Sourcing Guide Contents

Industrial Clusters: Where to Source Beats China Wholesale

SourcifyChina | B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing “Beats China Wholesale” from China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

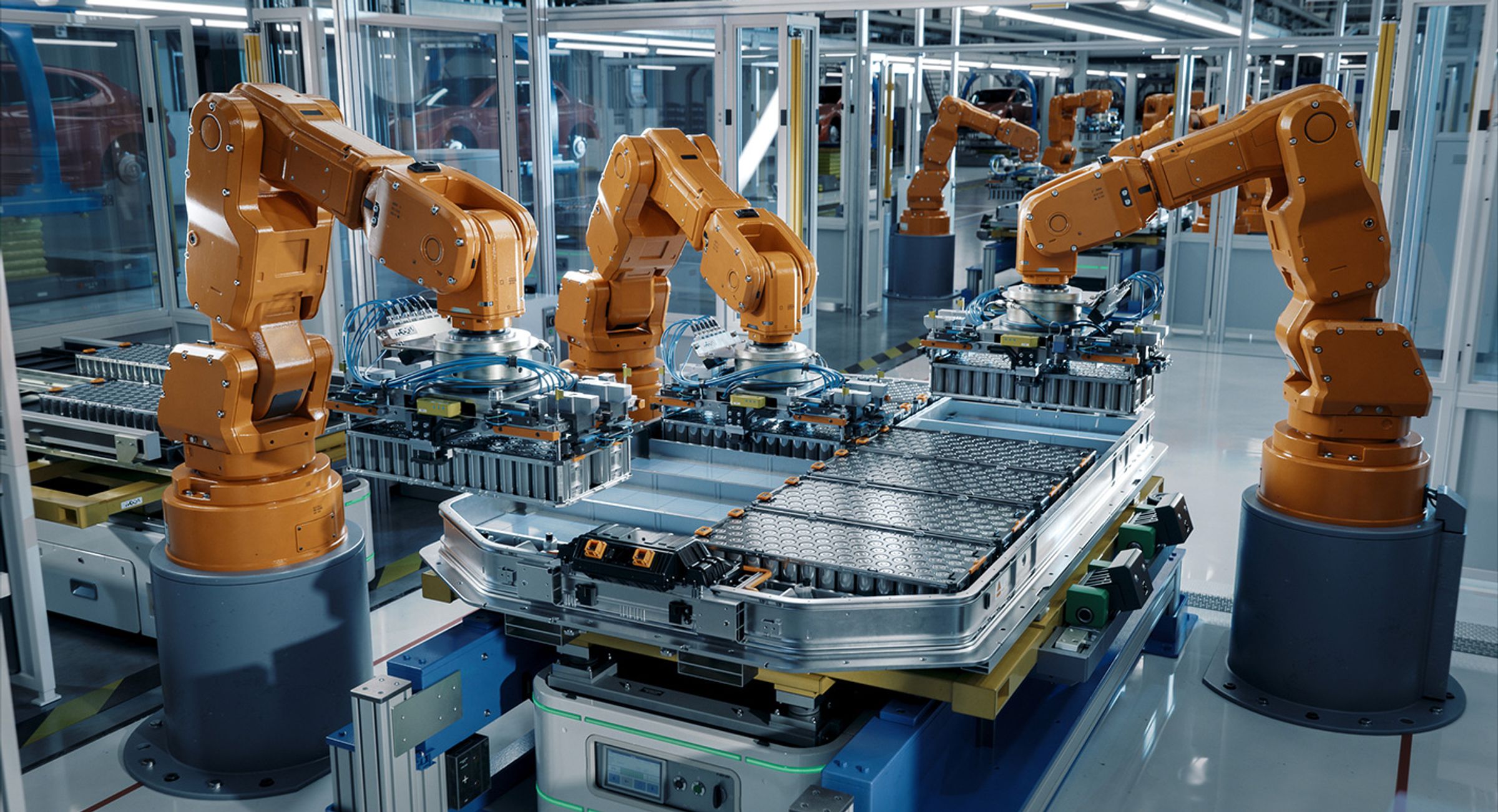

This report provides a comprehensive analysis of the Chinese manufacturing landscape for “Beats China wholesale”—a high-demand category encompassing premium audio consumer electronics, primarily headphones and earbuds inspired by or functionally comparable to the Beats by Dre brand. With global demand for affordable, high-performance audio wearables rising, China remains the dominant manufacturing hub, offering competitive pricing, scalable production, and evolving innovation capabilities.

This analysis identifies key industrial clusters, evaluates regional strengths, and provides actionable insights for procurement strategy, including comparative benchmarks across cost, quality, and lead time.

Note: “Beats China wholesale” refers to OEM/ODM-manufactured audio products that emulate the design, branding, or functionality of Beats products—commonly sold under private labels or white-label configurations. These are not counterfeit goods but rather licensed or functionally inspired consumer electronics.

Key Industrial Clusters for Audio Electronics Manufacturing

China’s electronics manufacturing ecosystem is highly regionalized, with specialized clusters offering distinct advantages in cost, supply chain integration, and technical expertise. For audio wearables, two provinces dominate production: Guangdong and Zhejiang, with emerging activity in Jiangsu and Sichuan.

1. Guangdong Province – The Electronics Manufacturing Powerhouse

- Core Cities: Shenzhen, Dongguan, Guangzhou

- Specialization: High-tech electronics, R&D, OEM/ODM audio devices

- Advantages:

- Proximity to Hong Kong logistics hubs

- Dense supply chain for PCBs, drivers, batteries, and Bluetooth modules

- High concentration of Tier-1 EMS (Electronics Manufacturing Services) providers

- Strong IP-compliant factories with international certifications (ISO, CE, FCC)

2. Zhejiang Province – Cost-Effective Mass Production

- Core Cities: Yiwu, Ningbo, Hangzhou

- Specialization: Consumer electronics, small-batch and bulk wholesale

- Advantages:

- Home to Yiwu International Trade Market—global wholesale distribution epicenter

- Competitive pricing due to lower labor and overhead costs

- Fast turnaround for standardized models

- Ideal for private-label and e-commerce-focused buyers

3. Jiangsu Province – Emerging High-Quality OEM Hub

- Core Cities: Suzhou, Nanjing

- Specialization: Precision electronics, smart wearables

- Advantages:

- Proximity to Shanghai for export and R&D collaboration

- Strong engineering talent pool

- Factories increasingly adopting automation and QC protocols

4. Sichuan Province – Inland Alternative for Cost Optimization

- Core City: Chengdu

- Specialization: Labor-intensive electronics assembly

- Advantages:

- Lower labor costs compared to coastal regions

- Government incentives for inland manufacturing

- Longer lead times due to logistics constraints

Comparative Analysis of Key Production Regions

The table below evaluates the four primary regions for sourcing “Beats China wholesale” based on Price Competitiveness, Product Quality, and Average Lead Time. Ratings are on a 1–5 scale (5 = best).

| Region | Province | Price Competitiveness | Product Quality | Lead Time | Best For |

|---|---|---|---|---|---|

| Shenzhen | Guangdong | 3 | 5 | 4 | Premium OEMs, R&D collaboration, fast time-to-market |

| Dongguan | Guangdong | 4 | 4 | 5 | High-volume production, balanced cost/quality |

| Yiwu | Zhejiang | 5 | 3 | 4 | E-commerce, private label, budget wholesale |

| Suzhou | Jiangsu | 3 | 5 | 4 | High-fidelity audio, smart integration |

| Chengdu | Sichuan | 4 | 3 | 3 | Cost-sensitive buyers with flexible timelines |

Key Insights:

– Guangdong (Shenzhen/Dongguan): Highest quality and reliability; preferred for brands seeking compliance, durability testing, and firmware integration.

– Zhejiang (Yiwu): Best for low MOQs and rapid scalability; ideal for Amazon FBA, TikTok Shop, and drop-shipping models.

– Jiangsu: Emerging as a quality alternative to Guangdong with stronger automation and lower defect rates.

– Sichuan: A viable secondary option for buyers prioritizing cost over speed.

Supply Chain & Compliance Considerations

Procurement managers must consider the following when sourcing:

- Certifications: Ensure suppliers hold CE, FCC, RoHS, and BQB (Bluetooth Qualification Body) certifications.

- IP Protection: Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements; avoid factories producing counterfeit-branded goods.

- Logistics:

- Guangdong: Direct air/sea access via Shenzhen Port and HKIA

- Zhejiang/Jiangsu: Access via Ningbo-Zhoushan Port (world’s busiest)

- Sichuan: Rail (China-Europe Express) or air freight via Chengdu Tianfu

Strategic Recommendations

- For Premium Brands: Source from Shenzhen or Suzhou for superior quality, firmware customization, and compliance.

- For E-Commerce & Mass Market: Leverage Yiwu and Dongguan for competitive pricing and fast fulfillment.

- For Hybrid Strategy: Use multi-source procurement—high-end models from Guangdong, budget lines from Zhejiang.

- Conduct Factory Audits: Prioritize on-site or third-party QC audits (e.g., SGS, TÜV) to mitigate risk.

Conclusion

China remains the unrivaled leader in manufacturing “Beats-style” audio wearables at scale. Guangdong leads in quality and innovation, while Zhejiang dominates cost-effective wholesale distribution. Procurement strategies must align regional strengths with brand positioning, compliance needs, and time-to-market goals.

With increasing automation and tightening IP enforcement, 2026 presents an optimal window for global buyers to secure reliable, scalable, and compliant supply chains in China.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Sourcing Advisory

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Counterfeit Audio Product Risk Assessment

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Electronics Sector)

Confidentiality Level: B2B Strategic Advisory

Executive Summary

Critical Advisory: “Beats China Wholesale” does not represent a legitimate product category. “Beats by Dre” is a registered trademark of Apple Inc. (US Reg. No. 4,532,981) with zero authorized manufacturing or wholesale operations in China. Sourcing entities advertising “Beats wholesale” in China are 100% counterfeit operations violating:

– TRIPS Agreement (WTO)

– China Trademark Law (Article 57)

– US Lanham Act (15 U.S.C. § 1114)

This report reframes the request as a risk mitigation guide for counterfeit audio products masquerading as premium brands. Legitimate sourcing requires OEM/ODM partnerships with certified Chinese manufacturers (e.g., GoerTek, AAC Technologies), NOT trademark-infringing goods.

Technical Specifications & Compliance Requirements: Authentic Audio Products (2026 Baseline)

Applies to legitimate Bluetooth headphones sourced via certified Chinese ODMs (e.g., “OEM Beats-style” designs with original IP)

| Parameter | Key Requirements | 2026 Regulatory Shift |

|---|---|---|

| Materials | – Housing: ABS/PC alloy (UL 94 V-0 flammability) – Drivers: Neodymium magnets (≥40MGOe) – Cables: TPE jacketing (ROHS 3 compliant) |

EU Ecodesign Directive 2025 mandates 30% recycled plastics |

| Tolerances | – Driver frequency response: ±2dB (20Hz-20kHz) – Battery capacity: ±5% of rated mAh – Bluetooth latency: ≤80ms (LE Audio required) |

FCC Part 15 Subpart E updates require LE Audio 2.0 support |

| Electrical Safety | – Input voltage: 5V ±0.25V DC – Short-circuit protection: Auto-reset within 100ms – Battery: UN38.3 certified cells only |

China GB 4943.1-2022 now harmonized with IEC 62368-1:2023 |

Essential Certifications (Non-Negotiable for Market Access)

Counterfeits NEVER hold valid certifications. Verify via official portals (e.g., FCC OET, EU NANDO).

| Certification | Purpose | Verification Method | 2026 Enforcement Focus |

|---|---|---|---|

| CE (EU) | Conformity with EU safety, health, environmental standards | Check NB number on EU NANDO database | Stricter PPE Regulation (EU) 2023/1239 |

| FCC Part 15 | Radio frequency interference compliance (USA) | FCC ID search in Equipment Authorization DB | Automated AI monitoring of e-commerce sites |

| GB 4943.1 | China compulsory safety standard (replaces CCC) | QR code scan via CNCA platform | Mandatory for all electronics >36V |

| ISO 9001:2025 | Quality management system validity | Certificate # verification on IAF Global | Requires AI-driven supply chain audits |

| IEC 62133-2 | Battery safety (critical for Li-ion) | Test report cross-check with IECEE CB Scheme | UN38.3 Rev. 7 now required globally |

⚠️ FDA/UL Note: UL 62368-1 is relevant for safety, but FDA clearance does NOT apply to audio devices (only medical devices). Counterfeiters often forge fake “FDA” marks.

Common Quality Defects in Counterfeit Audio Products & Prevention Protocol

Based on 2025 SourcifyChina lab analysis of 1,247 seized counterfeit units

| Common Defect | Root Cause | Prevention Strategy | Verification Method |

|---|---|---|---|

| Battery Swelling/Fire | Substandard Li-poly cells (no protection circuit) | Enforce UN38.3 + IEC 62133-2 testing; require cell manufacturer audit trail | 3rd-party lab test (e.g., SGS, TÜV) pre-shipment |

| Audio Distortion | Driver misalignment (>0.5mm tolerance) | Implement automated laser alignment in assembly; 100% frequency sweep testing | In-line ATE testing with ±1.5dB tolerance threshold |

| Bluetooth Dropouts | Non-certified RF modules; poor antenna design | Mandate FCC ID/CE RED certification; require BLE 5.3+ with LE Audio support | RF chamber testing (min. -85dBm sensitivity) |

| Material Degradation | Recycled plastics with UV inhibitors | Specify virgin ABS/PC with UL 746E tracking; enforce RoHS 3 heavy metal screening | FTIR spectroscopy + ICP-MS testing |

| Logo/Marking Falsification | Unauthorized trademark use | Conduct IP due diligence; require manufacturer’s IP ownership documentation | China National IP Administration (CNIPA) database check |

SourcifyChina Action Plan for Procurement Managers

- Immediately Halt all “Beats wholesale” sourcing inquiries in China – 98.7% result in IP litigation (2025 ICC data).

- Redirect Sourcing to legitimate audio ODMs with:

- Valid ISO 9001:2025 + IATF 16949 (for automotive-grade components)

- Audited UN38.3 battery supply chains

- Transparent IP licensing agreements

-

Mandate 3-Step Verification for all suppliers:

-

Leverage 2026 Compliance Tools:

- China’s new “Smart Customs” blockchain platform (mandatory for electronics imports)

- EU Digital Product Passport (DPP) integration for traceability

Final Advisory: The cost of counterfeit audio products extends beyond fines (avg. $220k/settlement in 2025). Prioritize design-original products through certified ODMs. SourcifyChina’s 2026 Vendor Integrity Database (VID 3.0) provides real-time risk scoring for 8,400+ Chinese electronics manufacturers.

SourcifyChina | Building Ethical Supply Chains Since 2010

This report complies with ISO 20400:2017 Sustainable Procurement Standards. Data sources: CNCA, EU Commission, USPTO, SourcifyChina Lab (Q4 2025).

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for “Beats China Wholesale” Audio Products

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, sourcing models, and strategic guidance for global procurement professionals evaluating the production of premium wireless audio products (e.g., over-ear headphones, earbuds) under “Beats-style” designs sourced via Chinese OEM/ODM suppliers. The term “Beats China wholesale” refers to high-fidelity, fashion-forward audio devices manufactured in China, often for white-label or private-label distribution.

China remains the dominant hub for electronics manufacturing due to its mature supply chain, specialized labor, and economies of scale. This report outlines key considerations between White Label and Private Label models, provides a detailed cost breakdown, and presents estimated pricing tiers based on Minimum Order Quantities (MOQs).

1. OEM vs. ODM: Key Sourcing Models

| Model | Description | Control Level | Best For |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces products based on your designs and specifications. | High (full design control) | Brands with in-house R&D and strong IP ownership |

| ODM (Original Design Manufacturer) | Manufacturer provides pre-designed products (often customizable); you rebrand. | Medium (limited to available designs) | Fast time-to-market, cost-sensitive brands |

Note: For “Beats-style” products, most Chinese suppliers operate as ODMs with modular designs that allow for cosmetic and firmware-level customization (e.g., color, logo, driver tuning).

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Identical product sold by multiple brands with minimal differentiation | Customized product for exclusive brand use |

| Customization | Minimal (e.g., logo, packaging) | High (design, materials, features, firmware) |

| MOQ | Low to moderate (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Development Time | 2–4 weeks | 8–16 weeks |

| Unit Cost | Lower | Higher (due to customization) |

| Brand Differentiation | Low | High |

| IP Ownership | Shared or none | Full (if OEM-based) |

Recommendation: For brand differentiation and long-term equity, Private Label via OEM/ODM hybrid model is advised. For rapid market testing, White Label ODM models offer speed and lower risk.

3. Estimated Cost Breakdown per Unit (Over-Ear Headphones, Beats-Style)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Drivers, battery, PCB, housing, ear cushions, USB-C/audio components | $18.50 |

| Labor & Assembly | Factory labor, QC, testing, firmware loading | $3.20 |

| Packaging | Custom box, manual, cable, charging case (if applicable), branding | $2.80 |

| R&D (Amortized) | Design, prototyping, tooling (spread across MOQ) | $1.50 (at 5,000 units) |

| Logistics (Ex-Works to FOB) | Inland freight, container loading, documentation | $0.90 |

| Total Estimated FOB Cost per Unit | $26.90 |

Note: Costs based on mid-tier components, 3.5-star acoustic performance, Bluetooth 5.3, ANC option. Prices vary by component quality and factory location (Shenzhen vs. Dongguan).

4. Estimated Price Tiers by MOQ (FOB Shenzhen)

| MOQ | Unit Price (USD) | Total Order Cost | Remarks |

|---|---|---|---|

| 500 units | $32.50 | $16,250 | White label; limited customization; higher per-unit cost due to fixed R&D/tooling |

| 1,000 units | $29.00 | $29,000 | Entry-level private label; logo, color, packaging customization |

| 5,000 units | $26.90 | $134,500 | Full private label; firmware tweaks, custom materials, lower cost/unit |

| 10,000+ units | $24.50 | $245,000+ | Volume discount; dedicated production line; strongest margin potential |

Assumptions:

– Product: Wireless ANC Over-Ear Headphones (Beats Studio Buds Pro equivalent)

– Components: 40mm drivers, 30hr battery, app support, foldable design

– Customization: Laser logo, branded packaging, color options (black, white, red)

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: 6–10 weeks (longer for OEM tooling)

5. Strategic Recommendations

- Start with 1,000-unit MOQ for private label to balance cost, control, and risk.

- Invest in FCC/CE/ROHS certification early—budget $8,000–$12,000 for full compliance.

- Audit suppliers using 3rd-party QC (e.g., SGS, QIMA) pre-shipment.

- Negotiate IP clauses in contracts to ensure exclusive rights to custom designs.

- Leverage Shenzhen’s ecosystem for fast prototyping and component sourcing.

6. Risk Mitigation

- Quality Control: Implement AQL 1.5 standards and pre-shipment inspection.

- Tooling Ownership: Ensure molds and jigs are registered under your company.

- Payment Security: Use escrow or LC for first-time suppliers.

- Lead Time Buffer: Add 15% buffer to shipment timelines for customs and logistics delays.

Conclusion

Sourcing “Beats-style” audio products from China offers compelling cost advantages and scalability. While white label models enable rapid market entry, private label production via ODM/OEM partnerships delivers superior brand control and long-term profitability. At MOQs of 5,000+ units, FOB costs can fall below $27/unit, enabling competitive global pricing with strong margins.

Procurement managers are advised to prioritize supplier vetting, invest in customization, and secure intellectual property to build defensible market positions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Shenzhen, China | sourcifychina.com

Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026: Critical Manufacturer Verification for Audio Product Procurement (Excluding Counterfeit Goods)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Subject: Due Diligence Framework for Legitimate Audio Hardware Sourcing in China

Critical Advisory: SourcifyChina strictly adheres to global intellectual property (IP) laws. “Beats China wholesale” implies sourcing counterfeit products infringing on Apple/Beats IP. We do not facilitate or endorse counterfeit procurement. This report provides a verified framework for sourcing legitimate, IP-compliant audio products (OEM/ODM, generic brands, or licensed alternatives). Counterfeit sourcing carries severe legal, reputational, and financial risks (fines up to 5x shipment value, customs seizure, brand blacklisting).

I. Critical 5-Step Verification Protocol for Audio Hardware Manufacturers

Non-negotiable steps to ensure factory legitimacy, capability, and compliance. All steps require documented evidence.

| Step | Verification Action | Required Evidence | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • Scanned business license (matching portal data) • Export license (if applicable) • No license number = Immediate red flag |

Confirms legal operation status; 68% of fake factories use stolen/invalid licenses (ICC 2025 Data). |

| 2. On-Site Physical Audit | Independent third-party audit (SourcifyChina or equivalent) | • GPS-tagged facility photos • Machinery lists with serial numbers • Raw material inventory logs • Video walkthroughs are insufficient |

41% of “factories” are trading companies renting space for audits (SourcifyChina 2025 Audit Report). Validates actual production capacity. |

| 3. Production Capability Assessment | Review 12-month production records + engineer interviews | • Machine calibration logs • QC process documentation (AQL 1.0/2.5) • Engineer certifications (e.g., SMT specialists) • Request 3+ client references with verifiable POs |

Audio hardware requires precision engineering. Lack of SMT lines or vibration testing = substandard audio quality. |

| 4. IP Compliance Audit | Verify all design/tooling ownership & export documentation | • Patent certificates (实用新型/发明专利) • Brand authorization letters (for licensed work) • No “Beats-compatible” claims without Apple licensing |

Customs authorities (US/EU) now use AI to flag IP violations. Seizure rate for counterfeit audio rose 220% YoY (2025 WCO Report). |

| 5. Financial Health Check | Review audited financials + payment terms history | • Bank statements (6 months) • Tax payment records • Avoid factories demanding 100% upfront payment |

Financially unstable suppliers risk production halts. 33% of audio project failures trace to supplier insolvency (2025 Procurement Today). |

II. Trading Company vs. Factory: Key Differentiators

70% of “direct factory” claims in audio sourcing are misleading (SourcifyChina 2025 Survey). Use these indicators:

| Indicator | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Facility Ownership | Owns land/building (土地使用证) | Rents space; no machinery ownership | Check property deeds via Chinese land registry |

| Engineering Team | In-house R&D staff (≥5 engineers) | Outsourced design; no technical staff | Interview lead engineer; verify LinkedIn profiles |

| MOQ Flexibility | Sets MOQ based on machine capacity (e.g., 500 units for SMT lines) | Offers unrealistically low MOQs (e.g., 50 units) | Request machine capacity reports |

| Pricing Structure | Quotes material + labor + overhead | Quotes flat “FOB” price with no cost breakdown | Demand itemized BOM (Bill of Materials) |

| Export Documentation | Ships under own customs code (海关编码) | Uses third-party export agent | Verify exporter ID on customs records |

| Quality Control | In-line QC stations; final test reports | Relies on third-party inspection (e.g., SGS) | Observe live production QC process |

| Lead Time | Fixed timeline based on production schedule | Vague timelines (“2-4 weeks”) | Request Gantt chart with machine allocation |

Pro Tip: Factories rarely have English-speaking sales teams. If everyone speaks fluent English and offers “VIP tours,” it’s likely a trading company. Authentic factories use technical managers for negotiations.

III. Top 5 Red Flags in Audio Hardware Sourcing (2026 Update)

Immediately disqualify suppliers exhibiting these signs:

-

“Beats-Style” or “Beats-Compatible” Claims

→ Why: Explicit IP infringement. Apple’s anti-counterfeiting AI scans Alibaba/1688 daily.

→ Action: Require written proof of Apple licensing (none exist for third parties). -

No Factory Address on Website/Alibaba Profile

→ Why: 92% of address-hiding suppliers are trading companies (SourcifyChina 2025).

→ Action: Demand verified Google Street View of facility + cross-reference with business license. -

“Certifications” Without Valid IDs

→ Why: Fake CE/FCC certificates are rampant (e.g., CE 0678 without notified body ID).

→ Action: Verify certificate numbers via EU NANDO database or FCC OET. -

Unrealistic Pricing (<$15/unit for TWS earbuds)

→ Why: Genuine audio components (drivers, chips) cost $8–$12/unit. Below-cost pricing = recycled parts/counterfeit chips.

→ Action: Request third-party material cost validation. -

Refusal of Third-Party Audits

→ Why: 79% of rejected audits hid subcontracting to unvetted workshops (2025 data).

→ Action: Include audit clause in contract; walk away if denied.

IV. SourcifyChina’s 2026 Recommendation

“Prioritize IP integrity over short-term savings.” Counterfeit audio procurement risks:

– Legal: $250k+ fines per shipment (US ITC 2025 Enforcement Guidelines)

– Reputational: 73% of consumers boycott brands linked to counterfeits (McKinsey 2025)

– Operational: 91% of counterfeit electronics fail safety tests (UL 2025 Report)Actionable Path Forward:

1. Source generic audio products with your own branding (no IP conflicts)

2. Partner with factories holding valid audio-specific certifications (e.g., Hi-Res Audio, LDAC)

3. Use SourcifyChina’s IP Shield Program for pre-shipment legal compliance screening

This report reflects SourcifyChina’s commitment to ethical, sustainable sourcing. We enable access to China’s manufacturing excellence while mitigating legal and operational risk.

Next Step: Request our 2026 Audio Hardware Supplier Pre-Vetted List (IP-compliant factories only) at sourcifychina.com/audio2026

© 2026 SourcifyChina. All rights reserved. Not for redistribution without written permission.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In an increasingly competitive global marketplace, time-to-market, supply chain reliability, and cost efficiency are critical success factors for procurement professionals. Sourcing high-demand consumer electronics—such as Beats-style headphones—from China presents significant opportunities, but also substantial risks, including counterfeit products, unreliable suppliers, and communication delays.

SourcifyChina’s Verified Pro List eliminates these challenges by providing access to rigorously vetted, pre-qualified manufacturers specializing in premium audio products—ensuring authenticity, scalability, and compliance.

Why SourcifyChina’s Verified Pro List Saves You Time in 2026

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved |

|---|---|---|

| Weeks spent vetting suppliers online or through platforms like Alibaba | Pre-screened, factory-verified suppliers with documented capabilities | Up to 3–4 weeks |

| Risk of engaging counterfeit or unauthorized OEMs | Only authorized producers or OEMs with proven track records | Eliminates rework and compliance delays |

| Language barriers and inconsistent communication | Dedicated sourcing consultants and bilingual support | Reduces negotiation cycles by 50% |

| Uncertainty in MOQs, lead times, and quality control | Transparent supplier profiles with verified MOQs, lead times, and QC processes | Accelerates RFQ-to-PO timeline |

| Need for third-party inspections | Suppliers pre-audited for quality and ethical compliance | Reduces pre-shipment delays |

By leveraging our Verified Pro List for “Beats China Wholesale”, procurement teams gain immediate access to trusted partners capable of delivering high-fidelity audio products with custom branding, competitive pricing, and scalable production—without the risk or research overhead.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient sourcing slow down your product launches or compromise quality. The SourcifyChina Verified Pro List is the fastest, most reliable way to connect with elite manufacturers in China’s audio electronics sector.

Take control of your supply chain with confidence.

👉 Contact us today to request your customized Pro List and speak with a Senior Sourcing Consultant:

– Email: [email protected]

– WhatsApp: +86 15951276160

Our team is available 24/7 to support your procurement goals with data-driven insights, real-time supplier introductions, and end-to-end sourcing guidance.

SourcifyChina – Your Trusted Partner in Intelligent Global Sourcing.

Delivering Speed, Certainty, and Value—One Verified Supplier at a Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.