The global automotive scan tools market is experiencing robust growth, driven by increasing vehicle complexity, rising demand for advanced diagnostics, and the widespread adoption of onboard diagnostics II (OBD-II) systems. According to a 2023 report by Mordor Intelligence, the market was valued at approximately USD 2.8 billion in 2022 and is projected to grow at a CAGR of over 7.5% from 2023 to 2028. A key segment within this growth is automotive scan tools with Anti-lock Braking System (ABS) diagnostic capabilities, as modern vehicles increasingly integrate safety and driver assistance systems that require specialized diagnostic access. ABS functionality not only enhances vehicle safety but also necessitates sophisticated scan tools capable of reading, diagnosing, and clearing ABS-related trouble codes—making such tools essential for professional technicians and DIY enthusiasts alike. With expanding vehicle production, stricter emission regulations, and growing after-sales service demand, the need for reliable, multifunctional scan tools has never been greater. This rising demand has spurred innovation among leading manufacturers, positioning the following 10 companies at the forefront of developing and supplying top-tier automotive scan tools with advanced ABS diagnostics.

Top 10 Automotive Scan Tool With Abs Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

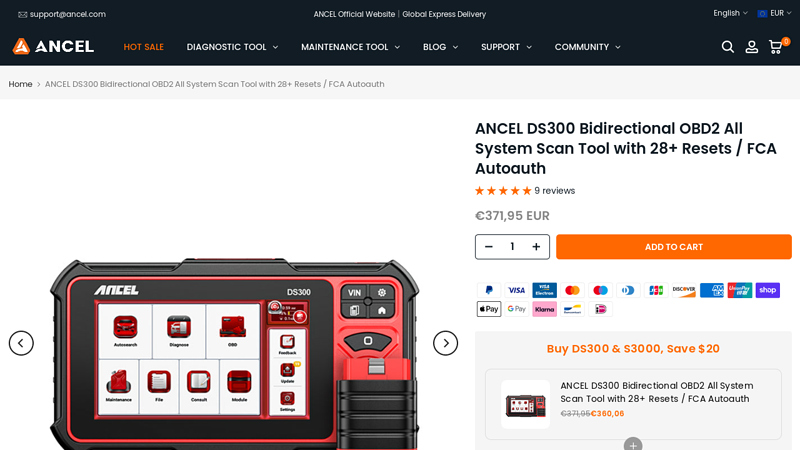

#1 ANCEL DS300 Bidirectional OBD2 All System Scan Tool with 28+ …

Domain Est. 2001

Website: ancel.com

Key Highlights: In stock Rating 5.0 (9) The DS300 is a high-end automotive diagnostic DIY product developed based on the Android 8.1 system. It has a smart OBD2 code reading card function, ……

#2 CarDr

Domain Est. 2002

Website: cardr.com

Key Highlights: CarDr Ultra is a professional automotive scan tool delivering fast vehicle diagnostic scan tools, vehicle health monitor, and online car diagnostic ……

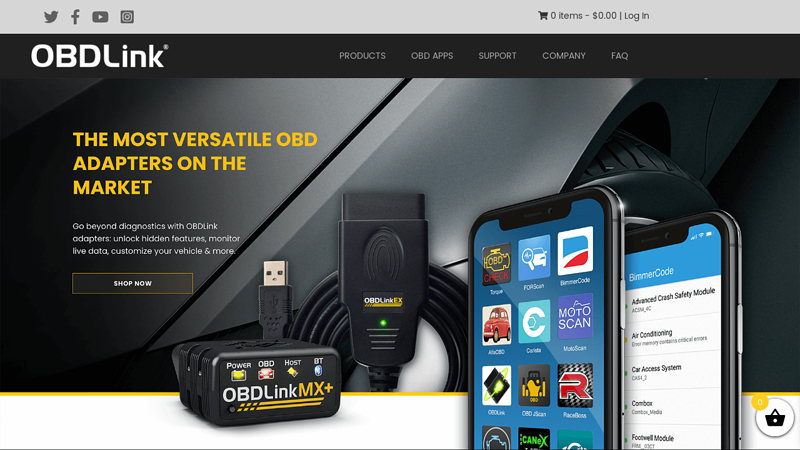

#3 OBDLink®

Domain Est. 2004

Website: obdlink.com

Key Highlights: The OBDLink® scan tools offer you ultimate access to your vehicle so you can take back control of your vehicle! Purchase one today….

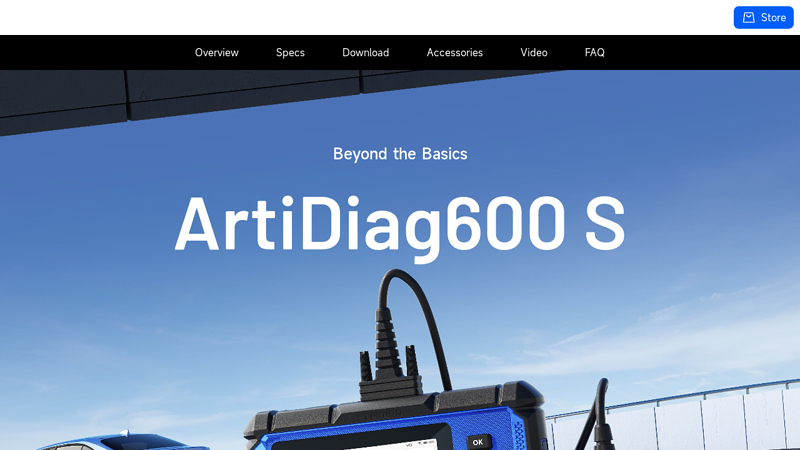

#4 ArtiDiag600 S

Domain Est. 2004

Website: topdon.com

Key Highlights: Designed to provide a detailed analysis of four major vehicle systems—Engine, Transmission, Airbag, and ABS—this scanner enables fast and efficient repairs….

#5 Autel

Domain Est. 2008

Website: autel.us

Key Highlights: Future-proof your shop with Autel Webinars covering ADAS calibration, TPMS Service and Advanced Vehicle Diagnostics. Get the know-how your shop needs with….

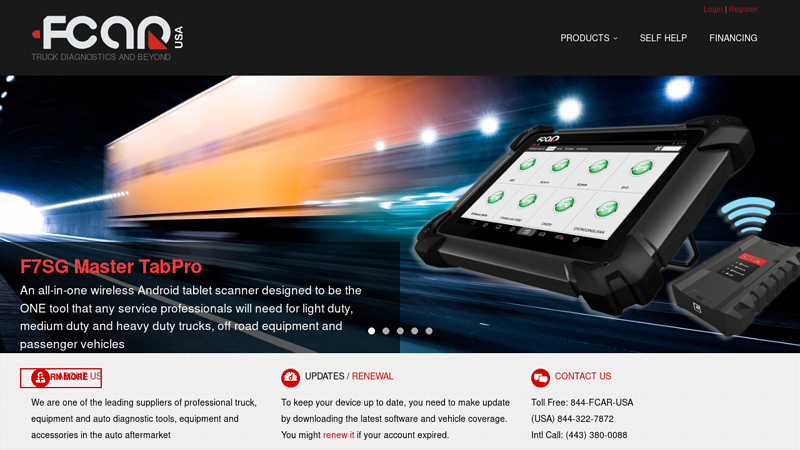

#6 FCAR Tech USA

Domain Est. 2011

Website: fcarusa.com

Key Highlights: We are one of the leading suppliers of professional truck, equipment and auto diagnostic tools, equipment and accessories in the auto aftermarket….

#7 Ship from US 100% Original Autel AutoLink AL619 OBDII CAN ABS …

Domain Est. 2016

Website: autelsale.com

Key Highlights: Free delivery 42-day returnsAutel AutoLink AL619 ABS/SRS OBDII CAN Diagnostic Tool is built to help you determine why the Malfunction Indicator Light or the ABS / SRS warning light…

#8 THINKDIAG 2 Automotive Diagnostic Scanner

Domain Est. 2019

Website: mythinkcar.com

Key Highlights: In stock Rating 4.8 (409) ThinkDiag 2 Enhanced diagnostic scanner can perform OE-level diagnostics on all systems, such as ABS, SRS, Engine, Transmission, Wiper, Seat, EPB, TPMS,…

#9 Foxwell Diag

Domain Est. 2021

#10 XTOOL D9S Automotive OBD2 Scanner Diagnostic Tool

Domain Est. 2022

Website: xtoolglobal.com

Key Highlights: In stock Rating 4.9 (26) XTOOL D7W full system diagnostics and provides a complete scan of engine, AT, ABS, TPMS, fuel, BCM diagnostic data so that you can quickly capture all fa…

Expert Sourcing Insights for Automotive Scan Tool With Abs

H2: 2026 Market Trends for Automotive Scan Tools with ABS Functionality

The global market for automotive scan tools with Anti-lock Braking System (ABS) diagnostic capabilities is poised for significant transformation by 2026, driven by technological advancements, evolving vehicle complexity, and increasing demand for comprehensive vehicle diagnostics. Below is an in-depth analysis of the key market trends shaping this sector:

1. Rising Complexity of Vehicle Electronics

Modern vehicles are increasingly equipped with advanced driver assistance systems (ADAS), integrated braking systems, and electronic stability controls—all of which rely heavily on ABS modules. As a result, scan tools that offer dedicated ABS diagnostics are becoming essential for accurate troubleshooting. By 2026, the integration of scan tools with multi-system diagnostic capabilities, particularly ABS, will be a standard requirement rather than a premium feature.

2. Growth in ADAS Adoption

The rapid adoption of ADAS technologies—such as automatic emergency braking, lane-keeping assist, and traction control—depends on properly functioning ABS systems for sensor calibration and system coordination. This interdependence is increasing the demand for scan tools that support bi-directional ABS communication and recalibration functions. By 2026, scan tools with ABS and ADAS calibration capabilities are expected to dominate the professional aftermarket and dealership service channels.

3. Expansion of the Aftermarket and DIY Segment

The aftermarket automotive repair sector is growing, fueled by longer vehicle lifespans and the rising cost of dealership services. Consumers and independent mechanics are investing in advanced scan tools that offer reliable ABS diagnostics at a lower cost. Affordable handheld scan tools with robust ABS functionality are projected to see significant market penetration, especially in emerging economies.

4. Wireless and Cloud-Connected Diagnostic Tools

By 2026, wireless Bluetooth and Wi-Fi-enabled scan tools with ABS support are expected to become mainstream. These tools integrate with smartphones and tablets, offering real-time diagnostics, cloud-based software updates, and remote troubleshooting. Enhanced connectivity allows technicians to access OEM-level ABS data and repair procedures on-demand, improving accuracy and efficiency.

5. Software-Driven Updates and Subscription Models

Manufacturers are shifting toward software-centric business models, offering regular firmware updates and subscription-based access to advanced ABS diagnostic features. This trend enables users to keep their tools up to date with evolving vehicle protocols and ensures compatibility with newer car models featuring advanced brake-by-wire systems.

6. OEM vs. Aftermarket Tool Competition

Original Equipment Manufacturer (OEM)-approved scan tools continue to offer superior ABS diagnostics, but third-party brands are closing the gap through partnerships with software developers and reverse engineering. By 2026, high-end aftermarket tools are expected to provide 80–90% of OEM functionality at a fraction of the cost, intensifying competition and driving innovation.

7. Regulatory and Safety Compliance Demands

Stricter vehicle safety regulations worldwide are mandating thorough ABS system checks during routine maintenance and inspections. Governments and transport authorities in regions like the EU, North America, and parts of Asia are emphasizing brake system integrity, increasing the use of ABS-capable scan tools in inspection centers and repair shops.

8. Regional Market Dynamics

- North America and Europe: Mature markets with high adoption of advanced scan tools due to stringent emission and safety norms.

- Asia-Pacific: Fastest-growing region, driven by expanding automotive ownership in China, India, and Southeast Asia, alongside rising investments in automotive repair infrastructure.

- Latin America and Africa: Gradual uptake due to increasing availability of affordable scan tools with ABS support.

Conclusion:

By 2026, automotive scan tools with ABS functionality will be indispensable in both professional and consumer repair ecosystems. The convergence of connectivity, software intelligence, and vehicle electrification will redefine diagnostic expectations. Companies that innovate in user experience, cross-platform compatibility, and real-time data analytics will lead the market, while affordability and ease of use will remain critical for broader adoption.

Common Pitfalls When Sourcing Automotive Scan Tools with ABS Functionality (Quality and Intellectual Property Concerns)

Logistics & Compliance Guide for Automotive Scan Tool with ABS

Introduction

This guide provides a comprehensive overview of the logistics and compliance requirements for the import, distribution, and use of an Automotive Scan Tool with ABS (Anti-lock Braking System) diagnostic capabilities. Whether you are a manufacturer, distributor, or end-user, understanding the regulatory, transportation, and operational standards is critical to ensure legal compliance and efficient supply chain management.

Regulatory Compliance

1. Product Safety and Certification

Automotive scan tools with ABS functionality must meet various regional and international safety and electromagnetic compatibility (EMC) standards.

United States (FCC & DOT)

- FCC Part 15: Ensures the device does not cause harmful interference and can operate in the presence of radio frequency emissions.

- Certification required for digital devices.

- Labeling with FCC ID is mandatory.

- DOT Compliance: While the scan tool itself is not a vehicle component, it must not interfere with vehicle safety systems during diagnostics.

European Union (CE Marking)

- CE Marking: Required for sale within the EU.

- Must comply with:

- EMC Directive (2014/30/EU): Electromagnetic compatibility.

- RoHS Directive (2011/65/EU): Restriction of Hazardous Substances (e.g., lead, mercury, cadmium).

- REACH Regulation (EC 1907/2006): Chemical substance safety.

- Radio Equipment Directive (RED 2014/53/EU): If the device includes wireless functions (e.g., Bluetooth, Wi-Fi).

Canada (ISED)

- Innovation, Science and Economic Development Canada (ISED): Equivalent to FCC compliance.

- Certification required under RSS-210 and RSS-Gen for radio interference.

- ISED certification number must be displayed.

2. Software and Data Compliance

- GDPR (EU): If the scan tool collects or stores personal vehicle or user data, compliance with General Data Protection Regulation is required.

- Cybersecurity Standards: Tools with connectivity (e.g., Bluetooth, OBD-II) must ensure secure data transmission to prevent unauthorized access.

- Software Updates: Regular updates must be documented and distributed securely to maintain diagnostic accuracy and compliance.

Logistics and Supply Chain Management

1. Import and Export Documentation

Ensure proper documentation to avoid customs delays or penalties.

Required Documents:

- Commercial Invoice: Includes product description, value, buyer/seller details.

- Packing List: Itemizes contents of each shipment.

- Certificate of Origin: May be required to determine tariff eligibility.

- FCC/CE/ISED Certification Documents: To demonstrate compliance upon customs inspection.

- Bill of Lading or Air Waybill: Proof of shipment and contract with carrier.

2. Tariff Classification (HS Codes)

Use accurate Harmonized System (HS) codes for customs clearance.

- Example HS Code (US): 9032.89 – Instruments and appliances used for checking or regulating automatic control systems.

- Note: Some countries may classify diagnostic tools under 8543.70 (electronic diagnostic apparatus). Verify local classification.

- Duty Rates: Vary by country; some offer reduced or zero tariffs for diagnostic equipment under trade agreements.

3. Transportation and Packaging

Packaging Requirements:

- Protective Packaging: Use anti-static materials and shock-absorbing packaging to protect sensitive electronics.

- Labeling:

- Product name and model.

- Safety warnings.

- Compliance marks (FCC, CE, ISED).

- Handling symbols (e.g., “Fragile,” “This Side Up”).

Shipping Considerations:

- Temperature & Humidity Control: Avoid extreme conditions during transit to prevent component damage.

- Battery Safety (if applicable):

- If the tool contains lithium-ion batteries, follow IATA/IMDG regulations for air and sea freight.

- Batteries must be properly installed or shipped at ≤30% charge.

- Mark packages with UN3481 (for devices containing batteries) and include appropriate documentation.

Market-Specific Requirements

United States

- EPA and State Regulations: While not directly applicable, tools used in emissions testing must support required OBD-II protocols (e.g., CARB compliance in California).

- State-Level Compliance: Some states require certification for diagnostic tools used in vehicle inspections.

European Union

- WEEE Directive (2012/19/EU): Producers must register and provide take-back options for electronic waste.

- EPR (Extended Producer Responsibility): Registration with national authorities may be required.

China

- CCC Mark (China Compulsory Certification): Required for electronic devices sold in China.

- SRRC Certification: For wireless communication modules (e.g., Bluetooth).

- GB Standards: Must comply with national technical standards for EMC and safety.

Australia / New Zealand

- RCM Mark: Regulatory Compliance Mark for electrical and electronic products.

- Covers EMC, safety, and telecommunications requirements.

- ACMA Regulations: For devices with wireless capabilities.

After-Sales and User Compliance

1. User Instructions and Manuals

- Provide multilingual manuals including:

- Setup and operation instructions.

- Safety warnings.

- Compliance information.

- Software update procedures.

2. Warranty and Repair Logistics

- Establish authorized service centers or return logistics.

- Track compliance of replacement parts to original certifications.

3. Software Licensing and Updates

- Ensure license compliance for proprietary diagnostic software.

- Maintain update logs for audit and regulatory purposes.

Conclusion

Successfully managing the logistics and compliance of an Automotive Scan Tool with ABS functionality requires attention to international regulations, proper documentation, secure transportation, and ongoing software compliance. By adhering to this guide, stakeholders can ensure smooth market entry, avoid penalties, and provide reliable, safe diagnostic solutions globally.

Note: Regulations vary by country and are subject to change. Always consult local authorities or compliance experts before shipping or selling.

Conclusion:

Sourcing an automotive scan tool with ABS (Anti-lock Braking System) functionality is a critical investment for automotive technicians, repair shops, and fleet maintenance operations. These advanced diagnostic tools not only enable efficient troubleshooting of engine and transmission systems but also provide specialized access to the ABS, airbag, and other critical safety systems that are essential for modern vehicle safety and performance.

When selecting a scan tool with ABS capabilities, it is important to consider factors such as compatibility with a wide range of vehicle makes and models, update frequency, ease of use, reliability, and customer support. Higher-end professional tools offer comprehensive diagnostics, bi-directional control, and real-time data streaming, which significantly improve accuracy and reduce downtime.

In conclusion, choosing the right ABS-compatible scan tool enhances diagnostic efficiency, ensures accurate repairs, improves customer satisfaction, and ultimately contributes to safer and more reliable vehicle operation. Investing in a high-quality, versatile scan tool is not just a technical upgrade—it’s a strategic move toward professional excellence in the automotive service industry.