The global automotive battery terminal connectors market is experiencing steady growth, driven by rising vehicle production, increasing demand for electric and hybrid vehicles, and the need for reliable electrical connectivity in modern automotive systems. According to Mordor Intelligence, the automotive connectors market, which includes battery terminal connectors, was valued at USD 25.6 billion in 2023 and is projected to grow at a CAGR of over 6.8% from 2024 to 2029. A key segment within this broader market, battery terminal connectors are critical components ensuring efficient power transmission between the battery and a vehicle’s electrical system. With advancements in automotive electronics and the global shift toward electrification, demand for high-performance, corrosion-resistant, and durable connectors has intensified. As of 2024, Asia-Pacific dominates market share due to high automotive manufacturing volumes in countries like China, India, and Japan. This evolving landscape has led to increased competition among manufacturers striving to meet stringent OEM standards and emerging technological requirements. Below are the top 10 automotive battery terminal connectors manufacturers leading the industry in innovation, quality, and global reach.

Top 10 Automotive Battery Terminal Connectors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Terminal Supply Company

Domain Est. 2000

Website: terminalsupplyco.com

Key Highlights: For more than 50 years we have become a trusted supplier to the heavy-duty and industrial markets because of the quality manufacturers that we stock….

#2 Automotive Terminals

Domain Est. 1992

Website: te.com

Key Highlights: Our products are used for connecting fuses, battery terminals, and vehicle sensors. TE automotive terminals serve every OEM in the automotive market, as well as ……

#3 A.C. Terminals

Domain Est. 2000 | Founded: 1973

Website: acterminals.com

Key Highlights: A.C. Terminals has been a leading battery terminal manufacturer since 1973. We make and supply terminals and accessories to businesses across the US….

#4 Terminal Technologies

Domain Est. 2000

Website: terminaltechnology.com

Key Highlights: We are India’s leading manufacturers and suppliers of terminal, connector solutions, serving the Auto, Appliances, Electronics, and Electrical industries ……

#5 Connectors

Domain Est. 1994

Website: molex.com

Key Highlights: Molex offers a wide variety of Board-to-Board Connectors for microminiature, high-speed, high-density, and high-power applications….

#6 Connectors

Domain Est. 1995

Website: aptiv.com

Key Highlights: Aptiv offers one of the industry’s most complete automotive connection system portfolios. We offer a large variety of connectors and housings, with options ……

#7 Anderson Power

Domain Est. 1996

Website: andersonpower.com

Key Highlights: An Innovative Connector for the Future of Battery Charging. Our new IBC DIN-style connector is designed to take your battery charging to the next level….

#8 Battery Connectors, Cables, & Protective Products

Domain Est. 1996

Website: grote.com

Key Highlights: Grote’s has a complete line of battery connectors, cable, replacement and service parts, test clips and terminal protective products….

#9 QuickCable

Domain Est. 1996

Website: quickcable.com

Key Highlights: QuickCable is your source for the widest selection of battery terminals and lugs. We manufacture our products using die-cast copper or premium copper tubing to ……

#10 JST Sales America: Cutting

Domain Est. 1998

Website: jst.com

Key Highlights: Automotive. From airbags and headlights to ignition coils and data control modules, JST connectors can be found in almost every part of every automotive….

Expert Sourcing Insights for Automotive Battery Terminal Connectors

H2: 2026 Market Trends for Automotive Battery Terminal Connectors

The global market for automotive battery terminal connectors is poised for significant transformation by 2026, driven by the rapid evolution of vehicle electrification, advancements in materials science, and stringent regulatory standards. As the automotive industry shifts toward electrified mobility, battery terminal connectors—critical components that ensure reliable electrical connections between batteries and vehicle systems—are gaining increased importance in terms of performance, durability, and safety.

1. Surge in Electric Vehicle (EV) Adoption

The most influential trend shaping the 2026 market landscape is the accelerating global adoption of electric vehicles. With automakers committing to electrify their fleets and governments enforcing stricter emissions regulations, the demand for high-performance battery terminal connectors in EVs is rising sharply. Unlike traditional internal combustion engine (ICE) vehicles, EVs require connectors capable of handling higher currents, improved thermal management, and enhanced corrosion resistance. This shift is driving innovation in connector design, particularly for high-voltage battery systems used in battery electric vehicles (BEVs) and plug-in hybrids (PHEVs).

2. Advancements in Connector Materials and Design

By 2026, manufacturers are expected to increasingly adopt advanced materials such as copper alloys, tin-plated brass, and composite polymers to improve conductivity, reduce weight, and resist environmental degradation. Innovations in anti-corrosion coatings and sealing technologies will also enhance connector reliability in harsh operating conditions. Additionally, modular and compact connector designs are being developed to support the space-constrained battery packs typical in modern EV architectures.

3. Integration of Smart and Sensor-Enabled Connectors

A growing trend is the integration of smart technologies into battery terminal connectors. By 2026, an increasing number of connectors will feature embedded sensors to monitor critical parameters such as temperature, voltage drop, and connection integrity. These smart connectors enable real-time diagnostics, support predictive maintenance, and enhance overall battery management system (BMS) efficiency—key requirements for ensuring the safety and longevity of EV batteries.

4. Regional Market Dynamics and Supply Chain Localization

Asia-Pacific, particularly China, will remain the dominant market for automotive battery terminal connectors, driven by robust EV production and supportive government policies. However, North America and Europe are expected to witness accelerated growth due to local EV manufacturing investments and initiatives to build resilient supply chains. Automakers and Tier-1 suppliers are increasingly prioritizing regional sourcing to mitigate geopolitical risks and reduce logistics costs, influencing connector manufacturing locations and partnerships.

5. Sustainability and Recycling Initiatives

Environmental considerations are becoming a core factor in connector design and production. By 2026, there will be a stronger emphasis on recyclable materials and manufacturing processes that minimize carbon footprint. Regulatory frameworks such as the EU’s End-of-Life Vehicles (ELV) Directive are pushing manufacturers to design connectors that are easier to disassemble and recycle, contributing to the circular economy in the automotive sector.

6. Consolidation and Strategic Partnerships

The competitive landscape is likely to see increased consolidation among component suppliers. Strategic collaborations between connector manufacturers and battery or EV OEMs will become more common to co-develop customized solutions that meet specific performance and safety requirements. These partnerships will be crucial for staying ahead in a market that demands rapid innovation and compliance with evolving industry standards.

In conclusion, the 2026 market for automotive battery terminal connectors will be defined by the convergence of electrification, digitalization, and sustainability. As vehicles become more electric and intelligent, the role of battery terminal connectors will expand beyond mere electrical conduction to become integral elements of vehicle safety, efficiency, and smart functionality. Companies that invest in R&D, embrace smart technologies, and align with global sustainability goals will be best positioned to capture growth in this dynamic market.

Common Pitfalls When Sourcing Automotive Battery Terminal Connectors (Quality & IP)

Sourcing automotive battery terminal connectors may seem straightforward, but overlooking critical quality and intellectual property (IP) considerations can lead to significant issues down the line. Here are the most common pitfalls to avoid:

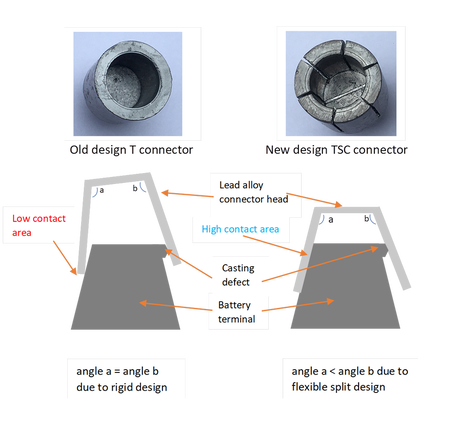

Poor Material Quality and Corrosion Resistance

Many low-cost connectors use substandard copper alloys or inadequate plating (e.g., thin tin or insufficient lead-free coatings), leading to increased electrical resistance, overheating, and premature corrosion. This compromises vehicle reliability and safety, especially in harsh environments. Always verify material specifications (e.g., ASTM or ISO standards) and demand corrosion test reports (e.g., salt spray testing per ASTM B117).

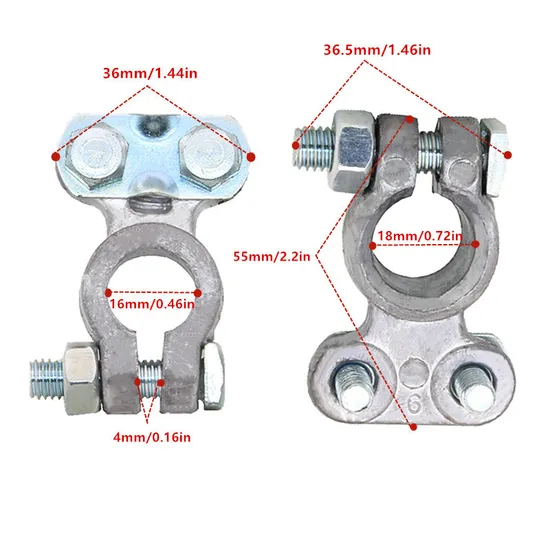

Inadequate Mechanical Strength and Fit

Connectors that do not meet OEM torque specifications or lack proper crimping strength can loosen over time due to engine vibration. This results in intermittent electrical connections or complete failure. Ensure connectors comply with dimensional and mechanical standards (e.g., SAE J563 or DIN 72553) and request proof of pull-out force and vibration testing.

Non-Compliance with Environmental and Safety Standards

Sourcing connectors without proper certification for flammability (e.g., UL 94 V-0), temperature range, or chemical resistance can lead to fire hazards or degradation in under-hood conditions. Verify compliance with relevant standards such as ISO 16750 (road vehicle environmental conditions) and AEC-Q200 (passive component stress testing).

Counterfeit or Unlicensed OEM-Style Designs

Some suppliers offer connectors that visually mimic branded OEM parts (e.g., designs resembling Delphi or Deutsch) but lack proper licensing. This poses serious IP infringement risks, including legal liability, shipment seizures, and reputational damage. Always obtain written confirmation that the supplier holds valid IP rights or produces connectors under license.

Lack of Traceability and Documentation

Suppliers that do not provide batch traceability, material certifications (e.g., RoHS, REACH), or test reports make quality assurance difficult. In regulated automotive markets, this can prevent compliance with IATF 16949 requirements. Insist on full documentation and audit rights as part of your procurement agreement.

Inconsistent Manufacturing Processes

Without adherence to automotive-grade production controls (e.g., PPAP, APQP), even minor process variations can result in inconsistent crimp quality, plating thickness, or dimensional accuracy. This increases field failure rates. Choose suppliers with IATF 16949 certification and robust quality management systems.

Avoiding these pitfalls requires due diligence in supplier qualification, clear technical specifications, and proactive IP validation—ensuring reliable performance and legal compliance in automotive applications.

Logistics & Compliance Guide for Automotive Battery Terminal Connectors

This guide outlines key considerations for the safe, efficient, and regulatory-compliant logistics and handling of automotive battery terminal connectors throughout the supply chain.

Regulatory Compliance & Safety

- Hazardous Materials Classification: While connectors themselves are typically non-hazardous, they are often shipped alongside batteries or battery systems classified as Dangerous Goods (e.g., UN 3090, UN 3480, UN 3481). Ensure connectors are not contaminated with electrolyte or other hazardous substances. Adhere to local and international regulations (e.g., ADR/RID/ADN for Europe, 49 CFR for US, IMDG Code for sea, IATA DGR for air) if co-shipped or stored near batteries.

- REACH & RoHS Compliance: Verify materials (copper, lead-tin plating, steel, plastics) comply with EU REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives. Maintain documentation (e.g., SVHC declarations, RoHS compliance certificates) for traceability.

- Material Documentation: Require suppliers to provide Material Safety Data Sheets (MSDS/SDS) and certificates of conformance (CoC) detailing material composition, plating specifications, and compliance with relevant standards (e.g., SAE J1777, DIN 72553).

- Labeling & Marking: Ensure packaging is clearly labeled with product identification (part number, description), quantity, weight, handling symbols (e.g., “Do Not Stack,” “Protect from Moisture”), and any relevant hazard warnings if applicable. Barcode/QR codes for traceability are recommended.

- Environmental Regulations: Comply with local waste disposal regulations (e.g., WEEE in EU) for packaging and potential end-of-life connector management. Implement recycling programs where feasible.

Packaging & Handling

- Protection from Damage: Use packaging that prevents physical damage (bending, denting, plating abrasion). Individual sleeving, blister packs, or compartmentalized trays are common for small connectors. Larger connectors or bulk shipments require robust boxes with internal dividers or cushioning (e.g., foam, corrugated inserts).

- Corrosion Prevention: Protect connectors, especially plated surfaces (lead-tin, nickel), from moisture and corrosive atmospheres. Use vapor corrosion inhibitors (VCI) paper or bags, desiccants, and moisture-barrier packaging (e.g., sealed polyethylene bags) for sensitive finishes or long-term storage.

- Contamination Control: Prevent contamination from dust, dirt, oils, or salts. Ensure packaging is clean and sealed. Handle connectors with clean gloves to avoid fingerprint corrosion on plated surfaces.

- Packaging Integrity: Use strong, undamaged outer containers (corrugated cardboard, plastic totes) suitable for stacking and handling. Ensure closures are secure to prevent spillage.

- Unit Load Stability: Palletize cartons securely using stretch wrap and/or strapping. Ensure pallet loads are stable, within weight limits, and properly labeled (top and side). Avoid overhang.

Storage

- Environment: Store in a clean, dry, temperature-controlled environment (typically 10°C to 30°C / 50°F to 86°F, <60% RH). Avoid direct sunlight, extreme temperatures, and proximity to corrosive chemicals or fumes.

- Inventory Management: Implement FIFO (First-In, First-Out) or FEFO (First-Expired, First-Out) practices to prevent aging and potential degradation of plating or plastics. Use clear labeling for date of receipt/manufacture.

- Segregation: Store away from batteries, solvents, acids, and other incompatible materials. Keep different connector types/part numbers segregated to prevent mix-ups.

- Stacking: Observe safe stacking heights as per packaging specifications to prevent crushing lower layers. Use pallets and racking appropriately.

Transportation

- Mode Selection: Choose transportation mode (truck, rail, sea, air) based on urgency, cost, volume, and destination. Air freight requires strict adherence to IATA DGR if batteries are involved; ground/sea transport follows IMDG/ADR.

- Securement: Ensure loads are properly secured within the transport vehicle (e.g., using straps, dunnage, load bars) to prevent shifting, impact, and vibration damage during transit.

- Documentation: Maintain accurate shipping documentation, including commercial invoices, packing lists, bills of lading/air waybills, and any required dangerous goods declarations (if applicable). Include HS codes for customs (e.g., 8536.69 for electrical connectors).

- Temperature & Humidity Monitoring: For sensitive shipments or long durations, consider using data loggers to monitor and record environmental conditions.

- Carrier Qualification: Use carriers experienced in handling automotive components and compliant with relevant transportation regulations.

Traceability & Documentation

- Lot/Batch Tracking: Implement systems to track connectors by lot or batch number from raw material to finished goods. This is critical for recalls and quality investigations.

- Record Keeping: Maintain records of supplier certifications, incoming inspection results, storage conditions, shipping documentation, and compliance certificates for the required retention period (often 10+ years in automotive).

- Serialization: Consider using serialized labels (barcodes, QR codes) for high-value or safety-critical applications to enable end-to-end traceability.

Returns & Reverse Logistics

- Process Definition: Establish clear procedures for handling customer returns, including inspection for damage, contamination, or non-compliance.

- Segregation: Isolate returned goods from new inventory to prevent cross-contamination.

- Disposition: Define processes for rework, refurbishment (if plating allows), recycling, or disposal according to environmental regulations and quality standards.

- Documentation: Track returned items and their disposition thoroughly.

Adherence to this guide ensures the reliable delivery of automotive battery terminal connectors while meeting stringent automotive industry quality, safety, and environmental standards.

In conclusion, sourcing automotive battery terminal connectors requires a careful balance of quality, compatibility, cost-efficiency, and supplier reliability. Ensuring that connectors meet industry standards for conductivity, corrosion resistance, and mechanical durability is critical to maintaining vehicle performance and safety. Evaluating suppliers based on material traceability, manufacturing certifications (such as ISO/TS 16949), and consistent quality control helps mitigate risks associated with component failure. Additionally, considering long-term supply chain stability, lead times, and total cost of ownership—rather than upfront price alone—leads to more sustainable procurement outcomes. By prioritizing technical specifications, regulatory compliance, and strategic supplier partnerships, organizations can secure reliable, high-performance battery terminal connectors that support the demands of modern automotive applications.