The global automotive wheel parts market continues to accelerate, fueled by rising vehicle production, increasing demand for lightweight components, and advancements in materials technology. According to Grand View Research, the market was valued at USD 47.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is driven by the automotive industry’s shift toward fuel-efficient vehicles, where lightweight aluminum and alloy wheels play a critical role in reducing emissions and enhancing performance. Additionally, Mordor Intelligence projects steady expansion in aftermarket wheel demand, particularly in emerging economies across Asia-Pacific and Latin America, where vehicle ownership rates are climbing. As OEMs and aftermarket suppliers alike prioritize durability, design innovation, and sustainability, a select group of manufacturers have risen to the forefront. Below is a data-driven look at the top 10 auto wheel parts manufacturers shaping the industry’s future.

Top 10 Auto Wheel Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Superior Industries Inc

Domain Est. 1996

Website: supind.com

Key Highlights: Superior Industries International Inc is a globally recognized manufacturer of cast aluminum wheels for the worlds largest automobile companies….

#2 U.S. Wheel Corp.

Domain Est. 1998

Website: uswheel.com

Key Highlights: US Wheel Corp – Steel and Aluminum Wheel manufacturer for Hot Rod, Muscle Car, Truck, Off-Road, VW, Trailer, OEM Replacement, and Import Performance….

#3 ACDelco: OEM & Aftermarket Auto Parts

Domain Est. 1996

Website: gmparts.com

Key Highlights: ACDelco offers the only aftermarket parts backed by GM. ACDelco’s Gold and Silver lines of premium aftermarket parts offer a precise fit for GM vehicles….

#4 Maxion Wheels

Domain Est. 2011

Website: maxionwheels.com

Key Highlights: We are the world’s leading manufacturer of steel and aluminum wheels for passenger, commercial and specialty vehicles….

#5 Automotive Light & Commercial Vehicles

Domain Est. 1994

Website: timken.com

Key Highlights: We offer an extensive line of premium wheel hub units, tapered roller bearings, seals and driveline products designed to cover most light passenger vehicles on ……

#6 Forgeline

Domain Est. 1996

Website: forgeline.com

Key Highlights: Forgeline Motorsports designs, engineers, and manufactures the world’s finest custom made-to-order lightweight forged aluminum street and racing performance ……

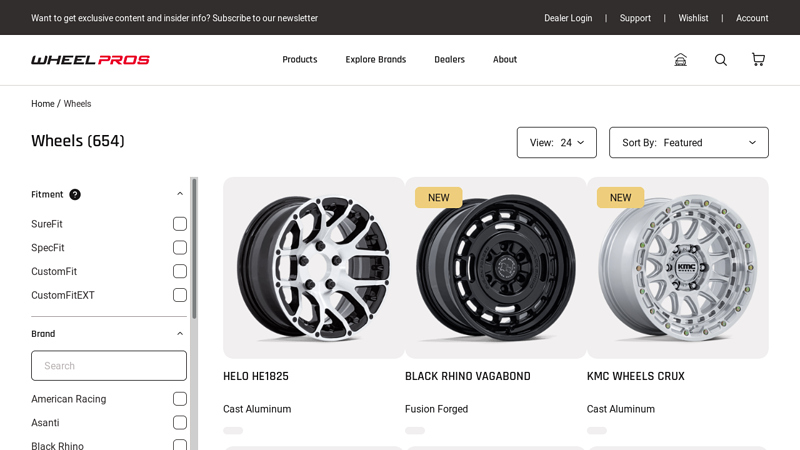

#7 Shop Wheels

Domain Est. 1998

Website: wheelpros.com

Key Highlights: 30-day returnsHeadquartered in Denver, Colorado, Wheel Pros is a leading designer, marketer, and distributor of branded aftermarket wheels….

#8 TSW Alloy Wheels

Domain Est. 1999

Website: tsw.com

Key Highlights: TSW Alloy Wheels engineers custom wheels to precisely fit your car or SUV. With 35 breathtaking designs, from 17″ to 22″, our selection is only surpassed by ……

#9 Homepage

Domain Est. 2001

Website: thewheelgroup.com

Key Highlights: Wheels. Tires. Accessories. Accessories. Company. ABOUT US · LOCATIONS · CAREERS · CONTACT US · PRIVACY POLICY. Information. SHOP TWG GEAR · 2025 CATALOG · 2025 ……

#10 Bosch Auto Parts

Domain Est. 2004

Website: boschautoparts.com

Key Highlights: Keep your vehicles moving. Experience our full portfolio of auto parts and solutions. ; Get to Know Robert Bosch. We invite you to chat with this delightful ……

Expert Sourcing Insights for Auto Wheel Parts

2026 Market Trends for Auto Wheel Parts

The global auto wheel parts market is poised for significant transformation by 2026, driven by technological innovation, evolving consumer preferences, and regulatory shifts toward sustainability and electrification. This analysis examines key trends shaping the industry, including material advancements, demand for lightweight components, growth in electric vehicles (EVs), regional market dynamics, and the impact of smart technologies on wheel system design.

Rising Demand for Lightweight and High-Performance Materials

A dominant trend in the 2026 auto wheel parts market is the accelerated shift toward lightweight materials such as aluminum alloys, magnesium, and advanced composites. Automakers are under pressure to improve fuel efficiency and extend EV range, making weight reduction a top priority. Aluminum wheels already dominate the premium and mid-range segments, but by 2026, increased use of forged aluminum and hybrid composites is expected to expand into mass-market vehicles. Innovations in metal matrix composites and nano-coatings are also enhancing durability and corrosion resistance, further supporting adoption.

Expansion Driven by Electric Vehicle Proliferation

The surge in electric vehicle production is reshaping wheel part specifications. EVs require wheels designed to handle higher torque, increased vehicle weight from batteries, and optimized aerodynamics to maximize range. As a result, manufacturers are developing wider, stronger, and more aerodynamically efficient wheel designs. By 2026, the EV segment is projected to account for over 30% of global auto wheel part demand, creating new opportunities for custom-fit solutions and integration with regenerative braking systems.

Growth in Customization and Premiumization

Consumers are increasingly viewing wheels as both functional components and aesthetic enhancements. The trend toward personalization, especially in North America and Europe, is driving demand for custom finishes, larger diameters (20 inches and above), and unique designs. OEMs and aftermarket suppliers are responding with modular wheel systems and digital configurators, allowing buyers to customize appearance and performance features. This premiumization trend supports higher price points and margins in the market.

Regional Market Divergence and Supply Chain Resilience

Regional dynamics will play a crucial role in shaping the 2026 landscape. Asia-Pacific, led by China and India, remains the largest production and consumption hub due to booming automotive output and urbanization. Europe emphasizes sustainability, with stricter emissions standards pushing adoption of lightweight wheels. North America sees strong aftermarket demand driven by SUVs and trucks. Meanwhile, geopolitical factors and supply chain disruptions are prompting manufacturers to localize production, particularly near EV manufacturing clusters, to ensure resilience and reduce logistics costs.

Integration of Smart Wheel Technologies

Emerging smart technologies are paving the way for intelligent wheel systems. By 2026, increased integration of tire pressure monitoring systems (TPMS), sensors for load and temperature detection, and connectivity with vehicle diagnostics is expected. Some manufacturers are experimenting with self-healing alloys and embedded sensors that monitor wheel integrity in real time. While still in early adoption, these innovations are anticipated to become standard in premium and commercial vehicles, creating a new segment within the wheel parts market.

Sustainability and Circular Economy Initiatives

Environmental regulations and corporate ESG goals are pushing the industry toward sustainable manufacturing. Key developments include the use of recycled aluminum, energy-efficient casting processes, and end-of-life recyclability programs. By 2026, circular economy models—such as remanufacturing and refurbishing of alloy wheels—are expected to gain traction, particularly in mature markets. Regulatory bodies may also introduce carbon footprint labeling for automotive components, influencing procurement decisions.

Conclusion

The 2026 auto wheel parts market will be defined by innovation, electrification, and sustainability. As vehicles evolve, so too do the requirements for wheel systems—demanding lighter, smarter, and more durable components. Companies that invest in advanced materials, digital customization, and sustainable practices will be best positioned to lead in this dynamic and expanding market.

Common Pitfalls Sourcing Auto Wheel Parts: Quality and Intellectual Property Risks

Sourcing auto wheel parts—such as rims, hubs, center caps, lug nuts, and TPMS sensors—can be fraught with challenges, particularly concerning quality inconsistencies and intellectual property (IP) violations. Failing to address these pitfalls can result in safety hazards, regulatory non-compliance, brand damage, and costly legal disputes.

Quality Inconsistencies and Substandard Materials

One of the most prevalent risks when sourcing auto wheel parts is receiving components that do not meet required safety, performance, or durability standards. Many suppliers, particularly in low-cost regions, may use inferior materials (e.g., sub-grade aluminum alloys or low-tensile steel) or skip critical manufacturing processes like proper heat treatment and dynamic load testing. This can lead to wheel cracking, hub failure, or TPMS malfunction under real-world driving conditions. Additionally, inconsistent machining tolerances or poor finishing can impact fitment and vehicle dynamics. Without rigorous quality audits, third-party testing, and clear specifications, buyers risk integrating defective parts into vehicles, potentially leading to recalls or safety incidents.

Intellectual Property Infringement

Auto wheel parts often incorporate patented designs, trademarks, or trade dress protected by original equipment manufacturers (OEMs). Sourcing imitation or counterfeit parts—such as replica rims that mimic branded designs or hub caps with unauthorized logos—can expose buyers to significant IP liability. Even if a supplier claims the parts are “compatible” or “aftermarket,” replicating distinctive design elements (e.g., specific spoke patterns or branded center caps) may still constitute infringement. Legal consequences can include cease-and-desist orders, seizure of goods at customs, financial penalties, and reputational harm. To mitigate this risk, buyers must conduct thorough due diligence on supplier IP compliance, request design freedom-to-operate documentation, and avoid sourcing parts that closely mimic protected OEM designs.

Logistics & Compliance Guide for Auto Wheel Parts

Overview

This guide outlines the essential logistics and compliance considerations for the transportation, storage, and distribution of auto wheel parts—including rims, hubs, bolts, center caps, and related components. Adhering to these standards ensures product integrity, regulatory compliance, and customer satisfaction across domestic and international markets.

Regulatory Compliance

International Trade Regulations

Auto wheel parts shipped across borders must comply with country-specific import/export requirements. Key regulations include:

– Harmonized System (HS) Codes: Accurately classify parts (e.g., 8708.70 for wheel rims) to determine tariffs and duties.

– Customs Documentation: Prepare commercial invoices, packing lists, and certificates of origin. Include detailed descriptions, weights, and values.

– Import Restrictions: Verify country-specific bans or quotas (e.g., certain aluminum alloy compositions may be regulated).

– Trade Agreements: Leverage preferential tariffs under agreements such as USMCA, EU-UK Trade Agreement, or RCEP where applicable.

Safety & Environmental Standards

- DOT Compliance (U.S.): Wheels must meet U.S. Department of Transportation safety standards (FMVSS No. 120 for rims).

- E-Mark Certification (EU): Mandatory for sale in the European Economic Area; demonstrates compliance with UN Regulation No. 124.

- REACH & RoHS: Ensure materials used (e.g., coatings, alloys) are free from restricted substances like lead, cadmium, or phthalates.

- TSCA (U.S.): Comply with Toxic Substances Control Act for chemical components in manufacturing.

Labeling and Traceability

- Part Markings: Wheels must include permanent markings (e.g., manufacturer ID, size, load rating, compliance symbols like DOT or E).

- Packaging Labels: Include handling instructions (e.g., “Fragile,” “This Side Up”), country of origin, and batch/lot numbers for traceability.

- Barcodes/QR Codes: Implement for inventory tracking and warranty verification.

Packaging and Handling

Protective Packaging

- Use corrugated cardboard, foam inserts, or palletized stretch-wrapping to prevent scratches, dents, or corrosion.

- Isolate alloy wheels from steel components to avoid galvanic corrosion.

- Apply anti-corrosion inhibitors (e.g., VCI paper) for long-term storage or sea freight.

Unit Load Design

- Stack wheels uniformly on skids or pallets, secured with strapping or shrink wrap.

- Maximize load stability while adhering to weight limits (typically ≤ 4,000 lbs per standard pallet).

- Use edge protectors and corner boards for overhang protection.

Handling Instructions

- Label packages with “Do Not Stack,” “Protect from Moisture,” and “Handle with Care” as appropriate.

- Train warehouse and transport personnel on proper lifting techniques to avoid injury and product damage.

Transportation Logistics

Mode Selection

- Road Freight: Ideal for regional distribution; ensure trailers are enclosed and weather-protected.

- Ocean Freight: Use dry containers; control humidity with desiccants for transoceanic shipments.

- Air Freight: Reserved for urgent or high-value orders; verify dimensional weight pricing.

Temperature and Humidity Control

- Store and transport in dry, temperature-stable environments to prevent condensation and corrosion.

- Monitor humidity levels; maintain below 60% relative humidity in storage facilities.

Carrier Compliance

- Partner with carriers experienced in automotive parts logistics.

- Require proof of insurance, cargo securement training, and adherence to safety regulations (e.g., CSA, ADR).

Warehousing and Inventory Management

Storage Conditions

- Store indoors on racks or pallets off the ground.

- Segregate finished goods by type, size, finish, and compliance certification.

- Implement FIFO (First-In, First-Out) inventory rotation.

Security and Stock Accuracy

- Use RFID or barcode scanning for real-time inventory tracking.

- Conduct regular cycle counts and audits to maintain >98% inventory accuracy.

- Secure facilities with access controls and surveillance to prevent theft.

Returns and Reverse Logistics

Return Authorization Process

- Require a Return Merchandise Authorization (RMA) number for all returns.

- Inspect returned wheels for damage, compatibility, and compliance with return policies.

Refurbishment and Disposal

- Assess reusable parts for remanufacturing or resale.

- Recycle non-repairable wheels through certified metal recyclers.

- Document waste disposal to meet environmental regulations.

Documentation and Recordkeeping

Required Records

- Maintain copies of shipping manifests, customs filings, compliance certifications, and inspection reports for a minimum of 5 years.

- Store digital records with secure backup and access controls.

Audit Preparedness

- Conduct annual internal audits to verify compliance with ISO 9001, IATF 16949, or other applicable standards.

- Prepare for customs audits with organized, retrievable documentation.

Conclusion

Effective logistics and compliance management for auto wheel parts reduces risk, ensures regulatory adherence, and enhances supply chain efficiency. Regular review of international regulations, investment in proper packaging, and adherence to industry standards are critical for sustained success in the global automotive aftermarket.

Conclusion for Sourcing Auto Wheel Parts

In conclusion, sourcing auto wheel parts requires a strategic approach that balances quality, cost, reliability, and compliance with industry standards. As the automotive industry continues to evolve with advancements in materials, manufacturing technologies, and supply chain dynamics, selecting the right suppliers becomes critical to ensuring vehicle performance, safety, and customer satisfaction.

Key considerations such as supplier credibility, material specifications, certification standards (e.g., ISO, DOT, TÜV), and logistical efficiency play a vital role in making informed sourcing decisions. Partnering with reputable manufacturers—whether local or global—can enhance supply chain resilience and reduce downtime. Additionally, leveraging technologies like e-procurement platforms and supply chain analytics enables better visibility and faster decision-making.

Ultimately, a well-structured sourcing strategy for auto wheel parts not only supports operational efficiency but also contributes to long-term competitiveness in the automotive market. Continuous evaluation of suppliers, market trends, and emerging technologies will ensure sustained quality and innovation in wheel part procurement.