The global alloy forgings market is experiencing robust growth, driven by rising demand from aerospace, automotive, and energy sectors for high-strength, durable components capable of withstanding extreme conditions. According to a report by Mordor Intelligence, the global metal forging market was valued at USD 112.6 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5.8% from 2024 to 2029. This expansion is fueled by increasing adoption of lightweight, high-performance alloys in critical applications, particularly in aircraft engines, power generation turbines, and commercial vehicles. As industries prioritize efficiency, safety, and regulatory compliance, the demand for precision-engineered alloy forgings continues to rise—positioning specialized manufacturers at the forefront of advanced material innovation. In this evolving landscape, the top 10 alloy forgings manufacturers distinguish themselves through technological expertise, scalable production capabilities, and strategic investments in material science and sustainability.

Top 10 Alloy Forgings Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Forging products|Copper & Copper Alloy Business Unit …

Domain Est. 2020

Website: mitsubishi-copper.com

Key Highlights: Sambo Forging Co., Ltd. is a professional manufacturer of copper alloy forging with plants in the premises of Sambo plant….

#2 Forged Parts

Domain Est. 1994

Website: steelforge.com

Key Highlights: All Metals & Forge Group manufactures open die forgings and seamless rolled rings in our 160,000 S.F. · AMFG is an ISO9001, AS9100 manufacturer ……

#3 PCC Forged Products

Domain Est. 2010

Website: pccforgedproducts.com

Key Highlights: PCC Forged Products manufactures nickel, titanium and steel alloy forgings for aerostructures, aero engines, gas turbines, and industrial applications….

#4 Queen City Forging: Metal Forging Company

Domain Est. 1995

Website: qcforge.com

Key Highlights: Queen City Forging is a leading U.S. forging company in Cincinnati, OH that specializes in forging steel, aluminum, copper, specialty alloys ……

#5 Special Metals

Domain Est. 1995

Website: specialmetals.com

Key Highlights: Special Metals has over a century of expertise creating high-performance alloy products for the most brutal, mission-critical services in the industry….

#6 Scot Forge

Domain Est. 1997

Website: scotforge.com

Key Highlights: Recognized as the industry leader in open die forging and rolled ring forging, we’re the world’s premier provider of high-quality metal forging solutions….

#7 Microalloy Forging

Domain Est. 2000

Website: cornellforge.com

Key Highlights: Discover high-strength, precise microalloy forged steel from Cornell Forge. Enhance performance, reduce costs, and skip heat treatment….

#8 American Handforge

Domain Est. 2001

Website: handforge.com

Key Highlights: American Handforge is your one source for quality titanium, aluminum, and stainless steel open die forgings. Manufacturing here in the USA….

#9 Forge Resources Group

Domain Est. 2006

Website: forgeresourcesgroup.com

Key Highlights: We supply custom closed-die forgings in carbon, alloy and stainless steels, aluminum, and other non-ferrous grades from our forging cells….

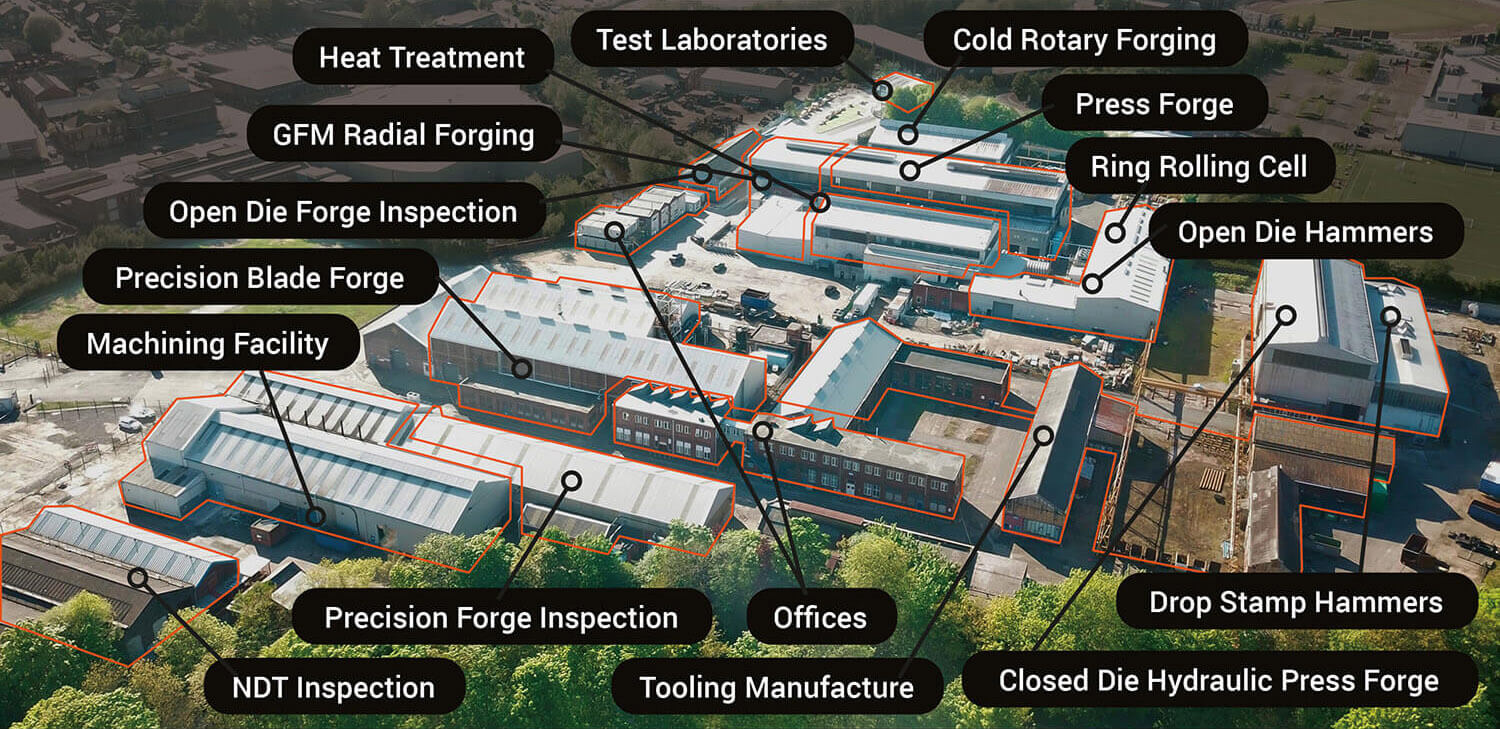

#10 Independent Forgings and Alloys

Domain Est. 2006

Website: independentforgings.com

Key Highlights: Independent Forgings and Alloys Ltd (IFA) sits uniquely as the only single sited forge with open-die radial, press, hammer & ring rolling AND closed-die ……

Expert Sourcing Insights for Alloy Forgings

H2: Market Trends in Alloy Forgings for 2026

The global alloy forgings market is poised for significant transformation by 2026, driven by evolving industrial demands, technological advancements, and shifting regulatory landscapes. As industries continue to prioritize performance, durability, and energy efficiency, the demand for high-strength, lightweight, and corrosion-resistant components is accelerating the adoption of advanced alloy forgings. Below is an analysis of the key market trends expected to shape the alloy forgings sector in 2026:

1. Rising Demand from Aerospace and Defense Sectors

The aerospace and defense industries remain the primary drivers of high-performance alloy forgings, particularly nickel-based superalloys, titanium alloys, and high-strength steel alloys. With increasing aircraft production (e.g., Boeing and Airbus backlogs) and modernization of military platforms, there is a growing need for forged components in jet engines, landing gear, and airframes. By 2026, the push for fuel-efficient and low-emission aircraft will further boost demand for lightweight titanium and nickel alloy forgings.

2. Expansion in Renewable Energy Applications

The renewable energy sector, especially wind and hydrogen energy systems, is emerging as a key growth area. Large alloy-forged components such as wind turbine shafts, hubs, and gearbox parts require high durability under extreme conditions. The global push toward clean energy targets is expected to increase investments in offshore wind farms, where corrosion-resistant alloy forgings are essential. Additionally, hydrogen production and storage systems will demand specialized alloys capable of withstanding high pressure and temperature.

3. Technological Advancements in Forging Processes

By 2026, digitalization and automation will play a pivotal role in enhancing precision, yield, and consistency in alloy forging. Adoption of technologies such as closed-die forging with real-time monitoring, AI-driven quality control, and simulation-based process optimization will improve efficiency and reduce material waste. Moreover, near-net-shape forging techniques will gain traction, minimizing post-processing and lowering overall manufacturing costs.

4. Growth in Electric Vehicle (EV) and Automotive Lightweighting

Although traditional automotive forging demand may plateau due to material substitution, the EV revolution is creating new opportunities. High-strength alloy forgings are being used in critical EV components such as motor housings, gearbox parts, and suspension systems. Automakers are increasingly using aluminum and advanced steel alloys to reduce vehicle weight and extend battery range. This trend is expected to accelerate through 2026, especially in premium and performance EV segments.

5. Supply Chain Resilience and Regionalization

Geopolitical tensions and supply chain disruptions have prompted manufacturers to reevaluate sourcing strategies. By 2026, there will be a noticeable shift toward regional forging hubs in North America, Europe, and Southeast Asia to reduce dependency on single-source suppliers. Nearshoring and vertical integration will become more common, particularly for mission-critical applications in aerospace and energy.

6. Sustainability and Environmental Regulations

Environmental regulations are pushing the forging industry toward greener practices. Forging operations are investing in energy-efficient furnaces, scrap recycling, and low-carbon alloy development. The European Green Deal and similar initiatives globally will enforce stricter emissions standards, favoring forging over casting in certain applications due to lower material waste and energy consumption per component.

7. Development of Advanced Alloys and Materials

Material innovation will be a cornerstone of market growth. Research into high-entropy alloys (HEAs), oxide dispersion-strengthened (ODS) alloys, and next-generation titanium aluminides is expected to yield forgings with superior strength-to-weight ratios and thermal stability. These materials will find applications in next-gen jet engines, hypersonic vehicles, and nuclear systems by 2026.

Conclusion

By 2026, the alloy forgings market will be shaped by a confluence of technological innovation, sustainability imperatives, and growing demand from high-growth sectors such as aerospace, renewable energy, and electric mobility. Companies that invest in R&D, digital manufacturing, and sustainable practices will be best positioned to capitalize on these emerging opportunities. The market is expected to witness steady growth, with a compound annual growth rate (CAGR) projected between 5% and 7% through 2026, depending on the region and end-use industry.

Common Pitfalls in Sourcing Alloy Forgings: Quality and Intellectual Property Risks

Sourcing alloy forgings—critical components in aerospace, defense, energy, and automotive industries—exposes buyers to significant risks if not managed carefully. Two major areas of concern are quality inconsistencies and intellectual property (IP) vulnerabilities. Failing to address these pitfalls can lead to costly delays, safety hazards, legal disputes, and reputational damage.

Quality-Related Pitfalls

Inadequate Material Certification and Traceability

One of the most frequent quality issues arises when suppliers fail to provide complete and verifiable material certifications (e.g., mill test reports, heat treatment records). Without full traceability from raw material to finished forging, buyers risk receiving substandard alloys that don’t meet specified mechanical or chemical properties, potentially compromising component performance.

Insufficient Process Control and Documentation

Alloy forgings require tightly controlled processes including forging temperature, cooling rates, and post-forging heat treatments. Suppliers with weak process documentation or inconsistent quality management systems (e.g., non-compliance with AS9100, ISO 9001, or NADCAP) may deliver parts with internal defects like porosity, inclusions, or improper grain structure, which are difficult to detect without rigorous NDT (non-destructive testing).

Inconsistent Dimensional Accuracy and Surface Finish

Poor tooling maintenance or inadequate process validation can result in forgings that require excessive machining or fail to meet dimensional tolerances. Surface defects such as laps, seams, or scale can also go undetected without proper inspection protocols, leading to premature part failure.

Lack of Qualified Testing and Inspection

Relying on suppliers that perform only basic inspections or outsource critical testing without oversight increases the risk of undetected flaws. Buyers must ensure suppliers conduct appropriate mechanical testing, microstructure analysis, and non-destructive evaluation (e.g., ultrasonic, magnetic particle) per industry standards.

Intellectual Property-Related Pitfalls

Unprotected Design and Process IP

Sharing forging designs, specifications, or proprietary manufacturing processes with suppliers without proper legal safeguards (e.g., robust Non-Disclosure Agreements, IP ownership clauses) can result in unauthorized use, replication, or disclosure to competitors. This is especially risky when sourcing from regions with weaker IP enforcement.

Reverse Engineering and Technology Leakage

Alloy forging techniques—particularly for high-performance alloys—often involve trade secrets or patented methods. Suppliers may reverse engineer components or use shared information to develop competing products, particularly if contractual terms do not explicitly prohibit such actions.

Inadequate Control Over Tooling and Fixtures

Tooling used in forging (dies, mandrels, etc.) often embodies significant IP. Failing to retain ownership of tooling or allowing suppliers to replicate it without authorization can lead to unauthorized production or loss of supply chain control.

Unclear IP Rights in Joint Development

In collaborative development scenarios, unclear agreements on IP ownership can result in disputes over who controls the resulting innovations. Without defined terms, suppliers may claim rights to improvements or adaptations made during production.

Mitigation Strategies

To reduce exposure, buyers should:

– Conduct thorough supplier audits, including quality systems and IP practices.

– Require full material traceability and third-party certification.

– Implement stringent contractual terms covering IP ownership, confidentiality, and usage rights.

– Retain ownership of design data and tooling, with clear audit rights.

– Use geographically strategic sourcing with attention to local IP protection laws.

Proactively addressing these pitfalls ensures both the integrity of the forged components and the protection of valuable intellectual assets.

Logistics & Compliance Guide for Alloy Forgings

Overview of Alloy Forgings in Global Trade

Alloy forgings are high-strength metal components produced through the controlled deformation of alloy steel, stainless steel, or specialty alloy ingots under high pressure. Due to their critical use in aerospace, energy, automotive, and industrial equipment sectors, logistics and compliance for alloy forgings involve stringent standards for handling, documentation, and regulatory adherence. This guide outlines key logistical considerations and compliance requirements to ensure safe, efficient, and legally compliant transportation and trade.

Material Classification and Regulatory Framework

Alloy forgings are typically classified under the Harmonized System (HS) Code 7326.19 (Other forged articles of iron or steel) or more specific codes depending on composition and end-use. Compliance begins with accurate classification to determine applicable tariffs, trade agreements, and regulatory obligations. Key regulatory frameworks include:

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals – requires disclosure of substances in alloys.

– RoHS (EU): Restriction of Hazardous Substances – applies if forgings are used in electrical equipment.

– ITAR/EAR (USA): International Traffic in Arms Regulations / Export Administration Regulations – may apply if forgings are used in defense or dual-use applications.

– AD/CVD Orders: Anti-Dumping and Countervailing Duty measures may apply based on country of origin.

Export Documentation and Certifications

Proper documentation is essential for customs clearance and regulatory compliance:

– Commercial Invoice: Must detail material grade, heat number, weight, and value.

– Packing List: Specifies packaging type, dimensions, and gross/net weight per shipment.

– Certificate of Origin: Required for preferential tariffs under trade agreements (e.g., USMCA, EU-India CEPA).

– Material Test Report (MTR): Also known as a Mill Test Certificate (EN 10204 3.1 or 3.2), certifying chemical composition and mechanical properties.

– Third-Party Inspection Reports: Often required by end-users (e.g., API, ASME, NACE).

– Export License: Required for controlled items under ITAR, EAR, or other national export control regimes.

Packaging and Handling Requirements

Alloy forgings are susceptible to mechanical damage, corrosion, and contamination. Appropriate packaging includes:

– Corrosion Protection: Use of VCI (Vapor Corrosion Inhibitor) paper, rust preventive oils, and sealed moisture barriers.

– Cradling and Securing: Wooden skids or custom crates to prevent movement during transit.

– Labeling: Clear identification of heat number, material grade, and handling instructions (e.g., “Do Not Stack,” “Protect from Moisture”).

– Lifting Points: Forged components should have designated lifting lugs or be rigged using approved slings to prevent deformation.

Transportation and Logistics Planning

Transportation mode depends on size, weight, destination, and delivery urgency:

– Ocean Freight: Most cost-effective for heavy forgings; requires waterproof containers and proper lashing.

– Air Freight: Used for urgent or high-value small components; subject to weight and dimensional constraints.

– Overland Transport: Flatbed trucks or specialized trailers for oversized loads; permits may be needed for abnormal dimensions.

– Incoterms Selection: Use precise terms such as FOB, CIF, or DDP to allocate logistics responsibilities and risks.

Quality and Traceability Compliance

Traceability is critical throughout the supply chain:

– Heat Traceability: Each forging must be traceable to its original melt/heat number.

– Non-Destructive Testing (NDT): Documentation of ultrasonic, magnetic particle, or dye penetrant inspections as per ASTM, ISO, or customer specifications.

– Quality Management Systems: Compliance with ISO 9001, AS9100 (aerospace), or API Q1 ensures consistent quality control.

Environmental and Safety Regulations

- Hazardous Materials: Some alloys contain regulated elements (e.g., chromium, nickel); SDS (Safety Data Sheet) may be required.

- Waste Disposal: Packaging and protective materials must be disposed of in accordance with local environmental laws.

- DOT/ADR Regulations: Apply if transporting coated forgings with flammable residues or chemicals.

Import Clearance and Duty Optimization

Importers must verify:

– Customs Valuation: Ensure declared value aligns with transaction value and related-party rules.

– Duty Drawback or Bonded Warehousing: Explore programs to defer or reduce duties for re-exported finished goods.

– Post-Import Audits: Maintain records for 5–7 years to support audits by customs authorities.

Risk Mitigation and Best Practices

- Insurance: Cover for damage, loss, and delay; specify all-risk marine cargo insurance.

- Supplier Audits: Verify compliance capabilities of forging suppliers and logistics partners.

- Digital Tracking: Use IoT sensors or GPS tracking for high-value shipments.

- Contingency Planning: Identify alternate routes and carriers for supply chain resilience.

Conclusion

Successful logistics and compliance for alloy forgings require meticulous planning, accurate documentation, and adherence to international standards. By integrating quality control, regulatory compliance, and efficient transportation strategies, companies can ensure on-time delivery, minimize customs delays, and maintain trust with global customers. Regular training and updates on trade regulations are recommended to stay compliant in a dynamic global market.

Conclusion for Sourcing Alloy Forgings:

Sourcing high-quality alloy forgings is a critical component in ensuring the reliability, performance, and longevity of components used in demanding industries such as aerospace, energy, automotive, and heavy machinery. The selection of the right supplier must be based on a thorough evaluation of material expertise, forging capabilities, quality assurance processes, and adherence to international standards. Factors such as alloy composition, grain structure, mechanical properties, and dimensional accuracy directly impact the end-product’s performance under extreme conditions.

Moreover, strategic sourcing should balance cost-efficiency with consistent quality, taking into account supply chain resilience, lead times, and the supplier’s ability to support custom specifications and rigorous testing requirements (e.g., NDT, heat treatment certification). Establishing long-term partnerships with certified and experienced forging providers enhances traceability, reduces risk, and supports continuous improvement.

In conclusion, successful sourcing of alloy forgings requires a comprehensive, quality-driven approach that aligns technical requirements with reliable supply chain practices—ultimately ensuring operational safety, regulatory compliance, and long-term cost savings.