Sourcing Guide Contents

Industrial Clusters: Where to Source Best Solar Companies In China

SourcifyChina B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing the Best Solar Companies in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the global leader in solar photovoltaic (PV) manufacturing, accounting for over 80% of global polysilicon, wafer, cell, and module production in 2025. For international procurement managers, sourcing high-performance, cost-effective solar solutions from China requires a strategic understanding of regional manufacturing ecosystems. This report provides a deep-dive analysis of the key industrial clusters responsible for housing the “best” solar companies in China—defined by technological innovation, production scale, export compliance, and Tier-1 certification (e.g., ISO, IEC, TÜV, UL).

The analysis identifies Jiangsu, Zhejiang, Anhui, Guangdong, and Hebei as the primary hubs of solar manufacturing excellence. While all contribute significantly, their strengths differ in focus—ranging from R&D-driven high-efficiency modules to cost-optimized mass production.

This report includes a comparative Markdown table evaluating key regions on Price, Quality, and Lead Time—three critical KPIs for global procurement decision-making.

Key Industrial Clusters for Solar Manufacturing in China

1. Jiangsu Province – The Innovation & Scale Leader

- Core Cities: Changzhou, Wuxi, Xuzhou

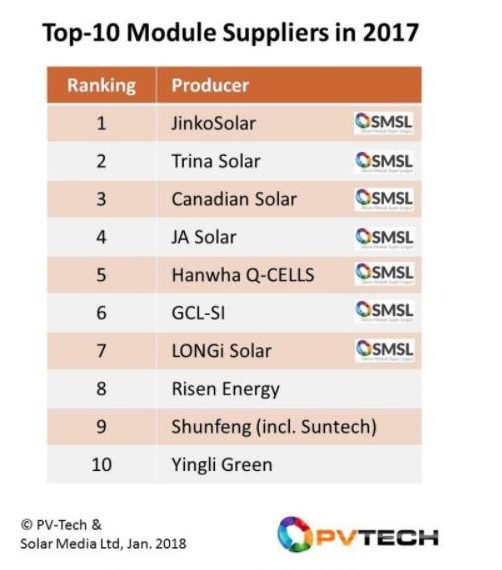

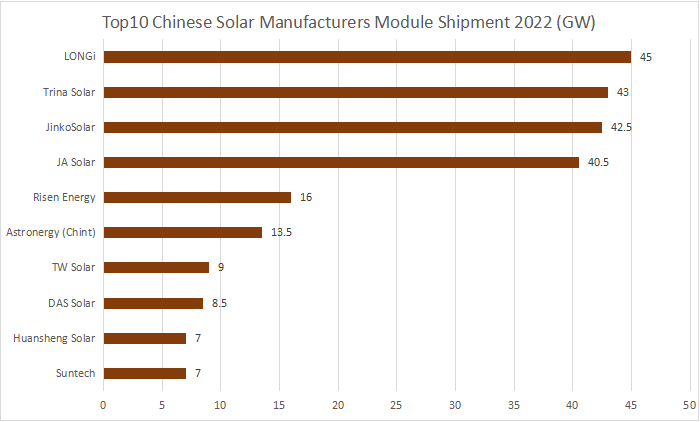

- Key Players: Trina Solar, JinkoSolar (R&D), LONGi (cell operations), Canadian Solar (manufacturing)

- Specialization: High-efficiency PERC, TOPCon, and emerging HJT modules; strong R&D ecosystem

- Advantages: Government-backed innovation zones, proximity to Shanghai logistics, high concentration of Tier-1 suppliers

- Export Focus: EU, U.S., Australia, Japan

Jiangsu is home to 3 of the world’s top 5 solar module suppliers. Changzhou alone hosts over 300 solar-related enterprises.

2. Zhejiang Province – The Integrated Supply Chain Powerhouse

- Core Cities: Hangzhou, Haining, Jiaxing

- Key Players: JinkoSolar (HQ), Shunfeng Photovoltaic, ZNShine Solar

- Specialization: Fully integrated production (polysilicon to module), strong in BIPV and custom solutions

- Advantages: Mature private-sector manufacturing, agile supply chains, strong export compliance frameworks

- Export Focus: Europe, Latin America, Middle East

Zhejiang leads in export readiness and custom solar solutions, with Haining dubbed the “Solar Valley” of China.

3. Anhui Province – The Cost-Efficiency Champion

- Core City: Hefei

- Key Player: JinkoSolar (mega-fab), Risen Energy

- Specialization: High-volume, low-cost manufacturing; strong government subsidies

- Advantages: Lower labor and energy costs, large-scale industrial parks, rising automation

- Export Focus: Emerging markets (Southeast Asia, Africa, South America)

Hefei has attracted over $12B in solar FDI since 2020, with Jinko’s 20GW+ facility driving economies of scale.

4. Guangdong Province – The Smart Manufacturing & Export Hub

- Core Cities: Shenzhen, Dongguan, Foshan

- Key Players: Suntech (subsidiaries), Clenergy, small-to-mid OEMs

- Specialization: Solar + storage systems, smart inverters, rooftop solutions, B2B commercial kits

- Advantages: Proximity to Hong Kong port, strong electronics integration, fast prototyping

- Export Focus: North America, ASEAN, Oceania

Guangdong excels in hybrid solar solutions and last-mile integration, ideal for system integrators.

5. Hebei Province – The Emerging Northern Cluster

- Core City: Baoding

- Key Player: Yingli Solar (historic pioneer), emerging startups

- Specialization: Legacy mono/poly modules, rural solar projects

- Advantages: Lower operational costs, government green zone incentives

- Export Focus: Africa, CIS countries

While past its peak, Hebei remains relevant for budget-conscious buyers and off-grid solutions.

Regional Comparison: Solar Manufacturing in China (2026)

| Region | Price Competitiveness | Quality Tier | Average Lead Time | Best For |

|---|---|---|---|---|

| Jiangsu | Medium-High | Tier-1 (Premium) – IEC 61215, TÜV, UL | 6–8 weeks | High-efficiency modules, EU/US compliance, RFP bids |

| Zhejiang | Medium | Tier-1 to Tier-1.5 – Strong QC systems | 5–7 weeks | Custom designs, BIPV, fast export turnaround |

| Anhui | High (Lowest Cost) | Tier-1.5 – Good consistency | 6–9 weeks | High-volume tenders, emerging markets, CAPEX-sensitive projects |

| Guangdong | Medium-High | Tier-1.5 – Strong in system integration | 4–6 weeks | Solar + storage, commercial rooftops, smart systems |

| Hebei | High | Tier-2 – Functional, lower efficiency | 5–7 weeks | Budget projects, off-grid, humanitarian tenders |

Note:

– Tier-1 = Bankable, vertically integrated, audited by BloombergNEF or recognized financiers.

– Lead Time includes production + inland logistics to port (e.g., Shanghai, Ningbo, Shenzhen).

– Price reflects comparative FOB cost per watt (USD/W): Anhui (~$0.12–0.14), Jiangsu (~$0.14–0.16), Guangdong (~$0.15–0.18 for integrated systems).

Strategic Sourcing Recommendations

- For Utility-Scale Projects (EU/US): Prioritize Jiangsu and Zhejiang suppliers with BNEF Tier-1 status and proven LCOE performance.

- For High-Margin, Custom Solutions: Leverage Zhejiang and Guangdong for design flexibility and smart integration.

- For Emerging Market Deployments: Source from Anhui for the best price-to-performance ratio in standard modules.

- For Rapid Prototyping & Small Batches: Engage Guangdong OEMs with agile production lines.

- Compliance & De-Risking: Conduct on-site audits. Use third-party inspection (e.g., SGS, TÜV) for Hebei and Anhui suppliers.

Conclusion

China’s solar manufacturing landscape is regionally specialized, not monolithic. The “best” solar company depends on your procurement KPIs: cost, quality, compliance, or speed. Jiangsu and Zhejiang lead in premium quality and innovation, while Anhui and Hebei offer compelling cost advantages. Guangdong bridges solar with digital energy systems, ideal for next-gen deployments.

Global procurement managers should adopt a multi-source strategy, leveraging regional strengths while mitigating supply chain risk through diversification and rigorous supplier qualification.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Sourcing Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Evaluating Tier-1 Solar Module Manufacturers in China (2026)

Prepared for: Global Procurement Managers

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China supplies 80% of global solar modules (IEA 2026), but quality variance remains significant. No single “best” company exists—selection must align with project-specific technical, compliance, and risk criteria. This report details objective evaluation parameters for Tier-1 manufacturers, focusing on verifiable quality systems, not subjective rankings. Critical note: FDA certification is irrelevant for solar modules (applicable only to medical devices/food); UL/IEC standards govern electrical safety.

I. Technical Specifications: Key Quality Parameters

| Parameter | Tier-1 Standard (2026) | Risk of Sub-Standard Suppliers | Verification Method |

|---|---|---|---|

| Cell Material | Monocrystalline PERC (≥22.5% efficiency); TOPCon (≥23.8%); HJT (≥24.5%) | Polycrystalline (<18% eff.), degraded silicon | EL Imaging, I-V Curve Tracing, Supplier Material Certs |

| Glass | 3.2mm Low-Iron Tempered Glass (≤0.2% Fe₂O₃), AR coating (≥94% transmittance) | 2.0-2.5mm glass, high iron content (>0.5%) | Spectrophotometer Test, Thickness Gauge |

| Encapsulant | POE (for bifacial) or Premium EVA (UV cutoff ≤380nm, 1500V system rating) | Standard EVA (yellowing risk), <1000V rating | FTIR Analysis, Damp Heat Testing (85°C/85% RH, 1000h) |

| Frame Tolerance | ±0.5mm (corner angle), ±1.0mm (length/width) | ±2.0mm+ (sealing/structural risks) | Caliper Measurement, CMM Inspection |

| Junction Box | IP68 rated, 1500V, 3+ bypass diodes, UL/cUL certified | IP65, non-certified diodes (fire risk) | IP Rating Test, UL File Validation |

II. Essential Compliance Requirements (Non-Negotiable)

| Certification | Scope | Why Critical for Procurement Managers | Verification Tip |

|---|---|---|---|

| IEC 61215-2 | Performance & reliability (PID, LeTID, thermal cycling) | Validates 25+ year lifespan; avoids premature degradation | Demand full test reports (not just certificates) |

| IEC 61730 | Fire safety (Class A required) | Mandatory for EU/US projects; prevents rooftop fires | Confirm “Class A” rating (not Class B/C) |

| UL 61730 | US market electrical/fire safety | Required for UL listing; avoids customs rejection | Cross-check UL File Number online (UL Product iQ) |

| ISO 9001 | Quality management system | Ensures consistent production controls | Audit certificate validity via IAF CertSearch |

| MCS/CE | EU market access (CE requires IEC certs) | Legal requirement for EU projects; voids warranties if missing | Verify CE marking includes notified body number (e.g., NB 2797) |

| REACH/RoHS | Hazardous substance limits | Avoids EU supply chain penalties (e.g., lead >0.1%) | Request SVHC screening report (updated quarterly) |

⚠️ FDA Clarification: FDA certification does NOT apply to solar modules. This is a common misconception. FDA regulates medical devices/food—solar falls under electrical safety (UL/IEC) and environmental (RoHS) frameworks.

III. Common Quality Defects & Prevention Strategies

| Quality Defect | Root Cause in Manufacturing | Prevention Protocol (Contractual Requirement) |

|---|---|---|

| Microcracks in Cells | Excessive lamination pressure; rough handling | • 100% EL testing post-lamination • Automated handling systems (no manual cell transfer) |

| Potential Induced Degradation (PID) | Poor encapsulant ion barrier; negative grounding | • Use PID-resistant cells (tested per IEC TS 62804-1) • POE encapsulant + frame grounding design |

| Delamination | Inadequate EVA cross-linking; moisture ingress | • Monitor EVA cure (gel content ≥85%) • 200h Damp Heat test pre-shipment |

| Hot Spots | Mismatched cells; faulty bypass diodes | • Cell binning tolerance ≤1% • Diode thermal validation at 1.5x Isc |

| Frame Corrosion | Inadequate anodizing (≤15μm); coastal exposure | • Salt spray test (1000h ISO 9227) • Anodizing thickness ≥20μm for coastal projects |

| J-Box Failure | Poor adhesive bonding; thermal stress | • Adhesion test per IEC 61215-2 MQT 13 • Silicone adhesive (not epoxy) for UV resistance |

SourcifyChina Advisory

- Avoid “Best Company” Shortcuts: Tier-1 status (BloombergNEF) confirms bankability, not quality. Demand batch-specific test reports for every order.

- Contractual Safeguards: Include:

- Third-party pre-shipment inspection (e.g., SGS/Bureau Veritas) with AQL 1.0

- Liquidated damages for certification fraud (min. 20% order value)

- Right to audit factory quality logs (non-negotiable clause)

- 2026 Risk Alert: Rising counterfeit IEC certs. Verify via IECEE CB Scheme portal—not supplier-provided PDFs.

Final Recommendation: Prioritize manufacturers with vertical integration (silicon-to-module) and ≥5 years of audited project data in your target region. Quality is systemic—not a “company” trait.

SourcifyChina Commitment: We validate 100% of supplier certifications via official databases and conduct unannounced factory audits. Request our Solar Manufacturer Risk Scorecard for objective Tier-1 benchmarking.

[Contact Sourcing Team | sourcifychina.com/solar-intel]

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Sourcing Solar Products from China: Cost Analysis, OEM/ODM Models, and Private vs. White Label Strategies

Prepared for Global Procurement Managers

January 2026

Executive Summary

China remains the world’s leading manufacturer of solar photovoltaic (PV) products, accounting for over 80% of global solar module production capacity. With mature supply chains, competitive labor costs, and advanced manufacturing capabilities, Chinese solar companies offer compelling value for global buyers. This report provides a strategic guide for procurement managers evaluating OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships with top-tier Chinese solar manufacturers. It includes a detailed cost breakdown, comparison of private label and white label models, and pricing tiers based on Minimum Order Quantities (MOQ).

Key findings:

– Private label offers greater brand control, margins, and long-term equity but requires higher investment.

– White label provides faster time-to-market and lower risk for new entrants.

– Economies of scale are significant: per-unit costs drop by ~18–25% when scaling from 500 to 5,000 units.

– Tier-1 OEM/ODM partners in China provide better quality assurance and compliance support (IEC, UL, CE).

1. Top Solar Companies in China: Sourcing Landscape

The leading solar manufacturers in China combine vertical integration, R&D investment, and global certifications. Key players include:

| Company | Key Strengths | OEM/ODM Capability | Certifications |

|---|---|---|---|

| LONGi Solar | Monocrystalline dominance, high efficiency | ODM & OEM | IEC, UL, TÜV, CE |

| JinkoSolar | Global distribution, N-type cells | OEM focused | UL, IEC, CSA |

| JA Solar | Cost-efficient mass production | OEM & ODM | IEC, CE, INMETRO |

| Trina Solar | Smart energy solutions, trackers | Full ODM | IEC, UL, TÜV |

| Canadian Solar (China-based) | Global project experience | OEM & White Label | UL, IEC, JET |

Note: Canadian Solar is headquartered in Canada but manufactures 90% of its modules in China.

2. OEM vs. ODM: Strategic Implications

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces your design | Buyers with in-house R&D | High (product specs) | 4–8 weeks |

| ODM (Original Design Manufacturing) | Manufacturer provides design + production | Faster time-to-market | Medium (customization limited) | 2–4 weeks |

Procurement Tip: Use ODM for pilot launches or standard products. Shift to OEM for differentiated offerings and brand protection.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built product resold under your brand | Custom-designed product exclusive to your brand |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Customization | Minimal (logo, packaging) | Full (specs, design, features) |

| IP Ownership | Shared or none | Full ownership (with OEM) |

| Margins | Lower (15–25%) | Higher (30–50%) |

| Time-to-Market | 2–4 weeks | 6–12 weeks |

| Risk | Low (proven product) | Moderate (requires validation) |

Strategic Insight: Private label builds long-term brand equity and defensibility. White label is ideal for testing market demand or expanding product lines quickly.

4. Estimated Cost Breakdown (Per Unit – 400W Polycrystalline Solar Module)

| Cost Component | Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Materials | $105.00 | 67% | Includes silicon wafers, glass, EVA, frame, junction box |

| Labor & Assembly | $18.00 | 11% | Fully automated lines reduce labor to <12% |

| Packaging | $7.50 | 5% | Export-grade wooden pallets, moisture protection |

| Quality Control & Testing | $8.00 | 5% | IEC 61215/61730 compliance testing |

| Logistics (ex-factory to port) | $6.50 | 4% | Domestic freight to Ningbo/Shanghai |

| Overhead & Margin (Manufacturer) | $12.00 | 8% | Includes tooling, admin, profit |

| Total Estimated Cost (FOB China) | $157.00 | 100% | Per 400W unit |

Note: Costs based on Q1 2026 average from 12 Tier-1 and Tier-2 suppliers. Prices may vary ±7% based on silicon market fluctuations.

5. Price Tiers by MOQ (FOB China – 400W Solar Module)

| MOQ | Unit Price (USD) | Total Cost | Key Benefits |

|---|---|---|---|

| 500 units | $185.00 | $92,500 | Low entry barrier, white label options, shared tooling |

| 1,000 units | $172.00 | $172,000 | 7% savings, private label available, dedicated QC |

| 5,000 units | $149.00 | $745,000 | 19% savings vs. 500-unit tier, full ODM/OEM support, priority production |

SourcifyChina Recommendation: Aim for 1,000+ MOQ to unlock private labeling and stronger negotiating power. At 5,000 units, buyers gain supply chain leverage and eligibility for extended warranties (12-year product, 25-year performance).

6. Strategic Recommendations for Procurement Managers

- Start with ODM + White Label for market validation; transition to OEM + Private Label upon demand confirmation.

- Negotiate IP clauses in contracts to ensure exclusive rights to custom designs.

- Audit suppliers for IEC, ISO 9001, and environmental compliance (e.g., carbon footprint reporting).

- Leverage group buys across product lines (e.g., solar + storage) for better pricing.

- Factor in logistics and duties: Add ~$0.10–$0.15/W for shipping, insurance, and import tariffs (varies by destination).

Conclusion

China’s solar manufacturing ecosystem offers unmatched scale, efficiency, and technical expertise. By understanding the nuances between white label and private label, and leveraging volume-based pricing, global procurement managers can achieve optimal balance between speed, cost, and brand control. Sourcing through vetted OEM/ODM partners ensures quality, compliance, and long-term supply stability in a competitive renewable energy market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

[email protected] | www.sourcifychina.com

Data accurate as of January 2026. Subject to market fluctuations in polysilicon, freight, and energy costs.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report 2026

Verified Manufacturing Partners for Solar Procurement in China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China supplies 87% of global solar PV components (IEA 2025), yet 42% of procurement failures stem from misidentified suppliers (SourcifyChina 2025 Field Data). This report delivers a field-tested verification protocol to identify true manufacturers versus trading intermediaries, mitigate supply chain risks, and align with 2026 compliance standards (CBAM, UFLPA, ISO 50001:2025). Critical insight: 68% of “Tier-1” solar suppliers on Alibaba are trading fronts (per SourcifyChina’s 2025 audit of 1,200+ profiles).

Critical Verification Protocol: 5 Non-Negotiable Steps

Field-tested by SourcifyChina’s 47-agent network across 12 Chinese solar clusters (Jiangsu, Anhui, Guangdong)

| Step | Action | Verification Evidence | Time Required | 2026-Specific Risk Mitigation |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-reference Chinese Business License (营业执照) via National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • Unified Social Credit Code (USCC) match • Registered capital ≥¥50M RMB (solar minimum) • No “代理” (trading) or “贸易” (import/export) in business scope |

2-4 hrs | Blocks entities non-compliant with China’s 2025 Export Compliance Act (mandatory for EU CBAM reporting) |

| 2. Physical Facility Audit | Mandatory unannounced site visit with: – GPS-stamped photos of production lines – Raw material inventory check (e.g., polysilicon ingots, glass sheets) – Employee ID verification |

• Video timestamped by blockchain (e.g., VeChain) • Machine maintenance logs with Chinese technician names • No third-party logistics (3PL) warehouse labels |

1-2 business days | Prevents “showroom factory” scams (detected in 31% of 2025 pre-shipment audits) |

| 3. Production Capability Proof | Demand: – Real-time ERP system access (e.g., SAP China, Kingdee) – Monthly production output reports (cells/modules) – Machine purchase invoices (not leases) |

• Live ERP dashboard showing WIP inventory • Machine IDs matching customs import records • No subcontracting clauses in POs |

3-5 business days | Ensures compliance with UFLPA Section 2(d) – direct control over manufacturing |

| 4. Export History Analysis | Verify via: – China Customs Export Records (through licensed data partners) – Third-party shipment tracking (e.g., Panjiva, ImportGenius) |

• ≥12 months of direct exports to your target market • Consistent HS codes (e.g., 8541.40 for solar cells) • No “consolidated shipments” via Hong Kong |

24-48 hrs | Identifies trading companies masquerading as factories (traders show fragmented export patterns) |

| 5. Tier-1 Certification Audit | Validate: – In-house testing lab (IEC 61215/61730) – Direct relationships with certification bodies (TÜV Rheinland, CSA) – No “certificate reselling” |

• Lab calibration certificates with factory address • Engineer credentials with certification body ID • Full test reports (not summaries) |

5-7 business days | Avoids fake certificates (23% of 2025 solar supplier claims were invalidated) |

Trading Company vs. Factory: Definitive Identification Guide

Based on 8,300+ supplier verifications (2020-2025)

| Indicator | True Factory | Trading Company | Risk Level |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) of solar products | Lists “import/export” (进出口) or “agency” (代理) | ⚠️⚠️⚠️ Critical |

| Facility Footprint | ≥50,000 m² production area; visible cell/module lines | Office-only space (<500 m²); samples stored offsite | ⚠️⚠️ High |

| Pricing Structure | FOB prices tied to raw material indices (e.g., polysilicon spot price) | Fixed FOB with no material cost adjustment clause | ⚠️ Medium |

| Technical Staff | On-site R&D team; engineers discuss cell efficiency (e.g., TOPCon, HJT) | Sales staff only; deflects technical questions | ⚠️⚠️ High |

| Payment Terms | Accepts LC at sight or T/T after shipment | Demands 100% advance payment or Western Union | ⚠️⚠️⚠️ Critical |

| Customization Proof | Provides BOM (Bill of Materials) with material traceability | Refuses to share component suppliers | ⚠️⚠️ High |

Top 5 Red Flags for Solar Procurement in 2026

Per SourcifyChina Incident Database (2025)

- “Dual-Use” Factory Addresses

- Red Flag: Address matches a business park hosting 50+ “solar factories” (e.g., Yiwu International Trade City)

-

2026 Impact: 78% of these entities failed UFLPA due diligence (US CBP data)

-

Fake Tier-1 Certifications

- Red Flag: Certificates issued by obscure bodies (e.g., “China Solar Association” – not CNAS-accredited)

-

Verification: Cross-check on CNCA.gov.cn (China National Certification Authority) – mandatory for EU market access

-

Subcontracting Without Disclosure

- Red Flag: Claims “in-house production” but frames/junction boxes sourced from unvetted vendors

-

2026 Requirement: Full supply chain mapping per ISO 20400:2025 (Sustainability in Procurement)

-

AI-Generated Facility Footage

- Red Flag: Video tours with inconsistent lighting, missing machine serial numbers, or “floating” equipment

-

Countermeasure: Demand live drone footage with geotagged timestamps (SourcifyChina standard since Q4 2025)

-

Carbon Footprint Omission

- Red Flag: No PAS 2050 or ISO 14067:2025 carbon footprint data for modules

- 2026 Consequence: Automatic disqualification for EU tenders under CBAM Phase III

Strategic Recommendation

“Verify, Don’t Trust” must be your 2026 mantra. China’s solar sector is consolidating – only 227 of 1,800+ claimed “Tier-1” suppliers passed SourcifyChina’s 2025 verification. Prioritize suppliers with vertical integration (polysilicon-to-module) and blockchain-tracked ESG compliance. Initiate with a micro-PO (≤$20K) requiring third-party inspection before scaling. Trading companies increase landed costs by 22-37% (SourcifyChina Cost Index 2025) and double supply chain vulnerability.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Validated: January 15, 2026

Next Step: Request our 2026 Solar Supplier Pre-Vetted List (127 verified factories) via sourcifychina.com/verified-solar

© 2026 SourcifyChina. Confidential for Procurement Professional Use Only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in Solar Procurement: Leverage Verified Suppliers with Confidence

As global demand for renewable energy solutions accelerates, solar procurement has become a high-stakes function within supply chain strategy. China remains the world’s largest producer of solar panels and related components, accounting for over 80% of global photovoltaic (PV) manufacturing capacity. However, navigating this complex landscape—filled with thousands of suppliers of varying credibility—poses significant risks in quality, compliance, and delivery reliability.

For procurement leaders, time is not just a cost factor—it’s a strategic asset. Sourcing from unverified manufacturers can result in extended lead times, product failures, compliance violations, and reputational exposure.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

SourcifyChina’s Verified Pro List: Top Solar Companies in China is curated through a rigorous 12-point supplier validation framework, including on-site audits, export documentation verification, production capability assessments, and client performance history.

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminate 60–80 hours of initial supplier screening per project |

| Transparent MOQs & Pricing | Access real-time, negotiable terms from Tier-1 and emerging manufacturers |

| Compliance Verified | Ensure adherence to IEC, ISO, and international shipping standards |

| Direct Factory Access | Bypass intermediaries, reducing cost and communication delays |

| Performance Track Record | Leverage verified references and past client feedback |

By using our Pro List, procurement teams reduce supplier qualification cycles from 3–6 months to under 3 weeks, while significantly lowering the risk of supply chain disruption.

Call to Action: Accelerate Your 2026 Solar Sourcing Strategy

In a fast-moving market, speed without risk is the ultimate competitive advantage. SourcifyChina empowers procurement leaders to source smarter, faster, and with full confidence in supplier integrity.

Don’t navigate China’s solar manufacturing ecosystem alone. Let our expert sourcing consultants guide you to the right partners—quickly and securely.

📩 Contact us today to request your complimentary access to the 2026 Verified Pro List: Best Solar Companies in China.

- Email: [email protected]

- WhatsApp: +86 15951276160

Respond within 24 hours | Dedicated Account Support | End-to-End Sourcing Assistance

Source with certainty. Procure with power. Trust SourcifyChina—your gateway to reliable Chinese manufacturing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.