The global back traction equipment market is experiencing steady growth, driven by rising prevalence of musculoskeletal disorders, sedentary lifestyles, and increasing demand for non-invasive pain management solutions. According to Mordor Intelligence, the therapeutic devices market—which includes spinal traction equipment—is projected to grow at a CAGR of over 5.8% from 2023 to 2028. Similarly, Grand View Research valued the global physical therapy equipment market at USD 1.7 billion in 2022 and forecasts a CAGR of 6.3% through 2030, with traction devices representing a key segment. As healthcare providers and consumers alike prioritize conservative treatment options for chronic back pain, innovation and reliability in traction equipment have become critical. In this evolving landscape, a select group of manufacturers have emerged as industry leaders, combining clinical efficacy, technological advancement, and regulatory compliance to meet growing global demand.

Top 10 Back Traction Equipment Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 BTL Spinal Decompression Machine

Domain Est. 2000

Website: btlnet.com

Key Highlights: BTL Spinal Decompression offers a revolutionary non-invasive solution for back pain. By targeting spinal issues with advanced, precise decompression technology, ……

#2 ComforTrac Lumbar Traction Unit

Domain Est. 2000

Website: smeincusa.com

Key Highlights: The ComforTrac Lumbar Traction Device has automatic carriage return that increases ease of use. Aids in intermittent traction applications….

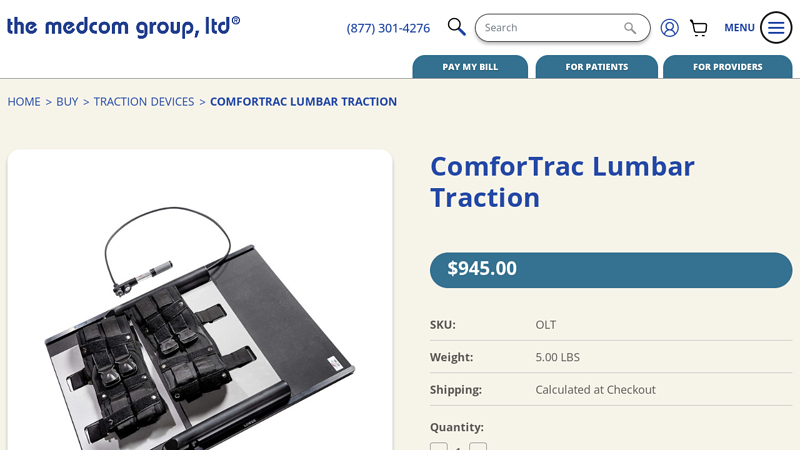

#3 ComforTrac Lumbar Traction

Domain Est. 1996

Website: medcomgroup.com

Key Highlights: This Lumbar Traction Device is designed to help separate the spaces between your vertebrae to help in relieving lower back and sciatica pain….

#4 True Back

Domain Est. 1998

#5 Medical Traction Equipment

Domain Est. 1999

Website: allegromedical.com

Key Highlights: 4–6 day delivery · 30-day returnsShop for Cervical & Lumbar Traction Devices for your home or medical office at the lowest prices guaranteed. Exceptional service and fast shipping…

#6 Traction Devices

Domain Est. 2011

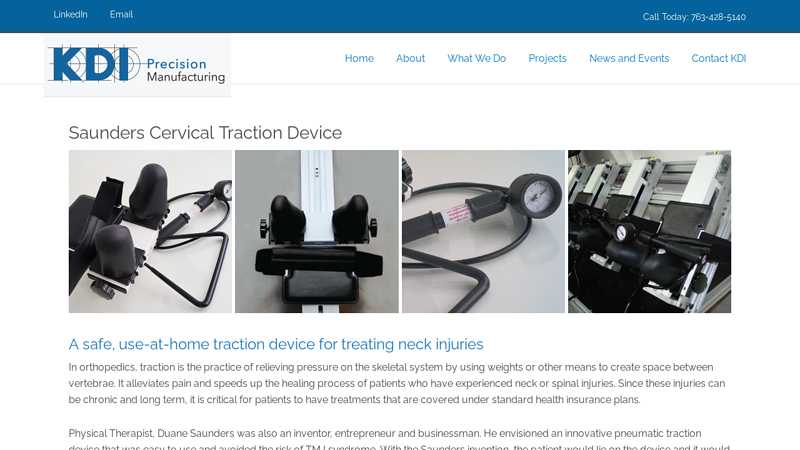

#7 Saunders Cervical Traction Device

Domain Est. 2017

Website: kdimfg.com

Key Highlights: A safe, use-at-home traction device for treating neck injuries. In orthopedics, traction is the practice of relieving pressure on the skeletal system….

#8 Chirp™

Domain Est. 2017

Website: gochirp.com

Key Highlights: Free delivery over $70From deep back stretches with the Contour to wireless muscle care with the Halo to everyday rolling with the Wheel 4-Pack, Chirp brings feel-good relief to …..

#9 Traction & Decompression

Domain Est. 2019

Website: chattanoogarehab.com

Key Highlights: Chattanooga Clinic Traction provides clinically-proven pain treatment that gets to the root of Cervical and Lumbar Pain….

#10 Spinal Decompression Machine

Domain Est. 2019

Website: antalgictrak.com

Key Highlights: This spinal decompression device can provide a soothing and gentle vertebral, disc and facet traction….

Expert Sourcing Insights for Back Traction Equipment

H2: 2026 Market Trends for Back Traction Equipment

The global back traction equipment market is poised for significant transformation by 2026, driven by demographic shifts, technological advancements, and evolving healthcare delivery models. As chronic back pain remains one of the leading causes of disability worldwide, demand for non-invasive and cost-effective treatment solutions continues to grow, positioning back traction devices at the forefront of conservative spinal care.

One of the key drivers shaping the 2026 landscape is the aging global population. With increasing life expectancy, particularly in developed regions such as North America and Western Europe, age-related spinal conditions like degenerative disc disease and spinal stenosis are on the rise. This demographic trend fuels demand for home-use and clinical-grade back traction systems that offer pain relief without surgical intervention.

Technological innovation is another pivotal trend. By 2026, manufacturers are increasingly integrating smart technologies into traction devices, including Bluetooth connectivity, mobile health apps, real-time posture tracking, and AI-driven therapy personalization. These intelligent features enhance user engagement, improve treatment adherence, and enable remote monitoring by healthcare providers—aligning with the broader telehealth movement.

Additionally, the shift toward decentralized healthcare delivery is reshaping market dynamics. The post-pandemic emphasis on home-based care has accelerated consumer preference for portable, easy-to-use traction devices that can be operated independently. This trend is supported by rising health awareness and the growing adoption of preventive wellness strategies, particularly among middle-aged and active populations.

From a regional perspective, North America is expected to maintain its dominance in the back traction equipment market in 2026 due to high healthcare expenditure, widespread insurance coverage for non-surgical spinal treatments, and a strong presence of key market players. Meanwhile, the Asia-Pacific region is projected to witness the fastest growth, driven by expanding healthcare infrastructure, rising disposable incomes, and increasing awareness of non-pharmacological pain management options.

However, the market also faces challenges, including regulatory scrutiny, variability in reimbursement policies, and the need for robust clinical evidence to support device efficacy. As a result, leading companies are investing in clinical trials and partnerships with medical professionals to validate product claims and gain competitive advantage.

In summary, the 2026 back traction equipment market reflects a convergence of medical necessity, technological innovation, and consumer-centric care models. With continued advancements and strategic market positioning, back traction devices are expected to play an increasingly vital role in global musculoskeletal health management.

Common Pitfalls When Sourcing Back Traction Equipment: Quality and Intellectual Property Risks

Sourcing back traction equipment—devices designed to relieve spinal pressure and alleviate back pain—requires careful due diligence. Overlooking quality and intellectual property (IP) concerns can lead to product failures, legal disputes, and reputational damage. Below are critical pitfalls to avoid.

Compromised Product Quality and Safety

One of the most significant risks in sourcing back traction equipment is receiving substandard products that fail to meet safety or performance standards. Many suppliers, particularly in low-cost manufacturing regions, may cut corners on materials, construction, or testing. Poor-quality traction devices can lead to ineffective treatment or even patient injury. Common quality issues include weak structural components, inconsistent tension control, and lack of biomechanical accuracy, compromising both efficacy and user safety.

Lack of Regulatory Compliance

Back traction devices may be classified as medical devices depending on their intended use and design, requiring compliance with regulations such as FDA 510(k) clearance in the U.S., CE marking in Europe, or other regional medical device standards. Sourcing from suppliers who do not adhere to these requirements exposes buyers to legal liability, import bans, and market access restrictions. Failure to verify compliance can result in costly recalls or halted distribution.

Inadequate Testing and Certification

Reliable back traction equipment should undergo rigorous biomechanical, durability, and electrical safety testing (if motorized). Many sourced products lack independent third-party certifications (e.g., ISO 13485, IEC 60601), increasing the risk of malfunction or non-compliance. Buyers often assume certifications are in place when they are not, leading to unverified claims about product performance and safety.

Intellectual Property Infringement

A major legal pitfall is inadvertently sourcing equipment that infringes on existing patents, trademarks, or design rights. Some manufacturers produce “look-alike” devices that mimic branded traction systems protected by IP. Purchasing such equipment—even unknowingly—can expose the buyer to infringement lawsuits, seizure of goods, and financial penalties. Conducting IP due diligence, including patent landscape analysis and freedom-to-operate assessments, is essential before finalizing procurement.

Misrepresentation of Manufacturing Origin and Capabilities

Suppliers may misrepresent their role as the actual manufacturer or exaggerate their production capabilities and quality control processes. This “trading company” risk can lead to inconsistent quality, delayed deliveries, and difficulty enforcing contracts. Buyers should conduct on-site audits or use third-party inspection services to verify manufacturing facilities and traceability.

Insufficient Documentation and Traceability

Proper technical documentation—including design specifications, test reports, risk assessments, and user manuals—is crucial for regulatory compliance and post-market support. Sourced products often come with incomplete or falsified documentation, making it difficult to validate quality, obtain certifications, or address field issues. Lack of serial number traceability also hinders effective recall management.

Overlooking After-Sales Support and Warranty

Back traction devices may require maintenance, calibration, or replacement parts. Sourcing from suppliers with weak after-sales infrastructure can lead to customer dissatisfaction and increased long-term costs. Additionally, unclear or unenforceable warranty terms may leave buyers responsible for repair or replacement expenses.

Failure to Secure IP Ownership in Custom Designs

When developing customized traction equipment, buyers may assume they automatically own the resulting IP. However, without a clear contract specifying IP assignment, the manufacturer may retain rights to design modifications, tooling, or software. This can prevent future product improvements, limit exclusivity, or allow the supplier to sell similar designs to competitors.

Avoiding these pitfalls requires thorough supplier vetting, legal review of contracts, independent quality inspections, and proactive IP management. Engaging legal and technical experts early in the sourcing process can mitigate risks and ensure a reliable, compliant supply chain.

Logistics & Compliance Guide for Back Traction Equipment

This guide outlines the essential logistics and compliance considerations for the safe, legal, and efficient handling, transportation, and use of back traction equipment. Adhering to these guidelines ensures product integrity, regulatory adherence, and user safety.

Regulatory Compliance

Understanding and complying with relevant regulations is critical for both manufacturers and distributors. Key regulatory frameworks include:

Medical Device Classification

Back traction equipment is typically classified as a medical device in most jurisdictions. In the United States, the FDA regulates such devices under Class I or Class II, depending on risk level. Ensure proper classification, registration, and adherence to Quality System Regulation (QSR) requirements. In the European Union, compliance with the Medical Device Regulation (MDR) 2017/745 is mandatory, requiring CE marking and a notified body assessment for higher-risk devices.

Labeling and Instructions for Use (IFU)

All back traction devices must be accompanied by clear, multilingual labeling and IFUs that include intended use, contraindications, warnings, precautions, usage instructions, maintenance, and disposal information. Labels must comply with local language requirements and include essential details such as manufacturer name, address, model number, serial number, and regulatory markings.

Electrical Safety and EMC

If the equipment includes powered components, compliance with electrical safety standards (e.g., IEC 60601-1) and electromagnetic compatibility (EMC) standards (eEC 60601-1-2) is required. Certification from recognized bodies (e.g., UL, TÜV) may be necessary for market access.

Transportation and Handling

Proper logistics planning ensures that back traction equipment reaches end users without damage and in full working condition.

Packaging Requirements

Equipment must be packaged in durable, shock-resistant materials designed to withstand standard shipping hazards. Inner packaging should immobilize components, while outer cartons must display handling labels (e.g., “Fragile,” “This Side Up”) and comply with international shipping standards (e.g., ISTA 3A).

Shipping Methods

Choose appropriate shipping methods based on equipment size, weight, and destination. Small units may be shipped via courier, while larger systems may require freight services. For international shipments, use carriers experienced in medical device logistics to ensure temperature and humidity control if necessary.

Import/Export Documentation

Ensure all required documentation is prepared, including commercial invoices, packing lists, certificates of origin, and regulatory compliance certificates (e.g., FDA export certificates, CE declarations). Verify import regulations in destination countries, as some may require special permits or pre-shipment inspections.

Storage and Inventory Management

Efficient storage practices maintain product quality and ensure traceability.

Storage Conditions

Store equipment in a clean, dry, temperature-controlled environment (typically 10°C to 30°C) away from direct sunlight, moisture, and corrosive substances. Avoid stacking items beyond recommended limits to prevent damage.

Inventory Control

Implement a robust inventory management system to track lot numbers, expiration dates (if applicable), and shipment history. Use serialized tracking where possible to support recalls and post-market surveillance.

Post-Market Surveillance and Recall Preparedness

Compliance does not end at delivery. Ongoing monitoring is crucial.

Adverse Event Reporting

Establish procedures for receiving, documenting, and reporting adverse events or malfunctions to relevant regulatory authorities (e.g., FDA MedWatch, EUDAMED). Timely reporting is mandatory under most medical device regulations.

Field Safety Notices and Recalls

Develop a recall plan that includes procedures for identifying affected units, notifying customers and regulators, retrieving products, and implementing corrective actions. Maintain up-to-date customer contact information for rapid communication.

Training and User Support

Ensure end users and healthcare providers are adequately trained to use the equipment safely and effectively.

User Training Programs

Provide comprehensive training materials and, where applicable, on-site or virtual training sessions. Training should cover assembly, operation, maintenance, and troubleshooting.

Technical Support and Maintenance Guidance

Offer accessible technical support and clear maintenance instructions. Include recommended service intervals and authorized service providers in IFUs.

By following this logistics and compliance guide, stakeholders can ensure that back traction equipment is distributed safely, used effectively, and remains in compliance with global regulatory standards.

Conclusion on Sourcing Back Traction Equipment

In conclusion, sourcing back traction equipment requires a comprehensive evaluation of product quality, supplier reliability, cost-effectiveness, and compliance with medical and safety standards. After assessing potential suppliers, reviewing technical specifications, and considering customer feedback, it is evident that selecting a reputable vendor with certifications (such as ISO, FDA, or CE) ensures the delivery of safe and effective traction devices. Additionally, long-term factors such as warranty, after-sales service, and technical support play a crucial role in maintaining equipment performance and user satisfaction. By prioritizing these elements, organizations can secure reliable back traction solutions that enhance patient outcomes, support clinical effectiveness, and provide lasting value for both healthcare providers and end-users.