The global aluminum 6061 alloy market is experiencing steady expansion, driven by rising demand across aerospace, automotive, and construction sectors due to its excellent strength-to-weight ratio, corrosion resistance, and weldability. According to a 2023 report by Grand View Research, the global aluminum alloy market was valued at USD 123.7 billion and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030, with Al6061 being a key contributor due to its widespread industrial application. Similarly, Mordor Intelligence projects a CAGR of over 4% for the aluminum alloy market between 2023 and 2028, underscoring the increasing reliance on high-performance materials in lightweighting initiatives. Against this backdrop, the production of Al6061 has become a strategic focus for leading manufacturers aiming to meet stringent quality standards and evolving customer requirements. Below is a data-driven overview of the top nine Al6061 alloy manufacturers shaping the global supply chain.

Top 9 Al6061 Alloy Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

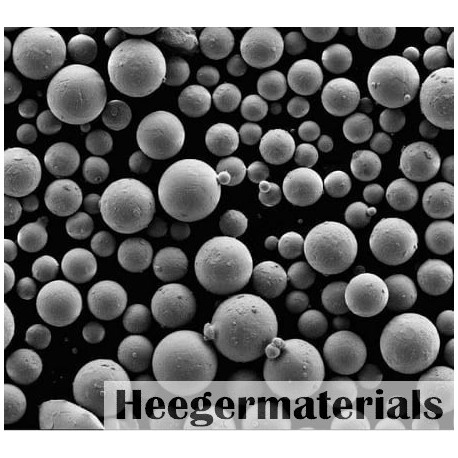

#1 Spherical Atomized Aluminum Powder and Aluminum Alloy Powders

Domain Est. 1997

Website: valimet.com

Key Highlights: VALIMET, Inc. is a leading manufacturer of spherical atomized metal powders in the United States. We’re flexible in offering standard and customized solutions….

#2 Ye Fong Aluminium

Domain Est. 2007

Website: ye-fong.com

Key Highlights: Ye Fong Aluminum Industrial Ltd. is the aluminum alloy manufacturer/mill in TAIWAN. Ye Fong has established indirect/direct extrusion pressers, and ……

#3 Aluminum 6061

Domain Est. 1995

Website: glemco.com

Key Highlights: Aluminum 6061-T6 is the one of the most common types of aluminum metals used in the industrial world today. With its high strength-to-weight ratio and excellent ……

#4 6061 Aluminum Manufacturers

Domain Est. 2015

Website: aluminummanufacturers.org

Key Highlights: Find top USA manufacturers of 6061 aluminum with diverse grades, advanced equipment, custom solutions, and swift delivery….

#5 Aluminum Alloy 6061

Domain Est. 1996

Website: unitedaluminum.com

Key Highlights: Originally called “Alloy 61S”, it was developed in 1935. It has good mechanical properties and exhibits good weldability. It is one of the most common alloys ……

#6 Aluminium / Aluminum 6061 Alloy (UNS A96061)

Domain Est. 1999

Website: azom.com

Key Highlights: Aluminium / Aluminum 6061 alloy is the most commonly available and heat treatable alloy. The following datasheet gives an overview of Aluminium / Aluminum 6061 ……

#7 Products and services

Domain Est. 1999

Website: raffmetal.com

Key Highlights: Discover Raffmetal products and services: 100% recycled aluminium alloys, tailor-made solutions and certified processes with low environmental impact….

#8 Aluminum Alloy 6061

Domain Est. 2021

Website: zy-materials.net

Key Highlights: Zuoyuan alloys such as AlSi alloys, Al6061 and super high strength aluminum alloys are suitable for use in medical industry. Read More · Optical Fiber ……

#9 Aluminium Alloy A6061

Website: aluminium.com.vn

Key Highlights: Aluminium 6061 -T6 is an extremely ideal alloy, has many great uses, has very good durability, corrosion resistance and good weldability….

Expert Sourcing Insights for Al6061 Alloy

H2: Projected Market Trends for Aluminum 6061 Alloy in 2026

The global market for Aluminum 6061 alloy is expected to experience steady growth by 2026, driven by increasing demand across key industrial sectors, technological advancements, and regional economic developments. As one of the most versatile and widely used aluminum alloys—known for its excellent mechanical properties, weldability, and corrosion resistance—Al6061 is poised to maintain a dominant position in various high-performance applications.

1. Rising Demand from Automotive and Transportation Sectors

In 2026, the automotive industry will continue to be a major driver for Al6061 consumption, particularly with the global push toward lightweight vehicles to improve fuel efficiency and reduce emissions. The alloy is extensively used in structural components, frames, and wheels for both internal combustion engine (ICE) vehicles and electric vehicles (EVs). The expansion of EV production, especially in North America, Europe, and China, will significantly boost demand for Al6061 due to its favorable strength-to-weight ratio.

2. Growth in Aerospace and Defense Applications

The aerospace industry is expected to increase its reliance on Al6061 for non-critical structural parts, such as fuselage components, brackets, and landing gear parts. With projected growth in commercial air travel and defense modernization programs globally, demand for lightweight and durable materials like Al6061 will remain strong through 2026.

3. Expansion in Renewable Energy Infrastructure

Al6061 is increasingly being used in solar panel frames, wind turbine components, and energy storage systems. The global shift toward renewable energy sources, supported by government incentives and sustainability goals, will drive new applications for the alloy. By 2026, solar energy installations—especially in emerging markets—are expected to contribute significantly to Al6061 consumption.

4. Advancements in Manufacturing and Material Processing

Technological developments in extrusion, CNC machining, and additive manufacturing will enhance the performance and application scope of Al6061. Improved heat treatment processes and tighter quality control will allow for more consistent mechanical properties, making the alloy more attractive for precision engineering applications.

5. Regional Market Dynamics

Asia-Pacific, particularly China and India, will remain the largest consumers and producers of Al6061 alloy, driven by rapid industrialization and infrastructure development. Meanwhile, North America is expected to see growth due to reshoring of manufacturing and investments in clean energy. Europe will maintain steady demand, supported by stringent environmental regulations and the green transition.

6. Sustainability and Recycling Trends

By 2026, environmental concerns will continue to influence market dynamics. The high recyclability of Al6061—retaining nearly all its properties after recycling—will make it a preferred choice for eco-conscious industries. Increased use of secondary aluminum in alloy production is expected to reduce carbon footprints and production costs, further enhancing market appeal.

7. Price Volatility and Supply Chain Considerations

While demand grows, the Al6061 market may face challenges from fluctuating raw material prices (especially bauxite and alumina) and geopolitical factors affecting aluminum supply chains. However, strategic investments in recycling infrastructure and supply chain diversification are expected to mitigate these risks by 2026.

In conclusion, the Al6061 alloy market in 2026 will be shaped by technological innovation, sustainability imperatives, and expanding applications across transportation, energy, and manufacturing sectors. With favorable material properties and strong industry adoption, Al6061 is expected to maintain robust demand, supported by a resilient and adaptive global supply chain.

Common Pitfalls When Sourcing AL6061 Alloy (Quality and Intellectual Property)

Sourcing high-quality AL6061 aluminum alloy while protecting intellectual property (IP) involves navigating several critical challenges. Below are key pitfalls to avoid in both quality assurance and IP protection:

1. Inconsistent Material Quality and Certification

Pitfall: Receiving AL6061 alloy that does not meet ASTM B221 or AMS 4027 standards due to poor supplier controls or lack of traceability.

- Risk: Substandard mechanical properties (e.g., lower tensile strength, poor weldability) leading to product failure.

- Cause: Suppliers may substitute lower-grade alloys or fail to provide proper heat treatment (e.g., T6 temper).

- Solution: Require mill test reports (MTRs) with every shipment, verify chemical composition and mechanical properties, and conduct third-party material testing for critical applications.

2. Lack of Traceability and Heat Number Verification

Pitfall: Inadequate batch traceability increases the risk of counterfeit or mixed-alloy materials.

- Risk: Inability to recall or investigate materials if failures occur; potential safety hazards in aerospace or automotive applications.

- Cause: Some suppliers, especially in secondary markets, do not maintain full heat trace documentation.

- Solution: Enforce strict traceability requirements in procurement contracts and audit supplier documentation practices.

3. Counterfeit or Non-Compliant Materials

Pitfall: Sourcing from unverified suppliers who mislabel alloys or use recycled content without proper controls.

- Risk: Material performance does not meet design specifications; potential regulatory non-compliance.

- Cause: Global supply chains with weak oversight, especially in spot market or gray-market sourcing.

- Solution: Source only from certified suppliers (e.g., Nadcap, ISO 9001), conduct periodic audits, and use positive material identification (PMI) testing upon receipt.

4. Intellectual Property Exposure During Sourcing

Pitfall: Sharing detailed design specifications, tolerances, or end-use applications with suppliers can lead to IP leakage.

- Risk: Competitors gaining access to proprietary designs or reverse engineering products.

- Cause: Over-disclosure in RFQs or lack of NDAs with suppliers.

- Solution: Share only essential technical data under robust non-disclosure agreements (NDAs); use generic part numbers and limit functional descriptions.

5. Unprotected Tooling and Process Know-How

Pitfall: Supplier gains insight into proprietary manufacturing processes (e.g., special machining, heat treatment cycles).

- Risk: Loss of competitive advantage; supplier replicates or sells similar products.

- Cause: Inadequate contractual protections or lack of process segmentation.

- Solution: Use work-for-hire agreements, restrict access to critical process parameters, and consider dual-sourcing to limit dependency.

6. Geopolitical and Supply Chain Vulnerabilities

Pitfall: Relying on single-source suppliers in regions with unstable supply chains or lax IP enforcement.

- Risk: Disruptions in delivery and increased risk of IP theft.

- Cause: Cost-driven sourcing decisions without risk assessment.

- Solution: Diversify supplier base across regions, prioritize suppliers with strong compliance records, and include IP protection clauses in international contracts.

Conclusion

To mitigate risks when sourcing AL6061 alloy, companies must implement rigorous supplier qualification processes, enforce material certification and traceability, and safeguard IP through legal and operational controls. A proactive approach combining technical diligence and legal protection is essential for maintaining quality and competitive advantage.

H2: Logistics & Compliance Guide for Aluminum 6061 (Al6061) Alloy

Aluminum 6061 (Al6061) is one of the most widely used aluminum alloys in industrial applications due to its excellent mechanical properties, weldability, and corrosion resistance. Proper logistics and compliance measures are essential to ensure safe handling, transportation, regulatory adherence, and environmental responsibility throughout the supply chain.

1. Material Classification & Identification

- Material: Aluminum Alloy 6061 (Al6061)

- Common Forms: Sheet, plate, bar, rod, tube, extrusions, forgings

- Composition: Primarily aluminum, with magnesium (Mg) and silicon (Si) as key alloying elements; may contain small amounts of copper, chromium, and zinc.

- UNS Number: UNS A96061

- Temper Designations: T4, T6, T651, etc. — each indicating specific heat treatment and mechanical properties.

Compliance Note: Ensure all material is certified with Mill Test Reports (MTRs) compliant with ASTM B221 (extruded shapes), ASTM B209 (sheet/plate), or other applicable standards.

2. Regulatory Compliance

a. International Regulations

- REACH (EU): Al6061 is generally compliant; however, verify that any coatings, lubricants, or surface treatments applied do not contain Substances of Very High Concern (SVHC).

- RoHS (EU): Aluminum alloy 6061 is exempt from RoHS restrictions under Article 2(3), as it is not an electrical/electronic component. However, if alloy is part of an EEE assembly, downstream due diligence is required.

b. North American Regulations

- OSHA (Occupational Safety and Health Administration):

- Aluminum dust/fumes generated during machining or welding are regulated. Exposure limits apply:

- Aluminum metal, as Al: 15 mg/m³ (total dust), 5 mg/m³ (respirable fraction) — TWA.

- Use proper ventilation and respiratory protection when processing.

- EPA (Environmental Protection Agency):

- No significant environmental hazard in solid form.

- Recycling is encouraged; disposal of aluminum scrap must comply with local solid waste regulations.

c. DOT (U.S. Department of Transportation)

- Hazard Class: Not classified as hazardous material when in solid form (ingots, sheets, extrusions).

- UN Number: Not applicable (NA) for solid aluminum alloys.

- Packaging: Standard industrial packaging (wooden crates, steel strapping, pallets) sufficient.

- Labeling: No hazardous labels required unless contaminated or in powder form.

d. IMDG Code (International Maritime Dangerous Goods)

- Classification: Not regulated as dangerous goods in solid, unprocessed form.

- Stowage & Segregation: Stow away from corrosive or oxidizing materials if stored in mixed cargo.

e. Customs & Trade Compliance

- HS Code:

- 7604.21.00 – Non-alloy aluminum bars, rods, and profiles (Al6061 may fall here or under 7606 depending on form).

- Verify country-specific tariff classifications (e.g., U.S. HTS, EU CN).

- Trade Restrictions: No international embargoes on Al6061; however, monitor export controls if destined for sanctioned regions.

- Documentation: Include commercial invoice, packing list, bill of lading, and MTRs.

3. Logistics & Handling

a. Packaging & Protection

- Use moisture-resistant wrapping (e.g., VCI paper) to prevent surface oxidation.

- Secure loads with edge protectors and strapping to prevent shifting during transit.

- Avoid direct contact between aluminum and dissimilar metals (e.g., steel) to prevent galvanic corrosion — use plastic or wooden spacers.

b. Storage Conditions

- Store indoors in a dry, well-ventilated area.

- Elevate from concrete floors to avoid moisture absorption.

- Maximize separation from salt, acids, and alkaline substances.

c. Transportation Modes

- Road: Standard flatbed or enclosed trailers; secure against movement.

- Rail: Use cushioning and dunnage; avoid overloading.

- Sea: Containerized shipment preferred; protect against salt air and condensation.

- Air: Permitted without restrictions; suitable for urgent deliveries.

4. Environmental & Safety Considerations

- Recyclability: Al6061 is 100% recyclable; recycling saves up to 95% of the energy required for primary production.

- Waste Management: Chips, swarf, and machining waste should be collected and sent to certified aluminum recyclers.

- Fire Hazards: Solid Al6061 is non-combustible, but fine powders or turnings can be flammable. Avoid accumulation in machinery or work areas.

5. Quality Assurance & Documentation

- Certifications Required:

- Material Test Reports (MTRs) per ASTM, AMS, or customer specifications.

- Certificate of Conformance (CoC).

- RoHS/REACH compliance declaration (if requested).

- Traceability: Maintain lot traceability from mill to end use, especially in aerospace, automotive, or medical applications.

6. Special Considerations

- Aerospace & Defense: If Al6061-T6 is used in certified applications, compliance with AS9100 and NADCAP standards may be required.

- Food & Pharmaceutical Equipment: Ensure surface finish and cleaning meet FDA or EHEDG guidelines if used in contact with consumables.

Summary

Al6061 alloy is non-hazardous in solid form and generally exempt from stringent hazardous materials regulations. However, compliance with environmental, safety, and quality standards is essential. Proper documentation, handling, and storage ensure material integrity and regulatory adherence across global supply chains.

For specific applications, always consult relevant standards (e.g., ASTM, ISO, EN) and local regulatory authorities.

Conclusion for Sourcing AL6061 Alloy:

Sourcing AL6061 alloy presents a reliable and cost-effective solution for applications requiring a strong, lightweight, and corrosion-resistant aluminum material. Its excellent weldability, machinability, and versatility make it ideal for industries such as aerospace, automotive, marine, and structural manufacturing. When sourcing AL6061, it is essential to procure from certified suppliers adhering to international standards (such as ASTM B221 or AMS 4027) to ensure material consistency, traceability, and quality. Evaluating factors such as form (sheet, bar, tube, etc.), temper condition (e.g., T6, T4), lead times, and total landed cost will optimize procurement efficiency. Ultimately, establishing long-term partnerships with reputable suppliers enhances supply chain stability and supports consistent production performance using AL6061 alloy.