The global automotive wiring harness market is undergoing robust expansion, driven by increasing vehicle electrification, rising demand for advanced driver-assistance systems (ADAS), and the proliferation of electric vehicles (EVs). According to a report by Mordor Intelligence, the market was valued at USD 67.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2024 to 2029. Similarly, Grand View Research estimates the market size at USD 70.3 billion in 2023, forecasting a CAGR of 6.8% over the same period, underscoring the escalating complexity and volume of electronic content in modern vehicles. As safety, connectivity, and energy efficiency become central to automotive innovation, the demand for high-performance wiring harnesses—critical for transmitting power and data across vehicle systems—has intensified. This growth trajectory has solidified the role of key manufacturers in driving innovation, scalability, and reliability in automotive electronics. The following analysis highlights the top nine auto wiring harness manufacturers shaping this evolving landscape through technological investment, global supply chain integration, and strategic partnerships with OEMs.

Top 9 Auto Wiring Harnesses Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wiring Harness Manufacturer’s Association

Domain Est. 1995

Website: whma.org

Key Highlights: The Wiring Harness Manufacturer’s Association is the ONLY trade association exclusively representing the cable and wiring harness manufacturing industry ……

#2 Wiring Harness

Domain Est. 1997

Website: motherson.com

Key Highlights: The company is one of the largest manufacturers of wiring harnesses and electrical components globally and is a complete solutions provider to all its customers ……

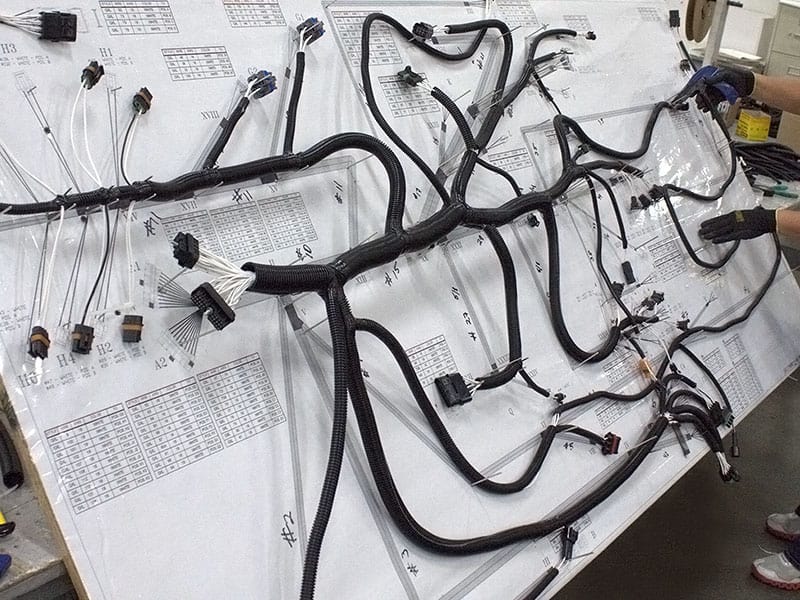

#3 Wire Harness

Domain Est. 1999

Website: yazaki-group.com

Key Highlights: Yazaki Group began producing wire harnesses in 1939, and they have now been adopted by all domestic automobile manufacturers….

#4 Wire Harness Manufacturers

Domain Est. 2000

Website: pca-llc.com

Key Highlights: PCA manufactures a wide variety of wire harnesses that range from single circuit simplicity to three hundred plus circuit complexity….

#5 Wiring Harness Manufacturer

Domain Est. 2008

Website: wiring-harness-manufacturer.com

Key Highlights: Vanguard Manufacturing specializes in designing and manufacturing innovative wiring harness solutions for various industries worldwide….

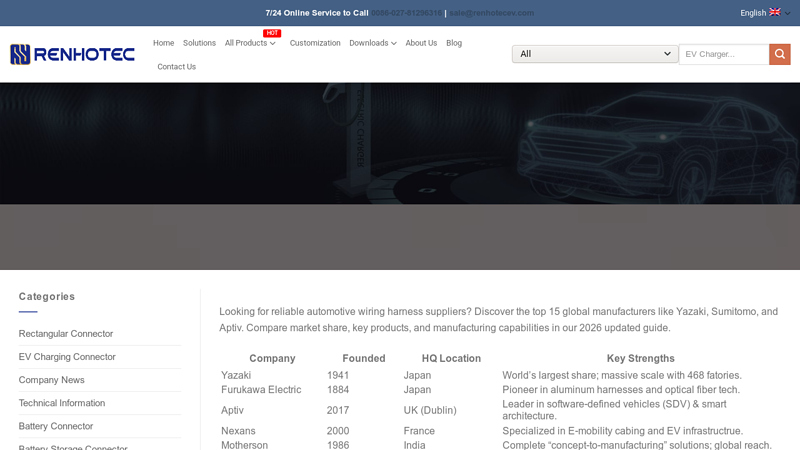

#6 The Top 15 Automotive Wiring Harness Manufacturers and …

Domain Est. 2021

Website: renhotecev.com

Key Highlights: The two largest Japanese automotive wiring harness manufacturers, Yazaki and Sumitomo Wiring Systems, have a combined market share of over 50%….

#7 Page

Domain Est. 1996

Website: sewsus.com

Key Highlights: SEWS has grown to be a global leader in the automotive wiring systems industry. We continue to build our customer base by providing the very best products….

#8 Painless Performance

Domain Est. 1999

Website: painlessperformance.com

Key Highlights: All our harnesses are made out of high-grade TXL wiring and labeled every 12-inches to make installation as Painless as possible….

#9 BP Automotive

Domain Est. 2012

Website: bp-automotive.com

Key Highlights: BP Automotive is the go to source for all of your LS Swap needs! We build standalone harnesses for GM engines from 1992 to present day!…

Expert Sourcing Insights for Auto Wiring Harnesses

H2: 2026 Market Trends for Auto Wiring Harnesses

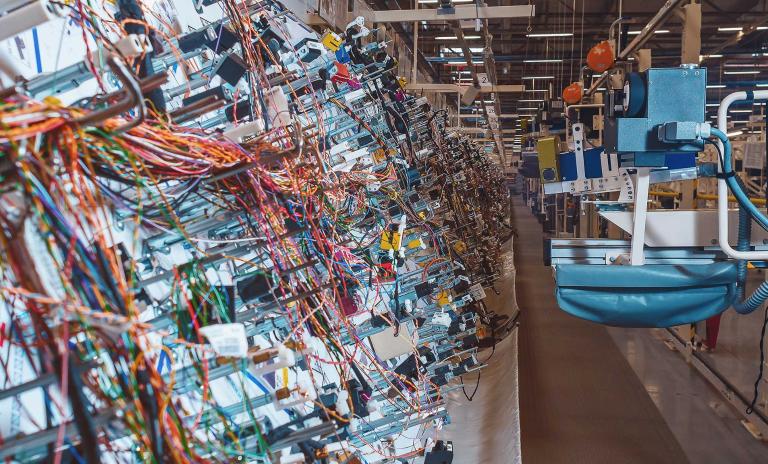

The auto wiring harness market is poised for significant transformation by 2026, driven by rapid advancements in vehicle electrification, autonomous driving technologies, and increasing demand for connected and lightweight vehicles. As a critical component in automotive electrical systems, wiring harnesses are evolving to meet the complex demands of next-generation vehicles. Below are key market trends expected to shape the auto wiring harness industry in 2026:

1. Surge in Electric Vehicle (EV) Adoption

With global automakers accelerating their transition to electric mobility, the demand for high-voltage and high-current wiring harnesses is growing exponentially. EVs require more robust and specialized harnesses to manage battery systems, power electronics, and thermal management systems. By 2026, EV-specific wiring harnesses are expected to account for over 35% of total market value, driven by supportive government policies and declining battery costs.

2. Lightweight and Miniaturized Harness Designs

Automakers are prioritizing weight reduction to enhance fuel efficiency and extend EV range. This has led to the adoption of aluminum conductors, thinner insulation materials, and compact connector systems. In 2026, the market will see increased use of lightweight alloy-based harnesses and modular designs that reduce complexity and assembly time.

3. Integration with Advanced Driver Assistance Systems (ADAS)

The proliferation of ADAS and autonomous driving technologies necessitates more sophisticated wiring systems to support sensors, cameras, radar, and LiDAR units. Wiring harnesses are being redesigned to handle high-speed data transmission with minimal electromagnetic interference. By 2026, over 60% of new vehicles are projected to include Level 2+ automation, boosting demand for high-bandwidth, fault-tolerant harnesses.

4. Rise of Domain and Zone Architectures

Traditional centralized electrical architectures are being replaced by domain and zone-based systems, which reduce the length and weight of wiring harnesses. This shift, led by OEMs like Tesla and Volkswagen, allows for better scalability and software-defined vehicle functionality. By 2026, zone architectures are expected to dominate new vehicle platforms, significantly altering harness design and manufacturing processes.

5. Automation and Digitalization in Manufacturing

To meet growing complexity and volume demands, wiring harness manufacturers are investing in automated production lines, AI-driven quality control, and digital twin technologies. These advancements improve precision, reduce waste, and accelerate time-to-market. The integration of Industry 4.0 practices will be a key competitive differentiator by 2026.

6. Regional Shifts in Production and Supply Chains

Geopolitical factors and supply chain resilience concerns are prompting automakers to regionalize harness production. While Asia-Pacific remains the largest manufacturing hub, North America and Eastern Europe are seeing increased investments in local harness plants to support EV and battery gigafactories. This trend will continue into 2026, reshaping global supply dynamics.

7. Sustainability and Circular Economy Initiatives

Environmental regulations are pushing manufacturers to adopt recyclable materials and eco-friendly production methods. By 2026, major harness producers will likely offer modular, repairable, and recyclable harness solutions to support end-of-life vehicle sustainability goals.

In conclusion, the auto wiring harness market in 2026 will be defined by innovation, electrification, and digital integration. Companies that adapt to these trends through R&D investment, strategic partnerships, and agile manufacturing will be best positioned to lead in this evolving landscape.

Common Pitfalls When Sourcing Auto Wiring Harnesses: Quality and Intellectual Property Risks

Logistics & Compliance Guide for Auto Wiring Harnesses

Overview and Importance

Auto wiring harnesses are critical components in vehicle manufacturing, serving as the nervous system that connects electrical systems across the vehicle. Efficient logistics and strict compliance are essential to ensure quality, reliability, and adherence to automotive industry standards. This guide outlines best practices and regulatory requirements for the logistics and compliance management of auto wiring harnesses.

Supply Chain Management

Establish a resilient supply chain by qualifying reliable suppliers of wires, connectors, terminals, and protective materials. Implement just-in-time (JIT) or just-in-sequence (JIS) delivery models to reduce inventory costs and ensure alignment with assembly line schedules. Maintain dual sourcing strategies for critical components to mitigate supply disruptions.

Packaging and Handling Requirements

Use ESD-safe (electrostatic discharge) packaging materials to protect sensitive electronic components. Employ structured packaging solutions such as custom trays, totes, or clamshells that prevent tangling, abrasion, and deformation. Clearly label packages with part numbers, revision levels, and handling instructions (e.g., “Fragile,” “This Side Up”).

Transportation and Storage Conditions

Maintain controlled environmental conditions during transportation and storage. Avoid exposure to extreme temperatures, humidity, and direct sunlight. Store harnesses in clean, dry areas with controlled ventilation. Stack packages according to weight limits to prevent crushing. Implement first-in, first-out (FIFO) inventory practices.

Regulatory Compliance Standards

Auto wiring harnesses must comply with international and regional regulations, including:

– ISO 9001: Quality management systems

– IATF 16949: Automotive-specific quality standards

– RoHS (EU): Restriction of hazardous substances

– REACH (EU): Chemical substance registration and restrictions

– UL/CSA: Safety certification for wire insulation and flammability

– GMW, Ford, FCA specifications: OEM-specific requirements

Traceability and Documentation

Ensure full traceability from raw materials to finished harnesses using barcode or RFID labeling. Maintain documentation such as Certificates of Compliance (CoC), material declarations, test reports (e.g., continuity, pull tests), and process validation records. Implement ERP or MES systems to track lot numbers, production dates, and shipment details.

Customs and International Trade Compliance

For cross-border shipments, prepare accurate commercial invoices, packing lists, and certificates of origin. Classify products correctly under the Harmonized System (HS Code), typically under 8544.42 (insulated wire harnesses for vehicles). Comply with import regulations, including country-specific labeling and conformity assessments (e.g., CCC for China, KC for Korea).

Quality Inspection and Testing Protocols

Conduct in-process and final inspections per AQL (Acceptable Quality Level) standards. Perform electrical tests (continuity, insulation resistance, high-pot), mechanical tests (pull force on terminals), and visual inspections. Retain samples for audit purposes and implement corrective actions for non-conformances through a documented CAR (Corrective Action Report) process.

Environmental and Sustainability Practices

Adopt eco-friendly materials and processes where possible. Recycle scrap wires and packaging materials. Comply with end-of-life vehicle (ELV) directives requiring recyclability reporting. Partner with suppliers who follow sustainable manufacturing principles.

Risk Management and Contingency Planning

Identify potential risks such as component shortages, logistics delays, or compliance failures. Develop contingency plans including safety stock, alternate transportation routes, and rapid response teams. Conduct regular audits and simulate disruption scenarios.

Conclusion

Effective logistics and compliance for auto wiring harnesses require a coordinated approach across procurement, manufacturing, transportation, and regulatory domains. By adhering to industry standards and implementing robust processes, manufacturers can ensure reliability, reduce costs, and maintain trust with automotive OEMs.

Conclusion on Sourcing Auto Wiring Harnesses

Sourcing auto wiring harnesses is a critical component in ensuring the reliability, safety, and performance of modern vehicles. As automotive systems become increasingly complex with the integration of advanced electronics, ADAS (Advanced Driver Assistance Systems), and electric powertrains, selecting the right wiring harness supplier is more important than ever.

A successful sourcing strategy should prioritize quality, compliance with international standards (such as ISO/TS 16949, UL, and ROHS), and technical expertise. Close collaboration with reliable suppliers—whether OEMs, Tier 1 vendors, or specialized harness manufacturers—ensures that design specifications are met, lead times are minimized, and long-term supply chain resilience is maintained.

Cost-efficiency should not come at the expense of quality, especially given the safety-critical nature of wiring systems. Evaluating suppliers based on their manufacturing capabilities, testing procedures, traceability, and ability to scale production is essential. Additionally, regional sourcing considerations, such as proximity for just-in-time delivery or cost advantages of offshore manufacturing, must be carefully balanced.

In conclusion, effective sourcing of auto wiring harnesses requires a strategic, quality-driven approach that aligns with the technical demands of modern automotive applications. By building strong partnerships, investing in supplier qualification, and staying ahead of industry trends—like electrification and autonomous driving—automakers and suppliers can ensure a robust, efficient, and future-ready supply chain.