The global demand for automation in packaging has surged in recent years, driven by rising labor costs, increasing production volumes, and the need for consistent packaging quality across industries such as food & beverage, pharmaceuticals, and consumer goods. According to Grand View Research, the global packaging machinery market was valued at USD 44.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. A key driver within this segment is the adoption of auto bagging machines, which streamline product weighing, filling, sealing, and labeling with minimal manual intervention. Mordor Intelligence corroborates this trend, forecasting steady growth in the automated packaging equipment sector, with particular momentum in emerging economies adopting Industry 4.0 practices. As manufacturers seek to enhance throughput and reduce operational inefficiencies, the importance of selecting reliable, high-performance auto bagging machine suppliers has never been greater. Based on market presence, technological innovation, and customer feedback, the following seven manufacturers represent the leaders shaping the future of automated bagging solutions worldwide.

Top 7 Auto Bagging Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Automatic Bagging Machines & Equipment

Domain Est. 1996

Website: shorr.com

Key Highlights: Shorr offers both semi-automatic and automatic bagging machines from leading manufacturers known for their commitment to quality and innovation….

#2 Rennco

Domain Est. 1997

Website: rennco.com

Key Highlights: Rennco manufacturers both automatic vertical bagging machines & semi-automatic vertical bagging machines as well as l bar sealing machines, heat sealers,……

#3 AUTOBAG® Brand Automated Systems

Domain Est. 1998

Website: sealedair.com

Key Highlights: AUTOBAG® brand bagging solutions help improve packaging line speed, lower labor costs, and reduce material waste, while offering customization to enhance brand ……

#4 Rollbag Auto Baggers

Domain Est. 2004

Website: pacmachinery.com

Key Highlights: We manufacture a wide range of Rollbag automatic baggers for paper and poly mailer bagging applications. These systems come in a range of configurations, from ……

#5 Bagging Solutions

Domain Est. 2021

Website: sealedairupsdcsolutions.com

Key Highlights: Automated Packaging Systems by Sealed Air, provides innovative bagging machinery, high-quality, system-matched bags, and exceptional customer service to ……

#6 Automatic Bagging Machines

Domain Est. 2021

Website: impacktpkg.com

Key Highlights: The SwiftPack automatic bagging machine is: Powerful: Processes up to 900 packages/hour; Versatile: Handles a range of dimensions and materials; Intuitive: ……

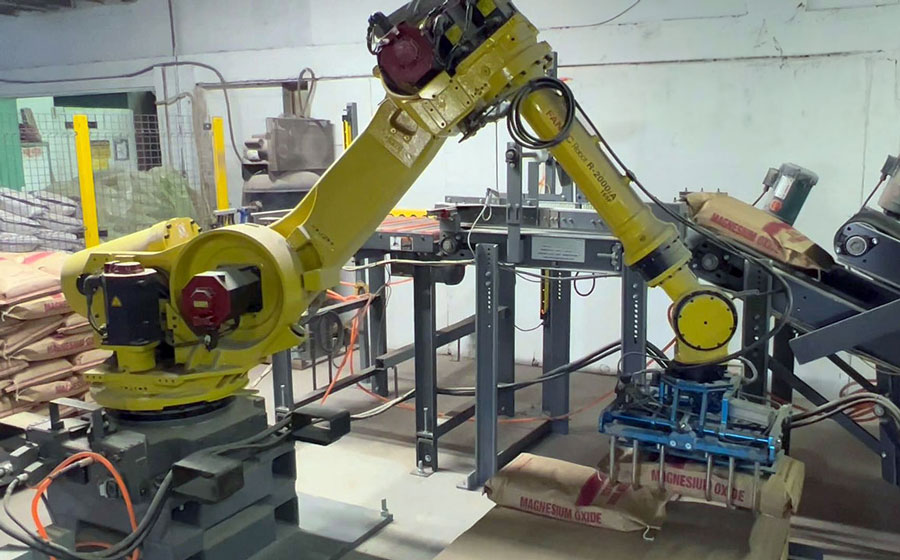

#7 Automatic Bagging Machines

Website: tinsleycompany.com

Key Highlights: Learn more about automatic bagging machines and equipment that greatly increase efficiency, bag filling capabilities, and palletizing rates….

Expert Sourcing Insights for Auto Bagging Machine

2026 Market Trends for Auto Bagging Machines

The global auto bagging machine market is poised for significant transformation by 2026, driven by evolving industry demands, technological advancements, and shifting economic landscapes. Key trends shaping this market include:

Rising Automation Across Industries

Manufacturers in food & beverage, pharmaceuticals, consumer goods, and e-commerce are increasingly prioritizing automation to address labor shortages, ensure consistent product handling, and improve throughput. Auto bagging machines offer a scalable solution, reducing reliance on manual labor and minimizing human error. The push for operational efficiency, especially in high-volume production environments, is accelerating adoption, with industries like fresh produce and frozen foods leading the charge due to hygiene and speed requirements.

Advancements in Smart and Connected Technologies

By 2026, integration with Industry 4.0 principles will be a critical differentiator. Auto bagging machines will increasingly feature IoT connectivity, enabling real-time monitoring of performance, predictive maintenance alerts, and seamless data exchange with warehouse management systems (WMS) and enterprise resource planning (ERP) platforms. AI-powered vision systems will enhance quality control by detecting product defects or incorrect fill levels before bagging, improving accuracy and reducing waste.

Demand for Flexibility and Customization

As consumer preferences diversify and product lines expand, manufacturers require bagging solutions that can handle variable product sizes, shapes, and packaging formats. Modular auto bagging machines capable of quick format changes and compatible with multiple bag types (gusseted, stand-up pouches, flat bags) will see growing demand. Customization options for branding, multi-pack configurations, and sustainable materials will also influence machine design and capabilities.

Sustainability and Eco-Friendly Packaging Integration

Environmental regulations and consumer pressure are pushing brands toward sustainable packaging. Auto bagging machines will need to adapt to handle biodegradable films, recyclable materials, and lightweight packaging formats without compromising speed or integrity. Machine manufacturers are focusing on reducing material waste during operation and improving energy efficiency, aligning with broader corporate sustainability goals.

Growth in E-commerce and On-Demand Packaging

The surge in online grocery and direct-to-consumer retail is creating demand for automated systems that can efficiently package individual or small-batch orders. Auto bagging machines integrated with pick-and-pack workflows will become essential for fulfilling e-commerce logistics, supporting faster turnaround times and reducing fulfillment costs.

Regional Market Expansion

Emerging economies in Asia-Pacific and Latin America are expected to witness accelerated adoption due to industrialization, rising disposable incomes, and expanding food processing sectors. Localized manufacturing and support services will play a crucial role in market penetration, with vendors focusing on cost-effective, durable solutions tailored to regional needs.

In conclusion, the 2026 auto bagging machine market will be defined by intelligent automation, sustainability, and adaptability. Companies that invest in flexible, connected, and eco-conscious solutions will be best positioned to capitalize on these evolving trends.

Common Pitfalls When Sourcing an Auto Bagging Machine: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for Auto Bagging Machine

This guide outlines the key logistics considerations and compliance requirements for the shipment, import/export, installation, and operation of an Auto Bagging Machine. Adhering to these guidelines ensures timely delivery, legal conformity, and safe usage.

Shipping & Transportation

- Packaging Requirements: Ensure the machine is securely crated with shock-absorbing materials and marked with handling labels (e.g., “Fragile,” “This Side Up”). Use export-grade wooden crates compliant with ISPM 15 standards for international shipments.

- Weight and Dimensions: Confirm the gross weight, dimensions, and center of gravity for proper freight classification and handling equipment needs (e.g., forklift capacity).

- Carrier Selection: Use experienced freight forwarders familiar with heavy machinery logistics. Choose air, sea, or ground transport based on urgency, cost, and destination accessibility.

- Documentation: Prepare a commercial invoice, packing list, bill of lading (or air waybill), and certificate of origin. Include detailed technical specifications for customs clearance.

Import/Export Regulations

- Harmonized System (HS) Code: Identify the correct HS code (e.g., 8422.30 for packaging machinery) to determine tariffs, duties, and import restrictions in the destination country.

- Export Controls: Verify if the machine contains controlled components subject to export regulations (e.g., dual-use technology under EAR or ITAR, if applicable).

- Customs Compliance: Ensure all documentation is accurate and complete. Partner with a licensed customs broker to manage declarations and duty payments.

- Import Permits: Check if the destination country requires special permits, safety certifications, or pre-shipment inspections for industrial equipment.

Regulatory & Safety Compliance

- Electrical Standards: Confirm the machine meets voltage, frequency, and plug standards of the destination country (e.g., CE for EU, UL/CSA for North America, CCC for China).

- Machine Safety Directives: Comply with relevant safety regulations such as EU Machinery Directive 2006/42/EC, OSHA standards in the U.S., or other regional equivalents. Ensure inclusion of safety interlocks, emergency stops, and proper guarding.

- EMC Compliance: Verify electromagnetic compatibility (EMC) conformity to prevent interference with other equipment (e.g., EMC Directive 2014/30/EU).

- RoHS & REACH (if applicable): Ensure restricted substances are not used in components, especially for shipments to the EU.

Installation & Site Preparation

- Facility Requirements: Confirm adequate floor space, load-bearing capacity, power supply (voltage, phase, amperage), compressed air (if needed), and ventilation.

- Unloading Plan: Coordinate with the receiving site for forklift access, dock availability, and clear pathways to the installation area.

- Commissioning: Schedule technician support for installation, calibration, and operator training. Retain manuals and compliance certificates on-site.

Post-Delivery Compliance

- User Training: Provide documented training on safe operation, maintenance, and emergency procedures.

- Maintenance Records: Keep logs of inspections, repairs, and part replacements to meet safety audit requirements.

- Warranty & Service: Register the machine with the manufacturer and maintain service contracts as needed to comply with operational standards.

By following this logistics and compliance framework, businesses can ensure a smooth, legal, and safe deployment of their Auto Bagging Machine across domestic and international operations.

Conclusion for Sourcing an Auto Bagging Machine

Sourcing an automatic bagging machine is a strategic investment that can significantly enhance operational efficiency, reduce labor costs, and improve packaging consistency and product quality. After evaluating various suppliers, machine specifications, and technological capabilities, it is clear that selecting the right auto bagging machine requires a careful balance between performance, reliability, cost-effectiveness, and after-sales support.

Key considerations such as production capacity, compatibility with existing packaging lines, ease of maintenance, and adaptability to different bag types and product sizes play a crucial role in the decision-making process. Additionally, compliance with industry standards and safety regulations ensures long-term reliability and operational safety.

Ultimately, partnering with a reputable supplier offering proven technology, strong customer service, and scalable solutions will maximize return on investment and support future growth. By implementing the appropriate auto bagging system, businesses can achieve greater automation, improve throughput, and remain competitive in an increasingly demanding market.