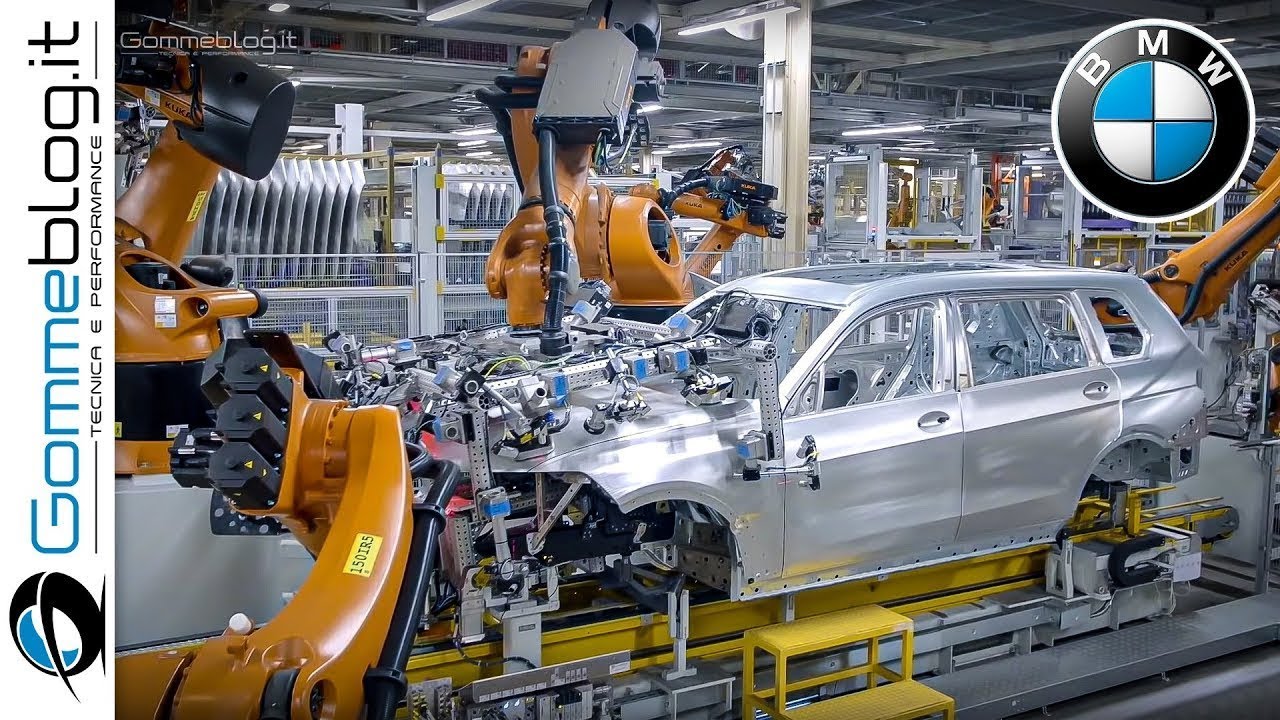

The global automotive machinery manufacturing industry is experiencing robust expansion, driven by rising demand for automation, electric vehicles (EVs), and advanced manufacturing technologies. According to a 2023 report by Mordor Intelligence, the automotive robotics and automation market was valued at USD 8.2 billion in 2022 and is projected to grow at a CAGR of 7.5% through 2028. Similarly, Grand View Research estimates that the global automotive manufacturing equipment market size reached USD 38.6 billion in 2022 and is expected to expand at a CAGR of 6.8% from 2023 to 2030. This growth is fueled by Industry 4.0 adoption, increased precision requirements, and the need for cost-efficient production processes across OEMs and tier suppliers. As automakers scale up EV production and retool factories for smart manufacturing, the role of high-performance auto machine manufacturers has become more critical than ever. In this evolving landscape, the top 10 auto machine manufacturers are leading innovation with integrated solutions in machining, assembly, welding, and quality control—setting new benchmarks in efficiency, reliability, and digital integration.

Top 10 Auto Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Makino

Domain Est. 1996

Website: makino.com

Key Highlights: A Makino is more than a CNC machine. It’s relentless consistency, historic accuracy, industry leading expertise and game-changing digital technology….

#2 Cummins

Domain Est. 1990

Website: cummins.com

Key Highlights: Cummins specializes in diesel and alternative fuel engines and generators, and related components and technology. Learn more at cummins.com….

#3 Haas Automation Inc.

Domain Est. 1996

Website: haascnc.com

Key Highlights: Haas Automation is the largest machine tool builder in the western world, manufacturing a complete line of CNC vertical machining centers, ……

#4 Omron Automation

Domain Est. 1997

Website: automation.omron.com

Key Highlights: Your trusted partner in industrial automation and safety. Omron Automation works with customers to develop solutions for their manufacturing challenges….

#5

Domain Est. 1995

Website: hunter.com

Key Highlights: Hunter Engineering is a global leader in wheel alignment machines, wheel balancers, tire changers, brake service equipment, alignment lifts and inspection ……

#6 to Mazak Corporation

Domain Est. 1998

Website: mazak.com

Key Highlights: Mazak provides products and solutions that can support a wide range of parts machining processes, such as high-speed and high-accuracy machines, various ……

#7 Metal Fabrication Machinery

Domain Est. 1998

Website: mcmachinery.com

Key Highlights: MC Machinery Systems, a supplier of metal fabrication machines, provides EDM, milling, laser, press brake, finishing, and automation solutions….

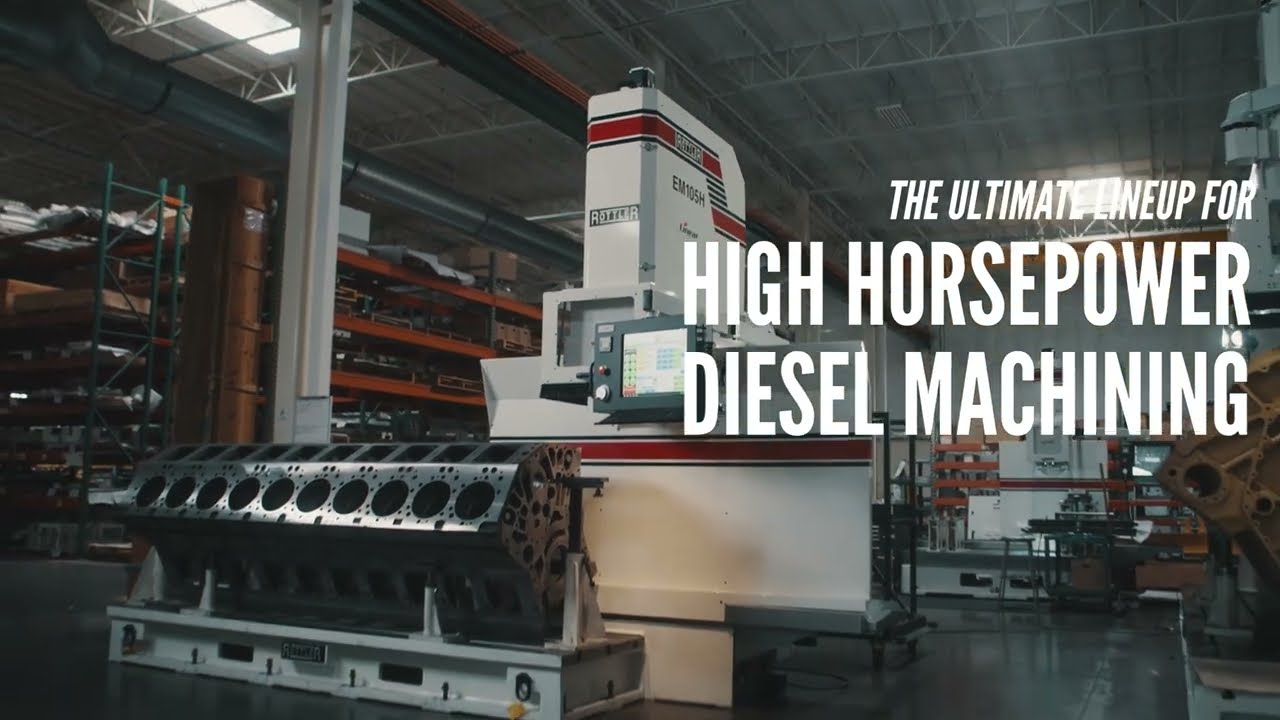

#8 Rottler Manufacturing

Domain Est. 1998

Website: rottlermfg.com

Key Highlights: A complete range of 5 Axis CNC Head Porting Machines, Automatic Tool Changer, Multi Purpose CNC, Seat & Guide Machines, Honing Machines, Connecting Rod ……

#9 to Lincoln Electric Automation

Domain Est. 1999

Website: coldwatermachine.com

Key Highlights: Lincoln Electric Automation specializes in transforming industries through cutting-edge robotic integration and automation solutions….

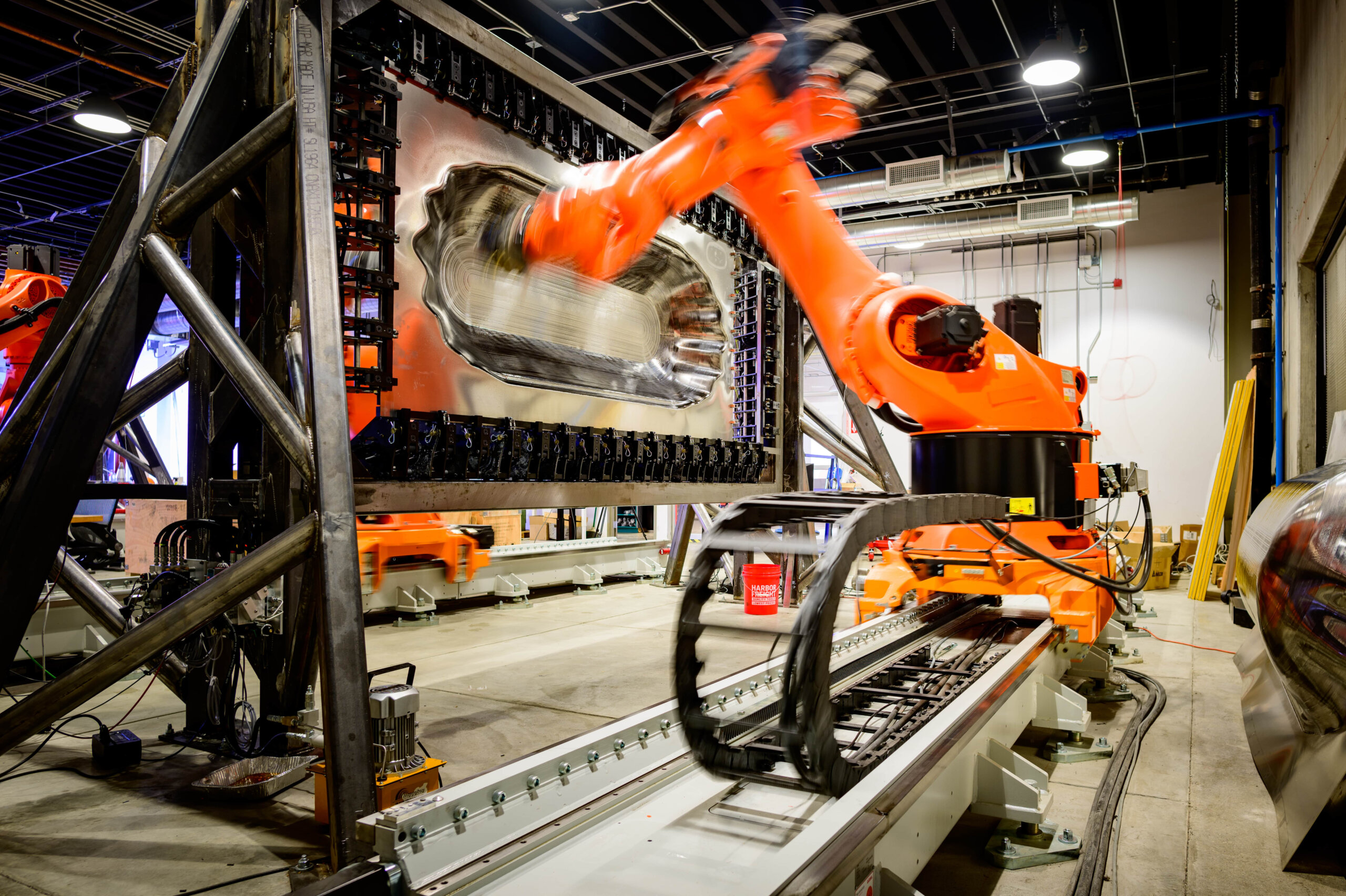

#10 Machina Labs

Domain Est. 2019

Website: machinalabs.ai

Key Highlights: Machina Labs is an advanced manufacturing company using next-gen AI and robotics technologies to build software-defined factories of the future….

Expert Sourcing Insights for Auto Machine

H2 2026 Market Trends for the Automotive Industry

As the automotive sector progresses through 2026, the second half of the year is expected to reflect intensified shifts driven by technological innovation, regulatory pressures, and evolving consumer behaviors. Building on developments from the first half, H2 2026 will likely be defined by the following key trends:

1. Accelerated Electrification and EV Maturity

The transition to electric vehicles (EVs) will enter a new phase in H2 2026, characterized less by early adoption and more by mainstream integration. Automakers are expected to roll out next-generation EV platforms with improved battery chemistry—such as silicon-anode and solid-state batteries—leading to longer ranges (often exceeding 400 miles) and faster charging times. Price parity with internal combustion engine (ICE) vehicles is anticipated to be achieved in several major markets, supported by declining battery costs and government incentives. Legacy OEMs and new entrants alike will focus on scalable, cost-efficient EV production to meet tightening emissions regulations in the EU, North America, and China.

2. Software-Defined Vehicles (SDVs) and OTA Dominance

By H2 2026, vehicles will increasingly be viewed as upgradable software platforms. Over-the-air (OTA) updates will become standard across most new models, enabling continuous improvements in performance, safety, and infotainment. Automakers will monetize software features through subscription models—covering advanced driver assistance systems (ADAS), enhanced navigation, and personalized user experiences. Cybersecurity will emerge as a critical concern, with increased investment in secure architectures and compliance with evolving global standards (e.g., UN R155, R156).

3. Consolidation in the Autonomous Driving Sector

While fully autonomous Level 4 vehicles remain limited to specific geofenced applications, H2 2026 will see consolidation among AV startups due to high R&D costs and slower-than-expected commercialization. Partnerships between OEMs, tech companies, and mobility providers will intensify, focusing on robotaxi pilot expansions in urban hubs and autonomous logistics. Regulatory clarity in select regions (notably the U.S. and parts of Europe) may pave the way for limited deployment, but widespread consumer adoption is still on the horizon.

4. Supply Chain Resilience and Regionalization

Geopolitical tensions and trade policies will continue to push automakers toward regionalized supply chains. In H2 2026, North American and European manufacturers will prioritize local sourcing of critical components—especially batteries and semiconductors—under initiatives like the U.S. Inflation Reduction Act (IRA) and the EU’s Critical Raw Materials Act. Nearshoring and vertical integration (e.g., automakers investing in battery gigafactories) will be key strategies to mitigate disruptions and qualify for subsidies.

5. Sustainability and Circular Economy Focus

Environmental, Social, and Governance (ESG) imperatives will gain greater traction. Automakers will emphasize lifecycle carbon footprint reduction, with expanded use of recycled materials, low-CO₂ steel, and closed-loop battery recycling. Transparency in supply chains—particularly for lithium, cobalt, and nickel—will become a competitive differentiator. Consumer demand for sustainable mobility options will also drive growth in certified pre-owned EVs and battery leasing models.

6. Rise of AI-Driven Manufacturing and Design

Artificial intelligence will play a transformative role in automotive production by H2 2026. Generative AI will be used to optimize vehicle design, simulate performance, and reduce development timelines. In manufacturing, predictive maintenance, robotic automation, and AI-powered quality control will enhance efficiency and reduce downtime. Digital twins of production lines will allow real-time monitoring and adaptive planning, improving responsiveness to market demand shifts.

7. Evolving Consumer Preferences and Mobility-as-a-Service (MaaS)

Younger demographics will continue to favor access over ownership, boosting interest in subscription-based vehicle services and integrated mobility platforms. Automakers will expand their MaaS offerings or partner with ride-hailing and car-sharing platforms. Personalization—via AI-driven interfaces and adaptive interiors—will differentiate brands in a competitive market.

Conclusion:

H2 2026 will mark a pivotal phase for the automotive industry, where electrification, digitalization, and sustainability converge to reshape the competitive landscape. Companies that successfully integrate software, secure resilient supply chains, and align with consumer and regulatory expectations will lead the next era of mobility. The “auto machine” is no longer just a vehicle—it’s a connected, intelligent, and sustainable ecosystem.

Common Pitfalls When Sourcing Auto Machines: Quality and Intellectual Property Risks

Sourcing automated machinery from international suppliers—particularly from low-cost manufacturing regions—can deliver significant cost savings and production advantages. However, companies often encounter critical challenges related to quality control and intellectual property (IP) protection. Failing to address these pitfalls can lead to production delays, safety hazards, legal disputes, and reputational damage.

Quality-Related Pitfalls

Inconsistent Build Quality and Material Standards

Suppliers may use substandard materials or deviate from engineering specifications to reduce costs. This inconsistency can lead to machine breakdowns, increased maintenance, and safety risks. Without robust on-site inspections or third-party quality audits, buyers may only discover defects after the machines are deployed.

Lack of Rigorous Testing and Validation

Some suppliers perform minimal functional testing before shipment. Machines might not undergo endurance, stress, or integration testing under real-world conditions. This increases the risk of performance failures once installed at the buyer’s facility.

Insufficient Documentation and Technical Support

Poorly documented machines—with incomplete manuals, unclear schematics, or missing software interfaces—make maintenance and troubleshooting difficult. Limited technical support from the supplier can delay production line repairs and escalate operational costs.

Hidden Defects and Short-Term Performance Bias

Machines may appear functional during initial demonstrations but exhibit wear or failure under prolonged use. Suppliers might optimize performance for short-term demo conditions, masking long-term reliability issues.

Intellectual Property-Related Pitfalls

Unprotected Design and Technology Disclosure

Sharing detailed specifications, CAD files, or proprietary control logic with suppliers exposes IP to theft or unauthorized replication. Without strong contractual safeguards, suppliers may reverse-engineer designs or sell similar machines to competitors.

Weak or Unenforceable IP Clauses in Contracts

Many sourcing agreements lack clear IP ownership terms. Ambiguity about who owns custom tooling, software, or design modifications can lead to disputes. In jurisdictions with lax IP enforcement, even well-drafted contracts may be difficult to uphold.

Risk of Counterfeiting and Parallel Manufacturing

Unscrupulous suppliers may produce duplicate machines for other buyers or create knock-off versions for sale in other markets. This not only undermines competitive advantage but can also flood the market with inferior copies bearing your brand.

Software and Firmware Vulnerabilities

Proprietary control software embedded in auto machines may be copied, modified, or contain backdoors if not properly protected. Lack of encryption, licensing controls, or audit trails increases exposure to IP theft and cybersecurity threats.

Mitigation Strategies

To avoid these pitfalls, companies should:

– Conduct thorough due diligence on suppliers, including site audits and reference checks.

– Implement phased payment terms tied to quality milestones and third-party inspections.

– Use Non-Disclosure Agreements (NDAs) and clearly define IP ownership in contracts.

– Limit the release of sensitive design data and consider modular or obfuscated designs.

– Register IP in relevant jurisdictions and work with legal counsel experienced in international manufacturing law.

– Include audit rights and penalties for IP violations in supplier agreements.

Proactively addressing quality and IP risks ensures that sourcing auto machines delivers long-term value without compromising innovation or operational integrity.

Logistics & Compliance Guide for Auto Machine

This guide outlines the essential logistics and compliance considerations for the transportation, handling, and regulatory adherence related to Auto Machine equipment. Proper planning ensures timely delivery, cost efficiency, and full compliance with local and international regulations.

Shipping and Transportation

Ensure all Auto Machine units are securely packaged using industry-standard crating to prevent damage during transit. Coordinate with certified freight carriers experienced in handling heavy machinery. Utilize lift-gate services and forklift availability at pickup and delivery points. Confirm transport modes (road, rail, sea, or air) based on destination, timeline, and machine specifications. Provide accurate weight, dimensions, and handling instructions to carriers in advance.

Import and Export Compliance

Verify that all Auto Machine exports comply with the International Traffic in Arms Regulations (ITAR), Export Administration Regulations (EAR), or other applicable trade controls based on technical specifications. Obtain required export licenses or apply for license exceptions where eligible. Prepare accurate commercial invoices, packing lists, and certificates of origin. Classify machinery using correct Harmonized System (HS) codes to ensure proper customs clearance and tariff application.

Customs Documentation

Submit complete and accurate customs documentation for all international shipments. Required documents typically include a commercial invoice, bill of lading or air waybill, packing list, and any applicable permits or certifications. Ensure all descriptions, values, and quantities match physical shipments to avoid delays or penalties. Designate a licensed customs broker at the destination if necessary to facilitate smooth entry.

Product Certification and Standards

Confirm that Auto Machine units meet relevant safety, electrical, and environmental standards for the destination market. Common certifications include CE (Europe), UL/CSA (North America), CCC (China), and PSE (Japan). Maintain up-to-date technical files and test reports. Label machines appropriately with certification marks, technical specifications, and compliance statements as required.

Hazardous Materials and Environmental Compliance

If Auto Machine contains batteries, coolants, or other regulated substances, classify and label them according to IATA, IMDG, or ADR regulations as applicable. Provide Safety Data Sheets (SDS) and ensure packaging meets hazardous materials transport standards. Follow local environmental regulations for disposal or recycling at end-of-life, including WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions.

Recordkeeping and Audits

Maintain detailed records of all logistics transactions, compliance certifications, export licenses, and shipment documentation for a minimum of five years. Conduct regular internal audits to verify adherence to logistics procedures and regulatory requirements. Prepare for potential customs or regulatory audits by ensuring all files are organized and up-to-date.

Training and Responsibility

Assign a qualified compliance officer or logistics manager to oversee all Auto Machine shipments. Provide regular training for relevant staff on export controls, customs procedures, and safety protocols. Ensure all personnel involved in handling or shipping are aware of compliance responsibilities and emergency procedures.

By following this guide, your organization can ensure reliable logistics operations and maintain full regulatory compliance when shipping and managing Auto Machine equipment globally.

Conclusion for Sourcing an Automatic Machine:

In conclusion, sourcing an automatic machine requires a strategic approach that balances cost, quality, capacity, and long-term operational needs. A thorough evaluation of suppliers—considering factors such as reputation, technical support, lead times, and compliance with industry standards—is essential to ensure reliability and performance. Additionally, assessing the total cost of ownership, including maintenance, energy consumption, and integration with existing systems, will contribute to a more informed and sustainable investment decision. By aligning machine specifications with production goals and conducting due diligence during the procurement process, businesses can enhance efficiency, reduce downtime, and achieve a strong return on investment. Ultimately, the successful sourcing of an automatic machine not only streamlines manufacturing processes but also strengthens competitiveness in a rapidly evolving market.