The global aluminum enclosures market is experiencing robust expansion, fueled by increasing demand across industries such as electronics, telecommunications, industrial automation, and renewable energy. According to a 2023 report by Mordor Intelligence, the aluminum enclosures market was valued at USD 18.2 billion in 2022 and is projected to grow at a CAGR of 6.4% from 2023 to 2028. This growth is driven by aluminum’s favorable strength-to-weight ratio, corrosion resistance, and excellent thermal and electrical conductivity—qualities that make it ideal for protective enclosures in harsh environments. Additionally, rising investments in smart infrastructure and industrial IoT are accelerating the adoption of modular and scalable enclosure solutions. As sustainability becomes a key focus, aluminum’s high recyclability further strengthens its position as a preferred material. In this evolving landscape, a select group of manufacturers have emerged as leaders, combining innovation, global reach, and engineering excellence to meet the growing and diverse needs of end users. Here are the top nine aluminum enclosures manufacturers shaping the industry.

Top 9 Aluminum Enclosures Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Electrical & Electronic Enclosures, Cabinets & Racks, Outlet Strips …

Domain Est. 1996

Website: hammfg.com

Key Highlights: Hammond Manufacturing is a leading manufacturer of industrial enclosures, electronic enclosures, racks & rack cabinets, transformers, outlet strips and ……

#2 OKW Enclosures

Domain Est. 1999

Website: okwenclosures.com

Key Highlights: OKW manufacture plastic enclosures, aluminium enclosures and tuning knobs for OEM electronics industry; standard and with individual modifications More……

#3 main

Domain Est. 2003

Website: apx-enclosures.com

Key Highlights: APX Enclosures, Inc. is an award-winning enclosures manufacturer specializing in custom-designed NEMA 3R and 4X electrical enclosures. Learn more today….

#4 TAKACHI

Domain Est. 2011

Website: takachi-enclosure.com

Key Highlights: TAKACHI is a manufacturer of electronics enclosures and industrial enclosures.We provide over 22000 items : Plastic enclosure, Handheld enclosure, Aluminium ……

#5 ROLEC US

Domain Est. 2016

Website: rolec-usa.com

Key Highlights: Manufacturers of aluminum, plastic and GPR enclosures for industrial electronics. IP66, IP67 and IP69K. Also HMI enclosures and suspension arm systems….

#6 Aluminum NEMA 4X & 5052 Enclosures

Domain Est. 1999

Website: nemaenclosures.com

Key Highlights: A leading aluminum electrical enclosure manufacturer, produces high-quality aluminum electrical enclosures in wall-mount, free-standing, floor-mount, junction ……

#7 Bud Industries

Domain Est. 1996

Website: budind.com

Key Highlights: At Bud Industries, we have a wide selection of electronic enclosures to choose from. From diecast aluminum to plastic, click here to learn more!…

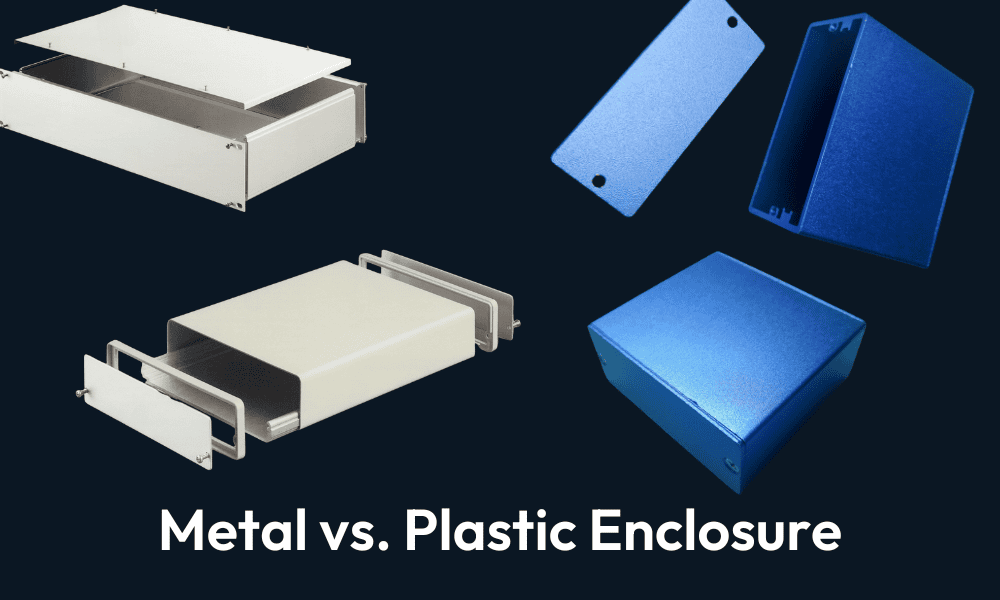

#8 Electronic enclosures in plastic and metal

Domain Est. 2001

Website: tekoenclosures.com

Key Highlights: Teko offers its customers a wide range of plastic and metal electronic enclosures, characterized by an extremely accurate and innovative design, ……

#9 Commercial Residential Aluminum

Domain Est. 2009

Website: craluminum.com

Key Highlights: CRA designs, manufactures, and installs premium aluminum outdoor structures that transform how you enjoy your home. Our expertise includes pool cages, lanai ……

Expert Sourcing Insights for Aluminum Enclosures

H2: 2026 Market Trends for Aluminum Enclosures

The global market for aluminum enclosures is poised for significant transformation by 2026, driven by technological advancements, sustainability imperatives, and evolving industry demands. As industries increasingly prioritize lightweight, durable, and corrosion-resistant materials, aluminum enclosures are gaining traction across key sectors such as electronics, telecommunications, industrial automation, renewable energy, and electric vehicles (EVs).

One of the primary drivers shaping the 2026 outlook is the surge in demand for compact and modular electronic systems. With the expansion of 5G infrastructure, IoT devices, and edge computing, there is a growing need for enclosures that offer superior electromagnetic interference (EMI) shielding, efficient thermal management, and space optimization—all of which aluminum effectively provides. Manufacturers are responding with innovative designs, including customizable, anodized, and powder-coated aluminum housings that enhance both performance and aesthetics.

Sustainability is another critical trend influencing the market. Aluminum is 100% recyclable and has a significantly lower carbon footprint compared to alternative materials like steel or plastics. As global regulatory frameworks tighten around emissions and circular economy principles, industries are shifting toward aluminum enclosures to meet environmental standards and achieve corporate sustainability goals. This trend is particularly evident in Europe and North America, where green manufacturing certifications are becoming a competitive differentiator.

The rise of electric mobility and renewable energy systems is also fueling demand. Aluminum enclosures are widely used in battery management systems (BMS), solar inverters, and EV charging stations due to their lightweight nature and thermal conductivity. By 2026, the integration of smart energy systems is expected to further increase deployment of aluminum-encased components in smart grids and energy storage solutions.

Regionally, Asia-Pacific is projected to lead market growth, supported by robust electronics manufacturing in China, India, and Southeast Asia. Meanwhile, North America and Europe are focusing on high-value, precision-engineered enclosures for aerospace, defense, and medical applications.

In conclusion, the aluminum enclosure market in 2026 will be characterized by innovation in design, stronger emphasis on sustainability, and expansion into high-growth technology sectors. Companies that invest in R&D, adopt eco-friendly production practices, and tailor solutions for emerging applications will be well-positioned to capture market share in this evolving landscape.

Common Pitfalls When Sourcing Aluminum Enclosures (Quality, IP)

Sourcing aluminum enclosures involves several critical considerations, particularly concerning build quality and ingress protection (IP) ratings. Overlooking these aspects can lead to product failures, safety hazards, and increased long-term costs. Below are common pitfalls to avoid:

Inaccurate or Unverified IP Ratings

Many suppliers, especially on open marketplaces, claim high IP ratings (e.g., IP65, IP66) without proper certification or testing. These claims may be based on design intent rather than actual performance. Enclosures might lack proper gaskets, sealing methods, or tight tolerances needed to achieve the stated protection. Always request third-party test reports or certification documents to verify IP claims.

Poor Material Quality and Thickness

Low-cost enclosures often use thinner aluminum or substandard alloys that compromise structural integrity, heat dissipation, and corrosion resistance. Thin walls can dent easily and may not support secure mounting of components. Verify material specifications (e.g., 5052 or 6061 aluminum) and check wall thickness—especially for outdoor or industrial applications.

Inconsistent Manufacturing Tolerances

Inferior manufacturing processes lead to inconsistent dimensions, misaligned mounting holes, or poorly machined cutouts. This makes integration with internal components or panel mounting difficult and time-consuming. Ensure suppliers use CNC machining and maintain tight tolerances, particularly for custom or precision-fit applications.

Substandard Surface Finish and Corrosion Protection

Anodizing or powder coating protects aluminum from oxidation and environmental damage. Poor surface treatment—such as uneven coating, thin anodization, or lack of sealing—can lead to premature corrosion, especially in humid or coastal environments. Confirm the type and thickness of protective finish and inquire about salt spray test results if needed.

Inadequate Gasket Quality and Seal Design

Even with a proper IP rating, poor-quality or incorrectly sized gaskets degrade over time, leading to moisture or dust ingress. Silicone or EPDM gaskets should be UV-resistant and compressible. Check whether gaskets are integrated properly and whether the enclosure design allows even compression when fastened.

Overlooking Thermal and Electrical Performance

Aluminum enclosures serve as heat sinks and sometimes grounding points. Poor thermal conductivity due to alloy choice or excessive paint coverage can impair heat dissipation. Similarly, painted surfaces may interfere with electrical grounding unless designed with grounding lugs or conductive paths. Confirm thermal and electrical requirements are met for your application.

Lack of Customization Verification

Custom enclosures may deviate from prototypes or drawings due to miscommunication or cost-cutting. Always request samples before mass production and verify dimensions, cutouts, labeling, and finish against specifications. Unapproved substitutions can invalidate IP ratings or cause compatibility issues.

Ignoring Long-Term Supplier Reliability

Choosing suppliers solely on price can backfire if they lack consistent quality control or technical support. Evaluate supplier reputation, manufacturing capabilities, lead times, and responsiveness. A reliable supplier provides documentation, supports audits, and stands behind their product claims.

Avoiding these pitfalls requires due diligence, clear specifications, and verification at every stage—from sample evaluation to final delivery.

Logistics & Compliance Guide for Aluminum Enclosures

Overview of Aluminum Enclosures in Global Trade

Aluminum enclosures are widely used across industries such as electronics, telecommunications, industrial automation, and renewable energy due to their durability, lightweight properties, and corrosion resistance. Proper logistics and compliance management are essential to ensure safe transportation, regulatory adherence, and timely delivery across international and domestic markets.

Material Classification and HS Code

Aluminum enclosures typically fall under Harmonized System (HS) codes related to aluminum structures or electrical equipment housings. Common classifications include:

– HS 7610.90: “Other containers, tanks, and similar articles, of aluminum”

– HS 8548.90: “Parts suitable for use solely or principally with electrical machines, of aluminum”

– Specific sub-codes may apply based on design, use, and region; consult local customs authorities for accurate classification.

Correct HS coding is crucial for determining import/export duties, tariffs, and regulatory requirements.

Packaging and Handling Requirements

Proper packaging ensures product integrity during transit:

– Use sturdy, moisture-resistant cardboard or wooden crates to protect against impact and environmental exposure.

– Apply anti-corrosion coatings or VCI (Vapor Corrosion Inhibitor) paper to prevent oxidation.

– Secure enclosures with foam inserts or dividers to minimize movement.

– Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up,” “Do Not Stack”).

– Include protective film on finished surfaces to prevent scratches.

Transportation and Freight Considerations

- Mode of Transport: Aluminum enclosures can be shipped via air, sea, or ground. For large volumes, containerized sea freight (FCL/LCL) is cost-effective. Air freight suits urgent or high-value shipments.

- Weight and Dimensions: Account for aluminum’s density in freight cost calculations. Optimize palletization to maximize container or truck space.

- Incoterms: Clearly define responsibilities using standard Incoterms (e.g., FOB, CIF, DDP) to avoid disputes over shipping costs, insurance, and risk transfer.

Regulatory Compliance and Certifications

Ensure enclosures meet regional and industry-specific standards:

– RoHS (Restriction of Hazardous Substances): Required in the EU; verify aluminum alloys and finishes are free of restricted substances.

– REACH (EU): Confirm compliance with chemical safety regulations.

– UL/CSA/ETL Listings: Required for enclosures used in North American electrical applications.

– IP (Ingress Protection) Ratings: Must be validated per IEC 60529 for dust and water resistance.

– Customs Documentation: Include commercial invoice, packing list, bill of lading/air waybill, and certificates of origin.

Environmental and Recycling Regulations

- Aluminum is highly recyclable; comply with local waste and recycling laws (e.g., WEEE Directive in the EU).

- Maintain documentation demonstrating responsible end-of-life management.

- Some regions impose recycled content requirements; source materials accordingly.

Import/Export Documentation

Essential documents include:

– Commercial Invoice: Details product description, value, currency, and terms.

– Packing List: Specifies quantity, weight, dimensions, and packaging type per unit.

– Certificate of Origin: May be required for preferential tariff treatment under trade agreements (e.g., USMCA, EU-South Korea FTA).

– Bill of Lading (B/L): Serves as title, receipt, and contract of carriage.

– Export Declaration: Required in the country of origin (e.g., AES filing in the U.S.).

Duty and Tariff Management

- Leverage free trade agreements (FTAs) when applicable to reduce or eliminate duties.

- Monitor changes in aluminum tariffs (e.g., Section 232 tariffs in the U.S. on aluminum imports).

- Consider bonded warehousing or duty drawback programs for cost optimization.

Safety and Hazard Compliance

- While aluminum enclosures are generally non-hazardous, coated or anodized finishes may contain regulated chemicals.

- If treated with chromate conversion coatings, ensure compliance with OSHA and GHS labeling standards.

- Declare any hazardous processing residues in safety data sheets (SDS), if applicable.

Quality Assurance and Traceability

- Maintain production records, material test reports (MTRs), and quality control documentation.

- Implement lot tracking for recalls or compliance audits.

- Provide customers with product conformity certificates (e.g., ISO 9001, ISO 14001).

Conclusion

Successful logistics and compliance for aluminum enclosures require careful planning across classification, packaging, transportation, and regulatory domains. Proactive management reduces delays, avoids penalties, and ensures market access. Regularly review evolving regulations and work with certified logistics partners to maintain compliance throughout the supply chain.

Conclusion for Sourcing Aluminum Enclosures:

Sourcing aluminum enclosures requires a balanced approach that considers quality, cost, customization capabilities, lead times, and supplier reliability. Aluminum enclosures offer significant advantages, including durability, lightweight properties, excellent thermal conductivity, and corrosion resistance, making them ideal for industries such as electronics, telecommunications, industrial automation, and medical devices.

After evaluating multiple suppliers and sourcing options—whether domestic, offshore, or via online platforms—it is essential to prioritize long-term value over initial cost savings. Factors such as material grade (e.g., 6061-T6 or 5052), manufacturing processes (e.g., extrusion, CNC machining), surface finishes (anodizing, powder coating), and compliance with industry standards should guide decision-making.

Establishing strong relationships with reputable suppliers who offer consistent quality, technical support, and scalability ensures supply chain stability. Additionally, considering sustainability and recyclability of aluminum aligns with environmental goals and regulatory trends.

In summary, a strategic sourcing approach that emphasizes quality, partner reliability, and technical suitability will ensure optimal performance and cost-efficiency in acquiring aluminum enclosures for your application.