The global market for industrial valves, including automatic recirculation valves (ARVs), is experiencing steady expansion driven by rising demand in critical sectors such as power generation, oil & gas, chemical processing, and HVAC systems. According to a report by Mordor Intelligence, the industrial valves market was valued at USD 71.5 billion in 2023 and is projected to grow at a CAGR of 5.8% through 2029. A key contributor to this growth is the increasing need for energy efficiency and equipment protection in pumping systems, where automatic recirculation valves play a vital role by preventing pump damage due to low flow conditions. These valves ensure optimal system performance by automatically recirculating fluid when flow drops below a critical threshold—making them essential in high-efficiency applications across industries. With global industrialization and infrastructure development accelerating, particularly in Asia-Pacific and the Middle East, demand for reliable, high-performance ARVs is on the rise. This growing market landscape has intensified competition among manufacturers, emphasizing innovation, durability, and compliance with international standards. Below, we profile the top 10 automatic recirculation valve manufacturers leading this space through technological advancement and robust product offerings.

Top 10 Automatic Recirculation Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Automatic Recirculation Valves

Domain Est. 1999

Website: agivalves.com

Key Highlights: Automatic Recirculation Valves protect centrifugal pumps from damage that may occur during low-flow operations….

#2 HPM Series Automatic Recirculation Valve

Domain Est. 2001

Website: flotechinc.com

Key Highlights: Developed for high-pressure centrifugal pump protection. Popular applications include boiler feed water, petroleum, and steel mill hot strip descale water….

#3 Valve Pipe Engineering Company & Valve Manufacturer(Supplier …

Domain Est. 2009

Website: datianvalve.com

Key Highlights: With 20 Years Experience. More than 2 decades of experience in design and manufacture of Control Valve and Automatic Recirculation Valve….

#4 Yarway

Domain Est. 1995

Website: emerson.com

Key Highlights: Yarway is a global provider of products for the entire steam loop including pump protection valves, desuperheaters, globe valves, blowoff and blowdown ……

#5 Automatic Recirculation Valve

Domain Est. 1996

Website: bermad.com

Key Highlights: Protecting Pumps Automatically: An Automatic Recirculation Valve is designed to protect pumps from damage by ensuring a minimum flow rate is maintained….

#6 HBE Engineering

Domain Est. 1997

Website: hbe-engineering.com

Key Highlights: Our automatic recirculation valves provide effective centrifugal pump protection from serious damage which can result from temperature rise or instability….

#7 Automatic Recirculation Valves

Domain Est. 2000

Website: fetterolfvalves.com

Key Highlights: Automatic Recirculation valves protect pumps with a main line non return function, bypass and let down in one body. Low Delta P designs available….

#8 Schroeder Valves

Domain Est. 2005 | Founded: 1950

Website: schroeder-valves.com

Key Highlights: Since 1950. Already in 1950, Wilhelm Schroeder developed the world’s first Automatic Recirculation Valve (models GD + SD) and thus not only became the inventor ……

#9 Automatic Recirculation Valve

Website: schuf.de

Key Highlights: The SchuF automatic recirculation valve is a unique design whose performance has been perfected through simulation and joint research and development….

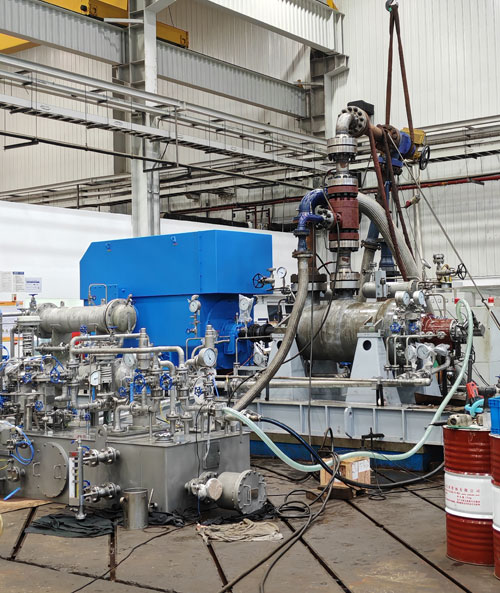

#10 Automatic Recirculation Valves: Enhancing Operational Saf

Website: hora.de

Key Highlights: Enhance your fluid systems’ reliability and efficiency with our innovative automatic recirculation valves, designed for optimal performance….

Expert Sourcing Insights for Automatic Recirculation Valve

H2: 2026 Market Trends for Automatic Recirculation Valves

The global market for Automatic Recirculation Valves (ARVs) is poised for significant transformation by 2026, driven by technological advancements, increasing energy efficiency demands, and growing industrial automation. ARVs, which are primarily used to prevent pump damage by ensuring a minimum flow through centrifugal pumps during low or no-flow conditions, are becoming increasingly critical across oil & gas, power generation, chemical processing, and water treatment industries.

One of the key trends shaping the 2026 landscape is the integration of smart technologies into ARV systems. The rise of Industry 4.0 and the Industrial Internet of Things (IIoT) is leading to the development of intelligent ARVs equipped with sensors, real-time monitoring, and predictive maintenance capabilities. These smart valves enable remote diagnostics and performance optimization, reducing downtime and maintenance costs—factors highly valued in mission-critical applications.

Additionally, sustainability and energy efficiency regulations are pushing industries to adopt more efficient pumping systems. ARVs contribute to energy savings by ensuring pumps operate within their optimal flow range, thus reducing wear and energy consumption. Regulatory frameworks in North America and Europe, such as the EU Ecodesign Directive, are expected to further drive ARV adoption by mandating efficient pump system designs.

The Asia-Pacific region is anticipated to witness the highest growth rate by 2026, fueled by rapid industrialization, infrastructure development, and expanding power and water treatment facilities in countries like China, India, and Southeast Asian nations. Local manufacturing and technological partnerships are helping global valve manufacturers penetrate emerging markets more effectively.

Furthermore, customization and modular design are becoming increasingly important. End users are demanding ARVs tailored to specific operational conditions, leading to a rise in engineered-to-order (ETO) solutions. This trend is particularly evident in the oil & gas sector, where extreme operating environments require robust and application-specific valve designs.

In summary, the 2026 Automatic Recirculation Valve market will be characterized by technological innovation, regulatory influence, geographic expansion, and a shift toward smarter, more sustainable fluid control solutions. Companies that invest in digital integration, energy efficiency, and regional market adaptation are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing Automatic Recirculation Valves (Quality & IP)

Sourcing an Automatic Recirculation Valve (ARV) requires careful consideration to ensure reliable pump protection and system efficiency. Overlooking key aspects related to quality and Ingress Protection (IP) ratings can lead to premature failure, safety hazards, and costly downtime.

Poor Manufacturing Quality and Material Selection

One of the most significant pitfalls is selecting an ARV based solely on price, leading to compromises in build quality. Low-cost valves often use inferior materials such as non-certified alloys or substandard elastomers that degrade rapidly when exposed to process fluids, high temperatures, or pressure cycles. This can result in internal leakage, spring fatigue, or mechanical failure. Additionally, poor machining tolerances affect the precision of flow control and recirculation setpoints, undermining the valve’s core function of protecting the pump during low-flow conditions.

Inadequate Ingress Protection (IP) Rating for the Environment

The IP rating defines the level of protection against solid objects and liquids. A common mistake is selecting an ARV with an IP rating insufficient for the installation environment. For example, deploying an IP54-rated actuator in a washdown or outdoor area exposed to heavy rain may lead to moisture ingress, causing electrical short circuits in solenoids or corrosion in control components. Conversely, over-specifying an IP68-rated valve in a dry indoor setting increases cost unnecessarily. Always match the IP rating to the environmental conditions—considering dust, moisture, hose-directed water, and potential submersion.

Lack of Certification and Compliance Documentation

Many suppliers fail to provide valid certifications (e.g., ISO 9010, PED, ATEX, or NACE MR0175 for sour service), making it difficult to verify quality and suitability for regulated industries. Without proper documentation, end users risk non-compliance with safety standards and may face liability issues. Always request and verify material test reports (MTRs), conformity certificates, and third-party validation to ensure the ARV meets required industry standards.

Insufficient Testing and Factory Acceptance Procedures

Some manufacturers skip or minimize performance testing, such as flow calibration, pressure testing, or cycle endurance. Without rigorous factory acceptance tests (FAT), hidden defects may go undetected until installation or operation. This can result in incorrect recirculation thresholds or failure to open during low-flow events, putting the pump at risk. Ensure your supplier conducts and documents comprehensive testing per applicable standards.

Neglecting Compatibility with Control Systems

ARVs often integrate with PLCs or DCS systems via electronic positioners or solenoid valves. A frequent oversight is assuming universal compatibility. Mismatched signal types (4–20 mA vs. digital), voltage requirements, or communication protocols (HART, Foundation Fieldbus) can delay commissioning. Verify electrical and control compatibility early in the sourcing process to avoid integration challenges.

Avoiding these pitfalls requires due diligence in supplier evaluation, clear specification of technical requirements, and insistence on verifiable quality assurance processes. Investing time upfront ensures long-term reliability and safety of your pumping systems.

Logistics & Compliance Guide for Automatic Recirculation Valves (ARVs)

Overview

Automatic Recirculation Valves (ARVs) are critical components in pump protection systems, preventing damage due to low-flow or deadhead conditions by automatically recirculating fluid when flow drops below a set threshold. Proper logistics handling and adherence to compliance standards are essential to ensure valve integrity, performance, and regulatory conformity throughout the supply chain.

Transportation & Handling

Packaging Requirements

– ARVs must be shipped in robust, moisture-resistant packaging to prevent mechanical damage and corrosion.

– Valves should be individually wrapped with protective end caps installed on all ports to prevent contamination.

– Use anti-corrosion VCI (Vapor Corrosion Inhibitor) paper or equivalent for extended storage or international shipping.

– Clearly label packages with “Fragile,” “This Side Up,” and “Protect from Moisture” indicators.

Shipping Conditions

– Maintain temperatures between 5°C and 40°C during transit to avoid seal degradation.

– Avoid exposure to direct sunlight, rain, or extreme humidity.

– Secure loads to prevent shifting during transit; use dunnage to minimize vibration.

– For hazardous environments (e.g., offshore, chemical plants), ensure compliance with ADR, IMDG, or IATA regulations if applicable.

Receiving & Inspection

– Upon receipt, inspect packaging for damage and verify seals are intact.

– Check for missing or damaged end caps and visible corrosion.

– Confirm shipment contents against packing list and purchase order.

– Document and report discrepancies immediately to the supplier.

Storage Conditions

Environmental Controls

– Store ARVs in a clean, dry, indoor environment with temperature between 10°C and 35°C and relative humidity below 60%.

– Avoid storage near corrosive chemicals, salt spray, or high-vibration equipment.

Orientation & Stacking

– Store valves in their natural installation orientation (typically upright) to prevent internal component stress.

– Do not stack packages unless designed for multi-tier storage; follow manufacturer stacking limits.

Duration & Inventory Management

– Minimize storage duration; follow First-In, First-Out (FIFO) principles.

– Inspect stored valves every 6 months for corrosion, seal integrity, and packaging condition.

– Reapply protective coatings or repackage if storage exceeds 12 months.

Regulatory & Industry Compliance

Pressure Equipment Directive (PED) – EU

– ARVs with pressure > 0.5 bar must comply with PED 2014/68/EU.

– Verify CE marking and availability of EU Declaration of Conformity.

– Classification based on fluid group, pressure, and volume (e.g., Category II–IV).

ASME & API Standards – North America

– Design and testing must align with ASME B16.34 (valve flanges and ends) and API 6D or API 598 (testing).

– ARVs used in oil & gas applications may require API 6D certification.

– Ensure NACE MR0175/ISO 15156 compliance for sour service environments.

ATEX & IECEx – Hazardous Areas

– For installations in explosive atmospheres, ARVs must comply with ATEX (EU) or IECEx standards.

– Verify equipment group (I/II), category (1G, 2G, etc.), and temperature class (T-rating).

– Documentation must include Ex Certificate and Installation Manual.

Environmental & Safety Regulations

– Comply with REACH (EU) and RoHS directives regarding restricted substances.

– Adhere to local environmental laws for packaging waste (e.g., WEEE in EU).

– Follow OSHA (US) or equivalent workplace safety regulations during handling.

Documentation & Traceability

Required Documentation

– Material Test Reports (MTRs) for body, trim, and critical components.

– Certificate of Conformity (CoC) or EU Declaration of Conformity.

– Test Reports (shell test, seat leakage per API 598 or ISO 5208).

– Traceability records (heat numbers, serial numbers, manufacturing dates).

Labeling Requirements

– Permanent marking on valve body including: manufacturer name, size, pressure rating, material grade, serial number, and applicable standards.

– For PED, include CE mark, notified body number, and year of manufacture.

Installation & Pre-Commissioning

Pre-Installation Checks

– Remove end caps carefully; inspect ports for debris.

– Verify flow direction markings align with piping layout.

– Conduct a visual inspection for shipping damage.

Commissioning

– Perform a functional test to confirm recirculation activation at set flow rates.

– Verify integration with control systems (if applicable).

– Record baseline performance data for future reference.

Conclusion

Adherence to this logistics and compliance guide ensures Automatic Recirculation Valves arrive at their destination in optimal condition and meet all regulatory requirements for safe and reliable operation. Always consult the manufacturer’s specific instructions and applicable regional regulations to maintain compliance throughout the valve lifecycle.

Conclusion for Sourcing Automatic Recirculation Valve:

The selection and sourcing of an automatic recirculation valve (ARV) are critical to ensuring the efficient, safe, and reliable operation of pump systems, particularly under low-flow or dead-head conditions. After evaluating technical specifications, operational requirements, material compatibility, industry standards, and supplier capabilities, it is evident that choosing a high-quality ARV from a reputable manufacturer significantly contributes to system longevity and energy efficiency.

Key factors such as flow rate, pressure rating, temperature range, connection type, and control mechanism must align with the specific application to avoid premature failure or system inefficiencies. Additionally, considering total cost of ownership—factoring in maintenance, durability, and energy savings—rather than focusing solely on initial purchase price, leads to better long-term outcomes.

In conclusion, a well-sourced automatic recirculation valve not only protects critical pumping equipment but also enhances operational safety and reduces downtime. Prioritizing quality, proper sizing, and supplier support ensures optimal performance and reliability within the system, making it a worthwhile investment for industrial, commercial, and process applications.