The global industrial air dryer market is experiencing robust growth, driven by increasing demand for compressed air systems in manufacturing, automotive, and heavy machinery sectors. According to a report by Mordor Intelligence, the air dryer market was valued at USD 2.15 billion in 2023 and is projected to grow at a CAGR of 5.2% through 2029. This expansion is fueled by the critical role air dryers play in maintaining system efficiency and preventing moisture-related damage in pneumatic equipment—particularly in high-performance applications like heavy-duty trucks and construction machinery. As Volvo, a global leader in commercial vehicle manufacturing, continues to prioritize reliability and operational efficiency, sourcing high-quality air dryers from specialized manufacturers has become a strategic imperative. The following analysis identifies the top four air dryer manufacturers that support Volvo’s stringent performance standards, leveraging market data, product innovation, and global supply chain integration to meet rising industry demands.

Top 4 Air Dryer Volvo Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Volvo Air Dryers UT1003 Truck Filter

Domain Est. 2015

Website: fonho.com

Key Highlights: FONHO is the best truck air dryer filter manufacturer in China. VOLVO AIR DRYERS UT1027 are made specifically for Volvo trucks!…

#2 Volvo Truck 85122949 Air Dryer

Domain Est. 2008

Website: class8truckparts.com

Key Highlights: In stock Free deliveryThis air dryer will remove moisture, oil, and other contaminants from the compressed air system, which will enhance the performance of your truck….

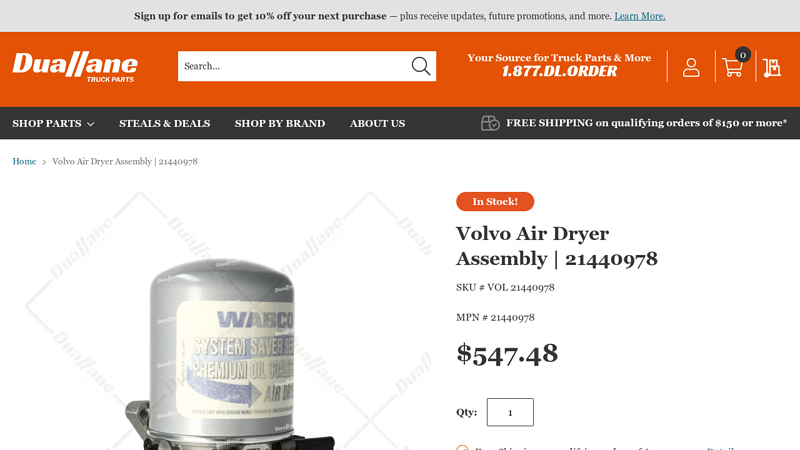

#3 Volvo Air Dryer Assembly

Domain Est. 2018

Website: duallane.com

Key Highlights: In stock Free deliveryThe 21440978 Volvo Air Dryer Assembly is a crucial component designed to remove moisture and contaminants from the compressed air system in heavy-duty vehicle…

#4 21488734 Genuine Volvo Air Dryer

Domain Est. 2020

Website: advancedtruckparts.com

Key Highlights: Out of stockThis air dryer from VOLVO is designed to deliver reliable performance and durability. Key Features. Designed to match or exceed applicable specifications ……

Expert Sourcing Insights for Air Dryer Volvo

H2: 2026 Market Trends for Air Dryers in Volvo Trucks

As the global commercial vehicle industry evolves toward greater efficiency, sustainability, and advanced technology integration, the air dryer segment—particularly for Volvo trucks—is expected to undergo significant transformation by 2026. Air dryers play a critical role in maintaining the integrity and performance of air brake systems by removing moisture and contaminants from compressed air. With Volvo’s strong commitment to safety, reliability, and innovation, several key market trends are expected to shape the demand, design, and functionality of air dryers in its truck lineup by 2026.

-

Increased Demand for Integrated and Compact Designs

Volvo is anticipated to prioritize modular and space-efficient air dryer systems as part of its broader trend toward optimizing under-hood packaging. With the growing adoption of electric and hybrid powertrains, space constraints will drive demand for compact, high-efficiency air dryers that integrate seamlessly with other air management components. Manufacturers are likely to develop co-molded or multi-functional units that reduce weight and improve serviceability. -

Advancements in Desiccant Technology

By 2026, expect next-generation desiccant materials with higher moisture absorption rates and longer service intervals. Volvo may adopt air dryers utilizing advanced molecular sieve technologies or hybrid desiccants that maintain performance under extreme temperatures and high humidity—common in global logistics operations. These improvements will support extended maintenance cycles, reducing total cost of ownership (TCO) for fleet operators. -

Smart Air Dryers with Diagnostic Capabilities

Digitalization and predictive maintenance are key pillars of Volvo’s strategy. Air dryers integrated with sensors and IoT connectivity are expected to become mainstream by 2026. These “smart” dryers can monitor desiccant saturation, pressure differentials, purge cycle efficiency, and temperature, transmitting real-time data to Volvo’s remote diagnostics platform, such as Volvo Connect. This enables proactive maintenance, minimizes brake system failures, and enhances safety. -

Focus on Sustainability and Recyclability

In alignment with Volvo Group’s 2040 climate-neutral ambition, there will be increased emphasis on eco-friendly materials and recyclable air dryer components. Manufacturers will likely adopt bioplastics, aluminum housings, and sealed cartridge systems that reduce waste during servicing. Additionally, regenerative drying cycles and energy-efficient purge mechanisms will support lower engine load and fuel consumption, especially in conventional diesel models. -

Compliance with Stricter Emissions and Safety Regulations

Global regulations such as Euro 7 and updated UNECE standards will demand higher reliability in pneumatic systems. Volvo’s air dryers will need to meet tighter moisture removal efficiency benchmarks to ensure brake performance and longevity. This will lead to the adoption of multi-stage drying systems and fail-safe mechanisms, especially in regions with extreme climates. -

Growth in Aftermarket and Service Solutions

As Volvo’s global fleet expands—particularly in North America, Europe, and emerging markets—the aftermarket for air dryers will grow. By 2026, Volvo is expected to expand its certified remanufactured parts program, offering cost-effective, high-quality replacement dryers. Training programs for technicians and expanded digital service tools will support efficient maintenance and reduce downtime. -

Electrification and Air System Innovation

With Volvo’s aggressive push into electric trucks (e.g., Volvo VNR Electric), the role of air dryers will evolve. Electric compressors operate differently than engine-driven units, requiring redesigned air management systems. Air dryers will need to adapt to intermittent compressor cycles and variable pressure profiles. This will drive innovation in control algorithms and adaptive drying cycles tailored to electric powertrains.

In conclusion, the 2026 market for air dryers in Volvo trucks will be shaped by technological integration, sustainability goals, and evolving regulatory landscapes. Volvo is likely to lead in adopting intelligent, efficient, and durable air drying solutions that align with its vision of safer, cleaner, and more connected transport systems. Suppliers and service providers must prepare for a shift toward data-driven maintenance, advanced materials, and system-level integration to remain competitive in this evolving ecosystem.

H2: Common Pitfalls When Sourcing an Air Dryer for Volvo – Quality and IP Rating Issues

When sourcing an air dryer for a Volvo vehicle or machinery, several common pitfalls can compromise system performance, longevity, and safety. Two critical areas often overlooked are product quality and Ingress Protection (IP) rating. Failing to address these can lead to premature failure, system contamination, and costly downtime.

- Compromised Quality from Low-Cost Suppliers

- Many third-party or non-OEM air dryers are marketed as compatible with Volvo systems but may use inferior materials or substandard manufacturing.

- Poor-quality desiccant media reduces moisture absorption efficiency, increasing the risk of corrosion in air brake systems.

- Inadequate filtration allows oil and particulate contaminants to pass through, damaging downstream components like valves and actuators.

-

Seals and housings prone to cracking or leakage under pressure or temperature fluctuations reduce reliability.

-

Incorrect or Misrepresented IP Rating

- The IP rating indicates the level of protection against dust and water ingress. Air dryers in Volvo trucks and equipment often operate in harsh environments, requiring a minimum of IP65 (dust-tight and protected against water jets).

- Some suppliers falsely claim high IP ratings without certification, leading to moisture or debris entering the unit.

-

Installing an air dryer with insufficient IP protection can result in internal corrosion, electrical faults (if integrated with sensors), and failure in wet or dusty conditions.

-

Lack of Compatibility and Certification

- Even if a unit appears to fit, it may not meet Volvo’s performance specifications or regulatory standards (e.g., ISO 11077 for air dryers).

-

Non-certified parts may void warranties or fail compliance during safety inspections.

-

Inadequate After-Sales Support and Documentation

- Low-quality suppliers may lack technical support or fail to provide test reports, IP certification documents, or traceability data.

- This makes troubleshooting and compliance verification difficult.

Best Practices to Avoid Pitfalls:

– Source from authorized Volvo dealers or reputable OEM-approved suppliers.

– Verify IP ratings through official documentation or third-party test reports.

– Inspect desiccant quality, housing material, and sealing mechanisms before purchase.

– Ensure the air dryer meets Volvo’s technical specifications for flow rate, pressure, and mounting configuration.

By prioritizing quality and accurate IP ratings, fleet operators and maintenance teams can ensure reliable air system performance and avoid the hidden costs of premature component failure.

Logistics & Compliance Guide for Air Dryer – Volvo

1. Product Overview

The air dryer is a critical component in the braking system of Volvo commercial vehicles, responsible for removing moisture and contaminants from compressed air. Ensuring proper logistics and compliance for this part is essential for maintaining vehicle safety, performance, and regulatory adherence.

2. Logistics Handling and Packaging

2.1 Packaging Requirements

- Use manufacturer-approved packaging to prevent damage during transit.

- Each air dryer must be sealed in moisture-resistant packaging to avoid internal corrosion.

- Include protective end caps on all ports to prevent contamination.

- Clearly label packages with:

- Part number (e.g., 26166720, 26297750 – verify based on Volvo model)

- “Fragile – Handle with Care”

- Orientation arrows indicating correct upright positioning

2.2 Storage Conditions

- Store in a dry, temperature-controlled environment (5°C to 30°C).

- Avoid exposure to direct sunlight, dust, and chemical fumes.

- Maximum recommended storage duration: 24 months from manufacturing date.

- Use First-In, First-Out (FIFO) inventory management.

2.3 Transportation

- Use enclosed, climate-controlled vehicles for long-distance transport.

- Secure packages to prevent movement during transit.

- Avoid stacking more than three layers high to prevent crush damage.

- Maintain documentation of shipment conditions (especially humidity and temperature for sensitive routes).

3. Regulatory Compliance

3.1 International Standards

- Comply with ISO 11821:2021 – Road vehicles — Pneumatic brake system compressors and air dryers.

- Ensure conformity with ECE R24 (United Nations Economic Commission for Europe Regulation 24) for braking components.

3.2 Environmental Regulations

- Air dryers may contain desiccant materials (e.g., silica gel); comply with REACH (EU) and TSCA (USA) for chemical content.

- No hazardous substances (RoHS compliant) in electronic components (if applicable).

- Proper labeling for recyclability per WEEE directives (if applicable).

3.3 Import/Export Compliance

- Verify Harmonized System (HS) Code: Typically 8708.29.50 (parts for braking systems).

- Provide Certificate of Conformity (CoC) issued by Volvo or authorized distributor.

- Include technical data sheets and safety data sheets (SDS) for desiccant material.

- Ensure compliance with local customs and transportation safety regulations (e.g., IATA for air freight, ADR for road in Europe).

4. Quality Assurance & Traceability

4.1 Serial Number and Batch Tracking

- Each air dryer must carry a unique serial or batch number for traceability.

- Maintain records of manufacturing date, origin, and distribution chain.

- Support Volvo’s warranty and recall management systems.

4.2 Inspection and Testing

- Conduct pre-shipment visual and functional checks.

- Verify pressure ratings (typically tested up to 16 bar) and purge functionality.

- Retain test records for minimum 5 years.

5. Installation & Aftermarket Compliance

5.1 Authorized Distribution

- Distribute only through Volvo-authorized service centers or dealers.

- Avoid parallel market distribution to maintain compliance and warranty validity.

5.2 Technician Certification

- Recommend installation by certified technicians trained in Volvo pneumatic systems.

- Use only genuine Volvo tools and procedures (per VIDA documentation).

6. Documentation & Recordkeeping

- Maintain copies of:

- Material Safety Data Sheets (MSDS/SDS)

- Certificates of Conformity (CoC)

- Test reports and inspection logs

- Shipping manifests and customs declarations

- Retain records for a minimum of 7 years for audit purposes.

7. Disposal & End-of-Life Management

- Follow local waste management regulations for end-of-life air dryers.

- Desiccant cartridges may require separate disposal as industrial waste.

- Volvo recommends returning used units to authorized centers for proper recycling.

8. Contact & Support

For compliance or logistics inquiries, contact:

Volvo Parts Logistics Support

Email: [email protected]

Phone: +46 31 66 60 00 (Sweden HQ)

Visit: www.volvo.com/parts-support

Note: Always refer to the latest Volvo Technical Documentation (VIDA) for model-specific requirements.

Conclusion for Sourcing Air Dryer for Volvo:

In conclusion, sourcing an air dryer for a Volvo vehicle—particularly commercial trucks or construction equipment—requires a careful balance between quality, compatibility, and cost-effectiveness. Ensuring the air dryer meets original equipment manufacturer (OEM) specifications is critical to maintaining the integrity and performance of the vehicle’s air braking and pneumatic systems. Opting for genuine Volvo parts or high-quality aftermarket alternatives from reputable suppliers guarantees reliability, durability, and compliance with safety standards.

Additionally, evaluating factors such as supplier credibility, warranty offerings, lead times, and total cost of ownership aids in making an informed procurement decision. Establishing partnerships with authorized distributors or certified vendors minimizes the risk of counterfeit products and ensures technical support when needed.

Ultimately, proper sourcing of a Volvo air dryer contributes to enhanced vehicle safety, reduced downtime, and improved operational efficiency, making it a vital component of effective fleet maintenance and management.