The global aluminum coil market is experiencing robust growth, driven by rising demand across key industries such as construction, automotive, HVAC, and packaging. According to a 2023 report by Mordor Intelligence, the market was valued at USD 64.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2028. This expansion is fueled by the increasing adoption of lightweight materials to improve fuel efficiency in vehicles and the surge in sustainable building practices that favor aluminum’s recyclability and durability. Grand View Research further supports this trend, highlighting that Asia-Pacific dominates global production and consumption, with China and India leading in manufacturing output and infrastructure development. In this competitive landscape, a select group of manufacturers have emerged as leaders, setting industry benchmarks for quality, innovation, and supply chain reliability. Below are the top 10 aluminum coil manufacturers shaping the future of the industry.

Top 10 Alum Coil Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Vulcan Aluminum Mill

Domain Est. 1996

Website: aluminummill.vulcaninc.com

Key Highlights: Constructed in 1986, Vulcan Aluminum Mill, a division of Vulcan, Inc., produces aluminum coil and sheet from which a variety of products are manufactured….

#2 Aluminum Coil Suppliers

Domain Est. 2015

Website: aluminummanufacturers.org

Key Highlights: Find premier aluminum coil manufacturers and suppliers in the USA, delivering cost-effective custom solutions and high-quality products….

#3 Mid South Aluminum

Domain Est. 2017

Website: midsouthalum.com

Key Highlights: Choose Mid South Aluminum as your aluminum coil stock distributor. We provide high-quality, durable coils for diverse industrial needs….

#4 Aluminium Sheets & Coils Manufacturer Company

Domain Est. 2018

Website: manaksiaaluminium.com

Key Highlights: Manaksia aluminium, a trusted name in the field of metal products, brings to you high quality aluminium corrugated sheets & coils to meet your needs….

#5 Custom Rolled Aluminum Coil

Domain Est. 1996

Website: unitedaluminum.com

Key Highlights: United Aluminum manufactures and supplies any size order of rolled aluminum coil tailored to meet your most demanding specifications….

#6 Logan Aluminum

Domain Est. 1996

Website: logan-aluminum.com

Key Highlights: Logan Aluminum is a 1500+ team member aluminum rolling mill in Russellville, Logan County, Kentucky, nestled in beautiful rolling hills and surrounded by trees ……

#7 Jupiter Aluminum Corp.

Domain Est. 1997

Website: jupiteraluminum.com

Key Highlights: At Jupiter, we transform tons of recycled aluminum each day into valuable coil used in building and construction, agricultural irrigation, recreational vehicles ……

#8 Gränges circular and sustainable aluminium

Domain Est. 1997

Website: granges.com

Key Highlights: Gränges is a global leader in aluminium rolling and recycling in selected niches. We’re committed to creating circular and sustainable aluminium solutions in ……

#9 to Aluminum Coils

Domain Est. 2000

Website: aluminumcoilsinc.com

Key Highlights: Aluminum Coils has the alloys, gauges, tempers and colors you need. With four slitters and two embossing lines at our Cleveland, Ohio and Tampa, ……

#10 Novelis

Domain Est. 2000

Website: novelis.com

Key Highlights: Novelis is a subsidiary of Hindalco Industries Limited, an industry leader in aluminum and copper and metals flagship company of the Aditya Birla Group, a ……

Expert Sourcing Insights for Alum Coil

H2: Analysis of 2026 Market Trends for Aluminum Coil

The global aluminum coil market is expected to experience significant transformation by 2026, driven by technological advancements, evolving industry demands, and sustainability imperatives. As a critical raw material across sectors such as automotive, construction, packaging, and renewable energy, aluminum coil is positioned for robust growth, with several key trends shaping its trajectory in the second half of the decade.

1. Rising Demand from the Automotive and Transportation Sector

One of the primary drivers of aluminum coil demand in 2026 is the continued shift toward lightweight vehicles to meet stringent fuel efficiency and emissions regulations. Automakers are increasingly adopting aluminum-intensive designs to reduce vehicle weight and improve battery range in electric vehicles (EVs). Aluminum coil, used in body panels, heat exchangers, and battery housings, will benefit from this trend. The expansion of EV production in North America, Europe, and China is expected to significantly boost demand for high-strength, formable aluminum coil alloys.

2. Growth in Renewable Energy Applications

The renewable energy sector, particularly solar power, is emerging as a key market for aluminum coil. Aluminum is extensively used in solar panel frames and mounting systems due to its corrosion resistance, light weight, and recyclability. With global investments in solar infrastructure accelerating—especially in line with net-zero targets—the demand for aluminum coil in photovoltaic (PV) manufacturing is projected to rise steadily through 2026.

3. Expansion in Construction and Infrastructure

Urbanization and infrastructure development, particularly in Asia-Pacific and the Middle East, are fueling demand for aluminum coil in building and construction applications. Aluminum coils are used in roofing, cladding, and architectural facades due to their durability and aesthetic versatility. Government initiatives promoting green buildings and energy-efficient designs are further supporting the use of aluminum, which has a lower carbon footprint over its lifecycle compared to other structural materials.

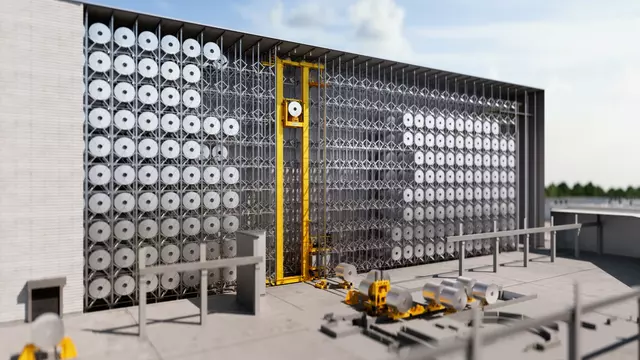

4. Sustainability and Recycling Momentum

Environmental concerns are reshaping aluminum production and consumption patterns. By 2026, there will be greater emphasis on using recycled aluminum (post-consumer and post-industrial) in coil production. Aluminum’s infinite recyclability without loss of quality makes it attractive for circular economy models. Regulatory pressures and consumer preferences are pushing manufacturers to adopt low-carbon aluminum, with increased investment in renewable-powered smelting and closed-loop recycling systems.

5. Technological Innovation and Product Differentiation

Aluminum coil producers are investing in advanced alloy development and surface treatment technologies to meet specific performance requirements. For instance, corrosion-resistant and high-conductivity alloys are gaining traction in the electronics and HVAC sectors. Continuous improvements in coil coating, embossing, and precision slitting are enabling customization for niche applications, enhancing value addition and market competitiveness.

6. Supply Chain Resilience and Regionalization

Geopolitical uncertainties and trade dynamics are prompting companies to reevaluate supply chain strategies. In 2026, there is a growing trend toward regional production and localization of aluminum coil manufacturing to mitigate risks related to logistics disruptions and import tariffs. Nearshoring in North America and Europe, supported by government incentives, is expected to strengthen domestic supply chains.

7. Price Volatility and Raw Material Constraints

Despite favorable demand drivers, the aluminum coil market may face challenges related to bauxite supply, energy costs, and alumina refining bottlenecks. Energy-intensive smelting processes make aluminum production sensitive to electricity prices, particularly in regions reliant on fossil fuels. However, increased use of hydropower and solar energy in smelters—especially in Iceland, Canada, and the Middle East—may help stabilize costs and reduce carbon intensity.

Conclusion

By 2026, the aluminum coil market is poised for sustained growth, underpinned by structural shifts in transportation, energy, and construction. Sustainability, innovation, and supply chain localization will be critical success factors for market participants. Companies that invest in low-carbon production, develop high-performance alloys, and align with circular economy principles are likely to gain a competitive edge in the evolving landscape. Overall, the outlook for aluminum coil remains positive, with H2 2026 expected to reflect stronger demand recovery and market maturity.

Common Pitfalls When Sourcing Aluminum Coil (Quality & Intellectual Property)

Sourcing aluminum coil involves navigating several potential challenges that can impact product performance, cost, and legal compliance. Understanding these pitfalls is essential for ensuring supply chain reliability and protecting your business interests.

Quality-Related Pitfalls

Inconsistent Material Specifications

One of the most frequent issues is receiving aluminum coil that does not meet specified alloy, temper, thickness, or width tolerances. Suppliers may cut corners or mislabel products, leading to downstream manufacturing defects or performance failures. Always verify mill test certificates (MTCs) and conduct third-party inspections when possible.

Surface Defects and Contamination

Aluminum coils are prone to surface imperfections such as scratches, dents, roll marks, oil stains, or oxidation. These defects can compromise coating adhesion, aesthetic appeal, and structural integrity—especially in visible or high-precision applications. Insist on protective packaging and clear surface quality standards (e.g., ASTM B479 or customer-specific guidelines).

Poor Dimensional Accuracy

Coils with inconsistent thickness, camber (side-to-side curvature), or improper winding tension can cause problems during slitting, stamping, or forming operations. This often results in production downtime and material waste. Define tight dimensional tolerances in procurement contracts and perform incoming quality checks.

Inadequate Certifications and Traceability

Some suppliers, especially from less-regulated markets, may provide falsified or incomplete documentation. Lack of traceability (e.g., batch/heat numbers) makes it difficult to investigate quality issues or manage recalls. Require full traceability and audit suppliers’ quality management systems (e.g., ISO 9001 certification).

Intellectual Property (IP)-Related Pitfalls

Unauthorized Production Using Your Specifications

Providing detailed technical drawings, alloy compositions, or processing instructions to suppliers—especially overseas mills—can expose your proprietary designs. Unethical suppliers may replicate your product for competitors or sell it under their own brand. Always use non-disclosure agreements (NDAs) and limit the technical data shared to only what’s necessary.

Reverse Engineering and Copying

High-performance or custom aluminum coils are susceptible to reverse engineering. Once a supplier understands your requirements, they may offer identical materials to rival companies at lower prices, undercutting your market position. Mitigate this risk by working with trusted partners and varying specifications where possible.

Lack of IP Clauses in Contracts

Many procurement agreements fail to clearly define ownership of designs, tooling, or process innovations developed during collaboration. This can lead to disputes over rights to use or modify the product. Ensure contracts include explicit IP ownership terms and restrictions on resale or reuse of proprietary information.

Grey Market and Diversion Risks

Some suppliers may divert coils intended for your company into unauthorized markets, often selling them under different branding. This undermines pricing strategies and brand reputation. Implement supply chain monitoring and include anti-diversion clauses in supplier agreements.

By proactively addressing both quality and intellectual property concerns during the sourcing process, companies can reduce risk, maintain product integrity, and protect competitive advantages in the aluminum supply chain.

Logistics & Compliance Guide for Aluminum Coil

Overview

This guide outlines key logistics and compliance considerations for the safe, efficient, and legally compliant transportation, handling, and documentation of aluminum coil. Adherence to these guidelines ensures product integrity, regulatory compliance, and smooth operations throughout the supply chain.

Packaging and Handling

Proper packaging and handling are essential to prevent damage during transit and storage.

– Core Protection: Use plastic or fiber inner sleeves to protect the coil’s inner diameter.

– Edge Protection: Apply edge protectors or foam to prevent damage to coil edges during handling.

– Coil Wrapping: Seal coils with waterproof plastic film or laminated paper to guard against moisture and corrosion.

– Palletization: Secure coils on sturdy wooden or metal pallets using strapping or banding. Ensure even weight distribution.

– Lifting Equipment: Use coil lifters or C-hooks specifically designed for aluminum coils to avoid deformation.

Transportation Requirements

Transport methods must ensure coil stability and safety.

– Trucking: Use flatbed or step-deck trailers. Secure coils with straps, chains, or load locks. Avoid exposure to rain or extreme temperatures.

– Rail: Coils should be placed on flatcars or in covered gondolas. Follow railroad carrier guidelines for weight and lashing.

– Maritime Shipping: Store coils in dry, ventilated containers. Use desiccants to control humidity. Comply with IMO and carrier-specific stowage regulations.

– Stacking Limits: Never exceed maximum stack heights specified by the manufacturer to avoid crushing lower coils.

Regulatory Compliance

Compliance with international, national, and industry standards is mandatory.

– HS Code Classification: Use correct Harmonized System (HS) code (e.g., 7606.12 for unwrought aluminum in coils) for customs declaration.

– Export Controls: Verify if destination country requires export licenses (e.g., under EAR or ITAR when applicable).

– REACH & RoHS (EU): Confirm compliance with substance restrictions if applicable, though aluminum typically poses minimal risk.

– TSCA (USA): Ensure aluminum coil production complies with Toxic Substances Control Act regulations.

– Customs Documentation: Provide commercial invoice, packing list, bill of lading, and certificate of origin. Include coil specifications (alloy, temper, dimensions, weight).

Safety and Environmental Considerations

Prioritize workplace safety and environmental responsibility.

– Material Safety Data Sheet (MSDS/SDS): Maintain up-to-date SDS for aluminum coil, noting it is non-hazardous but may produce fine dust during cutting.

– Worker Training: Train personnel on proper lifting techniques, use of PPE (gloves, safety shoes), and handling procedures.

– Waste Management: Recycle packaging materials (plastic, wood, metal) in accordance with local environmental regulations.

– Spill Response: Although aluminum is not hazardous, have protocols for cleaning metal shavings or damaged packaging.

Quality Assurance and Inspection

Ensure product conformity before and after transit.

– Pre-Shipment Inspection: Verify coil dimensions, surface quality, labeling, and packaging integrity.

– In-Transit Monitoring: Use tracking and temperature/humidity loggers for sensitive shipments.

– Receiving Inspection: Document and report any damage upon delivery. Retain packaging evidence for insurance claims if needed.

Documentation and Recordkeeping

Maintain accurate records for compliance and traceability.

– Batch Traceability: Record heat/lot numbers, production date, and destination for each coil.

– Retention Period: Store shipping, customs, and compliance documents for a minimum of 5–7 years, depending on jurisdiction.

– Digital Records: Use ERP or logistics software to manage documentation and improve audit readiness.

Conclusion

Effective logistics and compliance management for aluminum coil minimizes risk, ensures customer satisfaction, and supports global trade operations. Regular review of regulations and continuous improvement in handling practices are recommended to adapt to evolving standards and market demands.

Conclusion for Sourcing Aluminum Coil

In conclusion, sourcing aluminum coil requires a strategic approach that balances quality, cost, reliability, and sustainability. Selecting the right supplier involves thorough evaluation of material specifications, production capabilities, certifications, and logistical efficiency. Key factors such as alloy type, temper, thickness tolerance, surface finish, and compliance with international standards (e.g., ASTM, ISO) are critical to ensuring the aluminum coil meets the intended application requirements—whether for construction, automotive, HVAC, or packaging industries.

Establishing long-term partnerships with reputable suppliers can enhance supply chain stability, ensure consistent quality, and provide opportunities for cost optimization through volume agreements and just-in-time delivery. Additionally, considering factors like environmental impact, recyclability, and supplier sustainability practices aligns with growing corporate social responsibility goals.

Ultimately, a well-structured sourcing strategy for aluminum coil not only supports operational efficiency and product performance but also contributes to overall business competitiveness in a global market. Regular supplier assessments and market monitoring will ensure continued alignment with evolving industry demands and technological advancements.