The Bitcoin mining hardware market is experiencing robust expansion, driven by increasing cryptocurrency adoption and advancements in ASIC technology. According to Grand View Research, the global cryptocurrency mining market was valued at USD 7.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.2% from 2024 to 2030. A key contributor to this growth is the rising demand for high-efficiency mining rigs, particularly from manufacturers producing next-generation ASIC miners such as the Antminer X5. While Bitmain remains the dominant player in the space, a growing cohort of manufacturers is entering the ecosystem, leveraging improvements in chip design and thermal efficiency to compete on performance and energy consumption. Based on market trends, shipment data, and technological innovation, we examine the top five Antminer X5 manufacturers shaping the future of cryptocurrency mining.

Top 5 Antminer X5 Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Shop Bitmain Asic Miners

Domain Est. 2018

Website: cryptominerbros.com

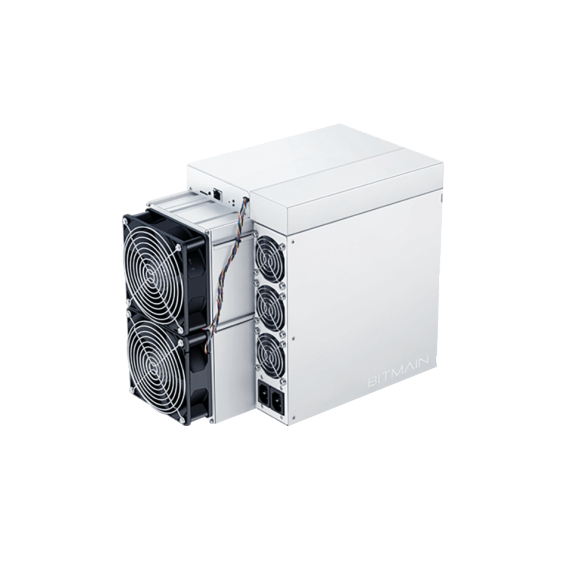

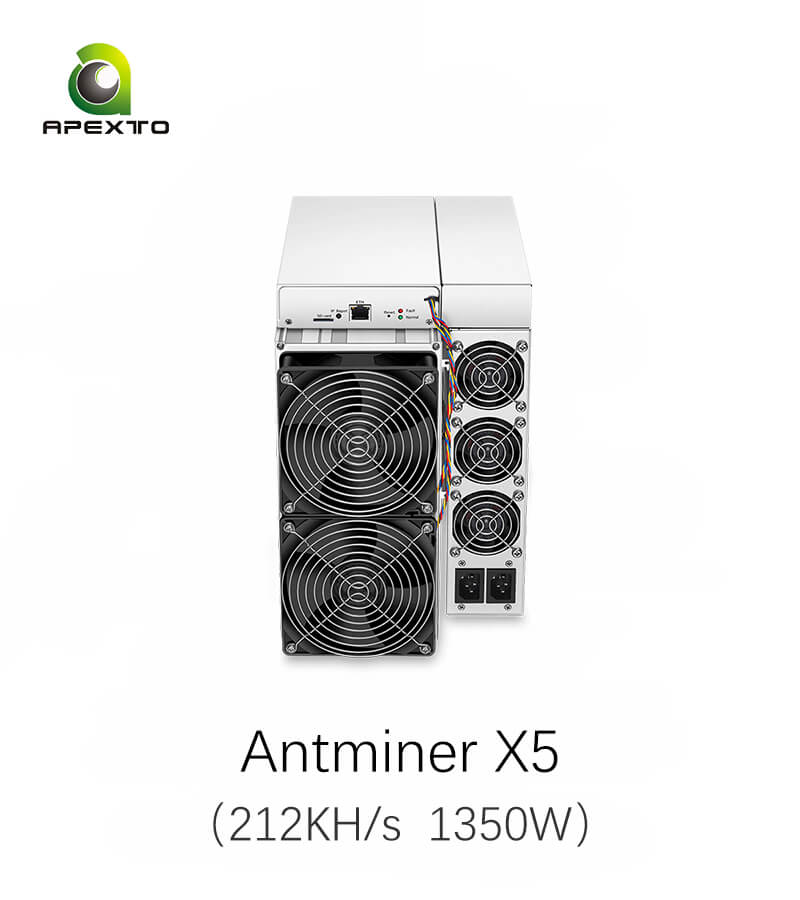

Key Highlights: Bitmain is recognized as a leading cryptocurrency mining device manufacturer serving more than 100 countries. … Antminer X5 Miner. Sold Out. Bitmain Antminer X5 ……

#2 BITMAIN

Domain Est. 2007

Website: bitmain.com

Key Highlights: Looking for crypto mining products? BITMAIN offers hardware and solutions, for blockchain and artificial intelligence (AI) applications. Order now!…

#3 BITMAIN

Domain Est. 2007

Website: m.bitmain.com

Key Highlights: XMR Miner X5. XMR RandomX. 212K 1350W 6.37J/K. Sold Out $2,999. Price/K $14.15. Home. About BITMAIN. News & Events · Careers. Customer Support. Hotline +1(717) ……

#4 BITMAIN Support

Domain Est. 2007

Website: support.bitmain.com

Key Highlights: ANTMINER. Announcement & FAQ. Product Manuals. Account & Ordering. Specifications & Instructions. Shipping & Customs Clearance. Operation & Maintenance ……

#5 Antminer X5 (XMR) 212k

Domain Est. 2014

Expert Sourcing Insights for Antminer X5

H2: 2026 Market Trends for the Antminer X5

As of 2026, the market outlook for the Antminer X5—a hypothetical ASIC miner presumably designed for a specific hashing algorithm such as SHA-256 or another proof-of-work (PoW) consensus mechanism—must be evaluated within the broader context of cryptocurrency mining dynamics, technological advancements, regulatory shifts, and energy economics.

-

Technological Obsolescence and Efficiency Pressures

By 2026, the Antminer X5, if launched in earlier years, is likely to face significant obsolescence due to rapid advancements in ASIC technology. Newer generations of miners (e.g., successors like the Antminer X7 or competitors from Bitmain, MicroBT, and others) are expected to offer substantially higher hash rates with improved energy efficiency (measured in joules per terahash). This renders older models less competitive in a mining environment where electricity costs and efficiency are primary profitability drivers. -

Mining Difficulty and Network Hash Rate

Bitcoin and other major PoW networks are projected to maintain or increase their mining difficulty through 2026, driven by global hash rate growth. As a result, less efficient hardware like the Antminer X5 may struggle to generate positive returns unless operated in regions with exceptionally low electricity costs (e.g., below $0.04/kWh). Most industrial-scale mining operations are likely to have phased out such hardware in favor of more powerful alternatives. -

Market Niche and Secondary Use Cases

While no longer viable for mainstream Bitcoin mining, the Antminer X5 may find niche applications: - Educational and Development Purposes: Used in academic settings or by hobbyists to understand ASIC operations.

- Alternative Cryptocurrencies: If programmable or adaptable, it could be repurposed for mining less competitive or emerging PoW coins, though profitability would remain limited.

-

Geothermal or Stranded Energy Projects: In remote locations with excess renewable energy, older miners can still contribute marginally to revenue without straining the grid.

-

Resale and Secondary Market Value

The secondary market for the Antminer X5 is expected to decline significantly by 2026. Prices will likely drop below 20–30% of original retail value, reflecting depreciation and reduced earning potential. Second-hand platforms may list units primarily for parts, refurbishment, or collectors. -

Regulatory and Environmental Factors

Global scrutiny on cryptocurrency mining’s environmental impact continues to grow. Jurisdictions with carbon regulations or mining restrictions may devalue older, less efficient equipment like the X5. Conversely, regions promoting green mining may incentivize upgrades, further accelerating the phase-out of energy-intensive legacy hardware. -

Manufacturer Support and Firmware Updates

By 2026, Bitmain or the manufacturer is likely to discontinue firmware updates and technical support for the X5. Lack of security patches and optimization updates increases vulnerability and reduces reliability, diminishing its appeal even for small-scale operators.

Conclusion

The Antminer X5 is projected to be largely obsolete in the 2026 mining landscape. While it may persist in limited, low-cost, or experimental settings, it will no longer be a competitive tool for profitable cryptocurrency mining. Investors and miners should consider upgrading to newer models or exploring alternative revenue streams such as cloud mining hosting or participation in newer blockchain ecosystems beyond PoW.

Common Pitfalls When Sourcing Antminer X5 (Quality, IP)

The Antminer X5, a cryptocurrency mining device focused on the Scrypt algorithm, is no longer in production and was never officially released by Bitmain in large quantities. As such, sourcing one—especially a functional or authentic unit—comes with significant risks. Below are key pitfalls related to quality and intellectual property (IP) concerns.

Quality Risks and Counterfeit Devices

One of the most pressing issues when sourcing an Antminer X5 is the high probability of receiving a counterfeit or non-functional unit. Since Bitmain discontinued the X5 early and never widely distributed it, most units available on secondary markets or third-party platforms are either fake, refurbished, or misrepresented.

- Counterfeit Hardware: Many sellers offer cloned or rebranded devices that mimic the X5’s appearance but use inferior components. These units often fail prematurely or deliver significantly lower hash rates than advertised.

- Used or Refurbished Units Sold as New: Some vendors market heavily used or previously damaged miners as “new in box,” leading to inflated expectations and early failures.

- Lack of Firmware Support: Genuine X5 units already face limited firmware updates and community support. Counterfeit versions may not be flashable or compatible with standard mining software, rendering them unusable.

- Overheating and Reliability Issues: Even authentic X5 models were known for thermal challenges. Poorly maintained or modified units exacerbate these problems, increasing the risk of sudden failure.

Intellectual Property and Legal Concerns

Sourcing an Antminer X5 also raises potential IP and legal issues, particularly with clones or modified versions.

- Unauthorized Clones and IP Infringement: Many devices sold as “Antminer X5” are produced without Bitmain’s authorization, violating trademarks and design patents. Purchasing such devices may inadvertently support IP theft, and in some jurisdictions, could expose buyers to legal scrutiny—especially if used commercially.

- Firmware and Software Licensing: Bitmain’s firmware is proprietary. Unauthorized modifications or redistribution of firmware on cloned hardware may breach software licenses, creating legal and operational risks.

- Import and Customs Issues: Customs authorities in various countries are increasingly vigilant about counterfeit electronics. Devices infringing on Bitmain’s IP may be seized, leading to financial loss and delays.

In summary, sourcing an Antminer X5 involves navigating a market rife with counterfeits and legal gray areas. Buyers should exercise extreme caution, verify seller authenticity, and consider the long-term viability and legality of acquiring such a niche and discontinued device.

Logistics & Compliance Guide for Antminer X5

Overview and Background

The Bitmain Antminer X5 is a high-performance ASIC miner designed for cryptocurrency mining, particularly optimized for algorithms like SHA-256. Due to its advanced technology, high power draw, and global regulatory scrutiny around cryptocurrency mining hardware, shipping and deploying the Antminer X5 requires strict adherence to logistics best practices and international compliance standards.

Export Regulations and Licensing

Exporting the Antminer X5 may be subject to restrictions under national and international trade control regimes. Key considerations include:

– Dual-Use Classification: Cryptocurrency mining hardware may be classified under dual-use export control lists (e.g., Wassenaar Arrangement), particularly if capable of high computational performance that could be repurposed.

– U.S. Export Administration Regulations (EAR): If components originate from the U.S. or use U.S.-controlled technology, an Export Control Classification Number (ECCN) must be assigned. The Antminer X5 may fall under ECCN 3A090 (electronic assemblies for data processing).

– Licensing Requirements: Export to embargoed countries (e.g., Iran, North Korea, Crimea) is prohibited. Check the U.S. Department of Commerce’s Commerce Control List (CCL) and obtain a license if required for restricted destinations.

Import Compliance by Region

Import regulations vary significantly by country. Key regions and their compliance considerations include:

– European Union: Requires CE marking compliance for electronic equipment. Importers must comply with the EU’s Waste Electrical and Electronic Equipment (WEEE) directive and provide proper documentation (commercial invoice, packing list, certificate of origin).

– United States: Subject to CBP (Customs and Border Protection) regulations. Duties may apply based on HTS code 8471.80 (other automatic data processing machines). FCC certification may be required for electromagnetic interference.

– China: Import of mining equipment may face restrictions due to the country’s cryptocurrency mining ban. Verify current PRC regulations through General Administration of Customs.

– Russia and CIS Countries: Requires EAC (Eurasian Conformity) marking. Customs may scrutinize shipments of mining hardware due to energy consumption concerns.

Shipping and Handling Requirements

Proper logistics handling ensures the Antminer X5 arrives undamaged and meets carrier requirements:

– Packaging: Use original manufacturer packaging with anti-static materials and shock-absorbing foam. Include desiccant packs to prevent moisture damage.

– Weight and Dimensions: Confirm shipping specifications (dimensions: approx. 195 x 290 x 365 mm, weight: ~10.5 kg per unit) for accurate freight classification.

– Carrier Restrictions: Notify carriers (e.g., DHL, FedEx, UPS) that the shipment contains high-value electronic equipment. Some carriers may require additional insurance or special handling.

– Temperature and Environment: Avoid extreme temperatures during transit. Store and ship in dry, ventilated environments to prevent condensation.

Power and Operational Compliance

The Antminer X5 consumes significant power (approx. 3,600W), requiring adherence to local electrical standards:

– Voltage Compatibility: Verify local voltage (110V vs. 220V) and use appropriate power supplies (e.g., APW3++, APW12).

– Electrical Safety Certifications: Ensure compliance with IEC/UL/CSA standards. Equipment must meet local electrical code requirements for commercial or industrial installations.

– Energy Regulations: Some jurisdictions (e.g., New York State) restrict high-energy-use mining operations. Check local energy board regulations before deployment.

Documentation Requirements

Complete and accurate documentation is critical for customs clearance:

– Commercial Invoice (with HS code, value, and detailed description)

– Packing List (item count, weight, dimensions)

– Bill of Lading or Air Waybill

– Certificate of Origin

– Export License (if applicable)

– FCC/CE/EAC Certification (if required by destination)

Environmental and Disposal Compliance

End-of-life handling of the Antminer X5 must comply with environmental regulations:

– E-Waste Regulations: Follow local e-waste disposal laws (e.g., EU WEEE, U.S. state-level regulations).

– Recycling Programs: Partner with certified e-waste recyclers to ensure responsible disposal of circuit boards and power components.

Risk Mitigation and Best Practices

- Insurance: Purchase all-risk cargo insurance covering loss, damage, and theft.

- Due Diligence: Screen end users to prevent diversion to embargoed regions or illegal operations.

- Regulatory Monitoring: Stay updated on evolving cryptocurrency and export control policies, as regulations frequently change.

Conclusion

Shipping and deploying the Antminer X5 requires careful coordination between logistics providers, customs brokers, and compliance officers. By adhering to export controls, import regulations, proper handling procedures, and environmental standards, organizations can ensure lawful and efficient global distribution of this high-performance mining hardware.

As of now, sourcing an Antminer X5 is not advisable due to several critical factors. The Antminer X5, originally designed for Ethereum mining using the DaggerHashimoto (Ethash) algorithm, was never officially released by Bitmain due to performance and efficiency issues. As a result, it never reached mass production, making genuine units extremely rare—if they exist at all.

Any Antminer X5 units currently available on the market are likely either prototypes, mislabeled equipment, or potentially fraudulent. Given the evolution of mining technology and the shift of Ethereum to proof-of-stake (The Merge in 2022), Ethash mining is no longer profitable or viable on a large scale.

Conclusion:

Sourcing an Antminer X5 is impractical and carries high risks, including purchasing counterfeit or non-functional hardware. Even if obtained, it would offer poor energy efficiency and negligible returns, especially in the current mining landscape. Instead, investors and miners should consider more reliable, modern, and ASIC-efficient alternatives for other proof-of-work cryptocurrencies (e.g., Bitcoin, Kaspa, or Monero, depending on algorithm compatibility).

Recommendation: Focus on currently supported, high-efficiency mining hardware from reputable suppliers, and conduct thorough due diligence before any purchase. Avoid chasing obsolete or unproven models like the Antminer X5.