The global automatic lubrication system market is experiencing robust growth, driven by increasing industrial automation, rising demand for predictive maintenance technologies, and the need to enhance equipment longevity and operational efficiency. According to a report by Mordor Intelligence, the market was valued at USD 876.2 million in 2023 and is projected to reach USD 1,186.5 million by 2029, growing at a CAGR of approximately 5.0% during the forecast period. Similarly, Grand View Research estimates the market size at USD 850 million in 2022, with a projected CAGR of 5.2% from 2023 to 2030, citing expanding applications in manufacturing, mining, wind energy, and transportation sectors. As industries prioritize minimizing downtime and optimizing maintenance costs, the adoption of advanced lubrication systems has become a strategic imperative. This growing demand has fostered a competitive landscape of innovators and established players alike, shaping a market defined by technological precision and reliability. In this context, identifying the leading manufacturers becomes essential for businesses seeking high-performance automatic lubrication solutions.

Top 9 Automatic Lubrication System Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Dropsa

Domain Est. 1996

Website: dropsa.com

Key Highlights: DropsA designs and manufactures centralized lubrication systems with high-technological innovation, which are guaranteed by efficient pre- and after-sale ……

#2 In

Domain Est. 1994

Website: graco.com

Key Highlights: Graco automatic lubrication systems extend equipment lifecycles and improve productivity for a wide range of in-plant applications….

#3

Domain Est. 2019

Website: groeneveld-beka.com

Key Highlights: Groeneveld-BEKA, part of the Timken Company, is one of the world’s largest manufacturers of automatic lubrication systems, lubricants and fluid management ……

#4 WOERNER

Website: woerner.de

Key Highlights: WOERNER – The world’s leading manufacturer of centralized lubrication systems. EUGEN WOERNER GmbH & Co. KG has been developing and producing high-quality ……

#5 Lubrication lifetime solutions

Domain Est. 1996

Website: skf.com

Key Highlights: Lubricants – Lubricators – Tools · Automatic lubrication systems · Lubrication system components · Solutions for specific industries….

#6 A.T.S. Electro

Domain Est. 1998

Website: atselectrolube.com

Key Highlights: A.T.S. Electro-Lube is the market leader for reliable, quality, self-contained automatic lubrication systems for every industry application….

#7 FLO Components

Domain Est. 1998 | Founded: 1977

Website: flocomponents.com

Key Highlights: Since 1977, FLO has been designing, assembling, and installing high-quality auto lube systems, as well as delivering comprehensive solutions for manual greasing ……

#8 Bijur Delimon International

Domain Est. 2005

Website: bijurdelimon.com

Key Highlights: A global leader in the design & manufacturing of world-class lubrication systems and equipment … Automatic Lubrication Systems · Lubrication Products….

#9 Pulsarlube USA, Inc. Automatic Lubricators. The Best Lubrication …

Domain Est. 1999

Website: pulsarlube.com

Key Highlights: Pulsarlube a Variety of Lubrication Solutions for Most Applications and Environments. machinery lubrication, Luber, lube oil system, automatic lubrication ……

Expert Sourcing Insights for Automatic Lubrication System

H2: 2026 Market Trends for Automatic Lubrication Systems

The global market for Automatic Lubrication Systems (ALS) is poised for significant transformation by 2026, driven by technological advancements, increasing industrial automation, and a growing emphasis on predictive maintenance. Key trends shaping the market include:

-

Rising Demand for Industrial Automation

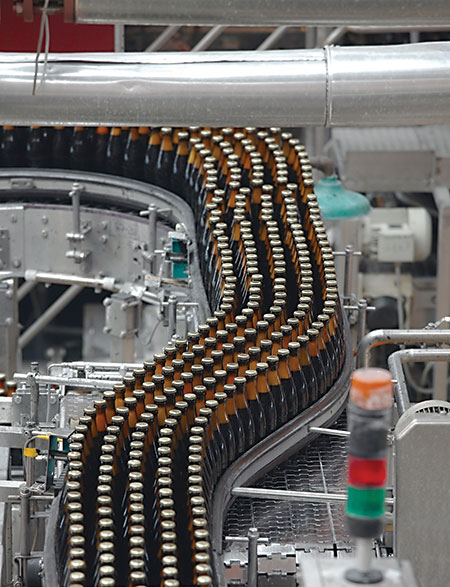

As industries across manufacturing, automotive, mining, and energy prioritize operational efficiency, the integration of ALS into automated production lines is accelerating. These systems minimize human intervention, reduce downtime, and ensure consistent lubrication—critical for maintaining equipment longevity and reducing maintenance costs. -

Growth in Predictive and Condition-Based Maintenance

By 2026, predictive maintenance is expected to dominate industrial strategies, with ALS playing a central role. Integration with IoT sensors and data analytics platforms enables real-time monitoring of lubrication conditions, allowing for proactive maintenance scheduling and improved asset performance. -

Expansion in Emerging Markets

Rapid industrialization in Asia-Pacific, Latin America, and parts of Africa is fueling demand for ALS. Countries like India, Vietnam, and Brazil are investing heavily in infrastructure and manufacturing, creating new opportunities for ALS manufacturers and service providers. -

Technological Innovations and Smart Systems

The ALS market is witnessing a shift toward smart lubrication solutions equipped with wireless connectivity, cloud-based monitoring, and AI-driven diagnostics. These systems offer remote control capabilities and generate actionable insights, enhancing reliability and reducing operational risks. -

Stringent Environmental and Safety Regulations

Environmental concerns and workplace safety regulations are pushing industries to adopt ALS, which reduces over-lubrication, minimizes waste, and lowers the risk of accidents associated with manual lubrication. This regulatory push is particularly strong in Europe and North America. -

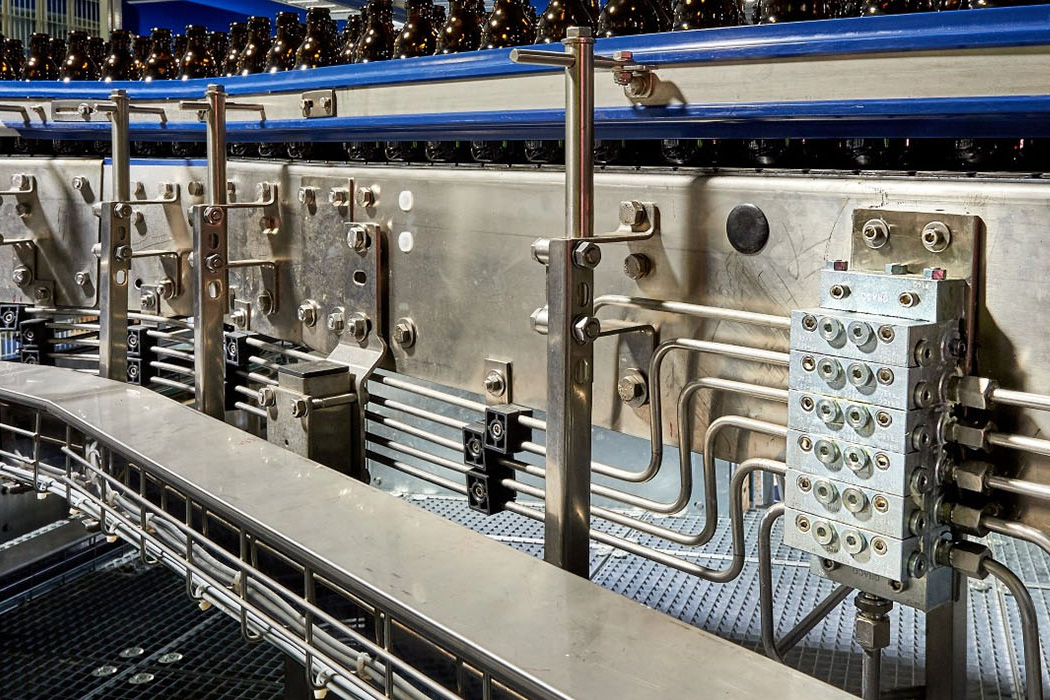

Adoption Across Diverse Sectors

While traditionally used in heavy industries, ALS adoption is expanding into sectors such as food and beverage, pharmaceuticals, and renewable energy. The need for contamination-free and precise lubrication in clean environments is a key growth driver. -

Consolidation and Strategic Partnerships

Leading players in the ALS market are engaging in mergers, acquisitions, and partnerships to enhance product portfolios and expand geographical reach. Collaboration with automation and digital solution providers is becoming increasingly common to offer integrated maintenance ecosystems.

In summary, by 2026, the Automatic Lubrication System market will be characterized by intelligent, connected solutions that support the broader Industry 4.0 transformation. Companies that innovate in digital integration, sustainability, and global scalability will be best positioned to capture growth in this evolving landscape.

Common Pitfalls When Sourcing Automatic Lubrication Systems (Quality, IP)

When procuring automatic lubrication systems, overlooking critical quality and intellectual property (IP) aspects can lead to performance issues, safety hazards, and legal risks. Below are common pitfalls to avoid:

Inadequate Quality Assurance Processes

Many suppliers lack robust quality control systems, resulting in inconsistent product performance. Buyers often assume certifications like ISO 9001 guarantee reliability, but without verifying on-site manufacturing practices or requesting independent test reports, they risk receiving substandard components prone to failure under operating conditions.

Use of Non-Compliant or Counterfeit Components

Some low-cost suppliers incorporate unbranded or counterfeit pumps, valves, or controllers that do not meet industry standards (e.g., ISO, DIN, or ANSI). These components may fail prematurely or malfunction, leading to machine downtime and safety concerns. Always require documentation of component origins and validate compliance with relevant technical specifications.

Insufficient IP Due Diligence

Purchasing systems from manufacturers that infringe on patented technologies—such as proprietary pump designs or control algorithms—can expose the buyer to legal liability. It is essential to confirm that the supplier holds legitimate rights to the technology or has proper licensing agreements in place.

Lack of Traceability and Documentation

Reliable suppliers provide full traceability, including batch numbers, material certifications, and test records. Systems sourced without proper documentation make troubleshooting, maintenance, and warranty claims difficult, increasing long-term operational costs.

Overlooking Environmental and IP Ratings

Automatic lubrication systems often operate in harsh environments. A frequent mistake is selecting components with insufficient Ingress Protection (IP) ratings (e.g., IP54 vs. required IP66/IP67). This can lead to water, dust, or chemical ingress, resulting in electrical failures or mechanical degradation.

Failure to Verify Performance Claims

Suppliers may exaggerate flow rates, pressure tolerance, or service life. Without independent validation or pilot testing, buyers risk integrating systems that underperform or fail to meet application demands, undermining equipment reliability.

Ignoring Software and Firmware IP Risks

Modern systems often include proprietary software for monitoring and control. Using systems with unlicensed or pirated firmware not only violates IP laws but may also introduce cybersecurity vulnerabilities and prevent future updates or support.

Avoiding these pitfalls requires thorough supplier evaluation, technical validation, and legal review of IP rights before finalizing procurement.

Logistics & Compliance Guide for Automatic Lubrication Systems

Product Classification and Regulatory Compliance

Automatic Lubrication Systems (ALS) are classified under industrial machinery and fluid control systems. These systems must comply with international and regional standards, including but not limited to:

- ISO 9001: Quality Management Systems – Ensures consistent product quality and manufacturing processes.

- ISO 22093: Industrial automation systems – Specifies performance criteria for centralized lubrication systems.

- CE Marking (EU): Mandatory for products placed on the European market, indicating conformity with health, safety, and environmental protection standards.

- RoHS (Restriction of Hazardous Substances): Applies to electronic components within ALS control units, restricting substances like lead, mercury, and cadmium.

- REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals): Governs the use of lubricants and sealing materials if they contain regulated substances.

Compliance must be verified through technical documentation, declarations of conformity, and third-party certifications where applicable.

Shipping and Transportation Requirements

Packaging Standards

Automatic Lubrication Systems must be packaged to prevent damage during transit:

– Use moisture-resistant, shock-absorbent materials.

– Secure all moving parts and electrical components.

– Clearly label packages with “Fragile,” “This Side Up,” and handling instructions.

Transport Regulations

- Domestic Shipments: Comply with local transportation safety regulations (e.g., DOT in the U.S.).

- International Shipments: Adhere to IATA (air) or IMDG (sea) codes if lubricants are included or classified as hazardous.

- Hazardous Materials: If the system contains pressurized components or flammable lubricants, SDS (Safety Data Sheets) and proper labeling are required.

Export Controls

- Check ITAR (International Traffic in Arms Regulations) and EAR (Export Administration Regulations) to determine if any ALS components are subject to export restrictions.

- Obtain necessary export licenses for controlled technologies, especially those used in defense or aerospace applications.

Import and Customs Clearance

Documentation Requirements

Ensure the following documents accompany every shipment:

– Commercial Invoice (with HS code: typically 8481.80 or 8413.60 for mechanical appliances and pumps)

– Packing List

– Certificate of Origin

– Bill of Lading or Air Waybill

– CE Declaration of Conformity or other applicable compliance certificates

Tariff and Duty Considerations

- Classify the ALS under the correct Harmonized System (HS) code to determine applicable duties.

- Leverage Free Trade Agreements (e.g., USMCA, EU agreements) where eligible to reduce tariffs.

- Account for VAT, GST, or other import taxes depending on destination country.

Storage and Handling

Warehouse Requirements

- Store in dry, temperature-controlled environments (typically 5°C to 40°C).

- Protect from direct sunlight and corrosive atmospheres.

- Keep systems in original packaging until installation.

Inventory Management

- Implement FIFO (First In, First Out) for lubricant reservoirs and consumable components.

- Monitor shelf life of integrated lubricants or pre-filled systems.

Installation and On-Site Compliance

Safety Standards

- Follow OSHA (U.S.) or equivalent national safety guidelines during installation.

- Ensure electrical components meet local codes (e.g., NEC in the U.S., IEC 60204 internationally).

- Provide lockout/tagout (LOTO) procedures during servicing.

Environmental Compliance

- Prevent lubricant leaks using sealed systems and secondary containment where necessary.

- Dispose of used lubricants in accordance with EPA (U.S.) or local environmental regulations.

- Recycle packaging and obsolete components responsibly.

Maintenance and Service Logistics

Spare Parts Management

- Maintain an inventory of common replacement parts (pumps, hoses, controllers).

- Use serialized tracking for warranty and recall purposes.

Service Compliance

- Technicians must be trained and certified per manufacturer guidelines.

- Service records must be maintained to support warranty claims and regulatory audits.

End-of-Life and Recycling

Disposal Regulations

- Decommission systems in accordance with WEEE (Waste Electrical and Electronic Equipment) directives in the EU.

- Recycle metal components and properly dispose of electronic control units.

- Handle residual lubricants as hazardous waste if applicable.

Product Take-Back Programs

- Offer or participate in take-back initiatives to ensure environmentally responsible disposal and enhance corporate sustainability efforts.

By adhering to this logistics and compliance guide, businesses can ensure safe, efficient, and legally compliant handling of Automatic Lubrication Systems throughout their lifecycle.

Conclusion: Sourcing an Automatic Lubrication System

Sourcing an automatic lubrication system is a strategic investment that significantly enhances equipment reliability, reduces maintenance costs, and extends machinery lifespan. After evaluating various suppliers, technologies, and system types—such as single-line, dual-line, progressive, and resistive systems—it is clear that selecting the right solution requires a thorough understanding of operational needs, environmental conditions, and compatibility with existing equipment.

Key factors in the sourcing decision include system reliability, ease of maintenance, scalability, technical support, and total cost of ownership. Partnering with reputable suppliers who offer proven technology, comprehensive training, and responsive after-sales service ensures long-term performance and minimizes downtime.

Ultimately, implementing an automatic lubrication system not only improves operational efficiency but also supports safety and sustainability goals by reducing manual intervention and optimizing lubricant usage. By carefully selecting the appropriate system and supplier, organizations can achieve significant returns on investment and maintain a competitive edge in their industry.