The global air purifier market is experiencing robust growth, driven by rising awareness of indoor air quality, increasing urbanization, and heightened health concerns worldwide. According to a report by Grand View Research, the global air purifier market size was valued at USD 8.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.7% from 2023 to 2030. Similarly, Mordor Intelligence projects steady expansion, attributing growth to technological advancements, stringent air quality regulations, and growing demand in residential, commercial, and healthcare sectors. Within this evolving landscape, air fuze—a critical component in advanced air purification systems that combines filtration with electrical safety mechanisms—has emerged as a key differentiator among manufacturers. As demand for high-efficiency, low-maintenance air purification solutions rises, leading companies are investing heavily in innovative air fuze technologies to enhance performance, ensure safety, and meet certification standards. Below, we highlight the top 9 air fuze manufacturers shaping the future of clean air solutions.

Top 9 Air Fuze Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 FuzeHub

Domain Est. 2013

Website: fuzehub.com

Key Highlights: FuzeHub is the go-to resource for startup, small, and mid-size manufacturers and technology companies in New York State….

#2 air fuze smart vape Manufacturer, Wholesaler & OEM Supplier

Domain Est. 2021

Website: mytastefog.com

Key Highlights: We are here today to inform you that one of our new products, TASTEFOG ASTRO 7000puffs disposable vape box, is officially released and sold today. ASTRO is a ……

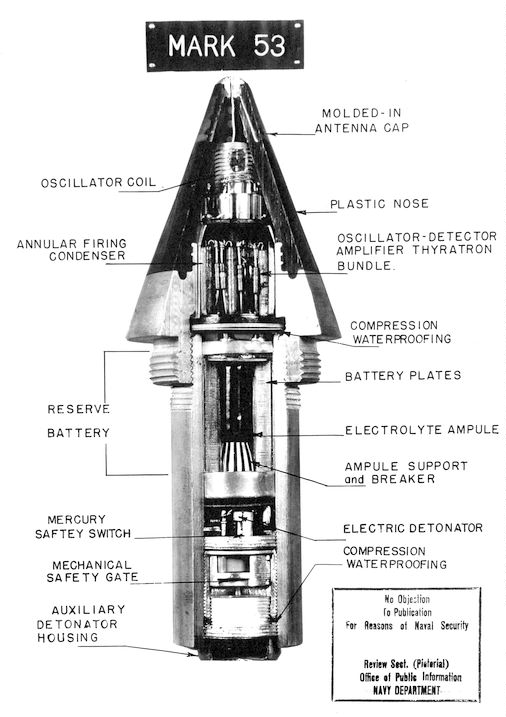

#3 American Rheinmetall Munitions, Inc.

Domain Est. 1997

Website: rheinmetall.com

Key Highlights: American Rheinmetall Munitions, Inc. is a leading U.S. supplier for infantry munitions, medium caliber, direct and indirect fire large caliber munitions….

#4 Shop Airfuze Disposable Vapes Online

Domain Est. 2009

Website: provape.com

Key Highlights: Airfuze specializes in smart disposable vapes that incorporate advanced technology, including Bluetooth connectivity to smartphones….

#5 Fuzes

Domain Est. 2002

Website: elbitsystems.com

Key Highlights: We specialize in the research, development, manufacturing, and integration of advanced fuses for aerial munitions and custom fuzing systems….

#6 SmartLabel

Domain Est. 2012

Website: smartlabel.org

Key Highlights: SmartLabel gives you the product information you want – when you want it. Check out ingredients, allergens and more….

#7 About Us

Domain Est. 2024 | Founded: 2023

Website: airfuze.net

Key Highlights: Established in 2023, AirFuze famous for unique and innovative design, immersing flight by AIRFUZE JET 20000, Which has the world first ultra-large dynamic ……

#8 Airfuze Smart Vape

Website: airfuzevapesmart.com

Key Highlights: Airfuze vape is a device with up to 30,000 puffs, a 900 mAh battery and unique features such as touchscreen, Bluetooth and music control. Airfuze also offers a ……

#9 Naval Air Weapons Station China Lake

Website: navfac.navy.mil

Key Highlights: The official website of the Naval Facilities Engineering Systems Command. … fuze and explosives research laboratories and associated machining shops. In ……

Expert Sourcing Insights for Air Fuze

H2: 2026 Market Trends for Air Fuze

Overview

Air Fuze, as an emerging player in the drone or aerial technology sector (context assumed based on name), is poised to experience significant shifts in 2026 driven by technological advancements, regulatory evolution, and expanding commercial applications. This analysis explores key market trends expected to shape Air Fuze’s growth trajectory in the coming years, focusing on innovation, regulation, industry adoption, and competitive dynamics.

1. Accelerated Adoption in Enterprise and Industrial Sectors

By 2026, enterprise drone usage is projected to grow at a CAGR of over 20%, with Air Fuze well-positioned to benefit from increased demand in industries such as:

– Construction & Infrastructure: Drone-powered site surveys, progress monitoring, and asset inspection will become standard. Air Fuze’s potential in high-resolution imaging and real-time data analytics will be critical.

– Energy & Utilities: Inspections of wind turbines, solar farms, and power lines will increasingly rely on AI-enabled drones for predictive maintenance—areas where Air Fuze could differentiate through automation and thermal sensing capabilities.

– Agriculture: Precision agriculture will expand with drones offering crop health analytics, planting, and spraying. Air Fuze may leverage edge computing for faster field data processing.

2. Regulatory Maturation and Beyond Visual Line of Sight (BVLOS) Expansion

Regulatory frameworks—especially in North America and Europe—are expected to mature by 2026, enabling broader BVLOS operations. Key developments include:

– FAA’s UTM (Unmanned Traffic Management) Integration: Air Fuze will need to ensure compatibility with national UTM systems to support scalable, safe drone operations.

– Remote ID Compliance: Full implementation of Remote ID protocols will be standard, enhancing airspace safety and public trust—critical for Air Fuze’s operational legitimacy.

– Certification Pathways: Regulatory clarity on type certification and operator licensing will lower barriers to commercial deployment, particularly for autonomous systems.

3. AI and Edge Computing Integration

By 2026, drones will increasingly function as intelligent edge devices. Air Fuze must prioritize:

– Onboard AI Processing: Real-time object detection, anomaly recognition, and adaptive flight paths will reduce latency and reliance on cloud connectivity.

– Predictive Analytics: Machine learning models will turn flight data into actionable insights, especially valuable in logistics and inspection markets.

– Autonomy Levels: Progress toward Level 4 autonomy (highly automated operations) will differentiate leaders like Air Fuze in competitive bidding for industrial contracts.

4. Growth in Urban Air Mobility (UAM) and Delivery Ecosystems

While Air Fuze may not be a passenger drone developer, it could play a supporting role in the UAM ecosystem:

– Last-Mile Delivery Support: Partnerships with logistics firms for inventory monitoring, warehouse scanning, or route optimization using smaller drones.

– Infrastructure Monitoring for Vertiports: Inspection of takeoff/landing zones and charging stations will be essential as UAM scales.

5. Sustainability and Energy Innovation

Environmental concerns will drive demand for greener solutions:

– Hybrid-Electric and Hydrogen Propulsion: By 2026, early adoption of alternative power sources may offer Air Fuze a first-mover advantage in long-endurance missions.

– Carbon-Neutral Operations: Clients will prioritize vendors with sustainable practices, pushing Air Fuze toward eco-conscious supply chains and flight planning.

6. Consolidation and Competitive Landscape

The drone market will see increased M&A activity, with large tech firms and aerospace giants acquiring niche innovators. Air Fuze’s strategic options include:

– Partnerships: Collaboration with telecom providers (for 5G-enabled drone control) or cloud platforms (for data storage and AI training).

– Niche Specialization: Focusing on verticals like environmental monitoring or defense applications to avoid direct competition with industry giants.

Conclusion

In 2026, Air Fuze’s success will depend on its ability to integrate AI-driven autonomy, comply with evolving regulations, and deliver specialized solutions to high-growth industrial sectors. By embracing edge intelligence, forming strategic alliances, and prioritizing sustainability, Air Fuze can position itself as a key enabler in the next phase of aerial technology adoption. Market readiness, regulatory agility, and continuous innovation will be paramount.

Common Pitfalls When Sourcing Air Fuze (Quality, IP)

Sourcing Air Fuze—a specialized pyrotechnic or energetic component used in aerospace, defense, or safety systems—presents significant challenges, particularly concerning quality assurance and intellectual property (IP) protection. Failure to address these areas can result in safety risks, legal liabilities, and project delays. Below are the most common pitfalls in both domains.

Quality-Related Pitfalls

1. Inadequate Supplier Qualification

Many organizations source Air Fuze components from suppliers without rigorous vetting. This can lead to inconsistent performance, non-compliance with military or industry standards (e.g., MIL-STD, ISO 9001, AS9100), and potential safety hazards. Relying solely on cost or speed without verifying a supplier’s track record in high-reliability components is a critical error.

2. Lack of Traceability and Documentation

Air Fuze components must be fully traceable in terms of materials, manufacturing processes, and testing. Poor documentation—missing lot numbers, test reports, or process certifications—makes it difficult to verify quality or conduct root cause analysis in the event of a failure.

3. Insufficient Testing and Validation

Skipping or minimizing environmental, functional, and safety testing (e.g., thermal cycling, vibration, ESD sensitivity) to reduce costs or accelerate delivery timelines increases the risk of field failures. Air Fuze devices must perform reliably under extreme conditions, and inadequate validation compromises system integrity.

4. Use of Non-Conforming or Counterfeit Materials

Unverified supply chains may introduce substandard or counterfeit energetic materials, which can alter ignition characteristics or cause catastrophic malfunction. This is particularly common in global sourcing where oversight is limited.

Intellectual Property (IP)-Related Pitfalls

1. Incomplete or Ambiguous IP Ownership Agreements

When sourcing custom-designed Air Fuze components, failure to clearly define IP ownership in contracts can result in disputes. Suppliers may claim rights to design improvements or manufacturing processes, limiting your ability to reproduce or modify the component in the future.

2. Lack of IP Due Diligence on Supplier

Sourcing from a supplier that uses patented technologies without proper licensing exposes the buyer to infringement claims. Conducting IP audits—reviewing patents, trademarks, and technical literature—is essential to ensure freedom to operate.

3. Inadequate Protection of Proprietary Information

Sharing sensitive design or performance specifications without robust non-disclosure agreements (NDAs) or data protection clauses risks trade secret exposure. This is especially critical when working with offshore manufacturers who may not adhere to the same IP protection standards.

4. Reverse Engineering Risks

Poorly protected designs can be reverse-engineered by suppliers or third parties, leading to unauthorized replication or competition. Implementing technical safeguards (e.g., obfuscation, modular design) and legal protections is crucial to mitigate this risk.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Partner only with certified, audited suppliers experienced in energetic systems.

– Require full documentation, traceability, and independent validation testing.

– Define IP ownership, licensing terms, and confidentiality obligations in legally binding contracts.

– Conduct regular supplier audits and IP risk assessments.

Proactively addressing quality and IP concerns ensures the safe, reliable, and legally compliant integration of Air Fuze components into critical systems.

Logistics & Compliance Guide for Air Fuze

This guide outlines the essential logistics and compliance procedures for Air Fuze to ensure efficient operations and adherence to regulatory standards across all supply chain activities.

Order Fulfillment Process

All customer orders must be processed within 24 hours of placement. Verify inventory availability, pack items using approved packaging materials, and generate shipping labels with accurate tracking information. Coordinate with designated carriers for daily pickups to ensure timely dispatch.

Inventory Management

Maintain real-time inventory tracking using the designated warehouse management system (WMS). Conduct cycle counts weekly and full physical inventories quarterly. Reorder thresholds should be set to prevent stockouts while minimizing overstocking. Report discrepancies immediately to the Logistics Manager.

Shipping & Carrier Coordination

Shipments must comply with carrier-specific requirements (e.g., FedEx, UPS, DHL). Use Air Fuze-approved packaging and labeling standards, including proper product identification, barcodes, and handling instructions. All international shipments require accurate commercial invoices and packing lists.

International Compliance

For cross-border shipments, ensure compliance with export and import regulations. Complete required documentation, including:

– Commercial Invoice

– Packing List

– Certificate of Origin (if applicable)

– Export Declaration (where required)

Verify destination country restrictions and obtain necessary licenses or permits before shipping controlled goods.

Regulatory Compliance

Adhere to all applicable regulations, including:

– International Air Transport Association (IATA) Dangerous Goods Regulations (if shipping hazardous materials)

– U.S. Department of Commerce Export Administration Regulations (EAR)

– Customs-Trade Partnership Against Terrorism (C-TPAT) guidelines

– General Data Protection Regulation (GDPR) for handling customer data

Packaging Standards

Use environmentally responsible, durable packaging that meets dimensional and weight standards for air and ground transport. Clearly label all packages with Air Fuze branding, tracking numbers, and handling symbols (e.g., “Fragile,” “This Side Up”). Avoid over-packaging to reduce waste and shipping costs.

Returns Management

Process all returns within 48 hours of receipt. Inspect returned items for condition and document reasons for return. Update inventory and initiate refunds or replacements per Air Fuze’s return policy. Report frequent return causes monthly to improve product and packaging quality.

Data Security & Privacy

Protect all customer and shipment data in compliance with data protection laws. Restrict access to logistics systems to authorized personnel only. Encrypt sensitive information during transmission and storage.

Audits & Documentation

Maintain complete records of all shipments, inventory transactions, and compliance documentation for a minimum of five years. Prepare for internal and external audits by ensuring all logs and procedures are up to date and accessible.

Continuous Improvement

Review logistics performance metrics monthly, including on-time delivery rate, order accuracy, and shipping costs. Implement process improvements based on data analysis and feedback from customers and partners.

Conclusion for Sourcing Air Fuze:

Sourcing air fuzes requires a strategic, compliant, and security-conscious approach due to their critical role in munitions systems and the stringent regulations governing their procurement. Successful sourcing involves identifying qualified and certified suppliers with proven expertise in military-grade components, ensuring full compliance with national and international arms trade regulations such as ITAR or EAR. Factors such as reliability, technical specifications, quality assurance, and after-sales support must be prioritized to maintain operational safety and effectiveness. Additionally, establishing long-term partnerships with reputable manufacturers, conducting thorough due diligence, and maintaining robust supply chain security are essential to mitigate risks and ensure timely delivery. In conclusion, effective sourcing of air fuzes hinges on balancing regulatory adherence, technical precision, and supply chain integrity to support defense and aerospace mission readiness.