The global market for high-performance titanium alloys, including those serving as alternatives to AMS4914, is experiencing robust growth, driven by increasing demand from aerospace, defense, and medical sectors. According to Grand View Research, the global titanium alloys market was valued at USD 7.8 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 6.4% through 2030. This growth is fueled by the need for materials offering superior strength-to-density ratios, corrosion resistance, and performance at elevated temperatures—attributes central to AMS4914 and its viable substitutes. As supply chain resilience and cost-efficiency become critical, manufacturers are seeking qualified alternative sources and chemistries that meet or exceed AMS specifications. Based on technical compliance, production capability, and market presence, the following four manufacturers have emerged as leading providers of AMS4914 alternative alloys, offering certified, high-reliability solutions to meet rising global demand.

Top 4 Ams4914 Alternative Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 AMS4914 : TITANIUM ALLOY SHEET AND STRIP 15V

Domain Est. 1995

Website: sae.org

Key Highlights: 30-day returnsThis specification covers a titanium alloy in the form of sheet and strip….

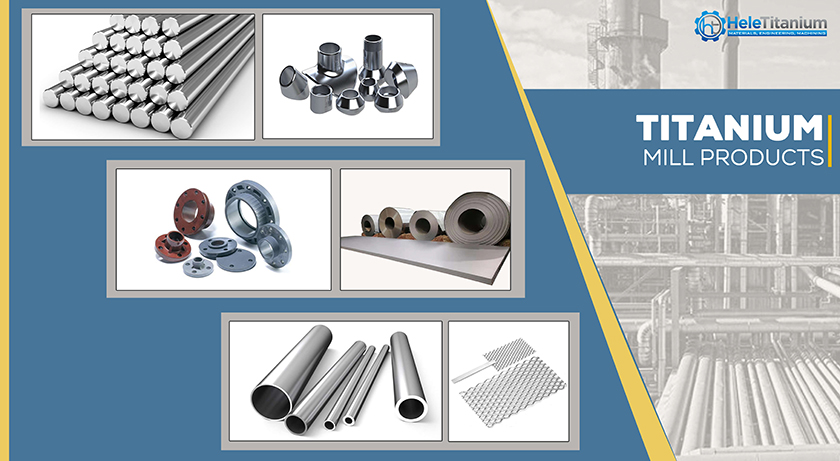

#2 Titanium Mill Products for Aerospace and Medical

Domain Est. 1998

Website: tricormetals.com

Key Highlights: AMS 4914, Cold Rolled Sheet and Strip, 15V – 3AL – 3Cr – 3Sn Solution … Titanium Grade 12 – Alternative Alloy for Cost Reduction & Corrosion Resistance ……

#3 Grátis: AWS B2 1

Domain Est. 2011

Website: passeidireto.com

Key Highlights: Rating 5.0 (1) Feb 10, 2021 · Veja grátis o arquivo AWS B2 1-B2 1M-2014 Specification for Welding Procedure and Performance Qualification enviado para a disciplina de ……

#4 MMPDS

Domain Est. 2018

Website: pdfcoffee.com

Key Highlights: This document contains design information on the strength properties of metallic materials and elements for aircraft and aerospace vehicle structures….

Expert Sourcing Insights for Ams4914 Alternative

H2: 2026 Market Trends for AMS4914 Alternatives

The global demand for high-performance titanium alloys, particularly those used in aerospace, defense, and medical applications, continues to evolve. AMS4914, a specification for Ti-6Al-4V (Grade 5) titanium alloy in the form of bars, forgings, and rings, has long been a cornerstone material due to its excellent strength-to-density ratio, corrosion resistance, and performance at elevated temperatures. However, by 2026, increasing cost pressures, supply chain volatility, and the push for sustainable and lightweight materials are accelerating the adoption of AMS4914 alternatives. This analysis outlines key market trends shaping the landscape for these alternatives in 2026.

1. Rising Demand for Cost-Effective Substitutes

One of the dominant trends in 2026 is the growing preference for lower-cost alternatives to AMS4914, particularly in commercial aerospace and industrial sectors. The high cost of processing Ti-6Al-4V—driven by energy-intensive melting and forging procedures—has prompted manufacturers to explore materials such as Ti-5Al-2.5Sn (AMS4912), Ti-6Al-2Sn-4Zr-2Mo (AMS4917), and near-alpha or beta titanium alloys that offer comparable performance at reduced cost. Additionally, new process innovations like additive manufacturing (AM) are enabling the use of alternative titanium powders with optimized chemistries, lowering material waste and production costs.

2. Expansion of Additive Manufacturing Driving Material Innovation

Additive manufacturing has matured significantly by 2026, becoming a mainstream production method in aerospace and medical device manufacturing. This shift has catalyzed the development of AMS4914 alternatives specifically engineered for AM processes. Alloys such as Ti-6Al-4V ELI (Extra Low Interstitial), Ti-6.5Al-3.5Mo-1.5Zr-0.3Si, and newly developed high-deposition-rate titanium powders are gaining traction. These materials offer enhanced printability, reduced residual stress, and improved fatigue performance—making them viable replacements for traditionally forged AMS4914 components, especially in complex geometries.

3. Sustainability and Supply Chain Resilience

Environmental regulations and ESG (Environmental, Social, and Governance) mandates are pushing aerospace OEMs to reduce the carbon footprint of material production. By 2026, there is increased scrutiny on the sustainability of titanium sourcing and processing. This has led to growing interest in alternative titanium alloys produced using hydrogen-assisted processing, recycled titanium feedstock, or low-carbon smelting methods. Furthermore, geopolitical tensions and supply chain disruptions have incentivized regional sourcing and the development of domestically produced alternatives to reduce reliance on traditional titanium suppliers.

4. Performance-Enhanced Alloys for Next-Gen Applications

The aerospace and defense industries are adopting next-generation platforms—such as hypersonic vehicles, advanced UAVs, and high-efficiency jet engines—that require materials capable of withstanding higher temperatures and mechanical loads. In response, alternatives to AMS4914 with improved creep resistance, thermal stability, and oxidation resistance are gaining market share. Examples include Ti-Al-Nb-based orthorhombic alloys and metastable beta titanium alloys (e.g., Ti-10V-2Fe-3Al), which offer superior performance above 400°C—conditions where traditional Ti-6Al-4V begins to degrade.

5. Medical and Industrial Diversification

Beyond aerospace, the medical implant sector is increasingly exploring AMS4914 alternatives due to biocompatibility and mechanical compatibility requirements. In 2026, alloys such as Ti-6Al-7Nb and Ti-13Nb-13Zr are seeing increased adoption in orthopedic and dental applications, offering reduced aluminum content (mitigating potential neurotoxicity concerns) and improved osseointegration. Similarly, in industrial applications like chemical processing and marine engineering, corrosion-resistant alternatives are being adopted to replace AMS4914 in less structurally demanding roles.

Conclusion

By 2026, the market for AMS4914 alternatives is being reshaped by cost efficiency, advanced manufacturing technologies, sustainability imperatives, and evolving performance requirements. While Ti-6Al-4V remains a dominant material, its alternatives are no longer niche solutions but strategic choices across high-tech industries. Companies investing in R&D for next-generation titanium alloys, recycling technologies, and AM-optimized materials are well-positioned to capture growth in this dynamic market segment.

Common Pitfalls When Sourcing AMS4914 Alternatives (Quality, IP)

When seeking alternatives to AMS4914—a high-strength titanium alloy commonly used in aerospace applications—organizations must navigate several critical risks related to material quality and intellectual property (IP). Failing to address these pitfalls can lead to performance failures, regulatory non-compliance, and legal exposure.

1. Compromised Material Quality and Certification

One of the most significant risks is sourcing alternatives that do not meet the stringent mechanical, chemical, and structural requirements of AMS4914. Common quality-related pitfalls include:

- Inadequate Traceability: Suppliers may provide material without full mill test reports (MTRs) or proper heat traceability, making it impossible to verify compliance with AMS4914 specifications.

- Non-Compliant Chemistry or Microstructure: Alternatives may fall outside allowable elemental ranges or fail to achieve the required alpha-beta microstructure, reducing fatigue life and fracture toughness.

- Lack of Third-Party Certification: Using materials not certified by recognized aerospace authorities (e.g., NADCAP, FAA, or EASA) increases the risk of in-service failure.

- Inconsistent Heat Treatment: Improper or undocumented heat treatment can severely degrade mechanical properties such as tensile strength and stress corrosion resistance.

2. Intellectual Property (IP) and Specification Infringement

AMS4914 is a controlled aerospace material specification governed by SAE International. Sourcing alternatives may inadvertently lead to IP issues:

- Unauthorized Use of Proprietary Processes: Some alternatives may rely on patented thermo-mechanical processing or alloying techniques. Using such materials without proper licensing can expose buyers to legal action.

- Misrepresentation as “Equivalent” Without Validation: Suppliers may market materials as “AMS4914 equivalent” without rigorous testing or approval from the original equipment manufacturer (OEM), potentially violating trademark or specification rights.

- Reverse Engineering Risks: Developing or sourcing close replicas of AMS4914 without proper IP clearance may infringe on proprietary alloy designs or processing methods protected by patents.

To mitigate these risks, buyers should require full documentation, conduct independent material testing, engage OEMs for approval of substitutes, and perform due diligence on supplier IP compliance.

Logistics & Compliance Guide for AMS4914 Alternative Materials

Material Substitution Overview

When considering alternatives to AMS4914 (a titanium alloy commonly used in aerospace applications), it is essential to ensure that any substitute material meets equivalent or superior mechanical, chemical, and performance specifications. Common alternatives may include Ti-6Al-4V variants (such as ASTM B348 or AMS4928), or other high-strength titanium alloys depending on application requirements. Substitution must be conducted in accordance with engineering approval and regulatory guidelines.

Regulatory and Industry Compliance

Any AMS4914 alternative must comply with relevant aerospace and defense standards, including but not limited to:

– SAE International specifications (e.g., AMS, AS standards)

– FAA and EASA airworthiness requirements

– NADCAP accreditation for materials processing (e.g., heat treatment, NDT)

– ITAR and EAR regulations if handling controlled materials or exporting components

Documentation must demonstrate material traceability (e.g., mill test reports, CoC – Certificate of Conformance) and compliance with the original design intent.

Supply Chain and Sourcing Considerations

Selecting an alternative material requires evaluation of supplier reliability and supply chain stability:

– Source materials only from qualified suppliers listed on OEM Preferred Supplier Lists (PSL) or equivalent

– Verify supplier adherence to AS9100 or equivalent quality management systems

– Ensure availability of full material traceability, including heat and lot numbers

– Assess lead times and scalability to avoid production delays

Testing and Qualification Requirements

Before implementation, alternative materials must undergo rigorous qualification processes:

– Chemical composition analysis (per ASTM E1479 or equivalent)

– Mechanical property testing (tensile, fatigue, fracture toughness) per AMS or ASTM standards

– Non-destructive testing (NDT) such as ultrasonic (UT) or radiographic (RT) inspection

– Environmental testing, including corrosion resistance and elevated temperature performance

Qualification data must be reviewed and approved by engineering and airworthiness authorities.

Documentation and Change Control

All material substitutions must be formally documented and controlled:

– Submit Material Change Request (MCR) or Engineering Change Proposal (ECP)

– Maintain records of test reports, approvals, and risk assessments

– Update Configuration Management (CM) systems and Bill of Materials (BOM)

– Ensure traceability throughout the product lifecycle, including in-service components

Transportation and Handling

Titanium alloys require specific handling and shipping protocols:

– Prevent contamination from carbon steel or chloride environments

– Use dedicated, clean containers and protective packaging

– Label materials clearly with alloy type, heat number, and compliance status

– Comply with hazardous materials transport regulations if applicable (e.g., IATA, IMDG for international shipments)

Storage and Inventory Management

Proper storage ensures material integrity:

– Store in dry, climate-controlled environments to prevent moisture absorption or oxidation

– Segregate titanium materials from dissimilar metals to avoid galvanic corrosion

– Implement First-In, First-Out (FIFO) inventory practices

– Conduct periodic audits to verify material condition and documentation

End-of-Life and Sustainability

Consider environmental and recycling implications:

– Titanium is highly recyclable; ensure end-of-life components are processed by certified recyclers

– Comply with REACH, RoHS, and other environmental regulations where applicable

– Document recycling rates and sustainability metrics for corporate reporting

Conclusion

Adopting an AMS4914 alternative requires a structured approach encompassing compliance, qualification, logistics, and documentation. Close coordination between engineering, quality, supply chain, and regulatory teams is critical to ensure safety, performance, and airworthiness throughout the component lifecycle.

Conclusion: Sourcing an AMS4914 Alternative

In conclusion, sourcing a qualified alternative to AMS4914 (a titanium alloy commonly used in aerospace applications, typically Ti-6Al-4V annealed) requires a thorough evaluation of mechanical properties, chemical composition, microstructure, and compliance with industry standards. While direct substitution is not always permissible due to stringent aerospace certification requirements, suitable alternatives can be identified through material equivalence programs such as NADCAP-approved sourcing, ESCI/PMI listings, or recognized specifications like AMS4928, AMS4967, or ASTM B265.

Any alternative material must meet or exceed the performance criteria of AMS4914 under the intended service conditions, including fatigue resistance, fracture toughness, and thermal stability. Traceability, quality assurance, and approval from the original equipment manufacturer (OEM) or regulatory body (e.g., FAA, EASA) are critical to ensure airworthiness and regulatory compliance.

Ultimately, successful substitution involves close collaboration with qualified suppliers, documentation of material certifications, and rigorous testing when necessary. While cost, availability, and lead time are important drivers, they must not compromise the integrity and safety of the final application. A disciplined, documented, and compliant approach to sourcing ensures that alternative materials can be safely and effectively implemented in place of AMS4914 where technically and regulatorily justified.