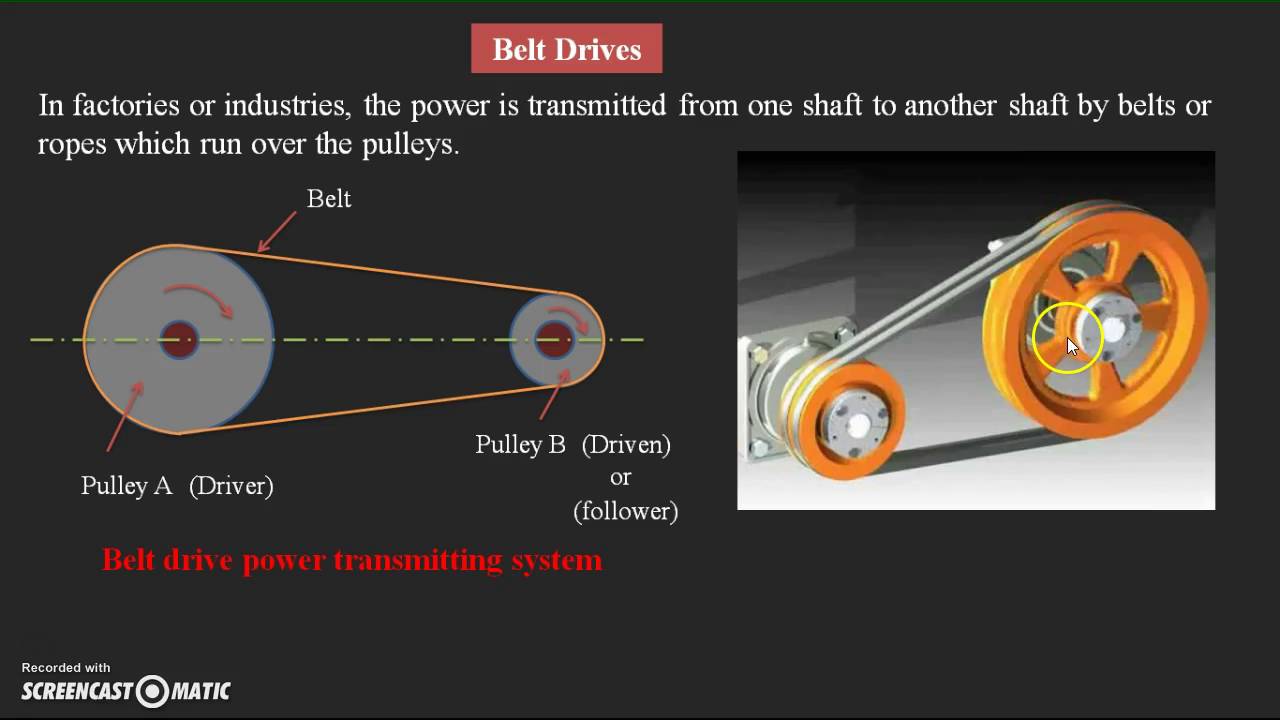

The global belt drive transmission market is experiencing steady growth, driven by increasing demand across automotive, industrial machinery, and manufacturing sectors. According to Mordor Intelligence, the market was valued at approximately USD 8.3 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. This expansion is fueled by the rising need for energy-efficient power transmission systems, advancements in material durability, and growing automation in production environments. Belt drive systems, known for their low maintenance, quiet operation, and high efficiency, are increasingly preferred over traditional chain and gear drives in a wide range of applications. As industries prioritize precision and sustainability, leading manufacturers are investing in innovative designs and high-performance materials to meet evolving technical requirements. In this competitive landscape, a select group of companies are emerging as key players, shaping the future of power transmission through technological excellence and global reach.

Top 10 Belt Drive Transmission Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

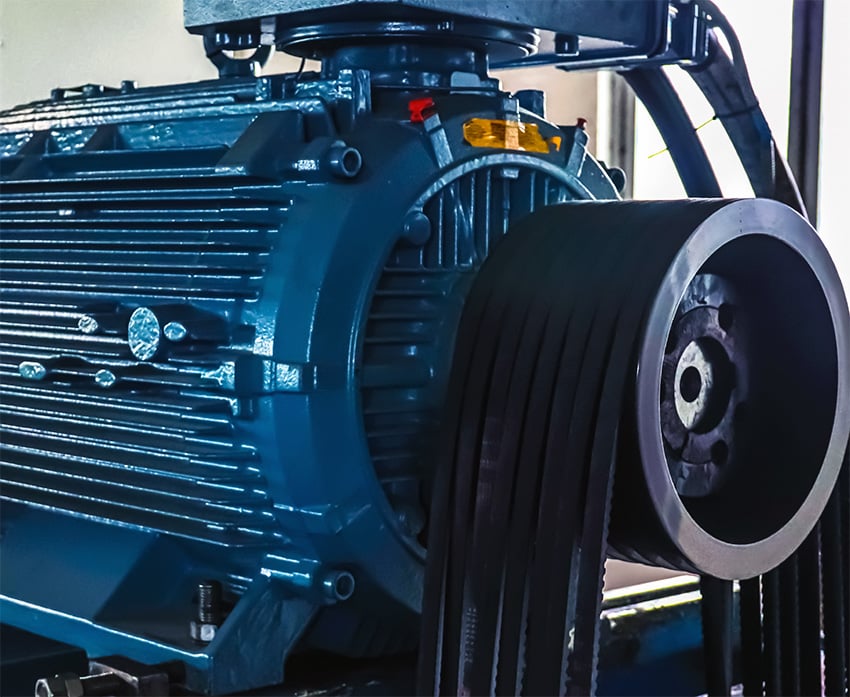

#1 Industrial belt manufacturer

Domain Est. 2001

Website: hutchinsontransmission.com

Key Highlights: Industrial belt manufacturer. Hutchinson, Belt drive manufacturer, develops and manufactures complete industrial power transmission systems incorporating ……

#2 BRECOflex: Timing Belt Manufacturer

Domain Est. 1996

Website: brecoflex.com

Key Highlights: BRECOflex CO., L.L.C. manufacturers timing belts, pulleys and drive components for linear drives, conveying & power transmission applications….

#3 PowerDrive LLC

Domain Est. 1997

Website: powerdrive.com

Key Highlights: PowerDrive manufactures Synchronous Drives, Sprockets, V-Belt Drives, Couplings & Bearings for high technology applications and power transmission industry….

#4 PIX Power Transmission Belts Manufacturer

Domain Est. 1998

Website: pixtrans.com

Key Highlights: PIX Transmissions Ltd is the world’s leading manufacturer of V belts, Timing belts, poly v belts and pulleys for nearly every application in the automotive, ……

#5 Power Transmission Solutions

Domain Est. 2018

Website: continental-industry.com

Key Highlights: As an expert in the power transmission technology area, Continental is a global leader offering belt drives custom-tailored to customer requirements….

#6 Power Transmission

Domain Est. 1994

Website: gates.com

Key Highlights: Trust the leaders in research, design, material science, and the manufacturing of the best power transmission solutions in the world – only with Gates….

#7 Belt Drives, LTD.

Domain Est. 1997

Website: beltdrives.com

Key Highlights: BDL has long been known for it’s American-made products. Be sure to check out the GMA by BDL line of motorcycle brakes and controls….

#8 B&B Manufacturing

Domain Est. 1999

Website: bbman.com

Key Highlights: Our expertly engineered belted drive solutions are trusted across industries like 3D Printing, Air-Cooled Heat Exchangers, CNC Machinery, and Oil & Gas, ……

#9 Fenner Transmission Belts

Domain Est. 2003

Website: fptgroup.com

Key Highlights: Ultra PLUS. Designed for use in single or multi-belt drives, Fenner Ultra PLUS transmission belts deliver maximum cost and performance….

#10 D&D Global Best Power Transmission Belts

Domain Est. 2011

Website: ddglobal.com

Key Highlights: D&D is a leading manufacturer of top-tier power transmission belts for various industries. Fast access to 35000+ SKUs with personalized service….

Expert Sourcing Insights for Belt Drive Transmission

H2: 2026 Market Trends for Belt Drive Transmission

The global belt drive transmission market is poised for significant transformation by 2026, driven by technological advancements, shifting industrial demands, and growing emphasis on energy efficiency. As industries continue to prioritize performance optimization and sustainability, belt drive systems are evolving beyond traditional applications into more sophisticated, high-efficiency solutions.

One major trend shaping the 2026 landscape is the increased adoption of synchronous (timing) belt drives in automation and robotics. These systems offer precise motion control, low maintenance, and reduced noise—attributes critical in advanced manufacturing and Industry 4.0 environments. With the expansion of smart factories, demand for reliable and accurate power transmission systems is expected to surge, favoring high-performance polyurethane and rubber-based timing belts with fiber reinforcements.

Another key development is the integration of advanced materials and coatings. Belt manufacturers are increasingly using carbon fiber tensile cords, thermoplastic polyurethanes (TPU), and nano-composite rubbers to enhance durability, temperature resistance, and efficiency. These material innovations are helping belt drives compete with chain and gear systems in high-torque applications, broadening their market reach into automotive, aerospace, and renewable energy sectors.

The automotive industry remains a major growth driver. By 2026, belt drive systems—especially serpentine and timing belts—are expected to gain traction in hybrid and electric vehicles (EVs), where noise, vibration, and harshness (NVH) reduction is paramount. While EVs reduce reliance on traditional engine-driven accessories, auxiliary systems such as air compressors, cooling pumps, and turbochargers still utilize belt drives, supporting continued demand.

Sustainability and energy efficiency regulations are also influencing market dynamics. Governments worldwide are enforcing stricter energy consumption standards in industrial motors and HVAC systems. As a result, energy-efficient belt drive systems—such as those using notched V-belts or variable speed belt drives—are being adopted to minimize energy losses, contributing to lower operational costs and carbon footprints.

Regionally, Asia-Pacific is projected to lead market growth due to rapid industrialization, expanding automotive production, and rising investments in infrastructure. China, India, and Southeast Asian countries are expected to account for a significant share of belt drive demand, supported by robust manufacturing and transportation sectors.

In summary, the 2026 belt drive transmission market will be characterized by innovation in materials, increased automation integration, and growing demand from high-efficiency and electric mobility applications. Companies that invest in R&D for lightweight, durable, and smart belt technologies will be best positioned to capitalize on these emerging opportunities.

Common Pitfalls Sourcing Belt Drive Transmission (Quality, IP)

Poor Quality Components

Sourcing low-grade belt drive transmissions often results in premature wear, belt slippage, and reduced efficiency. Inferior materials in belts, pulleys, or tensioners can lead to frequent maintenance, unplanned downtime, and higher total cost of ownership. Buyers may be tempted by lower upfront prices but face reliability issues under operational stress.

Lack of Intellectual Property (IP) Protection

Procuring belt drive systems without proper IP clearance risks legal exposure, including infringement claims from original equipment manufacturers. Counterfeit or reverse-engineered products may lack certification, compromising performance and safety. Ensuring suppliers have legitimate licensing or proprietary designs is critical to avoid litigation and ensure long-term supply stability.

Inadequate Environmental Sealing (IP Rating Mismatch)

Selecting belt drives with insufficient IP (Ingress Protection) ratings for the operating environment can lead to failure. For example, using an IP54-rated unit in a high-dust or washdown setting (requiring IP65 or higher) exposes internal components to contaminants, accelerating wear and risking system failure. Misunderstanding IP codes during procurement compromises durability and safety.

Insufficient Supplier Qualification

Failing to vet suppliers for manufacturing standards, quality control processes, and compliance certifications (e.g., ISO, CE) increases the risk of inconsistent product quality. Unqualified suppliers may not adhere to tight tolerances or perform required testing, resulting in poor belt alignment, vibration, and premature transmission failure.

Overlooking Compatibility and Integration

Sourcing belt drives without verifying compatibility with existing motors, shafts, or control systems can lead to integration challenges. Mismatches in pulley dimensions, belt type, or mounting configurations cause inefficiencies, increased wear, and potential damage to connected equipment.

Hidden Costs from Short-Term Sourcing Decisions

Prioritizing initial cost over total lifecycle value often leads to higher expenses from frequent replacements, maintenance, and downtime. Low-quality or IP-infringing products may lack technical support or spare parts availability, disrupting operations and increasing long-term costs.

Logistics & Compliance Guide for Belt Drive Transmission

Overview

Belt drive transmissions are critical components used in various industrial, automotive, and mechanical applications to transfer power between rotating shafts. Proper logistics planning and regulatory compliance are essential to ensure safe transportation, timely delivery, and adherence to international and regional standards.

Packaging and Handling Requirements

Proper packaging protects belt drives from damage during transit and storage.

– Use moisture-resistant, durable packaging materials (e.g., corrugated cardboard with internal foam or molded inserts).

– Secure belt drives to prevent movement within the container.

– Label packages clearly with “Fragile,” “This Side Up,” and handling instructions.

– Avoid exposure to extreme temperatures, humidity, and direct sunlight during storage.

Transportation Considerations

Choose transportation methods based on distance, volume, and urgency.

– Land Transport: Use cushioned and secured pallets; avoid stacking heavy items on top.

– Air Freight: Comply with IATA regulations; ensure proper documentation for customs clearance.

– Sea Freight: Use waterproof containers; consider VCI (Vapor Corrosion Inhibitor) packaging for long voyages.

– Ensure temperature-controlled environments when transporting high-precision or elastomer-based belts.

International Shipping and Customs Compliance

Adhere to international trade regulations to avoid delays.

– Prepare accurate commercial invoices, packing lists, and certificates of origin.

– Classify products under the correct HS (Harmonized System) code (e.g., 8483.90 for transmission shafts and cranks).

– Comply with import/export controls, including ECCN (Export Control Classification Number) if applicable.

– Follow REACH (EU), RoHS, and other chemical/environmental regulations for materials used in belt construction.

Regulatory and Safety Standards

Meet industry-specific standards to ensure product safety and performance.

– ISO Standards: ISO 5293 (V-belt drives), ISO 18164 (timing belts).

– DIN/ANSI Standards: DIN 7753 (industrial V-belts), ANSI B77.1 (conveyor belts).

– CE Marking: Required for sale in the European Economic Area; indicates compliance with EU safety, health, and environmental directives.

– UL/CSA Certification: May be required for electrical or industrial equipment applications in North America.

Documentation and Traceability

Maintain comprehensive records for compliance and quality assurance.

– Include batch numbers, manufacturing dates, and material certifications with each shipment.

– Provide technical datasheets and user manuals compliant with local languages (e.g., EU requires multilingual instructions).

– Implement a traceability system to track components from production to delivery.

Environmental and Sustainability Compliance

Adopt eco-friendly logistics practices.

– Minimize packaging waste through recyclable or reusable materials.

– Comply with WEEE (Waste Electrical and Electronic Equipment) directives if applicable.

– Partner with logistics providers that follow carbon-reduction initiatives.

Conclusion

Effective logistics and compliance management for belt drive transmissions ensures product integrity, regulatory adherence, and customer satisfaction. By following standardized packaging, transportation, and documentation practices, manufacturers and distributors can reduce risks, avoid penalties, and support global market access. Regular audits and updates to compliance protocols are recommended to align with evolving regulations.

In conclusion, sourcing a belt drive transmission system offers numerous advantages in terms of efficiency, noise reduction, maintenance, and flexibility across various industrial and mechanical applications. The selection of the appropriate belt type—such as timing, V-belts, or synchronous belts—depends on specific requirements including power transmission needs, alignment precision, environmental conditions, and operational speed. Careful consideration of material quality, compatibility with pulleys, and supplier reliability ensures long-term performance and cost-effectiveness. Additionally, partnering with reputable suppliers who provide technical support and quality assurance contributes significantly to the reliability and durability of the system. Overall, a well-sourced belt drive transmission enhances operational efficiency, reduces downtime, and supports sustainable mechanical design, making it a critical component in modern power transmission solutions.