The global aluminum market continues to expand, driven by rising demand for lightweight, corrosion-resistant materials across automotive, aerospace, electronics, and construction sectors. According to Grand View Research, the global aluminum market size was valued at USD 193.4 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2030. A key driver within this expansion is the increasing adoption of anodized aluminum, which offers enhanced durability, aesthetic flexibility, and environmental resistance compared to bare aluminum. Mordor Intelligence projects the anodizing services market will grow at a CAGR of over 5.2% during the same period, underpinned by advancements in surface treatment technologies and heightened regulatory focus on material longevity and sustainability. As demand surges, manufacturers are differentiating themselves through process innovation, scale, and material specialization. This analysis evaluates the top eight anodized aluminum versus aluminum manufacturers, leveraging production capacity, technological capabilities, geographic reach, and market presence to identify leaders shaping the future of high-performance aluminum solutions.

Top 8 Anodized Aluminum Vs Aluminum Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Anodized Aluminum vs Painted Aluminum: Important Attributes

Domain Est. 1996

Website: lorin.com

Key Highlights: Learn about many of the important attributes that make anodized aluminum a more viable opiton than the painted aluminum alternative….

#2 Aluminum Anodizers Council

Domain Est. 1998

Website: anodizing.org

Key Highlights: Anodizing is an electrochemical process that converts the metal surface into a decorative, durable, corrosion-resistant, anodic oxide finish….

#3 Industry Standards

Domain Est. 1998

Website: aluminum.org

Key Highlights: For 70 years, the Aluminum Association has worked with the industry to develop and maintain technical standards for aluminum production….

#4 When to Choose Anodized vs. Painted Aluminum

Domain Est. 1998

Website: chemresearchco.com

Key Highlights: We compared the advantages of anodized vs. painted aluminum so you can decide which finish works best for your application….

#5 How Aluminum Metal Is Anodized

Domain Est. 1999

Website: monroeengineering.com

Key Highlights: The main benefit of anodized aluminum is greater protection from corrosion. Aluminum, whether anodized or not, isn’t susceptible to rust. Even ……

#6 Anodized vs. Non

Domain Est. 2001

Website: tri-stateal.com

Key Highlights: Anodized aluminum is less reactive, easier to dye, and offers exceptional corrosion resistance….

#7 Exploring Aluminum vs Anodized Aluminum

Domain Est. 2024

Website: premiumalu.com

Key Highlights: Yes, anodized aluminum generally offers superior properties compared to raw aluminum. The anodizing process creates a thicker, more robust protective oxide ……

#8 Guide on Anodized Aluminum Colors

Domain Est. 1996

Website: lightmetalscoloring.com

Key Highlights: Anodized aluminum is widely valued for its durability, color stability, and ability to enhance both appearance and performance….

Expert Sourcing Insights for Anodized Aluminum Vs Aluminum

H2: Market Trends for Anodized Aluminum vs. Aluminum in 2026

As global industries continue to prioritize durability, sustainability, and aesthetic innovation, the competition between standard aluminum and anodized aluminum is expected to intensify by 2026. While both materials share a common base, their applications, performance, and market demand are diverging due to technological advancements and shifting consumer preferences. This analysis explores key market trends shaping the future landscape of anodized aluminum versus untreated aluminum.

1. Rising Demand for Anodized Aluminum in High-Performance Industries

By 2026, anodized aluminum is projected to gain significant market share in sectors such as automotive, aerospace, consumer electronics, and architecture. The enhanced corrosion resistance, improved surface hardness (up to 60 Rockwell hardness), and ability to retain color and finish make anodized aluminum increasingly favorable. In electric vehicles (EVs), anodized components are being adopted for battery enclosures and structural trims due to their lightweight properties and resistance to environmental stress.

2. Sustainability and Regulatory Pressures Favoring Anodized Aluminum

Environmental regulations across North America and Europe are pushing manufacturers to adopt eco-friendly surface treatments. The anodizing process, which uses electrolytic passivation with minimal VOC emissions and recyclable byproducts, aligns with green manufacturing standards. In contrast, alternative coatings like powder coating or paint may involve higher carbon footprints. By 2026, compliance with sustainability benchmarks is expected to increase the adoption of anodized aluminum, especially in green building certifications (e.g., LEED).

3. Cost Considerations Maintaining Aluminum’s Dominance in Mass Applications

Despite its advantages, anodized aluminum remains more expensive due to additional processing steps. Standard aluminum continues to dominate cost-sensitive markets such as packaging, basic construction, and commodity goods. In emerging economies, where price sensitivity is high, untreated aluminum is projected to maintain a larger market share. Innovations in roll-forming and extrusion technologies are also helping to reduce the cost gap, but not enough to displace untreated aluminum in high-volume, low-margin applications.

4. Aesthetic and Customization Trends Driving Anodized Aluminum Growth

The consumer preference for premium finishes in electronics, appliances, and architectural facades is fueling demand for anodized aluminum. By 2026, advancements in two-step and hardcoat anodizing allow for deeper color integration, matte finishes, and improved UV resistance. Brands in the tech sector (e.g., smartphones, laptops) are increasingly using anodized aluminum to convey durability and sophistication, further elevating its market value.

5. Regional Market Dynamics

Asia-Pacific, particularly China and India, will remain the largest consumer of both aluminum and anodized aluminum due to rapid urbanization and industrialization. However, North America and Western Europe are expected to see faster growth in anodized aluminum demand, driven by high-end construction and EV manufacturing. Localized anodizing facilities and shorter supply chains are also enhancing regional production efficiency.

6. Technological Innovations and Market Consolidation

By 2026, integration of Industry 4.0 technologies—such as automated anodizing lines and real-time quality monitoring—is expected to improve yield and reduce waste in anodized aluminum production. Additionally, consolidation among aluminum fabricators and surface treatment providers may lead to vertically integrated supply chains, favoring producers who offer both base aluminum and value-added anodizing services.

Conclusion

While standard aluminum will remain essential for bulk and cost-driven applications, anodized aluminum is poised for accelerated growth in premium and performance-critical sectors by 2026. The material’s superior durability, eco-compatibility, and aesthetic versatility position it as a strategic choice for future-facing industries. Market players must balance cost efficiency with value-added processing to capitalize on this evolving dichotomy.

Common Pitfalls Sourcing Anodized Aluminum vs. Aluminum (Quality, IP)

When sourcing aluminum components, selecting between raw aluminum and anodized aluminum involves important trade-offs in quality, performance, and intellectual property (IP) considerations. Misunderstanding these differences can lead to significant issues in product performance, compliance, and legal risks. Below are key pitfalls to avoid.

Quality-Related Pitfalls

Inconsistent Anodizing Thickness and Durability

One of the most frequent quality issues when sourcing anodized aluminum is inconsistent coating thickness. Suppliers may cut corners by applying thinner anodized layers to save time and cost. This results in reduced corrosion resistance, wear performance, and overall durability. Without strict quality control and adherence to standards (e.g., MIL-A-8625, ISO 7599), the anodized layer may fail prematurely in demanding environments.

Poor Color and Finish Uniformity

Anodized aluminum is often chosen for aesthetic reasons, but poor process control can lead to color variation, streaking, or uneven finishes—especially across large batches or multiple production runs. This is particularly problematic for consumer-facing products where visual consistency is critical. Sourcing from suppliers without robust process validation increases the risk of non-conforming appearances.

Substandard Base Aluminum Material

The quality of the underlying aluminum alloy significantly affects the final anodized product. Using low-grade or inconsistent aluminum (e.g., improper alloy composition or impurities) can cause pitting, poor adhesion, or uneven anodizing. Some suppliers may substitute cheaper alloys without notice, undermining performance and appearance. Always specify the alloy (e.g., 6061-T6) and verify material certifications.

Inadequate Sealing or Post-Treatment

After anodizing, proper sealing is essential to close the porous oxide layer and enhance corrosion resistance. Skipping or poorly executing this step leaves the surface vulnerable to staining and environmental degradation. Suppliers in regions with lax quality oversight may omit or rush sealing processes, leading to premature failure in humid or corrosive conditions.

IP-Related Pitfalls

Unauthorized Replication of Anodized Finishes

Anodized finishes—particularly unique colors, textures, or two-tone effects—can be integral to a product’s design and brand identity. However, these finishes may not be protected by patents or trademarks, making them easy to copy. Sourcing from unvetted suppliers, especially in regions with weak IP enforcement, increases the risk of design theft and counterfeit components entering the market.

Lack of Process Confidentiality and Trade Secret Exposure

The anodizing process parameters (e.g., voltage, temperature, electrolyte composition) can constitute valuable trade secrets. When working with third-party anodizers, especially offshore, there’s a risk these proprietary methods are exposed or reused for competing products. Without strong NDAs and controlled documentation, your competitive advantage may be compromised.

Ambiguous Ownership of Custom Tooling and Fixtures

Custom jigs or masking tools used in anodizing are often required to achieve complex finishes. If IP ownership of these tools isn’t clearly defined in supplier contracts, the supplier may retain rights or reuse them for other clients. This can lead to unauthorized replication of your design or increased costs when switching vendors.

Compliance and Certification Gaps

Anodized aluminum used in regulated industries (e.g., aerospace, medical devices) must meet specific performance and testing standards. Sourcing from non-certified suppliers may result in components that fail audits or do not meet required IP (Ingress Protection) ratings—especially if the anodized layer’s integrity affects environmental sealing. Always verify supplier certifications and test reports relevant to your application.

Best Practices to Avoid Pitfalls

- Specify exact anodizing standards, alloy grades, and finish requirements in procurement contracts.

- Audit suppliers for quality systems (e.g., ISO 9001) and request batch-specific test reports.

- Protect design IP through design patents, trademarks, and robust supplier NDAs.

- Clearly define ownership of custom tooling and process documentation.

- Conduct pre-production samples and ongoing quality checks to ensure consistency.

By addressing these common pitfalls proactively, buyers can ensure they source aluminum and anodized aluminum components that meet both performance expectations and IP protection needs.

Logistics & Compliance Guide: Anodized Aluminum vs. Aluminum

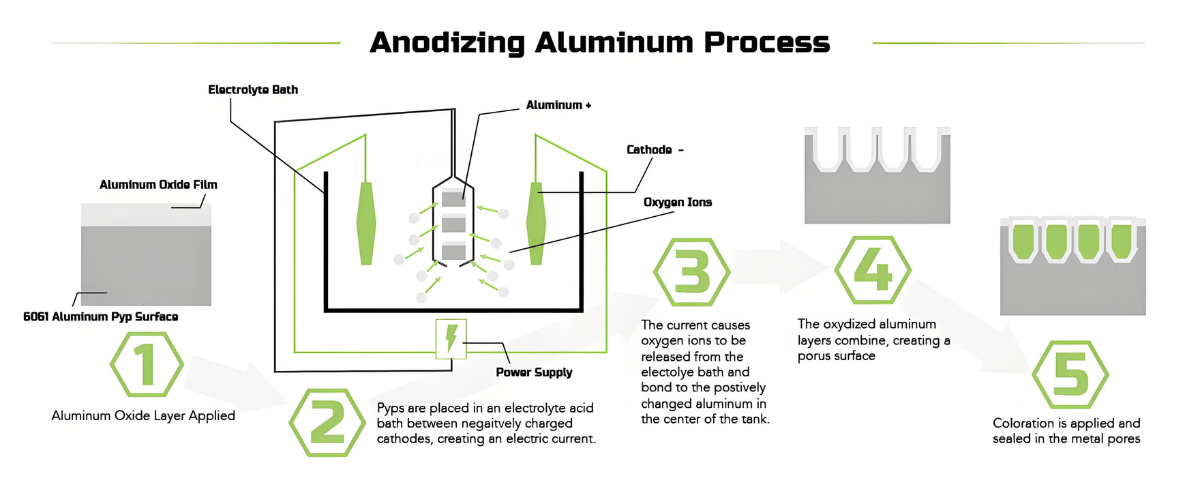

Overview of Material Differences

Anodized aluminum and standard aluminum differ fundamentally in surface treatment and performance characteristics. Standard aluminum refers to the base metal in its natural or mechanically finished state, while anodized aluminum undergoes an electrochemical process that thickens the naturally occurring oxide layer. This treatment enhances corrosion resistance, surface hardness, and aesthetic options. These differences impact logistics, handling, regulatory compliance, and environmental considerations throughout the supply chain.

Regulatory Compliance Considerations

Both materials are generally compliant with major international regulations, but key distinctions exist. Standard aluminum is widely accepted under REACH, RoHS, and other global material safety directives due to its inert nature. Anodized aluminum may involve process chemicals—such as sulfuric, chromic, or organic acids—during anodization. Facilities using chromic acid anodizing (less common today) must comply with stricter environmental and worker safety regulations due to hexavalent chromium, a known carcinogen regulated under OSHA, EU REACH Annex XVII, and Proposition 65. Sulfuric acid anodizing is more common and less regulated, but wastewater treatment and disposal of spent electrolytes must still comply with local environmental laws (e.g., EPA in the U.S., EEA in Europe).

Transportation and Handling Requirements

Standard aluminum is lightweight and corrosion-resistant under normal conditions but can be prone to surface oxidation and scratching during transit. It typically requires minimal protective packaging unless used in precision applications. Anodized aluminum, while more durable, is sensitive to alkaline and acidic environments, abrasive contact, and prolonged exposure to salt spray if seals are compromised. During transportation, anodized parts should be segregated from corrosive chemicals and protected with non-abrasive wrapping (e.g., VCI paper or plastic film). Both materials are non-hazardous for transport under IATA, IMDG, and ADR regulations, but finished anodized components with dyes may require documentation if colorants contain regulated substances.

Storage Conditions and Shelf Life

Standard aluminum should be stored in dry, well-ventilated areas to prevent white oxide formation and galvanic corrosion when in contact with dissimilar metals. It has an indefinite shelf life under proper conditions. Anodized aluminum requires similar dry storage but benefits from controlled humidity (ideally <60%) to preserve seal integrity. Exposure to alkaline cleaning agents or prolonged UV light may degrade colored anodized finishes. Unsealed anodized parts are more porous and susceptible to staining; they should be used promptly or stored in sealed, climate-controlled environments. Labeling should clearly distinguish anodized from raw aluminum to prevent incorrect handling.

Environmental and Sustainability Compliance

Aluminum is highly recyclable, with both forms maintaining recyclability without downgrading. Recycling processes recover over 90% of the original metal content, supporting circular economy goals under frameworks like ISO 14001 and EU Green Deal. Anodizing is an eco-friendly surface treatment in its sulfuric acid form, producing inert aluminum oxide. Waste sludge from anodizing lines must be treated as industrial waste, especially if heavy metals are present. Facilities must adhere to local discharge permits and waste management standards. Cradle-to-gate life cycle assessments (LCAs) often favor anodized aluminum due to extended product life and reduced maintenance, but auditable documentation is needed to support environmental claims in ESG reporting.

Certifications and Documentation Requirements

Suppliers of both materials should provide Material Safety Data Sheets (MSDS/SDS), mill test certificates (e.g., EN 10204 3.1), and RoHS/REACH compliance statements. For anodized aluminum, additional documentation may include anodizing process specifications (e.g., MIL-A-8625, ISO 7599), coating thickness reports, and salt spray test results. Industries such as aerospace, medical, and food processing may require certified anodizing facility audits (e.g., NADCAP). Traceability from raw material to finished product is essential for compliance with AS9100, ISO 9001, and FDA 21 CFR regulations, particularly when used in regulated applications.

Conclusion: Sourcing Anodized Aluminum vs. Raw Aluminum

When deciding between sourcing anodized aluminum and raw aluminum, the choice ultimately depends on the specific application, performance requirements, and cost considerations.

Anodized aluminum offers superior corrosion resistance, increased surface hardness, enhanced durability, and aesthetic versatility due to its ability to be dyed in various colors. It is ideal for applications exposed to harsh environments, such as outdoor architecture, automotive components, consumer electronics, and aerospace parts. The anodized layer is integral to the metal, making it more durable than paint or coatings, and it requires minimal maintenance over time.

On the other hand, raw aluminum is more cost-effective upfront and easier to fabricate, machine, and weld without requiring additional surface treatment. It is suitable for applications where appearance and corrosion resistance are less critical, or when post-fabrication finishing will be handled separately.

In summary, if long-term durability, appearance, and performance in challenging environments are priorities, sourcing anodized aluminum is a worthwhile investment despite the higher initial cost. However, for cost-sensitive or internally used components where finishing can be managed in-house or is unnecessary, raw aluminum may be the more practical choice. Evaluating lifecycle costs, maintenance needs, and end-use conditions will guide the optimal material selection.