The global automotive camshaft market is experiencing steady growth, driven by increasing vehicle production, rising demand for fuel-efficient engines, and stringent emission regulations. According to Mordor Intelligence, the camshaft market was valued at approximately USD 5.8 billion in 2023 and is projected to grow at a CAGR of over 4.5% from 2024 to 2029. This expansion is fueled by advancements in variable valve timing (VVT) technologies and the ongoing shift toward lightweight, high-performance materials in modern internal combustion engines. As automakers strive to enhance engine efficiency and reduce environmental impact, the demand for precision-engineered camshafts continues to rise. In this evolving landscape, a select group of manufacturers have emerged as leaders, combining innovation, quality, and global reach to meet the dynamic needs of OEMs and aftermarket suppliers alike. Below, we highlight the top 9 auto camshaft manufacturers shaping the future of engine performance and efficiency.

Top 9 Auto Camshaft Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 COMP Cams Camshaft Series

Domain Est. 1996

Website: compcams.com

Key Highlights: Factory Muscle™. Benefits. Reproduction of factory original muscle car camshaft; Produce more torque and horsepower than original factory camshaft; Maintain ……

#2 Andrews Products

Domain Est. 2000

Website: andrewsproducts.com

Key Highlights: We utilize state-of-the-art engineering design and manufacturing technology to produce superior quality camshafts, transmission and gears for both street and ……

#3 Web Cam Inc.

Domain Est. 2002

Website: webcamshafts.com

Key Highlights: Web Cam Inc. provides you with performance and racing camshafts for most applications. If your application is not listed please call us!…

#4 Estas USA Camshaft Industry

Domain Est. 2005

Website: estasusa.com

Key Highlights: Estas Camshaft Industry is one of the largest independent camshaft manufacturers in the world, supplying the global automotive industry for over 40 years….

#5 Crower Cams

Domain Est. 1995

Website: crower.com

Key Highlights: Free delivery over $150 365-day returnsCrower builds performance racing parts from camshafts to crankshafts. Crower has worked hard to serve the performance parts needs of the raci…

#6 ISKY Racing Cams

Domain Est. 1996

Website: iskycams.com

Key Highlights: Engineered for serious speed enthusiasts and bracket racers, ISKY Complete Camshaft Kits deliver everything you need in one precision-matched package….

#7 Howards Cams

Domain Est. 2001

Website: howardscams.com

Key Highlights: Howards Cams & Racing Components 280 W 35th Ave Oshkosh, WI 54902 Mon – Fri 8:00 AM – 5:00 PM CST Tel: 920.233.5228 Fax: 920.233.0938…

#8 Precision Camshafts Limited

Domain Est. 2005

#9 Kelford Cams

Domain Est. 2007

Website: kelfordcams.com

Key Highlights: Our product range includes camshafts, valve springs, and various valve train components for top automotive brands. Kelford leads the performance aftermarket ……

Expert Sourcing Insights for Auto Camshaft

H2: 2026 Market Trends for Auto Camshaft

The global automotive camshaft market is poised for significant transformation in 2026, driven by evolving propulsion technologies, stringent emissions regulations, and advancements in materials and manufacturing. While internal combustion engines (ICEs) remain prevalent, the landscape is shifting rapidly, creating both challenges and opportunities for camshaft manufacturers. Key trends shaping the market include:

1. Demand Shift Towards High-Efficiency ICE & Hybrid Systems:

Despite the rise of electrification, ICE vehicles—particularly high-efficiency gasoline and diesel engines—will continue to dominate global fleets through 2026. This sustains demand for advanced camshaft technologies like Variable Valve Timing (VVT) and Variable Valve Lift (VVL), which optimize fuel economy and reduce emissions. Hybrid Electric Vehicles (HEVs) and Plug-in Hybrids (PHEVs) also rely on downsized, high-efficiency ICEs, further boosting demand for precision camshafts capable of supporting complex valve control strategies.

2. Electrification Pressure and Market Contraction for Conventional Camshafts:

The accelerating adoption of Battery Electric Vehicles (BEVs), supported by government mandates and consumer demand, will suppress long-term camshaft volume growth. BEVs do not require camshafts, leading to a gradual decline in demand per vehicle produced. This trend is most pronounced in regions with aggressive EV targets (e.g., EU, China). Camshaft manufacturers must adapt by diversifying into hybrid applications or non-automotive sectors.

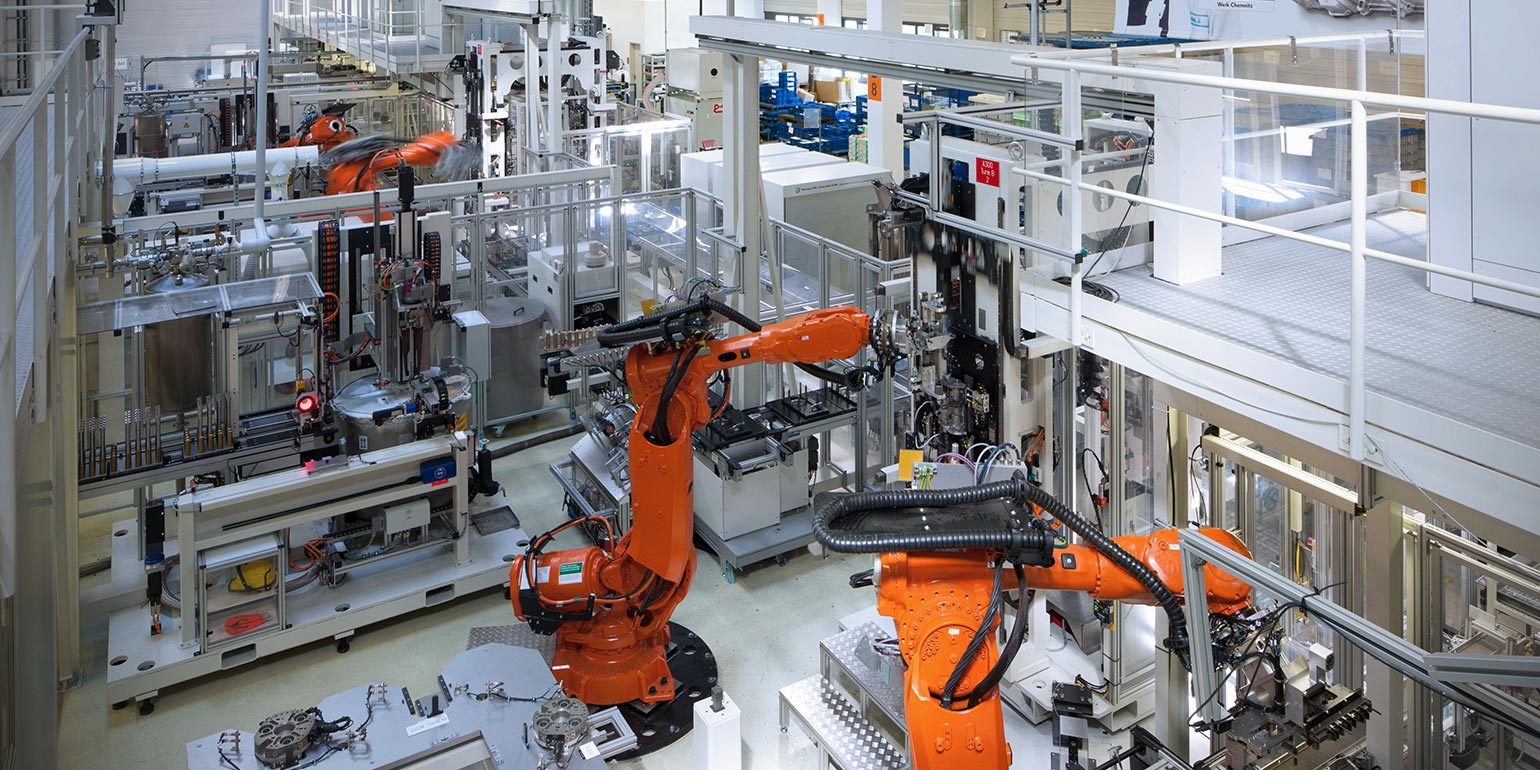

3. Material and Manufacturing Innovation:

To meet performance and durability requirements under higher engine loads and temperatures, camshafts are increasingly being made from ductile iron, alloy steel, and advanced cast irons. Processes like induction hardening and laser surface treatments enhance wear resistance. Additionally, modular and lightweight designs (e.g., hollow camshafts) are gaining traction to reduce engine weight and inertia, improving efficiency.

4. Regional Market Divergence:

Growth will vary significantly by region:

– Asia-Pacific (especially China and India): Remains the largest market due to high ICE vehicle production and rising demand for fuel-efficient engines.

– Europe: Transition to EVs will limit camshaft growth, but demand persists in high-performance and hybrid segments.

– North America: Steady demand supported by light-duty trucks and SUVs with powerful ICEs, though EV adoption is increasing.

– Emerging Markets: Continued reliance on ICE vehicles ensures sustained camshaft demand.

5. Consolidation and Strategic Partnerships:

Facing shrinking ICE markets, camshaft suppliers are likely to consolidate or form strategic alliances with engine and automotive OEMs. Investment in R&D for hybrid-compatible components and potential diversification into electric drivetrain parts (e.g., transmission shafts) will be critical for long-term viability.

Conclusion:

In 2026, the auto camshaft market will operate in a transitional phase—anchored by high-performance and hybrid ICE applications while navigating the structural decline of pure ICE vehicles. Success will depend on innovation in efficiency, materials, and adaptability to hybridization, alongside strategic positioning in high-growth regions and diversification efforts to mitigate electrification risks.

Common Pitfalls Sourcing Auto Camshafts (Quality, IP)

Sourcing auto camshafts, especially from offshore or lower-cost suppliers, involves significant risks related to both quality and intellectual property (IP). Failing to address these pitfalls can lead to costly recalls, reputational damage, legal disputes, and supply chain disruptions.

Quality-Related Pitfalls

Inconsistent Material Composition and Hardness

Camshafts are subjected to high stress and wear; therefore, precise material specifications (e.g., alloy composition, surface hardness via induction hardening) are critical. Suppliers may use substandard materials or skip heat treatment steps to cut costs, leading to premature failure, increased engine wear, or catastrophic breakdowns.

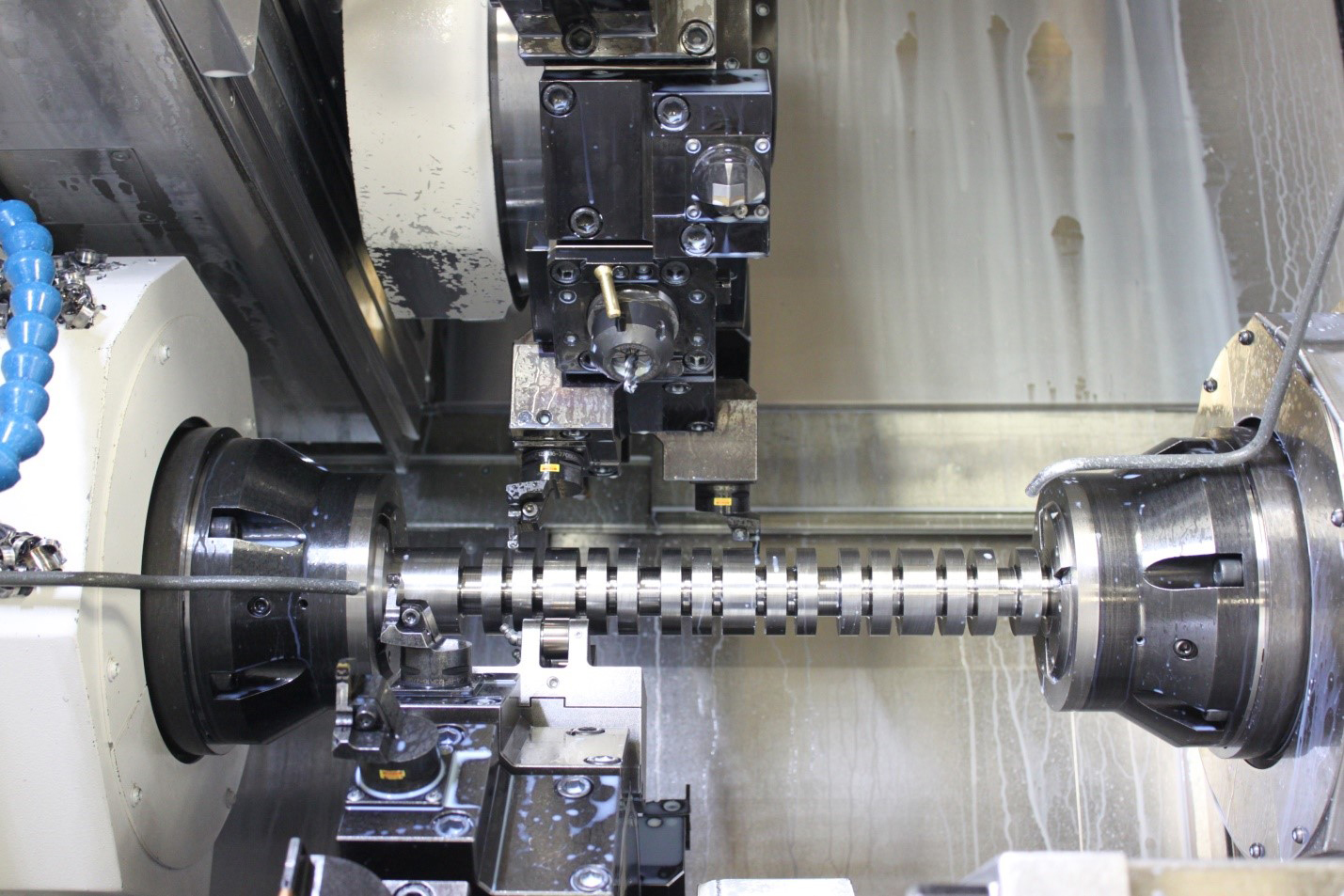

Poor Dimensional Accuracy and Surface Finish

Even minor deviations in lobe profile, journal roundness, or surface finish can cause improper valve timing, excessive noise (tappet rattle), and reduced engine efficiency. Inadequate machining capabilities or lack of proper inspection equipment at the supplier level often result in non-conforming parts.

Inadequate Quality Control and Testing

Many suppliers rely on basic visual inspections rather than comprehensive testing protocols such as CMM (Coordinate Measuring Machine) checks, dynamic balancing, or endurance testing. Without robust quality assurance systems like IATF 16949 certification, there’s a higher risk of undetected defects reaching production lines.

Lack of Traceability and Documentation

Reputable camshaft sourcing requires full traceability—batch numbers, material certs, heat treatment records, and inspection reports. Suppliers that fail to maintain or provide this documentation make root cause analysis nearly impossible during failure investigations.

Intellectual Property (IP) Risks

Unauthorized Reverse Engineering

Suppliers may reverse-engineer OEM camshaft designs without licensing, infringing on patented lobe profiles, phasing mechanisms, or variable valve timing (VVT) technologies. Using such parts exposes the buyer to legal liability, especially in regulated markets like the EU or North America.

Design Theft and Unauthorized Production

Sharing engineering drawings or CAD files with unvetted suppliers increases the risk of design cloning. Suppliers might produce and sell identical camshafts to competitors or in gray markets, undercutting your pricing and damaging brand integrity.

Weak Contractual IP Protections

Many procurement agreements lack clear IP clauses specifying ownership, confidentiality, and usage rights. Without strong legal safeguards, enforcing IP rights becomes difficult, especially in jurisdictions with lax IP enforcement.

Supply Chain Leakage

A supplier might divert production intended for a single buyer into secondary markets. This not only dilutes exclusivity but may also introduce counterfeit or substandard parts under your brand name.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct rigorous supplier audits, including on-site quality system reviews.

– Require material certifications and third-party test reports.

– Implement secure design-sharing protocols (e.g., watermarked files, NDAs).

– Include ironclad IP clauses in contracts, specifying ownership and penalties for infringement.

– Use tier-1 suppliers with OEM experience or certifications.

Proactively addressing quality and IP concerns ensures reliable performance, regulatory compliance, and long-term brand protection in the competitive automotive supply chain.

Logistics & Compliance Guide for Auto Camshaft

Product Overview and Classification

Auto camshafts are critical engine components used to control the opening and closing of valves in internal combustion engines. They are typically manufactured from forged or cast steel and require precision machining. For logistics and compliance purposes, camshafts are classified under specific HS (Harmonized System) codes. The most common classification is HS Code 8483.10, which covers transmission shafts (including camshafts and crankshafts), whether or not polished or having accessories attached. Accurate classification is essential for customs clearance, duty assessment, and regulatory compliance.

Packaging and Handling Requirements

Camshafts must be properly packaged to prevent damage during transit. Recommended packaging includes:

– Corrosion-inhibiting wrapping or VCI (Vapor Corrosion Inhibitor) paper

– Secure placement in sturdy corrugated cardboard or wooden crates with foam or molded inserts

– Waterproof outer wrapping to protect against moisture

– Clearly labeled with handling instructions such as “Fragile,” “Do Not Stack,” and “This Side Up”

Ensure that packaging complies with international shipping standards (e.g., ISTA, ISO) and is suitable for multimodal transport (air, sea, road).

Transportation and Shipping Logistics

- Mode of Transport: Camshafts are typically shipped via ocean freight for cost efficiency, but air freight may be used for urgent or low-volume orders.

- Documentation: Required shipping documents include commercial invoice, packing list, bill of lading (or air waybill), and certificate of origin.

- Incoterms: Clearly define responsibilities using standard Incoterms (e.g., FOB, CIF, DDP) to allocate risks and costs between buyer and seller.

- Lead Times: Plan for manufacturing, inland transport, port handling, and customs delays. Consider using bonded logistics warehouses for JIT (Just-In-Time) delivery to OEMs.

Customs and Import Compliance

- HS Code Declaration: Verify the correct HS code (e.g., 8483.10) with local customs authorities to determine duty rates and eligibility for trade agreements (e.g., USMCA, RCEP).

- Country-Specific Regulations: Some countries impose additional requirements, such as import licenses, product certifications, or labeling in local language.

- Duty and Tax Calculations: Account for import duties, VAT, and other local taxes based on the declared value and origin of the goods. Use binding tariff information (BTI) for certainty where available.

Regulatory and Safety Compliance

- REACH & RoHS (EU): Ensure materials used in camshaft production comply with REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives, particularly regarding heavy metals.

- EPA & DOT (USA): While camshafts are mechanical parts, ensure conformity with broader automotive emissions and safety regulations if supplied as part of an engine system.

- Marking and Traceability: Provide part numbers, batch/lot numbers, and manufacturer markings for traceability. CE marking may be required if sold within the European Economic Area as part of a complete engine.

Export Controls and Trade Restrictions

- Screen end-users and destinations against denied party lists (e.g., U.S. BIS, EU Consolidated List).

- While camshafts are generally not subject to strict dual-use export controls, confirm non-inclusion under ITAR or Wassenaar Arrangement controls.

- Maintain records of export transactions for a minimum of five years as required by most jurisdictions.

Returns, Warranty, and Reverse Logistics

Establish clear procedures for handling warranty claims, defective returns, and recalls. Use return material authorization (RMA) systems to track returned camshafts. Ensure reverse logistics comply with environmental regulations for metal recycling and disposal of packaging materials.

Sustainability and Environmental Considerations

- Optimize packaging to reduce waste and use recyclable materials.

- Partner with carriers offering carbon-neutral shipping options.

- Comply with End-of-Life Vehicles (ELV) directives in regions like the EU, ensuring camshafts are designed for disassembly and recycling.

Conclusion

Effective logistics and compliance management for auto camshafts ensures timely delivery, minimizes customs delays, and maintains adherence to global regulatory standards. Proactive planning, accurate documentation, and supplier collaboration are key to a resilient supply chain in the automotive sector.

Conclusion for Sourcing Auto Camshafts

In conclusion, sourcing automotive camshafts requires a strategic approach that balances quality, cost, reliability, and compliance with technical specifications. As a critical component in engine performance, the camshaft directly influences fuel efficiency, power output, and emissions, making it essential to partner with reputable suppliers who adhere to strict manufacturing standards and material specifications.

A successful sourcing strategy involves thorough supplier evaluation—including certification checks, quality control processes, production capacity, and geographic considerations—while also considering total cost of ownership rather than just unit price. Establishing long-term relationships with suppliers who offer technical support, consistent quality, and flexibility in delivery can enhance supply chain resilience.

Additionally, leveraging global sourcing opportunities must be weighed against risks such as logistics delays, currency fluctuations, and potential quality inconsistencies. Implementing robust quality assurance protocols, including pre-shipment inspections and sample testing, helps mitigate these risks.

Ultimately, aligning camshaft sourcing with overall production goals, regulatory requirements, and sustainability initiatives ensures optimal engine performance and supports the long-term success of automotive manufacturing operations.