The global aluminum blanking market is experiencing robust growth, driven by rising demand for lightweight materials in the automotive sector. According to Grand View Research, the global aluminum market size was valued at USD 186.2 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030, fueled in part by increasing adoption in automotive manufacturing for improved fuel efficiency and reduced emissions. As a key hub for automotive innovation, Pontiac, Michigan, sits at the heart of this transformation, hosting several advanced aluminum blanking manufacturers that serve major OEMs. These companies leverage high-precision cutting and forming technologies to deliver custom blanks for body panels, structural components, and powertrain systems. With aluminum’s role in vehicle lightweighting becoming increasingly critical—particularly in the development of electric vehicles—the concentration of specialized suppliers in Pontiac highlights the region’s strategic importance in the evolving supply chain. Here, we spotlight the top four aluminum blanking manufacturers based in Pontiac, evaluating their capabilities, technologies, and contributions to the growing demand for high-performance aluminum solutions.

Top 4 Aluminum Blanking Pontiac Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 CONTACT US

Domain Est. 2004

Website: 05d1aa7.netsolhost.com

Key Highlights: Aluminum Blanking Company, Inc. 360 West Sheffield Ave. Pontiac, Michigan 48340. Tel: 248-338-4422. Fax: 248-338-9779. Email: [email protected]. IATF 16949….

#2 If You Can Coil It and Ship It, Aluminum Blanking Can Process It!

Domain Est. 1998

Website: albl.com

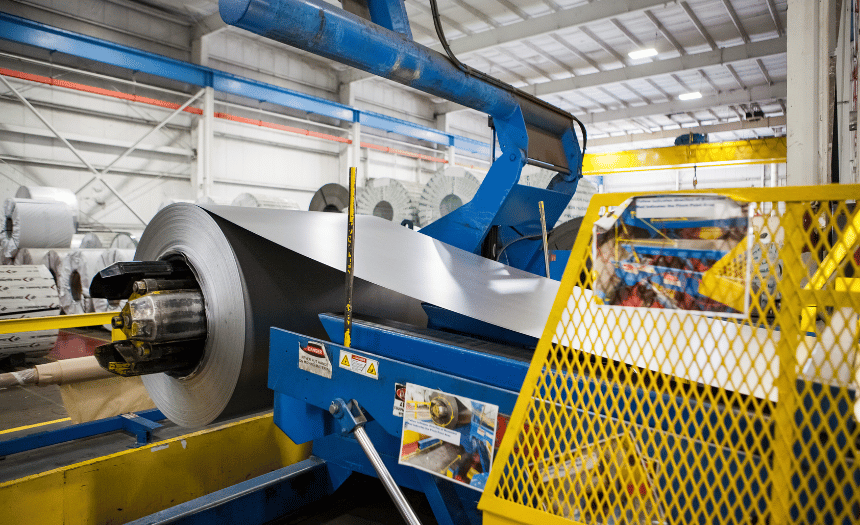

Key Highlights: Seven blanking lines offer unsurpassed blanking and cut-to-length capabilities. Our numerous value-added services enable us to provide our customers a quality ……

#3 Blank Stacker Headed to Aluminum Toll Processor

Domain Est. 2001

Website: metalformingmagazine.com

Key Highlights: In December 2008, Aluminum Blanking Co., Pontiac, MI, became the proud new owner of an aluminum blank-stacking system designed to protect the ……

#4 Aluminum Blanking Company, INC

Domain Est. 2009 | Founded: 1979

Website: leadiq.com

Key Highlights: Aluminum Blanking Company (ABCO) was established in 1979 as a toll processor of aluminum, stainless steel, and other surface-sensitive coiled material. Years of ……

Expert Sourcing Insights for Aluminum Blanking Pontiac

H2: Projected 2026 Market Trends for Aluminum Blanking in Pontiac

As the automotive and advanced manufacturing sectors continue to evolve, the aluminum blanking industry in Pontiac, Michigan, is poised for strategic growth and transformation by 2026. Driven by regional industrial revitalization, increasing demand for lightweight materials, and advancements in sustainable manufacturing, several key trends are expected to shape the market dynamics for aluminum blanking operations in the area.

-

Growing Demand from the Automotive Sector

Pontiac’s proximity to Detroit—the heart of the U.S. automotive industry—positions it as a critical hub for aluminum blank suppliers. By 2026, automakers are projected to intensify their shift toward lightweight vehicle designs to meet stringent fuel efficiency and emissions standards. Aluminum, with its high strength-to-weight ratio, is increasingly favored over steel, particularly in electric vehicles (EVs). As major OEMs expand EV production, demand for precision aluminum blanks—used in body panels, hoods, and structural components—is expected to rise significantly, directly benefiting Pontiac-based blanking facilities. -

Expansion of EV and Battery Manufacturing Ecosystem

The rise of EV production in Southeast Michigan, including nearby facilities like the Ultium Cells battery plant, is creating spillover demand for aluminum components. Aluminum is extensively used not only in vehicle bodies but also in battery enclosures and thermal management systems. By 2026, integrated supply chains are likely to emerge, with aluminum blanking operations in Pontiac serving as just-in-time (JIT) suppliers to nearby EV and battery manufacturers, enhancing regional competitiveness. -

Adoption of Advanced Blanking Technologies

To meet tighter tolerances and higher throughput requirements, aluminum blanking operations in Pontiac are expected to invest heavily in automation, AI-driven quality control, and high-speed press technologies by 2026. Innovations such as servo-driven blanking lines and real-time defect detection systems will improve yield rates and reduce waste, making local operations more efficient and attractive to OEMs seeking reliable, high-volume suppliers. -

Sustainability and Recycling Initiatives

Environmental regulations and corporate sustainability goals will drive increased use of recycled aluminum in blanking processes. By 2026, facilities in Pontiac may prioritize closed-loop recycling systems and low-carbon energy sources to reduce their environmental footprint. This shift aligns with broader industry trends and could position Pontiac as a leader in sustainable aluminum manufacturing within the Midwest. -

Workforce Development and Industry Collaboration

To support technological advancements, workforce training programs in advanced manufacturing—potentially through partnerships with Oakland Community College and Michigan’s Going PRO initiative—are expected to expand. By 2026, a more skilled labor pool could enhance productivity and innovation in Pontiac’s aluminum blanking sector, attracting further investment and fostering long-term resilience.

In summary, the 2026 outlook for aluminum blanking in Pontiac is characterized by strong automotive demand, technological modernization, sustainability focus, and regional integration within the EV supply chain. These factors position Pontiac as a growing node in the advanced materials manufacturing landscape of the United States.

Common Pitfalls Sourcing Aluminum Blanking for Pontiac (Quality & IP)

Sourcing aluminum blanking components for Pontiac vehicles—whether for restoration, replacement, or aftermarket production—comes with specific challenges, particularly concerning material quality and intellectual property (IP). Being aware of these pitfalls helps ensure reliable, compliant, and high-performing parts.

Quality-Related Pitfalls

1. Substandard Aluminum Alloy Composition

Using incorrect or inferior aluminum alloys (e.g., substituting 6061 for specified 5052 or 3003) can lead to poor formability, reduced corrosion resistance, or inadequate strength. This is especially critical in structural or exposed body panels where performance and longevity matter.

2. Inconsistent Material Thickness (Gauge Variation)

Blanks with inconsistent thickness can cause warping, cracking during stamping, or improper fitment. Suppliers may cut costs by using variable gauge stock, leading to rejected parts or inconsistent production output.

3. Poor Surface Finish and Contamination

Scratches, oil residue, or oxidation on aluminum blanks can compromise paint adhesion and final appearance. Contaminants introduced during cutting or handling may also interfere with welding or bonding processes common in automotive assembly.

4. Inaccurate Dimensional Tolerances

Blanks that do not meet tight dimensional tolerances result in misalignment during fabrication, increased scrap rates, and costly rework. This is particularly problematic when integrating with legacy Pontiac tooling or modern restoration jigs.

5. Inadequate Certification and Traceability

Lack of mill test reports (MTRs) or material certifications makes it difficult to verify alloy grade, heat treatment, and compliance with OEM specifications. This becomes a critical issue in safety-critical or high-visibility restoration projects.

Intellectual Property (IP) Pitfalls

1. Unauthorized Use of OEM Tooling or Designs

Replicating Pontiac-specific blank shapes or contours without proper licensing may infringe on General Motors’ design patents or trade dress rights, especially for iconic body panels like fenders or hoods from classic models (e.g., GTO, Firebird).

2. Trademark Infringement in Branding or Marketing

Using Pontiac names, emblems, or model designations (e.g., “Trans Am,” “Grand Prix”) on sourced or resold blanks without authorization can lead to legal action for trademark violation, even if the part itself is functionally generic.

3. Reverse Engineering Without Legal Clearance

While functional aspects of parts may be unprotected, reverse engineering complex stamped geometries that are protected under design patents can expose buyers and suppliers to IP litigation, particularly if the part is marketed as an OEM-equivalent.

4. Gray Market or Counterfeit Components

Sourcing blanks from unauthorized third parties may result in IP-infringing products. These components often lack quality control and may expose the buyer to liability for distributing unlicensed reproductions of GM designs.

5. Lack of Licensing Agreements for Restoration Parts

Reputable restoration suppliers often operate under licensed agreements with GM for legacy parts. Sourcing from unlicensed vendors increases IP risk and may limit resale or commercial use of the final product.

Best Practices to Avoid Pitfalls

- Specify exact alloy, temper, and ASTM/SAE standards in procurement contracts.

- Require full material certifications and batch traceability.

- Vet suppliers with automotive-grade quality systems (e.g., IATF 16949).

- Conduct legal review when reproducing branded or design-specific parts.

- Use licensed suppliers for OEM-identical restoration components.

By addressing both quality and IP concerns proactively, buyers can ensure durable, compliant, and legally safe aluminum blanking solutions for Pontiac applications.

Logistics & Compliance Guide for Aluminum Blanking – Pontiac Facility

Overview

This guide outlines the logistics procedures and compliance requirements specific to aluminum blanking operations at the Pontiac facility. Adherence to these protocols ensures operational efficiency, regulatory compliance, safety, and product quality.

Regulatory Compliance

Environmental Regulations

All aluminum blanking activities must comply with federal, state, and local environmental regulations, including the Clean Air Act (CAA), Clean Water Act (CWA), and Resource Conservation and Recovery Act (RCRA). The Pontiac facility is required to maintain permits for air emissions, stormwater discharge (MS4), and hazardous waste handling. Regular monitoring and reporting of emissions and waste streams are mandatory.

OSHA Standards

Operations must conform to OSHA guidelines for machine guarding, lockout/tagout (LOTO), respiratory protection, and hearing conservation. All personnel involved in blanking operations must complete annual safety training, with special emphasis on handling sharp metal edges and operating press equipment safely.

DOT & Transportation Compliance

Aluminum blanks shipped via motor carrier must comply with Department of Transportation (DOT) regulations, including proper load securement (49 CFR Part 393), hazardous materials classification (if applicable), and vehicle maintenance standards. Shipping documentation must include accurate weight, dimensions, and material specifications.

Material Handling & Storage

Incoming Aluminum Coil Management

Received aluminum coils must be inspected for damage, verified against purchase orders, and stored in a dry, designated area to prevent oxidation or surface contamination. Coils should be stored vertically or on approved racks to avoid deformation.

In-Process Material Flow

Blanks must be transported using non-abrasive methods (e.g., vacuum lifters or padded conveyors) to maintain surface quality. Work-in-progress (WIP) inventory should be clearly labeled and staged in accordance with production schedules to minimize bottlenecks.

Finished Blank Storage

Finished aluminum blanks must be stored in climate-controlled areas where possible, segregated by alloy type, temper, and coating. Stacking must not exceed approved height limits to prevent collapse or deformation.

Shipping & Receiving Procedures

Packaging Standards

Blanks must be packaged to prevent scratching, warping, or moisture exposure. Use edge protectors, interleaving paper, and moisture barriers as required. Each package must be labeled with part number, quantity, heat/lot number, and customer information.

Documentation Requirements

All shipments require a bill of lading (BOL), packing slip, and material test report (MTR) when applicable. Electronic data interchange (EDI) must be utilized for order confirmation, advance shipping notices (ASNs), and invoicing per customer requirements.

Carrier Coordination

Approved carriers must be pre-qualified for metal freight handling. Load appointments must be scheduled in advance with the Pontiac receiving/shipping dock. Real-time shipment tracking should be provided to customers upon dispatch.

Quality Assurance & Traceability

In-Process Inspections

Dimensional checks, surface quality audits, and edge condition inspections must be performed at defined intervals per the quality control plan. Non-conforming parts must be quarantined and documented using the facility’s non-conformance report (NCR) system.

Material Traceability

Full traceability from coil receipt to blank shipment must be maintained. Heat numbers, lot codes, and processing dates must be recorded in the ERP system (e.g., SAP or Oracle) and retained for a minimum of seven years.

Facility-Specific Requirements – Pontiac

Equipment Maintenance

All blanking presses and coil handling equipment must undergo preventive maintenance per OEM schedules. Maintenance logs must be kept on-site and available for audit.

Waste Management

Aluminum scrap (trimmings, offcuts) must be segregated and recycled through certified vendors. Oil-contaminated rags and cleaning solvents are classified as hazardous waste and require proper storage, labeling, and disposal via licensed handlers.

Emergency Preparedness

The Pontiac facility must maintain an up-to-date emergency response plan, including spill containment procedures for lubricants and coolant, fire suppression systems, and evacuation routes. Drills must be conducted biannually.

Continuous Improvement & Audits

Internal Audits

Quarterly internal audits will assess compliance with this guide, ISO 9001, IATF 16949, and customer-specific requirements. Audit findings must be addressed with corrective actions within 30 days.

Supplier & Customer Feedback

Feedback from suppliers and OEM customers will be reviewed monthly to identify logistical or quality improvement opportunities. Corrective action plans must be implemented for recurring issues.

Contact Information

For logistics inquiries: [email protected] | (248) 555-0198

For compliance support: [email protected] | (248) 555-0173

Emergency after-hours: (248) 555-0100

In conclusion, sourcing aluminum blanking for Pontiac models—whether for restoration, performance upgrades, or custom fabrication—requires careful consideration of material specifications, supplier reliability, and compatibility with original or modified designs. Aluminum blanking offers benefits such as weight reduction, improved fuel efficiency, and enhanced performance, making it a valuable option for classic and modern vehicles alike. It is essential to partner with reputable suppliers who provide high-quality, consistent materials that meet industry standards (such as ASTM or AMS specifications). Additionally, ensuring precise tolerances and appropriate alloy selection—such as 5xxx or 6xxx series aluminum for formability and corrosion resistance—will support optimal manufacturing outcomes. By prioritizing quality, technical accuracy, and supply chain efficiency, automotive restorers and manufacturers can successfully integrate aluminum blanking into Pontiac production or customization projects, balancing heritage with modern engineering advancements.