The global auxiliary contactor market is experiencing steady growth, driven by rising automation across industrial and commercial sectors, increased demand for energy-efficient control systems, and the expansion of smart infrastructure. According to Grand View Research, the global contactor market size was valued at USD 7.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of approximately 5.8% over the forecast period (2023–2028), citing increased deployment in HVAC systems, renewable energy installations, and industrial motor control applications. As demand for reliable and scalable electrical control components grows, auxiliary contactors—critical for extending the switching capacity of primary contactors—have become essential in complex control circuits. This increasing reliance has elevated the prominence of specialized manufacturers who deliver high durability, precision, and integration capabilities. Against this backdrop, we examine the top eight auxiliary contactor manufacturers shaping the industry through innovation, global reach, and adherence to international safety and performance standards.

Top 8 Auxiliary Contactor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Auxiliary Contacts

Domain Est. 1994

Website: grainger.com

Key Highlights: These auxiliary contact blocks send out low-power voltages/signals to control attached devices like pilot lights, alarms, and interlocks….

#2 Contactor relays for auxiliary circuit switching

Domain Est. 1990

Website: new.abb.com

Key Highlights: ABB’s contactor relays offering features products of technological advancement as well as products with specific purposes….

#3 Auxiliary Relays

Domain Est. 1997

Website: arteche.com

Key Highlights: Arteche plug-in auxiliary relays are designed to operate under demanding conditions, in locations where performance, reliability and security are a must….

#4 Contactor Relay

Domain Est. 1997

Website: se.com

Key Highlights: Contactors relays are essential electrical components used for switching high-power circuits. They control the flow of electricity, enabling or disabling power ……

#5 479U165D16 AUXILIARY CONTACT BLOCK

Domain Est. 1999

Website: store.konecranes.com

Key Highlights: In stock479U165D16 AUXILIARY CONTACT BLOCK ; Availability: 4 pieces in stock ; Superseded materials: 479U165D3, 1079Z2454, XX11616, 479U165D4, 1079Z2434, 479U165D1, ……

#6 Motor Control Auxiliary Contacts for Contactors: Front & Side

Domain Est. 2002

Website: kentstore.com

Key Highlights: 1–2 day delivery 30-day returnsShop auxiliary contacts at Kent Store for motor control. Find front & side-mount blocks, 1NO, 1NC & combo types. Get fast shipping and expert support…

#7 Auxiliary relays and contactors

Domain Est. 2004

Website: elkoep.com

Key Highlights: The auxiliary relays have quiet operation, LED signalling and switching contacts. ELKO EP contactors are baseless and switch over currents up to 63A. Kategorie ……

#8 Auxiliary contactor Series 8510

Domain Est. 2007

Website: r-stahl.com

Key Highlights: STAHL Series 8510 auxiliary contacts are fitted with up to seven contacts. They are screwed into the enclosure so that they are protected against vibrations….

Expert Sourcing Insights for Auxiliary Contactor

H2: 2026 Market Trends for Auxiliary Contactors

The global auxiliary contactor market is poised for steady growth leading into 2026, driven by broader industrial automation trends, energy efficiency mandates, and advancements in smart manufacturing. Key trends shaping the market include:

1. Integration with Smart Industry and IIoT:

By 2026, auxiliary contactors are increasingly being incorporated into smart industrial systems enabled by the Industrial Internet of Things (IIoT). Manufacturers are embedding communication capabilities and digital interfaces into contactors, allowing real-time status monitoring, predictive maintenance alerts, and seamless integration with PLCs and SCADA systems. This shift supports Industry 4.0 adoption, improving system reliability and reducing downtime.

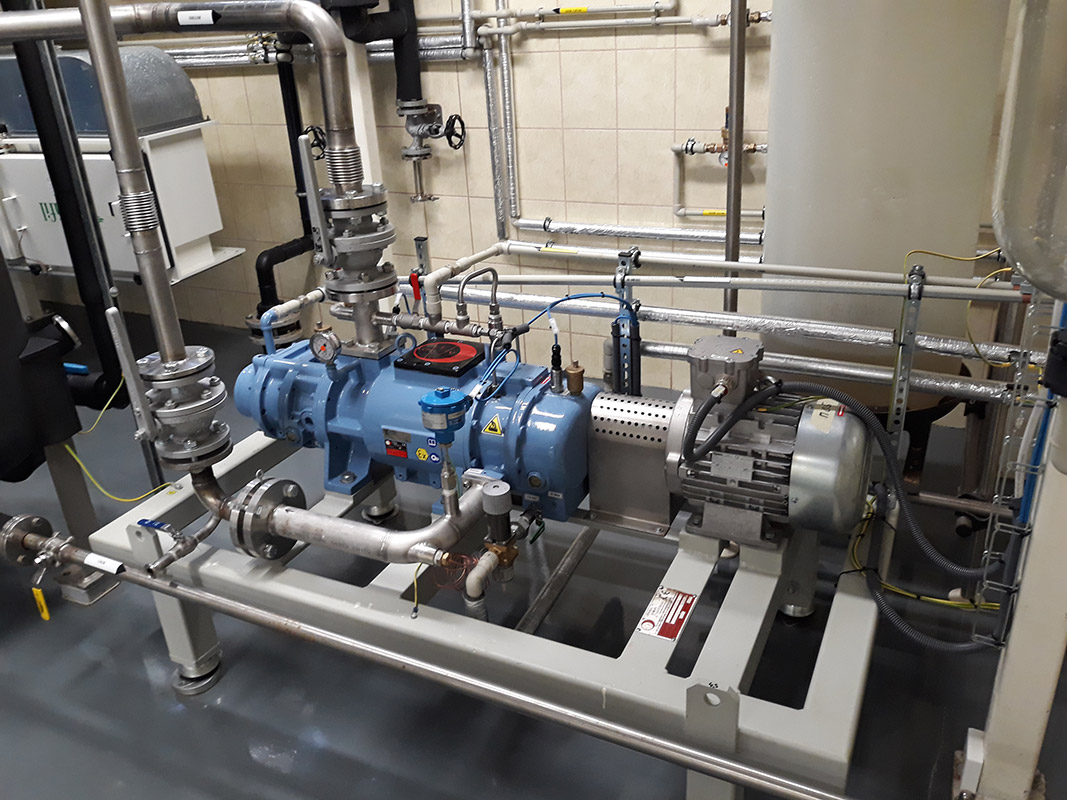

2. Demand from Renewable Energy and EV Infrastructure:

The rapid expansion of solar power installations, wind farms, and electric vehicle (EV) charging stations is creating new applications for auxiliary contactors. These systems require reliable control and signaling components for managing auxiliary circuits in inverters, battery storage systems, and charging stations. The auxiliary contactor’s role in remote monitoring and safety interlocks makes it essential in these high-growth sectors.

3. Focus on Miniaturization and Energy Efficiency:

With space constraints in modern control panels and a push for energy-efficient designs, manufacturers are developing compact, low-power auxiliary contactors. Improved coil designs and materials are reducing power consumption and heat generation, aligning with global energy efficiency standards and reducing operational costs for end-users.

4. Regional Growth in Asia-Pacific:

The Asia-Pacific region, particularly China, India, and Southeast Asia, is expected to lead market expansion by 2026 due to rapid industrialization, smart city initiatives, and government investments in infrastructure and manufacturing. Local production and rising demand for automation in sectors like automotive, electronics, and infrastructure are key drivers.

5. Consolidation and Strategic Partnerships:

Market consolidation among major electrical component manufacturers is accelerating. Companies are engaging in strategic partnerships and mergers to enhance product portfolios, expand geographic reach, and improve digital service offerings. This trend is expected to increase competition and innovation in auxiliary contactor design and functionality.

6. Regulatory and Safety Standards Compliance:

Growing emphasis on electrical safety and compliance with international standards (e.g., IEC 60947, UL 508) is influencing product design. By 2026, auxiliary contactors will increasingly feature enhanced safety certifications, arc fault protection, and improved durability to meet stringent regulatory requirements across regions.

In summary, the auxiliary contactor market in 2026 will be characterized by digital integration, sustainability-driven innovation, and strong regional growth, positioning the component as a critical enabler of modern, intelligent electrical control systems.

Common Pitfalls When Sourcing Auxiliary Contactors (Quality, IP)

Sourcing auxiliary contactors involves more than just matching electrical ratings—overlooking critical quality and Ingress Protection (IP) factors can lead to premature failure, safety hazards, and system downtime. Below are the most common pitfalls to avoid:

Inadequate IP Rating for the Environment

Selecting an auxiliary contactor with an insufficient IP rating for its operating environment is a frequent mistake. For example, using an IP20-rated device in a dusty or outdoor setting exposes internal components to contaminants, leading to arcing, corrosion, or short circuits. Always match the IP rating to the enclosure and environmental conditions—IP65 or higher may be needed for washdown areas or outdoor panels.

Compromising on Build Quality and Materials

Low-cost contactors often use inferior materials such as substandard plastics or low-grade contacts, which degrade faster under electrical stress or thermal cycling. Poor-quality silver alloy contacts increase contact resistance, leading to overheating and welding. Always verify manufacturer certifications (e.g., UL, IEC) and opt for reputable brands known for durability and consistent performance.

Ignoring Certification and Compliance Standards

Using non-certified or counterfeit contactors poses serious safety and compliance risks. Auxiliary contactors must meet regional standards (e.g., UL 508, IEC 60947-5-1). Sourcing from unauthorized distributors increases the risk of receiving fake or reconditioned units that fail under load or violate safety regulations.

Mismatched Mechanical and Electrical Life Ratings

Some suppliers exaggerate life cycle claims. Failing to verify both mechanical (no-load operations) and electrical (under-load switching) endurance can result in frequent failures in high-cycle applications. Always cross-check datasheet values with independent testing or customer reviews.

Poor Thermal and Vibration Resistance

In industrial environments, auxiliary contactors are exposed to heat and vibration. Low-quality units may lack robust coil construction or secure mounting, leading to coil burnout or loose connections. Ensure the contactor is rated for the expected ambient temperature and mechanical stress.

Overlooking Compatibility with Main Contactors

Auxiliary contactors must be electrically and mechanically compatible with the main contactor or control system. Mismatches in coil voltage, mounting style, or auxiliary contact configuration can cause control circuit malfunctions or installation delays.

Relying Solely on Price as a Selection Criterion

Prioritizing cost over reliability often results in higher total cost of ownership due to maintenance, downtime, and replacement expenses. Investing in a higher-quality auxiliary contactor from a trusted supplier reduces long-term risks and improves system uptime.

Avoiding these pitfalls requires due diligence in supplier selection, verification of technical specifications, and understanding of the application environment. Always request product samples, review test reports, and consult with application engineers when in doubt.

Logistics & Compliance Guide for Auxiliary Contactor

This guide outlines the essential logistics and compliance considerations for the safe and regulatory-compliant handling, transportation, storage, and use of auxiliary contactors. Adherence to these guidelines ensures operational safety, product integrity, and legal compliance.

Product Identification and Documentation

Ensure all auxiliary contactors are clearly labeled with manufacturer name, model number, voltage rating, current rating, and certification marks (e.g., UL, CE, CCC). Maintain up-to-date technical data sheets, safety data sheets (if applicable), certificates of conformity, and compliance declarations. Accurate documentation is critical for customs clearance and regulatory audits.

Packaging and Handling Requirements

Auxiliary contactors must be packed in manufacturer-approved, anti-static, and shock-resistant packaging to prevent damage during transit. Handle units with care, avoiding drops or impacts. Use appropriate lifting equipment when moving bulk quantities. Personnel should wear gloves to prevent contamination from oils or moisture that could affect electrical performance.

Storage Conditions

Store auxiliary contactors in a clean, dry, and temperature-controlled environment (typically 5°C to 40°C). Avoid exposure to humidity, direct sunlight, corrosive gases, or conductive dust. Units should be stored in their original packaging until ready for installation. Implement a first-in, first-out (FIFO) inventory system to prevent prolonged storage and potential degradation.

Transportation Guidelines

Ship auxiliary contactors via certified logistics providers compliant with IATA (for air), IMDG (for sea), or ADR (for road) regulations as applicable. Although auxiliary contactors are generally non-hazardous, proper packaging and labeling are required to meet general electrical equipment transport standards. Ensure secure loading to prevent shifting during transit.

Regulatory Compliance

Auxiliary contactors must comply with regional and international safety and electromagnetic compatibility (EMC) standards such as:

– IEC 61095 (Electromechanical contactors for household and similar purposes)

– UL 508 (Industrial Control Equipment)

– CE Marking (EU Low Voltage and EMC Directives)

– CCC (China Compulsory Certification)

Verify compliance through valid certification documentation before distribution or installation.

Import and Export Controls

Be aware of country-specific import regulations, including product certification requirements (e.g., KC for South Korea, PSE for Japan). Declare goods accurately using correct HS codes (e.g., 8536.50 for electrical contactors). Restricted substances (e.g., RoHS, REACH) must be declared, and conflict minerals reporting may be required depending on the destination.

End-of-Life and Environmental Responsibility

Dispose of or recycle auxiliary contactors in accordance with WEEE (Waste Electrical and Electronic Equipment) directives and local environmental regulations. Do not dispose of in regular waste streams. Encourage take-back programs and partner with certified e-waste recyclers to ensure responsible end-of-life management.

Training and Safety

Ensure all personnel involved in handling, installing, or maintaining auxiliary contactors are trained in electrical safety practices (e.g., lockout/tagout procedures). Only qualified electricians should perform installations. Review risk assessments and safety instructions provided by the manufacturer prior to use.

Conclusion for Sourcing Auxiliary Contactor:

After evaluating technical requirements, supplier reliability, cost-efficiency, and long-term maintenance considerations, the sourcing of auxiliary contactors should focus on selecting high-quality, standards-compliant components from reputable manufacturers. It is recommended to partner with suppliers offering proven product durability, technical support, and timely delivery to ensure seamless integration into control systems. Standardizing on a few trusted brands can also simplify inventory management and reduce operational downtime. Ultimately, a strategic sourcing approach will enhance system reliability, safety, and overall performance in industrial and automation applications.