The global artificial slate roof tiles market is experiencing robust growth, driven by increasing demand for durable, cost-effective, and aesthetically appealing roofing solutions. According to Mordor Intelligence, the roofing market—encompassing synthetic and composite materials—is projected to grow at a CAGR of approximately 5.8% from 2023 to 2028, with artificial slate emerging as a preferred alternative to natural slate due to its lighter weight, lower installation costs, and improved sustainability. Fueled by rising construction activities and stricter energy efficiency standards, Grand View Research further reports that the global synthetic roofing materials market was valued at USD 14.3 billion in 2022 and is expected to expand significantly over the next decade. As demand for long-lasting, weather-resistant roofing continues to rise, manufacturers of artificial slate tiles are scaling innovation in material composition and design. Below are the top eight artificial slate roof tile manufacturers shaping this competitive and evolving landscape.

Top 8 Artificial Slate Roof Tiles Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Lightweight Slate Roof Systems

Domain Est. 1998

Website: ncslate.com

Key Highlights: Rating 4.9 (54) This innovative lightweight slate roof system developed by SlateTec allows a 35-40% reduction in roof weight to accommodate slate roofs at less than 6 lbs.Missing…

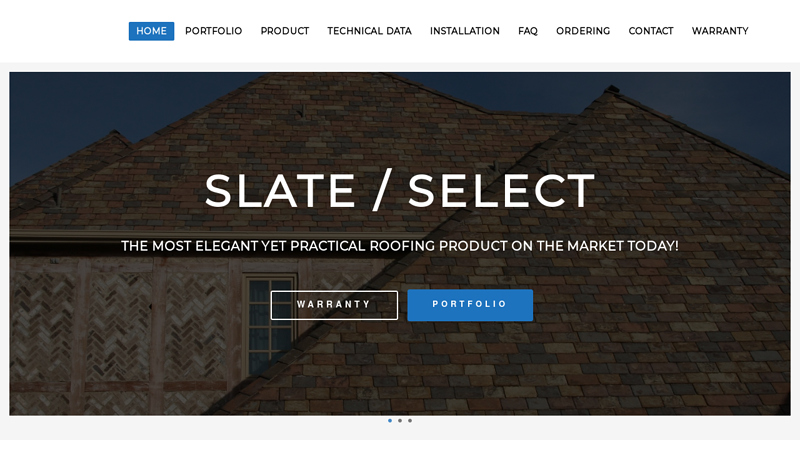

#2 Slate

Domain Est. 2002

Website: slateselect.com

Key Highlights: Slate/Select is a proprietary cement matrix with reinforcing non-alkaline glass fibers. This produces a material with great strength and durability in all …Missing: artificial m…

#3 Explore SLATE2 Lightweight Slate Roofing

Domain Est. 2006

Website: californiaslatecompany.com

Key Highlights: Discover SLATE2, the advanced lightweight slate roofing system combining elegance and durability. Explore genuine lightweight slate roofing today!Missing: artificial manufacturer…

#4 BORAL Residential Roof Products

Domain Est. 2015

Website: roofle.com

Key Highlights: Boral Roofing is the nation’s largest manufacturer of sustainable, durable and affordable clay, concrete, stone coated steel and composite slate and shake roof ……

#5 Slate Shingles

Domain Est. 1995

Website: certainteed.com

Key Highlights: Slate-like shingles combine durability and aesthetics with slate shingles replicating the charm of slate, at an affordable price….

#6 Cupa Pizarras

Domain Est. 2003

Website: cupapizarras.com

Key Highlights: Cupa Pizarras world leader in natural slate for roofing and cladding, known for its unmatched durability and exceptional aesthetic appeal….

#7 Synthetic Slate Roofing

Domain Est. 2010

Website: farharoofing.com

Key Highlights: Synthetic slate roofing tiles are a cost-effective alternative to natural slate because synthetic slate mimics the appearance and durability of genuine slate….

#8 Artificial Slate Roof Tile History by NZ Macmillan Slaters & Tilers est …

Website: macmillanslaters.co.nz

Key Highlights: The first type of Artificial slate roof tile is the Asbestos slate – They have been brought into this country since the early 1900`s original used on churches….

Expert Sourcing Insights for Artificial Slate Roof Tiles

2026 Market Trends for Artificial Slate Roof Tiles

The global artificial slate roof tiles market is poised for significant transformation by 2026, driven by evolving consumer preferences, technological advancements, and macroeconomic factors. Here are the key trends expected to shape the industry:

Rising Demand for Sustainable and Eco-Friendly Building Materials

Environmental consciousness is a major driver. Consumers and builders are increasingly prioritizing sustainable construction, favoring artificial slate tiles made from recycled polymers, rubber, or composite materials. By 2026, manufacturers are expected to enhance their eco-credentials through improved recyclability, reduced carbon footprints in production, and certifications such as EPDs (Environmental Product Declarations), further boosting market appeal.

Technological Innovations in Material Composition and Design

Advancements in polymer science and manufacturing techniques will lead to higher-performing artificial slate tiles. Expect innovations in UV resistance, fire retardancy, and impact strength. Additionally, digital printing and texturing technologies will enable increasingly realistic stone-like finishes, narrowing the aesthetic gap between artificial and natural slate and expanding consumer acceptance.

Cost-Effectiveness and Installation Efficiency Driving Adoption

Artificial slate remains significantly more affordable than natural slate, both in material and labor costs. By 2026, lightweight profiles and interlocking designs will continue to reduce structural requirements and accelerate installation times. This efficiency will appeal to contractors and developers focused on project timelines and cost savings, especially in large-scale residential and commercial developments.

Growth in Residential Renovation and New Construction

The aging housing stock in North America and Europe is fueling demand for roof replacements. Homeowners seeking durability and curb appeal are turning to artificial slate as a premium yet practical alternative. Simultaneously, new luxury and mid-tier housing projects are incorporating artificial slate to achieve high-end aesthetics without the logistical challenges of natural stone.

Geographic Expansion and Regional Market Dynamics

While North America and Europe remain dominant markets due to high renovation activity and building standards, Asia-Pacific is expected to witness the fastest growth by 2026. Countries like China, India, and Southeast Asian nations are seeing rising disposable incomes and urbanization, creating opportunities for premium roofing solutions in both private and public infrastructure projects.

Increasing Competition and Product Differentiation

As the market matures, competition among manufacturers will intensify. Companies will differentiate through warranties (often exceeding 50 years), color retention guarantees, and comprehensive accessory systems. Strategic partnerships with roofing contractors and distributors will become critical for market penetration and brand trust.

Regulatory and Code Compliance as a Growth Enabler

Stricter building codes related to fire safety, wind uplift resistance, and energy efficiency are favoring high-performance artificial slate products. Tiles that meet or exceed regional standards (e.g., Class A fire ratings, ASTM standards) will gain a competitive edge, particularly in high-risk areas such as wildfire-prone regions in the U.S. and hurricane-affected zones.

Integration with Smart Roofing and Energy Systems

By 2026, artificial slate tiles may increasingly be designed to integrate with solar roofing systems or smart sensors for energy monitoring and weather responsiveness. While not mainstream yet, early adoption of hybrid solutions could position certain brands at the forefront of the next generation of roofing technology.

In conclusion, the artificial slate roof tiles market in 2026 will be characterized by innovation, sustainability, and expanding global reach. As consumer expectations rise and technology advances, artificial slate is set to consolidate its position as a leading premium roofing solution across diverse construction sectors.

Common Pitfalls When Sourcing Artificial Slate Roof Tiles (Quality & IP)

Sourcing artificial slate roof tiles offers benefits like cost-efficiency and design flexibility, but buyers often encounter significant pitfalls related to quality inconsistencies and intellectual property (IP) issues. Being aware of these risks is crucial to ensuring a durable, compliant, and aesthetically pleasing roofing solution.

Poor Material Quality and Durability

One of the most frequent issues is receiving tiles made from substandard materials. Low-quality polymers or fiber-reinforced composites may degrade quickly under UV exposure, leading to fading, warping, or cracking. Buyers may also face inconsistent thickness or density, compromising both appearance and structural performance. Always request material specifications, UV resistance data, and independent test reports (e.g., for impact resistance, fire rating, and freeze-thaw cycles).

Inaccurate Aesthetic Representation

Artificial slate tiles are often marketed with high-resolution images or samples that don’t match the final delivered product. Color variations between batches, unrealistic texture replication, or oversimplified patterns can result in a roof that looks artificial or mismatched upon installation. Request physical samples from the actual production batch and verify colorfastness guarantees.

Lack of Compliance with Building Standards

Many suppliers, especially overseas manufacturers, may not adhere to regional building codes or certification requirements (e.g., CE marking in Europe, ASTM standards in the U.S., or local fire safety regulations). Using non-compliant tiles can lead to failed inspections, insurance issues, or liability in the event of structural failure. Confirm that products meet relevant national and local standards before purchase.

Intellectual Property (IP) Infringement Risks

A significant but often overlooked pitfall is the unauthorized replication of patented designs. Some artificial slate tiles mimic the exact look and profile of premium branded products (e.g., those by leading European manufacturers), potentially infringing on design patents or trademarks. Purchasing such tiles—even unknowingly—can expose contractors or developers to legal action, product seizure, or reputational damage. Always verify the supplier’s IP compliance and request documentation proving original design rights or licensing agreements.

Inadequate Warranties and Support

Many low-cost suppliers offer limited or ambiguous warranty terms that exclude common failure modes like color fading or thermal expansion. Some may lack local customer support, making claims difficult to process. Scrutinize warranty length, coverage scope, and the supplier’s service network to ensure long-term reliability and recourse.

Supply Chain and Lead Time Issues

Reliance on distant or unproven suppliers can result in delayed shipments, inconsistent batch production, or communication breakdowns. These disruptions can stall construction timelines and increase project costs. Prioritize suppliers with proven logistics, transparent production schedules, and responsive client service.

Avoiding these pitfalls requires due diligence: vet suppliers thoroughly, demand third-party certifications, validate IP rights, and insist on real-world performance data. Taking these steps ensures you get a high-quality, legally sound artificial slate roof that meets both aesthetic and functional expectations.

Logistics & Compliance Guide for Artificial Slate Roof Tiles

Product Overview and Handling Requirements

Artificial slate roof tiles are engineered roofing materials designed to replicate the appearance of natural slate while offering enhanced durability, lighter weight, and reduced installation complexity. Typically made from composite materials such as polymer, rubber, or fiber-cement blends, these tiles require specific handling and storage protocols to maintain integrity during transit and storage.

Handle tiles with care to avoid chipping, cracking, or warping. Always lift and transport full bundles using pallet jacks or forklifts—never drag or drop. Store tiles flat on a level, dry surface, preferably on wooden pallets, and cover with breathable tarpaulins to protect from UV degradation, moisture, and dirt. Avoid direct sunlight for prolonged periods, as excessive heat can cause deformation.

Packaging and Unit Load Standards

Artificial slate tiles are generally shipped in shrink-wrapped bundles stacked on standard wooden pallets. Each bundle must be uniformly stacked and secured to prevent shifting during transport. Standard pallet dimensions are 48” x 40” (1219 mm x 1016 mm), with a maximum stack height of 72” (1829 mm) and weight not exceeding 2,500 lbs (1,134 kg) per pallet unless otherwise specified by the manufacturer.

Use edge protectors and corner boards to prevent damage to tile edges. Avoid mixing tile colors or styles on the same pallet unless pre-approved. Include clear labeling indicating product type, color code, batch number, quantity, and handling instructions (e.g., “Fragile,” “This Side Up”). Barcodes and RFID tags should be applied for inventory tracking and supply chain visibility.

Transportation and Shipping Considerations

Transport artificial slate tiles via enclosed trucks or containers to protect from weather and road debris. Open-air flatbeds must be tightly covered with waterproof, UV-resistant tarps secured at all edges. Secure pallets using straps or load locks to prevent movement during transit.

Coordinate shipping schedules to minimize time in transit and avoid extreme temperature exposure. In hot climates, avoid midday loading/unloading to reduce thermal stress. In cold climates, allow materials to acclimate to ambient temperature before installation to prevent condensation and brittleness.

Use freight carriers experienced in handling construction materials and with tracking capabilities. Require proof of delivery and condition upon arrival, including photographic documentation if damage is suspected.

Import/Export Regulations and Documentation

For international shipments, comply with relevant customs regulations in both origin and destination countries. Required documentation includes:

- Commercial Invoice (with detailed product description, value, and Harmonized System (HS) code)

- Packing List (per pallet and shipment)

- Bill of Lading or Air Waybill

- Certificate of Origin

- Material Safety Data Sheet (MSDS) or Safety Data Sheet (SDS)

- Product Compliance Certifications (e.g., CE, UKCA, or ICC-ES)

The HS code for artificial slate roof tiles is typically 6807.10 (for cement-based composites) or 3925.30 (for plastic-based products), but confirm with local customs authorities. Ensure all labeling and documentation are in the official language of the destination country.

Regulatory Compliance and Building Standards

Artificial slate tiles must comply with regional building codes and fire, wind, and weather resistance standards. Key certifications include:

- United States: ICC-ES Evaluation Report, ASTM standards (e.g., ASTM D3161 for wind resistance, ASTM E108 for fire testing)

- European Union: CE Marking per EN 14963 (slates and tiles for roofing)

- United Kingdom: UKCA marking, compliance with BS 5534 (slating and tiling)

- Australia/NZ: AS/NZS 2049:2015 for metal and non-metal roof coverings

Verify that the product meets local requirements for fire classification (e.g., Class A in the U.S., Reaction to Fire Class B-s1,d0 in EU), wind uplift resistance, and impact rating (e.g., Class 4 hail resistance). Provide installation manuals and technical data sheets aligned with code requirements.

Environmental and Sustainability Compliance

Artificial slate tiles may contain recycled content (e.g., rubber from tires, reclaimed polymers). Manufacturers should provide Environmental Product Declarations (EPDs) and Health Product Declarations (HPDs) where applicable.

Ensure compliance with environmental regulations such as REACH (EU), RoHS (electronics-related materials), and TSCA (U.S.). Avoid substances of very high concern (SVHCs). Promote recyclability at end-of-life and provide guidance on disposal or recycling options.

For green building projects (e.g., LEED, BREEAM), document contributions to credits such as Materials & Resources (MR) and Indoor Environmental Quality (EQ).

Installation and Warranty Compliance

Only trained and approved installers should handle and install artificial slate tiles. Follow manufacturer-recommended fastening patterns, underlayment requirements, and flashing details. Deviation from installation guidelines may void product warranties and compromise code compliance.

Maintain records of installer certification, product batch numbers, and installation dates for traceability and warranty claims. Report defects or non-conformities promptly to the supplier.

Incident Response and Claims Management

In case of damaged goods, incorrect shipments, or compliance concerns:

- Document the issue with photos and written reports upon delivery.

- Notify the supplier or logistics provider within 24–48 hours.

- Retain all packaging and damaged materials for inspection.

- Submit a formal claim with supporting documentation.

- Follow up regularly until resolution.

Establish a clear chain of responsibility between supplier, freight carrier, and end-user to streamline dispute resolution.

Conclusion

Effective logistics and compliance management ensures artificial slate roof tiles reach their destination safely and meet all regulatory and performance standards. By adhering to proper handling, documentation, and certification requirements, stakeholders can mitigate risks, ensure product integrity, and support successful roofing projects worldwide.

Conclusion for Sourcing Artificial Slate Roof Tiles

Sourcing artificial slate roof tiles offers a compelling blend of aesthetic appeal, durability, and cost-effectiveness, making it an increasingly popular choice for both residential and commercial projects. These tiles successfully replicate the elegant, timeless look of natural slate while overcoming many of its limitations, such as excessive weight, brittleness, and high maintenance requirements.

Key factors to consider when sourcing artificial slate include material composition (typically composite polymers, fiber cement, or recycled materials), product quality, warranty, supplier reliability, and adherence to regional building standards. Opting for reputable manufacturers ensures consistent performance, long-term weather resistance, and fire and impact ratings suitable for various climates.

Additionally, the lightweight nature of artificial slate reduces structural load, easing installation and potentially lowering construction costs. Sustainability-conscious buyers will appreciate options made from recycled content and those that contribute to energy efficiency through improved insulation properties.

In conclusion, sourcing high-quality artificial slate roof tiles provides a practical, visually appealing, and sustainable roofing solution. By carefully evaluating suppliers, product specifications, and long-term value, builders and homeowners can achieve the premium look of slate with enhanced functionality and reduced lifecycle costs.