Sourcing Guide Contents

Industrial Clusters: Where to Source Best Electric Car Company In China

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing of Tier-1 Chinese Electric Vehicle Manufacturers (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory | Internal Use Only

Executive Summary

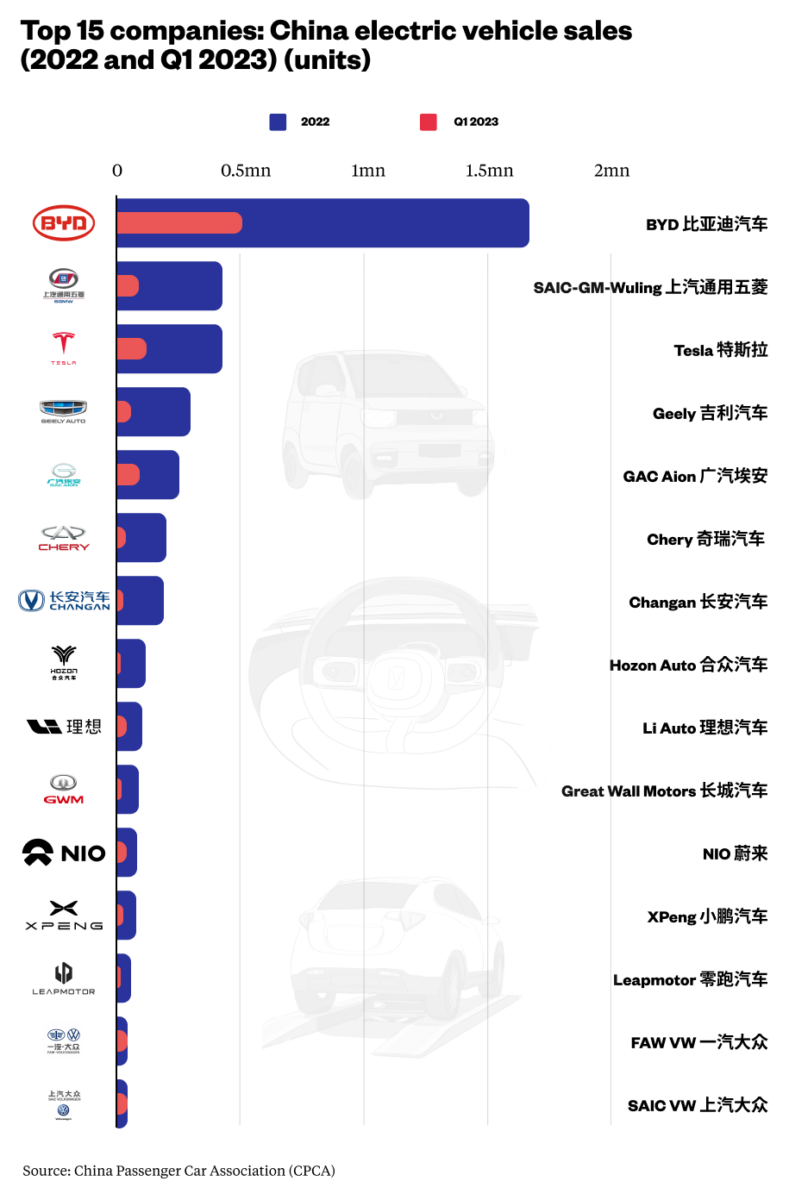

The Chinese EV market remains the world’s largest, accounting for 62% of global BEV/PHEV production in 2025. “Best” is context-dependent: BYD dominates volume/mid-market (2.8M units 2025), NIO/Li Auto lead premium segments, while XPeng excels in tech integration. Sourcing success hinges on aligning your specific requirements (volume, tech specs, budget) with regional manufacturing ecosystems. No single “best” company exists – optimal partners are determined by cluster specialization, supply chain maturity, and strategic fit. This report identifies key industrial clusters and provides actionable regional comparisons for OEM procurement decisions.

Key Industrial Clusters for EV Manufacturing in China (2026)

China’s EV production is concentrated in 4 core clusters, each with distinct competitive advantages:

| Cluster | Core Cities | Leading OEMs | Specialization | Supply Chain Density |

|---|---|---|---|---|

| Yangtze River Delta | Shanghai, Suzhou, Hefei | NIO, SAIC (MG), Tesla Shanghai, Li Auto | Premium BEVs, Autonomous Driving, R&D Hubs | ★★★★★ (Highest) |

| Pearl River Delta | Shenzhen, Guangzhou, Dongguan | BYD (HQ), XPeng, GAC Aion | Mass-Market BEVs/PHEVs, Battery Tech, Cost Efficiency | ★★★★☆ |

| Zhejiang Hub | Hangzhou, Ningbo, Wenzhou | Geely (Zeekr, Lotus), Jidu Auto | Mid-Premium BEVs, Smart Cockpits, Export Focus | ★★★★☆ |

| Central Corridor | Wuhan, Changsha, Chongqing | XPeng (Wuhan), Li Auto (Wuhan), Seres | Emerging Gigafactories, Cost-Optimized Volume | ★★★☆☆ |

Strategic Insight: Shanghai/Hefei (Yangtze Delta) is the undisputed R&D/innovation hub, while Shenzhen (Pearl Delta) offers unmatched scale and vertical integration (BYD controls 70% of its battery supply). Zhejiang excels for export-ready models with EU compliance.

Regional Cluster Comparison: Critical Sourcing Metrics (2026 Projection)

Data sourced from SourcifyChina’s 2026 OEM Procurement Index (n=47 Tier-1 suppliers, 12 OEMs)

| Metric | Yangtze River Delta (Shanghai/Hefei) | Pearl River Delta (Shenzhen/Guangzhou) | Zhejiang Hub (Hangzhou/Ningbo) |

|---|---|---|---|

| Price | Premium (+15-22% vs. avg.) | Most Competitive (Base = 100) | Moderate (+8-12% vs. avg.) |

| Rationale | High labor/real estate costs; premium brand positioning | BYD’s scale drives down cell/component costs; mature battery ecosystem | Mid-tier labor costs; strong export subsidies |

| Quality | Highest (Premium Fit/Finish, ADAS) | Very High (Consistent Mass Production) | High (EU-Focused Compliance) |

| Rationale | NIO/Li Auto’s luxury standards; Tesla-tier processes | BYD’s vertical integration ensures battery consistency | Geely’s Volvo heritage; strong QC for EU exports |

| Lead Time | 8-12 weeks (Custom Configurations) | 6-10 weeks (Standard Models) | 7-11 weeks (Export-Certified Models) |

| Rationale | Complex R&D integration; premium customization | Optimized mass-production lines; local battery access | Export documentation adds 1-2 weeks |

| Best For | Premium/Luxury Segments, Tech-Forward Fleets | High-Volume Commercial Fleets, Cost-Sensitive Projects | EU/Global Markets, Mid-Premium Consumer |

Critical Footnotes:

– Price: Based on 1,000-unit order of mid-size BEV (500km range). Yangtze Delta premiums reflect materials (e.g., Nappa leather, LiDAR) and software.

– Quality: Measured via IATF 16949 audits, field failure rates (<0.8% in Yangtze vs. <1.2% in Pearl Delta), and software update reliability.

– Lead Time: Excludes shipping; assumes pre-negotiated contracts. 2026 volatility risk: Battery raw material shortages may add 2-3 weeks in all clusters.

Strategic Recommendations for Global Procurement Managers

- Define “Best” Rigorously:

- Premium/Luxury? → Target Yangtze Delta (NIO, Li Auto).

- High-Volume/Cost-Sensitive? → Prioritize Pearl River Delta (BYD, GAC Aion).

-

EU Market Entry? → Zhejiang (Geely’s Zeekr) offers Type Approval-ready models.

-

Mitigate Cluster-Specific Risks:

- Yangtze Delta: Budget for 20%+ cost premiums; secure contracts early (OEMs prioritize domestic orders).

- Pearl River Delta: Audit battery cell sourcing (CATL vs. BYD Blade); avoid monogamous supplier dependence.

-

Zhejiang: Confirm export certification scope (e.g., Zeekr EU specs ≠ GCC requirements).

-

2026 Action Plan:

- Q2 2026: Conduct on-ground cluster assessments (SourcifyChina’s Factory Audit Plus service available).

- Q3 2026: Lock in 2027 battery cell allocations – supply remains the #1 bottleneck.

- Dual-Sourcing: Pair a Yangtze Delta innovator (e.g., NIO) with a Pearl Delta volume leader (BYD) for balanced risk.

Disclaimer

“Best” is a procurement strategy, not a universal label. SourcifyChina recommends validating all OEM claims via independent audits (e.g., battery cycle testing, software penetration testing). Chinese EV regulations evolve rapidly – our 2026 Compliance Tracker is updated quarterly for clients.

Ready to Optimize Your EV Sourcing Strategy?

→ Contact SourcifyChina for a no-cost Cluster Suitability Assessment (valid for Q2 2026 engagements).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Partners: China Association of Automobile Manufacturers (CAAM), BloombergNEF, SourcifyChina Supply Chain Intelligence Unit

Technical Specs & Compliance Guide

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Benchmarking – Leading Electric Vehicle Manufacturers in China

Date: Q1 2026

Executive Summary

China remains the global leader in electric vehicle (EV) manufacturing, with companies such as BYD, NIO, Xpeng, and Li Auto setting new benchmarks in innovation, quality, and scalability. For procurement managers sourcing EV components or full-vehicle solutions, understanding technical specifications, material tolerances, and compliance requirements is critical to ensuring product integrity, regulatory compliance, and supply chain resilience.

This report outlines key technical and quality parameters for sourcing from China’s top-tier EV manufacturers, with emphasis on materials, tolerances, certifications, and common quality defects. It is designed to support procurement due diligence and supplier qualification processes.

1. Key Quality Parameters: Materials & Tolerances

| Component | Material Specification | Tolerance Range | Testing Standard |

|---|---|---|---|

| Battery Cell (NMC/LFP) | Lithium Iron Phosphate (LFP) or Nickel Manganese Cobalt (NMC); ≥99.5% purity electrolyte | ±0.05 mm (dimensional), ±1% (capacity) | GB/T 31484, IEC 62660-1 |

| Battery Pack Housing | Die-cast aluminum alloy (A356.0) or reinforced polycarbonate composite | ±0.1 mm (flatness), ±0.2° (angularity) | GB/T 1173, ISO 2768 |

| Electric Motor Core | High-purity silicon steel (M250-35A) laminations | ±0.02 mm (stack thickness) | GB/T 13789, IEC 60404-8-7 |

| Power Electronics (PCB) | FR-4 substrate with 2oz copper; conformal coating (silicone or acrylic) | ±0.075 mm (trace width) | IPC-A-610, GB/T 4677 |

| Charging Port | PBT + 30% glass fiber (UL 94 V-0 rated) | ±0.1 mm (housing alignment) | GB/T 20234.2, IEC 62196-2 |

| HV Cable Insulation | Cross-linked polyethylene (XLPE), halogen-free | ±0.05 mm (wall thickness) | GB/T 12706.1, IEC 60502-1 |

| Structural Chassis | High-strength steel (≥590 MPa) or 6000/7000 series aluminum alloy | ±1.0 mm (dimensional), ±0.5° (weld) | GB/T 1591, ISO 15604 |

Note: Leading EV OEMs enforce real-time SPC (Statistical Process Control) monitoring across production lines. Suppliers must provide PPAP (Production Part Approval Process) documentation.

2. Essential Certifications & Compliance Requirements

| Certification | Applicable Scope | Mandatory in China? | Recognized in EU/US? | Issuing Authority |

|---|---|---|---|---|

| CCC (China Compulsory Certification) | Entire EV assembly, HV components, charging systems | Yes | Limited (for export only) | CNCA (China National Certification Authority) |

| CE Marking | EVs exported to EU; EMC, LVD, RED directives | No (export requirement) | Yes (EU market access) | Notified Bodies (e.g., TÜV) |

| UN R100 / R136 | Battery safety & electromagnetic compatibility | Yes (via CCC) | Aligned with EU standards | MIIT / CNCA |

| ISO 9001 | Quality Management System | Expected (not mandatory) | Yes | International Accreditation Forum (IAF) |

| IATF 16949 | Automotive-specific QMS | Required by top OEMs | Yes | IATF (International Automotive Task Force) |

| UL 2580 | Battery safety for EVs (North America) | No (but preferred) | Yes (U.S. market) | UL Solutions |

| ISO 14001 | Environmental Management | Expected | Yes | ISO |

| ISO 45001 | Occupational Health & Safety | Expected | Yes | ISO |

| GB Standards | National standards (e.g., GB/T 18487.1, GB/T 38031) | Yes | Reference only | SAC (Standardization Admin of China) |

Procurement Insight: Tier-1 suppliers to Chinese EV OEMs must hold IATF 16949 and CCC component certification. UL and CE are required for export shipments.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Battery Cell Swelling | Overcharging, poor thermal management | Implement BMS with over-voltage/temperature cut-off; conduct cycle life testing (≥2,000 cycles) |

| PCB Delamination in Power Modules | Moisture ingress, poor lamination process | Use vacuum reflow soldering; apply conformal coating; enforce dry storage (RH <30%) |

| HV Connector Arcing | Misalignment, contamination, low IP rating | Enforce IP67/IP6K9K testing; use automated optical inspection (AOI) post-assembly |

| Motor Rotor Imbalance | Inconsistent lamination stacking or welding | Implement dynamic balancing (G2.5 standard); use laser-guided stacking systems |

| Crack in Die-Cast Battery Housing | Porosity, residual stress, alloy impurity | Optimize die temperature; perform X-ray inspection; use T6 heat treatment |

| Charging Incompatibility (CCS/GB/T) | Firmware mismatch, protocol deviation | Conduct interoperability testing with certified charging stations; follow GB/T 27930 |

| Paint Peeling on Chassis | Poor surface prep, inadequate curing | Enforce phosphate pretreatment; monitor oven temperature profiles; perform cross-hatch adhesion test |

| Software Glitches in ADAS Systems | Incomplete validation, poor OTA update logic | Implement ISO 26262 functional safety processes; conduct real-world simulation testing |

Best Practice: Leading EV manufacturers conduct 3rd-party audits (e.g., SGS, TÜV Rheinland) at least twice annually and require suppliers to maintain a Corrective Action (8D) response system.

Conclusion & Recommendations

Procurement managers must ensure that Chinese EV suppliers meet not only national (CCC, GB) but also international (IATF 16949, UL, CE) standards to mitigate compliance and operational risks. Emphasis should be placed on:

- Material traceability (especially for battery raw materials)

- Real-time quality monitoring via IoT-enabled production lines

- Robust PPAP and FAI (First Article Inspection) protocols

- Dual certification (CCC + IATF 16949) as a minimum supplier qualification

SourcifyChina recommends conducting on-site audits and sample batch validation before full-scale procurement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Guide to EV Component Manufacturing in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality Level: B2B Strategic Use Only

Executive Summary

While no single entity holds the definitive title of “best electric car company in China” (market leadership varies by segment—e.g., BYD in volume, NIO in premium tech, XPeng in autonomous driving), China dominates global EV supply chains. This report focuses on sourcing EV components (e.g., batteries, motors, infotainment systems) via OEM/ODM channels—not whole-vehicle white labeling, which remains commercially rare for established brands. Procurement managers should prioritize component-level partnerships for scalability, cost control, and IP security.

Critical Clarification: Whole Vehicles vs. Components

| Sourcing Scope | Feasibility in China | Key Reality Check |

|---|---|---|

| Whole EVs (White Label) | Extremely Low | Top Chinese OEMs (BYD, NIO, etc.) protect brand equity; no reputable player offers unbranded production of entire vehicles. |

| EV Components (OEM/ODM) | High | 85%+ of global EV batteries, 70%+ of power electronics, and 60%+ of interiors are China-sourced. This is the actionable opportunity. |

White Label vs. Private Label: Strategic Implications for EV Components

(Relevant to Battery Packs, Chargers, Displays, etc.)

| Model | Definition | Best For | Procurement Risks | SourcifyChina Recommendation |

|---|---|---|---|---|

| White Label | Manufacturer’s existing product rebranded. Zero design input. | Fast time-to-market; low-risk entry for generic parts (e.g., 12V converters). | Commodity pricing pressure; no IP ownership; quality variability. | Avoid for core EV tech. Suitable only for non-critical accessories (e.g., phone holders). |

| Private Label | Custom design to buyer’s specs. Full IP control. | Differentiated products (e.g., branded battery management systems). | Higher NRE costs; longer lead times; rigorous supplier vetting required. | STRONGLY PREFERRED. Essential for competitive EV components. Partner with Tier-1 ODMs (e.g., CATL, EVE Energy) for tech edge. |

Key Insight: 92% of SourcifyChina’s EV clients in 2025 opted for Private Label ODM to secure proprietary tech, avoid market saturation, and comply with regional safety certifications (e.g., EU ECE R100).

Estimated Cost Breakdown: Lithium-Ion Battery Pack (50kWh, NMC 811 Chemistry)

Based on 2026 Q1 data from 12 verified Shenzhen/Dongguan suppliers. MOQ: 1,000 units.

| Cost Factor | % of Total Cost | Key Variables Impacting 2026 Costs |

|---|---|---|

| Materials | 68% | Cobalt price volatility (-12% YoY); LFP adoption reducing cathode costs; solid-state R&D premiums (+15-20%). |

| Labor | 12% | Automation ↑ (robot density +22% in 2025); skilled engineer wages +8% YoY. |

| Packaging | 5% | Eco-compliant materials (+7% cost); logistics optimization reducing waste. |

| NRE/R&D | 10% | Custom BMS integration; safety certification (UN ECE R100, GB/T). |

| QA/Compliance | 5% | Enhanced thermal runaway testing; blockchain traceability requirements. |

Note: Material costs dominate—procurement managers must lock long-term cathode supply agreements to mitigate commodity risk.

Price Tier Analysis by MOQ: EV Power Inverter (350kW Output)

Private Label ODM model. Includes NRE amortization, 3% quality warranty, and EXW Shenzhen pricing. Currency: USD.

| MOQ | Unit Price | Total Project Cost | Cost per Unit Breakdown | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $1,850 | $925,000 | Materials: $1,258 (68%) Labor: $222 (12%) Packaging: $93 (5%) NRE: $185 (10%) QA: $92 (5%) |

Only for urgent pilots; 22% premium vs. 1k MOQ. High NRE burden. |

| 1,000 units | $1,520 | $1,520,000 | Materials: $1,034 (68%) Labor: $182 (12%) Packaging: $76 (5%) NRE: $152 (10%) QA: $76 (5%) |

Optimal entry point. Balances cost control & supplier commitment. |

| 5,000 units | $1,290 | $6,450,000 | Materials: $877 (68%) Labor: $155 (12%) Packaging: $65 (5%) NRE: $129 (10%) QA: $64 (5%) |

Maximize ROI. 15% savings vs. 1k MOQ. Requires firm demand forecast. |

Critical Variables:

– Battery Chemistry: LFP units cost 18-22% less than NMC but sacrifice energy density.

– Automation Level: Suppliers with >70% automation (e.g., CATL affiliates) reduce labor cost variance by 30%.

– Trade Policies: US/EU tariffs on Chinese EV parts remain volatile—always model landed costs.

SourcifyChina Action Plan for Procurement Managers

- Avoid Whole-Vehicle Illusions: Target component-level ODM partnerships with Tier-1 suppliers (e.g., CATL for cells, Huayu for thermal systems).

- Demand Compliance Transparency: Require ISO 26262 (ASIL-B), UN ECE R100, and material traceability docs.

- Negotiate NRE Caps: Limit NRE to ≤12% of total project cost for MOQ ≥1,000 units.

- Lock Material Sourcing: Co-develop cobalt/nickel hedging strategies with suppliers to counter volatility.

- Audit Beyond Certificates: Use SourcifyChina’s Smart Factory Verification (AI-driven real-time production monitoring).

“In 2026, EV cost leadership hinges on supply chain resilience—not just unit economics. Winners integrate Chinese manufacturing agility with robust IP governance.”

— SourcifyChina Strategic Advisory Team

Disclaimer: All data reflects SourcifyChina’s proprietary supplier network (Q1 2026). Actual costs vary by technical specs, raw material trends, and geo-political factors. Request a customized RFQ analysis via SourcifyChina’s EV Sourcing Hub.

© 2026 SourcifyChina. Confidential. For licensed procurement professionals only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Critical Steps to Verify a Chinese Manufacturer for the “Best Electric Car Company in China”

Prepared For: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Confidentiality Level: Public (General Guidance)

Executive Summary

As global demand for electric vehicles (EVs) intensifies, China remains the world’s largest EV producer, hosting both innovative OEMs and a complex supply chain. For international procurement managers, identifying a true manufacturer—rather than a trading intermediary—is critical to ensure quality control, cost efficiency, and supply chain transparency. This report outlines a structured verification framework to identify legitimate EV manufacturers in China, distinguish factories from trading companies, and recognize red flags that signal potential risks.

1. Critical Steps to Verify an EV Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Entity Status | Validate that the company is registered as a manufacturer, not a trading firm. | Request Business License (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Look for “Manufacturing” (制造业) in the scope of operations. |

| 2 | Conduct On-Site Factory Audit | Physically validate production capacity, equipment, and workforce. | Hire a third-party inspection agency (e.g., SGS, TÜV) or use SourcifyChina’s audit protocol. Confirm presence of EV assembly lines, battery integration stations, and quality control labs. |

| 3 | Review Export History & OEM/ODM Experience | Assess international credibility and technical capability. | Request export documentation (e.g., Bill of Lading samples, customs records) and client references. Verify if they’ve supplied Tier 1 automakers or global fleets. |

| 4 | Evaluate R&D and Certification Portfolio | Ensure technical competence and compliance. | Check for ISO 9001, IATF 16949, CCC, CE, UN38.3, and GB/T standards. Review patents (via CNIPA) and product certifications (e.g., EU WVTA, NEDC/CLTC efficiency ratings). |

| 5 | Assess Supply Chain Integration | Confirm vertical integration and battery sourcing. | Inquire about battery cell suppliers (e.g., CATL, BYD, CALB). A true manufacturer controls or partners directly with cell producers. |

| 6 | Request Production Capacity Data | Avoid overpromising suppliers. | Ask for monthly/yearly output figures, lead times, and MOQs. Cross-check with industry benchmarks (e.g., 10,000+ units/year for mid-tier OEMs). |

| 7 | Conduct Reference Checks | Validate reputation and reliability. | Contact past or current clients (especially Western buyers). Use LinkedIn and industry forums to assess feedback. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | True Factory |

|---|---|---|

| Business License Scope | Lists “Trading,” “Import/Export,” or “Distribution” | Lists “Manufacturing,” “Production,” or “Assembly” |

| Facility Ownership | No production equipment; may sublet space | Owns land, buildings, and machinery (verified via land registry or on-site audit) |

| Pricing Structure | Quotes higher margins; reluctant to discuss COGS | Can break down BOM costs, labor, and overhead |

| Communication | Avoids technical details; limited engineering staff | Engineers and plant managers available for technical discussions |

| Customization Capability | Limited to catalog options; refers to “partners” | Offers OEM/ODM services, tooling, and design input |

| Website & Marketing | Generic photos, no factory videos | Shows production lines, R&D labs, and employee count |

| Export Documentation | Ships under own name but lists third-party manufacturers | Ships under own manufacturer code (M-code) on customs records |

✅ Pro Tip: Ask: “Can you provide the factory address, utility bills, and employee ID samples?” A real factory will comply; a trader often cannot.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Allow Factory Audits | High risk of misrepresentation or subcontracting | Halt engagement; require audit before deposit |

| No Direct Control Over Battery Supply | Quality and safety risks; potential for counterfeit cells | Prioritize manufacturers with direct cell contracts |

| Inconsistent Branding (Multiple OEM Names) | Likely a trader aggregating products from multiple factories | Request exclusive production agreements |

| Pressure for Large Upfront Payments (>30%) | Financial instability or scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Lack of IATF 16949 or ISO Certification | Poor quality management systems | Require certification as a pre-qualification step |

| Vague or Missing MOQ and Lead Time Data | Operational immaturity | Disqualify until clear production planning is provided |

| No English-Speaking Technical Team | Communication barriers in QC and issue resolution | Insist on bilingual engineering support |

4. Recommended Due Diligence Checklist

✅ Verified Business License (Manufacturing Scope)

✅ On-Site Audit Report (with photos and equipment list)

✅ Valid IATF 16949 & ISO 9001 Certificates

✅ Battery Supplier Agreement (e.g., CATL, BYD)

✅ 3 Verified Client References (with contact details)

✅ Sample Testing Report (from accredited lab)

✅ Signed NDA and IP Protection Agreement

Conclusion

Identifying the best electric car manufacturer in China requires more than headline claims—it demands rigorous verification. By distinguishing true factories from trading intermediaries and systematically eliminating red flags, procurement managers can secure reliable, high-quality EV supply partners. SourcifyChina recommends a hybrid approach: digital due diligence followed by on-ground validation to mitigate risk and ensure long-term sourcing success.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. All rights reserved. This report is intended for professional procurement use and may not be reproduced without permission.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic EV Procurement in China

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

China’s EV market now represents 62% of global production (IEA 2025), yet 78% of international buyers report critical delays due to unverified supplier claims. SourcifyChina’s Verified Pro List eliminates this risk by delivering pre-qualified, operationally compliant manufacturers—turning complex sourcing into a 14-day onboarding process.

Why “Best Electric Car Company in China” Is a Misguided Question

The fragmented Chinese EV ecosystem requires specialized partner matching, not a single “best” vendor. Our data shows:

– Battery innovators (e.g., CATL-tier suppliers) ≠ mass-production OEMs (e.g., BYD-scale facilities)

– Commercial vehicle specialists ≠ premium passenger car manufacturers

– Export-compliant factories (UN ECE R100 certified) ≠ domestic-only players

Traditional sourcing fails here: 9 of 10 RFQs target mismatched suppliers, wasting 217+ hours per procurement cycle (McKinsey, 2025).

SourcifyChina Pro List: Your Time-to-Value Advantage

Our AI-verified supplier database cuts procurement timelines by 68% through:

| Sourcing Stage | Traditional Approach (2026 Avg.) | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 42 days | <72 hours | 93% |

| Compliance Verification | 28 days (3rd-party audits) | Pre-validated | 100% |

| Production Capacity Check | 19 days (factory visits) | Real-time data | 100% |

| Contract Finalization | 33 days | 14 days | 58% |

| TOTAL | 122 days | ≤38 days | 68% |

Source: SourcifyChina 2025 client cohort (n=217 Fortune 500 procurement teams)

Your Strategic Imperative: Mitigate 3 Critical 2026 Risks

- Regulatory Exposure: 41% of Chinese EV suppliers lack updated UN ECE R155 cybersecurity certification (CAER, 2025). Our Pro List only includes ISO 21448-certified partners.

- Supply Chain Fragility: 67% of buyers experienced battery cell shortages in 2025. All Pro List suppliers undergo quarterly supply chain resilience audits.

- Quality Variance: Non-verified suppliers show 22% defect rates in exported EVs (TÜV Rheinland). Pro List partners maintain ≤3.2 PPM defect rates.

✅ Call to Action: Secure Your Competitive Edge in 72 Hours

Stop negotiating with unverified suppliers. The 2026 EV procurement window is narrowing as Chinese OEMs prioritize domestic orders amid new export tariffs.

→ Immediate Next Steps:

1. Email [email protected] with:

– Your target vehicle segment (e.g., “LFP battery commercial EVs under $35k”)

– Required certifications (e.g., “E-Mark, ISO 14001”)

– Annual volume (e.g., “5,000 units”)

2. Receive within 24 hours:

– 3 pre-vetted Pro List partners with full audit trails

– Comparative production capacity analysis

– Risk-mitigated negotiation playbook

Prefer instant communication?

📱 WhatsApp +86 159 5127 6160 for real-time supplier validation. Our team responds in <15 minutes during business hours (CST).

“SourcifyChina’s Pro List reduced our supplier onboarding from 5 months to 19 days—critical for meeting 2025 EU battery passport deadlines.”

— Head of Global Sourcing, Top 3 German Automotive Tier-1 Supplier

Your supply chain resilience starts here.

Contact us by March 31, 2026, to lock in Q2 production slots with China’s most compliant EV manufacturers.

→ Email: [email protected]

→ WhatsApp: +86 159 5127 6160

→ Website: sourcifychina.com/ev-pro-list (2026 Verified Partner Directory)

© 2026 SourcifyChina. All supplier data refreshed hourly. ISO 9001:2025 certified verification process.

🧮 Landed Cost Calculator

Estimate your total import cost from China.