The global aluminum cladding panel market is experiencing robust growth, driven by rising demand for lightweight, durable, and energy-efficient building materials in commercial and residential construction. According to Mordor Intelligence, the aluminum cladding market was valued at USD 59.4 billion in 2023 and is projected to reach USD 80.6 billion by 2029, growing at a CAGR of approximately 5.2% during the forecast period. This expansion is fueled by urbanization, increasing infrastructure development, and a shift toward sustainable architecture—particularly in regions like Asia-Pacific and the Middle East. Aluminum’s corrosion resistance, recyclability, and aesthetic flexibility make it a preferred choice for modern façades and building envelopes. As demand surges, several manufacturers have emerged as leaders in innovation, product quality, and global reach. Below are the top 10 aluminum cladding panel manufacturers shaping the industry’s present and future.

Top 10 Aluminum Cladding Panel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

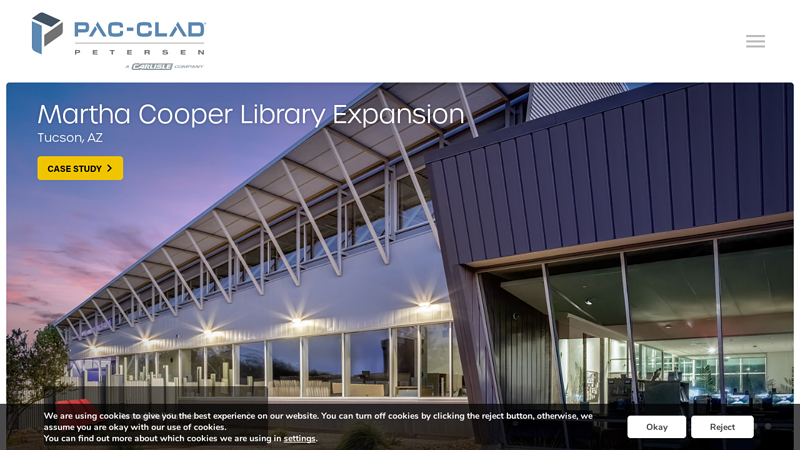

#1 PAC-CLAD

Domain Est. 1996

Website: pac-clad.com

Key Highlights: Made from high-quality steel and aluminum, PAC-CLAD panels are engineered for long service life, durability, and superior performance….

#2 Facades and Cladding

Domain Est. 1996

Website: lorin.com

Key Highlights: Lorin’s anodized aluminum stands out as the ideal material for creating perforated wall panels. With its superior surface finish and exceptional corrosion ……

#3 Aluminum cladding options from Alumil

Domain Est. 1998

Website: alumil.com

Key Highlights: Aluminium composite panel of high quality and wide variety, with polyethylene filling, ideal for exterior cladding and interior building decorations, ……

#4 Aluminum Composite Panels for Modern Architecture

Domain Est. 2004

Website: alucobondusa.com

Key Highlights: ALUCOBOND manufactures innovative fire retardant aluminum composite panels for modern building design. Browse our products for your next project….

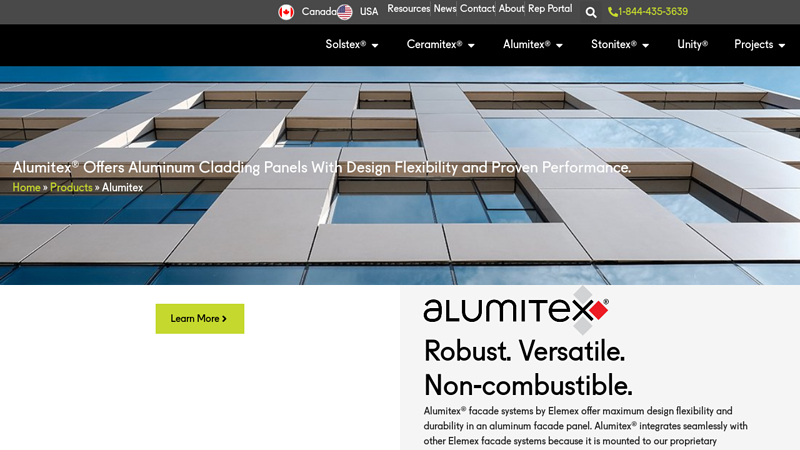

#5 Aluminum Cladding Panels

Domain Est. 2011

Website: elemex.com

Key Highlights: Alumitex® is an aluminum cladding by Elemex that exceeds North American codes and offers maximum design flexibility and durability. Find out more….

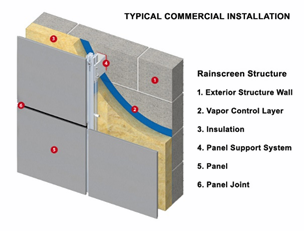

#6 Rainscreen Cladding Systems

Domain Est. 2012

Website: phoenixpanels.net

Key Highlights: Phoenix Panels is a premier fabricator of engineered and tested, pressure-equalized Rainscreen cladding systems and panel fabrication services….

#7 Eurobond ACP panels

Domain Est. 2015

Website: eurobondacp.com

Key Highlights: Bonds That Last. Eurobond is a globally recognized brand of Euro Panel Product Limited specializing in manufacturing world-class Aluminium Composite Panels….

#8 AlumLA

Domain Est. 2017

Website: alumla.com

Key Highlights: Explore AlumLA for sustainable, easy-to-install aluminum cladding systems. Perfect for both residential and commercial projects. Transform your space today!…

#9 ACP Sheets

Domain Est. 2020

Website: vivaacp.com

Key Highlights: Our ACP Sheets (Aluminium ACP Sheet) are eco-conscious and Thomas Bell Wright Certified. And it’s fully flexible, easy to install and many more….

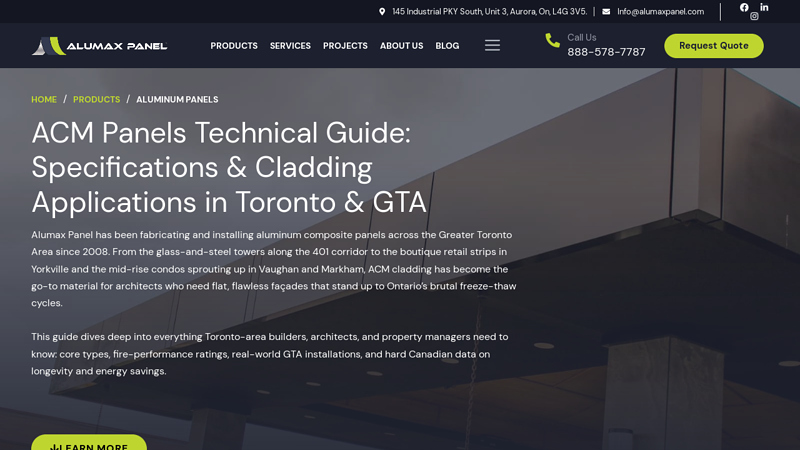

#10 Aluminum Composite Cladding Toronto & GTA

Domain Est. 2014

Expert Sourcing Insights for Aluminum Cladding Panel

H2: Market Trends in Aluminum Cladding Panels for 2026

By 2026, the global aluminum cladding panel market is poised for significant transformation, driven by evolving construction practices, sustainability imperatives, and technological advancements. Key trends shaping the landscape include:

1. Dominance of Sustainability and Circularity:

Environmental concerns will be paramount. Demand will surge for cladding panels made from high-recycled-content aluminum (often 70-90%), driven by stringent building regulations (like LEED, BREEAM, and local green codes) and corporate ESG commitments. Low-carbon aluminum production (using renewable energy) will become a major differentiator. Lifecycle analysis (LCA) will be crucial, with manufacturers emphasizing recyclability (near 100% at end-of-life) and durability (50+ year lifespan) as core sustainability selling points. Expect increased focus on transparent supply chains and Environmental Product Declarations (EPDs).

2. Technological Innovation in Performance and Aesthetics:

Panels will move beyond basic functionality:

* Enhanced Performance: Wider adoption of insulated metal panels (IMPs) combining aluminum skins with high-performance cores (mineral wool, polyiso) for superior thermal efficiency, crucial for net-zero energy buildings. Integration of photovoltaic (PV) elements into cladding (Building-Integrated Photovoltaics – BIPV) will accelerate, turning facades into power generators.

* Advanced Finishes: Growth in custom digital printing for unique, large-scale graphics and wood/stone effects. Self-cleaning and anti-fouling coatings (e.g., photocatalytic TiO2) will gain traction, reducing maintenance. Dynamic or responsive facades using materials that change color or opacity based on light/temperature will emerge in high-end projects.

3. Urbanization and High-Rise Construction Driving Demand:

Rapid urbanization, particularly in Asia-Pacific (China, India, Southeast Asia) and the Middle East, will fuel demand for modern, durable high-rise buildings. Aluminum cladding is ideal for these structures due to its high strength-to-weight ratio, design flexibility, and weather resistance. The trend towards mixed-use developments and regeneration projects in established cities (North America, Europe) will also boost demand.

4. Supply Chain Resilience and Regionalization:

Geopolitical tensions and past disruptions have highlighted vulnerabilities. Companies will prioritize diversifying raw material sources (especially bauxite and alumina) and regionalizing manufacturing to reduce logistics costs, carbon footprints, and exposure to trade barriers. Nearshoring and friend-shoring strategies will influence investment decisions.

5. Integration with Smart Building Systems:

Cladding will increasingly function as an active building component. Integration with Building Management Systems (BMS) via embedded sensors for monitoring structural health, temperature, and energy performance will grow. While still niche, cladding with integrated sensors or communication elements could emerge.

6. Competitive Landscape and Value-Added Services:

Competition will intensify, shifting focus beyond price to value-added services. Leaders will offer comprehensive design support (BIM integration, 3D modeling), performance guarantees, lifecycle cost analysis, and installation expertise. Partnerships between cladding manufacturers, architects, and facade consultants will become essential.

In summary, the 2026 aluminum cladding panel market will be characterized by a strong emphasis on sustainability, driven by innovation in performance and aesthetics, fueled by global urbanization, and shaped by resilient supply chains and integrated building solutions. Success will belong to players offering high-performance, low-carbon, technologically advanced products backed by robust services.

Common Pitfalls When Sourcing Aluminum Cladding Panels (Quality and Intellectual Property)

Sourcing aluminum cladding panels involves navigating complex supply chains where quality control and intellectual property (IP) protection are critical. Overlooking these aspects can lead to project delays, safety risks, legal disputes, and reputational damage. Below are the key pitfalls to avoid:

Quality-Related Pitfalls

1. Inconsistent Material Composition and Alloy Grade

A major risk is receiving panels that do not meet specified alloy standards (e.g., 3003, 5005, or 5052). Suppliers may substitute lower-grade aluminum to cut costs, resulting in reduced strength, corrosion resistance, or formability. Without proper material certification (e.g., mill test reports), it’s difficult to verify compliance.

2. Poor Surface Finish and Coating Defects

Inferior pre-treatment, paint application, or anodizing processes can lead to uneven finishes, color variation, chalking, or premature coating failure. Sourcing from suppliers without certified coating systems (e.g., PVDF or polyester) or proper quality assurance protocols increases the risk of aesthetic and performance issues, especially in harsh environments.

3. Lack of Third-Party Testing and Certification

Relying solely on supplier claims without independent verification is risky. Panels should undergo testing for fire performance (e.g., EN 13501-1, ASTM E84), wind load resistance, and weathering. Failure to require test reports from accredited labs may result in non-compliant products that jeopardize building safety and code approval.

4. Inadequate Quality Control During Manufacturing

High-volume production can lead to lapses in dimensional accuracy, flatness, or joint consistency. Suppliers without robust in-line quality checks may deliver substandard batches. Conducting factory audits and requesting production samples before full-scale orders helps mitigate this risk.

Intellectual Property-Related Pitfalls

1. Unauthorized Use of Patented Panel Designs or Profiles

Many cladding systems—especially those with unique interlocking mechanisms, rib patterns, or installation methods—are protected by patents. Sourcing from suppliers who replicate these designs without licensing exposes the buyer to legal liability, product seizure, or project stoppages.

2. Counterfeit or “Copycat” Products

Some suppliers market imitation panels as equivalent to premium branded systems (e.g., mimicking products from Alucobond, Reynobond, or 3A Composites). These may look similar but fail to meet performance standards and infringe on registered designs or trademarks, leading to IP litigation.

3. Ambiguous or Missing IP Clauses in Contracts

Purchase agreements that don’t clearly assign IP ownership, restrict reverse engineering, or require proof of IP clearance leave buyers vulnerable. Without explicit warranties that the product does not infringe third-party rights, the buyer may bear legal and financial consequences.

4. Lack of Traceability and Documentation

Failing to obtain detailed product documentation—including patent numbers, design registrations, and licensing agreements—makes it difficult to verify IP legitimacy. This is especially critical in public or high-profile projects where compliance scrutiny is high.

Mitigation Strategies

- Demand full material and test certifications from accredited bodies.

- Conduct factory inspections and request sample panels for independent testing.

- Verify IP status through patent searches and require suppliers to provide IP indemnity clauses.

- Source from reputable manufacturers with a proven track record and transparent supply chains.

- Engage legal counsel to review contracts for IP compliance and liability protection.

By proactively addressing these pitfalls, procurement teams can ensure they receive high-quality, compliant, and legally defensible aluminum cladding solutions.

Logistics & Compliance Guide for Aluminum Cladding Panels

Overview and Application Scope

This guide outlines the essential logistics and compliance requirements for the safe handling, transportation, storage, and regulatory adherence related to aluminum cladding panels used in architectural and construction applications. It is designed for manufacturers, suppliers, contractors, and logistics providers involved in the supply chain.

Material Classification and Regulatory Compliance

Aluminum cladding panels are generally non-hazardous materials under international transport regulations (e.g., IMDG, IATA, ADR). However, compliance with building codes, fire safety standards, and environmental regulations is critical. Key compliance areas include:

– Fire Safety Standards: Panels must meet local fire performance requirements (e.g., ASTM E84, EN 13501-1). Avoid use of combustible core materials unless explicitly permitted and tested.

– Environmental Regulations: Adherence to REACH (EU), RoHS, and TSCA (USA) regarding restricted substances in coatings or composite materials.

– Building Codes: Compliance with local building regulations (e.g., International Building Code, UK Building Regulations) regarding structural integrity, wind load resistance, and thermal performance.

Packaging and Handling Requirements

Proper packaging prevents surface damage, deformation, and contamination during transit. Guidelines include:

– Use edge protectors, protective films, and wooden crating for bundled panels.

– Secure panels vertically or flat on pallets with non-abrasive strapping.

– Avoid stacking beyond recommended weight limits to prevent bowing.

– Handle with non-metallic slings or padded forklift attachments to avoid scratches.

Transportation and Shipping

Ensure safe and efficient transport via road, sea, or air:

– Marine Freight: Use moisture-resistant wrapping and desiccants to prevent condensation in containers. Secure cargo to prevent shifting.

– Overland Transport: Cover with waterproof tarpaulins; avoid exposure to extreme weather.

– Air Freight: Comply with IATA packaging specifications; declare as non-hazardous general cargo.

– Provide clear labeling: “Fragile,” “This Side Up,” and handling instructions.

Storage Conditions

Store aluminum cladding panels in a controlled environment to maintain quality:

– Keep indoors, dry, and off the ground on level racks.

– Maintain temperature between 10°C and 30°C; avoid direct sunlight and humidity.

– Protect from dust, chemicals, and mechanical impact.

– Rotate stock using FIFO (First In, First Out) to prevent aging.

Import/Export Documentation and Customs

For international shipments, prepare accurate documentation:

– Commercial Invoice and Packing List detailing quantity, weight, dimensions, and material composition.

– Certificate of Origin to determine tariff eligibility.

– Material Test Reports (MTRs) or fire safety certifications upon request.

– Harmonized System (HS) Code: Typically 7610.90 (other aluminum building components). Verify with local customs.

Quality Assurance and Traceability

Maintain full traceability through batch numbering, production dates, and QC documentation. Conduct pre-shipment inspections to verify panel dimensions, surface finish, and compliance with project specifications.

Sustainability and End-of-Life Considerations

Aluminum cladding is highly recyclable. Encourage responsible disposal and recycling at end-of-life. Provide recyclability data and environmental product declarations (EPDs) when available to support green building certifications (e.g., LEED, BREEAM).

Emergency and Incident Response

In case of damage or contamination during transit:

– Document condition upon receipt with photos and inspection reports.

– Notify supplier and insurer immediately.

– Isolate damaged panels and follow disposal guidelines if unsafe for use.

For fire incidents involving panels, confirm material composition (especially core type) to inform firefighting and safety procedures.

Conclusion

Adhering to this logistics and compliance guide ensures the safe and legal movement of aluminum cladding panels while maintaining product integrity and regulatory compliance. Regular audits, staff training, and updates to regional regulations are recommended to sustain best practices.

Conclusion for Sourcing Aluminum Cladding Panels

Sourcing aluminum cladding panels requires a strategic approach that balances quality, cost, durability, and sustainability. After evaluating suppliers, material specifications, certifications, and project requirements, it is clear that selecting the right aluminum cladding solution significantly impacts the building’s aesthetics, performance, and long-term maintenance costs. High-quality panels with appropriate finishes—such as PVDF or polyester coatings—ensure resistance to weathering, corrosion, and UV exposure, especially in challenging environments.

Prioritizing suppliers with proven track records, adherence to international standards (e.g., ASTM, EN), and sustainable manufacturing practices supports both project integrity and environmental responsibility. Additionally, considering lead times, logistics, and technical support enables smoother project execution. Ultimately, a well-informed sourcing decision contributes to enhanced building performance, client satisfaction, and long-term value—making aluminum cladding a reliable and aesthetically versatile choice for modern architectural applications.