The global banding tape market is experiencing steady growth, driven by rising demand across industries such as logistics, packaging, and construction. According to Grand View Research, the global strapping market—of which banding tape is a key segment—was valued at USD 5.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by increasing e-commerce activities, the need for secure cargo handling, and advancements in material durability and tensile strength. Additionally, sustainability trends are pushing manufacturers to innovate with recyclable and high-performance polymers. As demand intensifies, a select group of manufacturers has emerged as leaders in delivering reliable, high-quality banding solutions. Below is a data-driven look at the top 9 banding tape manufacturers shaping the industry’s future.

Top 9 Banding Tape Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Edge Banding Tape Manufacturer For Furniture

Domain Est. 1996

Website: rehau.com

Key Highlights: Edge banding tape for furniture interiors from German-based manufacturer in India. Choose from glass & metal, wood veneer, 3D look edgebands & more….

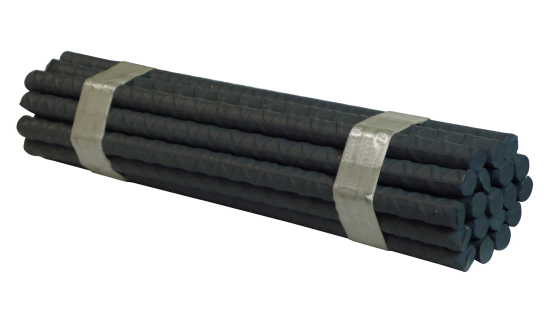

#2 Banding Tapes

Domain Est. 1996

#3 Edgebanding, Veneer Sheets Edgebanding at Edgemate of PA

Domain Est. 1999

Website: edgemate.com

Key Highlights: Edgemate is a manufacturer of quality veneer sheets and edgebanding products with an extensive inventory of Veneer species….

#4 PVC Edge Band Tape Manufacturer, PVC Edge Band Tape Near Me

Domain Est. 2019

Website: squareonedecor.com

Key Highlights: Square One decor is leading PVC Edge Band Tape Manufacturer. To buy PVC Edge Band Tape Near Me, call us now….

#5 Glass Banding

Domain Est. 1996

Website: peipittsburgh.com

Key Highlights: PEI’s glass banding tape is an excellent fiberglass banding tape. Also known as “Polyglass Tape,” it uses maximum tensile strength for every project….

#6 Madison Banders

Domain Est. 2018

Website: madisonbanders.com

Key Highlights: Madison Banders has spent over ten years developing better banding systems that provide secure movement of materials and packaging without the breakage….

#7 MKT North America

Domain Est. 2019 | Founded: 1991

Website: mktna.com

Key Highlights: Since 1991, MKT has focused on engineering the highest quality thermoplastic edgebanding products in the industry….

#8 SURTECO North America

Domain Est. 2024

Website: surteconorthamerica.com

Key Highlights: Find decorative films, laminates and edgeband and simplify the surface sourcing process with SURTECO….

#9 E3 Edgeband

Domain Est. 2014 | Founded: 2013

Website: e3edgeband.com

Key Highlights: E3 Edgeband Industries Pvt. Ltd., a key brand of E3 Group, leads India in high-precision edge band tapes. Since 2013, delivering perfect color match, ……

Expert Sourcing Insights for Banding Tape

H2: Projected Market Trends for Banding Tape in 2026

The global banding tape market is poised for significant evolution by 2026, driven by technological innovation, shifting industrial demands, and growing sustainability imperatives. As industries continue to prioritize efficiency, security, and environmental responsibility, banding tape—used widely in packaging, logistics, construction, and manufacturing—will adapt to meet these changing needs. The following analysis outlines key trends expected to shape the banding tape market in 2026 under the H2 economic and industrial outlook.

1. Rising Demand in E-Commerce and Logistics

With the continued expansion of e-commerce, especially in emerging markets, the demand for durable, reliable packaging solutions will remain strong. Banding tapes offer superior bundling strength compared to traditional strapping, making them ideal for securing parcels and pallets. By 2026, increased automation in fulfillment centers will favor banding tapes compatible with high-speed dispensing systems, boosting demand for precision-engineered, machine-applicable tapes.

2. Shift Toward Sustainable and Recyclable Materials

Environmental regulations and corporate sustainability goals will accelerate the adoption of eco-friendly banding tapes. Manufacturers are expected to invest heavily in biodegradable adhesives, recycled paper carriers, and water-based coatings. In H2 2026, regulatory pressure in Europe and North America may mandate minimum recycled content or reduced plastic usage, pushing suppliers to innovate with compostable or easily separable materials.

3. Technological Advancements and Smart Banding Solutions

Integration of smart labeling and tamper-evident features into banding tapes will gain traction. By 2026, expect growth in banding tapes embedded with RFID tags or QR codes for real-time tracking and authentication, especially in high-value logistics and pharmaceutical sectors. These advancements will enhance supply chain visibility and reduce theft and counterfeiting.

4. Regional Market Diversification

While North America and Europe remain stable markets, Asia-Pacific—particularly India, Southeast Asia, and China—will emerge as high-growth regions due to expanding manufacturing and export activities. Localized production hubs and rising infrastructure investments will drive demand for industrial-grade banding tapes, prompting global players to expand regional manufacturing and distribution networks.

5. Price Volatility and Supply Chain Resilience

H2 2026 may see fluctuations in raw material costs—particularly for polypropylene, paper, and adhesives—due to geopolitical tensions and energy market instability. As a result, companies will focus on supply chain resilience, nearshoring production, and long-term supplier contracts to mitigate risks. Cost-optimization strategies will include lightweighting tapes and improving yield per roll.

6. Consolidation and Competitive Dynamics

The banding tape market is expected to experience consolidation, with larger players acquiring niche innovators to expand their sustainable or high-performance product lines. Competition will intensify around product differentiation, with an emphasis on strength-to-weight ratios, ease of application, and customization for specific industrial uses.

Conclusion

By H2 2026, the banding tape market will be defined by sustainability, digital integration, and regional growth. Companies that proactively adapt to environmental standards, embrace smart technologies, and strengthen supply chains will be best positioned to capture market share. As packaging and logistics sectors evolve, banding tape will transition from a commodity product to a value-added solution, underpinning its long-term relevance in a dynamic global economy.

Common Pitfalls Sourcing Banding Tape (Quality, IP)

When sourcing banding tape for industrial, packaging, or consumer applications, overlooking key quality and intellectual property (IP) considerations can lead to operational failures, financial loss, and legal exposure. Below are common pitfalls to avoid:

Poor Material Quality and Inconsistent Performance

Low-grade banding tape may use inferior raw materials, resulting in reduced tensile strength, inconsistent adhesion, or premature degradation under stress or environmental exposure. Sourcing from unreliable suppliers often leads to batch-to-batch variability, increasing the risk of packaging failure, product damage, or safety hazards.

Lack of Compliance with Industry Standards

Many applications require banding tape to meet specific standards (e.g., ASTM, ISO, RoHS, REACH). Failing to verify compliance can result in rejected shipments, regulatory penalties, or incompatibility with automated packaging systems.

Inadequate Testing and Certification

Suppliers may provide incomplete or falsified test reports. Without verified third-party testing for properties like tensile strength, elongation, and temperature resistance, buyers risk deploying tape that fails under real-world conditions.

Intellectual Property Infringement Risks

Banding tape designs, adhesive formulations, or manufacturing processes may be protected by patents or trademarks. Sourcing counterfeit or unlicensed products exposes buyers to IP litigation, import bans, and reputational damage, especially in regulated markets.

Hidden Costs from Short-Term Savings

Opting for the lowest-cost supplier often leads to hidden expenses due to higher failure rates, increased waste, rework, or downtime. Total cost of ownership—including reliability and support—should outweigh initial price considerations.

Insufficient Supply Chain Transparency

Opaque supply chains increase the risk of unethical practices or substandard production. Without traceability, it’s difficult to verify material origins, manufacturing conditions, or consistency in quality control.

Overlooking Customization and Technical Support

Off-the-shelf tapes may not meet specific application needs. Suppliers lacking technical expertise or customization capabilities may fail to provide optimal solutions, leading to performance issues in specialized environments.

Failure to Audit Suppliers

Relying solely on documentation without on-site supplier audits increases vulnerability to quality lapses. Regular audits help verify production capabilities, quality management systems (e.g., ISO 9001), and IP compliance practices.

Avoiding these pitfalls requires due diligence, clear specifications, and partnerships with reputable, transparent suppliers who prioritize both quality assurance and IP integrity.

Logistics & Compliance Guide for Banding Tape

Overview

Banding tape, also known as strapping or bundling tape, is a critical material used to secure, stabilize, and bundle products during storage and transportation. Ensuring proper logistics handling and regulatory compliance is essential for safety, efficiency, and legal adherence across supply chains. This guide outlines key considerations for the logistics and compliance of banding tape.

Material Classification & Safety Data

Banding tape is typically manufactured from polypropylene (PP), polyester (PET), steel, or composite materials. Each material has distinct handling, storage, and safety requirements:

– Polypropylene (PP): Lightweight, non-corrosive; flammable—store away from heat sources.

– Polyester (PET): High tensile strength, UV-resistant; recyclable but requires proper waste segregation.

– Steel Strapping: High strength but prone to rust; edges are sharp—requires protective handling.

– Ensure Safety Data Sheets (SDS) are accessible per OSHA Hazard Communication Standard (HCS).

Storage Conditions

Proper storage preserves banding tape integrity and performance:

– Store in a dry, climate-controlled environment (ideally 10°C to 30°C).

– Avoid direct sunlight and moisture exposure, especially for PP and PET tapes.

– Keep reels or coils on racks to prevent deformation and tangling.

– Segregate different tape types to avoid cross-contamination and misuse.

Transportation & Handling

Follow best practices during shipping and material handling:

– Use pallets or containers to secure rolls, preventing shifting during transit.

– Label shipments clearly with contents, weight, material type, and handling instructions (e.g., “Fragile,” “This Side Up”).

– Use appropriate tools (tensioners, sealers, cutters) to minimize worker injury—train personnel on safe application techniques.

– Comply with carrier-specific packaging requirements (e.g., UPS, FedEx, DHL).

Regulatory Compliance

Adherence to international and regional regulations is mandatory:

– REACH (EU): Confirm banding tape components are registered and do not contain SVHCs (Substances of Very High Concern).

– RoHS (EU): Applicable if tape is part of electrical/electronic equipment assembly.

– OSHA (USA): Follow workplace safety standards for material handling and PPE (e.g., gloves, eye protection).

– DOT (USA): Steel strapping shipments may require hazard communication if sharp or under tension.

– Customs & Import Regulations: Provide proper HS codes (e.g., 3920.20 for plastic strapping) and country-of-origin labeling.

Environmental & Sustainability Requirements

Environmental compliance supports corporate responsibility goals:

– Recycle used strapping where feasible; provide clear disposal instructions.

– Use recyclable or biodegradable tapes (e.g., paper-based or PP with recyclability claims) to meet EPR (Extended Producer Responsibility) laws.

– Comply with packaging waste directives (e.g., EU Packaging Waste Directive 94/62/EC).

Labeling & Documentation

Accurate labeling ensures traceability and safety:

– Include product name, material type, width, tensile strength, manufacturer details, and batch/lot number.

– Affix hazard labels if applicable (e.g., “Sharp Edges” for steel strapping).

– Maintain compliance documentation (SDS, certificates of compliance, test reports) for audits.

Quality Assurance & Testing

Verify performance and consistency:

– Conduct periodic testing for tensile strength, elongation, and seal integrity per ASTM D3950 or ISO 1177.

– Audit suppliers for ISO 9001 certification and environmental management (ISO 14001).

– Retain test records to demonstrate compliance during regulatory inspections.

Emergency Procedures

Prepare for incidents involving banding tape:

– In case of injury (e.g., cuts from steel strapping), follow first-aid protocols and report per OSHA guidelines.

– If flammable tapes ignite, use appropriate fire suppression (e.g., CO₂ or dry chemical extinguishers).

– Establish spill or release response for damaged reels to prevent tripping hazards or machinery jams.

Conclusion

Effective logistics and compliance management for banding tape reduces operational risks, ensures worker safety, and supports global trade requirements. By following this guide, organizations can maintain regulatory adherence, optimize handling processes, and promote sustainable practices across the supply chain.

Conclusion for Sourcing Banding Tape

In conclusion, sourcing banding tape requires a strategic approach that balances quality, cost, durability, and supplier reliability. After evaluating various materials—such as polyester (PET), polypropylene (PP), and steel—polyester banding tape often emerges as the optimal choice for high-tensile strength and resistance to environmental factors, particularly in industrial and heavy-duty applications. However, cost-sensitive or lightweight uses may favor polypropylene as a more economical alternative.

Key considerations in the sourcing process include tensile strength, UV and moisture resistance, adhesive quality (if applicable), environmental sustainability, and compliance with industry standards. Additionally, building strong relationships with reputable suppliers, assessing lead times, and considering bulk purchasing benefits can significantly improve supply chain efficiency and cost-effectiveness.

Ultimately, the right banding tape solution depends on the specific application requirements, operational environment, and long-term goals of the organization. A thorough evaluation and ongoing performance monitoring will ensure that the selected banding tape delivers reliable performance, reduces waste, and supports overall operational productivity.