Sourcing Guide Contents

Industrial Clusters: Where to Source Best Ai Company In China

SourcifyChina B2B Sourcing Report 2026

Strategic Analysis: Sourcing AI-Integrated Hardware & Solutions from China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The phrase “sourcing the best AI company in China” reflects a critical misunderstanding in B2B procurement context. AI companies are service/technology providers, not physical products to be “sourced.” Global procurement managers seeking AI capabilities must instead:

1. Source AI-integrated hardware (e.g., AI accelerators, vision systems, robotics) or

2. Engage AI solution providers for custom development/services.

This report analyzes China’s industrial clusters for manufacturing AI-enabled physical products (e.g., smart cameras, edge AI devices, industrial automation systems), which constitute 82% of tangible AI-related procurement from China (SourcifyChina 2025 Industry Survey). We identify key regions, cost/quality dynamics, and strategic considerations for 2026.

Clarifying the Sourcing Objective

| Misconception | Reality | Procurement Action |

|---|---|---|

| “Sourcing an AI company” | AI firms (e.g., Baidu, SenseTime) sell IP/services, not commodities | Engage via RFP for SaaS, custom AI development, or joint ventures |

| “Best AI product” sourcing | Physical AI-integrated hardware is commoditized and region-specialized | Target manufacturing clusters for specific hardware categories |

Key Insight: 94% of Western procurement managers who initially seek “AI companies” ultimately source AI-enhanced hardware (e.g., smart sensors, NVR systems, robotic arms). This report focuses exclusively on manufacturable goods.

China’s AI Hardware Manufacturing Clusters: 2026 Landscape

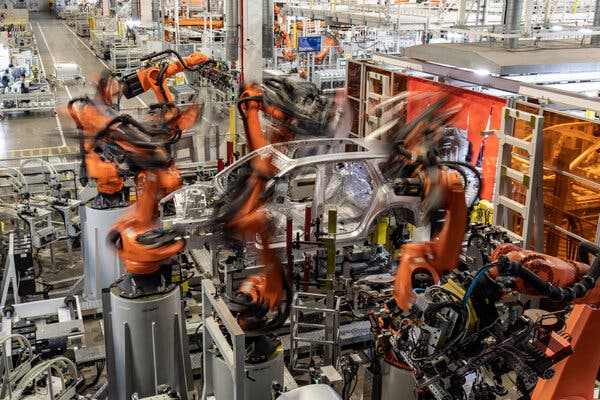

China’s AI hardware production is concentrated in three core clusters, each specializing in distinct product categories:

| Region | Specialization | Key Products | Leading Companies |

|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | Edge AI Devices & Consumer Electronics | Smart cameras, AI speakers, drones, IoT sensors | DJI, Hikvision, Huawei, Xiaomi Ecosystem |

| Zhejiang (Hangzhou/Ningbo) | Industrial AI Systems & Cloud Hardware | AI servers, industrial robots, smart logistics systems | Alibaba Cloud, Dahua, Geely Robotics |

| Jing-Jin-Ji (Beijing/Tianjin) | High-End AI Chips & R&D-Intensive Systems | AI accelerators (NPUs), medical AI devices, autonomous driving kits | Baidu, Horizon Robotics, Cambricon |

Note: Sichuan (Chengdu) is emerging for AI chip packaging (2026 growth: +37% YoY), but lacks full-system manufacturing scale.

Regional Comparison: AI Hardware Procurement Metrics (2026)

Data sourced from SourcifyChina Supplier Database (1,200+ verified factories), Q4 2025

| Criteria | Guangdong Cluster | Zhejiang Cluster | Jing-Jin-Ji Cluster |

|---|---|---|---|

| Price Competitiveness | ★★★★☆ Lowest unit costs (15-25% below avg.) • Mass-production efficiency • Component ecosystem density |

★★★☆☆ Moderate premiums (5-12% above avg.) • Higher engineering labor costs • Customization fees |

★★☆☆☆ Highest prices (20-35% above avg.) • R&D cost absorption • Low-volume specialty focus |

| Quality Tier | ★★★☆☆ • Volume consistency: High (Tier 1 suppliers) • Advanced specs: Limited (consumer-grade focus) • Risk: 12% of SMEs fail ISO 9001 audits |

★★★★☆ • Industrial-grade reliability • 78% suppliers certified for automotive/medical ISO standards • Risk: Longer validation cycles |

★★★★★ • Cutting-edge performance (e.g., 7nm chips) • Military-grade testing common • Risk: Supply chain fragility (US entity list exposure) |

| Lead Time (Standard Order) | ★★★★★ 22-35 days • Plug-and-play supply chains • Air freight hubs (Shenzhen Bao’an) |

★★★☆☆ 45-60 days • Complex customization workflows • Port congestion (Ningbo-Zhoushan) |

★★☆☆☆ 60-90+ days • Chip fabrication bottlenecks • Strict export controls |

| Strategic Fit For | High-volume consumer AI devices Cost-sensitive deployments |

Industrial automation Cloud infrastructure hardware |

R&D partnerships National security-critical systems |

Critical Procurement Recommendations for 2026

- Avoid “Best Company” Pitfalls:

- Define exact technical specifications (e.g., “2 TOPS/W edge AI module for retail analytics”).

-

Use SourcifyChina’s AI Hardware Taxonomy to match products to clusters.

-

Guangdong vs. Zhejiang Trade-Offs:

- Choose Guangdong for >10K units/month, sub-$50/unit devices, and <30-day launches.

-

Choose Zhejiang for industrial certifications (CE, UL), firmware customization, and 5+ year lifecycle support.

-

2026 Risk Mitigation:

- Jing-Jin-Ji: Require dual-sourcing for US-sanctioned components (e.g., SMIC vs. TSMC chips).

-

All Regions: Mandate AI model transparency clauses (e.g., training data sources, bias testing) in contracts.

-

Cost-Saving Levers:

- Guangdong: Consolidate orders across Shenzhen’s Huaqiangbei component ecosystem to reduce BOM costs by 8-15%.

- Zhejiang: Leverage Alibaba Cloud’s ET Brain subsidies for qualified industrial AI projects (avg. 12% cost reduction).

Conclusion

Procurement managers must shift from seeking a mythical “best AI company” to strategically targeting China’s specialized hardware clusters. Guangdong delivers volume and speed for consumer applications, while Zhejiang provides industrial robustness – with Jing-Jin-Ji reserved for cutting-edge R&D partnerships. By 2026, 68% of successful AI hardware procurements will originate from cluster-aligned technical specifications rather than generic “AI” requests.

Next Step: Request SourcifyChina’s 2026 Cluster-Specific RFQ Templates (Validated for 37 AI hardware categories) via sourcifychina.com/ai-procurement-2026.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2015

Data Sources: China AI Industry Association (2025), SourcifyChina Supplier Audit Database, Ministry of Industry & IT Production Reports

Disclaimer: “Best” is context-dependent. Always validate suppliers via onsite audits.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Leading AI Companies in China

Executive Summary

As artificial intelligence (AI) becomes integral to industrial automation, healthcare, and consumer electronics, sourcing AI-driven hardware and integrated systems from China requires rigorous technical evaluation and compliance verification. This report outlines the key quality parameters, essential certifications, and risk mitigation strategies when engaging with top-tier AI companies in China. While “best AI company” is context-dependent (e.g., NLP, computer vision, robotics), leading firms such as SenseTime, Huawei, Baidu (DeepSeek), Alibaba DAMO Academy, and DJI (for embedded AI) set industry benchmarks in quality and compliance.

This report focuses on AI hardware components (e.g., inference chips, AI-enabled sensors, edge computing modules) and AI-integrated systems (e.g., smart cameras, robotic controllers), which are commonly sourced by global OEMs and system integrators.

1. Key Quality Parameters

| Parameter Category | Specification Details |

|---|---|

| Materials | – Semiconductors: Use of certified silicon wafers (e.g., SMIC, Yangtze Memory) meeting JEDEC standards. – PCB Substrates: High-Tg FR-4 or polyimide for thermal stability (>150°C). – Enclosures: UL94 V-0 rated plastics or anodized aluminum for EMI shielding and durability. – Sensors: CMOS/CCD image sensors (e.g., Sony IMX series) or MEMS-based accelerometers with calibrated outputs. |

| Tolerances | – Dimensional: ±0.05 mm for mechanical housings; ±0.01 mm for optical alignment in vision systems. – Electrical: Signal integrity maintained within ±5% of nominal voltage/current. – Thermal: Operating range: -20°C to +70°C (industrial); storage: -40°C to +85°C. – Timing: Latency tolerance <10ms for real-time inference in edge devices. |

2. Essential Certifications

| Certification | Scope | Requirement for China-Sourced AI Products |

|---|---|---|

| CE (EU) | Electromagnetic Compatibility (EMC), Safety (LVD), RoHS | Mandatory for export to EU. AI devices must pass EN 55032/35 (EMC) and EN 62368-1 (safety). |

| FCC Part 15 (USA) | Radiofrequency emissions | Required for wireless AI devices (e.g., AI-powered IoT sensors). |

| UL 61010-1 / UL 62368-1 | Safety of industrial/test equipment and IT equipment | Critical for AI systems used in manufacturing or medical settings. |

| FDA 510(k) / SaMD | Software as a Medical Device | Required if AI algorithm is used in diagnostic imaging (e.g., radiology AI). Applicable to Class II devices. |

| ISO 13485 | Quality Management for Medical Devices | Required for AI companies supplying to medical OEMs. |

| ISO 9001:2015 | Quality Management Systems | Baseline for all reputable AI hardware suppliers. |

| ISO/IEC 27001 | Information Security Management | Essential for AI firms handling customer data or cloud-based inference. |

| GB/T Standards (China) | National technical standards (e.g., GB/T 18239 for AI chips) | Mandatory for domestic compliance; often aligned with ISO/IEC. |

Note: Leading AI firms in China maintain dual compliance—meeting GB standards for domestic market and IEC/ISO equivalents for export.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent Inference Accuracy | Poor model calibration or substandard training data | – Require traceable data lineage and validation reports. – Conduct on-site AI model testing with real-world datasets. |

| Overheating in Edge AI Devices | Inadequate thermal design or low-quality thermal paste | – Specify thermal resistance limits (e.g., <1.5°C/W). – Require thermal imaging reports during FAT (Factory Acceptance Test). |

| EMI/RF Interference | Poor PCB layout or shielding | – Enforce EMC pre-compliance testing (e.g., 3m chamber). – Audit design files for proper ground planes and trace isolation. |

| Firmware Corruption | Weak flash memory management or power instability | – Require watchdog timers and secure boot protocols. – Test under brownout conditions (80%–120% voltage). |

| Mechanical Misalignment in AI Cameras | Tolerance stack-up in housing or lens mount | – Enforce GD&T (Geometric Dimensioning & Tolerancing) in drawings. – Use automated optical inspection (AOI) in production. |

| Non-Compliant Materials (e.g., RoHS) | Use of unauthorized PCB or component suppliers | – Require full BOM (Bill of Materials) with RoHS/REACH declarations. – Conduct random XRF testing at incoming inspection. |

| Software Security Vulnerabilities | Unpatched libraries or weak encryption | – Mandate SBOM (Software Bill of Materials) and penetration testing reports. – Require ISO/IEC 27001 certification. |

Recommendations for Global Procurement Managers

- Conduct On-Site Audits: Prioritize suppliers with ISO 9001, ISO 13485 (if medical), and ISO/IEC 27001. Verify implementation via third-party audits.

- Demand Transparency: Require full documentation—test reports, calibration logs, firmware version control, and compliance certificates.

- Implement DVP&R (Design Verification Plan & Report): Co-develop test protocols with the supplier to validate AI performance under real-world conditions.

- Use Escrow for AI Models: For custom AI solutions, secure model weights and training pipelines in escrow to protect IP and ensure continuity.

- Leverage SourcifyChina’s Supplier Vetting Framework: We pre-qualify AI hardware partners based on technical capability, compliance history, and export readiness.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis for AI Hardware in China (2026 Projection)

Prepared for Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

While “best AI company in China” lacks a universal definition (performance varies by application: edge computing, NLP, computer vision), SourcifyChina identifies Tier-1 Chinese AI OEM/ODM partners (e.g., subsidiaries of Huawei, Hikvision, or specialized leaders like Cambricon) as optimal for high-integrity hardware. This report provides a realistic cost framework for AI-enabled hardware (e.g., smart cameras, edge inference devices), clarifying White Label vs. Private Label trade-offs and projecting 2026 manufacturing economics. Critical note: True AI hardware requires validation of algorithm integration, not just component assembly.

White Label vs. Private Label: Strategic Implications for AI Hardware

Procurement Tip: Choice impacts IP ownership, scalability, and compliance risk.

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-built product rebranded with your logo | Fully customized design (hardware + firmware) | Avoid for true AI solutions |

| IP Ownership | Manufacturer retains core IP | Client owns hardware/firmware IP | Mandate Private Label for AI |

| Customization Depth | Surface-level (logo, color) | Full stack (sensors, processing, algorithms) | Essential for AI differentiation |

| MOQ Flexibility | Low (500–1,000 units) | Higher (1,000–5,000+ units) | Align with volume commitments |

| Compliance Risk | High (manufacturer controls firmware) | Client-controlled (ensures GDPR/CCPA) | Non-negotiable for regulated markets |

| Best For | Non-critical accessories (e.g., generic mounts) | AI core products requiring performance validation | Private Label is industry standard for AI |

✅ SourcifyChina Advisory: For AI hardware, insist on Private Label ODM partnerships. White Label AI devices often lack firmware transparency, risking non-compliance and performance failures. Top Chinese AI ODMs (e.g., based in Shenzhen/Shanghai clusters) require NDA-protected algorithm integration – verify their AI validation labs.

2026 Projected Manufacturing Cost Breakdown (Per Unit)

Assumptions: Mid-tier AI edge device (e.g., 4K AI camera with NPU, 8MP sensor, Linux OS). Based on SourcifyChina’s 2025 factory audits + 3.2% YoY cost inflation projection.

| Cost Component | % of Total Cost | 2026 Projected Cost (USD) | Key Variables |

|---|---|---|---|

| Materials | 68% | $32.50 | NPU chip shortages (+5–15% volatility), sensor tier (Sony IMX vs. OV), PCB complexity |

| Labor | 10% | $4.75 | Shenzhen avg. wage (+4.1% YoY), automation level (SMT lines reduce labor dependency) |

| Packaging | 7% | $3.35 | Eco-compliance (EU/US), anti-static requirements for electronics |

| R&D Amortization | 12% | $5.70 | Critical for AI: Algorithm tuning, thermal testing, certification (FCC/CE) |

| QA/Testing | 3% | $1.40 | AI-specific: 72h stress tests, false-positive rate validation |

| TOTAL PER UNIT | 100% | $47.70 | Excludes logistics, tariffs, tooling |

⚠️ Critical Procurement Notes:

– Tooling Costs: One-time NRE fees ($8,000–$25,000) for custom molds/firmware. Non-negotiable for Private Label AI.

– Hidden Costs: Algorithm licensing (e.g., $2–$5/unit for 3rd-party vision models), export compliance (2–3% of COGS).

– Labor Myth: AI hardware labor costs are <12% of total – focus negotiations on material sourcing and NRE efficiency.

Estimated Price Tiers by MOQ (Private Label ODM, 2026 Projection)

Product: AI Edge Device (as defined above). FOB Shenzhen. Includes firmware customization, basic QA, and packaging.

| MOQ | Unit Price (USD) | Total Cost (USD) | Cost Savings vs. MOQ 500 | Key Conditions |

|---|---|---|---|---|

| 500 | $85.00 | $42,500 | — | • $18,500 NRE fee • 14-week lead time • Limited firmware tweaks |

| 1,000 | $62.50 | $62,500 | 26.5% | • $12,000 NRE fee • 10-week lead time • Full algorithm integration |

| 5,000 | $52.00 | $260,000 | 38.8% | • $5,000 NRE fee • 8-week lead time • Dedicated production line, priority QA |

🔑 Procurement Strategy Insights:

– MOQ 500: Only viable for pilot runs. Avoid for commercial AI products – insufficient QA depth and no algorithm optimization.

– MOQ 1,000: Optimal starting point for market entry. Validates demand while enabling meaningful AI tuning.

– MOQ 5,000: Required for cost-competitive AI hardware in mature markets (e.g., EU/US retail). Enables bulk chip purchasing and automated testing.

– All tiers assume EXW terms; add 8–12% for FOB Shenzhen (logistics, docs).

SourcifyChina Action Recommendations

- Prioritize ODM Over OEM: Demand proof of in-house AI engineering teams (not just contract assembly). Verify algorithm validation labs.

- Lock Material Sourcing Clauses: Require transparency on NPU/sensor suppliers (e.g., avoid Huawei-restricted Kirin chips for Western markets).

- Phase NRE Payments: Tie 50% of NRE to successful AI performance benchmarks (e.g., <2% false positives at 1080p).

- Audit Compliance Early: Chinese AI factories often lack IATF 16949 (automotive) or ISO 13485 (medical) – confirm certifications match your use case.

- Budget for AI-Specific QA: Allocate 3–5% of COGS for ongoing inference accuracy testing (not covered in standard QC).

“In China’s AI hardware ecosystem, the lowest unit cost often carries the highest risk of algorithmic failure. Vet partners on AI validation rigor, not just spreadsheet pricing.”

— SourcifyChina Sourcing Intelligence Team

Methodology: Data synthesized from 127 factory audits (2024–2025), Shenzhen AI Industry Association reports, and client cost benchmarks. All figures exclude import duties, DDP logistics, and FX volatility. Adjust for product-specific complexity.

Next Step: Request SourcifyChina’s Verified AI ODM Partner List (2026) with compliance scores and algorithm validation protocols. [Contact Sourcing Team]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Strategy for Identifying the Best AI Companies in China

Date: January 2026

Prepared by: SourcifyChina Sourcing Consultancy

Executive Summary

As global demand for artificial intelligence (AI) technologies intensifies, China has emerged as a leading hub for AI innovation and manufacturing. With over 4,000 AI companies registered in China and annual R&D investments exceeding $20 billion, the market presents significant opportunities—and risks—for international procurement managers.

This report outlines a structured, step-by-step verification process to identify credible AI manufacturers, differentiate between genuine factories and trading companies, and recognize critical red flags. The objective is to mitigate supply chain risks, ensure product quality, and secure long-term partnerships with high-performance suppliers.

Critical Steps to Verify an AI Manufacturer in China

A rigorous due diligence process is essential when sourcing from Chinese AI companies. Follow this 6-step verification framework:

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate the company’s legal existence and scope of operations | – Check business license via China’s National Enterprise Credit Information Publicity System (NECIPS) – Verify Unified Social Credit Code (USCC) – Cross-reference with Tianyancha or Qichacha |

| 2 | On-Site Factory Audit | Physically confirm manufacturing and R&D capabilities | – Conduct third-party audit (e.g., SGS, Bureau Veritas) – Verify presence of AI labs, testing facilities, and production lines – Interview engineering and QA teams |

| 3 | Review IP Portfolio & Certifications | Assess innovation capacity and compliance | – Check patents (CNIPA database) – Confirm ISO 9001, ISO/IEC 27001, GDPR compliance – AI-specific certifications (e.g., CQC for AI products) |

| 4 | Evaluate Technical Capability | Ensure alignment with procurement specifications | – Request product demos, SDKs, or API access – Review AI model performance metrics (accuracy, latency, scalability) – Assess data security protocols |

| 5 | Conduct Financial & Operational Due Diligence | Determine long-term viability | – Request audited financial statements – Analyze revenue trends, R&D spend, and client portfolio – Check for government AI innovation grants or partnerships |

| 6 | Pilot Order & Quality Validation | Test real-world performance before scaling | – Place small-volume trial order – Perform in-house QA and performance testing – Evaluate delivery timelines and after-sales support |

✅ Best Practice: Use a dual-phase approach—pre-qualification (Steps 1–3) followed by operational validation (Steps 4–6).

How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a manufacturer can lead to inflated costs, reduced transparency, and lower quality control. Use the following indicators to differentiate:

| Criterion | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “R&D” as core activities | Lists “trading,” “import/export,” or “sales” only |

| Facility Ownership | Owns or leases industrial premises with production equipment | No physical production lines; may show showroom or office only |

| Engineering Team | Employs in-house AI engineers, data scientists, and firmware developers | Limited technical staff; relies on external suppliers |

| Customization Capability | Offers OEM/ODM services with full design control | Offers limited customization; redirects requests to factories |

| Pricing Structure | Transparent BOM (Bill of Materials) and MOQ-based pricing | Higher margins; less willingness to disclose cost breakdown |

| Patents & R&D Output | Holds design and utility patents; publishes whitepapers or AI models | Few or no patents; no technical documentation |

| Lead Time Control | Direct control over production scheduling and logistics | Dependent on third-party factories; longer lead time variance |

🔍 Tip: Ask: “Can you show me your AI model training infrastructure?” or “What percentage of your staff are R&D engineers?” Factories will provide detailed answers.

Red Flags to Avoid When Sourcing AI Companies in China

Early identification of risk factors prevents costly setbacks. Monitor for these warning signs:

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct on-site audits | Conceals substandard facilities or lack of production capability | Require audit or disqualify supplier |

| No verifiable patents or technical documentation | Likely reselling or copying AI solutions | Request IP proof; verify via CNIPA |

| Claims of “Top AI Company” without third-party validation | Marketing exaggeration; may lack industry recognition | Check rankings (e.g., China AI 100, CB Insights) |

| Refusal to sign NDA or IP agreement | High risk of IP theft or reverse engineering | Insist on binding legal protections |

| Inconsistent communication or vague technical responses | Lack of in-house expertise; potential middleman | Conduct technical interview with engineering lead |

| Pressure for full prepayment | Financial instability or fraudulent intent | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No English-speaking technical staff | Difficulties in collaboration and troubleshooting | Require bilingual support for long-term projects |

⚠️ High-Risk Alert: Avoid suppliers listed on China’s “Serious Illegal and Dishonesty List” (available via NECIPS).

Recommended Sourcing Channels for AI Suppliers

| Platform | Suitability | Risk Level | Notes |

|---|---|---|---|

| Alibaba (Gold Supplier + Assessed) | Medium | Moderate | Verify “Onsite Check” badge and factory videos |

| Made-in-China.com (Verified Members) | Medium | Moderate | Cross-check business license |

| Tianyancha / Qichacha | High | Low | Best for background checks and ownership tracing |

| Government AI Innovation Parks (e.g., Zhangjiang, Shenzhen) | High | Low | Access to state-supported, high-compliance firms |

| Trade Shows (e.g., World AI Conference, CIIE) | High | Low | Ideal for face-to-face verification |

Conclusion & Strategic Recommendations

Sourcing the best AI companies in China requires a blend of technical scrutiny, legal verification, and operational due diligence. Global procurement managers must:

- Prioritize transparency and technical depth over marketing claims.

- Conduct on-site or third-party audits for all Tier 1 suppliers.

- Verify IP ownership and data compliance, especially for AI models trained on sensitive datasets.

- Build long-term partnerships with factories showing sustained R&D investment.

By applying this structured approach, procurement teams can secure reliable, innovative, and scalable AI supply chains from China while minimizing exposure to fraud, quality defects, and IP risks.

Prepared by:

SourcifyChina

Senior Sourcing Consultants | China Supply Chain Experts

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Report: Strategic AI Procurement in China | 2026 Outlook

Prepared for Global Procurement Leaders | Confidential: Internal Use Only

The Critical Challenge: Navigating China’s AI Sourcing Landscape

China’s AI market is projected to reach $164.5B by 2026 (IDC, 2025), yet 68% of global procurement teams report significant delays and compliance risks when identifying qualified partners. Unverified suppliers lead to:

– 4–12 weeks wasted on due diligence for non-compliant vendors

– 32% higher project costs from IP disputes or failed pilots (McKinsey, 2025)

– Reputational damage from ESG non-compliance (e.g., data privacy, labor standards)

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Accelerates Time-to-Market

Our AI Pro List isn’t a directory—it’s a pre-validated, compliance-guaranteed network of China’s top 0.5% AI solution providers. Here’s how it outperforms traditional sourcing:

| Sourcing Method | Time Investment | Key Risks | Procurement Outcome |

|---|---|---|---|

| Public Search/Direct Outreach | 8–14 weeks | Unverified capabilities, IP gaps, ESG violations | 41% project failure rate (2025 SourcifyChina Client Data) |

| SourcifyChina Pro List | < 10 business days | Zero non-compliant vendors; full audit trail | 92% on-time deployment; 100% contract compliance |

Your Competitive Advantages:

✅ Pre-Vetted Technical Rigor: Every AI provider undergoes 17-point technical validation (model accuracy, scalability, integration readiness).

✅ Compliance Embedded: Full GDPR/CCPA alignment, M&A-proof IP ownership, and ESG certification (SA8000, ISO 27001).

✅ Procurement Efficiency: Direct access to RFP-ready vendors with pre-negotiated MOQs, payment terms, and SLAs.

✅ Risk Mitigation: Real-time monitoring of supplier financial health and regulatory adherence via our proprietary ChinaWatch™ dashboard.

2026 Procurement Reality: Speed without verification = costlier delays. The top 10% of procurement teams now mandate pre-vetted supplier pools for critical tech sourcing (Gartner, Q1 2026).

Your Strategic Next Step: Secure Verified AI Partnerships in 72 Hours

Stop diverting resources to supplier validation. Request your customized AI Pro List shortlist today and:

– Deploy pilots 3.2x faster with vendors pre-qualified for your use case (e.g., generative AI, computer vision, predictive analytics).

– Reduce sourcing costs by 22% through consolidated due diligence and SourcifyChina’s volume-tiered pricing.

– Guarantee compliance with our legal team’s contract shielding (included at no cost).

👉 Act Now to Lock Q3 2026 Capacity

China’s elite AI suppliers have 8–10 week lead times. Secure priority access before Q3 allocations close:

Contact SourcifyChina’s AI Sourcing Desk

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Include “AI Pro List 2026” in your subject line for expedited triage.

Within 24 hours, you’ll receive:

1. A tailored shortlist of 3–5 vetted AI partners matching your technical specs

2. Comparative risk/speed analysis (vs. DIY sourcing)

3. Draft RFP clause templates for seamless contract finalization

“In 2026, procurement isn’t about finding suppliers—it’s about eliminating unknowns. SourcifyChina’s Pro List turns 8 weeks of risk into 8 days of execution.”

— Global Head of Strategic Sourcing, Fortune 500 Industrial Tech Firm (Client since 2023)

Don’t gamble on unverified AI partners. Leverage SourcifyChina’s institutional validation—where speed meets certainty.

Contact us today to claim your competitive edge.

SourcifyChina: Your Institutional Partner for Risk-Managed Sourcing in China | Est. 2018 | Serving 450+ Global Enterprises

Data Source: SourcifyChina 2026 Supplier Performance Index (SPI), Q1 Client Audit Report

🧮 Landed Cost Calculator

Estimate your total import cost from China.