The global automotive bushings market is experiencing robust growth, driven by increasing vehicle production, rising demand for enhanced ride comfort, and the proliferation of electric vehicles requiring advanced NVH (noise, vibration, and harshness) solutions. According to a 2023 report by Mordor Intelligence, the market was valued at USD 6.8 billion in 2022 and is projected to grow at a CAGR of over 5.2% from 2023 to 2028. This expansion is further supported by ongoing advancements in material science, including the adoption of polyurethane, rubber composites, and self-lubricating synthetic materials that improve durability and performance. With stringent emission and safety regulations pushing automakers to optimize suspension and engine mounting systems, the demand for high-performance bushings continues to rise—positioning leading manufacturers at the forefront of automotive innovation. As the industry evolves, these top 10 auto bushings manufacturers stand out for their technological expertise, global supply reach, and strategic partnerships with OEMs.

Top 10 Auto Bushings Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Plain Bearings, Self-lubricating Bushings Manufacturer

Domain Est. 2001

Website: ggbearings.com

Key Highlights: Design partners in reliable tribology, GGB offers surface engineering expertise to the world in motion for plain bearings and self-lubricating bushings….

#2 NSK Global

Domain Est. 1996

Website: nsk.com

Key Highlights: Global leader in Motion & Control. NSK keeps the world moving with bearings, ball screws, linear guides, auto parts, and precision machinery solutions….

#3 Polymer and Composite Bearings & Bushings

Domain Est. 1996

Website: trelleborg.com

Key Highlights: Our Range of Polymer and Composite Bearings: Trelleborg Sealing Solutions offers composite bearings and thermoplastic bearings for a wide range of applications….

#4 PEM – PennEngineering

Domain Est. 1996

Website: pemnet.com

Key Highlights: PEM offers innovative fastening solutions for a variety of applications across industries like Automotive Electronics, Consumer Electronics, Datacom and more….

#5 Prothane

Domain Est. 1997

Website: prothane.com

Key Highlights: We offer an extensive line of professional urethane-based high-performance products for cars and trucks, all made in the USA!…

#6 Polyurethane Suspension Parts

Domain Est. 2004

Website: energysuspensionparts.com

Key Highlights: Find Energy Suspension polyurethane bushings and other suspension parts by make and model or by size. FREE Lifetime Warranty upgrade….

#7 PowerflexUSA Premium Suspension Bushings

Domain Est. 2005

Website: powerflexusa.com

Key Highlights: Powerflex premium suspension bushings are a perfect upgrade for stock replacement, street performance or track use. Lifetime warranty included on all ……

#8

Domain Est. 2007

Website: spcalignment.com

Key Highlights: Specialty Products Company | SPC Alignment | The Automotive Alignment Leaders. … Ball Joint & Bushing · Board Set · Camber & Caster · Gauges · Heavy Duty · Misc ……

#9 Whiteline USA: Suspension & Chassis Components

Domain Est. 2016

Website: whitelineperformance.com

Key Highlights: Industry Leaders in Suspension & Chassis Components. Shop Sway Bars, Bushings, Lowering Springs, Alignment Products & Bracing. Time to Activate More Grip….

#10 Energy Suspension

Domain Est. 2021

Website: teamenergysuspension.com

Key Highlights: AUTOMOTIVE. Energy Suspension Car, Truck, SUV, Jeep and Classic bushings, tools and accessories. POWERSPORTS. Energy Suspension UTV Powersports bushings and ……

Expert Sourcing Insights for Auto Bushings

H2: 2026 Market Trends for Auto Bushings

The global auto bushings market in 2026 is poised for steady growth, driven by evolving automotive technologies, stringent regulations, and shifting consumer preferences. Key trends shaping the landscape include:

1. Electrification Driving Material & Design Innovation:

The rapid rise of electric vehicles (EVs) is a primary catalyst. EVs demand bushings with superior vibration damping (due to different motor harmonics and lack of engine noise masking), higher weight capacity (from heavy batteries), and enhanced durability. This is accelerating the adoption of advanced materials like high-damping synthetic rubber compounds (e.g., EPDM, Neoprene), polyurethanes, and engineered thermoplastics. Expect increased R&D in hybrid bushings combining elastomers with metal or composite elements for optimal NVH (Noise, Vibration, Harshness) performance and weight reduction.

2. Lightweighting Imperative:

Fuel efficiency (ICE) and extended range (EV) remain critical, pushing OEMs towards lightweight materials. This trend favors polymer-based bushings (especially high-performance thermoplastics and composites) over traditional steel-reinforced rubber, reducing unsprung mass. Suppliers are innovating with materials like glass-fiber-reinforced polymers (GFRP) for structural applications, balancing strength, weight, and cost.

3. Focus on Enhanced NVH Performance:

Consumer demand for quieter, more comfortable rides, amplified in premium and luxury EVs, is elevating NVH requirements. Bushings are becoming more sophisticated, with designs incorporating variable stiffness, fluid-filled chambers (hydro-bushings), or even semi-active/active technologies (though still niche in 2026). Advanced simulation and testing are crucial for optimizing performance.

4. Sustainability & Circular Economy Pressures:

Regulations (e.g., EU End-of-Life Vehicles Directive) and ESG goals are pushing for recyclability and reduced environmental impact. This drives R&D into bio-based elastomers, recyclable thermoplastics, and designs facilitating easier disassembly. Increased focus on reducing rolling resistance (linked to fuel efficiency) also influences material choices.

5. Supply Chain Resilience & Regionalization:

Ongoing geopolitical tensions and past disruptions have prompted OEMs and Tier 1s to diversify supply chains. This favors regional manufacturing hubs (e.g., increased production in Eastern Europe, Mexico, Southeast Asia) and dual-sourcing strategies. Nearshoring/reshoring, particularly for critical components, is gaining traction, impacting global sourcing patterns for bushings.

6. Consolidation & Vertical Integration:

The market is seeing consolidation among suppliers as competition intensifies and R&D costs for advanced materials rise. Larger players are acquiring specialized firms to gain technology (e.g., polymer expertise) or market reach. Tier 1s may also increase vertical integration for critical bushing components to ensure supply security and quality.

7. Growth in Emerging Markets & Commercial Vehicles:

While EVs dominate headlines, strong growth in emerging economies (India, Southeast Asia, Latin America) will drive demand for cost-effective, durable bushings for ICE vehicles, particularly in the growing commercial vehicle segment (trucks, buses) where durability under harsh conditions is paramount.

Conclusion:

By 2026, the auto bushings market will be characterized by technological sophistication driven by electrification and lightweighting. Success will depend on suppliers’ ability to innovate with advanced materials (polymers, composites), meet stringent NVH and sustainability standards, adapt to regionalized supply chains, and cater to diverse vehicle segments. The shift towards higher-performance, lighter, and more sustainable bushings is irreversible, reshaping the competitive landscape.

Common Pitfalls Sourcing Auto Bushings (Quality, IP)

Sourcing auto bushings—critical components for vibration damping, noise reduction, and maintaining alignment in vehicle suspension and drivetrain systems—can be fraught with challenges, especially when balancing quality, cost, and intellectual property (IP) concerns. Below are key pitfalls to avoid:

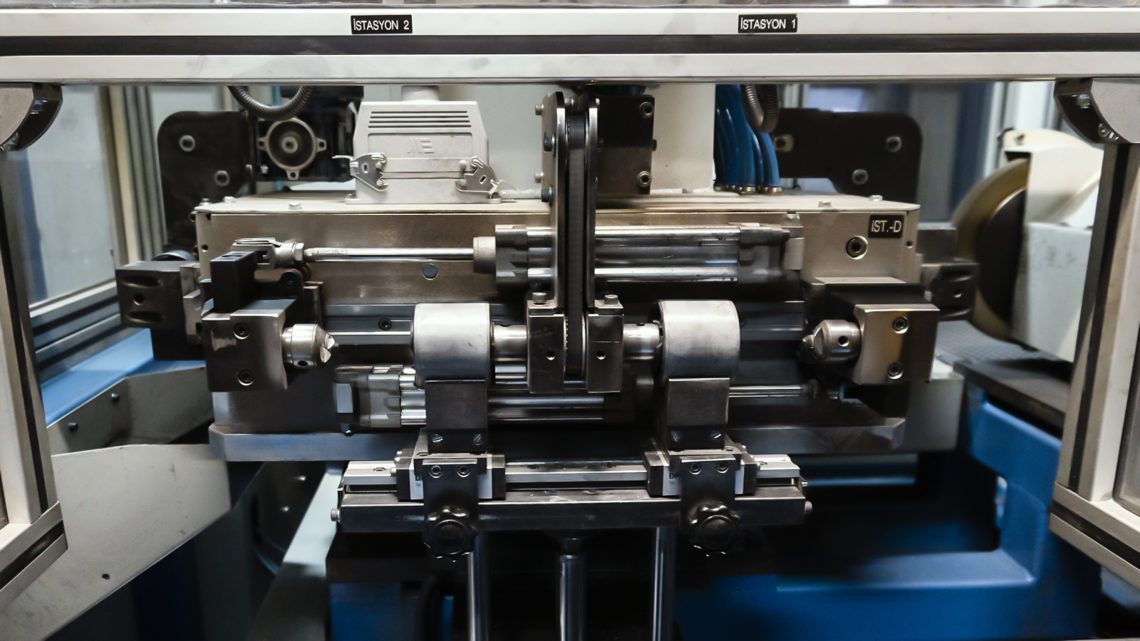

Poor Material and Manufacturing Quality

Low-cost bushings often use substandard rubber or polyurethane compounds that degrade quickly under heat, oil, or stress, leading to premature failure, increased NVH (noise, vibration, harshness), and safety risks. Inconsistent manufacturing processes may result in dimensional inaccuracies or poor bonding between rubber and metal sleeves, compromising performance and durability. Always verify material specifications (e.g., Shore hardness, temperature resistance) and demand certifications like ISO/TS 16949.

Inadequate Testing and Validation

Some suppliers skip rigorous performance testing such as dynamic fatigue, compression set, or salt spray corrosion resistance. Without proper validation data, bushings may fail under real-world conditions. Insist on access to test reports and, if possible, conduct third-party validation to ensure compliance with OEM or industry standards (e.g., SAE, DIN).

Intellectual Property (IP) Infringement Risks

Sourcing generic or “pattern” bushings from certain regions may expose buyers to IP violations if the designs replicate patented OEM geometries or formulations. This is especially common in the aftermarket. Using such parts can lead to legal liability, shipment seizures, or reputational damage. Always confirm that suppliers have the right to manufacture and sell the parts, and consider licensing agreements where applicable.

Lack of Traceability and Documentation

Poor record-keeping from suppliers can hinder root cause analysis during failures and complicate compliance with automotive quality standards. Ensure suppliers provide full traceability (batch numbers, material certs, production dates) and maintain documented quality control processes.

Supply Chain Instability

Overreliance on single-source or low-tier suppliers increases risk of disruption due to geopolitical issues, logistics delays, or quality inconsistencies. Diversify your supplier base and conduct regular audits to ensure continuity and quality consistency.

Avoiding these pitfalls requires due diligence, clear specifications, and strong supplier relationships grounded in transparency and compliance.

Logistics & Compliance Guide for Auto Bushings

This guide provides essential information for the safe, efficient, and compliant handling, transportation, and documentation of auto bushings across the supply chain.

Product Classification and Identification

Auto bushings—typically made from rubber, polyurethane, or composite materials—are critical suspension and chassis components used to reduce vibration, dampen noise, and allow controlled movement in automotive systems. They are classified under specific Harmonized System (HS) codes for international trade, commonly falling under HS Code 8708.29 (Other parts and accessories of motor vehicles). Accurate product identification, including part numbers, material composition, and application (e.g., control arm, sway bar), is essential for proper customs clearance and compliance.

Packaging and Handling Requirements

To prevent damage during transit, auto bushings must be packaged to resist compression, moisture, and contamination. Use corrugated cardboard boxes with internal dividers or foam inserts to avoid part deformation. For bulk shipments, palletize securely using stretch wrap or banding. Avoid exposure to extreme temperatures, direct sunlight, and ozone sources (e.g., electric motors), which can degrade rubber components. Handle packages with care to prevent crushing, especially for polyurethane bushings, which are more rigid and susceptible to cracking.

Transportation Modes and Considerations

Auto bushings can be shipped via road, air, or sea freight depending on volume, destination, and urgency. For air freight, ensure packaging meets IATA standards and declare contents accurately. Sea freight requires moisture-resistant packaging and proper container ventilation to prevent condensation. Road transport should use enclosed, climate-controlled vehicles when possible, particularly in extreme weather. Always comply with carrier-specific requirements for weight, dimensions, and labeling.

Regulatory Compliance and Documentation

Ensure compliance with international and regional regulations, including:

– REACH (EU): Confirm that materials used in bushings do not contain restricted substances above threshold levels (e.g., certain phthalates, SVHCs).

– RoHS (EU): While primarily for electronics, compliance may be relevant if bushings include metallic inserts or coatings.

– TSCA (USA): Verify chemical substances comply with Toxic Substances Control Act regulations.

– Customs Documentation: Provide accurate commercial invoices, packing lists, certificates of origin, and material safety data sheets (MSDS) when required. Include full product descriptions, HS codes, country of origin, and value for duty assessment.

Import/Export Controls and Duties

Auto bushings may be subject to import duties and tariffs depending on the destination country and trade agreements (e.g., USMCA, EU-UK Trade Agreement). Verify duty rates and preferential treatment eligibility. Some countries may require additional inspections or conformity assessments. Use an approved freight forwarder or customs broker to ensure smooth clearance and avoid delays.

Environmental and Sustainability Considerations

Dispose of packaging materials in accordance with local recycling regulations. Consider using recyclable or biodegradable packaging to meet environmental standards. Manufacturers and suppliers should maintain environmental compliance programs, especially regarding waste rubber and chemical use in production.

Quality Assurance and Traceability

Maintain lot traceability throughout the supply chain. Each shipment should include batch numbers and manufacturing dates to support recalls or quality investigations. Adhere to ISO/TS 16949 or IATF 16949 quality management standards for automotive components to ensure reliability and compliance with OEM requirements.

Emergency and Incident Response

In case of damaged shipments or non-compliance findings, isolate affected materials and initiate root cause analysis. Report significant compliance breaches (e.g., chemical violations) to relevant authorities promptly. Maintain a documented incident response plan, including contact details for regulatory bodies and internal compliance officers.

Final Recommendations

Partner with logistics providers experienced in automotive parts shipping. Conduct regular audits of packaging, labeling, and documentation processes. Stay updated on regulatory changes in key markets to maintain continuous compliance.

Conclusion for Sourcing Auto Bushings:

In conclusion, sourcing auto bushings requires a strategic approach that balances quality, cost, durability, and supplier reliability. As critical components in vehicle suspension and steering systems, bushings significantly influence ride comfort, noise reduction, and overall vehicle performance. Therefore, selecting the right material—such as rubber, polyurethane, or hydraulic options—must align with the intended application and performance requirements.

A successful sourcing strategy involves evaluating suppliers based on certifications, production capabilities, quality control processes, and track record in the automotive industry. Additionally, considering Total Cost of Ownership (TCO)—including logistics, lead times, and potential downtime—rather than just unit price ensures long-term reliability and cost-efficiency.

Adopting partnerships with reputable manufacturers, conducting thorough testing and validation, and staying updated on advancements in materials and manufacturing technologies further enhance sourcing effectiveness. Ultimately, a well-executed sourcing plan for auto bushings contributes to improved vehicle performance, customer satisfaction, and competitive advantage in the automotive market.