The global alumina market is experiencing robust growth, driven by rising demand across industries such as electronics, automotive, and industrial ceramics—particularly for high-purity alumina used in thermal and electrical conductivity applications. According to Mordor Intelligence, the alumina market was valued at USD 20.7 billion in 2023 and is projected to grow at a CAGR of over 5.2% through 2029, fueled by advancements in material science and increasing adoption in high-performance applications. As demand for materials with superior thermal management and insulating properties intensifies, manufacturers specializing in conductive and high-purity alumina ceramics are positioned at the forefront of innovation. This list highlights the top eight alumina conductivity manufacturers leading the charge in product development, technical precision, and global market reach.

Top 8 Alumina Conductivity Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

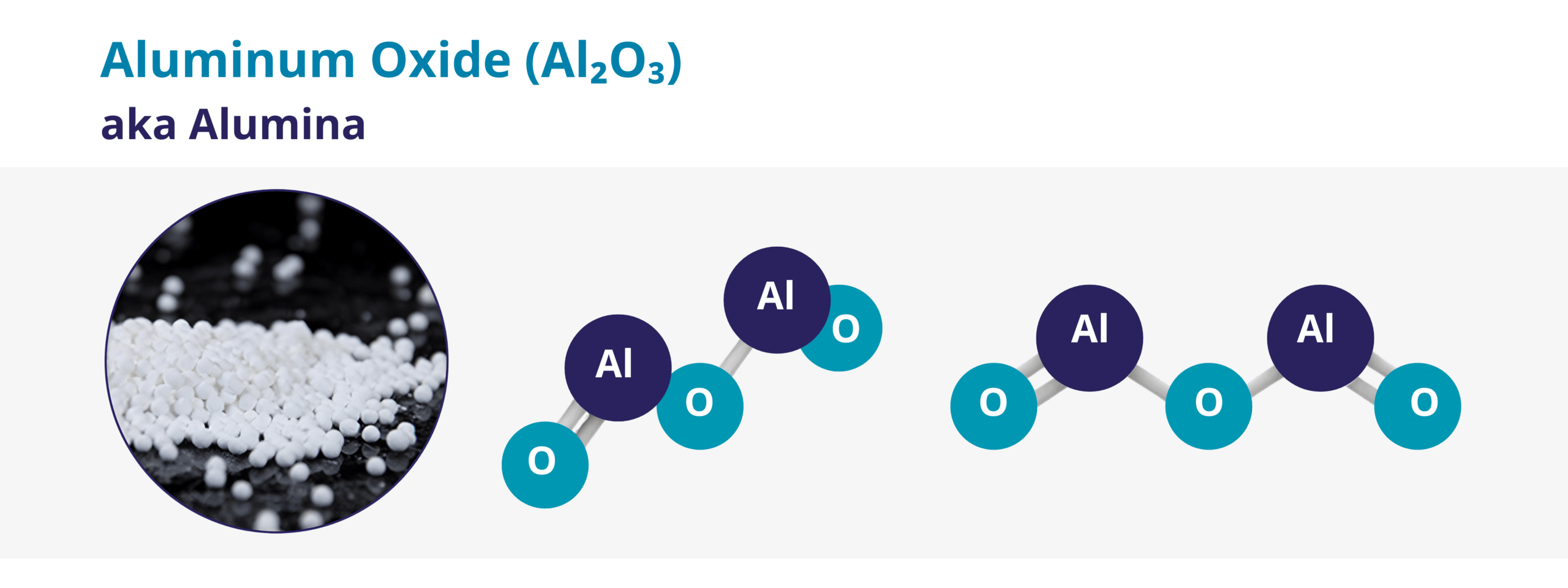

#1 Alumina (Al2O3)

Domain Est. 1993

Website: global.kyocera.com

Key Highlights: Alumina (Al2O3) is material of Fine Ceramics. KYOCERA is the global leading manufacturer of superior precision Fine Ceramics (Advanced Ceramics) products….

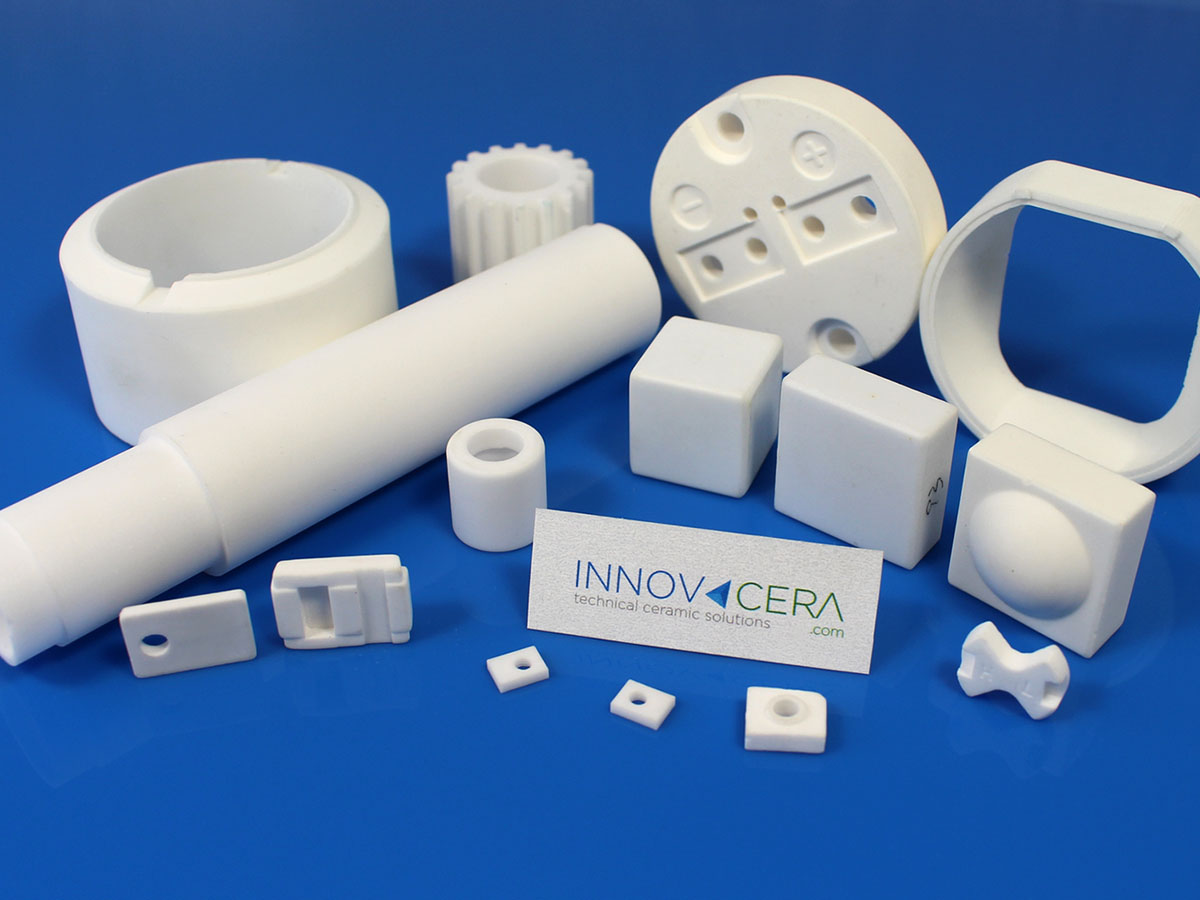

#2 Alumina Ceramic Components Manufacturer

Domain Est. 2007

Website: cmacintl.com

Key Highlights: Precision-engineered alumina ceramics in 6 grades (95-99.8%). High-temperature resistance, superior strength & insulation. ISO 9001 certified. 24-hr quotes….

#3 Alumina: Properties and Industrial Applications

Domain Est. 2013

Website: precision-ceramics.com

Key Highlights: Alumina is a very hard ceramic that is excellent at resisting abrasion and is ideal for wear-resistant inserts or products….

#4 Aluminum Oxide

Domain Est. 1995

Website: ceramicsrefractories.saint-gobain.com

Key Highlights: Aluminum Oxide (Al2O3), often abbreviated as Alumina, is one of the most popular fine ceramic material families worldwide. Learn more about Al2O3 today….

#5 Alumina

Domain Est. 1999

Website: coorstek.com

Key Highlights: CoorsTek offers an extensive line of aluminas (Al2O3). CoorsTek ceramics experts fine-tune the choice of alumina grade according to customer requirements….

#6 Durox Alumina Technical Ceramics

Domain Est. 1999

Website: materion.com

Key Highlights: Durox AL ceramic: 99.8% pure and offers higher tensile strength, dielectric strength and thermal conductivity. MATERION CERAMICS EXPERTS. We can produce Durox ……

#7 Alumina Ceramic

Domain Est. 1999

Website: associatedceramics.com

Key Highlights: Alumina ceramics also feature very high mechanical strength, high thermal conductivity, and high resistance to chemical and corrosion attack at room and ……

#8 Aluminum Oxide

Domain Est. 2013

Website: samaterials.com

Key Highlights: Alumina is the most well-known fine ceramic material for chemical and physical stability. It features high heat resistance and high thermal conductivity….

Expert Sourcing Insights for Alumina Conductivity

H2: 2026 Market Trends for Alumina Conductivity

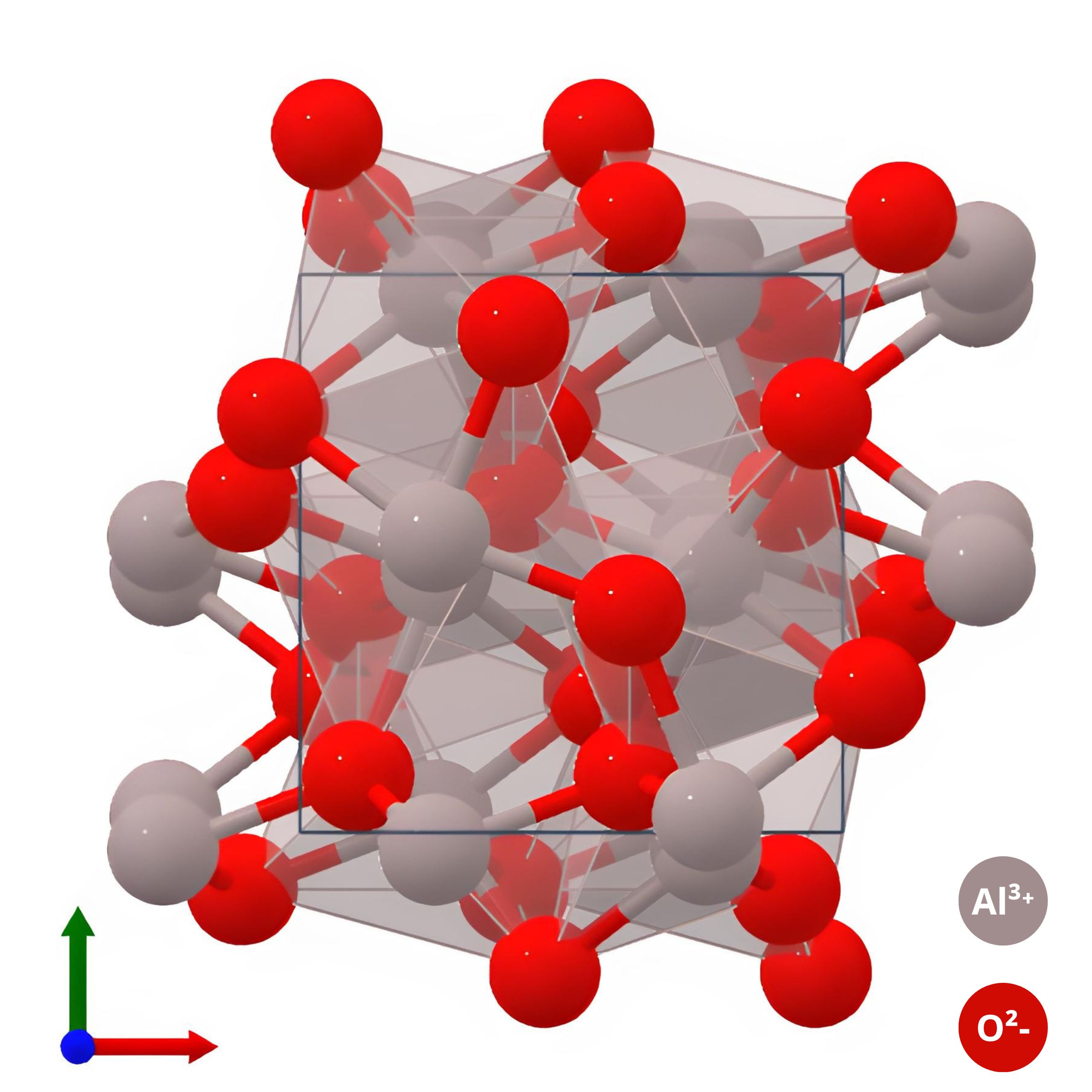

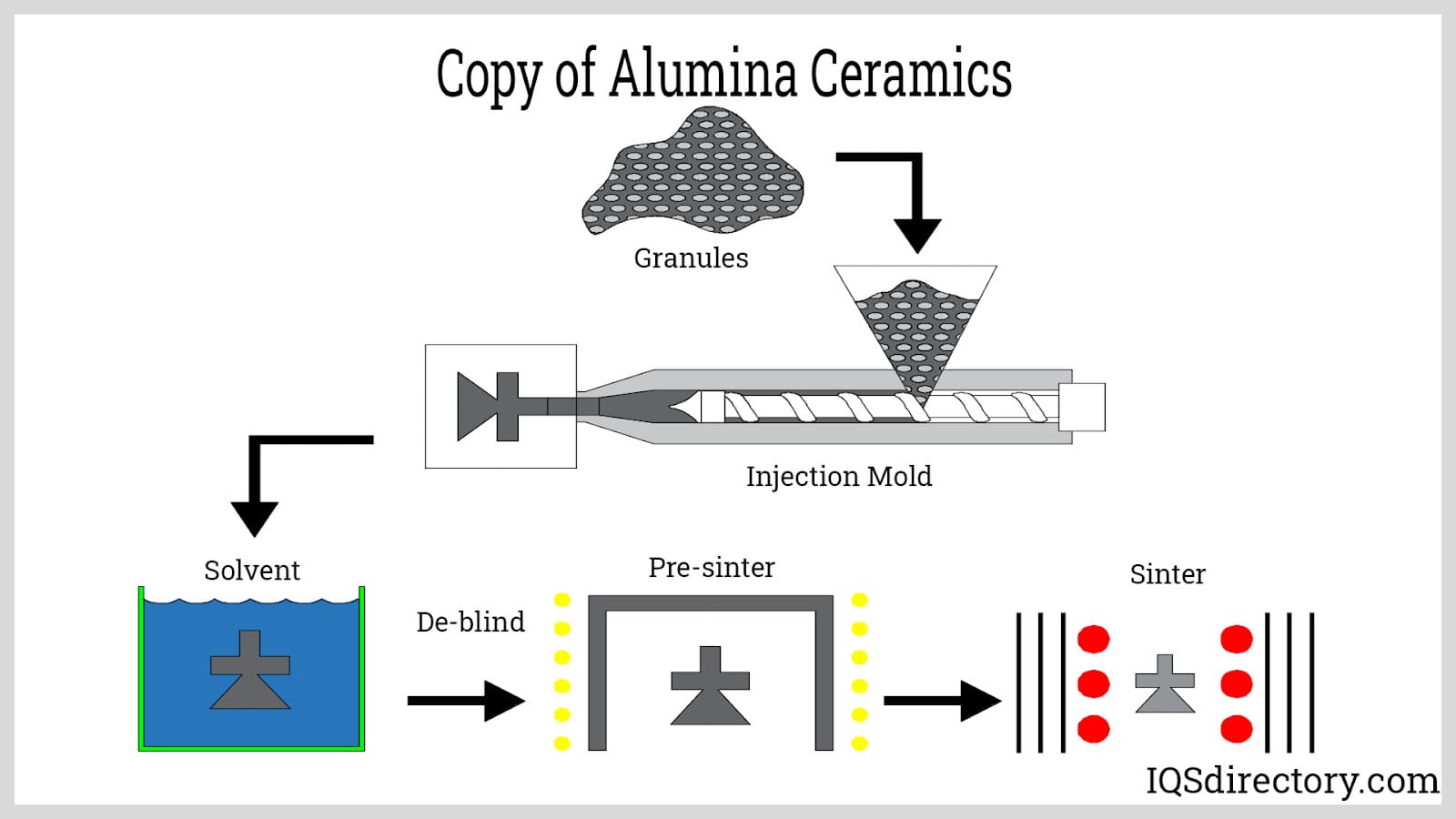

As we approach 2026, the market for alumina (aluminum oxide, Al₂O₃) conductivity—particularly in advanced industrial and technological applications—is undergoing significant transformation. Alumina is traditionally valued for its electrical insulation properties, high thermal stability, and mechanical strength. However, innovations in materials science and rising demand in high-performance sectors are reshaping its role in conductivity-related applications. Below are the key market trends shaping the alumina conductivity landscape in 2026:

-

Growing Demand in Electronics and Semiconductor Packaging

With the continued miniaturization of electronic components and the expansion of 5G, AI, and IoT infrastructure, there is increasing demand for high-purity alumina substrates and insulators. While alumina itself is an insulator, its thermal conductivity makes it essential in managing heat dissipation in power electronics. In 2026, high-thermal-conductivity alumina ceramics are being optimized for use in LED heat sinks, semiconductor packages, and RF modules, driving market growth in Asia-Pacific, especially in China, Japan, and South Korea. -

Advancements in Doped and Composite Alumina for Enhanced Conductivity

Research into modifying alumina’s electrical properties through doping (e.g., with magnesium, titanium, or rare earth elements) and hybrid composites is gaining momentum. These engineered variants exhibit semi-conductive or tailored dielectric behaviors, expanding applications in sensors, fuel cells, and electroceramics. By 2026, commercialization of such doped alumina materials is expected to open niche markets in energy storage and solid-state battery technologies. -

Rise of Solid Oxide Fuel Cells (SOFCs) and Electrolysis Technologies

Alumina-based electrolytes and supports are being explored in next-generation SOFCs due to their stability at high temperatures. Although zirconia remains dominant, alumina composites are being developed for cost-effective, durable alternatives. The push for green hydrogen and decarbonization is accelerating R&D in this area, with pilot projects in Europe and North America expected to scale by 2026. -

Increased Focus on Sustainable and Energy-Efficient Production

The alumina industry is under pressure to reduce its carbon footprint, particularly in primary aluminum production where alumina is an intermediate. Innovations in low-temperature calcination and alternative refining methods are improving energy efficiency. Additionally, recycled and nanostructured alumina are gaining attention for their enhanced thermal conductivity and lower environmental impact, aligning with ESG goals. -

Expansion in Electric Vehicles (EVs) and Power Electronics

The EV revolution is fueling demand for reliable, heat-resistant materials in battery management systems, power modules, and charging infrastructure. Alumina ceramics are used in insulating components and busbars where thermal conductivity without electrical conduction is critical. The global EV market is projected to grow over 20% annually through 2026, directly boosting alumina demand in power electronics. -

Regional Market Shifts and Supply Chain Dynamics

China remains the largest producer and consumer of industrial alumina, but geopolitical factors and trade policies are prompting diversification. India, Southeast Asia, and the Middle East are emerging as key growth regions due to expanding manufacturing bases and government incentives for high-tech industries. This shift is influencing investment in localized alumina processing with higher quality standards for electronic-grade materials. -

Technological Integration with AI and Digital Twins

By 2026, leading alumina producers are adopting AI-driven process optimization and digital twin technologies to enhance product consistency and tailor material properties such as thermal conductivity. These advancements enable precise control over grain size, porosity, and purity—critical factors in high-conductivity applications.

Conclusion:

While alumina is inherently an electrical insulator, its thermal conductivity and adaptability are making it indispensable in modern high-tech industries. The 2026 market for alumina conductivity is characterized by innovation in material engineering, sustainability, and integration into next-generation energy and electronic systems. Companies investing in R&D, quality control, and sustainable production methods are positioned to lead in this evolving market.

H2: Common Pitfalls in Sourcing Alumina for Conductivity Applications (Quality and Intellectual Property)

Sourcing high-purity alumina for conductivity-related applications—such as in solid oxide fuel cells (SOFCs), sensors, or advanced ceramics—requires careful attention to both material quality and intellectual property (IP) considerations. Below are key pitfalls to avoid:

-

Insufficient Purity and Impurity Control

Pitfall: Assuming standard-grade alumina meets conductivity requirements.

Detail: Even trace impurities (e.g., silica, sodium, iron) can drastically alter ionic or electronic conductivity. High-purity (>99.99%) alpha-alumina with tightly controlled dopants (e.g., yttria-stabilized zirconia composites) is often required.

Risk: Poor performance, inconsistent results, or premature failure in application. -

Inadequate Crystal Phase and Microstructure Specification

Pitfall: Not specifying the desired phase (alpha, gamma) or grain size.

Detail: Conductivity is highly dependent on crystal structure and grain boundaries. For instance, fine-grained alumina may exhibit different dielectric or ionic transport properties than coarse-grained forms.

Risk: Material may not perform as modeled or tested in R&D. -

Lack of Traceability and Certification

Pitfall: Accepting material without full material test reports (MTRs) or batch traceability.

Detail: Reputable suppliers should provide documentation on purity, particle size distribution, surface area, and sintering behavior.

Risk: Inability to reproduce results or validate quality in audits or failure analysis. -

Overlooking Intellectual Property (IP) Risks

Pitfall: Using proprietary alumina formulations or processing methods without proper licensing.

Detail: Certain high-conductivity alumina composites or doping techniques may be protected by patents (e.g., doped alumina for enhanced ionic conductivity). Sourcing from a supplier who infringes on IP can expose your organization to legal liability.

Risk: Injunctions, royalties, or forced redesigns. -

Supplier Confidentiality Agreements vs. IP Ownership

Pitfall: Assuming co-developed materials are freely usable.

Detail: If you collaborate with a supplier to optimize alumina for your conductive application, clarify IP ownership upfront. Ambiguity can result in lost rights to critical process innovations.

Risk: Loss of freedom to operate or exclusivity. -

Inconsistent Supply Chain and Scalability

Pitfall: Qualifying material at lab scale but failing to ensure scalable production.

Detail: Pilot-grade alumina may differ significantly from full-scale batches due to changes in calcination or milling processes.

Risk: Technology transfer failure or non-reproducible conductivity performance. -

Neglecting Regulatory and Export Compliance

Pitfall: Importing specialty alumina without checking ITAR, EAR, or REACH compliance.

Detail: Some high-performance ceramic powders are subject to export controls due to dual-use potential (e.g., in defense or energy tech).

Risk: Customs delays, fines, or shipment seizures.

Best Practices:

– Require full material characterization and batch-to-batch consistency data.

– Conduct independent validation testing (e.g., impedance spectroscopy for conductivity).

– Perform IP landscape searches before product development.

– Use clear contractual terms on IP ownership and confidentiality.

– Audit suppliers for quality systems (e.g., ISO 9001, AS9100 if applicable).

By proactively addressing these pitfalls, organizations can ensure reliable performance of alumina in conductivity-critical applications while safeguarding their intellectual assets.

Logistics & Compliance Guide for Alumina Conductivity

Alumina (aluminum oxide, Al₂O₃) is widely used in industrial applications, including refractories, ceramics, abrasives, and as a precursor in aluminum production. When assessing or transporting alumina with respect to electrical conductivity—or more accurately, its insulating properties—specific logistics and compliance considerations are essential due to its classification as a non-conductive (insulating) material in most forms. This guide outlines key logistics and regulatory requirements for handling, transporting, and storing alumina, particularly emphasizing safety and compliance in relation to its electrical characteristics.

Regulatory Classification and Safety Data

Alumina is generally classified as a non-hazardous material under major regulatory frameworks, but proper documentation and handling are still required.

- GHS Classification: Alumina is not classified as hazardous under the Globally Harmonized System (GHS) for most forms (e.g., calcined or smelter-grade alumina), though inhalation of fine dust may pose respiratory risks.

- OSHA & WHMIS: Not listed as a hazardous substance, but dust exposure limits apply (e.g., OSHA PEL: 10 mg/m³ total dust, 5 mg/m³ respirable fraction).

- SDS Requirements: A Safety Data Sheet (SDS) must be available, detailing physical properties including electrical resistivity (typically >10¹² Ω·cm), confirming its role as an electrical insulator.

Transportation and Packaging

Due to its insulating nature, alumina does not pose electrical conductivity risks during transport, but physical and environmental factors must be managed.

- Packaging:

- Bulk shipments: Use sealed railcars, ISO containers, or bulk bags (super sacks) with moisture barriers.

- Bagged shipments: Multi-wall paper or poly-lined bags (25–50 kg) to prevent dust emission and moisture absorption.

- Transport Modes:

- Marine: Alumina is commonly shipped in bulk carriers. IBC Code does not regulate it as a hazardous cargo.

- Rail & Road: Use covered hoppers or enclosed trucks to prevent spillage and contamination.

- Air: Permitted under IATA regulations as a non-dangerous good (UN3261, CORROSIVE SOLID, ACIDIC, INORGANIC, N.O.S., >80% alumina typically exempt if non-reactive).

- Labeling: No hazardous labels required, but packages should indicate contents, weight, and handling instructions (e.g., “Avoid Dust Formation”).

Storage and Handling

Alumina’s high electrical resistance means it does not accumulate static charges as readily as conductive powders, but dust control remains critical.

- Storage Conditions:

- Store in dry, well-ventilated areas to prevent caking from moisture absorption.

- Keep away from strong acids and bases to avoid chemical reactions.

- Use grounded containers if processing generates fine dust, despite low conductivity, to mitigate any static buildup.

- Handling Precautions:

- Use local exhaust ventilation when transferring or processing.

- Operators should wear PPE: dust masks (NIOSH N95 or equivalent), safety goggles, and gloves.

- Avoid creating airborne dust; use enclosed systems where possible.

Environmental and Disposal Compliance

Alumina is inert and non-toxic, but environmental regulations still apply to dust emissions and waste.

- Emissions Control:

- Comply with EPA or local air quality regulations (e.g., PM10/PM2.5 limits) in processing facilities.

- Dust suppression systems (e.g., misting, filters) are recommended in loading/unloading areas.

- Waste Disposal:

- Spent or contaminated alumina may be disposed of in licensed landfills as non-hazardous industrial waste.

- Verify local regulations; some jurisdictions require leachate testing (e.g., TCLP) to confirm non-hazardous status.

Special Considerations for Conductive Alumina

While standard alumina is an insulator, doped or modified forms (e.g., with metal ions) may exhibit ionic or semi-conductive properties. In such cases:

- Classification Review: Re-evaluate GHS and transport classification.

- Conductivity Testing: Document electrical resistivity; values below 10⁶ Ω·cm may trigger additional safety assessments.

- Static Dissipation: Use conductive flooring and grounding during handling if static charge accumulation is a concern.

Regulatory References

- UN Number: UN3261 (if acidic impurities present); otherwise, not regulated.

- IMO/IMDG Code: Not classified as marine pollutant.

- DOT (49 CFR): Not a hazardous material when pure.

- REACH (EU): Registered; no significant SVHCs in standard alumina.

Conclusion

Alumina’s low electrical conductivity makes it safe from an electrical hazard standpoint during logistics operations. However, compliance with dust control, packaging, and environmental regulations is essential. Always consult the latest SDS and local regulatory authorities when shipping or storing alumina, especially if the material has been modified for enhanced conductivity.

Conclusion on Sourcing Alumina for Conductivity Applications:

Sourcing high-purity alumina for applications requiring controlled electrical conductivity involves a careful balance between material characteristics, production methods, and end-use requirements. While pure alumina (Al₂O₃) is inherently an electrical insulator, its conductivity can be modified through doping, temperature variation, or composite formulation to suit specific applications such as sensors, fuel cells, or high-temperature insulators. Effective sourcing requires selecting alumina with precise chemical purity, crystal phase (typically alpha-alumina), and tailored additives that influence ionic or electronic conductivity. Suppliers must adhere to stringent quality control standards to ensure consistency in particle size, density, and impurity levels. Ultimately, successful sourcing depends on close collaboration between material scientists, engineers, and reliable suppliers to match alumina properties with the conductivity demands of the application, ensuring performance, durability, and cost-efficiency.