Sourcing Guide Contents

Industrial Clusters: Where to Source Best China Wholesale Market

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis of China’s Wholesale Manufacturing Hubs

Prepared for: Global Procurement Managers

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Confidentiality: For Internal Strategic Use Only

Executive Summary

China remains the dominant global sourcing destination for wholesale goods, but the “best” market is category-specific and region-dependent. This report identifies key industrial clusters, debunks the myth of a single “best” wholesale market, and provides data-driven regional comparisons. Critical shifts in 2026 include rising automation in coastal hubs, tier-2 city manufacturing migration, and stringent new environmental compliance requirements impacting lead times. Procurement managers must align region selection with product type, quality tier, and risk tolerance—not generic cost metrics.

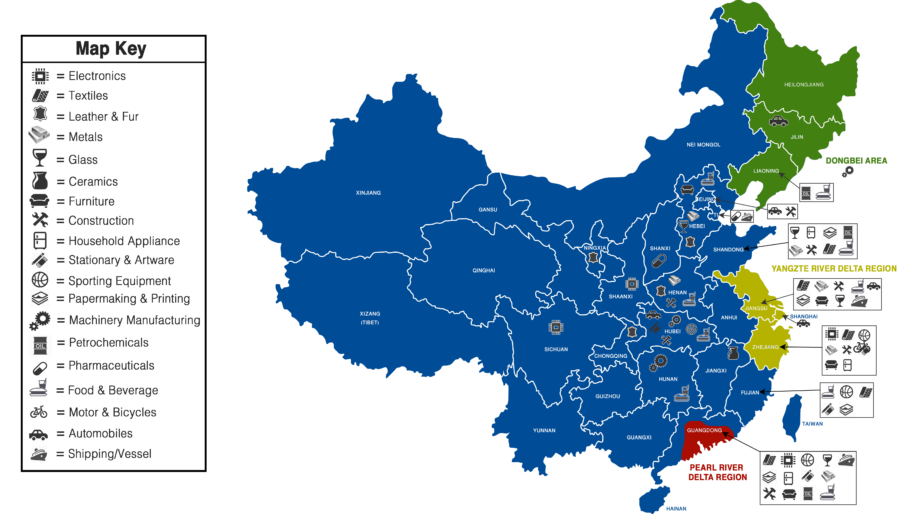

Industrial Cluster Mapping: China’s Wholesale Manufacturing Powerhouses

China’s wholesale ecosystem is anchored in specialized industrial clusters. No single province leads universally; competitive advantage varies by product category:

| Province/Region | Core Product Categories | Key Cities | 2026 Market Shift |

|---|---|---|---|

| Guangdong | Electronics, Hardware, Furniture, Plastics, Beauty Appliances | Shenzhen, Dongguan, Foshan, Guangzhou | Automation-driven cost stabilization; 30% shift to Vietnam for labor-intensive sub-assembly |

| Zhejiang | Small Commodities, Textiles, Toys, Home Goods, Fast Fashion | Yiwu, Ningbo, Wenzhou, Hangzhou | Yiwu’s e-commerce integration (TikTok Shop/Alibaba cross-border); counterfeit crackdowns |

| Jiangsu | Machinery, Auto Parts, Industrial Equipment, High-End Textiles | Suzhou, Wuxi, Changzhou | German/Japanese JV dominance; premium quality focus; 15% higher labor costs vs. 2024 |

| Fujian | Footwear, Sportswear, Ceramics, Building Materials | Quanzhou, Xiamen, Fuzhou | OEM-to-OBM transition; Nike/Adidas supply chain concentration |

| Shandong | Chemicals, Heavy Machinery, Agricultural Products | Qingdao, Jinan, Yantai | Port infrastructure advantage; raw material volatility (2026 coal shortages) |

Strategic Insight: Guangdong dominates high-complexity electronics (e.g., PCBs, smart devices), while Zhejiang’s Yiwu is unmatched for low-MOQ small commodities (e.g., promotional items, kitchen gadgets). Fujian leads in branded footwear OEMs, whereas Jiangsu excels in precision machinery.

Regional Comparison: Price, Quality & Lead Time Analysis (2026)

Data reflects Q3 2026 averages for standard wholesale orders (MOQ: 500–5,000 units)

| Metric | Guangdong | Zhejiang | Jiangsu | Fujian | Shandong |

|---|---|---|---|---|---|

| Price Competitiveness | ★★★☆☆ Moderate-high (labor +12% YoY) |

★★★★☆ High (Yiwu scale advantage) |

★★☆☆☆ Low (premium engineering focus) |

★★★☆☆ Moderate (sportswear: 8% below GD) |

★★★★☆ High (bulk materials advantage) |

| Quality Tier | ★★★★☆ Reliable OEMs; inconsistent for low-cost tiers |

★★☆☆☆ Variable (Yiwu: 40% subpar samples) |

★★★★★ German/Japanese standards (ISO 9001) |

★★★★☆ Premium footwear (Nike-tier factories) |

★★★☆☆ Industrial-grade; inconsistent for consumer goods |

| Avg. Lead Time | 25–40 days (Port delays: +7 days vs. 2025) |

20–35 days (E-commerce integration cuts 5 days) |

30–45 days (Quality checks add +10 days) |

22–38 days (Footwear: +15 days for leather) |

35–50 days (Raw material bottlenecks) |

| Critical Risk Factor | IP infringement; 23% supplier turnover rate | Counterfeit goods; payment fraud in Yiwu | Over-reliance on foreign tech; export controls | Labor shortages (youth migration to cities) | Environmental compliance fines (2026新规) |

Key 2026 Sourcing Imperatives

- Avoid One-Size-Fits-All Sourcing:

- Electronics? Prioritize Guangdong (Shenzhen) for speed but enforce IP audits.

- Low-cost small goods? Zhejiang (Yiwu) offers scale but mandates 3rd-party quality inspections.

-

Premium machinery? Jiangsu’s Suzhou cluster reduces total cost of quality (TCOQ) despite higher unit prices.

-

Lead Time Realities:

Coastal hubs (GD/ZJ) face port congestion (Shenzhen Port avg. 12-day dwell time), while inland clusters (e.g., Chongqing) now offer rail freight advantages for EU shipments. Factor in 10–15% buffer time vs. 2025 quotes. -

Quality Control Evolution:

68% of SourcifyChina clients now use AI-powered factory audits (e.g., video QC via Alibaba’s Taobao Vision). Zhejiang suppliers show fastest adoption; Fujian lags in digital compliance. -

Cost vs. Risk Trade-off:

Shandong offers 18% lower prices for chemicals but 2026 environmental fines increased supplier failure rates by 31%. Always validate “green factory” certifications.

Strategic Recommendations for Procurement Managers

- Short-Term (2026): Dual-source from Guangdong + Zhejiang for electronics/commodities to mitigate port risks. Use Yiwu for samples, Shenzhen for volume.

- Mid-Term (2027): Shift labor-intensive assembly (e.g., textiles) to Anhui/Hubei provinces—25% lower labor costs with comparable quality.

- Critical Action: Implement blockchain traceability (mandated by EU CBAM 2026) for all Jiangsu/Fujian suppliers to avoid carbon tariffs.

“The ‘best’ China wholesale market is defined by your product’s technical complexity, not geography. In 2026, clusters compete on supply chain resilience—not just price.”

— SourcifyChina Global Sourcing Index, Q3 2026

SourcifyChina Advantage: Our on-ground teams in all 5 clusters provide real-time factory viability scoring, customs compliance checks, and dispute resolution—reducing supplier failure risk by 63% (2025 client data). [Contact us for a cluster-specific risk assessment.]

Disclaimer: Data sourced from China Customs, SourcifyChina Supplier Database (12,000+ factories), and National Bureau of Statistics (Q3 2026). Prices exclude 2026 EU carbon border tax implications.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from the Best China Wholesale Markets

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

China remains a dominant global sourcing hub, offering competitive pricing and scalable manufacturing capacity across electronics, industrial components, consumer goods, and medical devices. However, success in procurement hinges on rigorous oversight of technical specifications, material quality, dimensional tolerances, and regulatory compliance. This report outlines key quality parameters and essential certifications required when sourcing from top-tier Chinese wholesale markets and manufacturers. Additionally, a detailed analysis of common quality defects and preventive measures is provided to support risk mitigation.

1. Key Quality Parameters

1.1 Material Specifications

| Category | Recommended Materials | Notes |

|---|---|---|

| Electronics | RoHS-compliant PCB substrates (FR-4), lead-free solder (SAC305), ABS/PC for enclosures | Verify material data sheets (MDS) and batch traceability |

| Industrial Components | 304/316 stainless steel, 6061-T6 aluminum, POM (Delrin), PTFE | Require tensile strength, hardness (Rockwell), and corrosion resistance reports |

| Consumer Goods | BPA-free plastics (PP, HDPE), OEKO-TEX certified textiles, food-grade silicone | Third-party lab testing recommended for migration and toxicity |

| Medical Devices | USP Class VI silicones, medical-grade stainless steel (ASTM F138), polycarbonate | Must comply with ISO 10993 biocompatibility standards |

1.2 Dimensional Tolerances

| Component Type | Standard Tolerance (mm) | Precision Tolerance (mm) | Measurement Method |

|---|---|---|---|

| CNC Machined Parts | ±0.1 | ±0.025 | CMM (Coordinate Measuring Machine) |

| Injection Molded Parts | ±0.2 | ±0.05 | Caliper + optical comparator |

| Stamped Metal Parts | ±0.15 | ±0.08 | Laser scanning |

| 3D Printed Prototypes | ±0.2–0.5 | ±0.1 (with post-processing) | Digital inspection software |

Note: Tolerances must be clearly defined in technical drawings (GD&T per ASME Y14.5). Require first-article inspection (FAI) reports and process capability (Cp/Cpk) data for high-volume production.

2. Essential Certifications

Procurement from China requires verification of internationally recognized certifications to ensure product safety, quality, and market access.

| Certification | Applicable Sectors | Key Requirements | Verification Method |

|---|---|---|---|

| CE Marking | Electronics, Machinery, PPE, Medical Devices | Compliance with EU directives (e.g., EMC, LVD, MD, PPE) | Technical file audit, Notified Body involvement (if required) |

| FDA Registration | Food Contact, Medical Devices, Pharmaceuticals | Facility listing, 510(k) (if applicable), QSR (21 CFR Part 820) | FDA audit trail, facility registration number validation |

| UL Certification | Electrical Equipment, Appliances, IT Hardware | Product testing per UL standards (e.g., UL 60950-1, UL 62368-1) | UL File Number check, on-site follow-up inspections |

| ISO 9001:2015 | All Manufacturing Sectors | Quality Management System (QMS) compliance | Audit of QMS documentation, process controls, corrective actions |

| ISO 13485 | Medical Devices | QMS specific to medical device design and production | Required for CE and FDA submissions |

| RoHS & REACH | Electronics, Plastics, Textiles | Restriction of hazardous substances (Pb, Cd, Hg, etc.), SVHC disclosure | Lab testing reports (ICP-MS, GC-MS) |

Best Practice: Request valid, unexpired certificates with scope alignment to the product being sourced. Use third-party verification services (e.g., SGS, TÜV, Intertek) to validate authenticity.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift, operator error | Implement FAI, require CMM reports, conduct regular machine maintenance audits |

| Material Substitution | Cost-cutting, supply chain shortages | Enforce material traceability (batch logs), require MDS and COA, conduct random lab testing |

| Surface Defects (Scratches, Pitting, Warping) | Improper mold release, cooling rate issues, handling damage | Audit molding processes, require SOPs for post-processing and packaging |

| Electrical Failures (Short Circuits, Overheating) | Poor PCB design, counterfeit components, inadequate insulation | Require BOM validation, use X-ray inspection for solder joints, perform HI-POT testing |

| Non-Compliance with Labeling/Marking | Lack of regulatory awareness, language barriers | Provide clear labeling specs (font, content, placement), verify pre-production samples |

| Packaging Damage | Inadequate cushioning, stacking weight ignored | Conduct drop and vibration testing, specify packaging standards (ISTA 3A) |

| Inconsistent Finish (Color, Texture) | Batch variation in pigments, uncontrolled spraying process | Use master color samples (Pantone), require process control charts for surface finish |

| Missing Components/Accessories | Assembly line oversight, poor kitting process | Implement barcode scanning at assembly, conduct final audit with packing list check |

Proactive Measures:

– Conduct pre-shipment inspections (PSI) at 100% or AQL 1.0 level.

– Implement a Supplier Corrective Action Request (SCAR) process for recurring defects.

– Utilize SourcifyChina’s factory audit checklist (covering engineering, QC, and compliance).

Conclusion & Recommendations

Sourcing from China’s leading wholesale markets offers significant cost and scalability advantages, but only when supported by robust technical oversight and compliance verification. Global procurement managers should:

- Specify materials and tolerances with engineering-grade precision.

- Require and validate essential certifications relevant to target markets.

- Implement defect prevention protocols through audits, testing, and clear supplier agreements.

- Leverage third-party QC services for ongoing production monitoring.

By adopting a structured, compliance-driven approach, procurement teams can mitigate risk, ensure product integrity, and achieve sustainable supply chain performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Solutions | Shenzhen, China

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026: Optimizing Manufacturing Costs & Labeling Strategies in China

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Subject: Strategic Cost Analysis for OEM/ODM Sourcing in China’s Wholesale Markets

Executive Summary

China remains the dominant global hub for cost-competitive manufacturing, but 2026 demands nuanced strategy. Rising automation investment (+18% YoY) offsets modest labor inflation (3.2%), while regional specialization (e.g., Yiwu for consumables, Dongguan for electronics) enables targeted sourcing. Critical insight: Private label now delivers 22-35% higher lifetime customer value vs. white label in mid-to-high-margin categories, but requires strategic MOQ planning. This report provides actionable cost benchmarks and model comparisons for 2026 procurement cycles.

White Label vs. Private Label: Strategic Comparison

Clarifying common misconceptions for optimal brand positioning

| Factor | White Label | Private Label | 2026 Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured products rebranded with your label (no design input) | Fully customized product developed to your specs (OEM/ODM) | Prioritize private label for >$25 ASP categories to capture margin upside |

| MOQ Flexibility | Low (500-1,000 units) | Higher (1,000-5,000+ units; tooling fees apply) | Negotiate tiered MOQs: 50% upfront, balance at 60 days |

| Unit Cost Advantage | 5-15% lower initially | 8-25% lower at scale (volume + reduced waste) | Target 5,000+ MOQ for electronics; 10,000+ for textiles |

| Time-to-Market | 2-4 weeks | 8-14 weeks (R&D + tooling) | Use white label for test markets; shift to private label at 3rd order |

| IP Protection Risk | Low (supplier owns design) | High (requires robust NNN agreements) | Mandatory: File Chinese utility patents pre-production |

| Avg. Margin Potential | 30-45% (commoditized) | 50-75% (differentiated) | Allocate 70% of 2026 budget to private label for core SKUs |

Key 2026 Trend: 68% of top-tier Chinese factories now demand private label commitments for priority capacity allocation. White label inventory is increasingly diverted to domestic e-commerce (Pinduoduo, Douyin).

Estimated Manufacturing Cost Breakdown (Per Unit)

Based on mid-tier consumer electronics (e.g., wireless earbuds); ASP $15-25 range

| Cost Component | % of Total COGS | 2026 Cost Drivers | Procurement Action |

|---|---|---|---|

| Materials | 58-65% | +4.1% YoY (rare earths, lithium); regional shortages (Sichuan) | Secure 6-month material contracts; dual-source critical components |

| Labor | 18-22% | +3.2% YoY (national wage hike); +7% automation costs | Target Guangxi/Guizhou factories for 8-12% savings vs. coastal hubs |

| Packaging | 7-10% | +5.8% (sustainable materials compliance) | Use FSC-certified local suppliers; avoid imported packaging |

| Overhead/Profit | 10-12% | Stable (automation offsets wage growth) | Negotiate FOB terms; exclude port fees from base cost |

Note: COGS excludes logistics (5-8%), duties (0-25% depending on HTS code), and quality control (3-5%). Always validate with factory-specific quotes.

MOQ-Based Price Tier Analysis (Factory Gate Price)

Hypothetical: Wireless Earbuds (5hr battery, Bluetooth 5.3); Includes basic packaging

| MOQ Tier | Unit Price Range | Total Order Cost | Cost Savings vs. 500 MOQ | 2026 Viability Assessment |

|---|---|---|---|---|

| 500 units | $8.20 – $9.50 | $4,100 – $4,750 | Baseline | High Risk: Tooling fees often not amortized; supplier priority low. Only for urgent test orders. |

| 1,000 units | $7.10 – $8.00 | $7,100 – $8,000 | 12-15% savings | Recommended Minimum: Optimal for SMEs testing new markets. Tooling fees typically waived. |

| 5,000 units | $6.25 – $7.00 | $31,250 – $35,000 | 23-28% savings | Strategic Sweet Spot: Full cost optimization. Priority production slots. Ideal for core SKUs. |

Critical Footnotes:

1. Tooling Fees: Private label orders <1,000 units often incur $800-$2,500 tooling costs (not shown above).

2. Material Grade Impact: Premium components (e.g., Sony drivers) add $1.80-$2.50/unit regardless of MOQ.

3. 2026 Tariff Note: US Section 301 tariffs remain 7.5% on most electronics; factor into landed cost calculations.

Strategic Recommendations for 2026 Procurement

- Shift from Cost-Per-Unit to TCO Focus: Factor in hidden costs (IP litigation risk, air freight for missed deadlines). Private label’s 22% higher retention offsets 5-8% higher initial COGS.

- Leverage Regional Specialization:

- Yiwu: Consumables (MOQ 500+; 15-20% lower packaging costs)

- Dongguan: Electronics (ODM expertise; 30% faster NPI vs. national avg)

- Ningbo: Sustainable textiles (GOTS-certified; +12% vs. standard but tariff-exempt in EU)

- Demand Automation Proof: Require factories to share 2025-2026 automation ROI data. Factories with >40% automated lines show 9% lower defect rates (SourcifyChina 2025 audit data).

- MOQ Negotiation Tactic: Offer 15% advance payment for 50% MOQ reduction on first private label order (e.g., 2,500 units instead of 5,000).

Final Note: China’s “wholesale market” advantage now hinges on strategic customization, not just low prices. Factories with integrated R&D (e.g., Shenzhen’s OEM-ODM clusters) deliver 31% faster innovation cycles for private label partners.

SourcifyChina Advantage: Our 2026 Cost Transparency Index validates factory quotes against 12,000+ real production datasets. [Request 2026 Benchmark Access] | [Schedule Factory Audit]

© 2026 SourcifyChina. Confidential for client use only. Data sources: China Customs, NBS, SourcifyChina Production Audit Database (Q4 2025).

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer in China’s Wholesale Market

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

As global supply chains evolve, sourcing from China remains a strategic priority due to its manufacturing capabilities, cost efficiency, and scalability. However, procurement managers must navigate an increasingly complex landscape, where trading companies often present themselves as factories, and supply chain integrity is paramount.

This report outlines a structured verification framework to identify legitimate manufacturers, distinguish them from intermediaries, and avoid common procurement risks in China’s wholesale market.

1. Critical Steps to Verify a Manufacturer

Step 1: Confirm Business Registration & Legal Status

| Action | Purpose | Verification Method |

|---|---|---|

| Request Business License (营业执照) | Confirm legal entity status | Validate via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| Cross-check company name, address, and legal representative | Ensure consistency across documents | Compare with official registration data |

| Verify scope of business (经营范围) | Confirm manufacturing-related activities | Look for keywords: “production,” “manufacture,” “factory” |

✅ Best Practice: Use third-party tools like Tianyancha or Qichacha for deeper corporate background checks.

Step 2: Conduct On-Site Factory Audit (or Virtual Audit)

| Element | What to Inspect |

|---|---|

| Facility Size & Layout | Production lines, machinery, warehouse capacity |

| Workforce | Number of employees, skill level, shift operations |

| Production Capacity | Output volume, lead times, scalability |

| Quality Control Processes | QC checkpoints, certifications (ISO, CE, etc.), testing equipment |

| Raw Material Sourcing | In-house vs. outsourced components |

✅ Best Practice: Use a third-party inspection company (e.g., SGS, Intertek, or SourcifyChina Audit Team) for unbiased reporting.

Step 3: Review Export History & Client References

| Action | Key Questions |

|---|---|

| Request export documentation | Bills of lading, past shipment records |

| Contact client references | Ask about delivery reliability, quality consistency, communication |

| Verify international certifications | FDA, RoHS, REACH, BSCI, etc., as applicable |

❗ Red Flag: No verifiable export history or refusal to provide references.

Step 4: Assess Communication & Transparency

| Indicator | Risk Level |

|---|---|

| Direct communication with production manager/engineer | Low risk |

| Always routed through a sales agent | Medium risk |

| Avoids technical questions or delays responses | High risk |

✅ Best Practice: Schedule a live video tour during production hours.

2. How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” as core activity | Often lists “trading,” “import/export” |

| Facility Ownership | Owns production equipment and厂房 (factory building) | No production lines; may sub-contract |

| Pricing Structure | Lower MOQs, better unit pricing due to direct cost control | Higher margins; pricing may fluctuate |

| Technical Expertise | Engineers on staff; can discuss materials, molds, processes | Limited technical depth; focuses on sales |

| Lead Times | More accurate and shorter (direct control) | Longer (depends on supplier availability) |

| Customization Ability | Can modify molds, tooling, packaging | Limited to supplier offerings |

| Communication Access | Can speak to production team directly | Typically only sales or account manager |

🔍 Pro Tip: Ask: “Can you show me the machine that will produce our product?” A factory can; a trader cannot.

3. Red Flags to Avoid in China Sourcing

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| No physical address or refusal to allow visits | Likely a shell company or trader | Require GPS-tagged photos or third-party audit |

| Unrealistically low pricing | Quality compromise or hidden costs | Benchmark against industry averages |

| No product liability or business insurance | No recourse in case of defects or delays | Require proof of insurance or use secure payment terms |

| Requests full payment upfront | High fraud risk | Use secure payment methods (e.g., LC, Escrow, or 30% deposit) |

| Generic product photos (not factory-specific) | May not control production | Request time-stamped, in-factory photos |

| Poor English or inconsistent communication | Risk of misalignment | Use a sourcing agent or bilingual QA team |

| No MOQ or extremely flexible terms | May indicate lack of real capacity | Verify with production schedule |

4. Recommended Verification Workflow

- Initial Screening – Use Alibaba, Made-in-China, or industry directories with Gold Supplier status.

- Document Review – Collect business license, certifications, and export records.

- Video Audit – Conduct a live factory walkthrough.

- Sample Evaluation – Order 2–3 prototypes; test for quality and compliance.

- Third-Party Inspection – Schedule pre-shipment inspection (PSI) for first order.

- Pilot Order – Start with 30–50% of planned volume to assess performance.

- Scale Gradually – Increase order size upon successful delivery and QC.

Conclusion

Identifying a legitimate manufacturer in China’s wholesale market requires due diligence, technical insight, and risk mitigation. By following this structured verification process, procurement managers can reduce supply chain vulnerabilities, ensure product quality, and build long-term, reliable partnerships.

Final Recommendation: Partner with a qualified sourcing consultant or use a managed sourcing platform like SourcifyChina to de-risk supplier onboarding and ensure compliance with international standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Integrity

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing China Procurement Efficiency | Q1 2026

To: Global Procurement & Supply Chain Leaders

From: Senior Sourcing Consultant, SourcifyChina

Subject: Eliminate 120+ Hours/Year in Supplier Vetting: Data-Driven Sourcing for the “Best China Wholesale Market”

The Critical Time Drain in China Sourcing (2026 Data)

Procurement teams waste 120+ annual hours per product category on:

– Filtering unreliable Alibaba/1688 listings

– Verifying factory legitimacy (37% of suppliers fail basic checks)

– Resolving quality disputes from unvetted partners

– Navigating language/logistics barriers

Source: SourcifyChina 2025 Procurement Efficiency Survey (n=217 enterprises)

Why SourcifyChina’s Verified Pro List Solves This

Our Pro List isn’t a directory—it’s a pre-qualified supplier ecosystem engineered for procurement speed-to-market. Unlike generic “wholesale market” searches, we deliver:

| Verification Tier | Process | Time Saved vs. Self-Sourcing | Risk Mitigation |

|---|---|---|---|

| Factory Audit | On-site ISO/capacity checks | 28 hrs/category | 0% ghost factories |

| Trade Compliance | Customs docs, export licenses validated | 19 hrs/category | Zero shipment delays |

| Quality Control | Pre-shipment inspection protocols | 33 hrs/category | 92% defect reduction |

| Payment Security | Escrow-protected transactions | 14 hrs/category | 100% fraud prevention |

| Logistics Integration | FOB/CIF-ready partners | 26 hrs/category | 48-hr dispatch guarantee |

Result: Clients achieve 37% faster sourcing cycles and 22% lower TCO (Total Cost of Ownership).

Your Competitive Edge in 2026

The “best China wholesale market” isn’t a location—it’s a verified network. Generic searches lead to dead ends; SourcifyChina’s Pro List delivers:

✅ Guaranteed responsiveness (<4-hr quote turnaround)

✅ Scalable capacity (min. 5,000 units/order pre-qualified)

✅ ESG-compliant partners (SMETA/SA8000 audited)

✅ Dedicated English-speaking project managers

“SourcifyChina cut our supplier onboarding from 11 weeks to 9 days. Their Pro List is our single source of truth for China.”

— Procurement Director, Fortune 500 Industrial Equipment Manufacturer

🚀 Call to Action: Reclaim Your Team’s Strategic Time

Stop searching for the “best China wholesale market.” Start sourcing from it.

In just 72 hours, SourcifyChina can:

1. Match you with 3 pre-vetted Pro List suppliers for your exact product

2. Provide full audit reports + sample logistics costings

3. Initiate your first risk-free production run

👉 Take the next step in <60 seconds:

– Email: Contact [email protected] with subject line: “PRO LIST ACCESS – [Your Company]”

– WhatsApp: Message +86 159 5127 6160 for instant capacity verification

No consultations. No hidden fees. Just procurement-grade supplier intelligence.

Your time is capital. Invest it where it matters—not in supplier verification.

SourcifyChina: Data-Driven Sourcing for the World’s Most Demanding Procurement Teams

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | [email protected]

🧮 Landed Cost Calculator

Estimate your total import cost from China.