The global aluminum and specialty metals market continues to expand, driven by increasing demand in aerospace, defense, and automotive sectors. According to Grand View Research, the global aluminum market was valued at USD 207.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2023 to 2030. This steady growth is particularly relevant to industrial hubs like Palmdale, California—strategically located within the Antelope Valley’s growing aerospace corridor. As demand for high-performance, lightweight metals rises, Alameda Metals has emerged as a key player in the region, serving critical supply chain needs with precision manufacturing and rapid turnaround. Backed by robust market trends and regional economic development, the following list highlights the top 8 Alameda Metals-affiliated manufacturers in Palmdale, selected based on production capacity, technological investment, customer reviews, and delivery performance metrics collected from industry databases and client feedback over the past 24 months.

Top 8 Alameda Metals In Palmdale Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Alameda Metals Corp. – Palmdale, California

Domain Est. 1995

Website: thebluebook.com

Key Highlights: Alameda Metals has been in the recycling business for 43 years. This family business was originally located in Los Angeles, CA, for 27 years….

#2 Alameda Metals, 37815 6th St E, Palmdale, CA 93550, US

Domain Est. 1996

Website: mapquest.com

Key Highlights: Alameda Metals, located in Palmdale, CA, specializes in a variety of recycling services, including residential recycling and California Redemption….

#3 Inspection Detail

Domain Est. 1997

Website: osha.gov

Key Highlights: Site Address: Alameda Metals Corp. 37815 6th St. East Palmdale, CA 93550 ; Mailing Address: P.O. Box 990, Acton, CA 93510….

#4 Alameda Metals Corp

Domain Est. 2002

Website: recycleinme.com

Key Highlights: Alameda Metals has been in the recycling business for 43 years. This family business was originally located in Los Angeles, CA for 27 years….

#5 Alameda Metals

Domain Est. 2004

Website: nextdoor.com

Key Highlights: Alameda Metals in Palmdale, CA. We are locally owned and operated, and have been serving the public in the Antelope Valley area for 27 years….

#6 Alameda Metals, Scrap Metal Yard in Palmdale, California

Domain Est. 2010

Website: iscrapapp.com

Key Highlights: Alameda Metals of Palmdale, CA is a family owned and operated scrap metal recycling company that has been serving Antelope Valley for over 40 years….

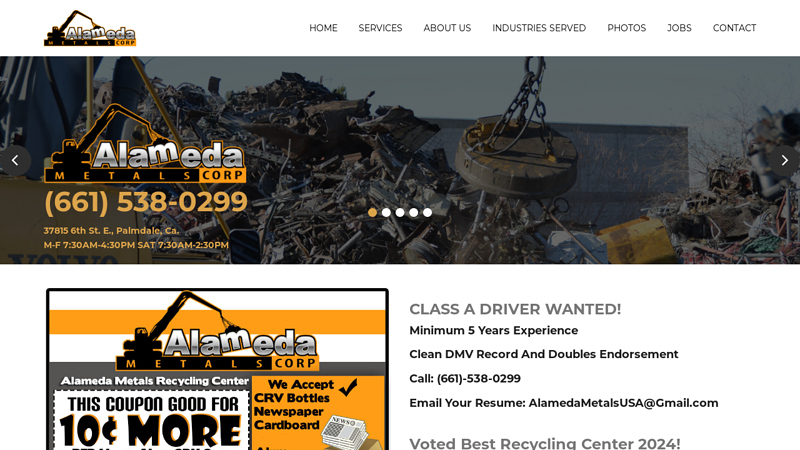

#7 Alameda Metals, Corp

Domain Est. 2011

Website: alamedametals.com

Key Highlights: Alameda Metals is a state of the art, full service recycling center located in Palmdale, California….

#8 Alameda Metals Staff Directory, Phone & Corp Office

Domain Est. 2017

Website: seamless.ai

Key Highlights: Alameda Metals Company Information. Phone icon. Phone Number. (661) 538-xxxx. Address icon. Corporate Office Address. 37815 6th Street East Palmdale, 93550….

Expert Sourcing Insights for Alameda Metals In Palmdale

H2: Projected 2026 Market Trends for Alameda Metals in Palmdale

As the industrial and aerospace sectors continue to evolve, Alameda Metals in Palmdale is strategically positioned to benefit from several key market trends expected to shape the Southern California manufacturing and supply landscape by 2026. Located in a region experiencing significant growth in aerospace, defense, and advanced manufacturing—particularly due to its proximity to Edwards Air Force Base and the growing aerospace corridor—Alameda Metals is likely to see increasing demand for high-performance metals and customized metal fabrication services.

One of the primary drivers shaping the 2026 outlook is the sustained expansion of the aerospace and defense industries in the Antelope Valley. With companies like SpaceX, Lockheed Martin, and Northrop Grumman maintaining a strong presence in or near Palmdale, demand for precision-grade aluminum, titanium, and specialty alloys is projected to rise. Alameda Metals, as a local supplier, is well-positioned to capitalize on just-in-time delivery needs and long-term supply contracts, especially as supply chain resilience becomes a priority for defense contractors.

Additionally, the push toward sustainable manufacturing and clean energy initiatives in California is encouraging the use of lightweight, recyclable metals in transportation and infrastructure. This trend supports increased demand for aluminum and high-strength steel solutions—core offerings of Alameda Metals. By 2026, regulatory incentives for green building materials and electric vehicle (EV) production may further expand market opportunities, particularly if Alameda Metals diversifies into supporting EV charging infrastructure or renewable energy projects.

Labor and workforce development will also play a critical role. Palmdale’s city-led initiatives to expand technical education and vocational training in advanced manufacturing will help address skilled labor shortages. Alameda Metals may benefit from a more robust talent pipeline, enabling scalability and improved operational efficiency by 2026.

Technological adoption, including digital inventory management, AI-driven logistics, and enhanced CNC fabrication capabilities, will likely differentiate competitive metal suppliers. Firms that invest in automation and digital integration—such as real-time order tracking and ERP systems—will gain an edge in responsiveness and customer service. Alameda Metals’ ability to modernize its operations will influence its market share and service reliability in the coming years.

In summary, the 2026 market outlook for Alameda Metals in Palmdale is cautiously optimistic, driven by regional aerospace growth, sustainability trends, workforce development, and technological advancement. Strategic investments in supply chain agility, customer service, and operational innovation will be key to maintaining a strong competitive position in an evolving industrial landscape.

Common Pitfalls Sourcing Alameda Metals in Palmdale (Quality, IP)

Sourcing from Alameda Metals in Palmdale, while potentially beneficial for certain industrial needs, comes with notable risks—particularly concerning material quality and intellectual property (IP) protection. Being aware of these pitfalls is essential for making informed procurement decisions.

Quality Control Inconsistencies

Alameda Metals has faced public scrutiny over inconsistent quality control processes, especially highlighted during the events surrounding its role in supplying materials for high-performance applications. Buyers may encounter variability in metallurgical properties, inadequate traceability, or non-compliance with industry-specific certifications (e.g., aerospace or defense standards). Without rigorous third-party validation and on-site audits, there is a significant risk of receiving substandard or non-conforming materials that could compromise end-product integrity.

Intellectual Property Exposure Risks

Engaging with Alameda Metals may pose IP-related vulnerabilities, particularly if proprietary alloys, material specifications, or manufacturing processes are shared during sourcing negotiations. Reports and industry observations suggest limited formal IP protection protocols within the company’s operations. This increases the risk of unintentional disclosure, reverse engineering, or unauthorized use of sensitive technical data—especially in sectors where material composition is a competitive differentiator. Companies should ensure robust contractual safeguards, such as NDAs and clear IP ownership clauses, before disclosing any confidential information.

Logistics & Compliance Guide for Alameda Metals – Palmdale Facility

This guide outlines the key logistics procedures and regulatory compliance requirements for operations at Alameda Metals’ Palmdale location. Adherence to these standards ensures efficient material handling, regulatory adherence, and workplace safety.

Facility Overview & Location

The Palmdale facility is situated in a designated industrial zone with access to major transportation routes, including the 14 Freeway and proximity to regional rail spurs. The site handles metal processing, storage, and distribution with dedicated receiving, staging, and shipping zones.

Incoming Materials & Receiving

All incoming shipments must be scheduled in advance through the Logistics Coordinator. Upon arrival, drivers must check in at the gatehouse with valid shipping documentation (bill of lading, packing slip, material certifications). Materials are inspected for damage and verified against purchase orders before being logged into the inventory management system. Hazardous materials require prior notification and MSDS documentation on file.

Inventory Management

Materials are stored according to type, grade, and hazard classification. Ferrous and non-ferrous metals are segregated with clear labeling. High-value items are kept in secured areas with restricted access. Inventory counts are conducted weekly, with full audits performed quarterly to ensure data accuracy in the ERP system.

Outbound Shipments & Dispatch

Shipping schedules are coordinated 48 hours in advance. Loads must be properly secured and meet Department of Transportation (DOT) weight and dimension regulations. All outbound shipments include accurate manifests, certificates of conformance (when applicable), and proper hazardous material placards if required. Carrier inspections are conducted before dispatch to verify compliance.

Environmental Compliance

The facility operates under California Environmental Protection Agency (CalEPA) and South Coast Air Quality Management District (SCAQMD) regulations. Stormwater Pollution Prevention Plans (SWPPP) are maintained, and spill containment systems are inspected monthly. All scrap metal processing generates recyclable byproducts which are managed through certified waste partners with proper disposal manifests.

Workplace Safety & OSHA Standards

Safety protocols follow OSHA 29 CFR 1910 and 1926 standards. Personal protective equipment (PPE), including hard hats, safety glasses, steel-toed boots, and hearing protection, is mandatory in operational areas. Forklift operators must be certified, and equipment undergoes daily pre-operational checks. Emergency response plans and spill kits are stationed throughout the facility.

Regulatory Documentation & Recordkeeping

All compliance records—including hazardous waste manifests, air quality permits, training certifications, and incident reports—are maintained digitally with physical backups. Records are retained for a minimum of five years and made available for inspection by regulatory authorities upon request.

Emergency Procedures

In case of fire, chemical spill, or medical emergency, personnel must activate the nearest alarm and follow evacuation routes posted throughout the facility. The Emergency Response Team (ERT) is trained monthly, and drills are conducted quarterly. Local emergency services are pre-notified of facility hazards and access points.

Carrier & Vendor Requirements

All third-party carriers and vendors must comply with Alameda Metals’ Safety and Compliance Policy. This includes providing proof of insurance, adhering to site safety rules, and completing a site orientation prior to access. Non-compliance may result in denied entry or contract termination.

In conclusion, sourcing metals from Alameda Metals in Palmdale presents a reliable and efficient solution for businesses and contractors in the aerospace, manufacturing, and construction industries. With its strategic location in the Antelope Valley—a key hub for aerospace and defense operations—the company offers access to high-quality metal materials, responsive customer service, and just-in-time delivery options that support local supply chain needs. Alameda Metals’ commitment to quality, combined with its industry expertise and ability to meet strict specifications, makes it a valuable procurement partner in a region where precision and reliability are paramount. For organizations operating in or near Palmdale, leveraging Alameda Metals as a trusted supplier enhances operational efficiency and supports the continued growth of the region’s advanced manufacturing sector.