The global demand for water treatment chemicals has surged in recent years, driven by increasing awareness of water quality and stricter regulatory standards. According to Mordor Intelligence, the water treatment chemicals market is projected to grow at a CAGR of over 6.3% from 2023 to 2028, with coagulants like aluminum sulfate playing a pivotal role in clarifying swimming pool water. Aluminum sulfate, widely used for removing suspended particles and improving water clarity, has become a staple in both commercial and residential pool maintenance. As the pool and spa industry expands—supported by rising disposable incomes and infrastructure development—the need for reliable, high-purity aluminum sulfate has intensified. This growing demand has elevated the importance of selecting manufacturers that deliver consistent quality, scalability, and compliance with environmental and safety standards. Against this backdrop, we identify the top 7 aluminum sulfate manufacturers serving the pool industry, evaluated on production capacity, regional reach, product specifications, and customer feedback.

Top 7 Aluminum Sulfate For Pools Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Aluminum Sulfate Liquid

Domain Est. 1997

Website: hawkinsinc.com

Key Highlights: Hawkins carries both Liquid and Dry Aluminum Sulfate. Aluminum sulfate is a versatile chemical with a wide range of industrial and commercial uses….

#2 Aluminum sulfate for water treatment Manufacturer & Supplier in …

Domain Est. 2017

Website: developchem.com

Key Highlights: A series of swimming pool products, everything you need. With a solid aluminum sulfate for water treatment design, development material procurement along ……

#3 Aluminum Sulfate Manufacturer & Supplier

Domain Est. 2019

Website: watertreatment-chemicals.com

Key Highlights: Aluminum sulfate is a white powder, flakes or granular. Soluble in water, acids, and bases, but not in ethanol. The aluminum sulfate liquid is acidic….

#4 Aluminium Sulphate (Alum) Flocculant CAS 10043

Domain Est. 2020

Website: aquaclear.com.cn

Key Highlights: ✓ Swimming Pools: Clarifies cloudy water, reduces filter load. ✓ Water Treatment: Removes phosphates and colloidal particles. ✓ Industrial Use: Paper sizing, ……

#5 China Aluminum Sulfate for Pools manufacturers and Exporters

Domain Est. 2022

Website: yuncangchemical.com

Key Highlights: Our Aluminum Sulfate acts as a pH regulator, helping to stabilize and maintain the optimal pH level in the pool water. Proper pH balance is crucial for ……

#6 China aluminium sulphate for swimming pools Manufacturers …

Domain Est. 2024

Website: aquaenjoychemical.com

Key Highlights: We’re professional aluminium sulphate for swimming pools manufacturers and suppliers in China, specialized in providing high quality products and service. We ……

#7 Aluminum Sulfate

Domain Est. 1999

Website: buckmansinc.com

Key Highlights: We are a top source if your business is in need of an Aluminum Sulfate supplier and distributor. Our Aluminum Sulfate is available in 50 pound bags….

Expert Sourcing Insights for Aluminum Sulfate For Pools

H2: 2026 Market Trends for Aluminum Sulfate for Pools

The global market for aluminum sulfate in pool applications is projected to experience steady growth by 2026, driven by increasing demand for water clarity, cost-effective water treatment solutions, and rising residential and commercial pool construction. Aluminum sulfate, commonly used as a flocculant to remove suspended particles and improve water clarity in swimming pools, continues to maintain relevance despite competition from alternative coagulants.

Key market trends shaping the aluminum sulfate for pools sector in 2026 include:

-

Growing Emphasis on Water Quality and Clarity

As health and safety regulations around recreational water use become stricter, pool operators are prioritizing water treatment solutions that ensure crystal-clear, contaminant-free water. Aluminum sulfate remains a preferred choice due to its proven effectiveness in clumping fine particles for easier filtration, particularly in outdoor and high-traffic pools. -

Rise in Residential and Commercial Pool Installations

Urbanization, expanding middle-class populations in emerging economies, and increasing investments in leisure infrastructure are fueling pool construction—especially in regions like North America, Europe, and parts of Asia-Pacific. This expansion is directly boosting demand for water treatment chemicals, including aluminum sulfate. -

Cost-Effectiveness and Availability

Compared to synthetic polymers and other coagulants, aluminum sulfate is relatively inexpensive and widely available. This economic advantage supports its continued use, particularly in price-sensitive markets and among independent pool service providers. -

Environmental and Health Considerations

While aluminum sulfate is effective, concerns about residual aluminum in pool water and environmental impact are prompting scrutiny. Regulatory bodies and consumers are increasingly favoring eco-friendlier alternatives. As a result, manufacturers are investing in refined formulations and dosage control systems to minimize environmental footprint and improve safety. -

Innovation in Dosage and Delivery Systems

By 2026, smart dosing technologies—such as automated feeders and IoT-enabled water monitoring systems—are gaining traction. These advancements allow for precise application of aluminum sulfate, reducing overuse and enhancing treatment efficiency, thereby improving user confidence and compliance. -

Regional Market Dynamics

North America and Europe dominate consumption due to established pool maintenance practices and high pool ownership rates. However, the Asia-Pacific region is expected to witness the fastest growth, driven by rapid urban development and increasing adoption of Western lifestyle amenities. -

Competition from Alternatives

Aluminum sulfate faces growing competition from polyaluminum chloride (PACl) and organic flocculants, which offer broader pH tolerance and lower sludge production. Nevertheless, aluminum sulfate retains a strong foothold in regions where infrastructure and technical knowledge support its safe and effective use.

In conclusion, the 2026 market for aluminum sulfate in pools is characterized by stable demand supported by ongoing construction and water quality needs, balanced by environmental concerns and technological innovation. While facing competitive pressures, aluminum sulfate is expected to remain a key player in the pool water treatment landscape, especially when integrated with modern dosing and monitoring solutions.

Common Pitfalls When Sourcing Aluminum Sulfate for Pools (Quality, IP)

Sourcing aluminum sulfate (alum) for swimming pool water treatment requires careful attention to quality and purity standards. Using substandard or improper-grade material can lead to ineffective treatment, water quality issues, and potential damage to pool surfaces or equipment. Here are the most common pitfalls to avoid:

1. Confusing Technical Grade with Water Treatment Grade

One of the biggest risks is selecting a technical or industrial-grade aluminum sulfate that is not certified for use in potable water or recreational water systems. Technical grades may contain higher levels of impurities such as:

- Heavy metals (e.g., arsenic, lead, mercury)

- Insoluble residues that cloud the water

- Excess acidity affecting pH stability

Best Practice: Always specify and source food-grade or NSF/ANSI Standard 60 certified aluminum sulfate, which is approved for use in drinking water and swimming pools. Verify the product documentation includes compliance with these standards.

2. Inadequate Purity and Active Content

Low-purity aluminum sulfate contains less aluminum (as Al₂O₃), reducing its effectiveness as a coagulant. Impurities dilute active ingredients, forcing you to use more product to achieve the same clarification results, which can inadvertently increase sulfate and aluminum levels in pool water.

Best Practice: Confirm the minimum aluminum oxide (Al₂O₃) content — typically 17% or higher for high-quality alum. Request a Certificate of Analysis (CoA) showing purity and contaminant levels.

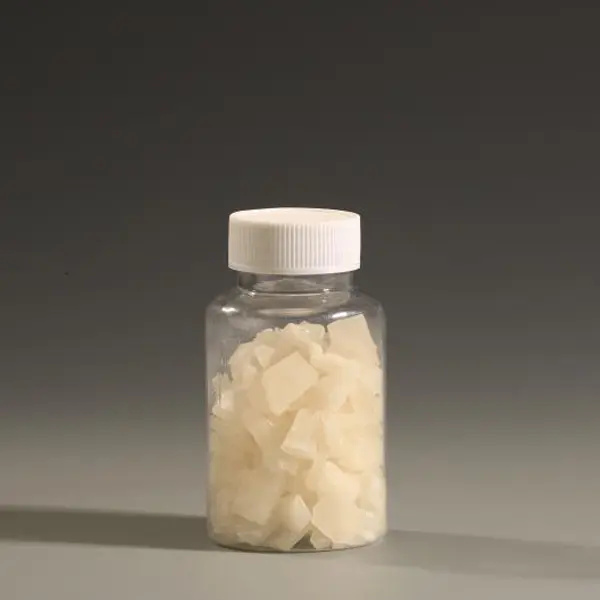

3. Incorrect Physical Form (Lumps, Moisture, Particle Size)

Aluminum sulfate is available in various forms — granular, powder, or liquid. Poor handling or storage can lead to:

- Caking or lumping due to moisture absorption, causing uneven dosing

- Dust formation (with powders), creating safety and handling issues

- Inconsistent dissolution, leading to localized high concentrations that may stain pool surfaces

Best Practice: Choose a granular form with controlled particle size for easier handling and consistent dissolution. Ensure packaging is moisture-resistant and store in a cool, dry place.

4. Ignoring Intellectual Property (IP) and Brand Substitution

In some markets, suppliers may offer “generic” or unbranded aluminum sulfate without disclosing origin or manufacturing processes. While not always an IP violation per se, using uncertified or untraceable sources risks:

- Unknown production methods (e.g., acid recovery processes that introduce contaminants)

- No accountability for batch consistency

- Potential infringement if branded formulations are replicated without authorization

Best Practice: Source from reputable, traceable suppliers with transparent manufacturing practices. Avoid ambiguous “private label” products unless they provide full compliance documentation.

5. Overlooking Packaging and Labeling Compliance

Improper labeling can lead to misuse. Labels should clearly state:

- Chemical name and concentration

- Safety data (GHS pictograms, first aid measures)

- Handling and storage instructions

- Regulatory compliance marks (e.g., NSF, EPA)

Best Practice: Ensure packaging meets local regulatory requirements and includes multilingual labeling if distributed across regions. Avoid bulk shipments without proper labeling.

6. Failing to Verify Supplier Credibility and Supply Chain

Unverified suppliers, especially from regions with lax environmental or quality controls, may offer cheaper products that compromise safety and performance.

Best Practice: Audit suppliers for ISO certifications (e.g., ISO 9001), request third-party test reports, and consider site visits or supplier qualification questionnaires.

By addressing these common pitfalls — particularly around quality certification, purity, physical properties, and supply chain transparency — pool operators and suppliers can ensure safe, effective, and compliant use of aluminum sulfate in water treatment.

H2: Logistics & Compliance Guide for Aluminum Sulfate for Pool Use

Aluminum Sulfate (Al₂(SO₄)₃), commonly known as “alum,” is frequently used in swimming pools as a flocculant to clarify cloudy water by clumping fine particles for easier filtration or vacuuming. Proper logistics and compliance are essential due to its chemical properties and regulatory requirements. This guide outlines key considerations for the safe handling, transport, storage, and regulatory compliance of Aluminum Sulfate intended for pool treatment.

H2: Regulatory Classification & Safety Data

1. Chemical Identification:

– Chemical Name: Aluminum Sulfate

– CAS Number: 10043-01-3

– Common Use: Water clarifier/flocculant in swimming pools and water treatment

– Form: Typically supplied as white granular crystals or powder

2. Hazard Classification (GHS):

– Hazard Class: May be classified as:

– Skin Corrosion/Irritation (Category 2)

– Serious Eye Damage/Eye Irritation (Category 1)

– Specific Target Organ Toxicity (Single Exposure, Category 3 – Respiratory Irritation)

– Hazard Statements (H-phrases):

– H315: Causes skin irritation

– H319: Causes serious eye irritation

– H335: May cause respiratory irritation

– Precautionary Statements (P-phrases):

– P261: Avoid breathing dust

– P280: Wear protective gloves, eye protection, face protection

– P305+P351+P338: IF IN EYES: Rinse cautiously with water for several minutes. Remove contact lenses, if present and easy to do. Continue rinsing

3. Safety Data Sheet (SDS):

– A current, manufacturer-issued SDS (in compliance with OSHA’s HazCom 2012/GHS standards in the U.S. or equivalent regional regulations) must be readily available for all handlers.

– The SDS must be reviewed before handling, storage, or transport.

H2: Transportation & Shipping Compliance

1. UN Number & Proper Shipping Name:

– UN Number: UN 1726

– Proper Shipping Name: ALUMINUM SULFATE

– Hazard Class: 8 (Corrosive Substances)

– Packing Group: III (Low to moderate hazard)

2. Packaging Requirements:

– Must be shipped in UN-rated, leak-proof containers suitable for Class 8 corrosive materials.

– Inner liners (e.g., polyethylene bags) are often used within fiberboard drums or multi-wall paper sacks.

– Ensure closures are secure to prevent dust release.

3. Labeling & Marking:

– Outer packaging must display:

– UN number (UN 1726)

– Proper shipping name

– Class 8 corrosive hazard label (black on white diamond with test tube and hand symbol)

– GHS pictograms (Corrosion, Exclamation Mark)

– Shipper/consignee information

– Net weight

4. Transport Regulations:

– U.S. (DOT): Comply with 49 CFR regulations for hazardous materials transportation.

– International (IMDG/ICAO): Required for ocean/air freight; ensure proper documentation (Shipper’s Declaration for Dangerous Goods) if applicable.

– Ground Transport: Non-bulk shipments under 25 kg (55 lbs) may be eligible for ORM-D or limited quantity exemptions—verify current rules.

5. Carrier Coordination:

– Inform carriers it is a Class 8 hazardous material.

– Use carriers trained in hazardous goods handling.

H2: Storage & Handling Procedures

1. Storage Conditions:

– Store in a cool, dry, well-ventilated area.

– Keep away from incompatible materials:

– Avoid contact with: Strong bases (e.g., sodium hydroxide), strong oxidizers, and organic materials.

– Separate from: Food, beverages, and animal feed.

– Keep containers tightly closed to prevent moisture absorption and dust formation.

2. Container Integrity:

– Store on pallets to avoid contact with concrete (which can degrade over time due to acidity).

– Use corrosion-resistant shelving if indoors.

3. Handling Best Practices:

– Use only in well-ventilated areas.

– Wear appropriate PPE:

– Chemical-resistant gloves (nitrile or neoprene)

– Safety goggles or face shield

– Dust mask (NIOSH-approved N95 or equivalent) when handling dry powder

– Protective clothing to avoid skin contact

– Avoid creating dust; use wet methods or local exhaust if transferring large quantities.

H2: Environmental, Health & Disposal Compliance

1. Environmental Impact:

– Aluminum Sulfate is harmful to aquatic life. Prevent runoff into waterways or storm drains.

– Pool backwash containing alum should be discharged in accordance with local wastewater regulations (may require neutralization or settling).

2. Exposure Control:

– Engineering Controls: Use local exhaust ventilation when handling in enclosed spaces.

– Hygiene Practices: Wash hands thoroughly after handling. Do not eat, drink, or smoke in handling areas.

3. Spill Response:

– Contain: Prevent spread using inert absorbent (e.g., sand, vermiculite).

– Neutralize (if needed): For large spills on surfaces, neutralize with sodium bicarbonate or lime.

– Clean Up: Collect material into a labeled, sealable container for proper disposal.

– Ventilate: Increase air circulation during cleanup.

– Report: Report significant spills to local environmental authorities if required.

4. Waste Disposal:

– Dispose of waste Aluminum Sulfate and contaminated packaging as hazardous waste in compliance with local, state, and federal regulations (e.g., RCRA in the U.S.).

– Contact a licensed hazardous waste disposal company.

– Never dispose of down drains or in regular trash without treatment and authorization.

H2: Labeling & Consumer Compliance (Retail & Distribution)

1. Product Labeling (Consumer Packaging):

– Display:

– Product name: “Aluminum Sulfate” or “Pool Clarifier”

– Active ingredient concentration

– Net weight

– Manufacturer/distributor contact information

– GHS-compliant hazard pictograms and statements

– First aid instructions

– Directions for use in pools (dosage, frequency, safety precautions)

2. Pool Use Guidelines:

– Clearly instruct users to:

– Dissolve in water before adding to pool

– Avoid direct addition to pool surfaces to prevent etching

– Test water chemistry (pH, alkalinity) before and after treatment

– Allow 6–8 hours of filtration after dosing

– Vacuum settled floc to waste

3. Regulatory Compliance:

– In the U.S., pool chemicals may be regulated by the EPA under FIFRA if making pesticidal claims (e.g., clarifying to improve sanitation). Check EPA registration requirements.

– States (e.g., California Prop 65) may require warnings for aluminum compounds.

– Ensure labels comply with TSCA (Toxic Substances Control Act) and state consumer product safety laws.

H2: Training & Documentation

1. Personnel Training:

– Train all staff involved in handling, shipping, or storing Aluminum Sulfate on:

– Hazards and PPE

– Spill response

– Emergency procedures

– SDS review

– Maintain training records.

2. Documentation:

– Keep records of:

– SDS for each batch

– Shipping manifests (if hazardous materials)

– Training logs

– Spill/incident reports

– Waste disposal manifests

Summary

Aluminum Sulfate is an effective pool clarifier but requires careful attention to logistics and compliance due to its corrosive and irritant properties. Adherence to transportation regulations (UN 1726, Class 8), proper storage, safe handling with PPE, and accurate labeling are essential. Always consult the SDS and local regulations to ensure full compliance across the supply chain—from manufacturer to end-user.

In conclusion, sourcing aluminum sulfate for pool use requires careful consideration of quality, purity, and suitability for water treatment. As a flocculant, aluminum sulfate effectively clumps fine particles for easier removal, improving water clarity in swimming pools—especially in cases where filtration alone is insufficient. When sourcing this chemical, it is essential to purchase from reputable suppliers who provide food or reagent-grade aluminum sulfate devoid of harmful impurities. Additionally, proper handling, storage, and dosing are critical to ensure safety and effectiveness, as overuse can lower pH and increase aluminum levels in pool water, potentially causing irritation or staining. Pool owners should also consider local regulations and environmental impacts. Ultimately, while aluminum sulfate is an effective solution for water clarification, it should be used judiciously and as part of a balanced overall pool maintenance strategy.