The global armored fiber optic cable market is experiencing robust growth, driven by rising demand for high-speed data transmission across telecommunications, data centers, and industrial infrastructure. According to Mordor Intelligence, the market was valued at USD 3.8 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2029. This expansion is fueled by the rapid deployment of 5G networks, increasing fiber-to-the-home (FTTH) adoption, and the need for durable cabling solutions in harsh environments. Armored fiber optic cables—known for their mechanical protection, rodent resistance, and long-term reliability—are becoming a critical component in modern network infrastructure. As demand escalates, a select group of manufacturers have emerged as industry leaders, combining innovation, scalability, and global reach to meet evolving connectivity needs. Based on market presence, production capacity, technological advancement, and geographic footprint, the following ten companies represent the top armored fiber optic cable manufacturers shaping the future of optical networks.

Top 10 Armoured Fiber Optic Cable Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Optical Cable Corporation

Domain Est. 1996

Website: occfiber.com

Key Highlights: Tactical Leadership. OCC has built a reputation of excellence by being the leading manufacturer of military ground tactical fiber optic cable and connectivity ……

#2 Fibermart

Domain Est. 2015

Website: fiber-mart.com

Key Highlights: Free delivery 60-day returnsAs a 15-years manufacturer, we provide high quality & innovative fiber optic product and solutions for private, companies, carriers, ISPs and network pr…

#3 Fiber Optic Cable Manufacturers

Domain Est. 2021

Website: usa.proterial.com

Key Highlights: Our extensive selection of optical communication solutions, from simplex fiber constructions to durable, armored multi-fiber cable assemblies, caters to a wide ……

#4 Armored Fiber Optic Cables

Domain Est. 1992

#5 Fiber Optic Cables

Domain Est. 1994

Website: commscope.com

Key Highlights: CommScope designs and manufactures a comprehensive line of fiber optic cables—from outside plant to indoor/outdoor and fire-rated indoor fiber ……

#6 Armored Fiber Optic Patch Cables

Domain Est. 2000

#7 nanoFIBER

Domain Est. 2001

Website: nanofiber.com

Key Highlights: nanoFIBER™ is an award-winning, new proprietary armoring system, that winds a flat stainless-steel coil around the inner fiber optic cables….

#8 Armored – Multimode & Singlemode – Fiber

Domain Est. 2002

Website: store.cablesplususa.com

Key Highlights: 4–11 day delivery 30-day returnsArmored fiber optic cable consists of a cable surrounded by a steel or aluminum jacket which is then covered with a polyethylene jacket to protect i…

#9 Fiber Optic Cable Solutions

Domain Est. 2008

Website: aflglobal.com

Key Highlights: We have a wide variety of fiber cable types to choose from, including single-mode, multimode, armored, and non-armored cable. We also offer a variety of ……

#10 TiniFiber: Crush

Domain Est. 2012

Website: tinifiber.com

Key Highlights: Learn more about our crush-proof stainless steel micro-armor fiber optic cables, the smallest and most flexible in the industry….

Expert Sourcing Insights for Armoured Fiber Optic Cable

H2: 2026 Market Trends for Armoured Fiber Optic Cable

The global armoured fiber optic cable market is poised for significant transformation by 2026, driven by rising demand for high-speed data transmission, expanding telecommunications infrastructure, and increasing deployment in harsh environments. This analysis outlines key market trends shaping the industry under the H2 (second half) outlook for 2026.

1. Surge in Data Center Expansion

By H2 2026, the exponential growth of cloud computing, artificial intelligence, and edge data centers will continue to fuel demand for armoured fiber optic cables. These cables, known for their durability and resistance to physical damage, are increasingly preferred in data center interconnects where reliability and signal integrity are paramount. Hyperscale data center investments—particularly across North America, Europe, and Asia-Pacific—are expected to drive volume procurement, with a notable shift toward bend-insensitive, high-fiber-count armoured cables.

2. 5G Network Rollouts Accelerate Deployment

The completion of 5G infrastructure rollouts in major economies by 2026 will necessitate robust backhaul and fronthaul networks. Armoured fiber optic cables are critical in these deployments due to their resistance to rodents, moisture, and mechanical stress—common challenges in outdoor and underground installations. In H2 2026, telecom operators are expected to prioritize armoured solutions for rural and suburban 5G tower connectivity, especially in regions with extreme weather or rugged terrain.

3. Growth in Industrial and Harsh Environment Applications

Industries such as oil & gas, mining, transportation, and smart manufacturing are increasingly adopting fiber optic networks for real-time monitoring and automation. Armoured cables offer superior protection in high-vibration, high-temperature, or chemically aggressive environments. By H2 2026, demand is projected to grow significantly in industrial IoT (IIoT) applications, with customized armoured solutions emerging to meet sector-specific standards and safety requirements.

4. Regional Market Divergence and Infrastructure Initiatives

Government-led broadband initiatives—such as the U.S. BEAD Program, EU Digital Decade, and Digital India—are expected to reach critical implementation phases by H2 2026. These programs are accelerating the deployment of fiber-to-the-home (FTTH) and rural broadband networks, where armoured cables are used in direct burial and aerial installations. Meanwhile, emerging markets in Southeast Asia, Africa, and Latin America are witnessing rising imports of cost-effective armoured cables to support national digitalization goals.

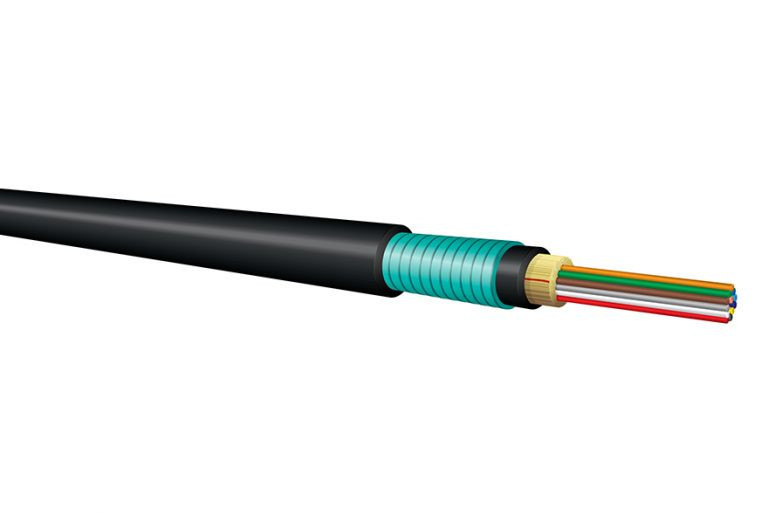

5. Technological Advancements and Material Innovation

In response to market demands for lighter, more flexible, and environmentally resilient solutions, manufacturers are introducing advanced armoring materials such as corrugated steel tape (CST), aluminum interlock, and non-metallic (e.g., glass yarn) armoring. By H2 2026, innovations in hybrid cables—combining power and data transmission with armoured protection—are gaining traction in smart city and renewable energy projects, particularly for solar and wind farm communications.

6. Supply Chain Resilience and Localization Trends

Geopolitical dynamics and post-pandemic supply chain restructuring will influence sourcing strategies in H2 2026. There is a growing emphasis on regional manufacturing hubs to reduce dependency on single-source suppliers. Countries like India, Vietnam, and Mexico are emerging as secondary production centers for armoured fiber cables, supported by favorable trade policies and rising local demand.

7. Sustainability and Regulatory Pressures

Environmental regulations, particularly in Europe and North America, are pushing manufacturers toward recyclable materials and reduced carbon footprints. By H2 2026, eco-friendly armoured cables with halogen-free jackets and lead-free components are expected to gain market share, driven by green building certifications and ESG compliance requirements.

Conclusion

By H2 2026, the armoured fiber optic cable market will be characterized by robust growth across telecom, data center, and industrial sectors, underpinned by technological innovation and infrastructure modernization. Vendors that invest in R&D, regional supply chain agility, and sustainable manufacturing are likely to capture significant market share in this evolving landscape.

Common Pitfalls When Sourcing Armoured Fiber Optic Cable (Quality & IP)

Sourcing armoured fiber optic cable involves navigating several potential risks related to product quality and intellectual property (IP). Avoiding these pitfalls is critical to ensuring network performance, longevity, and legal compliance.

Inadequate Cable Quality and Performance

One of the most prevalent issues when sourcing armoured fiber optic cable is receiving substandard products that fail to meet technical specifications or environmental requirements. Buyers may encounter cables with inferior materials—such as low-grade steel tape or poor-quality jacketing—that compromise mechanical protection and longevity. Additionally, inconsistent fiber attenuation, poor spliceability, or non-compliance with international standards (e.g., ITU-T G.652.D, IEC 60794) can lead to network failures and increased maintenance costs. These quality shortcomings are especially common when sourcing from suppliers with lax manufacturing controls or those offering unusually low prices.

Misrepresentation of IP and Brand Authenticity

Another significant risk involves the misrepresentation or infringement of intellectual property. Unscrupulous suppliers may falsely claim that cables are manufactured by or approved by well-known brands, using logos or model numbers without authorization. This includes selling counterfeit or “grey market” products that mimic reputable brands but lack proper certification, warranties, or technical support. Buyers may inadvertently violate IP rights or deploy unreliable infrastructure, exposing their organization to legal liability and operational risk.

Lack of Compliance with Regional and Safety Standards

Sourcing armoured fiber cables without verifying compliance with local and international standards (e.g., RoHS, REACH, CPR in Europe, NEC in the U.S.) can result in failed inspections, project delays, or safety hazards. Some suppliers provide misleading certifications or use expired test reports. Armoured cables used in hazardous or outdoor environments must meet specific fire resistance, UV protection, and rodent-resistance standards—failure to ensure compliance increases the risk of cable degradation and safety incidents.

Insufficient Documentation and Traceability

A common pitfall is receiving cables without proper documentation, such as test reports, material certifications, or traceability data (e.g., batch numbers, manufacturing dates). Without these, it becomes difficult to verify quality claims, manage warranty claims, or conduct root cause analysis in case of failure. Lack of documentation also raises red flags regarding IP legitimacy and adherence to regulatory frameworks.

Overlooking Supply Chain Transparency

Many buyers fail to assess the transparency and integrity of the supply chain. Armoured fiber cables may pass through multiple intermediaries, increasing the risk of substitution, counterfeiting, or diversion. Without direct engagement with authorized distributors or verified manufacturers, organizations may unknowingly source cables from unauthorized or unreliable sources, undermining both quality and IP assurance.

Logistics & Compliance Guide for Armoured Fiber Optic Cable

Overview

Armoured fiber optic cable is designed for durability in harsh environments, offering enhanced protection against rodents, crushing, and moisture. Its integration into network infrastructure demands strict adherence to logistics protocols and compliance standards to ensure safety, performance, and regulatory conformity.

Packaging and Handling

- Robust Packaging: Armoured fiber cables must be shipped on wooden or metal reels secured with protective end caps to prevent damage. Reels should be clearly labeled with product specifications, length, fiber type, and handling instructions (e.g., “This Side Up,” “Do Not Roll”).

- Handling Precautions: Use proper lifting equipment (e.g., forklifts with reel clamps) when moving reels. Avoid dragging or dropping reels, which can deform the cable or damage the armor and fibers.

- Storage Conditions: Store reels vertically in a dry, temperature-controlled environment (typically 0°C to 40°C). Avoid direct sunlight and ensure the area is free from chemicals, sharp objects, and moisture.

Transportation Requirements

- Transport Modes: Suitable for road, sea, and air freight. For air transport, verify weight and dimensions align with airline cargo restrictions.

- Securement: Reels must be firmly secured on pallets or in containers to prevent movement during transit. Use straps or dunnage to minimize shifting.

- Environmental Controls: In extreme climates, use temperature-controlled vehicles or insulated packaging to prevent condensation or thermal degradation.

Import/Export Compliance

- HS Code Classification: Armoured fiber optic cables generally fall under HS Code 8544.70 (Optical fiber cables, made up of individually sheathed fibers, whether or not assembled with electric conductors or fitted with connectors). Confirm with local customs authorities, as sub-classifications may vary by region.

- Export Controls: Check for dual-use or telecommunications-specific regulations (e.g., U.S. EAR – Export Administration Regulations). While most fiber cables are not export-restricted, high-performance or military-grade variants may require licensing.

- Documentation: Prepare commercial invoice, packing list, certificate of origin, and bill of lading/air waybill. Include technical specifications (e.g., fiber count, armor type, jacket material) for customs clearance.

Regulatory and Safety Standards

- International Standards:

- IEC 60794: Series covering generic specifications for optical fiber cables.

- ITU-T G.657: Bends-insensitive fiber standards (if applicable).

- RoHS & REACH (EU): Ensure materials comply with restrictions on hazardous substances.

- Regional Approvals:

- North America: UL 1666 (riser rating), NEC Article 770 (installation), and CPR/LSZH compliance for indoor use.

- Europe: CPR (Construction Products Regulation) classification (e.g., B2ca, Cca) based on fire performance.

- Other Regions: Verify local fire, smoke, and toxicity (FST) requirements.

Environmental and Disposal Compliance

- End-of-Life Management: Armoured cables contain metal (steel or aluminum armor) and plastic (jacket, strength members). Dispose of or recycle in accordance with local e-waste regulations.

- Hazardous Material Declaration: Confirm absence of restricted substances (e.g., lead, cadmium) per RoHS. Provide compliance documentation upon request.

Installation and Field Compliance

- Bend Radius: Maintain minimum bend radius (typically 10–15x cable diameter) during installation to prevent fiber breakage.

- Grounding Requirements: Metallic armor must be properly grounded to prevent electrical hazards, especially in outdoor or lightning-prone areas. Follow national electrical codes (e.g., NEC, IEC 60364).

- Permitting: In public infrastructure or utility projects, obtain necessary permits and coordinate with local authorities.

Documentation and Traceability

- Maintain batch/lot numbers, test reports (e.g., OTDR, tensile strength), and compliance certificates throughout the supply chain.

- Use barcodes or RFID tags on reels for inventory tracking and audit readiness.

Conclusion

Proper logistics and compliance management for armoured fiber optic cable ensures operational safety, regulatory acceptance, and network reliability. Adherence to international standards, accurate documentation, and careful handling are critical from manufacturing to installation. Regular training for logistics and field teams enhances compliance and reduces risk.

Conclusion:

Sourcing armoured fiber optic cable requires a careful evaluation of technical specifications, environmental demands, budget constraints, and long-term performance goals. Armoured cables offer superior protection against mechanical stress, moisture, and rodent damage, making them ideal for harsh or outdoor installations. When selecting a supplier, it is essential to ensure compliance with international standards (such as ITU-T G.652D or IEC 60794), verify the quality of the armouring material (typically corrugated steel or aluminum), and assess the cable’s durability and flexibility for the intended application.

Additionally, partnering with reputable manufacturers or suppliers who provide warranties, technical support, and consistent product quality can significantly reduce downtime and maintenance costs over the cable’s lifecycle. Considering total cost of ownership—rather than just initial purchase price—will lead to more informed and cost-effective sourcing decisions.

In summary, a strategic sourcing approach that balances performance, reliability, and value will ensure the successful deployment and longevity of armoured fiber optic cable in both telecommunications and industrial networks.