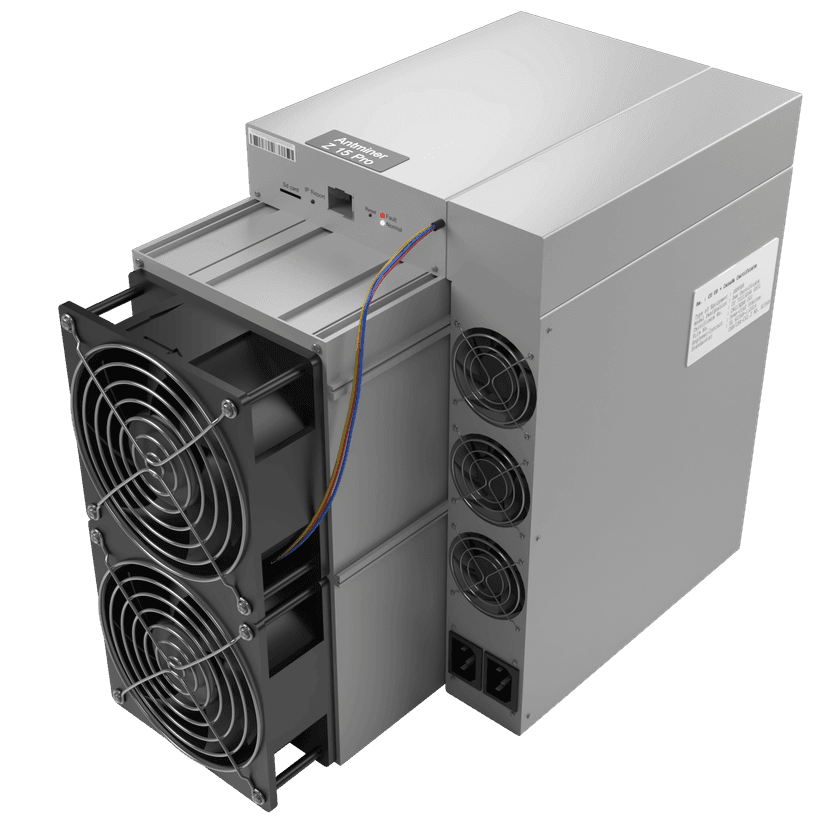

The global Bitcoin mining hardware market is experiencing robust expansion, driven by increasing cryptocurrency adoption, rising mining profitability, and advancements in ASIC (Application-Specific Integrated Circuit) technology. According to Grand View Research, the market was valued at USD 7.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 11.2% from 2023 to 2030. This upward trajectory underscores the growing demand for high-efficiency mining equipment, particularly in regions with favorable energy costs and regulatory environments. Within this competitive landscape, Antminer Z15 Pro—designed for mining Equihash-based cryptocurrencies like Zcash—has emerged as a key product category, attracting several manufacturers aiming to deliver optimal hash rates, power efficiency, and reliability. While Bitmain remains the original designer of the Antminer series, a handful of specialized manufacturers and authorized partners have entered the space, offering enhanced or compatible versions of the Z15 Pro. The following analysis identifies the top four manufacturers based on production volume, technical specifications, market presence, and user performance data.

Top 4 Antminer Z15 Pro Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 BITMAIN

Domain Est. 2007

Website: bitmain.com

Key Highlights: Looking for crypto mining products? BITMAIN offers hardware and solutions, for blockchain and artificial intelligence (AI) applications. Order now!…

#2 ANTMINER Z15 Pro

Domain Est. 2007

Website: support.bitmain.com

Key Highlights: What’s new? Specifications >. Buying a Z15 Pro. How to purchase > · How to make payment > · Use Coupon for Your Order >….

#3 Firmware Download

Domain Est. 2007

Website: service.bitmain.com

Key Highlights: Firmware Download … Updates:. 1. Optimized firmware. Please make sure the miner type and firmware type are the same before upgrading the miner firmware….

#4 Antminer Z15 Pro in stock now

Domain Est. 2014

Expert Sourcing Insights for Antminer Z15 Pro

H2: 2026 Market Trends for Antminer Z15 Pro

By 2026, the market for the Antminer Z15 Pro—a specialized ASIC miner for Equihash-based cryptocurrencies like Zcash (ZEC)—is expected to be shaped by several converging technological, economic, and regulatory trends. While the Z15 Pro was released in 2019 and is no longer cutting-edge, its role in 2026 will largely depend on the health of Zcash and the broader privacy coin ecosystem, as well as energy and regulatory dynamics.

1. Declining Hashrate Competitiveness

By 2026, the Z15 Pro (with a hashrate of ~420 kSol/s and efficiency of ~158 J/kSol) will be significantly outperformed by newer-generation ASICs. Even if Bitmain or other manufacturers release updated Equihash miners, the Z15 Pro will likely operate at a substantial efficiency disadvantage. This means higher electricity costs per unit of mining revenue, pushing it out of profitability for most miners unless electricity is extremely cheap (<$0.04/kWh).

2. Zcash Network Dynamics and Halving Impact

Zcash underwent a major halving in late 2023 (block reward reduced from 3.125 to 1.5625 ZEC). By 2026, this reduced block reward will have persisted for over two years. Lower rewards mean reduced mining income, increasing pressure on less-efficient hardware like the Z15 Pro. Unless ZEC’s price appreciates significantly (e.g., above $200–$250), the Z15 Pro may only remain marginally profitable for low-cost operators or those using stranded energy.

3. Shift Toward GPU Mining and Algorithm Resilience

Equihash was initially designed to resist ASIC dominance and favor GPU mining. While ASICs like the Z15 Pro gained prominence, community debates over centralization persist. By 2026, Zcash or similar networks might consider algorithm adjustments or forks to re-level the playing field. If such a change occurs, the Z15 Pro could become obsolete overnight. Alternatively, if the network remains stable, ASICs will retain dominance—but profitability will still depend on ZEC’s market value.

4. Regulatory and Privacy Coin Scrutiny

Privacy coins, including Zcash, continue to face regulatory scrutiny in major markets like the U.S., EU, and South Korea. Increased KYC/AML enforcement and exchange delistings could suppress demand and liquidity for ZEC. A negative regulatory environment would likely depress ZEC’s price and hash rate, further reducing the economic viability of older miners like the Z15 Pro. Conversely, favorable rulings or growing adoption in privacy-focused regions could provide a boost.

5. Secondary Market and Niche Use Cases

By 2026, the Z15 Pro will primarily exist in the secondary market. Its value will be limited to:

– Hobbyist miners or educational use

– Operations in regions with surplus or subsidized electricity

– Backup mining during spikes in ZEC price or network difficulty drops

– Repurposing for smaller Equihash-based altcoins (if any gain traction)

Resale value is expected to remain low, typically below $100, reflecting its diminished utility and high power consumption relative to newer models.

6. Energy and ESG Pressures

Environmental, Social, and Governance (ESG) concerns will continue to influence cryptocurrency mining. In 2026, miners using older, less efficient hardware like the Z15 Pro may face reputational and operational challenges, especially in regions with carbon pricing or renewable energy mandates. This could accelerate retirement of such devices unless integrated into waste-heat recovery or off-grid solar/wind setups.

Conclusion:

By 2026, the Antminer Z15 Pro will be a legacy device operating on the fringes of profitability. Its market relevance will depend heavily on Zcash’s price performance, regulatory climate, and the absence of disruptive algorithm changes. While it may still function in niche, low-cost environments, it is unlikely to be a competitive or recommended mining solution in mainstream operations. New entrants or upgrades will almost certainly favor newer hardware or alternative mining ecosystems.

Common Pitfalls When Sourcing Antminer Z15 Pro: Quality and Intellectual Property Risks

Substandard or Refurbished Units Sold as New

One of the most frequent issues when sourcing Antminer Z15 Pro units is receiving devices that are not genuinely new or original. Some suppliers may sell refurbished, used, or even counterfeit units rebranded as new. These rigs often exhibit reduced hash rates, higher power consumption, and shorter lifespans. Buyers might not detect these flaws immediately, leading to long-term performance issues and lost mining revenue.

Lack of Manufacturer Warranty or Support

Purchasing from unauthorized resellers or gray-market vendors often means the unit does not come with a valid Bitmain warranty. Without official support, users face challenges in servicing hardware failures or obtaining firmware updates. This lack of post-purchase support increases downtime risk and total cost of ownership.

Counterfeit or Cloned Devices

The popularity of the Antminer Z15 Pro has led to the proliferation of counterfeit versions that mimic the original design but use inferior components. These clones may have fake serial numbers, altered firmware, or subpar ASIC chips, resulting in unstable performance and potential security vulnerabilities. Distinguishing genuine units from counterfeits often requires technical verification or direct purchase from trusted sources.

Intellectual Property (IP) and Firmware Tampering

Unauthorized sellers may modify the original firmware to include malicious code, mining pool redirects, or backdoors. Such tampering not only violates Bitmain’s intellectual property rights but also poses serious security risks to the buyer’s mining operation. These firmware alterations can lead to revenue loss, unauthorized access, or participation in cryptojacking schemes.

Resale of Stolen or Illegally Obtained Units

In some cases, Antminer Z15 Pro units available through unofficial channels may be stolen, blacklisted, or sourced from liquidated data centers without proper documentation. These units might be tied to previous owners or flagged in manufacturer databases, making them ineligible for support or future resale.

Inadequate Supply Chain Verification

Without proper due diligence, buyers may engage with intermediaries who lack transparency about the origin of their inventory. This increases exposure to IP infringement and supply chain fraud. Ensuring traceability from Bitmain-authorized distributors is critical to avoid legal and operational risks.

To mitigate these pitfalls, always purchase from authorized Bitmain partners, verify device authenticity through serial numbers and firmware checks, and insist on full warranty and documentation.

Logistics & Compliance Guide for Antminer Z15 Pro

Product Overview

The Antminer Z15 Pro is a high-performance ASIC miner designed for mining cryptocurrencies that utilize the Equihash algorithm, such as Zcash (ZEC). With a hash rate of approximately 500 H/s (solution/s) and power efficiency around 13.5 J/sol, it is engineered for efficient mining operations. Proper handling, transportation, and regulatory compliance are essential to ensure safe delivery and legal deployment.

Packaging & Handling

- Original Packaging: Always ship the Antminer Z15 Pro in its original factory box, which includes internal foam padding to protect sensitive components.

- Anti-Static Precautions: Handle the unit using ESD-safe practices. Avoid touching circuit boards directly.

- Orientation: Keep the unit upright during handling and transport to prevent internal component shifting.

- Environmental Conditions: Store and transport in dry, temperature-controlled environments (0°C to 40°C recommended). Avoid exposure to moisture, dust, or corrosive substances.

Shipping Requirements

- Carrier Selection: Use reputable freight carriers experienced in electronics logistics (e.g., DHL, FedEx, UPS for air; DSV, DB Schenker for sea/land).

- Labeling: Clearly mark packages as “Fragile,” “This Side Up,” and “Electronic Equipment.” Include return and destination addresses.

- Insurance: Insure shipments for full replacement value due to the high unit cost.

- Documentation: Include commercial invoice, packing list, and bill of lading/air waybill. Specify exact quantity, weight (approx. 6.5 kg per unit), and value.

Export & Import Compliance

- Export Classification: The Antminer Z15 Pro may be classified under HS Code 8471.80 (Automatic Data Processing Machines) or 8543.70 (Electrical Apparatus for Transmission/Transformation). Confirm with local customs authority.

- Export Controls: In the U.S., mining hardware may fall under EAR (Export Administration Regulations). Check if a license is required based on destination country (e.g., restricted destinations include Cuba, Iran, North Korea, Syria, and Crimea).

- Import Duties & Taxes: Import duties vary by country. Research local VAT, GST, or import tariffs (e.g., 0–20% depending on jurisdiction). Provide accurate product description and value to avoid delays.

- Restricted Jurisdictions: Do not ship to countries where cryptocurrency mining or ASIC equipment import is prohibited (e.g., Egypt, Algeria, Bangladesh—verify current laws).

Regulatory & Safety Standards

- CE / FCC Certification: The Antminer Z15 Pro typically complies with FCC Part 15 Class B and CE (EMC & RoHS) standards for electromagnetic compatibility and environmental safety. Confirm compliance markings on device.

- Power Supply: The unit requires a compatible DC power supply (typically 12V). Ensure power infrastructure at destination meets electrical safety standards (e.g., NEC in U.S., IEC in EU).

- Noise & Heat: Operate in well-ventilated areas; the device generates significant heat and noise (~75 dB). Follow local occupational safety regulations for industrial equipment.

End-User Compliance

- Cryptocurrency Regulations: Users must comply with local laws regarding cryptocurrency mining, reporting, and taxation. Some countries require registration (e.g., Canada, Germany).

- Energy Usage Disclosure: In regions with energy reporting requirements (e.g., EU, parts of U.S.), operators may need to report power consumption.

- E-Waste Disposal: At end-of-life, dispose of the unit according to local e-waste regulations (e.g., WEEE Directive in EU). Do not discard in regular trash.

Warranty & Support

- Manufacturer Warranty: Bitmain typically offers 180-day limited warranty covering defects in materials and workmanship. Retain proof of purchase and shipping documentation.

- Void Conditions: Warranty is voided by unauthorized modifications, improper power supply use, or physical damage during non-compliant handling.

- Support Channels: Contact Bitmain support via official portal for logistics or compliance-related inquiries. Provide serial number and purchase details.

Best Practices Summary

- Verify destination country regulations before shipping.

- Use insured, trackable freight with proper labeling.

- Maintain complete documentation for customs clearance.

- Ensure end-users operate within local legal frameworks.

- Follow environmental and safety guidelines for installation and disposal.

Conclusion for Sourcing Antminer Z15 Pro:

Sourcing the Bitmain Antminer Z15 Pro requires careful consideration due to its discontinued status and limited availability in the current market. As an older-generation miner optimized for Equihash-based cryptocurrencies like Zcash, the Z15 Pro offers moderate efficiency and hash rate performance by today’s standards. While it may still be viable for miners with access to low-cost electricity or for use in regions where newer models are difficult to obtain, its power inefficiency compared to modern ASICs can significantly impact long-term profitability.

When sourcing, prioritize reputable suppliers or certified resellers to avoid counterfeit or refurbished units sold as new. Conduct thorough due diligence on the seller’s history, request proof of working condition, and, if possible, perform a pre-purchase inspection. Additionally, consider total cost of ownership—including power consumption, maintenance, noise, and cooling—before making a bulk purchase.

In summary, while the Antminer Z15 Pro can serve as a short-term mining solution or for specific niche applications, it is not recommended for large-scale or future-focused mining operations. Upgrading to more energy-efficient models or exploring alternative investment avenues in the crypto space may offer better returns in the current competitive mining landscape.