The global body armor market is experiencing robust growth, driven by rising security concerns, increasing military modernization initiatives, and expanding law enforcement requirements. According to Grand View Research, the global body armor market size was valued at USD 3.08 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Similarly, Mordor Intelligence forecasts a CAGR of over 6.5% during the period 2024–2029, underpinned by technological advancements and greater demand for lightweight, high-performance protective gear. Within this landscape, anti-stab vests have emerged as a critical segment, particularly for corrections, private security, and public safety personnel operating in high-risk environments. As demand surges, a select group of manufacturers have distinguished themselves through innovation, compliance with international standards (such as NIJ and HOSDB), and scalable production capabilities. Below is a data-informed overview of the top 9 anti-stab vest manufacturers shaping the industry’s future.

Top 9 Anti Stab Vest Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Stab Proof Vest Manufacturer and Factory

Domain Est. 2022

Website: choweyarmor.com

Key Highlights: Chowey Armor is a manufacturer and factory of stab-proof vests. Their vests are resistant to knives, stabbing, and abrasion. They use a specialized process to ……

#2 Soft body armor vests

Domain Est. 1999

Website: dyneema.com

Key Highlights: We test according to international anti-stab standards – and the results show outstanding protection against multiangle threats that police officers face every ……

#3 Anti Stab/Trauma Plates

Domain Est. 2000

Website: zahal.org

Key Highlights: Israeli made bulletproof anti stab plates and trauma reducing plates – Best Quality, universal size, 25cmx30cm / 10″x12″ plates. Shipping Worldwide!…

#4 Ballistic body armor, Bullet proof vest, ballistic insets and plates

Domain Est. 2005

Website: marsarmor.com

Key Highlights: Our bullet-resistance and stab protective vests defeat all threat levels meeting the latest US, German and British body armor standards and are regularly ……

#5 Bullet Proof Concealable Body Armor

Domain Est. 2008

Website: safeguardclothing.com

Key Highlights: We’re a trusted supplier of ballistic helmets, ballistic panels, and bullet and stab proof vests at affordable prices for military operatives and civilians….

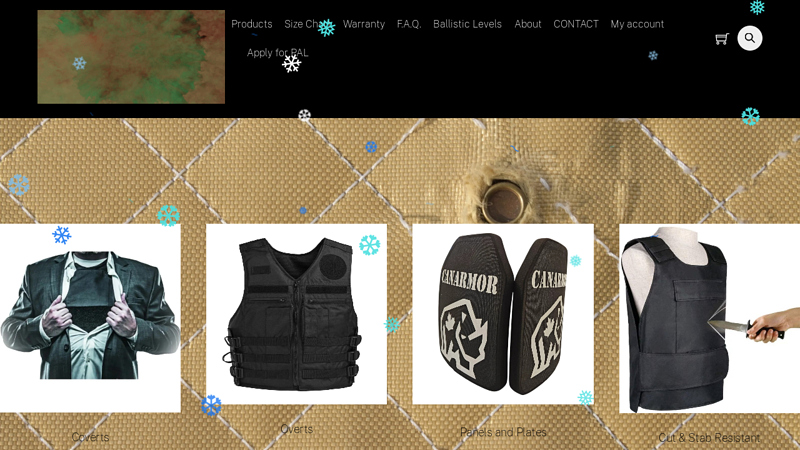

#6 CANARMOR

Domain Est. 2010

Website: canarmor.ca

Key Highlights: Products: Coverts, Overts, Plates & Panels, Cut & Stab Resistant Carriers, Helmets & Shields, Kits, Self Defense, K9 armour, Apparel, Accessories & Parts…

#7 Bulletproof Vests

Domain Est. 2020

Website: acelinkarmor.com

Key Highlights: Explore our range of Level 3A Bulletproof Vests, including concealable and stab-proof vest choices, all Body Armor proudly Manufactured in the USA….

#8 Stab proof vest

Domain Est. 2021

Website: protectiongroupdenmark.com

Key Highlights: Stab proof vest for guards, doormen, military, security personnel and police. High protection level NIJ IIIA. Low weight. Danish stab proof armor design….

#9 Stab Vests

Website: hardshell.ae

Key Highlights: Discover Hardshell FZE’s stab-proof and spike-proof vests—engineered for maximum safety, lightweight comfort, and reliable protection against edged threats….

Expert Sourcing Insights for Anti Stab Vest

H2 2026 Market Trends for Anti-Stab Vests

The anti-stab vest market is poised for significant evolution in H2 2026, driven by technological advancements, shifting security landscapes, and evolving regulatory demands. Key trends shaping the market include:

1. Heightened Demand from Law Enforcement & Corrections (Post-Policy Shifts)

- Mandated Wearing Policies: Increased adoption of mandatory anti-stab vest policies for frontline police officers, prison guards, and public transport security personnel across North America, Europe, and parts of Asia-Pacific, driven by recent high-profile attacks and union lobbying. This is a primary volume driver.

- Focus on Officer Safety & Retention: Departments are investing more in protective gear as part of broader strategies to improve officer safety, morale, and retention, recognizing the psychological impact of perceived vulnerability.

2. Technological Innovation Driving Performance & Comfort

- Next-Gen Materials: Wider commercialization of ultra-high-molecular-weight polyethylene (UHMWPE) and advanced aramid blends offering superior cut/stab resistance at significantly lower weight and bulk compared to traditional materials. Graphene-enhanced composites are moving from R&D to limited production.

- Multi-Threat Integration: Increased demand for combined anti-stab/anti-slash and low-level ballistic protection (e.g., NIJ 0115.00 Level 1 or specific threat standards) in a single, concealable carrier, especially for civilian security (bouncers, cash handlers) and tactical law enforcement.

- Enhanced Ergonomics & Climate Adaptation: Focus on improved breathability, moisture-wicking liners, and modular designs allowing for better fit, reduced heat stress (critical in warmer climates), and easier integration with body armor carriers and duty belts.

3. Expansion into Non-Traditional & Civilian Sectors

- Private Security & High-Risk Civilians: Growing adoption by security personnel in retail (especially in high-theft areas), healthcare (protecting staff from aggressive patients), and cash-in-transit. Increased personal concern is driving sales of discreet, lightweight vests for high-risk professionals (journalists, activists) and affluent individuals in volatile regions.

- Emerging Markets Growth: Significant market expansion expected in Latin America (e.g., Brazil, Mexico), Southeast Asia, and parts of Africa, fueled by rising crime rates, urbanization, and government initiatives to equip security forces, albeit with cost sensitivity influencing material choices.

4. Sustainability and Ethical Sourcing Gaining Traction

- Material Sourcing: Increased scrutiny on the environmental impact of synthetic fibers (UHMWPE, aramids) and demand for more sustainable production processes or recycled content options, though technical challenges remain significant.

- Durability & Lifecycle: Emphasis on longer product lifespans and repairability to reduce waste, driven by both cost considerations and corporate social responsibility (CSR) goals among large institutional buyers.

5. Supply Chain Resilience & Geopolitical Influences

- Diversification Efforts: Manufacturers are actively diversifying supply chains away from single-source dependencies (e.g., concerns over specific regional stability or trade policies) for critical raw materials like aramid fibers.

- Regional Manufacturing Hubs: Growth in manufacturing capacity within key demand regions (e.g., Southeast Asia for APAC, Eastern Europe for EU) to reduce lead times and mitigate geopolitical risks.

6. Regulatory Harmonization & Testing Evolution

- Global Standard Alignment: Continued efforts, though slow, towards harmonizing testing standards (e.g., UK Home Office, NIJ, VPAM) to facilitate international trade and reduce compliance complexity for multinational suppliers.

- Focus on Real-World Threats: Updating testing protocols to better reflect contemporary attack methods, including threats from improvised weapons and the effectiveness of vests against edged tools used in slashing attacks.

Conclusion for H2 2026:

The anti-stab vest market in the second half of 2026 will be characterized by strong volume growth driven by institutional mandates, significant technological advancements focused on lighter weight and multi-threat protection, and expanding market penetration into civilian and emerging economy sectors. Success will depend on manufacturers’ ability to innovate in materials and design, navigate complex supply chains, and meet the dual demands of enhanced performance and increasing sustainability expectations. The market is moving beyond basic protection towards smarter, more comfortable, and integrated personal safety solutions.

Common Pitfalls When Sourcing Anti-Stab Vests (Quality and Intellectual Property)

Sourcing anti-stab vests requires careful attention to both product quality and intellectual property (IP) considerations. Overlooking these aspects can lead to ineffective protection, legal risks, and reputational damage. Below are key pitfalls to avoid:

Inadequate Quality Standards and Testing Verification

One of the most significant risks is sourcing vests that do not meet recognized safety standards. Some suppliers may claim compliance with standards such as the UK Home Office Scientific Development Branch (HOSDB) or the US NIJ (National Institute of Justice), but fail to provide verifiable test reports from accredited third-party laboratories. Relying solely on supplier claims without independent certification can result in vests that offer insufficient protection in real-world scenarios.

Use of Substandard or Unverified Materials

Anti-stab vests depend heavily on advanced materials like ultra-high-molecular-weight polyethylene (UHMWPE) or laminated fabrics. Sourcing from manufacturers who cut costs by using inferior or untested materials compromises the vest’s performance. Without proper material traceability and quality control, the product may degrade quickly or fail under stress.

Lack of Batch-to-Batch Consistency

Even if a sample vest passes testing, inconsistent manufacturing processes can lead to variations in protection levels across production batches. Without robust quality assurance systems and regular batch testing, buyers risk receiving vests with unpredictable performance, undermining user safety.

Misrepresentation of Protection Levels

Some suppliers may exaggerate the protection level of their vests, claiming resistance to higher threat levels (e.g., spike and knife) without adequate testing. This mislabeling can mislead procurement teams into believing they are purchasing higher-grade protection than is actually provided.

Ignoring Ergonomics and Long-Term Usability

A vest may meet technical standards but fail in practical use due to poor design—excessive weight, lack of breathability, or restricted mobility. These factors affect wearer compliance and comfort, especially during extended shifts, potentially leading to vests being discarded or worn improperly.

Overlooking After-Sales Support and Warranty

Sourcing from vendors without a clear warranty, repair, or replacement policy can lead to long-term liabilities. Anti-stab vests degrade over time and after impacts; without proper maintenance guidance and support, organizations may unknowingly deploy compromised equipment.

Intellectual Property Infringement Risks

Purchasing vests that copy patented designs, trademarks, or proprietary technologies can expose buyers to legal action. Some manufacturers replicate leading brands’ designs without licensing, leading to potential IP violations. Sourcing without due diligence on the manufacturer’s IP rights—such as registered trademarks, patents, or design rights—can result in seizure of goods, fines, or reputational harm.

Failure to Verify Manufacturer Authenticity

Counterfeit or unauthorized production is a growing issue in personal protective equipment. Buyers may inadvertently source from factories producing “knock-off” versions of branded vests. Without auditing the manufacturer’s credentials and production legitimacy, organizations risk acquiring illegal or subpar products.

Inadequate Documentation and Traceability

Proper sourcing requires full traceability—from raw materials to final product—along with clear documentation of compliance, testing, and IP ownership. Lack of transparent records makes it difficult to verify authenticity, respond to incidents, or defend against legal challenges.

Conclusion

To avoid these pitfalls, buyers should conduct thorough due diligence, including third-party testing, factory audits, IP verification, and ongoing quality monitoring. Partnering with reputable, transparent suppliers and demanding certified documentation ensures both user safety and legal compliance.

Logistics & Compliance Guide for Anti-Stab Vests

Regulatory Compliance

Country-Specific Certification Requirements

Anti-stab vests must meet specific national or international standards to be legally sold, imported, or used. Common certification standards include:

– United Kingdom: Home Office Counter Terrorism (CT) Security Accreditation Scheme (TS 81/84 or CT-0014)

– United States: National Institute of Justice (NIJ) Standard 0115.00 for Stab Resistance

– European Union: EN 1621-1 (Body protectors for motorcyclists – Part 1: Test methods and performance requirements for limb protectors) and CE marking under PPE Regulation (EU) 2016/425

– Australia/New Zealand: AS/NZS 2359.1:2017

Always verify the required certification for the destination country before shipping.

Import and Export Controls

- Export Restrictions: Some countries regulate the export of protective gear under dual-use or security item classifications. Check with the exporting country’s trade authority (e.g., BIS in the U.S.).

- Import Permits: Recipient countries may require import licenses, especially if vests are classified as controlled or strategic goods.

- Customs Documentation: Provide detailed product descriptions, HS (Harmonized System) codes (e.g., 6213.90 for protective apparel), certificates of conformity, and commercial invoices.

Product Classification and Labeling

Harmonized System (HS) Code

Use accurate HS codes for customs clearance. Common classifications:

– 6213.90: Other made-up clothing accessories, including ballistic or stab-resistant garments

– 8306.30: Articles of apparel incorporating metal for protection

Confirm the correct code with local customs authorities to avoid delays.

Product Labeling Requirements

- Include certification standard met (e.g., “Complies with NIJ 0115.00”)

- Manufacturer name and address

- Size, care instructions, and material composition

- CE mark (if applicable) with notified body number

- Warning labels (e.g., “Not bullet-resistant” if applicable)

Packaging and Handling

Protective Packaging

- Use rigid, tamper-evident packaging to prevent damage during transit.

- Include moisture-resistant liners if transporting to humid climates.

- Clearly label packages as “Fragile” and “Protect from Moisture.”

Handling Instructions

- Label shipments with “This Way Up” and “Do Not Stack” if applicable.

- Avoid extreme temperatures during storage and transport, as adhesives and materials may degrade.

Transportation and Storage

Domestic and International Shipping

- Use reputable carriers familiar with regulated goods.

- For air freight, comply with IATA Dangerous Goods Regulations if composite materials contain restricted substances (rare but possible).

- Maintain a chain of custody for law enforcement or government orders.

Storage Conditions

- Store in a cool, dry place away from direct sunlight.

- Avoid compression or folding to maintain structural integrity.

- Ideal conditions: 15–25°C (59–77°F), relative humidity below 60%.

End-User Verification and Recordkeeping

Know Your Customer (KYC)

- Verify end-user legitimacy, especially for government, law enforcement, or security firms.

- Maintain records of buyer credentials to comply with anti-terrorism and export control regulations.

Documentation Retention

Keep copies of:

– Certificates of compliance

– Export licenses (if required)

– Commercial invoices and shipping records

– End-user declarations

Retention period typically 3–5 years, depending on jurisdiction.

Disposal and End-of-Life

Decommissioning Guidelines

- Anti-stab vests should not be resold or reused after expiration (typically 5 years from manufacture).

- Cut and mark as decommissioned to prevent unauthorized use.

Environmental Disposal

- Follow local waste regulations; vests may contain non-recyclable composites.

- Partner with certified e-waste or protective gear disposal services when available.

Compliance Monitoring and Audits

Internal Audits

- Conduct periodic reviews of documentation, certifications, and shipping practices.

- Train staff on export controls and product regulations.

Regulatory Updates

- Monitor changes in standards (e.g., updates to NIJ or EN norms).

- Subscribe to alerts from trade associations or regulatory bodies (e.g., U.S. Census Bureau, EU Access2Markets).

By adhering to this guide, organizations can ensure legal compliance, operational efficiency, and safety throughout the lifecycle of anti-stab vests.

Conclusion for Sourcing Anti-Stab Vests

In conclusion, sourcing anti-stab vests requires a comprehensive approach that balances quality, compliance, cost, and supplier reliability. It is essential to procure vests that meet internationally recognized safety standards—such as the UK Home Office Scientific Development Branch (HOSDB) or the NIJ standards—to ensure effective protection for end-users in high-risk environments. Careful evaluation of materials, design, comfort, and durability is crucial to guarantee both safety and wearability over extended periods.

Additionally, conducting thorough due diligence on suppliers—including assessing certifications, production capabilities, and track records—helps mitigate risks related to counterfeit or substandard products. Building strong partnerships with reputable manufacturers and maintaining clear communication throughout the procurement process can enhance supply chain resilience and lead to long-term operational efficiency.

Ultimately, investing in high-quality, properly tested anti-stab vests not only protects personnel but also reinforces organizational commitment to safety, compliance, and duty of care. A strategic sourcing approach ensures that protective equipment meets operational demands while delivering value for money and peace of mind.