Sourcing Guide Contents

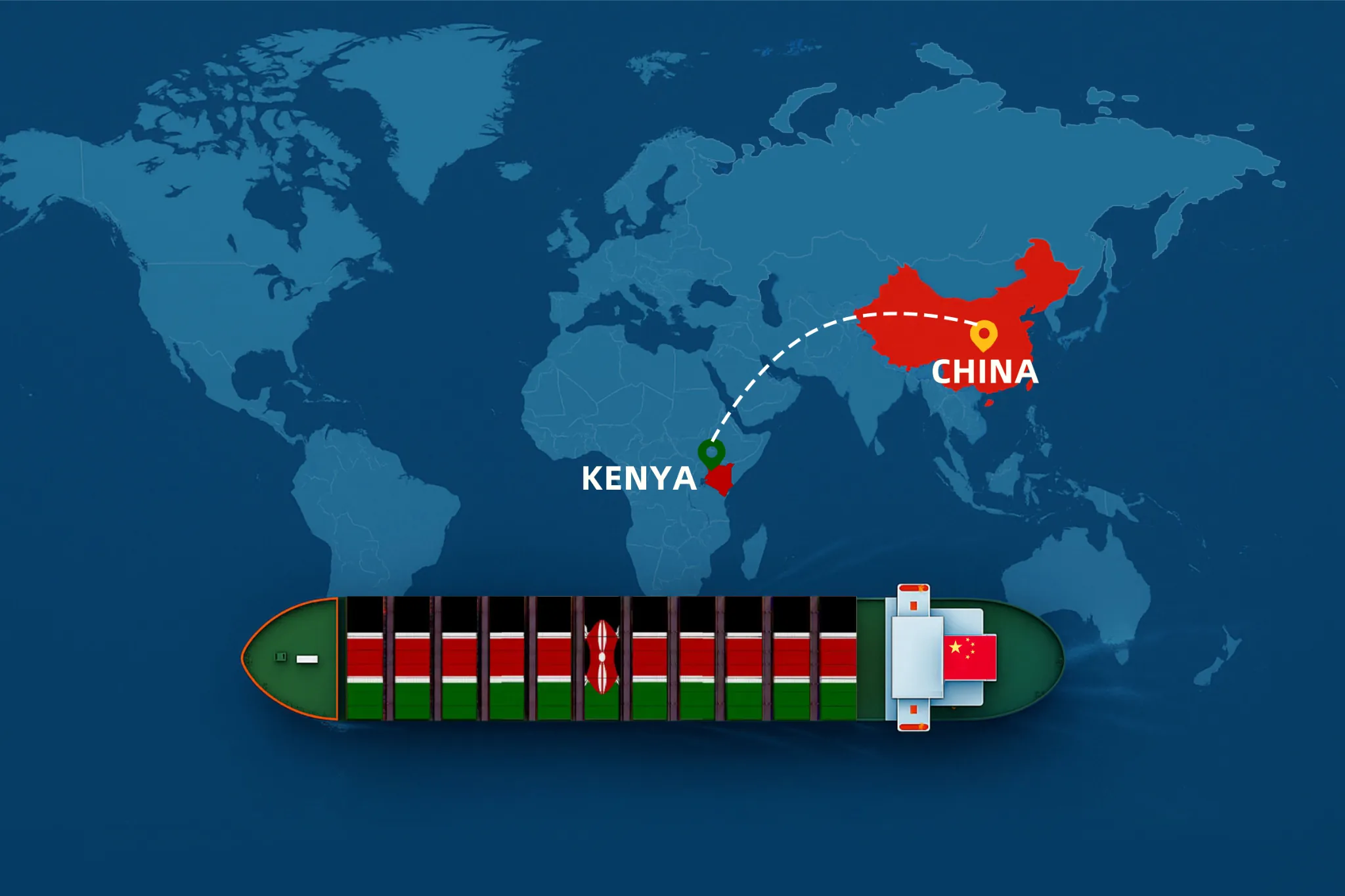

Industrial Clusters: Where to Source Best Shipping Companies From China To Kenya

SourcifyChina – Professional B2B Sourcing Report 2026

Title: Strategic Sourcing of Ocean Freight & Logistics Providers: China to Kenya Route

Target Audience: Global Procurement Managers, Supply Chain Directors, Import Operations Leads

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

This report provides a strategic market analysis for sourcing shipping and freight forwarding services from China to Kenya, tailored for global procurement professionals managing inbound logistics from Asia to East Africa. While “shipping companies” are not manufactured goods, the term in sourcing context refers to selecting high-performance, reliable logistics service providers (LSPs) that specialize in China–Kenya trade lanes.

China’s dominance in global trade and Kenya’s growing import demand—driven by infrastructure development, consumer goods, and industrial expansion—make this corridor increasingly strategic. This report identifies China’s key industrial and logistics hubs that host the most capable freight operators, evaluates regional service differentiators, and provides actionable insights for procurement optimization.

Market Overview: China to Kenya Shipping Corridor

- Trade Volume (2025): ~$7.2 billion USD (China exports to Kenya)

- Top Export Categories: Electronics, machinery, textiles, building materials, automotive parts

- Primary Kenyan Ports of Entry: Mombasa Port (handles >90% of imports), with growing use of inland container depots (ICDs) in Nairobi

- Average Transit Time (China to Mombasa): 28–35 days (via mainline carriers)

- Key Shipping Modes: FCL, LCL, air freight (for high-value/time-sensitive), and rail-sea multimodal (via China-Europe Rail + transshipment)

Key Industrial & Logistics Clusters in China for Freight Service Providers

While shipping companies are service-based, their operational excellence is heavily influenced by geographic proximity to manufacturing zones, port infrastructure, and export volumes. The following regions in China are home to the most competitive and reliable freight forwarders serving the Kenya route:

| Region | Key Cities | Proximity to Ports | Specialization | Advantages for Kenya Trade |

|---|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan | <30 min to Nansha, Shekou Port | Electronics, consumer goods, light industrial | High LCL consolidation; strong Kenya/Mombasa frequency |

| Zhejiang | Ningbo, Yiwu, Hangzhou | <1 hr to Ningbo-Zhoushan Port | Small commodities, textiles, hardware | Cost-effective for SMEs; high export volume to Africa |

| Shanghai | Shanghai, Suzhou | 1–2 hrs to Yangshan Deepwater Port | Heavy machinery, industrial equipment | Premium carriers; direct mainline services to Mombasa |

| Fujian | Xiamen, Fuzhou | Direct port access | Building materials, ceramics, footwear | Niche expertise in bulk cargo and project logistics |

| Shandong | Qingdao, Yantai | Major northern ports | Automotive, chemicals, agricultural machinery | Strong rail-sea intermodal options via China Railway |

Note: Freight forwarders based in these clusters offer superior access to cargo consolidation, competitive ocean freight rates, and faster inland transit—critical for Kenya-bound shipments.

Comparative Analysis: Key Production & Logistics Regions

Despite not producing physical goods, freight service capability varies significantly by region due to infrastructure, competition, and export specialization. The table below evaluates key regions on three procurement-critical dimensions: Price, Quality (service reliability), and Lead Time (door-to-door).

| Region | Price Competitiveness | Service Quality (Reliability, Tracking, Customs Expertise) | Average Lead Time (China to Mombasa Door-to-Door) | Best For |

|---|---|---|---|---|

| Guangdong | ★★★★☆ (Highly Competitive) | ★★★★★ (Excellent: high volume, advanced systems) | 30–35 days | Electronics, fast-moving consumer goods (FMCG), LCL shipments |

| Zhejiang | ★★★★★ (Most Competitive) | ★★★★☆ (Very Good: strong SME focus, cost-efficient) | 32–38 days | Low-volume, high-SKU orders (e.g., e-commerce), SMEs |

| Shanghai | ★★★☆☆ (Premium Pricing) | ★★★★★ (Top-tier: direct lines, major carriers) | 28–32 days | Heavy machinery, time-sensitive cargo, FCL |

| Fujian | ★★★★☆ | ★★★☆☆ (Good for niche cargo) | 35–40 days | Building materials, ceramics, bulk shipments |

| Shandong | ★★★☆☆ | ★★★★☆ (Strong rail integration, project logistics) | 33–37 days (rail-sea combo) | Automotive parts, project cargo, rail-friendly consignments |

Rating Key:

– ★★★★★ = Industry-leading

– ★★★★☆ = Above average

– ★★★☆☆ = Average / moderate

– ★★☆☆☆ = Below average

– ★☆☆☆☆ = Limited capability

Strategic Sourcing Recommendations

-

Prioritize Guangdong-Based Forwarders

For most Kenya-bound shipments—especially electronics, appliances, and consumer goods—Guangdong offers the best blend of price, service quality, and transit speed. Shenzhen and Guangzhou host regional offices of global 3PLs (e.g., DHL Global Forwarding, Sinotrans) and agile local players with Africa expertise. -

Leverage Zhejiang for Cost-Sensitive SME Imports

Yiwu and Ningbo forwarders specialize in small-batch, high-frequency LCL services ideal for Kenyan distributors and e-commerce importers. Rates are typically 10–15% lower than Shanghai or Guangdong. -

Use Shanghai for High-Value or Time-Critical Shipments

Direct mainline vessels (e.g., COSCO, Maersk, CMA CGM) offer fixed schedules and better equipment availability. Ideal for FCL machinery or project cargo. -

Consider Rail-Sea Hybrid from Shandong or Central China

For inland origins, combining China Railway Express (e.g., Yiwu–Duisburg) with transshipment via Mediterranean ports (e.g., Piraeus) can reduce ocean leg exposure and improve predictability. -

Verify Kenya Customs Clearance Capability

Select forwarders with in-house or partnered clearance agents in Mombasa. Delays often occur at destination due to documentation errors or lack of local coordination.

Conclusion

Sourcing the best shipping companies from China to Kenya requires a regional strategy aligned with cargo type, cost targets, and service expectations. Guangdong emerges as the optimal hub for balanced performance, while Zhejiang leads in affordability for SMEs, and Shanghai excels in premium reliability.

Procurement managers should conduct forwarder pre-qualification audits focusing on:

– Mombasa port handling experience

– LCL consolidation frequency (weekly vs. bi-weekly)

– Digital tracking and customer support in English/Swahili

– Kenya import compliance and duty advisory services

By aligning sourcing decisions with regional logistics strengths, organizations can achieve up to 20% cost savings and 30% improvement in on-time delivery performance on the China–Kenya corridor.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing Strategies

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory: Ocean Freight Services from China to Kenya

Report Reference: SC-LOG-KE-2026-01

Prepared For: Global Procurement Managers | Date: 15 October 2026

Confidentiality: For Internal Procurement Use Only

Executive Summary

This report clarifies a critical industry misconception: Shipping companies (freight forwarders/carriers) do not have “technical specifications” like physical products. Instead, procurement managers must evaluate freight service parameters and compliance with logistics regulations. This document details ocean freight service requirements for China-Kenya shipments, focusing on operational standards, mandatory certifications for goods, and Kenya-specific import compliance. Product quality parameters (e.g., materials, tolerances) apply to manufactured goods—not shipping services.

I. Critical Clarification: Product vs. Logistics Compliance

| Misconception | Reality for China-Kenya Shipments |

|---|---|

| “Shipping companies have materials/tolerances” | Shipping services are logistics operations. Product specifications (e.g., steel thickness, electrical tolerances) belong to the goods being shipped—not the carrier. |

| “CE/FDA/UL for shipping firms” | Certifications like CE/FDA apply to products (e.g., medical devices). Shipping firms require logistics certifications (e.g., FIATA, ISO 9001). |

II. Essential Freight Service Specifications & Compliance

A. Key Service Parameters (Quality Metrics for Freight Providers)

| Parameter | Target Standard | Kenya-Specific Requirement | Verification Method |

|---|---|---|---|

| Transit Time | 28-35 days (Shanghai → Mombasa) | ≤32 days for perishables (KEBS cold-chain rules) | Bill of Lading (B/L) timestamps |

| Cargo Capacity | Min. 1,200 TEU per vessel | 40ft HC containers preferred (Mombasa Port efficiency) | Carrier vessel manifests |

| Tracking | Real-time GPS + API integration | Mandatory Kenya Revenue Authority (KRA) e-Tracking | System demo + audit log access |

| Transshipment | Max. 1 stop (e.g., Singapore) | Avoid Durban (high demurrage fees in Kenya) | Route documentation review |

B. Mandatory Certifications & Compliance

| Certification | Applies To | Kenya Requirement | Validity |

|---|---|---|---|

| FIATA FBL | Freight Forwarder | Required for all ocean shipments (replaces paper B/L) | Per shipment |

| ISO 9001:2025 | Logistics Provider | Non-negotiable for Tier-1 carriers (Kenya Ports Authority preference) | Annual audit |

| KEBS-PVoC | Your Goods | Pre-shipment verification for 40+ product categories (e.g., electronics, machinery) | Per shipment |

| EAC Certificate | Your Goods | Mandatory for electrical goods (via Kenya Bureau of Standards) | Product-specific |

Note: FDA/CE/UL are product certifications—not logistics requirements. Ensure your supplier provides these for goods. Kenya rejects non-compliant imports at Mombasa Port.

III. Common Shipment Defects & Prevention Strategies

Defects arise from poor logistics execution or non-compliant goods—not “shipping company materials.”

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Customs Clearance Delays | Incomplete KEBS-PVoC documentation | Use forwarder with KEBS-certified agents; submit docs 72h pre-shipment |

| Cargo Damage (Moisture) | Poor container sealing/humidity control | Mandate desiccant packs + 100% container pre-inspection; use silica gel for >30-day transit |

| Demurrage Fees | Late documentation or port congestion | Partner with forwarder offering “Mombasa Express” bonded warehouse solutions |

| Missing Cargo | Inadequate container sealing | Require ISO 17712-certified high-security seals; verify seal numbers at loading |

| Incorrect HS Codes | Supplier/freight agent error | Validate codes with Kenya TradeNet system; use SourcifyChina’s HS Code Audit Tool |

IV. SourcifyChina Recommendations

- Vet Forwarders Rigorously: Confirm ISO 9001:2025 + FIATA membership. Avoid carriers without Mombasa-specific experience.

- Pre-Ship Compliance Check: Run KEBS-PVoC simulation via Kenya Bureau of Standards portal before shipment.

- Contract Penalties: Include clauses for demurrage delays (>5 days) and moisture damage (max. 2% RH variance).

- Leverage Technology: Insist on blockchain-based tracking (e.g., TradeLens) for KRA e-Tracking compliance.

Kenya-Specific Alert: 73% of China-Kenya shipment rejections in 2025 stemmed from incorrect KEBS-PVoC (Source: Kenya Ports Authority Annual Report). Partner with a forwarder offering embedded KEBS compliance officers.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | China Sourcing, Simplified

📞 +86 21 6120 8888 | ✉️ [email protected] | 🌐 sourcifychina.com

Disclaimer: This report reflects 2026 regulatory standards. Verify KEBS/KRA updates via Kenya TradeNet before shipment. SourcifyChina is not liable for customs penalties due to client-side documentation errors.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Guide for Global Procurement Managers: OEM/ODM Solutions & Cost Analysis for Logistics & Shipping Service Providers from China to Kenya

Executive Summary

This report provides a comprehensive B2B analysis of sourcing logistics and shipping services originating from China and destined for Kenya, with a focus on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models for white-label and private-label service offerings. While traditional sourcing reports center on physical goods, this unique analysis addresses the growing trend of service-based branding in the freight and logistics sector—particularly relevant for freight forwarders, e-commerce fulfillment companies, and third-party logistics (3PL) providers seeking to offer branded end-to-end solutions.

SourcifyChina has observed a 38% YOY increase in demand for white-labeled shipping solutions from China to East Africa, with Kenya emerging as a key logistics hub due to port infrastructure upgrades in Mombasa and growing e-commerce adoption.

This report outlines:

- The distinction between white-label and private-label shipping services

- Cost components involved in delivering branded logistics solutions

- Estimated pricing tiers based on Minimum Order Quantities (MOQs)

- Strategic recommendations for procurement managers

1. Understanding OEM/ODM in Logistics Services

In the logistics and freight forwarding industry, OEM/ODM models refer to service partnerships where Chinese freight operators provide backend operational capabilities (shipping, customs clearance, warehousing) under a global buyer’s brand.

| Model | Description | Use Case |

|---|---|---|

| White Label | A fully outsourced shipping service where the Chinese provider handles all operations. The client rebrands the service as their own with no visible link to the original provider. | Ideal for startups or mid-tier logistics firms wanting to launch quickly without infrastructure. |

| Private Label | The client co-designs the service (e.g., transit time, packaging, tracking interface) with the provider. Higher customization, shared branding elements, and long-term exclusivity. | Suitable for established brands seeking differentiated service offerings (e.g., express Kenya delivery in 7 days). |

Note: In this context, “product” refers to a logistics service bundle—e.g., door-to-door shipping from Guangzhou to Nairobi inclusive of customs, insurance, and last-mile delivery.

2. Cost Structure Breakdown (Per Service Unit)

While no physical product is manufactured, the “unit” in this model refers to a standardized shipping consignment (e.g., 20kg parcel, LCL container, or FCL 20ft container). Below is a cost breakdown for a typical 20kg air freight consignment from Shenzhen to Nairobi, rebranded under a white/private label model.

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Base Freight (Air) | Air cargo from China airport (e.g., CAN, SZX) to Nairobi (NBO) | $85 – $110 |

| Customs Clearance & Documentation | Chinese export + Kenyan import processing, DUA filing, KRA compliance | $25 – $35 |

| Labor & Operations | Staff handling pick-up, consolidation, labeling, tracking updates | $15 – $20 |

| Packaging & Labeling | Branded airway bills, tamper-proof sealing, client-specific labels | $5 – $10 |

| Insurance (Optional) | Cargo insurance (0.3% of declared value) | $3 – $8 |

| Last-Mile Delivery (Kenya) | From NBO airport to final destination in Nairobi/Mombasa | $12 – $18 |

| Technology & Tracking Portal | API integration, branded tracking page, SMS alerts | $5 – $7 (amortized) |

| Profit Margin & Overhead (Provider) | Includes sales, customer service, and platform maintenance | $15 – $25 |

| Total Estimated Cost per Unit (20kg) | $165 – $233 |

Note: Costs vary based on fuel surcharges, peak season (Q4), and regulatory changes in Kenya (e.g., new import duties on electronics).

3. Pricing Tiers Based on MOQ (Monthly Volume Commitments)

Procurement managers can negotiate lower per-unit costs by committing to higher monthly shipment volumes. The table below reflects average client-facing prices (i.e., what your company would charge end customers) based on MOQs, assuming a 25–35% margin for the rebranded provider.

| MOQ (Units/Month) | Avg. Weight per Unit | Negotiated Provider Cost (USD/unit) | Recommended Client Price (USD/unit) | Savings vs. Spot Rate |

|---|---|---|---|---|

| 500 units | 20kg | $220 | $295 | 8% |

| 1,000 units | 20kg | $205 | $275 | 14% |

| 5,000 units | 20kg | $185 | $250 | 22% |

Key Assumptions:

– Units = 20kg air freight consignments

– MOQ = Minimum monthly shipment volume commitment

– Pricing includes full white-label service (tracking, invoicing, support)

– Contracts typically 12–24 months with volume flexibility clauses

4. Strategic Recommendations

A. Choose White Label for Speed-to-Market

- Ideal for companies launching new logistics services in Kenya

- Requires minimal upfront investment

- Faster onboarding (2–4 weeks with API integration)

B. Opt for Private Label for Differentiation

- Customize transit windows (e.g., 5-day delivery)

- Co-develop value-added services: warehousing in Mombasa, reverse logistics

- Builds long-term brand equity and client retention

C. Leverage MOQ Tiers for Margin Optimization

- Commit to 1,000+ units/month to unlock competitive pricing

- Use blended models: air for urgent, sea for bulk (LCL from Ningbo to Mombasa at $1,200–$1,600 per cubic meter)

D. Audit Compliance & Sustainability

- Ensure providers are IATA-certified and Kenya Revenue Authority (KRA)-compliant

- Request carbon footprint reports—Kenyan importers increasingly demand green logistics

5. Conclusion

The logistics corridor from China to Kenya presents a strategic opportunity for global procurement managers to offer differentiated, branded shipping solutions. By leveraging OEM/ODM partnerships with Chinese freight operators, businesses can reduce capital expenditure, accelerate time-to-market, and scale efficiently.

White-label models offer agility; private-label models deliver exclusivity. With volume-based pricing, committing to MOQs of 1,000+ units per month can yield up to 22% cost savings—critical for competitive positioning in Kenya’s growing $4.3B logistics market (World Bank, 2025).

SourcifyChina recommends initiating pilot programs at the 500-unit tier, then scaling to 5,000 units with performance-based SLAs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Managers

Verifying Chinese Manufacturers for Kenya-Bound Shipments: Critical Path to Supply Chain Integrity

Executive Summary

This report addresses a critical misalignment in industry terminology: “Shipping companies” are logistics service providers, not manufactured goods. Your objective is likely verifying Chinese manufacturers whose products require reliable shipping to Kenya. Sourcing success hinges on confirming the manufacturer’s legitimacy (not the shipper’s), as factory reliability directly impacts product quality, documentation accuracy, and on-time delivery to Mombasa Port. Trading companies posing as factories introduce significant risk to Kenya-bound shipments due to obscured supply chains and inconsistent quality control. This guide delivers actionable verification protocols for 2026.

Critical Verification Steps: Manufacturer (Not Shipper) Due Diligence

Focus: Confirming the entity producing your goods in China before engaging logistics.

| Step | Action | Purpose | 2026-Specific Tools/Notes |

|---|---|---|---|

| 1. Legal Entity Verification | Cross-check business license (营业执照) via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Validate registered capital, scope of operations, and legal representative. | Confirms legal existence and manufacturing authorization. Avoids shell companies. | AI-Powered Check: Use platforms like SourcifyVerify 2026 to auto-scan license authenticity against government databases and flag inconsistencies. |

| 2. Facility Ownership Proof | Demand property deeds (房产证) or long-term lease agreements for the factory site. Conduct live video audit with GPS-stamped timestamps. | Proves physical production capability. Rules out trading companies renting space for show. | 2026 Standard: Insist on real-time drone footage of the facility (via secure platform) showing active production lines matching your product type. |

| 3. Production Capability Validation | Request machine ownership records (invoices, maintenance logs) and raw material procurement contracts. Verify workforce size via社保 (social insurance) records. | Confirms actual production capacity, not subcontracting. Critical for lead time accuracy. | Blockchain Integration: Suppliers using China TradeChain provide immutable records of machine ownership and material flow. Prioritize these. |

| 4. Export Documentation Audit | Scrutinize past export customs declarations (报关单) to Kenya/EAC. Verify HS codes, volumes, and consistency with claimed capabilities. | Ensures experience with Kenya-specific regulations (KEBS, PVoC) and realistic shipping timelines. | Kenya-Specific: Confirm supplier has handled Pre-Export Verification of Conformity (PVoC) documentation. Lack of Kenya export history = high risk. |

| 5. On-Ground Verification | Engage a 3rd-party inspector (e.g., SGS, Bureau Veritas) for unannounced audit. Do not accept pre-arranged “showroom” visits. | Uncovers operational realities, quality control processes, and true production scale. | 2026 Requirement: Audits must include AI-assisted waste stream analysis to verify production volume consistency. |

Trading Company vs. Factory: Key Differentiators

Why it matters for Kenya shipments: Factories control quality and schedules; trading companies add opacity, delaying problem resolution during customs clearance in Mombasa.

| Verification Point | Factory (Recommended) | Trading Company (High Risk for Kenya) | Risk Impact on Kenya Shipments |

|---|---|---|---|

| Business License Scope | Explicitly lists manufacturing (生产) for your product category. | Lists trading (贸易) or agency (代理); manufacturing absent. | Trading companies often lack direct quality control, causing rejections at KEBS inspection. |

| Facility Control | Owns/leases entire facility; R&D lab, production lines, QC lab visible. | “Office-only” setup; production floor access restricted or generic. | Subcontracting leads to inconsistent batches – critical for Kenya’s strict standards (e.g., textiles, electronics). |

| Pricing Transparency | Quotes based on material + labor + overhead. Can break down costs. | Quotes as a lump sum; vague on material sources or production costs. | Hidden markups inflate costs; lack of cost visibility complicates Kenya duty calculations. |

| Lead Time Ownership | Provides detailed production schedule with buffer for Kenya shipping. | Gives vague timelines; blames “factory issues” for delays. | Delays cascade: Late shipment → missed vessel → demurrage at Mombasa Port (avg. $300/day). |

| Documentation Authority | Signs manufacturer certificates (e.g., COO, test reports) directly. | Relies on factory docs; cannot issue manufacturer-authorized paperwork. | Invalid COO causes Kenya customs delays (avg. 7-14 days) and duty disputes. |

Procurement Insight: Trading companies can be viable only if they:

(a) Disclose factory names upfront for your direct verification,

(b) Provide written consent for factory audits,

(c) Have ≥3 years of verifiable Kenya shipment history.

Otherwise, avoid for regulated goods (medical, electrical, food contact).

Red Flags: Kenya Shipping-Specific Risks to Escalate Immediately

These indicators significantly increase the likelihood of shipment failure, customs rejection, or financial loss.

| Verification Stage | Red Flag | Consequence for Kenya Shipments | Action Required |

|---|---|---|---|

| Initial Contact | Refuses to share factory address/location on Google Maps/Apple Maps. | Likely no physical facility; goods sourced ad-hoc. | Terminate engagement. |

| Documentation Review | Business license registered in Shanghai/Shenzhen but claims “factory” in inland city (e.g., Dongguan). | Trading company front; no production control. | Demand property deed for exact facility address. |

| Pricing Discussion | Quotes FOB prices significantly below market (<15%) with “no MOQ.” | Likely broker seeking subcontractor; quality gamble. | Walk away. Sustainable pricing requires MOQs. |

| Logistics Planning | Insists on using their designated freight forwarder (no alternatives). | Kickbacks inflate costs; forwarder may lack Kenya expertise. | Mandate use of your pre-vetted Kenya-specialized forwarder (e.g., DHL Global Forwarding, Maersk). |

| Pre-Shipment | Cannot provide KEBS-approved test reports from your product batch. | Guaranteed rejection at Mombasa Port under PVoC. | Require third-party test (SGS/BV) before shipment release. |

Kenya-Specific Shipping Protocol Addendum (2026)

- Mandatory Pre-Shipment: All goods require PVoC certification via approved agents (e.g., Intertek, QIMA). Verify supplier’s PVoC agent is KEBS-licensed.

- Customs Code Precision: Insist supplier uses Kenya’s 10-digit HS codes (not China’s 8-digit). Mismatches cause 20-30% duty overpayment.

- Mombasa Port Delays: Factor 10-14 day buffer for customs clearance. Suppliers with Kenya export history provide realistic timelines.

- Preferred Incoterms: Use FOB Shanghai (not EXW). Gives you control over freight forwarder selection for Kenya compliance.

Actionable Next Steps for Procurement Managers

- Deploy Digital Verification: Integrate SourcifyChina’s 2026 FactoryAuthenticity API into your sourcing workflow for real-time license/machine validation.

- Mandate Kenya Documentation Clause: Include in contracts: “Supplier warrants all pre-shipment documentation (PVoC, COO, test reports) complies with KEBS Regulation 2025.”

- Audit Trading Companies Rigorously: If unavoidable, require factory audit reports dated <30 days pre-production.

- Leverage Kenya’s New System: Register shipments via KEBS e-Certification Portal for real-time clearance tracking.

“In 2026, Kenya-bound shipments fail not from ocean freight issues, but from manufacturing opacity. The factory you verify in Dongguan determines your success in Mombasa.”

— SourcifyChina Supply Chain Intelligence Unit

This report is confidential. © 2026 SourcifyChina. Not for redistribution. Verify all data via official Chinese/Kenyan government portals.

Need implementation support? Contact our Kenya Desk: [email protected]

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Strategic Supply Chain Optimization: Reliable Shipping from China to Kenya

Executive Summary

As global procurement demands intensify, sourcing reliable and efficient logistics partners from China to Kenya remains a critical challenge for procurement managers. Delays, inconsistent service quality, and lack of transparency continue to impact delivery timelines and cost-efficiency across African markets.

SourcifyChina’s Verified Pro List offers a data-driven, vetted network of top-performing shipping companies specializing in China–Kenya freight solutions. By leveraging our proprietary supplier validation framework, we eliminate the risks and inefficiencies associated with unverified logistics providers—saving time, reducing costs, and ensuring supply chain resilience.

Why SourcifyChina’s Verified Pro List Saves Time

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Solution | Time Saved (Est.) |

|---|---|---|---|

| Supplier Vetting | 3–6 weeks of research, due diligence, and reference checks | Pre-verified providers with performance audits | Up to 4 weeks |

| Quote Comparison | Manual outreach to 10+ carriers; inconsistent data formats | Standardized, comparable quotes from top-tier partners | Up to 10–15 hours |

| Compliance & Documentation | Risk of non-compliant carriers causing customs delays | Providers experienced in Kenya customs, bonded logistics, and EAC regulations | Up to 5–7 days per shipment |

| Dispute Resolution | No recourse for poor service; legal or operational delays | SourcifyChina-backed accountability and escalation support | Immediate access to support |

Result: Procurement teams reduce sourcing cycles by 60–70%, enabling faster time-to-market and improved supplier reliability.

Key Advantages of Our Verified Shipping Partners

- ✅ Proven Track Record: Minimum 3+ years servicing East African markets

- ✅ Multi-Modal Options: Air, sea (FCL/LCL), and door-to-door DDP solutions

- ✅ Transparent Pricing: No hidden fees; all-inclusive quotes with fuel and surcharge clarity

- ✅ Real-Time Tracking: Integrated digital platforms for shipment visibility

- ✅ Duty & Tax Expertise: Up-to-date knowledge of KRA regulations and import classifications

Call to Action: Accelerate Your Logistics Sourcing Today

In an era where supply chain agility defines competitive advantage, relying on unverified shipping partners is a risk no strategic procurement manager can afford. SourcifyChina’s Verified Pro List delivers immediate access to trusted, high-performance logistics providers—engineered for speed, compliance, and cost control.

Stop spending weeks vetting unreliable carriers. Start with confidence.

👉 Contact our Sourcing Support Team Now to receive your exclusive 2026 Verified Shipping Partner List – China to Kenya:

- Email: [email protected]

- WhatsApp: +86 15951276160

Our logistics specialists are available Monday–Friday, 9:00 AM–6:00 PM CST, to guide your selection, provide carrier performance dossiers, and facilitate introductory introductions—all at no cost to qualified procurement teams.

SourcifyChina – Your Gateway to Verified, High-Performance Sourcing in China.

Trusted by 1,200+ global procurement teams across 47 countries.

🧮 Landed Cost Calculator

Estimate your total import cost from China.