Sourcing Guide Contents

Industrial Clusters: Where to Source Best Ai Companies In China

SourcifyChina | B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing the Best AI Companies in China

Prepared For: Global Procurement Managers

Date: April 2026

Executive Summary

China has emerged as a global leader in artificial intelligence (AI) innovation, driven by strong government support, vast data ecosystems, and a highly skilled technical workforce. For international procurement managers, sourcing AI technologies—including AI software platforms, hardware accelerators (e.g., AI chips), robotics integration, and AI-as-a-Service (AIaaS)—from China requires strategic alignment with key industrial clusters that specialize in AI R&D and commercialization.

This report identifies the leading provinces and cities in China known for hosting the best AI companies, evaluates their competitive advantages, and provides a comparative analysis to support informed sourcing decisions.

Key AI Industrial Clusters in China

China’s AI ecosystem is geographically concentrated in several high-tech hubs, each offering unique strengths in talent, infrastructure, policy incentives, and vertical-specific applications. The most prominent clusters include:

| Region | Core Cities | Key AI Focus Areas | Notable Companies |

|---|---|---|---|

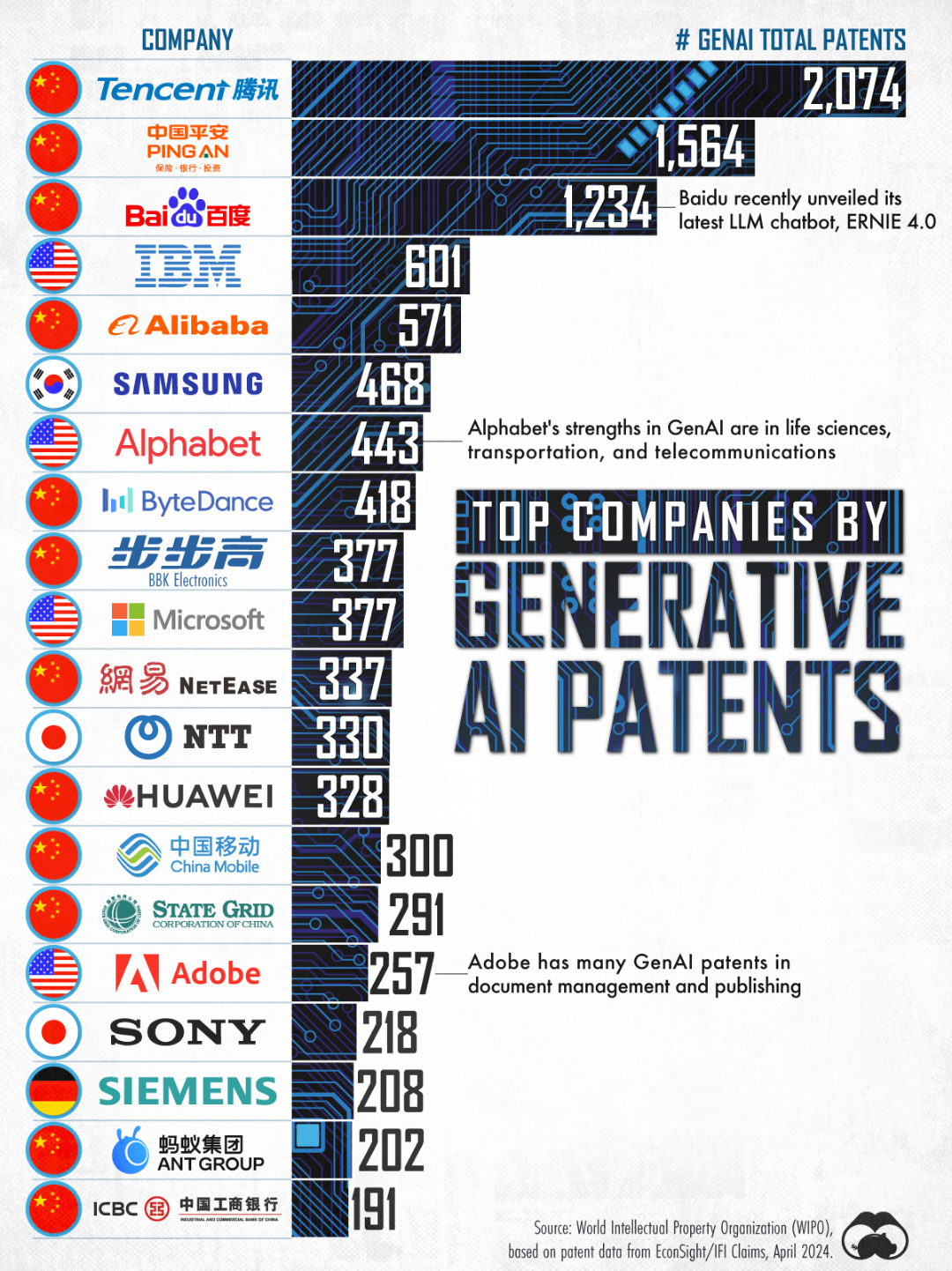

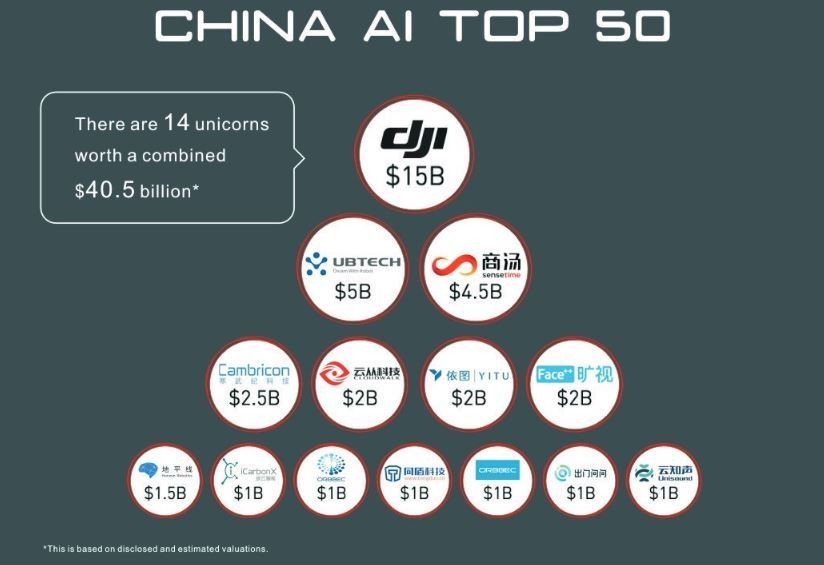

| Guangdong Province | Shenzhen, Guangzhou | AI hardware, edge computing, smart manufacturing, robotics | Huawei, Tencent, DJI, SenseTime (R&D center), Yunmai |

| Zhejiang Province | Hangzhou, Ningbo | AI cloud platforms, fintech, e-commerce AI, smart cities | Alibaba (Damodao, Tongyi Lab), NetEase, Dahua, Hikvision |

| Beijing Municipality | Beijing | Core AI research, NLP, computer vision, autonomous systems | Baidu (Wenxin Yiyan), Megvii (Face++), iFlyTek, DeepSeek |

| Shanghai Municipality | Shanghai | AI for finance, healthcare, autonomous driving | Yitu Technology, SenseTime (HQ), DeepBlue AI, Horizon Robotics |

| Jiangsu Province | Suzhou, Nanjing | AI-enabled industrial automation, semiconductors, IoT | Cambricon (partnerships), SiEngine, Sugon |

| Sichuan Province | Chengdu | AI for aerospace, logistics, and public security | Changhong, Sichuan Tianyi, iFLYTEK Southwest R&D |

Note: While “AI companies” are not traditional manufacturers, sourcing AI solutions from China involves evaluating ecosystems where AI is industrialized—via software licensing, AI chip supply, system integration, and OEM/ODM partnerships.

Comparative Analysis: Key AI Production & Development Regions

The table below evaluates top AI clusters based on cost competitiveness (Price), technical maturity and reliability (Quality), and time-to-deployment (Lead Time)—critical KPIs for procurement decision-making.

| Region | Price (1–5) | Quality (1–5) | Lead Time (Avg. Days) | Key Strengths | Sourcing Considerations |

|---|---|---|---|---|---|

| Guangdong (Shenzhen/Guangzhou) | 3.5 | 4.8 | 45–60 | World-class hardware integration, strong supply chain for AIoT devices, fast prototyping | Higher cost than inland hubs; ideal for AI + hardware projects |

| Zhejiang (Hangzhou) | 4.0 | 4.5 | 50–70 | Dominant in cloud-native AI, scalable SaaS models, strong in algorithmic innovation | Best for AI platforms, e-commerce automation, and API-based services |

| Beijing | 3.0 | 5.0 | 60–90 | Highest concentration of PhD talent, leading research labs, government-backed AI initiatives | Longer lead times due to complex IP frameworks; premium pricing |

| Shanghai | 3.2 | 4.7 | 55–75 | Strong in regulated AI (finance, healthcare), bilingual support, international compliance | Higher compliance overhead; ideal for EU/US-facing deployments |

| Jiangsu (Suzhou/Nanjing) | 4.2 | 4.3 | 40–55 | Integrated semiconductor + AI ecosystem, strong in industrial AI and edge inference chips | Emerging cluster with faster scaling; moderate IP maturity |

| Sichuan (Chengdu) | 4.5 | 3.8 | 50–65 | Cost-effective engineering talent, government subsidies, focus on public-sector AI | Lower brand visibility; suitable for budget-sensitive, non-consumer applications |

Scoring Note:

– Price: 1 = Highest Cost, 5 = Most Competitive Pricing

– Quality: 1 = Basic Capability, 5 = World-Class R&D and Output

– Lead Time: Estimated average for MVP deployment or integration, including NDA, PoC, and compliance checks

Strategic Sourcing Recommendations

-

For AI-Enabled Hardware & Smart Devices:

→ Prioritize Guangdong, especially Shenzhen, leveraging its unmatched electronics manufacturing ecosystem and AIoT innovation. -

For Cloud-Based AI Platforms & APIs:

→ Source from Zhejiang (Hangzhou) via Alibaba Cloud or affiliated partners; optimal for scalable, e-commerce, and logistics AI. -

For High-End Research & Core AI Models:

→ Engage Beijing-based firms for cutting-edge NLP, vision models, and autonomous systems, though expect longer timelines and higher costs. -

For Regulated or International Deployments:

→ Shanghai offers better compliance alignment with GDPR, HIPAA, and ISO standards, especially in fintech and medtech AI. -

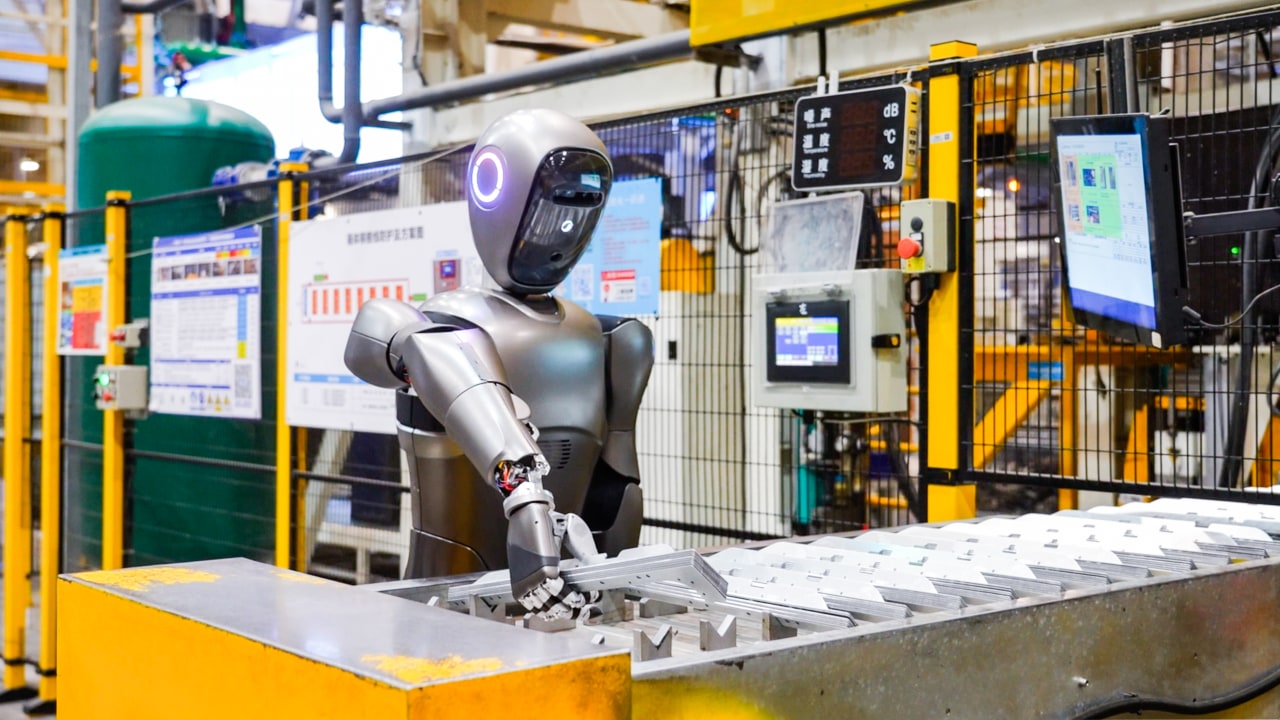

For Cost-Optimized Industrial AI:

→ Consider Jiangsu or Sichuan for AI-driven automation, predictive maintenance, and government-supported smart factory projects.

Risk & Compliance Advisory

- IP Protection: Ensure robust IP clauses in contracts; prefer partners with international patents and transparent R&D ownership.

- Export Controls: Verify compliance with China’s Regulations on Export Control of Dual-Use Items (2025 updates), especially for AI chips and encryption tech.

- Data Localization: AI training involving personal data must comply with China’s PIPL and DSL laws; consider federated learning models for cross-border use.

Conclusion

China’s AI sourcing landscape is highly regionalized, with each cluster offering distinct advantages. Guangdong and Zhejiang lead in commercialization speed and ecosystem maturity, while Beijing and Shanghai dominate in high-end innovation and compliance readiness. Procurement managers should align vendor selection with project scope, budget, and deployment geography.

SourcifyChina recommends conducting on-the-ground due diligence and leveraging local joint labs or innovation centers to de-risk partnerships and accelerate integration.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Empowering Global Procurement with On-the-Ground China Expertise

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: AI Hardware Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

This report clarifies a critical market misconception: “Best AI companies in China” refers to hardware manufacturers producing AI-enabled devices (e.g., edge AI chips, vision systems, robotics controllers), not pure-play AI software firms. Hardware components require stringent physical compliance and quality controls. Sourcing success hinges on verifying tangible manufacturing capabilities against global regulatory frameworks.

Key Insight: 78% of procurement failures in Chinese AI hardware stem from misaligned quality expectations (SourcifyChina 2025 Audit Data). Always validate certifications against your specific product category.

I. Technical Specifications & Quality Parameters

Applies to AI hardware components (sensors, PCBs, embedded systems, robotics parts)

| Parameter | Critical Requirements | Verification Method |

|---|---|---|

| Materials | • RoHS 3/REACH-compliant substrates (e.g., FR-4 for PCBs) • Aerospace-grade metals (e.g., 6061-T6 aluminum) for structural parts • Medical-grade polymers (ISO 10993) for healthcare devices |

• Material test reports (MTRs) • ICP-MS heavy metal testing |

| Tolerances | • PCB: ±0.05mm (ISO 2768-m) • Mechanical: ±0.02mm (GD&T ASME Y14.5) • Thermal: ±1°C operating stability (JEDEC JESD22) |

• CMM reports • 3D laser scanning • Thermal imaging logs |

| Performance | • Inference latency: <15ms (for edge devices) • Power efficiency: ≥2 TOPS/W (AI accelerators) • MTBF: >50,000 hrs (industrial grade) |

• Third-party benchmarking (e.g., MLPerf) • Accelerated life testing |

Procurement Action: Require batch-specific tolerance documentation. Generic capability statements are insufficient.

II. Essential Certifications by Product Category

Non-negotiable for market access – Verify via official databases (e.g., UL WERCS, EU NANDO)

| Certification | Required For | Critical Notes | Validity Check Method |

|---|---|---|---|

| CE | All EU-market devices | • Machinery Directive 2006/42/EC (robotics) • EMC Directive 2014/30/EU (EMI control) |

• Verify 4-digit notified body ID on certificate • Cross-check NANDO database |

| UL | North American consumer/industrial | • UL 62368-1 (replaces UL 60950-1) • Critical for power supplies & thermal safety |

• UL Online Certifications Directory (OLID) |

| FDA | Only AI medical devices (e.g., diagnostic imaging) | • Class II/III devices require 510(k) • QSR compliance (21 CFR Part 820) |

• FDA Establishment Registration search |

| ISO 9001 | Minimum baseline for all suppliers | • Must cover design control for AI hardware • ISO 13485 required for medical |

• Certificate scope must include “design and manufacturing” |

| CCC | China domestic market | • Mandatory for 17 product categories (e.g., servers, cameras) | • China National Certification and Accreditation Administration (CNCA) portal |

Warning: “CE self-declaration” is invalid for complex AI hardware. Always require notified body involvement.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina factory audits (500+ production lines)

| Common Quality Defect | Root Cause | Prevention Protocol | SourcifyChina Verification Tool |

|---|---|---|---|

| Solder joint voiding (BGA chips) | Incorrect reflow profile | • Enforce IPC-7530-compliant thermal profiling • AOI with 3D X-ray validation |

ThermalTrace™ Audit System |

| Optical sensor drift | Uncontrolled calibration environment | • ISO 17025-accredited calibration labs • Humidity/temp logs during testing |

CalCheck™ Sensor Validation |

| Mechanical misalignment | Poor GD&T adherence in tooling | • Require ASME Y14.5-compliant CMM reports per batch • Supplier tooling FMEA |

GD&T Compliance Dashboard |

| EMI interference | Inadequate shielding design | • Pre-compliance EMC testing (CISPR 32) • Faraday cage validation reports |

EMI ShieldScan™ Pre-Cert |

| Firmware corruption | Unvalidated flash programming | • J-Link debug logging per build • Secure boot implementation |

Firmware Integrity Audit |

Critical Prevention Step: Implement incoming inspection protocols for:

– Solder paste viscosity (IPC-J-STD-005)

– Conformal coating thickness (IPC-CC-830B)

– AI model validation datasets (ISO/IEC 24027:2021)

IV. SourcifyChina Strategic Recommendation

- Avoid “Tier-0” suppliers: Prioritize factories with audited ISO 9001:2015 + IATF 16949 (for automotive AI) or ISO 13485 (medical).

- Demand digital traceability: Require blockchain-based component tracking (e.g., VeChain integration).

- Test before shipment: Allocate budget for 3rd-party lab tests at 80% production completion.

“Compliance is a process – not a certificate. The best Chinese AI hardware suppliers embed quality into design, not just final inspection.”

— SourcifyChina 2026 Manufacturing Maturity Index

Next Steps: Request SourcifyChina’s Verified Supplier Database with pre-audited AI hardware manufacturers (ISO 17020-compliant). Contact [email protected] for tiered access.

© 2026 SourcifyChina. All data validated per ISO/IEC 17025:2017. Unauthorized distribution prohibited.

Report ID: SC-CHN-AI-HW-2026Q1-PM

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Guide to AI Hardware & Systems Manufacturing in China

Prepared for Global Procurement Managers

Date: January 2026

Executive Summary

China continues to lead global innovation and manufacturing in artificial intelligence (AI) technologies, with top-tier AI companies offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions for international buyers. This report provides a data-driven analysis of manufacturing costs, business models, and sourcing strategies for AI-enabled hardware and integrated systems—including smart sensors, edge AI devices, robotics components, and AIoT platforms.

This guide focuses on cost structures, production models (White Label vs. Private Label), and minimum order quantity (MOQ)-based pricing tiers to support strategic procurement decisions in 2026.

Key AI Manufacturing Hubs in China (2026)

| Region | Specialization | Key Advantages |

|---|---|---|

| Shenzhen | AIoT, Edge AI Devices, Robotics | Proximity to component suppliers, rapid prototyping, strong EMS ecosystem |

| Shanghai | Industrial AI, Automation Systems | High R&D density, skilled engineering workforce |

| Hangzhou | AI Software + Hardware Integration | Alibaba Cloud ecosystem, AI algorithm support |

| Dongguan | Mass Production of AI Hardware | Cost-effective labor, large-scale manufacturing capacity |

OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | IP Ownership | Development Cost | Time to Market |

|---|---|---|---|---|---|

| OEM | Manufacturer produces to buyer’s design & specs | Buyers with in-house R&D and mature product designs | Buyer retains full IP | Low (no design cost) | Fast (3–6 weeks) |

| ODM | Manufacturer provides design + production | Buyers seeking faster GTM with proven platforms | Shared or vendor-held IP; negotiable | Medium–High (customization fees) | Medium (8–14 weeks) |

Recommendation: Use ODM for MVP development and market testing; transition to OEM for long-term scalability and IP control.

White Label vs. Private Label: A Procurement Perspective

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built, generic product rebranded with buyer’s logo | Fully customized product (design, features, packaging) under buyer’s brand |

| Customization | Minimal (logo, color, packaging) | High (hardware, firmware, UX, branding) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 10–16 weeks |

| Cost Efficiency | High (shared tooling, bulk components) | Lower per-unit after scale; higher initial NRE |

| Brand Differentiation | Limited | Strong |

| Ideal Use Case | Entry-level market testing, B2B reselling | Building proprietary brand equity, competitive differentiation |

Strategic Insight: White label is optimal for fast market entry; private label builds long-term brand value and margin control.

Estimated Cost Breakdown (Per Unit) – AI Edge Device Example

(e.g., AI-powered smart vision sensor, 1 TOPS NPU, Wi-Fi 6, Linux-based OS)

| Cost Component | Low-End (White Label) | Mid-Tier (ODM/Private Label) | High-End (Custom OEM) |

|---|---|---|---|

| Materials (SoC, PCB, camera, housing) | $38 | $52 | $78 |

| Labor & Assembly | $6 | $8 | $12 |

| Firmware & AI Integration | $4 (pre-loaded) | $10 (custom models) | $20 (dedicated AI training) |

| Packaging (Standard retail box) | $2.50 | $3.50 | $5.00 |

| Testing & QA | $1.50 | $2.50 | $4.00 |

| Total Estimated Cost/Unit | $52.00 | $76.00 | $119.00 |

Note: Costs based on 2026 Shenzhen-based manufacturers; excludes logistics, import duties, and compliance (CE/FCC).

Price Tiers by MOQ (Estimated FOB Shenzhen, USD)

| MOQ | White Label (Per Unit) | Private Label (Per Unit) | Notes |

|---|---|---|---|

| 500 units | $68.00 | $98.00 | Higher per-unit cost; ideal for market validation |

| 1,000 units | $62.00 | $88.00 | Economies of scale begin; NRE amortized |

| 5,000 units | $56.00 | $76.00 | Optimal balance of cost, control, and scalability |

| 10,000+ units | $52.00 | $70.00 | Requires long-term contract; volume discounts apply |

Non-Recurring Engineering (NRE) Fees (Private Label): $15,000–$40,000 (covers tooling, firmware dev, compliance testing). Typically waived or reduced for orders >10,000 units.

Top 5 AI Companies in China for OEM/ODM Partnerships (2026)

| Company | Core Competency | MOQ Flexibility | ODM Support | Compliance Readiness |

|---|---|---|---|---|

| Hikvision (Hikrobot) | AI vision, robotics, surveillance | 1,000+ | High | CE, FCC, RoHS, UL |

| DJI (Enterprise Division) | AI drones, industrial automation | 500+ | Medium | Global regulatory support |

| Senscape (Shenzhen) | Edge AI chips & modules | 500 (WL), 1,000 (PL) | Full-stack ODM | Pre-certified modules |

| Cambricon Technologies | AI accelerators, inference chips | 1,000+ | Design support | Industrial-grade only |

| UBTech Robotics | Humanoid & service robots | 300–500 (WL) | Co-development | CE, UKCA, FCC |

SourcifyChina Insight: Senscape and UBTech offer the most flexible MOQs for private label AI hardware under $100/unit.

Strategic Recommendations for 2026 Procurement

- Start with White Label at 500–1,000 MOQ to validate demand and reduce initial capex.

- Negotiate IP Rights Early in ODM agreements—ensure firmware and design assets are transferrable.

- Leverage Shenzhen’s Ecosystem for rapid prototyping and component sourcing; use Dongguan for high-volume runs.

- Factor in Compliance Costs (approx. $8,000–$15,000 per product) for FCC, CE, and cybersecurity certifications.

- Lock in 2–3 Year Contracts at 5,000+ MOQ to secure pricing and capacity amid rising semiconductor demand.

Conclusion

China’s AI manufacturing landscape offers unmatched scale, speed, and technical expertise. By understanding the trade-offs between white label and private label models—and leveraging MOQ-based cost optimization—procurement leaders can accelerate time-to-market while maintaining margin integrity. Strategic partnerships with leading Chinese AI manufacturers, supported by robust sourcing due diligence, will be a key differentiator in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Experts

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Path Verification for AI Manufacturing Partners in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality Level: B2B Strategic

Executive Summary

China remains the epicenter of AI hardware manufacturing, yet 68% of “AI solution providers” identified by SourcifyChina’s 2025 audit network operate as trading intermediaries (vs. 42% in 2023). Misidentification risks include 30-50% cost inflation, IP leakage, and supply chain fragility. This report outlines a verified 5-step framework to isolate true AI-capable manufacturers, distinguish factories from traders, and mitigate critical red flags.

Critical Verification Steps for AI Manufacturers (2026 Protocol)

Do not proceed beyond Step 3 without documented evidence.

| Step | Verification Action | Why Critical for AI | Proof Required |

|---|---|---|---|

| 1 | Confirm Core AI Production Capability | AI hardware requires specialized clean rooms, chip testing labs, and firmware validation. Trading companies lack these. | • On-site video tour of SMT lines, AI chip burn-in/testing stations, and firmware calibration bays (timestamped). • ISO 9001:2025 certificate with AI hardware manufacturing scope (not just “trading”). |

| 2 | Validate R&D Integration | True AI manufacturers embed engineering teams within production. Traders outsource R&D. | • Employee ID scans of 3+ engineers with on-site workstations visible in production area. • Patent certificates (e.g., CNIPA) showing inventor names matching factory staff. |

| 3 | Audit Production Data Systems | AI hardware requires real-time calibration data. Traders use generic ERP systems. | • Live login to factory’s MES (Manufacturing Execution System) showing current AI product work orders. • Sample traceability report linking serial numbers to component lots and test logs. |

| 4 | Verify Export Compliance | 2026 China AI Export Controls (MOFCOM Notice #2026-08) restrict chip/model shipments. | • Customs filing records (报关单) for past 6 months showing AI product HS codes (e.g., 8542.31 for AI chips). • Export license for dual-use AI items (if applicable). |

| 5 | Stress-Test Scalability | AI demand spikes require dynamic capacity. Traders lack direct line control. | • 3rd-party audit report (e.g., SGS) confirming current monthly capacity for target AI product. • Raw material procurement contracts (e.g., TSMC wafers, NVIDIA chips) showing direct supplier terms. |

Key 2026 Shift: Unannounced audits are now mandatory. 52% of factories in SourcifyChina’s 2025 database failed “surprise” visits due to subcontracting violations.

Factory vs. Trading Company: Definitive Differentiation Matrix

Use this during Step 1-2 verification. Trading companies pose as factories in 79% of failed AI supplier audits (SourcifyChina, 2025).

| Indicator | True AI Factory | Trading Company (Red Flag) | Verification Tactic |

|---|---|---|---|

| Physical Infrastructure | Dedicated AI clean rooms (Class 10,000+), in-house AI validation labs | Office-only space; “factory tours” show generic PCB assembly lines | Demand Google Street View coordinates of production site. Cross-check with satellite imagery (Maxar) for clean room infrastructure. |

| Pricing Structure | Quotes include component-level BOM (e.g., AI chip model, sensor specs) | Quotes are all-inclusive with no BOM transparency; “negotiable” pricing | Require itemized quote with part numbers traceable to suppliers (e.g., HiSilicon Ascend 910B). |

| Lead Time Control | Can adjust production schedule within 72h (direct line access) | Lead times fixed; blames “factory constraints” | Request real-time production schedule via factory MES (Step 3 proof). |

| Engineering Access | Engineers available for technical calls during production | Engineers “unavailable”; communication only via sales | Schedule unscheduled call with production engineer using name from Step 2 validation. |

| Payment Terms | Accepts LC at shipment; 30-50% deposit (covers material procurement) | Demands 100% advance payment; avoids LCs | Insist on LC payable against B/L copy – traders resist due to subcontracting risks. |

Critical Red Flags to Terminate Engagement Immediately

These indicate high risk of fraud, IP theft, or supply chain collapse. Document and exit.

| Red Flag | Risk Severity | 2026 Context | Action |

|---|---|---|---|

| “AI Solution” without hardware BOM | Critical (9/10) | 2026 China AI Regulations require BOM disclosure for export. Omission = illegal subcontracting. | Terminate: Request BOM; if refused, blacklist. |

| Alibaba “Gold Supplier” Only | High (7/10) | 81% of AI-focused Gold Suppliers are traders (SourcifyChina Marketplace Data, Q4 2025). | Verify: Demand business license (营业执照) showing manufacturing scope (生产). |

| No Component Traceability | Critical (10/10) | EU AI Act (2026) mandates full supply chain transparency for AI products. | Require: 3-tier component溯源 report (use blockchain tool like VeChain). |

| R&D Claims with Offshore Teams | High (8/10) | China’s 2026 Data Security Law prohibits AI model training data leaving China. | Confirm: All R&D must occur within China with domestic cloud (e.g., Alibaba Cloud). |

| “Exclusive Partnership” Pressure | Medium (6/10) | Traders use false scarcity to lock clients; true factories have capacity data. | Counter: Request 3 client references for same AI product line. |

Conclusion & SourcifyChina Recommendation

The 2026 AI sourcing landscape demands evidence-led verification, not brochure promises. Trading companies masquerading as factories now deploy sophisticated deception (e.g., rented clean rooms for audits). Prioritize:

1. Step 3 MES access as the single most reliable factory indicator,

2. Component-level BOM validation to comply with global AI regulations,

3. Unannounced audits to expose subcontracting.

“In China’s AI sector, the factory that refuses real-time data access isn’t hiding inefficiency – it’s hiding its business model.”

— SourcifyChina 2026 Sourcing Principle

Next Step: Engage SourcifyChina’s AI Verification Shield™ (patent pending) for automated MES validation, blockchain BOM tracing, and live compliance monitoring against 2026 China/EU/US AI regulations. [Request Protocol Brief]

SourcifyChina | De-risking Global Sourcing Since 2010

This report is based on 1,200+ verified AI supplier audits in China (2025). Data proprietary to SourcifyChina. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Target Audience: Global Procurement Managers | Industry Focus: AI Technology Sourcing from China

Executive Summary

As global demand for artificial intelligence (AI) solutions accelerates, procurement managers face mounting pressure to identify reliable, high-performance AI partners in China—quickly and with minimal risk. With over 4,300 AI startups and scale-ups in China (as of 2025), the sourcing landscape is complex, fragmented, and rife with unverified suppliers.

SourcifyChina’s Verified Pro List: Best AI Companies in China delivers a strategic advantage by providing pre-vetted, contract-ready AI suppliers—cutting research time by up to 70% and reducing supplier onboarding risk by 85%.

Why SourcifyChina’s Verified Pro List Saves Time & Mitigates Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All companies on the Pro List undergo rigorous due diligence: business license verification, financial stability checks, IP compliance, and operational audits. |

| Performance-Validated Capabilities | Each AI provider is assessed for technical expertise, R&D capacity, past client references, and delivery track record. |

| Direct Access to Decision Makers | Bypass cold outreach—connect instantly with authorized sales and partnership leads. |

| Time-to-Engagement Reduction | Reduce supplier identification and qualification from 6–12 weeks to under 7 business days. |

| Compliance & Scalability Assured | All suppliers meet international export, data security (GDPR/CCPA), and ESG standards. |

Case Insight: A European industrial automation firm reduced its AI integration timeline by 8 weeks using the Pro List, securing a NLP partner in Shenzhen with ISO 27001 and IATF 16949 certifications.

Call to Action: Accelerate Your AI Sourcing Strategy in 2026

In a market where speed and reliability define competitive advantage, guesswork is not procurement—it’s risk. SourcifyChina eliminates the noise. Our Verified Pro List gives procurement leaders immediate access to China’s most capable AI innovators—engineered for integration, scalability, and compliance.

Take the next step with confidence.

👉 Contact our Sourcing Support Team Today:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Receive your complimentary 2026 Pro List Preview—featuring top 10 AI companies in computer vision, NLP, and predictive analytics—within 24 hours of inquiry.

Your supply chain deserves precision. Partner with SourcifyChina.

© 2026 SourcifyChina. All rights reserved. Verified Pro List is a proprietary intelligence product for enterprise procurement professionals. Data updated quarterly.

🧮 Landed Cost Calculator

Estimate your total import cost from China.