The global aluminum profile extrusion market is experiencing robust growth, driven by rising demand across construction, automotive, and industrial sectors. According to Grand View Research, the market was valued at USD 87.6 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This growth is fueled by aluminum’s lightweight properties, corrosion resistance, and recyclability—making it a preferred material in sustainable design and energy-efficient applications. Additionally, increasing urbanization and infrastructure development, particularly in Asia-Pacific, are amplifying demand for customized aluminum profiles. As industries seek precision-engineered solutions, the role of leading extrusion manufacturers becomes increasingly critical. Based on production capacity, global reach, innovation, and market presence, the following nine companies stand at the forefront of the aluminum profile extrusion industry.

Top 9 Aluminum Profile Extrusion Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 International Extrusions: Aluminum Extrusion

Domain Est. 1998

Website: extrusion.net

Key Highlights: As America’s leading aluminum extrusion manufacturer, we offer a wide range of deliverables in variable billet sizes for industrial or commercial applications….

#2 80/20 Aluminum T-slot Building Systems

Domain Est. 1997

Website: 8020.net

Key Highlights: T-Slots, aluminum extrusions, and parts. Architectural solutions and frames for industrial machine guards, workstations, data center enclosures, and more….

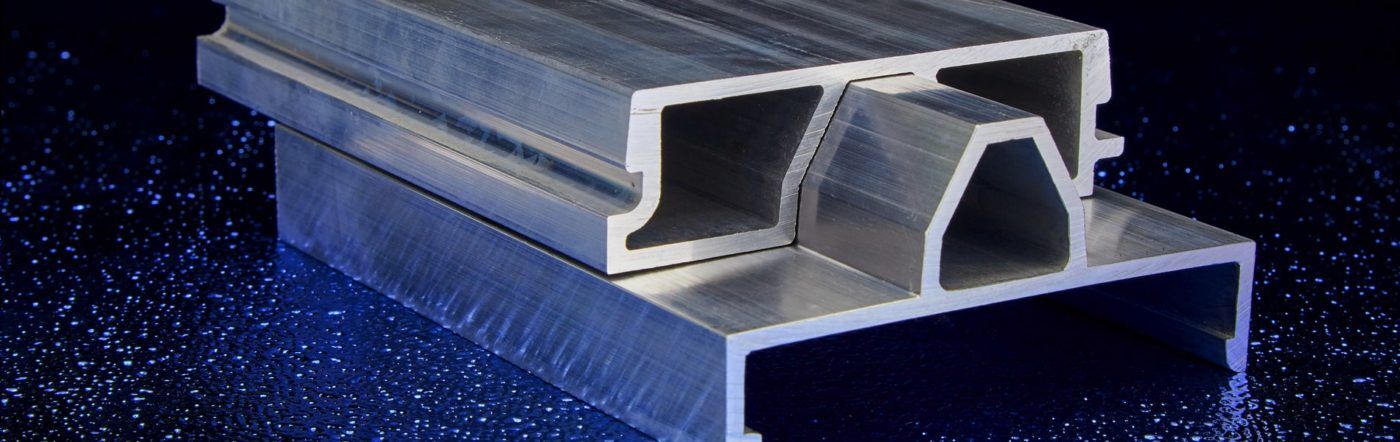

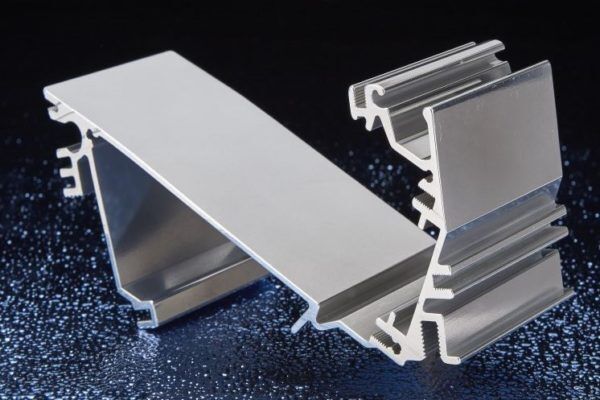

#3 Custom Aluminum Extrusions & Profiles Manufacturer

Domain Est. 2010

Website: eagle-aluminum.com

Key Highlights: Eagle’s aluminum extrusions manufacturer connections give you access to more than 10,000 custom aluminum profiles and extruded shapes….

#4 Custom Aluminum Extrusion Manufacturing

Domain Est. 2022

Website: mmgextrusions.com

Key Highlights: As a leading aluminum extrusion manufacturer, we provide a complete manufacturing solution for custom-extruded aluminum parts and components….

#5 Small Custom Aluminum Extrusions

Domain Est. 1996

Website: minalex.com

Key Highlights: We manufacture extruded aluminum profiles for windows in various shapes, sizes, and finishes and provide product for a whole range of applications. Read More ……

#6 Taber Extrusions

Domain Est. 1998

Website: taberextrusions.com

Key Highlights: Taber is A full service supplier of aluminum extrusions based products. Full range of aluminum alloys and aluminum CNC machining to meet our ……

#7

Domain Est. 2000

Website: tslots.com

Key Highlights: We offer the best aluminum extrusion TSLOTS in the industry and our in-house experts can work with any idea and any CAD drawing you bring to the table. DOWNLOAD….

#8 Profile Precision Extrusions

Domain Est. 2004

Website: profileprecisionextrusions.com

Key Highlights: Profile Precisions Extrusions has been an industry leader for over 35 years in manufacturing custom miniature aluminum extrusions. Our team has manufactured ……

#9 Bonnell Aluminum

Domain Est. 2007

Website: bonnellaluminum.com

Key Highlights: Bonnell Aluminum extrudes a variety of shapes used in architectural systems such as storefront, curtain walls and other flushed glazed projects. Learn More….

Expert Sourcing Insights for Aluminum Profile Extrusion

H2: Projected Market Trends for Aluminum Profile Extrusion in 2026

The global aluminum profile extrusion market is poised for significant transformation by 2026, driven by evolving industrial demands, sustainability imperatives, and technological advancements. As industries increasingly prioritize lightweight, durable, and recyclable materials, aluminum extrusion is emerging as a cornerstone solution across key sectors. Below are the dominant market trends expected to shape the industry in 2026:

1. Surge in Demand from Renewable Energy and Green Infrastructure

The global push toward carbon neutrality is accelerating investments in solar energy, wind infrastructure, and energy-efficient buildings. Aluminum profiles are essential in solar panel frames, mounting systems, and building-integrated photovoltaics (BIPV). By 2026, the renewable energy sector is projected to account for over 25% of aluminum extrusion demand growth, particularly in solar farms and smart urban developments.

2. Expansion in Electric Vehicle (EV) and Transportation Applications

Automotive lightweighting remains a critical strategy for improving EV range and reducing emissions. Aluminum extrusions are widely used in EV battery enclosures, chassis components, and structural frames. With EV production expected to double by 2026, especially in North America and Asia-Pacific, demand for high-strength, heat-treatable aluminum alloys (e.g., 6000 and 7000 series) will rise sharply.

3. Technological Advancements in Precision and Sustainability

Manufacturers are adopting Industry 4.0 technologies such as AI-driven process optimization, real-time quality monitoring, and digital twins to enhance extrusion precision and reduce scrap rates. Additionally, there is a growing shift toward low-carbon aluminum production, with increased use of recycled content and hydropower-smelted ingots. By 2026, over 40% of extruders in Europe and North America are expected to operate with certified low-carbon aluminum.

4. Regional Shifts and Supply Chain Resilience

Geopolitical factors and trade dynamics are prompting companies to localize supply chains. Nearshoring and reshoring of extrusion facilities are gaining momentum in the U.S. and EU to reduce dependency on Asian suppliers. Meanwhile, Southeast Asia and India are emerging as new hubs due to lower production costs and rising domestic demand.

5. Growth in Building and Construction with Focus on Energy Efficiency

Urbanization and green building standards (e.g., LEED, BREEAM) are fueling demand for thermally broken aluminum profiles in windows, curtain walls, and modular construction. By 2026, the construction sector will remain the largest end-user, with smart building integration further expanding the use of multifunctional aluminum profiles.

6. Product Customization and Value-Added Services

Customers increasingly demand tailored solutions—including surface treatments (anodizing, powder coating), integrated thermal breaks, and pre-assembled modules. Extruders are responding by expanding downstream capabilities and offering design-to-delivery services, enhancing margins and customer retention.

In summary, by 2026, the aluminum profile extrusion market will be defined by sustainability, digitalization, and sector-specific innovation. Companies that invest in green technologies, diversify applications, and strengthen regional supply chains will be best positioned to capitalize on these converging trends.

Common Pitfalls Sourcing Aluminum Profile Extrusion (Quality, IP)

Sourcing aluminum profile extrusions presents several challenges, particularly concerning quality consistency and intellectual property (IP) protection. Being aware of these pitfalls helps mitigate risks and ensures a reliable supply chain.

Quality Inconsistency and Material Specifications

One of the most frequent issues is inconsistent product quality across batches. Suppliers may use substandard aluminum alloys, deviate from specified temper (e.g., 6063-T5 vs. T6), or fail to maintain tight tolerances. Surface defects such as scratches, warping, or uneven anodizing are common when process controls are inadequate. Without strict quality audits and clear material certifications (e.g., mill test reports), buyers risk receiving profiles that don’t meet functional or aesthetic requirements—leading to assembly failures or rework costs.

Lack of Dimensional Accuracy and Tolerance Control

Extrusion dies wear over time, and less reputable suppliers may not recalibrate or replace them promptly, resulting in profiles that drift out of specification. This is especially problematic for precision applications like automation equipment or architectural glazing. Without detailed engineering drawings with clearly defined tolerances (per standards such as ISO 2768 or DIN 1712), disputes over acceptability are common. Buyers must verify suppliers’ capability to maintain tolerances consistently through first-article inspections and ongoing quality checks.

Poor Surface Finish and Post-Processing Defects

Surface quality is critical for visible components. Pitfalls include inconsistent anodizing thickness, color variation, chalking, or poor adhesion of powder coating. These issues often stem from inadequate pre-treatment, uncontrolled anodizing baths, or low-grade dyes. Suppliers without in-house finishing capabilities may outsource these steps, increasing variability and reducing accountability. Insufficient masking or handling can also lead to scratches or contamination.

Intellectual Property (IP) Theft and Design Leakage

Sharing custom profile designs—especially via CAD files—exposes buyers to IP risks. Unscrupulous suppliers may replicate designs for competing customers or sell them on secondary markets. This is particularly prevalent in regions with weak IP enforcement. Without robust legal agreements (e.g., NDAs and IP ownership clauses) and supplier vetting, companies risk losing competitive advantage and facing counterfeit products.

Inadequate Tooling Ownership and Control

Buyers often pay for custom extrusion dies but fail to secure clear ownership rights. Some suppliers retain physical or legal control over the tooling, making it difficult to switch vendors or scale production. This can lead to dependency, price gouging, or delays. Ensure contracts explicitly state that tooling is buyer-owned and specify conditions for die storage, maintenance, and replication rights.

Supply Chain and Lead Time Risks

Unreliable lead times, production bottlenecks, or raw material shortages can disrupt operations. Some suppliers overpromise capacity or lack contingency planning. Without transparent communication and robust supply agreements, delays cascade through the production pipeline. Dual sourcing or maintaining safety stock of critical profiles can help mitigate this risk.

Hidden Costs and Poor Communication

Initial quotes may exclude secondary operations (e.g., cutting, drilling, welding), packaging, or shipping—leading to unexpected expenses. Language barriers, time zone differences, and lack of technical engagement can exacerbate misunderstandings. Establishing clear communication channels and detailed scope-of-work documentation is essential to avoid cost overruns and project delays.

Logistics & Compliance Guide for Aluminum Profile Extrusion

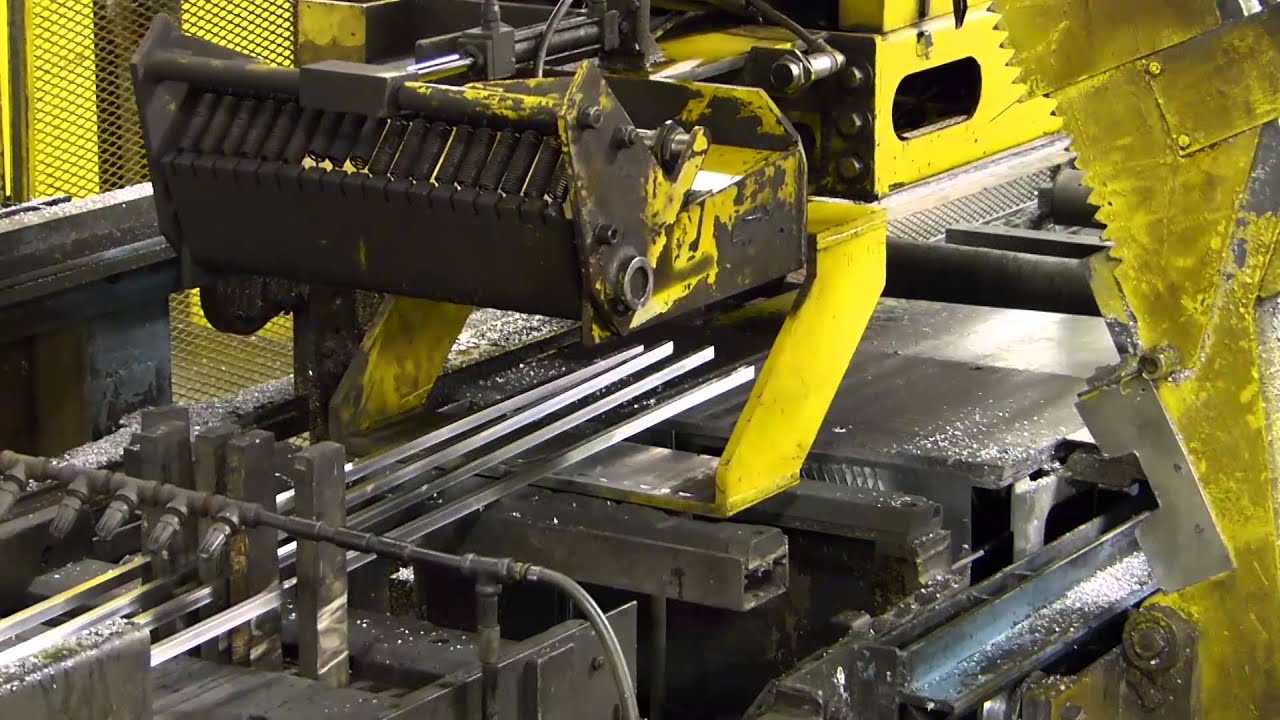

Overview of Aluminum Profile Extrusion Supply Chain

Aluminum profile extrusion involves transforming raw aluminum billets into custom-shaped profiles used across industries such as construction, automotive, electronics, and renewable energy. The supply chain spans raw material sourcing, extrusion manufacturing, surface treatment, finishing, packaging, and global distribution. Efficient logistics and strict compliance are crucial to ensure quality, timeliness, and legal adherence.

International Trade Regulations & Export Compliance

Export Control Classification

Aluminum profiles are generally not classified as dual-use or controlled items under the Export Administration Regulations (EAR) or International Traffic in Arms Regulations (ITAR). However, when used in defense, aerospace, or high-technology applications, export licenses may be required. Suppliers must determine the Export Control Classification Number (ECCN) for their products and assess license requirements based on destination countries.

Customs Documentation

Standard export documentation includes:

– Commercial Invoice

– Packing List

– Bill of Lading (B/L) or Air Waybill (AWB)

– Certificate of Origin (often required for preferential tariffs under trade agreements such as USMCA, RCEP, or EU free trade pacts)

– Material Test Reports (MTRs) or mill certificates

Ensure Harmonized System (HS) code accuracy (typically 7604.10 or 7608.10) to avoid customs delays or penalties.

Environmental & Safety Compliance

REACH & RoHS Regulations

In the European Union, aluminum profiles must comply with:

– REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Declare substances of very high concern (SVHCs), although aluminum metal itself is exempt.

– RoHS (Restriction of Hazardous Substances): Relevant for coated or anodized profiles used in electronics; restricts lead, cadmium, mercury, and certain brominated flame retardants.

Suppliers must provide a Declaration of Conformity and maintain traceability of materials and surface treatments.

OSHA & GHS Standards (U.S.)

In the U.S., workplace safety during extrusion operations must comply with OSHA standards for high-pressure systems, thermal processes, and handling of chemicals (e.g., in anodizing or powder coating). Chemical inventories must be accompanied by Safety Data Sheets (SDS) compliant with GHS (Globally Harmonized System).

Quality Standards & Certification Requirements

ISO 9001 & ISO 14001

Manufacturers should maintain ISO 9001 certification for quality management and ISO 14001 for environmental management. These certifications support export eligibility and are often required by international buyers.

Aluminum Association Certification (ANSI H35 Standards)

Adherence to ANSI H35.2 (dimensional tolerances) and H35.2M ensures product uniformity and interchangeability. Certification demonstrates technical compliance and enhances market access, especially in North America.

Industry-Specific Standards

- AAMA (American Architectural Manufacturers Association): For architectural applications, compliance with AAMA 2604 or 2605 ensures durability of finishes.

- EN Standards (Europe): EN 12020 (tight tolerance profiles), EN 12021 (anodizing), and EN 1396 (coil-coated aluminum).

- JIS H 4100 (Japan): Specifies tolerances and mechanical properties.

Transportation & Logistics Best Practices

Packaging & Handling

- Use edge protectors, anti-corrosion paper (VCI paper), and wooden or metal skids to prevent damage.

- Bundle profiles securely with straps or shrink wrap, especially for sea freight.

- Label each bundle with product details, heat number, batch ID, and handling instructions (e.g., “Fragile,” “Do Not Stack”).

Mode of Transport

- Sea Freight: Most cost-effective for bulk shipments. Use dry containers; avoid condensation with desiccants.

- Air Freight: Suitable for urgent, high-value, or prototype orders.

- Overland Transport (Truck/Rail): Common within regional markets (e.g., EU, North America). Ensure load stability and weather protection.

Incoterms Selection

Choose appropriate Incoterms to clarify responsibility:

– EXW (Ex Works): Buyer manages all logistics from the factory.

– FOB (Free On Board): Seller delivers to port; risk transfers upon loading.

– DDP (Delivered Duty Paid): Seller manages all logistics and customs clearance.

Traceability & Documentation Management

Maintain full traceability from billet sourcing to final shipment:

– Record alloy type (e.g., 6063-T5), heat number, extrusion die number, and quality inspection results.

– Store digital copies of mill certificates, test reports (tensile strength, hardness, coating thickness), and compliance declarations.

– Use ERP or MES systems to automate documentation and support audits.

Import Regulations by Key Markets

United States

- Subject to CBP (Customs and Border Protection) inspections.

- Potential anti-dumping or countervailing duties on aluminum extrusions from certain countries (e.g., China). Verify duty status using the U.S. International Trade Commission (USITC) database.

- Lacey Act compliance required if wood packaging materials are used (ISPM 15 certification).

European Union

- CE marking not mandatory for raw profiles but required for construction components under the Construction Products Regulation (CPR) if placed on the market as finished building elements.

- Importers must register under the EU’s REACH and CLP regulations.

China

- Requires CCC certification only for specific end-use products, not raw extrusions.

- Customs may inspect for compliance with GB/T standards (e.g., GB/T 6892 for industrial profiles).

Sustainability & Carbon Footprint Reporting

Growing demand for low-carbon aluminum:

– Provide Environmental Product Declarations (EPDs) showing lifecycle impacts.

– Source billets from smelters using renewable energy (e.g., hydro-powered).

– Report carbon footprint using standards such as ISO 14067 or the Aluminum Stewardship Initiative (ASI) Performance Standard.

Conclusion

Effective logistics and compliance in aluminum profile extrusion require coordinated attention to international trade rules, environmental regulations, quality standards, and transportation protocols. Proactive documentation, certification, and traceability practices reduce risks and enhance competitiveness in global markets.

In conclusion, sourcing aluminum profile extrusion requires a strategic approach that balances quality, cost, lead times, and supplier reliability. When selecting a supplier, it is essential to evaluate their technical capabilities, quality control processes, material certifications, and experience in your specific industry—whether it’s construction, automotive, electronics, or industrial manufacturing. Customization options, tooling costs, and post-extrusion services such as cutting, drilling, anodizing, or powder coating should also be considered to ensure the final product meets design and performance requirements.

Furthermore, geographic location and logistical factors can significantly impact delivery times and overall project timelines, especially for large-scale or time-sensitive orders. Building long-term relationships with reputable extruders can lead to better pricing, priority production, and collaborative engineering support.

Ultimately, a well-informed sourcing decision—based on thorough supplier vetting, clear communication of specifications, and consideration of total cost of ownership—will ensure durable, high-performance aluminum profiles that support the success and efficiency of your end application.