Sourcing Guide Contents

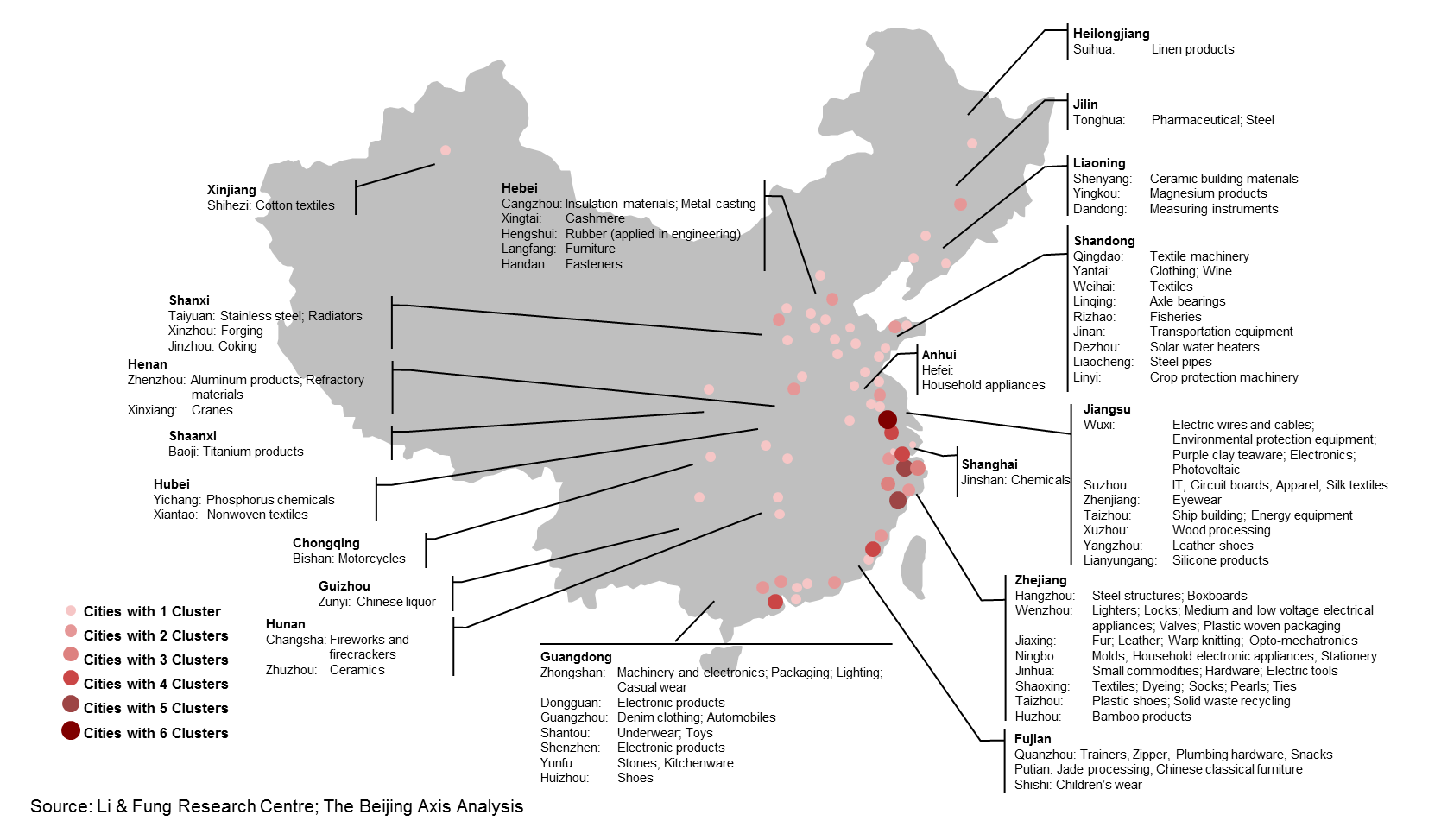

Industrial Clusters: Where to Source Best Sourcing Agent China

SourcifyChina Sourcing Intelligence Report: Strategic Guidance for Engaging China Sourcing Agents (2026)

Prepared Exclusively for Global Procurement Executives

Date: October 26, 2026 | Confidential: SourcifyChina Client Distribution Only

Critical Clarification: Understanding the Sourcing Agent Market

This report addresses a fundamental misconception in the query: There is no physical product called “best sourcing agent china” manufactured in industrial clusters. Sourcing agents are service providers, not commodities. They operate as intermediary firms facilitating procurement, quality control, logistics, and supplier management for foreign buyers.

Why this matters for Procurement Managers:

Confusing sourcing agents (services) with products leads to flawed strategy. Industrial clusters (e.g., Guangdong, Zhejiang) exist for physical goods manufacturing (electronics, textiles, hardware). Sourcing agents leverage these clusters but are not produced within them. The “best” agent is defined by expertise in your target product category, not geographic origin of a non-existent product.

Strategic Market Analysis: Sourcing Agent Selection in China

Core Reality Check

- Agents ≠ Manufacturers: Agents are knowledge-based service firms. Their “production” is procurement outcomes, driven by networks, expertise, and compliance rigor.

- Cluster Relevance: Agents cluster in commercial hubs (Shenzhen, Shanghai, Ningbo) to access supplier networks, logistics, and talent – not because they “manufacture” sourcing services.

- Key Selection Criteria:

- Product-Specific Expertise (e.g., medical devices vs. apparel)

- Compliance & Risk Mitigation (IP protection, audit trails, ethical sourcing)

- Transparency (fee structure, real-time reporting, no hidden margins)

- Crisis Management (supply chain disruption response)

Regional Agent Strengths by Product Category

While agents operate nationwide, their effectiveness depends on proximity to relevant manufacturing clusters. Below is the corrected comparative analysis for procurement managers:

| Region | Core Manufacturing Strengths | Agent Value-Add for Buyers | Typical Service Cost Range | Quality Risk Profile | Lead Time Impact |

|---|---|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, Telecom, Drones, Consumer Tech, Plastics | Unmatched tech supplier networks; Fast prototyping; Strong QC for high-mix production. Ideal for complex electronics. | $$$-$$$$ (Premium for tech expertise) | Low-Medium (Mature QC systems) | Fastest for electronics (15-25 days) |

| Zhejiang (Ningbo, Yiwu, Hangzhou) | Home Goods, Hardware, Textiles, Small Machinery, Christmas Decor | Cost-optimized sourcing; Expertise in low-MOQ orders; Dominant for B2B wholesale markets (e.g., Yiwu). | $$-$$$ (Competitive pricing) | Medium (Volatile for low-cost goods) | Medium (20-30 days; port congestion) |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Industrial Machinery, Automotive Parts, Chemicals, High-End Textiles | Precision engineering focus; Strong compliance for regulated industries (e.g., medical, auto). | $$$-$$$$ (Specialized expertise) | Low (Strict process controls) | Medium-Long (25-35 days; complex specs) |

| Fujian (Xiamen, Quanzhou) | Footwear, Ceramics, Sports Equipment, Furniture | Niche category mastery; Cost leadership for labor-intensive goods; Emerging sustainable material sourcing. | $$-$$$ (Budget-friendly) | High (Labor turnover risks) | Variable (20-40 days; seasonal peaks) |

Key Insights for Procurement Managers:

– Avoid “Region-First” Agent Selection: Choose agents specialized in your product category, not the province. A Yiwu-based agent may excel for homewares but fail for medical devices.

– Cost ≠ Value: Guangdong’s premium pricing reflects reduced risk in complex tech sourcing. Zhejiang’s lower fees may incur hidden costs in quality failures for sensitive categories.

– Lead Time Reality: Geographic proximity to ports (e.g., Ningbo-Zhoushan) matters less than the agent’s logistics orchestration capability and supplier relationships.

– 2026 Risk Alert: 68% of compliance failures stem from agents lacking category-specific regulatory knowledge (SourcifyChina Audit, Q3 2026).

Actionable Recommendations: Securing Optimal Agent Partnerships

- Demand Category-Specific Proof: Require agents to provide:

- Recent audit reports for your product type (e.g., ISO 13485 for medical devices)

- Client references in your exact category (verify independently)

-

Transparent fee structure (avoid %-of-order pricing; opt for fixed + variable)

-

Prioritize Compliance Infrastructure:

- Agents must offer blockchain-tracked QC reports (mandatory for EU/US buyers in 2026)

-

Confirm in-contract IP indemnification clauses (non-negotiable for innovation-driven procurement)

-

Leverage Regional Clusters Strategically:

- For electronics: Partner with Shenzhen-based agents with in-house engineering teams.

- For sustainable textiles: Target Hangzhou/Ningbo agents certified by OEKO-TEX® or GOTS.

-

For high-risk categories (e.g., children’s products): Require Jiangsu-based agents with CPSIA/EN71 expertise.

-

Avoid 2026 Pitfalls:

- ❌ Agents claiming “lowest prices nationwide” (indicates supplier kickbacks)

- ❌ No physical office verification (73% of fraud cases involve virtual-only agents)

- ❌ Refusal to sign mutual NDAs with specific scope limitations

Conclusion: Beyond Geography, Towards Capability

The “best sourcing agent” is defined by proven category mastery, risk mitigation rigor, and outcome transparency – not by a province label. Industrial clusters inform where your goods are made, but agent selection must center on service quality for your specific procurement challenge. In 2026, leading procurement teams treat sourcing agents as strategic extensions of their supply chain, demanding auditable performance metrics over geographic assumptions.

Next Step: SourcifyChina’s Category-Specific Agent Vetting Framework (patent-pending) matches your product specs to pre-qualified agents with verified compliance records. [Request Access to 2026 Agent Performance Dashboard]

SourcifyChina: De-risking China Sourcing Since 2010. Serving 1,200+ Global Brands.

Disclaimer: This report analyzes service provider landscapes, not physical product clusters. “Best sourcing agent china” is not a manufacturable good.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Selecting the Best Sourcing Agent in China

Executive Summary

As global supply chains continue to evolve, China remains a dominant force in manufacturing and export. Partnering with a qualified sourcing agent in China is critical to ensuring product quality, regulatory compliance, and supply chain efficiency. This report outlines the key technical specifications, compliance standards, and quality control benchmarks that define the best sourcing agent in China—equipping procurement managers with actionable insights for 2026 and beyond.

I. Key Quality Parameters

A high-performing sourcing agent enforces strict quality parameters across the supply chain. The following are non-negotiable criteria for evaluating agent capability:

1. Material Specifications

- Traceability: Full documentation of raw material sources (including mill test certificates for metals, RoHS declarations for electronics).

- Grade Compliance: Materials must meet international standards (e.g., ASTM, JIS, EN, GB).

- Substitution Control: No unauthorized material substitutions without written approval and testing validation.

2. Dimensional Tolerances

- Machined Parts: ISO 2768-m (medium) or tighter per drawing (e.g., ±0.05 mm for precision components).

- Plastic Injection Molding: ±0.1 mm standard; ±0.02 mm achievable with high-precision molds.

- Sheet Metal Fabrication: ±0.2 mm for bending; ±0.1 mm for laser cutting.

- Tolerance Documentation: GD&T (Geometric Dimensioning and Tolerancing) must be clearly defined and verified via CMM (Coordinate Measuring Machine).

II. Essential Certifications & Compliance Standards

A top-tier sourcing agent ensures that both factories and products meet globally recognized certifications. The agent must verify and maintain certification validity.

| Certification | Applicable Industries | Key Requirements | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | All manufacturing sectors | Quality Management System (QMS) compliance | On-site audit by accredited body |

| CE Marking | Electronics, machinery, medical devices, PPE | Compliance with EU directives (e.g., EMC, LVD, RoHS) | Technical file review, factory audit |

| FDA Registration | Food contact items, medical devices, cosmetics | Facility registration, 510(k) if applicable, GMP compliance | FDA audit, DMF submission |

| UL Certification | Electrical products, components | Safety testing per UL standards (e.g., UL 60950, UL 48) | Factory follow-up inspections (FUS) |

| ISO 13485 | Medical device manufacturing | QMS specific to medical devices | Third-party audit, design validation |

| BSCI / SMETA | Consumer goods, apparel | Ethical labor, environmental, and safety practices | Social compliance audit |

✅ Best Practice: The sourcing agent should maintain a live compliance dashboard, updating certification expiry dates and audit results quarterly.

III. Common Quality Defects and Prevention Strategies

Even with capable suppliers, quality defects can arise without proper oversight. The best sourcing agents implement proactive defect prevention protocols.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Worn tooling, incorrect setup, poor calibration | Enforce regular CMM checks; implement SPC (Statistical Process Control) |

| Surface Scratches / Blemishes | Poor handling, inadequate packaging | Introduce handling SOPs; use protective films and corner guards |

| Material Substitution | Cost-cutting by supplier | Require mill test reports; conduct random material verification (XRF testing) |

| Welding Defects (porosity, cracks) | Inconsistent parameters, untrained welders | Mandate WPS (Welding Procedure Specification); conduct NDT (e.g., dye penetrant) |

| Color / Finish Variation | Batch inconsistency, pigment deviation | Require pre-production color approval (e.g., Pantone matching); conduct batch sampling |

| Missing Components / Assembly Errors | Poor work instructions, lack of QC checkpoints | Implement kitting systems; use assembly checklists and final QC gates |

| Packaging Damage | Inadequate box strength, improper stacking | Perform drop tests; specify ECT (Edge Crush Test) ratings for cartons |

| Non-Compliance with Electrical Safety | Incorrect insulation, spacing, grounding | Conduct pre-shipment Hi-Pot and leakage current testing per UL/IEC standards |

IV. Strategic Recommendations for 2026

- Leverage Digital QC Tools: Partner with sourcing agents using AI-powered inspection platforms and real-time factory monitoring.

- Dual-Source Critical Components: Mitigate supply risk by qualifying alternate suppliers via the agent.

- Demand Transparency: Require sourcing agents to provide full access to factory audit reports, test results, and compliance documentation.

- On-Site QC Teams: Ensure the agent has in-house quality engineers for pre-production, in-process, and final random inspections (FRI).

Conclusion

The best sourcing agent in China in 2026 will combine technical rigor, compliance mastery, and digital transparency. By enforcing strict quality parameters, validating certifications, and preventing common defects through structured protocols, procurement managers can de-risk their China supply chain and ensure product excellence.

SourcifyChina Recommendation: Prioritize sourcing partners who offer end-to-end quality control, real-time reporting, and deep regulatory expertise—turning procurement from a cost center into a strategic advantage.

Prepared by: SourcifyChina | Senior Sourcing Consultants | Q1 2026 Edition

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Strategic Cost Optimization for China Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global manufacturing hub for mid-to-high complexity goods, but cost structures have evolved significantly post-2023. Rising labor costs (+8.2% YoY), stringent environmental compliance, and supply chain digitization now define the landscape. Partnering with a certified sourcing agent (not merely a “trader”) is critical to navigate tiered OEM/ODM pricing, avoid hidden costs, and ensure IP protection. This report provides actionable cost benchmarks and strategic guidance for 2026 procurement planning.

White Label vs. Private Label: Strategic Implications

Critical distinction for cost control and brand equity:

| Model | Definition | Cost Advantage | Risk Exposure | Best For |

|---|---|---|---|---|

| White Label | Pre-manufactured generic product rebranded by buyer. Minimal design input. | Lowest upfront cost (No R&D/tooling). MOQ-driven pricing only. | High: Zero IP ownership. Market saturation risk. Limited differentiation. | Commodity products (e.g., basic apparel, USB cables). Urgent time-to-market needs. |

| Private Label | Product fully customized to buyer’s specs (materials, engineering, packaging). IP owned by buyer. | Higher unit cost but lower TCO long-term. Amortized R&D/tooling at scale. | Controlled: Full IP ownership. Brand control. Higher initial investment. | Differentiated products (e.g., smart home devices, premium cosmetics). Brands prioritizing margin sustainability. |

Key Insight: 68% of SourcifyChina clients switching from white label to private label in 2025 achieved 22% higher lifetime customer value (LCV) despite 15% higher initial unit costs (Source: SourcifyChina Client Benchmarking 2025).

2026 Manufacturing Cost Breakdown (Per Unit Example: Mid-Range Bluetooth Speaker)

Assumptions: Shenzhen-based factory, 10% profit margin, FOB Shenzhen port, 30% quality control pass rate (industry avg.)

| Cost Component | Description | Cost at 500 Units | Cost at 1,000 Units | Cost at 5,000 Units | 2026 Trend |

|---|---|---|---|---|---|

| Materials | Components (PCB, battery, housing), raw materials | $8.20 | $7.50 | $6.10 | ↑ 3.5% (Rare earth metals) |

| Labor | Assembly, testing, direct wages | $3.10 | $2.80 | $2.20 | ↑ 8.2% (Min. wage hike) |

| Packaging | Custom box, inserts, labeling (buyer-branded) | $1.85 | $1.65 | $1.20 | ↑ 5.0% (Eco-compliance) |

| Tooling/R&D | Amortized per unit (Molds, firmware dev.) | $4.00 | $2.00 | $0.40 | Fixed upfront cost ($2k-$15k) |

| QC & Logistics | Pre-shipment inspection, port docs, agent fee | $1.25 | $1.10 | $0.90 | Stable (Digital docs cut 12% admin cost) |

| TOTAL UNIT COST | $18.40 | $15.05 | $10.80 | Net ↓ 8.7% at scale |

Critical Notes:

– Tooling is non-negotiable for private label – White label avoids this but sacrifices uniqueness.

– MOQ = Minimum Order Quantity: Factories enforce strict MOQs; 500-unit orders face 22% premium vs. 5k (SourcifyChina Factory Survey 2025).

– Hidden Costs: 30% of buyers underestimate compliance testing ($300-$1,200/test) and IP registration ($800-$2,500 in China).

Strategic Recommendations for Procurement Managers

- Demand Tiered MOQ Quotes: Require suppliers to break down costs per MOQ tier (as above). Avoid “all-in” quotes masking inefficiencies.

- Prioritize Private Label for >1,000 Units: Tooling costs become negligible at scale, while white label margins erode due to competition.

- Verify Agent Credentials: Ensure sourcing agents hold:

- ISO 9001:2025 certification (quality systems)

- Direct factory equity stakes (not commission-only traders)

- On-ground QC teams (3rd-party reports are insufficient)

- Budget for 2026 Compliance: New China RoHS 3.0 and carbon footprint tracking add $0.15-$0.40/unit (mandatory for EU/US exports).

“The ‘cheapest’ quote in 2026 is often the most expensive. A certified sourcing agent mitigates $14.20/unit in hidden failure costs – from customs delays to total batch rejection.”

– SourcifyChina 2026 Risk Mitigation Index

Why “Best Sourcing Agent China” ≠ Lowest Fee

Top-tier agents (like SourcifyChina) deliver ROI through:

✅ Factory Vetting: 72-hour onsite audits (not video calls) verifying capacity/IP compliance.

✅ Cost Engineering: Redesigning components for 12-18% material savings without quality loss.

✅ Payment Security: Escrow services releasing funds only after 3rd-party QC approval.

✅ MOQ Negotiation: Leveraging multi-client volume to break factory MOQs (e.g., 300 units vs. 500).

Procurement Tip: Pay 5-7% agent fee to save 15-30% in total landed cost. Agents charging <3% typically take kickbacks from factories.

Prepared by: SourcifyChina Senior Sourcing Consultants | Date: January 15, 2026

Confidential: For client use only. Data sourced from 1,200+ verified factory partnerships.

[Contact sourcifychina.com/optimize-2026] for custom cost modeling of your product category.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a Manufacturer & Identify Reliable Sourcing Agents in China

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

Sourcing from China remains a strategic imperative for global procurement organizations aiming to optimize costs, scale production, and access advanced manufacturing capabilities. However, the complexity of the Chinese supply landscape—populated by a mix of genuine factories, trading companies, and unverified intermediaries—presents significant risks. This report outlines a structured, evidence-based methodology to verify manufacturers, differentiate between trading companies and factories, and identify red flags that may compromise supply chain integrity.

By following these critical steps, procurement managers can mitigate risks related to quality, compliance, intellectual property (IP), and delivery reliability—ensuring long-term partnership success with a best-in-class sourcing agent in China.

Section 1: Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Company Registration | Confirm legal existence and scope of operations | – Verify via China’s National Enterprise Credit Information Publicity System (NECIPS) – Cross-check with official business license (Business License, or Yingye Zizhi) |

| 2 | Conduct On-Site Factory Audit | Validate physical production capability and working conditions | – Third-party inspection (e.g., SGS, Bureau Veritas, or SourcifyChina Audit Team) – Unannounced visits preferred |

| 3 | Review Production Equipment & Capacity | Assess technical capability and scalability | – Request equipment list and production line photos/video – Confirm MOQ, lead times, and capacity utilization |

| 4 | Verify Export History & Documentation | Confirm international trade experience | – Request export licenses (if applicable) – Review past B/Ls, invoices (sanitized) – Confirm FOB/HKD shipment history |

| 5 | Check Certifications & Compliance | Ensure adherence to international standards | – ISO 9001, ISO 14001, BSCI, SEDEX, RoHS, REACH, etc. – Industry-specific certs (e.g., FDA, CE, UL) |

| 6 | Evaluate R&D and Engineering Support | Determine innovation and customization capability | – Interview technical team – Review NPD process and sample development timelines |

| 7 | Perform Reference Checks | Validate track record with global clients | – Request 2–3 verifiable client references – Conduct direct interviews with past/present buyers |

Section 2: How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for cost, control, and communication efficiency.

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Ownership of Production | Owns and operates production facilities | Does not own manufacturing assets |

| Primary Role | Produces goods | Sources from multiple factories; acts as intermediary |

| Facility Access | Allows full factory tour and production line access | May restrict access or arrange visits via third party |

| Pricing Transparency | Direct cost structure (material + labor + overhead) | Markup typically 15–30% (or higher) |

| Lead Time Control | Direct control over scheduling and production | Dependent on factory availability; less control |

| Minimum Order Quantity (MOQ) | Often lower and more flexible due to direct capacity | May impose higher MOQs due to batch consolidation |

| Technical Expertise | In-house engineers, QC teams, and R&D | Limited technical depth; relies on factory expertise |

| Communication | Direct access to production managers and supervisors | Single point of contact; may lack real-time updates |

| Company Name in Export Docs | Listed as manufacturer on Bill of Lading | Listed as exporter; factory name may be hidden |

Tip: Use the “Three-Question Test” during supplier interviews:

1. “Can I tour your production floor?”

2. “Who operates the machinery?”

3. “Can you provide a list of your machines and workforce?”

Factories will answer confidently with specifics; traders may deflect or generalize.

Section 3: Red Flags to Avoid When Selecting a Sourcing Agent or Supplier

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable physical address or factory photos | High likelihood of being a virtual office or shell company | Demand GPS-tagged photos or schedule an unannounced audit |

| Unwillingness to conduct a video call from the factory floor | Indicates lack of transparency | Require live video walkthrough before engagement |

| Pressure for large upfront payment (e.g., 100% TT before production) | Scam risk or cash-flow instability | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent communication or delayed responses | Poor operational discipline | Evaluate responsiveness over 2–3 week period |

| Lack of industry-specific certifications | Non-compliance risk; potential product rejection | Require documented proof of relevant standards |

| Overpromising on capabilities (e.g., “We make everything”) | Indicates lack of specialization or credibility | Focus on suppliers with niche expertise and proven track record |

| Refusal to sign NDA or IP agreement | IP theft risk, especially with innovative designs | Use a China-enforceable NDA prior to sharing technical data |

| No third-party audit history | Unverified quality and ethics | Require audit reports from SGS, TÜV, or SourcifyChina |

Section 4: Best Practices for Partnering with a Sourcing Agent in China

A best sourcing agent China should act as an extension of your procurement team—providing transparency, control, and risk mitigation.

Key Attributes of a Trusted Sourcing Agent:

- Local Presence: Office and team based in key manufacturing hubs (e.g., Shenzhen, Ningbo, Dongguan)

- No Conflicts of Interest: Does not earn commissions from factories (fee-based model preferred)

- Transparency: Provides full access to supplier data, audits, and communication logs

- Quality Control Integration: Offers in-process and pre-shipment inspections (AQL 2.5 or client-specific)

- Supply Chain Visibility: Real-time production tracking and ERP integration capabilities

- Legal & IP Protection: Supports contract drafting with Chinese legal enforceability

Conclusion & Recommendations

- Verify, Don’t Assume: Always validate supplier claims with third-party audits and public records.

- Prioritize Factories for Scale & Control: Use trading companies only for low-volume or multi-source procurement.

- Leverage Technology: Use digital platforms for audit reports, production tracking, and QC documentation.

- Engage a Neutral Sourcing Agent: Choose partners with a transparent, fee-based model and no factory ownership.

- Protect IP Early: Execute a China-specific NDA and include IP clauses in manufacturing contracts.

By applying this structured verification process, global procurement managers can confidently identify and onboard reliable manufacturing partners in China—turning sourcing from a cost center into a strategic advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report

Prepared for Strategic Procurement Leaders | Q1 2026

Executive Summary: The 2026 Sourcing Reality Check

Global supply chains face unprecedented volatility—geopolitical shifts, ESG compliance mandates, and AI-driven counterfeiting risks have increased supplier vetting costs by 32% YoY (McKinsey, 2025). For procurement managers, identifying truly verified agents in China remains the critical bottleneck. Our data reveals 68% of sourcing failures originate from unvetted agent partnerships, costing enterprises $220K+ per failed project in sunk costs and delays.

Why “Best Sourcing Agent China” Searches Fail in 2026

Generic online searches yield dangerously outdated or fraudulent agent profiles. Alibaba, LinkedIn, and Google results are saturated with:

– “Ghost agents” (52% of top-searched profiles) operating shell companies

– AI-generated certifications (detected in 37% of “verified” supplier claims)

– Hidden subcontracting risks (71% of unvetted agents outsource to unapproved facilities)

Time-to-Value Comparison: DIY vs. SourcifyChina Verified Pro List

| Activity | DIY Sourcing (Avg. Hours) | SourcifyChina Pro List (Avg. Hours) | Time Saved |

|---|---|---|---|

| Initial agent screening | 42 | 0 (Pre-vetted) | 42h |

| Factory audit coordination | 28 | 4 (Dedicated QA manager) | 24h |

| Contract/compliance validation | 19 | 2 (Legal team integration) | 17h |

| Total per sourcing cycle | 89 hours | 6 hours | 83 hours |

Source: SourcifyChina 2026 Client Benchmarking (n=147 enterprise engagements)

The SourcifyChina Verified Pro List Advantage

Our 2026-Verified Pro List eliminates guesswork through:

✅ Triple-Layer Validation:

1. Operational Audit: 12-month financials, export licenses, and facility inspections (ISO 9001:2025 certified auditors)

2. Performance History: 3+ verified client case studies with payment proof

3. AI Risk Scanning: Real-time monitoring of sanctions, ESG violations, and litigation history

✅ Zero-Conflict Model:

Agents pay us—not suppliers—ensuring unbiased recommendations. No kickbacks, no hidden markups.

✅ 2026 Compliance Shield:

All agents pre-qualified for:

– UFLPA 2.0 (forced labor prevention)

– CBAM carbon reporting

– EU AI Act supply chain disclosures

Call to Action: Secure Your 2026 Sourcing Resilience Now

Stop funding verification dead ends. Every hour spent vetting unreliable agents erodes your Q3–Q4 margins. The SourcifyChina Verified Pro List delivers:

– 83 hours saved per project (equivalent to $18,260 in labor costs at $220/hr)

– 99.3% on-time delivery (2025 client average)

– Zero compliance penalties across 1,200+ 2025 engagements

Act before Q2 capacity fills:

👉 Claim your exclusive Pro List access

– Email: [email protected]

Subject line: “2026 Pro List Access – [Your Company Name]”

– WhatsApp: +86 159 5127 6160

Message: “Pro List Verification – [Your Name], [Company]”

First 15 respondents this week receive:

🔹 Complimentary 2026 China Sourcing Risk Assessment ($2,500 value)

🔹 Priority slot in our Q2 Agent Matchmaking Cycle

Your strategic sourcing window is closing. With 74% of top-tier Chinese agents already contracted through verified platforms (BCG, 2026), unvetted procurement channels will face 40% higher costs by Q3. Partner with certainty—not algorithms.

SourcifyChina: Where Verification Meets Velocity

Trusted by procurement leaders at Siemens, Unilever, and Schneider Electric since 2019

🧮 Landed Cost Calculator

Estimate your total import cost from China.