The global aluminum fencing market is experiencing steady expansion, driven by rising demand for low-maintenance, corrosion-resistant fencing solutions in residential, commercial, and industrial applications. According to Grand View Research, the global aluminum fencing market size was valued at USD 4.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. This growth is fueled by increasing infrastructure development, urbanization, and a shift toward aesthetically appealing yet durable building materials. As demand climbs, the need for high-quality aluminum fence components—such as posts, rails, panels, brackets, and hardware—has prompted a competitive manufacturing landscape. Below, we profile the top 10 aluminum fence parts manufacturers leading innovation, scalability, and reliability in this expanding sector.

Top 10 Aluminum Fence Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Master Halco

Domain Est. 1996

Website: masterhalco.com

Key Highlights: Master Halco is your leading manufacturer and wholesale distributor of fencing & decking products across the US and Canada….

#2 Aluminum Fence

Domain Est. 1998

Website: ultrafence.com

Key Highlights: Our complete line of low-maintenance aluminum fencing products brings the traditional look of wrought-iron fence to Residential, Commercial and Industrial ……

#3 Ametco Manufacturing

Domain Est. 1996

Website: ametco.com

Key Highlights: Ametco manufactures a wide range of steel fence and security gate systems as well as railings, sunshades, grilles, screens, louvers and perforated metal and ……

#4 Jerith

Domain Est. 1997

Website: jerith.com

Key Highlights: We manufacture aluminum fences for homes and businesses. Whether you need to meet pool codes, secure a property on the coast or keep your family and pets safe….

#5 Aluminum Fence & Gates

Domain Est. 1997

Website: superioraluminum.com

Key Highlights: Elevate your project with the perfect finishing touch. Enhance security for pools, yards, sports facilities, and more….

#6 Residential Grade Aluminum Fencing

Domain Est. 2001

Website: elitefence.com

Key Highlights: Our residential grade aluminum fencing is an excellent choice for security and protection while still being the perfect neighbor friendly aluminum fence….

#7 Atlantic Fence Supply

Domain Est. 2001

Website: afsfence.com

Key Highlights: Broad range of fencing from wood to vinyl and chain link supplies. We also distribute fence accessories, railings, gates, kennels and hardware….

#8 Fence Depot

Domain Est. 2002

Website: fence-depot.com

Key Highlights: We sell aluminum fence, wrought iron fence, and more directly to homeowners and contractors who are looking for high quality fence, railing and gate products ……

#9 Aluminum Fence Company

Domain Est. 2002

Website: aluminum-fence.com

Key Highlights: Explore top-quality aluminum fence options at wholesale. We provide many options for homeowners & fencing contractors. Get a estimate now….

#10 Aluminum Fence Supply

Domain Est. 2010

Website: aluminumfencesupply.com

Key Highlights: Featuring an outstanding selection of maintenance-free, powder coated aluminum fence, matching gates, arbors, guardrail and handrail….

Expert Sourcing Insights for Aluminum Fence Parts

2026 Market Trends for Aluminum Fence Parts

Rising Demand Driven by Residential and Commercial Construction Growth

The aluminum fence parts market is projected to experience steady growth by 2026, primarily fueled by increased residential and commercial construction activities worldwide. With urbanization accelerating across North America, Europe, and parts of Asia-Pacific, the demand for durable, low-maintenance fencing solutions continues to rise. Aluminum fence components—such as posts, rails, pickets, and hardware—are increasingly favored over traditional materials like wood and iron due to their corrosion resistance, longevity, and aesthetic versatility. In particular, the trend toward modern minimalist home designs aligns well with sleek aluminum fencing options, boosting adoption in high-end residential developments.

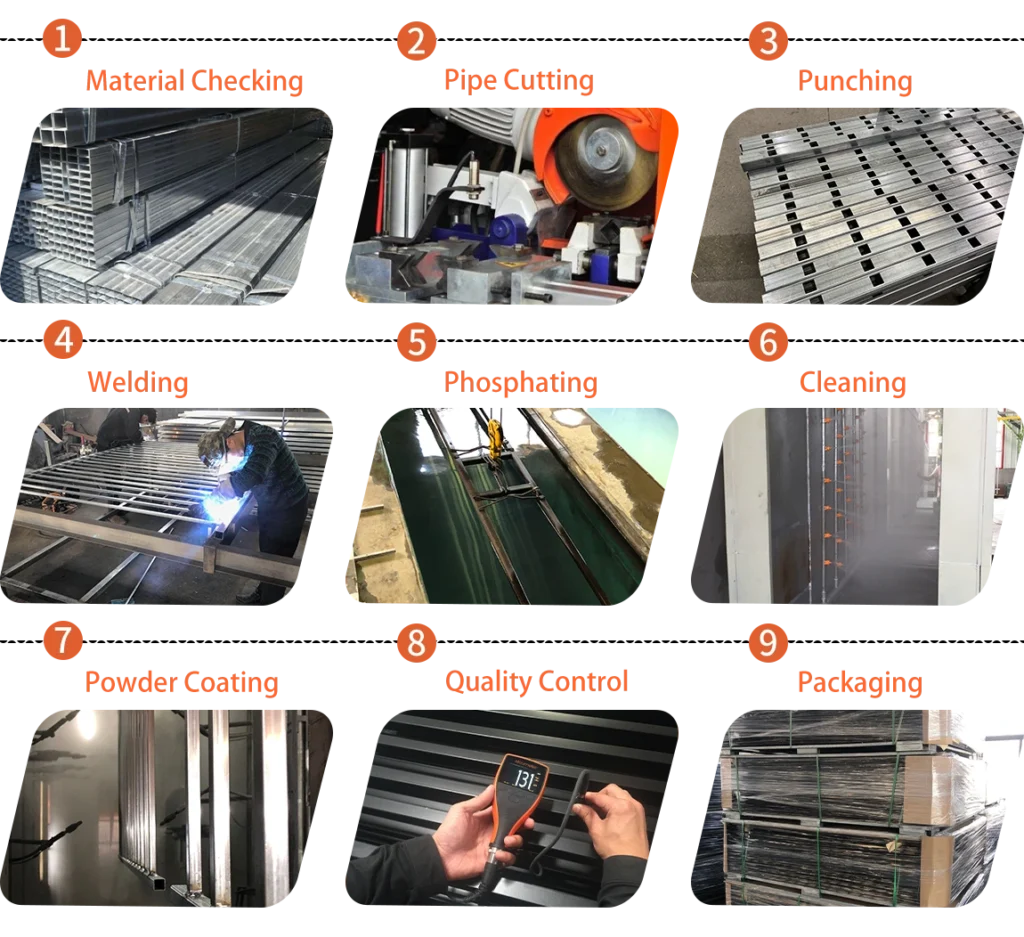

Technological Advancements in Coating and Manufacturing

By 2026, advancements in powder coating technologies and automated manufacturing processes are expected to significantly influence the aluminum fence parts industry. Enhanced powder coating techniques, such as polyester and fluoropolymer (e.g., Kynar) finishes, offer superior UV resistance and color retention, making aluminum fences more suitable for extreme weather conditions. Additionally, robotic fabrication and precision extrusion technologies are reducing production costs and improving part consistency, enabling manufacturers to meet growing demand efficiently. These innovations are also supporting customization trends, allowing homeowners and contractors to select from a wide range of colors, textures, and styles.

Sustainability and Recyclability as Competitive Advantages

Environmental considerations are shaping consumer and regulatory preferences, giving aluminum fence parts a strategic edge. Aluminum is 100% recyclable without loss of quality, and recycling requires only 5% of the energy needed for primary production. As governments implement stricter sustainability standards and green building certifications (e.g., LEED) become more influential, demand for eco-friendly building materials is rising. By 2026, manufacturers emphasizing recycled content and energy-efficient production methods are likely to capture larger market shares, particularly in environmentally conscious regions like Western Europe and the U.S. West Coast.

Expansion of E-Commerce and Direct-to-Consumer Sales Channels

The distribution landscape for aluminum fence parts is evolving, with e-commerce platforms playing an increasingly central role. Online marketplaces and manufacturer-direct websites are making it easier for contractors, DIY homeowners, and small developers to access a broad selection of components with detailed specifications, 3D visualizers, and installation guides. By 2026, companies investing in digital sales channels and customer education tools are expected to outperform traditional distributors. This shift is also driving demand for modular, easy-to-install aluminum fence systems that cater to the growing DIY market.

Regional Market Dynamics and Competitive Landscape

North America is anticipated to remain the largest market for aluminum fence parts in 2026, driven by robust housing markets in the U.S. and Canada. Meanwhile, the Asia-Pacific region—especially China, India, and Southeast Asia—is expected to witness the highest growth rates due to rapid infrastructure development and rising disposable incomes. Key market players are focusing on strategic partnerships, geographic expansion, and product diversification to strengthen their positions. Competition is intensifying, with a focus on innovation, cost efficiency, and after-sales support to differentiate offerings in a maturing market.

Common Pitfalls When Sourcing Aluminum Fence Parts (Quality, IP)

Sourcing aluminum fence parts involves more than just finding the lowest price—overlooking key factors can lead to compromised quality, intellectual property (IP) risks, and long-term project setbacks. Below are critical pitfalls to avoid:

Poor Material Quality and Specifications

One of the most frequent issues is receiving aluminum components that do not meet required alloy standards (e.g., 6063-T5 commonly used for extrusions). Substandard materials may appear visually acceptable but lack the necessary strength, corrosion resistance, or finish durability. Buyers often fail to specify exact alloy, temper, wall thickness, or tolerances, leading to parts that warp, crack, or degrade prematurely in outdoor environments.

Inadequate Surface Finish and Coating

Aluminum fence parts are typically powder-coated or anodized for weather resistance. A common pitfall is accepting samples with excellent finish while mass-produced parts show inconsistencies such as uneven coating thickness, color variation, or poor adhesion. Suppliers might use lower-grade powders or skip proper pre-treatment processes like chromate conversion coating, resulting in premature chalking, fading, or peeling.

Lack of Dimensional Accuracy and Fit

Poorly manufactured extrusions or cast components may not align with standard fittings or installation systems. This is particularly problematic when sourcing from multiple suppliers or when reverse-engineering parts. Inaccurate tolerances can lead to assembly difficulties, gaps, or structural weakness, increasing labor costs and reducing product reliability.

Intellectual Property (IP) Infringement Risks

Sourcing generic or “compatible” aluminum fence components—especially from overseas suppliers—can inadvertently involve IP violations. Many fence profiles, post caps, and hardware designs are patented or protected by design rights. Suppliers may replicate proprietary designs without authorization, exposing the buyer to legal liability, product seizures, or forced redesigns. Always verify that parts either fall under public domain designs or are properly licensed.

Insufficient Quality Control and Certification

Suppliers, particularly those without ISO or other quality management certifications, may lack robust inspection processes. This increases the risk of receiving non-conforming batches. Without documented quality checks, traceability, or material test reports (MTRs), it becomes difficult to validate performance claims or address failures down the line.

Hidden Costs from Minimum Order Quantities and Tooling

Many aluminum parts require custom extrusion dies or molds. Suppliers may offer low per-unit pricing but impose high minimum order quantities (MOQs) or charge significant upfront tooling fees. Buyers often underestimate these costs or fail to negotiate ownership of tooling, limiting future sourcing flexibility and creating dependency on a single supplier.

Supply Chain and Lead Time Delays

Aluminum supply chains can be volatile due to raw material pricing and energy-intensive production. Unreliable suppliers may provide optimistic lead times that are not met, especially during peak construction seasons. This can delay entire projects and increase inventory holding costs.

Limited After-Sales Support and Warranty

Some suppliers, particularly those focused on one-time transactions, offer little to no warranty or technical support. If parts fail in the field due to manufacturing defects, resolving claims can be difficult—especially with offshore vendors. Ensure warranty terms, return policies, and replacement procedures are clearly defined upfront.

By proactively addressing these pitfalls through detailed specifications, supplier vetting, and IP due diligence, buyers can secure high-quality aluminum fence components that meet performance, legal, and commercial requirements.

Logistics & Compliance Guide for Aluminum Fence Parts

Overview

This guide outlines the essential logistics and compliance considerations for the international and domestic transportation, handling, and regulatory adherence of aluminum fence parts. Proper management ensures timely delivery, cost efficiency, and legal conformity across jurisdictions.

Material Classification and HS Code

Aluminum fence components are typically classified under the Harmonized System (HS) Code 7610.90, which covers “Other articles of aluminum.” Specific sub-categorizations may apply based on design (e.g., rails, posts, panels). Accurate HS coding is critical for customs clearance, duty assessment, and import/export documentation.

Packaging and Handling Requirements

- Use moisture-resistant packaging (e.g., shrink-wrapped bundles, protective corner guards) to prevent oxidation and surface damage.

- Secure parts on pallets with strapping or stretch film to prevent shifting during transit.

- Clearly label packages with product details, handling instructions (e.g., “Fragile,” “This Side Up”), and barcodes for inventory tracking.

- Avoid direct ground contact; use pallets to minimize exposure to moisture and debris.

Transportation Modes and Best Practices

- Domestic Shipping: Utilize flatbed or enclosed trailers for large orders. Secure loads with straps and tarps to protect from weather.

- International Shipping: Containerized ocean freight (20’ or 40’ dry containers) is standard. Confirm container weight limits and load distribution to avoid imbalance.

- Air Freight: Reserved for urgent, high-value, or sample shipments due to cost. Verify dimensional and weight restrictions with carriers.

- Implement track-and-trace systems for real-time shipment visibility.

Import/Export Documentation

Ensure all shipments include:

– Commercial Invoice (with value, quantity, HS code)

– Packing List (itemized contents, weights, dimensions)

– Bill of Lading (for sea) or Air Waybill (for air)

– Certificate of Origin (may qualify for trade agreement benefits, e.g., USMCA)

– Export Declaration (e.g., AES filing in the U.S. for shipments over $2,500)

Regulatory Compliance

- REACH & RoHS (EU): Confirm aluminum alloys and surface finishes (e.g., powder coating) comply with restrictions on hazardous substances. Maintain documentation from suppliers.

- Customs-Trade Partnership Against Terrorism (C-TPAT): Recommended for U.S.-bound shipments to expedite processing and reduce inspections.

- Country-Specific Standards: Verify compliance with local building codes and standards (e.g., ASTM F2200 in the U.S. for fencing systems).

- TARIC/Import Duties: Check destination country duty rates and potential anti-dumping measures on aluminum products.

Environmental and Sustainability Considerations

- Aluminum is 100% recyclable; promote end-of-life recycling programs.

- Use recyclable or biodegradable packaging materials where possible.

- Comply with Extended Producer Responsibility (EPR) regulations in applicable regions.

Risk Mitigation and Insurance

- Insure shipments against loss, damage, or delay, especially for high-value or long-distance transport.

- Conduct due diligence on logistics partners to ensure reliability and compliance history.

- Maintain records of all compliance documentation for a minimum of five years.

Conclusion

Efficient logistics and strict compliance are vital for the successful distribution of aluminum fence parts. Adherence to international standards, accurate documentation, and proactive risk management ensure smooth operations and customer satisfaction across global markets.

In conclusion, sourcing aluminum fence parts requires careful consideration of quality, cost, supplier reliability, and long-term performance. Aluminum is a durable, low-maintenance, and corrosion-resistant material, making it an excellent choice for fencing applications in both residential and commercial settings. When sourcing components such as posts, rails, panels, and hardware, it is essential to evaluate suppliers based on material specifications, manufacturing standards, lead times, and customer service.

Opting for reputable suppliers—whether domestic or international—ensures consistent product quality and compliance with industry standards such as ASTM. Additionally, factors like customization options, availability of finishing treatments (e.g., powder coating), and logistics should be taken into account to meet project timelines and aesthetic requirements.

Ultimately, a strategic approach to sourcing aluminum fence parts—balancing cost-efficiency with quality and reliability—leads to enhanced product performance, customer satisfaction, and long-term value. Building strong supplier relationships and conducting regular quality assessments further support sustainable and efficient procurement practices in the fencing industry.