The global tools and hardware market has seen steady expansion, driven by rising residential construction and renovation activities worldwide. According to Mordor Intelligence, the global hand tools market was valued at USD 17.8 billion in 2023 and is projected to grow at a CAGR of 4.5% through 2028. As baseboard installation remains a critical component in finishing interior spaces, demand for precision tools—particularly baseboard cutters—has increased among contractors and DIY enthusiasts alike. This growth has spurred innovation and competition among manufacturers aiming to deliver accurate, efficient, and durable cutting solutions. In this evolving landscape, nine manufacturers have emerged as leaders, combining advanced engineering, user-focused design, and scalability to meet the needs of a broad customer base. These companies are not only shaping product standards but also influencing efficiency and safety practices in trim and molding work.

Top 9 Baseboard Cutter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

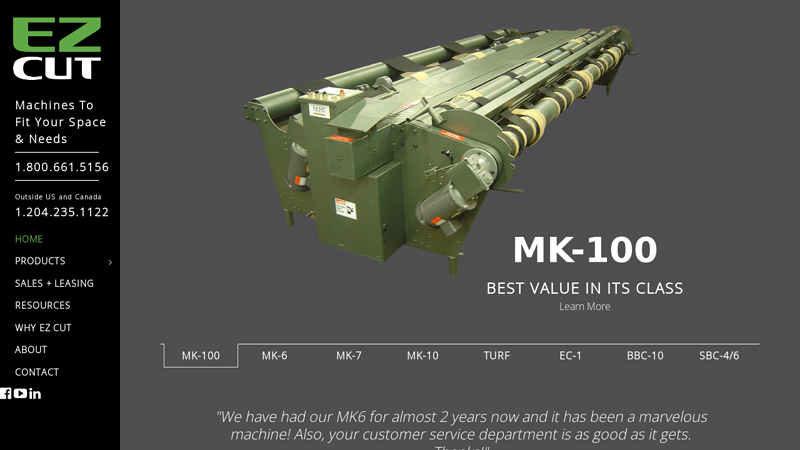

#1

Domain Est. 1997

Website: ezcut.com

Key Highlights: EZ Cut is proud to design, manufacture, sell and lease the most affordable, accessible and durable carpet cutting machines on the market….

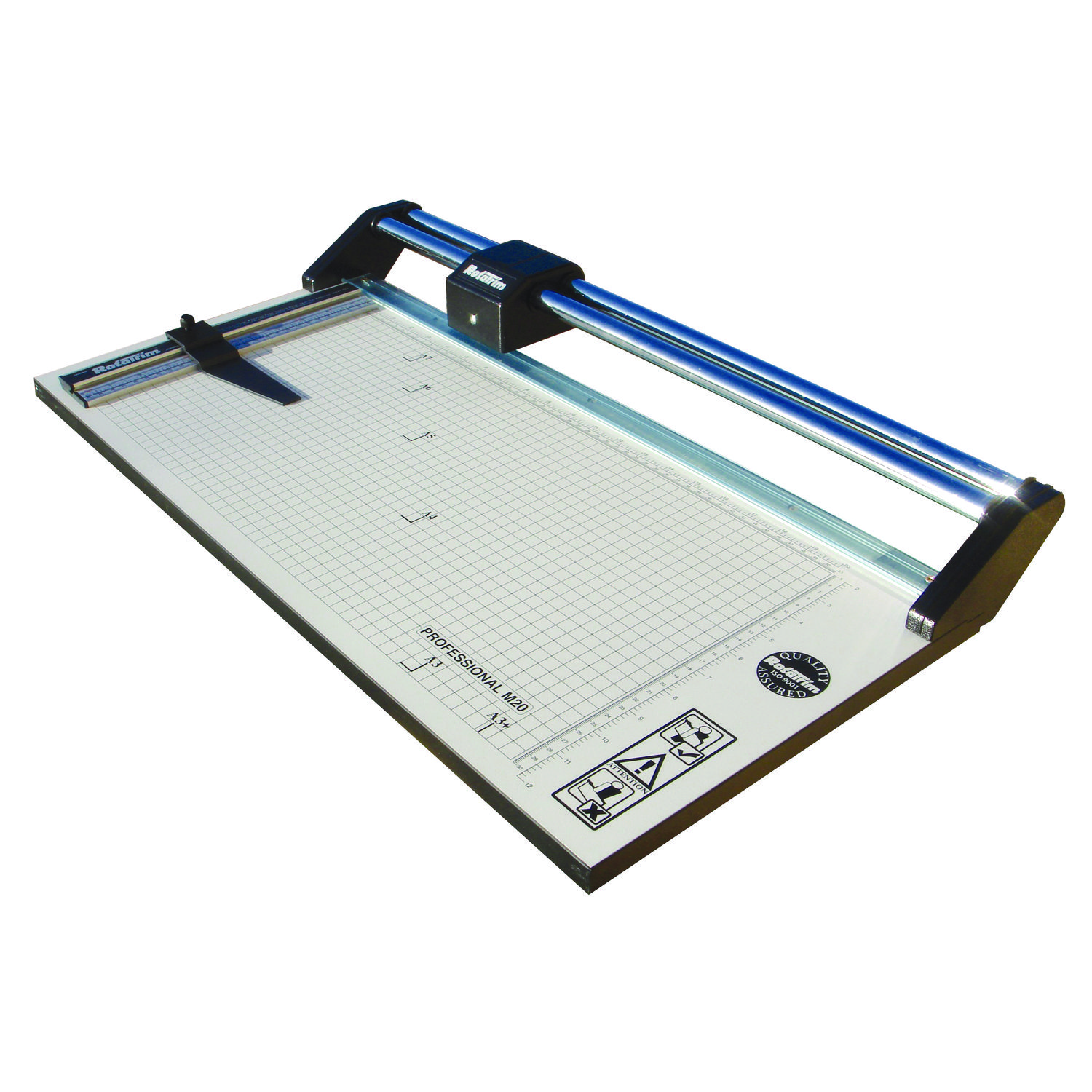

#2 Pro Series Trimmer Boards, 5 Sheets, 61″ Cut Length, Solid …

Domain Est. 1998

Website: hippoindustries.com

Key Highlights: In stockSolid one inch thick gridded baseboard and 1/12 inch edging strip provides extra stability and long durability. Dual stainless steel guide rails eliminate ……

#3 Ganahl Lumber

Domain Est. 1998

Website: ganahllumber.com

Key Highlights: Ganahl Lumber provides quality hardware, lumber and building materials for professional contractors and homeowners throughout Southern California….

#4 Builders FirstSource

Domain Est. 1998

Website: bldr.com

Key Highlights: Builders FirstSource is the nation’s largest supplier of structural building products, value-added components and services to the professional market….

#5 Crain Tools

Domain Est. 1999

Website: craintools.com

Key Highlights: Saws · Power Undercut Saws · Toe-Kick Saw · Hand Undercut Saws · Saw Blades · Carpet · Stretchers · Kickers · Seam Cutters · Seaming · Tackers · Trimmers ……

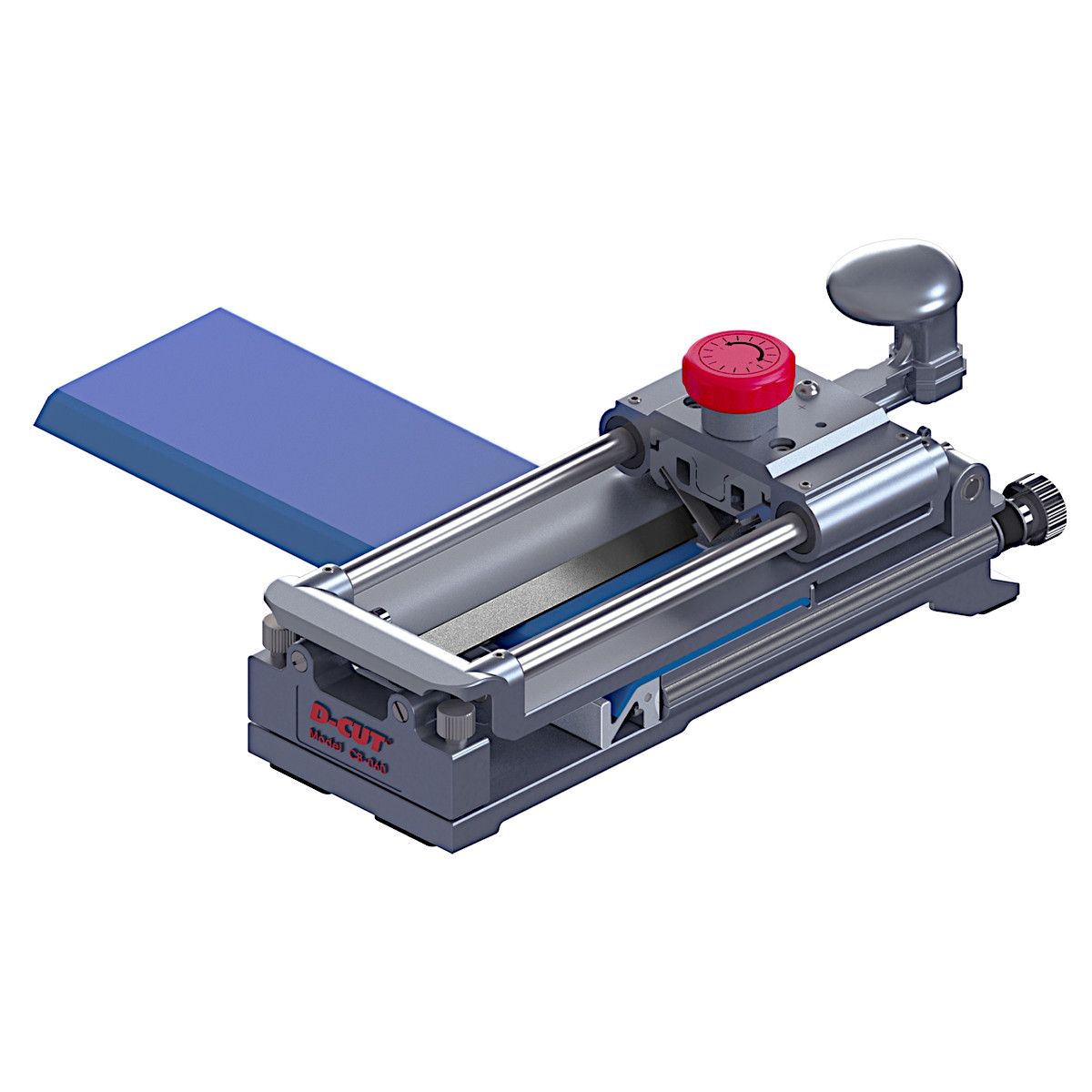

#6 RC

Domain Est. 2002

Website: dcutproducts.com

Key Highlights: It features a quick release lock for cutting angle changes. It makes precision cuts on 45°, 22.5°, and 90°. It is equipped with a long-lasting tungsten steel ……

#7 Cove Base Tools

Domain Est. 2004

#8 Corob Cutters

Domain Est. 2004

Website: corobcutters.com

Key Highlights: We offer fifty different knife profiles to help you create the perfect parts to fit your project. Click here to start or add to your collection….

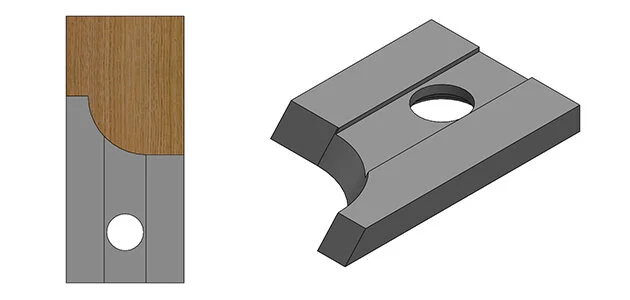

#9 Baseboard Molding Knives

Domain Est. 2013

Website: mywoodcutters.com

Key Highlights: These corrugated molding knives work for all corrugated molding knife systems, including molding machines by Weinig, Leadermac, or Wadkins….

Expert Sourcing Insights for Baseboard Cutter

H2: 2026 Market Trends for Baseboard Cutters

The baseboard cutter market is poised for notable evolution by 2026, driven by advancements in tool technology, increasing demand in residential and commercial construction, and a growing emphasis on precision and efficiency in DIY and professional woodworking. Here are the key trends expected to shape the baseboard cutter industry by 2026:

-

Rise in Demand for Precision and Automation

As construction and renovation projects demand higher accuracy, manufacturers are integrating precision-guided systems and digital measurement tools into baseboard cutters. Automated angle detection and laser-guided cutting features are becoming more common, reducing human error and increasing productivity—especially in professional contracting. -

Growth in the DIY and Home Renovation Sector

The surge in home improvement activities, accelerated by remote work trends and increased homeownership, is driving demand for user-friendly baseboard cutting tools. Compact, portable, and easy-to-use models are gaining popularity among DIY enthusiasts, fueling innovation in ergonomic design and safety features. -

Expansion of Cordless and Battery-Powered Tools

The broader power tool industry’s shift toward cordless technology is influencing baseboard cutters. By 2026, expect wider availability of cordless baseboard cutters powered by high-capacity lithium-ion batteries, offering greater mobility and convenience on job sites where access to power outlets is limited. -

Sustainability and Eco-Friendly Materials

Environmental awareness is impacting material choices in both construction and tool manufacturing. Baseboard cutters designed to handle sustainable materials like recycled composites and engineered wood products are likely to see increased demand. Additionally, manufacturers are focusing on recyclable tool components and energy-efficient production processes. -

Integration with Smart Technology

Smart features such as Bluetooth connectivity, app-based project planning, and tool performance tracking are emerging in premium baseboard cutter models. These innovations allow users to store cutting templates, receive maintenance alerts, and optimize workflow, especially appealing to professional contractors managing multiple projects. -

Regional Market Growth in North America and Europe

North America remains a dominant market due to robust construction activity and a strong DIY culture. Europe is also expected to see growth, supported by renovation initiatives and energy-efficient building upgrades that often involve interior remodeling, including baseboard installation. -

Competitive Pricing and Product Differentiation

As the market becomes more saturated, manufacturers are differentiating through value-added features, modular designs, and competitive pricing strategies. Entry-level models are becoming more affordable, while premium versions emphasize durability, precision, and advanced functionality.

In summary, the baseboard cutter market in 2026 will be shaped by technological innovation, user-centric design, and evolving construction trends. Companies that invest in smart, sustainable, and user-friendly solutions are likely to gain a competitive edge in this dynamic landscape.

Common Pitfalls When Sourcing a Baseboard Cutter (Quality, IP)

Sourcing a baseboard cutter—especially one that meets quality standards and has suitable IP (Ingress Protection) rating for its intended environment—can present several challenges. Being aware of these pitfalls helps ensure you select a durable, safe, and effective tool.

Poor Build Quality and Material Selection

Low-cost baseboard cutters often use substandard metals or plastics, leading to premature wear, misalignment, or structural failure. Thin blades or weak hinge mechanisms can result in inaccurate cuts and reduced tool lifespan. Always verify the materials used (e.g., hardened steel blades, reinforced frames) and look for reputable manufacturers known for durability.

Inadequate or Misrepresented IP Rating

Many suppliers claim an IP rating without proper certification. For baseboard cutters used in damp or dusty environments (e.g., construction sites), an appropriate IP rating (such as IP54 or higher) is essential to protect internal mechanisms from dust and water ingress. Always request certification documentation to validate the IP rating and avoid tools with vague or unverified claims.

Lack of Precision and Calibration

A poorly calibrated baseboard cutter will produce uneven or inaccurate cuts, compromising installation quality. Some budget models lack adjustable depth stops or stable clamping systems, increasing the risk of measurement errors. Ensure the tool offers fine-tuning capabilities and comes pre-calibrated from the factory.

Insufficient Safety Features

Cutting baseboards often requires high force, increasing the risk of slippage or injury. Tools lacking safety guards, non-slip grips, or blade retraction mechanisms can be hazardous. Always prioritize models with integrated safety features, especially when sourcing for professional or high-volume use.

Limited After-Sales Support and Warranty

Cheaply sourced baseboard cutters may come with little to no warranty or technical support. This becomes a major issue if the tool fails prematurely or requires spare parts. Choose suppliers offering clear warranty terms and accessible customer service to mitigate long-term risks.

Incompatibility with Regional Electrical or Safety Standards

If the cutter is electric or battery-powered, ensure it meets local electrical safety standards (e.g., CE, UL, RoHS). Tools sourced internationally may not comply, posing legal and safety issues. Verify certifications relevant to your region before procurement.

Logistics & Compliance Guide for Baseboard Cutter

Product Classification & Regulatory Compliance

Ensure the baseboard cutter is correctly classified under the appropriate Harmonized System (HS) code for international shipping—typically under 8467.21 or 8467.89 for hand-operated cutting tools. Confirm compliance with regional safety standards such as CE marking for the European Union, complying with the Machinery Directive 2006/42/EC, or UL/ANSI standards for the U.S. market. Verify that product labeling includes required safety warnings, voltage specifications (if electric), and manufacturer details in local languages.

Packaging & Shipping Requirements

Package the baseboard cutter securely using protective materials to prevent damage during transit. Include all necessary accessories, instruction manuals, and safety inserts. Use packaging that meets ISTA or ASTM standards for drop and vibration resistance. Clearly label each package with the SKU, product name, weight, dimensions, handling instructions (e.g., “Fragile,” “This Side Up”), and barcodes for inventory tracking. For international shipments, include a detailed packing list and commercial invoice.

Import/Export Documentation

Prepare complete export documentation, including a commercial invoice, packing list, bill of lading (or air waybill), and certificate of origin. For restricted regions, obtain an Export Control Classification Number (ECCN) and check if a license is required. Ensure all documentation includes accurate product descriptions, Harmonized Tariff Schedule (HTS) codes, and declared values to avoid customs delays. Retain records for a minimum of five years for audit purposes.

Transportation & Carrier Coordination

Select a freight carrier experienced in handling tools and hardware shipments, offering tracking and insurance options. For international delivery, work with a freight forwarder to manage customs clearance and inland transportation. Choose appropriate shipping modes—air for urgent deliveries, sea freight for bulk orders—balancing cost and transit time. Schedule pickups and deliveries to align with warehouse operations and customer requirements.

Warehouse Handling & Inventory Management

Upon receipt, inspect all baseboard cutters for damage and verify quantities against the packing list. Store in a dry, secure area with proper shelving to prevent deformation or rust. Implement a barcode or RFID inventory system to track stock levels, batch numbers, and expiration dates (if applicable). Follow FIFO (First In, First Out) practices to ensure older stock is shipped first, especially for models with replaceable blades.

Safety & Environmental Compliance

Adhere to OSHA guidelines for warehouse handling of sharp tools. Provide appropriate PPE (gloves, eye protection) for staff during packing and unpacking. For electric models, ensure compliance with RoHS and WEEE directives in applicable regions, including proper labeling and end-of-life recycling instructions. Dispose of damaged or obsolete units through certified e-waste or metal recycling channels.

Returns & Reverse Logistics

Establish a clear returns policy for defective or incorrect shipments. Inspect returned baseboard cutters for damage and determine eligibility for restocking or recycling. Use designated return labels and track return progress. For warranty claims, coordinate with the manufacturer or service center for repair or replacement. Update inventory and financial records accordingly.

Audit & Continuous Improvement

Conduct regular audits of logistics processes to ensure compliance with internal policies and external regulations. Review shipping accuracy, delivery times, and customer feedback to identify improvement areas. Update compliance documentation and training materials annually or as regulations change. Maintain communication with legal and compliance teams to stay informed about new trade laws or safety standards.

In conclusion, sourcing a baseboard cutter requires careful consideration of tool quality, cost-effectiveness, compatibility with materials, and supplier reliability. Investing in a high-performance, durable cutter tailored to your specific baseboard materials—whether wood, MDF, or composite—ensures clean, precise cuts and improves overall installation efficiency. Evaluating suppliers based on reputation, customer support, and warranty offerings further guarantees long-term satisfaction and return on investment. By prioritizing these factors, contractors, DIY enthusiasts, and construction professionals can streamline installations, reduce material waste, and achieve professional-grade results consistently.