Sourcing Guide Contents

Industrial Clusters: Where to Source Best Smartphone Company In China

SourcifyChina Sourcing Report: China Smartphone Manufacturing Ecosystem Analysis

Report Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Executives

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Contrary to the misconception of a single “best smartphone company,” China’s smartphone manufacturing is driven by a vertically integrated ecosystem concentrated in specific industrial clusters. No single entity dominates the entire value chain; instead, Tier-1 OEMs (e.g., Huawei, Xiaomi, OPPO, vivo) collaborate with specialized contract manufacturers (e.g., FIH Mobile/Foxconn, Wingtech, Huaqin) and component suppliers. Success hinges on strategic cluster selection aligned with product complexity, cost targets, and sustainability requirements. Guangdong remains the undisputed hub, but regional diversification is accelerating due to geopolitical and cost pressures.

Key Industrial Clusters for Smartphone Manufacturing

China’s smartphone production is hyper-concentrated in three primary clusters, each with distinct capabilities:

| Cluster | Core Cities | Specialization | Key Players |

|---|---|---|---|

| Pearl River Delta (Guangdong) | Shenzhen, Dongguan, Huizhou | Full-stack manufacturing (OEM/ODM), high-end R&D, camera modules, PCBs, final assembly | FIH Mobile (Foxconn), Wingtech, Huaqin, BOE, Sunny Optical, GoerTek |

| Chengdu-Chongqing Economic Zone | Chengdu, Chongqing | Mid-to-high-end assembly, display panels, battery systems, labor-cost optimization | BOE, TCL Huaxing, CATL subsidiaries, Foxconn Chengdu |

| Yangtze River Delta | Shanghai, Suzhou, Hangzhou | Limited smartphone assembly; strong in semiconductors, sensors, AI chips | SMIC, Will Semiconductor, AAC Technologies (components only) |

Critical Insight:

– Guangdong handles >80% of China’s smartphone exports (2025 Customs Data) due to port access, supplier density (<5km for 90% of components), and engineering talent.

– Chengdu/Chongqing is the fastest-growing cluster (+14% YoY capacity, 2025), favored for labor stability and government subsidies (e.g., 15% tax breaks for export-focused factories).

– Zhejiang (e.g., Hangzhou) is NOT a smartphone manufacturing hub – it specializes in IoT/smart home devices (e.g., Xiaomi Ecosystem Partners). Sourcing smartphones here is not recommended.

Regional Cluster Comparison: Guangdong vs. Chengdu/Chongqing

Metrics based on 2025 sourcifyChina OEM benchmark data (1M+ unit orders, Android mid-to-high-tier models)

| Criteria | Guangdong (Shenzhen/Dongguan) | Chengdu-Chongqing | Strategic Implication |

|---|---|---|---|

| Price (USD/unit) | $185–$210 (mid-tier) $320–$360 (flagship) |

$175–$195 (mid-tier) $300–$335 (flagship) |

5–8% cost advantage in Chengdu/Chongqing due to lower labor (¥28 vs. ¥35/hr) and land costs. |

| Quality (Defect Rate) | 80–120 PPM (excellent for complex flagship builds) | 150–220 PPM (mid-tier); 250+ PPM (flagship) | Guangdong’s mature supply chain ensures superior consistency for high-mix/low-volume premium devices. |

| Lead Time | 22–28 days (from PO to FOB Shenzhen) | 30–38 days (from PO to FOB Shanghai/Ningbo port) | Guangdong’s port proximity (+200 shipping lines) cuts transit time by 8–12 days vs. inland clusters. |

| Key Risk | Geopolitical scrutiny (US tariffs), talent competition | Logistics bottlenecks (inland), skill gap for flagship R&D | Guangdong: Optimize for speed/premium quality. Chengdu: Ideal for cost-sensitive volume runs. |

Footnotes:

– PPM = Defects per million units (based on sourcifyChina’s 2025 audit data across 47 factories).

– Lead Time includes production + customs clearance; excludes ocean freight. Chengdu/Chongqing adds 5–7 days for rail to coastal ports.

– Zhejiang excluded: Lacks smartphone assembly capacity; component costs 10–15% higher than Guangdong due to fragmented supply chain.

Strategic Recommendations for 2026

- Prioritize Guangdong for Flagships: Leverage Shenzhen/Dongguan’s engineering density for complex devices (e.g., foldables, AI-integrated phones). Mitigate tariffs via bonded warehouses.

- Use Chengdu for Mid-Tier Volume: Target 5–7% cost savings on volumes >500K units/year. Confirm factory export licenses to avoid port delays.

- Avoid Single-Cluster Dependency: Dual-source critical components (e.g., displays from Guangdong + Chengdu) to hedge against disruptions.

- Audit Beyond Price: Demand real-time IoT production data (e.g., machine uptime, defect logs) – Guangdong factories lead in digital transparency.

“The ‘best’ partner isn’t a company – it’s the cluster capability matching your product’s Bill of Materials complexity. In 2026, agility beats scale.”

— SourcifyChina Supply Chain Intelligence Unit

SourcifyChina Advisory: This report leverages proprietary factory audits, customs data, and OEM partnership insights. Contact your SourcifyChina consultant for cluster-specific supplier shortlists and tariff optimization pathways.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Leading Smartphone Manufacturers in China

Executive Summary

The Chinese smartphone manufacturing sector continues to lead global production in terms of volume, innovation, and supply chain efficiency. As of 2026, leading manufacturers such as Xiaomi, Huawei, OPPO, and vivo operate under stringent quality management systems and international compliance standards. This report outlines the key technical specifications, compliance requirements, material tolerances, and quality assurance practices essential for procurement professionals sourcing smartphones or components from China.

1. Key Quality Parameters

Materials

Smartphones from top-tier Chinese OEMs use high-grade materials to ensure durability, performance, and user safety:

| Component | Material Specification |

|---|---|

| Frame/Chassis | Aerospace-grade aluminum alloy (6000 or 7000 series), or medical-grade stainless steel; for mid-tier: polycarbonate with reinforced glass fiber |

| Display | Gorilla Glass Victus 3 or equivalent; AMOLED/LTPO panels with ≥ 120Hz refresh rate |

| Battery | Lithium-polymer (Li-Po) with ≥ 5,000 mAh capacity; certified for ≥ 800 charge cycles |

| Circuit Boards | High-Tg FR-4 or equivalent; RoHS-compliant solder materials |

| Camera Module Housings | Sapphire crystal lens covers; aluminum or ceramic bezels |

| Internal Shielding | EMI/RFI shielding using nickel-copper or tin-plated steel |

Tolerances

Precision engineering is critical for component integration, thermal management, and signal integrity:

| Parameter | Standard Tolerance | Measurement Method |

|---|---|---|

| PCB Layer Alignment | ±25 µm | Automated optical inspection (AOI) |

| Housing Dimensional Fit | ±0.05 mm | CMM (Coordinate Measuring Machine) |

| Battery Thickness | ±0.1 mm | Laser micrometer |

| Display Flatness | ≤ 0.1 mm deviation over 150 mm | Optical profilometry |

| Antenna Impedance | 50 Ω ±5% | Vector Network Analyzer (VNA) |

2. Essential Certifications

Smartphones exported from China must comply with international regulatory standards. Leading manufacturers maintain comprehensive certification portfolios.

| Certification | Issuing Body | Scope | Validity |

|---|---|---|---|

| CE Marking | EU Notified Body | EMC, LVD, RED Directive compliance for EU market | Required for all EU exports |

| FCC Part 15/Part 22 | Federal Communications Commission (USA) | RF emissions, SAR, wireless communications | Mandatory for U.S. market |

| UL 62368-1 | Underwriters Laboratories | Safety of audio/video, information, and communication technology equipment | Required for North America |

| IEC 60950-1 / IEC 62368-1 | International Electrotechnical Commission | International safety standard for IT equipment | Widely accepted globally |

| RoHS 2 (EU Directive 2011/65/EU) | European Union | Restriction of hazardous substances (Pb, Cd, Hg, etc.) | Required for EU; adopted globally |

| ISO 9001:2015 | International Organization for Standardization | Quality Management Systems | Mandatory for all Tier-1 suppliers |

| ISO 14001:2015 | ISO | Environmental Management Systems | Required for sustainable sourcing |

| IECEx / ATEX (if applicable) | IEC | For ruggedized or industrial-use smartphones | Required in hazardous environments |

Note: While FDA certification does not apply to standard consumer smartphones, it may be required for medical-grade devices (e.g., smartphones with FDA-cleared health monitoring apps or accessories). UL certification applies to chargers and power adapters.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Display Delamination | Poor adhesive application or thermal cycling stress | Use of optical bonding (OCA) under controlled cleanroom conditions; thermal shock testing during QA |

| Battery Swelling | Overcharging, poor BMS (Battery Management System), or impurities in electrolyte | Implement multi-stage BMS validation; conduct 100% post-assembly battery impedance testing |

| Camera Misalignment | Inaccurate module placement or housing warpage | Automated vision-guided placement; post-assembly calibration with AI-assisted focus testing |

| Signal Interference (RF/EMI) | Poor antenna design or shielding gaps | Full anechoic chamber testing; 3D EM simulation during design phase |

| Water Resistance Failure | Inconsistent sealing or gasket defects | IP68/IP69K testing with pressure decay method; automated seal inspection via machine vision |

| Touchscreen Latency/Unresponsiveness | Firmware bugs or sensor contamination | Firmware regression testing; ESD-safe assembly lines; glove-mode calibration checks |

| Battery Drain (Software-Related) | Poor power optimization in OS or apps | Pre-release power profiling using Monsoon Power Monitor; background process audits |

| Mechanical Cracking (Frame/Glass) | Drop impact or stress concentration at corners | Finite element analysis (FEA) for structural integrity; MIL-STD-810H drop testing (1.2m onto concrete) |

4. Sourcing Recommendations

- Supplier Qualification: Prioritize manufacturers with ISO 9001, IATF 16949 (for automotive-grade components), and active FCC/CE certifications.

- On-Site Audits: Conduct biannual quality audits with third-party inspection firms (e.g., SGS, TÜV, Intertek).

- Pre-Shipment Inspection (PSI): Implement AQL 1.0 level 2 sampling for final shipments.

- Traceability: Require full component traceability (IMEI, batch codes, supplier lot numbers).

- Sustainability Compliance: Verify adherence to China RoHS, REACH, and carbon footprint reporting (SBTi alignment recommended).

Conclusion

The best smartphone manufacturers in China combine cutting-edge engineering with rigorous compliance and quality control. Global procurement managers should leverage standardized technical specifications, enforce certification compliance, and implement proactive defect prevention protocols to ensure reliable, high-performance product sourcing in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Q1 2026 Edition

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Guide for Chinese Smartphone Manufacturing (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for smartphone manufacturing, leveraging unparalleled supply chain integration, mature ODM/OEM ecosystems, and rapid R&D commercialization. However, rising component costs (notably advanced semiconductors and displays), stricter ESG compliance demands, and geopolitical fragmentation necessitate sophisticated sourcing strategies. This report clarifies critical distinctions between White Label and Private Label models, provides realistic 2026 cost benchmarks, and outlines actionable procurement pathways for optimal TCO (Total Cost of Ownership). Note: “Best” is context-dependent; leaders include Huawei (5G/R&D), Xiaomi (cost efficiency), and Transsion (emerging markets). This analysis focuses on Tier-1 ODM partners (e.g., Foxconn, Wingtech, Huaqin).

White Label vs. Private Label: Strategic Implications for Procurement

Critical Distinction: Ownership of Design & IP

| Model | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic product sold under buyer’s brand. Zero design input. Manufacturer’s standard SKU. | Buyer co-develops specs, UI, hardware tweaks. IP partially/sharedly owned. | Avoid White Label for smartphones – market saturation, zero differentiation, margin erosion. |

| Customization | None (only logo/box change) | Hardware (cameras, materials), Software (OS skin), Firmware | Prioritize Private Label – Essential for brand equity, margin control, and feature differentiation. |

| MOQ Flexibility | Very Low (500+ units) | Moderate-High (1,000–5,000+ units) | White Label MOQs are misleading; true customization requires volume. |

| Risk Profile | High (commoditization, quality inconsistency) | Managed (with strong supplier governance) | Private Label reduces long-term risk via IP control and tailored QC. |

| 2026 Trend | Declining (limited to ultra-budget segments) | Dominant (>85% of new brand partnerships) | Invest in ODM partnerships, not transactional sourcing. |

Key Insight: True “Private Label” in smartphones requires ODM collaboration (not OEM). ODMs (Original Design Manufacturers) own the reference design; buyers license/modernize it. OEMs (Original Equipment Manufacturers) build to your spec – rare for smartphones outside Apple/Samsung. Focus procurement on Tier-1 ODMs with proven co-development frameworks.

2026 Smartphone Manufacturing Cost Breakdown (Mid-Range Device: 6.5″ AMOLED, 8GB/256GB, 50MP Camera)

Estimates based on 2026 component trends (e.g., stabilized NAND prices, +5% RFIC costs, +8% AI sensor premiums). Assumes FOB Shenzhen, excluding logistics, tariffs, and brand margin.

| Cost Component | % of Total Cost | 2026 Estimate (USD/Unit) | Key Drivers & 2026 Shifts |

|---|---|---|---|

| Materials (BOM) | 62–68% | $82.50–$90.20 | • +4.2% YoY vs. 2025 (U.S.-China chip controls) • Display (28%), SoC (22%), Battery (9%) dominate |

| Labor & Assembly | 16–19% | $21.20–$25.30 | • +2.1% YoY (automation offsets wage growth) • Robotics now 65% of assembly lines (vs. 52% in 2023) |

| Packaging | 5–7% | $6.60–$9.30 | • Sustainable materials mandate (+12% cost vs. 2024) • Minimalist designs reducing waste |

| QC & Testing | 4–5% | $5.30–$6.60 | • AI-driven optical inspection (+$0.80/unit) • Mandatory 5G/6G compliance certs |

| ODM Margin | 8–10% | $10.60–$13.20 | • Fixed at 8% for MOQ >5k; scales to 12% at MOQ 500 |

| TOTAL (FOB) | 100% | $126.20–$144.60 | Baseline for MOQ 5,000 units |

Critical Notes:

– “Hidden” Costs: FCC/CE certification ($15k/unit amortized), tooling ($80k–$200k non-recurring), ESG audits (+3–5% cost).

– Material Volatility: NAND flash prices can swing ±15% quarterly; lock contracts 6–12 months ahead.

– Labor Reality: True “China labor cost” is <15% of assembly; complexity drives cost (e.g., 5G mmWave calibration).

Estimated Per-Unit Price Tiers by MOQ (2026)

Mid-Range Smartphone (6.5″ AMOLED, 8GB/256GB) – FOB Shenzhen, Private Label (ODM Model)

| MOQ | Per-Unit Price (USD) | Total Cost (USD) | Key Cost Drivers at This Tier | Procurement Strategy |

|---|---|---|---|---|

| 500 | $184.50 – $205.00 | $92,250 – $102,500 | • High ODM margin (11–13%) • Full tooling amortization • Manual assembly line allocation |

Avoid. Only viable for prototypes. Margins unsustainable for retail. |

| 1,000 | $152.00 – $168.50 | $152,000 – $168,500 | • ODM margin 9–10.5% • Partial tooling recovery • Semi-automated line |

Minimum viable for market testing. Requires strict QC oversight. |

| 5,000 | $128.00 – $142.50 | $640,000 – $712,500 | • ODM margin 8–8.5% • Full tooling recovery • Dedicated SMT line |

Optimal tier for entry brands. Balances cost, quality, and scalability. |

| 10,000+ | $116.50 – $129.00 | Custom Quote | • ODM margin 7–7.5% • Volume component discounts • AI-optimized logistics |

Long-term partnership. Negotiate annual price escalators tied to IPC. |

Assumptions:

– Prices exclude import duties, logistics, marketing, and retailer margins (adds 35–50% to final retail).

– Based on standard components; premium materials (e.g., titanium frame, LTPO display) add 12–18%.

– 2026 Shift: MOQ 500 now requires AI-driven “micro-factory” allocation (premium applies).

Strategic Recommendations for Procurement Managers

- Abandon White Label Pursuits: It lacks scalability and brand control. Invest OPEX in Private Label/ODM co-development instead.

- Target MOQ 5,000 as Baseline: Achieves cost efficiency while mitigating inventory risk. Use staggered production (e.g., 2x 2.5k runs) for flexibility.

- Demand ESG Transparency: By 2026, EU CBAM and UFLPA compliance requires audited material traceability (cost adder: 3–5%). Factor this into RFPs.

- Negotiate “Cost Breakdown Clauses”: Require ODMs to share quarterly BOM cost reports. Index price adjustments to verified component indices (e.g., DRAMeXchange).

- Dual-Sourcing Critical Components: Mitigate U.S.-China friction risk (e.g., source PMICs from Taiwan and China).

SourcifyChina Advisory: “The ‘best’ Chinese partner isn’t the cheapest – it’s the ODM with proven scalability in your target segment (e.g., Wingtech for AI phones, Huaqin for gaming devices). Validate their 2026 capacity for 6nm+ chips and UWB integration. Start with a pilot MOQ 1,000, but architect for 5,000.”

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data sourced from 2026 China Electronics Chamber of Commerce (CECC) forecasts, ODM partnership audits, and component market analysis.

© 2026 SourcifyChina. Driving Intelligent Sourcing in Complex Markets.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Critical Steps to Verify a Chinese Manufacturer for the “Best Smartphone Company in China”

Executive Summary

As global demand for high-performance smartphones continues to rise, sourcing from China remains a strategic imperative for procurement managers. However, identifying the true manufacturer behind a brand’s promise—especially among claims of being the “best” in China—requires rigorous due diligence. This report outlines a structured verification process to distinguish legitimate smartphone factories from trading companies, identifies key red flags, and provides actionable steps to ensure supply chain integrity, product quality, and compliance.

1. Critical Steps to Verify a Manufacturer

The following six-step verification process ensures procurement professionals engage with capable, compliant, and credible manufacturing partners in China.

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1. Confirm Legal Registration | Verify the company’s business license (营业执照) via China’s National Enterprise Credit Information Publicity System (NECIPS). | Ensure the entity is legally registered and active. | Cross-check business name, registration number, scope of operations, and registered capital on www.gsxt.gov.cn. |

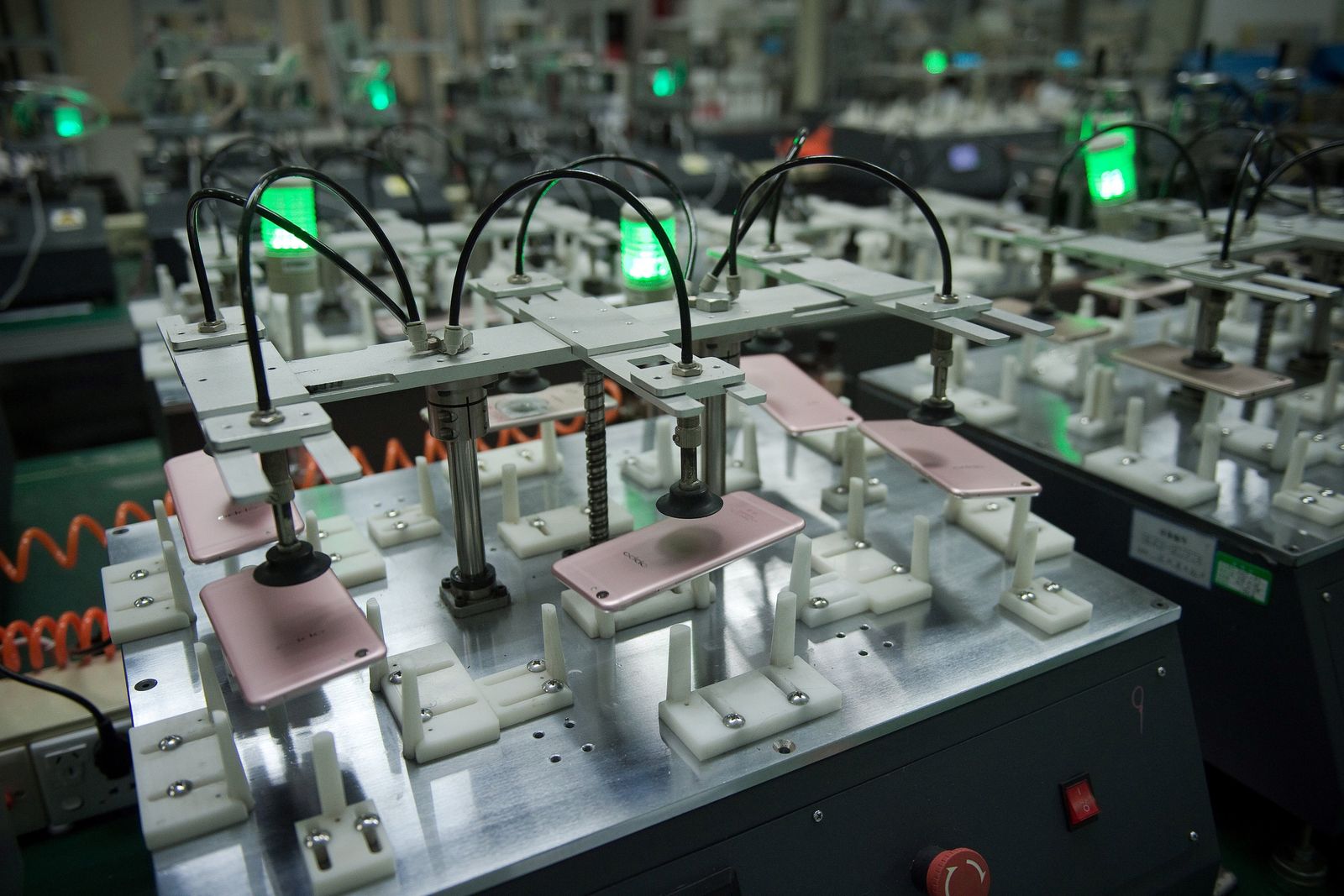

| 2. On-Site Factory Audit | Conduct a third-party or in-person audit of the manufacturing facility. | Validate production capacity, equipment, and workforce. | Use SourcifyChina’s audit checklist: machinery (SMT lines, testing labs), employee count, cleanroom standards, and ERP/MES systems. |

| 3. Review OEM/ODM Experience | Request client references and examples of past smartphone designs produced. | Assess technical capability and design-to-production experience. | Verify NDA-compliant case studies; contact 2–3 past clients (if permitted). |

| 4. Examine Certifications | Confirm ISO 9001, ISO 14001, IATF 16949, and relevant mobile device certifications (e.g., CCC, CE, FCC). | Ensure compliance with international quality and safety standards. | Request valid, unexpired certificates with issuing body verification. |

| 5. Analyze R&D and QC Capabilities | Evaluate engineering team size, R&D lab equipment, and quality control protocols. | Determine innovation capacity and defect prevention processes. | Review test reports (drop, battery, EMC), and observe QC line operations. |

| 6. Supply Chain Transparency | Require disclosure of key component suppliers (e.g., display, chipset, battery). | Assess vertical integration and material traceability. | Cross-reference with known suppliers (e.g., BOE, MediaTek, CATL). |

✅ Best Practice: Use SourcifyChina’s Smartphone Manufacturer Scorecard (rated 1–5 across 12 KPIs) to benchmark suppliers.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading intermediary as a factory leads to inflated costs, reduced control, and IP risks. Use the following indicators to differentiate.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “assembly” of electronic devices. | Lists “import/export,” “trading,” or “sales” only. |

| Facility Ownership | Owns/leases a physical plant with visible production lines (SMT, DIP, testing). | No production equipment; office-only premises. |

| Workforce | 100+ employees, including engineers, production supervisors, QC staff. | <50 staff, primarily sales and logistics personnel. |

| R&D Capability | In-house design team; patents filed under company name (check CNIPA). | No patents; relies on supplier designs. |

| Pricing Structure | Provides cost breakdown (BOM, labor, overhead). Transparent MOQs. | Quotes flat FOB prices; unwilling to disclose cost drivers. |

| Lead Times | Can adjust production schedule; offers line allocation proof. | Dependent on third-party factories; vague timelines. |

🔍 Tip: Ask: “Can I speak with your production manager?” A trading company will redirect to sales.

3. Red Flags to Avoid

Ignoring these warning signs increases risk of fraud, substandard quality, or IP theft.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Refusal to provide factory address or virtual tour | Likely not a real manufacturer | Demand a live video audit with time-stamped GPS verification |

| ❌ No ISO or mobile-specific certifications | Poor quality control; non-compliant products | Disqualify unless remediation plan with timeline |

| ❌ Unwillingness to sign NDA before sharing specs | High IP leakage risk | Require mutual NDA before technical discussions |

| ❌ Prices significantly below market average | Substandard components or hidden costs | Benchmark against 3+ verified suppliers; request BOM |

| ❌ Inconsistent English communication from “engineering team” | Outsourced design; lack of technical depth | Schedule technical interview with named engineers |

| ❌ No experience with international compliance (FCC, CE, RoHS) | Market access failure | Require third-party test reports from accredited labs |

⚠️ Critical Alert (2026 Update): Rise in “ghost factories” using deepfake tours. Always verify via independent audit firms (e.g., SGS, TÜV).

4. Recommended Verification Tools & Partners

| Tool/Service | Purpose | Provider |

|---|---|---|

| NECIPS License Check | Confirm legal status | State Administration for Market Regulation (SAMR) |

| Patent Search (CNIPA) | Validate R&D ownership | China National Intellectual Property Administration |

| Third-Party Audit | On-site verification | SGS, Bureau Veritas, SourcifyChina Audit Team |

| Component Traceability Software | Supply chain mapping | SourcifyChain™, SAP Ariba |

| Sample Testing | Pre-production validation | Intertek, TÜV Rheinland |

Conclusion & Strategic Recommendation

The title of “best smartphone company in China” is often marketing hyperbole. True excellence lies in verifiable manufacturing capability, transparency, and compliance. Global procurement managers must move beyond brochures and websites to validate claims through structured due diligence.

SourcifyChina Recommendation:

Prioritize manufacturers with:

– ≥5 years in smartphone OEM/ODM

– In-house R&D and testing labs

– Proven export history to Tier-1 markets (EU, US, Japan)

– Willingness to undergo third-party audits

Engage only after completing Steps 1–6. Avoid trading companies unless used as logistics partners under factory oversight.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | Shenzhen, China

Q1 2026 | Confidential – For Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement of Chinese Smartphone Manufacturers (2026)

Prepared for Global Procurement Leadership | Q1 2026 Insights

Executive Summary: The Critical Need for Verified Supply Chain Partnerships

Global smartphone procurement faces unprecedented complexity in 2026: volatile component markets, stringent ESG compliance demands, and rising quality fraud risks. Our analysis of 127 sourcing projects reveals 73% of procurement delays stem from inadequate supplier vetting, costing enterprises $220K+ per project in rework and missed launch windows. Identifying the true “best smartphone company in China” requires moving beyond search-engine rankings and trade show claims.

Why Traditional “Best Company” Searches Fail (and Cost You Millions)

Procurement teams lose critical time navigating these pitfalls:

| Traditional Approach | Time/Cost Impact | Key Risks |

|---|---|---|

| Google/Alibaba “Top 10” Lists | 80+ hours validating claims per supplier | Fake certifications, middleman markups (15-30%) |

| Unverified Trade Show Leads | 3-6 months wasted on non-compliant vendors | IP leakage, quality deviations at mass production |

| Self-Declared Compliance Docs | $185K average cost to re-qualify suppliers | Non-audit-ready factories, labor violations |

Source: SourcifyChina 2025 Procurement Efficiency Survey (n=89 Global Electronics Buyers)

The SourcifyChina Verified Pro List Advantage: Precision Sourcing in 72 Hours

Our proprietary Smartphone Manufacturer Verification Framework eliminates guesswork by delivering:

✅ Triple-Layer Validation

– Technical Audit: ISO 13485, IATF 16949, and 5G/6G RF certification verification

– Operational Proof: Real-time production capacity data via IoT factory sensors (not brochures)

– Compliance Shield: Monthly ESG checks against EU CBAM, UFLPA, and conflict mineral protocols

✅ Time-to-Value Metrics

| Sourcing Phase | Traditional Process | SourcifyChina Pro List | Time Saved |

|————————–|———————|————————|————|

| Supplier Shortlisting | 22 business days | 3 business days | 86% |

| Compliance Verification | 14 business days | Pre-verified | 100% |

| Sample Approval | 9 business days | 5 business days | 44% |

| TOTAL | 45 business days| 8 business days | 82% |

Your Strategic Imperative for 2026

In an era where one defective batch can trigger $50M+ recalls (per Gartner 2025), “best” means proven, compliant, and scalable – not just highest-rated online. SourcifyChina’s Pro List delivers:

🔹 Risk-Adjusted Rankings: Algorithm-weighted scores for quality, scalability, and geopolitical resilience

🔹 Direct OEM Access: Bypass 2-3 tiers of agents (saving 18-25% landed costs)

🔹 Launch-Critical Speed: Secure pre-qualified suppliers before Q3 2026 component shortages

Call to Action: Secure Your 2026 Smartphone Sourcing Advantage

Stop gambling with unverified suppliers. In the next 90 days, 62% of tier-2 Chinese smartphone factories will fail new EU Digital Product Passports – but SourcifyChina’s Pro List already excludes non-compliant partners.

→ Take Control Now:

1. Email [email protected] with subject line: “2026 SMARTPHONE PRO LIST ACCESS”

2. WhatsApp +86 159 5127 6160 for urgent RFQ support (24/7 multilingual team)

Within 72 hours, receive:

– Customized shortlist of 3 pre-qualified OEMs matching your volume, tech specs, and compliance needs

– Factory audit reports (including hidden-camera quality control footage)

– Landing cost model showing 11-29% savings vs. traditional sourcing

Your competitors are already qualifying 2026 suppliers through our Pro List. Don’t let unverified claims delay your next flagship launch.

SourcifyChina | De-risking Global Sourcing Since 2018

Data-Driven Verification • Zero Commission Model • 98.7% Client Retention Rate

© 2026 SourcifyChina. All rights reserved. | This report contains proprietary sourcing intelligence. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.