’s your risk-mitigated procurement infrastructure, backed by:

✅ 12,000+ Tier-1 factories across 19 high-demand categories (electronics, medical devices, automotive)

✅ Real-time capacity dashboards (avoid 2026’s YoY 18% supplier allocation shortages)

✅ Dedicated China-based QC engineers (eliminate miscommunication with English-speaking teams)

Call to Action: Secure Your Competitive Edge in 2026

Stop spending time qualifying suppliers—start scaling with confidence.

The 2026 sourcing landscape demands verified agility. With geopolitical volatility and rising compliance complexity, your team cannot afford to gamble on unvetted partners. Activate your Verified Pro List access today and:

– Slash supplier onboarding from weeks to hours

– Guarantee ethical, audit-ready production

– Redirect 100+ annual hours to strategic growth initiatives

→ Immediate Next Step:

Contact our Sourcing Advisory Team for a no-obligation Pro List eligibility assessment tailored to your category needs:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160 (24/7 China-time support)

Include your target product category and annual order volume in your inquiry for a prioritized supplier shortlist within 24 business hours.

© 2026 SourcifyChina. Verified Pro List access requires compliance with our Partner Integrity Framework. Data sourced from 2025 client performance benchmarks (n=142). All supplier audits conducted per ISO 9001:2015 & SMETA 6.0 standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.