The global air dispenser market is experiencing steady expansion, driven by increasing demand for hygiene, automation, and energy-efficient solutions across commercial, industrial, and residential sectors. According to Grand View Research, the global automatic soap and air freshener dispenser market was valued at USD 2.4 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. This growth is fueled by rising awareness of germ transmission in public spaces, stricter sanitation regulations, and the integration of smart technologies such as motion sensors and IoT-enabled monitoring systems. Additionally, Mordor Intelligence forecasts continued momentum in the Asia-Pacific region due to rapid urbanization and infrastructure development. As demand rises, manufacturers are focusing on sustainable designs, touchless operation, and smart connectivity. In this evolving landscape, the top eight air dispenser manufacturers have emerged as leaders through innovation, scalability, and performance—setting industry benchmarks in quality and reliability.

Top 8 Air Dispenser Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

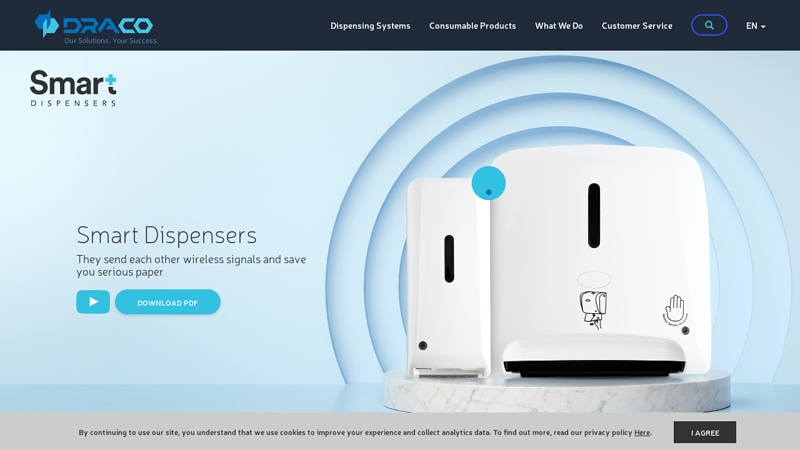

#1 Draco Hygienic Products

Domain Est. 1995

Website: draco.com

Key Highlights: Draco utilizes only 100% recycled materials for the grey and black components in our dispenser systems. Additionally, our consumable paper products are FSC- ……

#2 Mistral Coolers

Domain Est. 2004

Website: mistralcoolers.com

Key Highlights: Discover our range and choose the product which suits you among a wide choice of water dispensers and water coolers….

#3 DEMA Engineering Company

Domain Est. 1996

Website: demaeng.com

Key Highlights: Intorucing Pinnacle, the newest family of warewash dispensers from DEMA. The Pinnacle series is the most technologically advanced warewash dispenser available….

#4 Febreze: Air Fresheners & Odor

Domain Est. 1998

Website: febreze.com

Key Highlights: Searching for freshness? Welcome to Febreze.com. Find your favorite Febreze products and get tips to breathe happy….

#5 Commercial Air Freshener Holders

Domain Est. 2001

Website: kcprofessional.com

Key Highlights: Kimberly-Clark Professional offers air freshener dispensers that make it easy to keep commercial restrooms smelling fresh. See what’s available today….

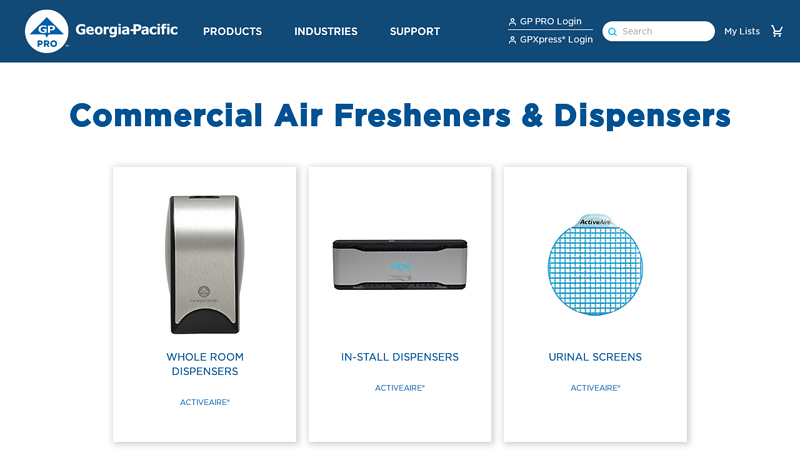

#6 Commercial Air Fresheners & Dispensers

Domain Est. 2002

Website: gppro.com

Key Highlights: Control unpleasant odor with Activeaire products, built to keep restrooms fresher for longer, with top quality commercial air fresheners and more….

#7 Tork

Domain Est. 2003

Website: torkglobal.com

Key Highlights: Find hygiene and cleaning products, dispensers, and services for your business. From offices or hospitality to manufacturing facilities, Tork has you ……

#8 Air Freshener Dispenser

Website: nozomimanufacturing.com

Key Highlights: Our comprehensive range of air freshener dispensers able to provide a fresh-smelling environment to the employees or visitors by eliminate the unpleasant ……

Expert Sourcing Insights for Air Dispenser

H2: 2026 Market Trends for Air Dispensers

The global air dispenser market is poised for significant transformation by 2026, driven by evolving consumer preferences, technological innovation, and heightened awareness of indoor air quality. Key trends shaping the market include smart home integration, sustainability demands, health-driven product development, and regional market expansion.

1. Smart and Connected Devices on the Rise

By 2026, smart air dispensers equipped with IoT capabilities are expected to dominate the market. Consumers increasingly favor devices that integrate with voice assistants (e.g., Amazon Alexa, Google Assistant) and smartphone apps for remote control, scheduling, and real-time air quality monitoring. Advanced models will use AI to adjust fragrance intensity based on occupancy, time of day, or environmental conditions, improving user convenience and energy efficiency.

2. Focus on Health and Wellness

Post-pandemic health consciousness continues to influence purchasing behavior. Air dispensers are evolving beyond fragrance delivery to include air purification features such as HEPA filters, UV-C light, and antimicrobial technologies. Hybrid models that combine scent diffusion with allergen reduction, odor elimination, and pathogen control are gaining traction, particularly in residential and healthcare settings.

3. Sustainable and Eco-Friendly Solutions

Environmental concerns are pushing manufacturers toward sustainable design. By 2026, expect increased adoption of refillable cartridges, biodegradable fragrance pods, and energy-efficient operation. Brands are emphasizing recyclable packaging and transparent sourcing of essential oils to appeal to eco-conscious consumers. Regulatory pressures in Europe and North America are also encouraging greener product development.

4. Personalization and Custom Fragrance Experiences

The demand for personalized home environments is fueling innovation in customizable scent profiles. Air dispensers with interchangeable scent modules or app-based fragrance blending allow users to tailor olfactory experiences. Subscription models for fragrance refills are becoming popular, offering curated seasonal or mood-based scent collections.

5. Expansion in Emerging Markets

While North America and Europe remain key markets, rapid urbanization and rising disposable incomes in Asia-Pacific, Latin America, and the Middle East are driving growth. In countries like India, China, and Brazil, increasing middle-class adoption of home automation and personal care products is creating new opportunities for air dispenser brands.

6. Commercial and Hospitality Sector Adoption

Beyond residential use, the commercial sector—including offices, hotels, retail spaces, and healthcare facilities—is investing in premium air dispensing systems to enhance ambiance and improve indoor air quality. Branded scent marketing is also gaining ground, with businesses using signature fragrances to strengthen brand identity and customer experience.

In conclusion, the 2026 air dispenser market will be defined by intelligence, health integration, sustainability, and personalization. Companies that innovate across these dimensions while addressing regional preferences and regulatory standards will be best positioned for success.

Common Pitfalls Sourcing Air Dispensers: Quality and IP Risks

Sourcing air dispensers—particularly those involving pressurized systems, electronics, or proprietary technology—can be fraught with challenges. Overlooking key quality and intellectual property (IP) considerations often leads to product failures, legal disputes, or reputational damage. Below are the most common pitfalls to avoid.

Poor Manufacturing Quality and Inconsistent Performance

One of the most frequent issues when sourcing air dispensers, especially from low-cost suppliers, is inconsistent build quality. Components such as valves, seals, motors, and pressure regulators may not meet required tolerances, leading to leaks, inconsistent airflow, or premature failure. Substandard materials can degrade when exposed to moisture or continuous use, reducing product lifespan. Without rigorous quality control and third-party testing, these flaws may go undetected until after mass production or customer deployment.

Lack of Compliance with Safety and Industry Standards

Air dispensers—particularly those used in industrial, medical, or commercial environments—must comply with relevant safety standards (e.g., ISO, CE, UL, RoHS). Sourcing from suppliers who do not adhere to these standards not only risks product recalls but can also expose the buyer to liability in case of accidents. For example, non-compliant pressure systems may pose explosion or injury risks, especially if burst discs or relief valves are improperly designed.

Inadequate Intellectual Property Protection

When developing or customizing air dispensers, IP ownership is crucial. A common pitfall is assuming that paying for design or manufacturing services automatically transfers IP rights. Without clear contractual agreements, the supplier may retain rights to the design, firmware, or mechanical innovations, limiting your ability to modify, reproduce, or protect the product. This is especially risky when working with overseas manufacturers who may produce knock-offs for other clients.

Risk of IP Infringement by the Supplier

Another critical risk is sourcing from suppliers who use counterfeit or patented components without authorization. If the air dispenser incorporates proprietary valve mechanisms, control algorithms, or patented nozzle designs developed by third parties, using them without a license could lead to infringement claims. Conducting due diligence on component origins and requiring IP warranties from suppliers is essential.

Insufficient Documentation and Traceability

High-quality sourcing requires complete technical documentation, including schematics, material specifications, test reports, and firmware source code (if applicable). Suppliers may withhold or provide incomplete documentation, making it difficult to ensure quality, perform audits, or support future product iterations. Lack of traceability also complicates root cause analysis when defects emerge post-launch.

Overlooking Software and Firmware IP

Modern air dispensers often include embedded software for timing, pressure control, or user interfaces. If the firmware is developed by the supplier, there may be hidden licensing restrictions or use of open-source code that imposes unintended obligations (e.g., GPL requirements). Failing to audit firmware for IP compliance can result in costly legal exposure or forced product redesigns.

Conclusion

To mitigate these risks, buyers should implement a structured sourcing strategy that includes supplier vetting, contractual IP clauses, third-party quality audits, and compliance verification. Investing time upfront to assess both quality systems and IP integrity pays dividends in product reliability, legal safety, and long-term scalability.

Logistics & Compliance Guide for Air Dispensers

Regulatory Classification and Documentation

Air dispensers, depending on their design and function, may fall under various regulatory frameworks. Proper classification is essential for compliance with international shipping, customs, and safety regulations. Typically, air dispensers are classified under the Harmonized System (HS) code 8414.59 – “Other fans and re-circulating air-conditioning units, n.e.s.” However, specific sub-classifications may vary by country and product features (e.g., inclusion of ionizers, humidifiers, or smart technology).

Ensure the following documentation is prepared for each shipment:

– Commercial Invoice

– Packing List

– Bill of Lading (B/L) or Air Waybill (AWB)

– Certificate of Origin (if required by destination country)

– Product Compliance Certifications (e.g., CE, FCC, RoHS)

Safety and Electrical Compliance

Air dispensers that are electrically powered must comply with electrical safety standards in both the country of origin and the destination market. Key compliance requirements include:

- CE Marking (European Union): Required for electrical safety (LVD 2014/35/EU) and electromagnetic compatibility (EMC 2014/30/EU).

- FCC Certification (USA): Mandatory for devices that may emit radio frequency interference.

- RoHS Compliance (Restriction of Hazardous Substances): Applies in the EU, UK, and several other countries to limit the use of lead, mercury, cadmium, and other hazardous materials.

- Energy Efficiency Standards: Some regions (e.g., California under Title 20, EU Ecodesign) may require energy labeling or minimum efficiency levels.

Manufacturers and distributors must maintain technical files and test reports to demonstrate compliance upon request by customs or market surveillance authorities.

Packaging and Labeling Requirements

Proper packaging ensures product integrity during transit and compliance with regulatory labeling. Requirements include:

- Use of durable, recyclable materials to protect against impact and moisture.

- Secure internal bracing to prevent movement during transport.

- Clear labeling on both the product and outer packaging, including:

- Manufacturer/importer name and address

- Model and serial number

- Voltage and power requirements (e.g., 120V~, 60Hz)

- Compliance marks (CE, FCC, etc.)

- Safety warnings in the local language of the destination country

- Handling symbols (e.g., “This Side Up,” “Fragile”)

Retail packaging may also require energy labels (e.g., EU Energy Label) and multilingual user instructions.

Transportation and Shipping Considerations

Air dispensers are generally non-hazardous goods and can be shipped via air, sea, or ground freight. However, logistics planning should account for:

- Battery-Operated Models: If the air dispenser contains lithium-ion batteries, IATA Dangerous Goods Regulations (DGR) may apply. Small batteries installed in equipment are typically permitted under Section II of PI 966, provided they are securely installed and packaging meets vibration and short-circuit protection standards.

- Dimensional Weight: Air freight charges are often based on dimensional weight. Optimize packaging to reduce volume without compromising protection.

- Customs Clearance: Accurate HS codes, valuation, and country-of-origin declarations are critical to avoid delays. Consider using an experienced customs broker in the destination country.

- Import Duties and Taxes: Rates vary by country. For example, the U.S. typically applies a 4.1% duty on HS 8414.59, while some countries may offer reduced or zero tariffs under trade agreements.

Environmental and Disposal Compliance

End-of-life management is increasingly regulated. Producers may be subject to:

- WEEE Directive (EU): Requires registration, collection, and recycling of electronic waste. Producers must provide take-back options and mark products with the crossed-out wheeled bin symbol.

- Battery Regulations: If the unit includes removable batteries, compliance with local battery recycling laws (e.g., EU Battery Directive) is required.

- Extended Producer Responsibility (EPR): Countries such as Germany, France, and Canada require registration and fees for placing electrical products on the market.

Ensure product design supports disassembly and recycling, and provide disposal instructions in user manuals.

Market-Specific Compliance Notes

- United States: FCC Part 15 Class B for digital emissions; California Proposition 65 warnings if applicable.

- European Union: CE marking, RoHS, REACH, and Ecodesign requirements.

- United Kingdom: UKCA marking (post-Brexit); adherence to GB version of CE regulations.

- Canada: Safety certification by a recognized body (e.g., CSA, cETL); ISED certification for radio interference.

- Australia/NZ: RCM mark for electrical safety and EMC.

Always verify the latest requirements with local authorities or compliance consultants prior to shipment.

Conclusion for Sourcing an Air Dispenser

In conclusion, sourcing an air dispenser requires a comprehensive evaluation of quality, cost-effectiveness, supplier reliability, and technical specifications to ensure the selected unit meets operational and environmental requirements. By assessing key factors such as airflow capacity, energy efficiency, durability, maintenance needs, and compliance with relevant industry standards, organizations can make informed procurement decisions that support long-term performance and sustainability goals. Additionally, establishing partnerships with reputable suppliers who offer after-sales support and warranty services enhances overall value and operational continuity. Ultimately, a well-sourced air dispenser not only improves indoor air quality and comfort but also contributes to enhanced productivity and occupant well-being in residential, commercial, or industrial settings.