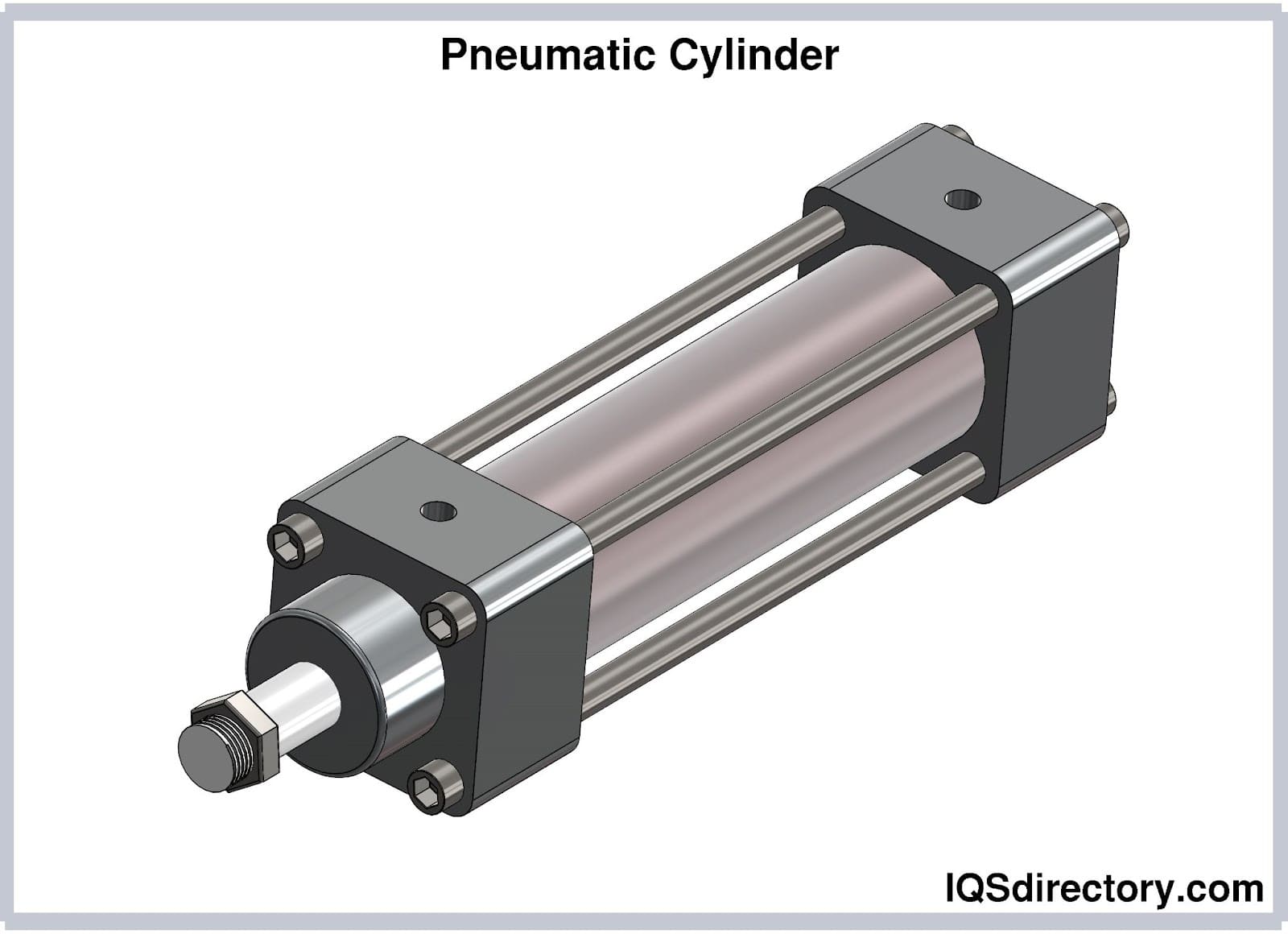

The global pneumatic cylinders market is experiencing robust growth, driven by increasing automation across manufacturing, automotive, and food & beverage industries. According to Mordor Intelligence, the air cylinders market was valued at USD 3.8 billion in 2023 and is projected to reach USD 5.2 billion by 2029, growing at a CAGR of 5.3% during the forecast period. This expansion is fueled by rising demand for energy-efficient and low-maintenance actuation solutions in industrial automation. Similarly, Grand View Research highlights that advancements in pneumatic technology and the integration of Industry 4.0 practices are further accelerating adoption. As demand surges, a select group of manufacturers are leading innovation, reliability, and global market share. Below are the top 10 air cylinders and pneumatic system manufacturers shaping the future of motion control.

Top 10 Air Cylinders Pneumatic Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Chicago Pneumatic Homepage

Domain Est. 1994

Website: cp.com

Key Highlights: We are a global manufacturer of high-performance power tools, air compressors, generators, light towers, and hydraulic equipment for professional and industrial ……

#2 Pneumatic Cylinder Manufacturer

Domain Est. 1996

Website: americancylinder.com

Key Highlights: American Cylinder Co., Inc. manufactures a variety of products to satisfy the needs of the International Fluid Power market, specializing in small bore air ……

#3 Milwaukee Cylinder

Domain Est. 1999

Website: milwaukeecylinder.com

Key Highlights: Milwaukee Cylinder is a premium manufacturer of air cylinders and hydraulic cylinders for standard and custom tie rod cylinder applications….

#4 Quality Industrial Pneumatic Fittings, Valves, & Cylinders

Domain Est. 1999

Website: allenair.com

Key Highlights: Allenair engineers, designs, and manufactures custom pneumatic fittings, valves, and cylinders for industrial use. Talk to our sales team about our system ……

#5 Air Cylinders Manufacturers

Domain Est. 2014

Website: air-cylinders.com

Key Highlights: Falcon Industries is a machine shop and manufactures hydraulic and air cylinders to your exacting specifications. Our air cylinders are lightweight and durable ……

#6 Air Cylinders, Solenoid Valves and Pneumatics

Domain Est. 1995

Website: smcusa.com

Key Highlights: LPV series is a 2-port solenoid normally closed or normally open pinch valve for fluid control. The LPV series pinch valve also comes with a u-shaped tube slot ……

#7 Fabco-Air

Domain Est. 1995

Website: fabco-air.com

Key Highlights: Fabco-Air offers a complete line of pneumatic components including cylinders, rotary actuators, slides, grippers and valves….

#8 Pneumatic Cylinders

Domain Est. 1995

Website: discreteautomation.emerson.com

Key Highlights: AVENTICS offers an expansive portfolio of air-actuated cylinders, many of which are designed to operate in tight spaces and harsh environments….

#9 IMI Bimba

Domain Est. 1996

Website: bimba.com

Key Highlights: We are a forward-thinking innovator providing industry-leading pneumatic, hydraulic, electric and vacuum motion solutions that are easy to use, reliable and ……

#10 SMC Pneumatics

Domain Est. 2001

Website: smcpneumatics.com

Key Highlights: SMC Pneumatics direct to your door. Free fast shipping. 99% of our orders leave within 24 hours or less. Order online or call 1-800-660-0733….

Expert Sourcing Insights for Air Cylinders Pneumatic

H2: Market Trends for Air Cylinders in the Pneumatic Industry (2026 Outlook)

The global air cylinders pneumatic market is poised for significant transformation by 2026, driven by technological advancements, evolving industrial automation demands, and sustainability initiatives. Key market trends shaping the industry include:

-

Increased Adoption in Industrial Automation

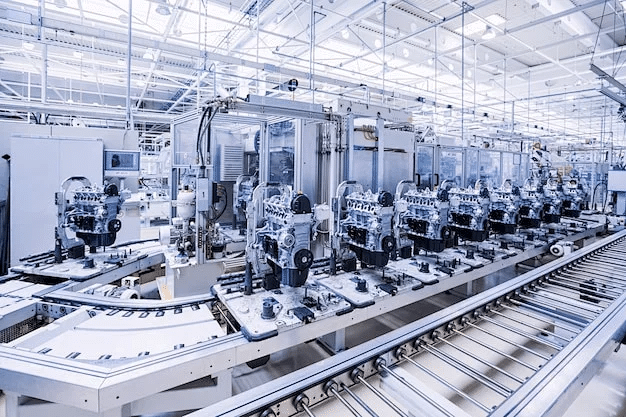

The growing reliance on automation across manufacturing, automotive, and logistics sectors is accelerating demand for pneumatic air cylinders. These components are essential in robotic systems, assembly lines, and material handling applications. By 2026, the integration of Industry 4.0 technologies—such as smart sensors and IoT-enabled pneumatic systems—is expected to drive demand for intelligent air cylinders capable of real-time monitoring and predictive maintenance. -

Miniaturization and Compact Design

As machinery becomes more space-constrained, especially in electronics and medical device manufacturing, there is a rising trend toward compact and lightweight air cylinders. Manufacturers are focusing on innovative designs that offer high force output in smaller footprints, enhancing efficiency in precision applications. -

Energy Efficiency and Sustainability

With increased regulatory pressure and corporate sustainability goals, the pneumatic industry is shifting toward energy-efficient solutions. Air cylinders with reduced air consumption, improved sealing technologies, and recyclable materials are gaining traction. By 2026, eco-conscious design and lower compressed air waste are expected to be key differentiators among leading suppliers. -

Growth in Emerging Markets

Rapid industrialization in Asia-Pacific (especially China, India, and Southeast Asia), coupled with expanding automotive and consumer goods production, is fueling market growth. Local manufacturing hubs are increasingly adopting cost-effective pneumatic solutions, contributing to rising air cylinder demand in these regions. -

Integration with Smart Manufacturing Systems

The convergence of pneumatics with digital control systems is enabling smarter factory operations. Air cylinders equipped with position feedback, pressure sensors, and compatibility with PLCs and MES platforms are becoming standard in next-generation production environments. This trend supports higher reliability, reduced downtime, and improved process control. -

Material Innovation and Customization

To meet diverse application needs, manufacturers are investing in advanced materials such as high-strength composites, corrosion-resistant alloys, and self-lubricating components. Customized cylinder solutions—tailored for specific stroke lengths, mounting configurations, and environmental conditions—are becoming increasingly common, particularly in aerospace and pharmaceutical industries. -

Competitive Landscape and Consolidation

The market is witnessing strategic partnerships, mergers, and R&D investments by key players such as SMC Corporation, Festo, Parker Hannifin, and CKD Corporation. These companies are focusing on expanding their smart pneumatics portfolios and global distribution networks to capture emerging opportunities by 2026.

In summary, the air cylinders pneumatic market in 2026 will be defined by digitalization, energy efficiency, and customization. Companies that innovate in smart integration, sustainable design, and regional market expansion are likely to lead the evolving landscape.

Common Pitfalls When Sourcing Air Cylinders (Pneumatic): Quality and IP Rating Issues

Sourcing pneumatic air cylinders involves more than just matching bore size and stroke length. Overlooking critical quality and Ingress Protection (IP) rating factors can lead to premature failure, safety hazards, and increased lifecycle costs. Below are common pitfalls to avoid:

1. Prioritizing Low Cost Over Build Quality

One of the most frequent mistakes is selecting air cylinders based solely on price. Low-cost cylinders often use inferior materials (e.g., low-grade aluminum, substandard seals, or thin steel rods), leading to:

- Premature wear of piston seals and rod wipers

- Corrosion of cylinder barrels or piston rods

- Reduced lifespan and unplanned downtime

- Higher total cost of ownership due to frequent replacements

Best Practice: Evaluate total cost of ownership, not just initial price. Choose reputable manufacturers with proven track records and certifications (e.g., ISO 9001).

2. Ignoring IP Rating Requirements for the Environment

The Ingress Protection (IP) rating defines the level of protection against solid objects and liquids. Selecting a cylinder with inadequate IP protection for the application environment leads to:

- Contamination from dust, metal shavings, or moisture entering the cylinder

- Seal degradation and internal corrosion

- Sticking or failure of the piston rod

Common Missteps:

– Using standard IP65-rated cylinders in washdown or high-humidity environments without verifying resistance to high-pressure water jets (IP67 or IP69K may be required).

– Assuming all “industrial” cylinders are suitable for outdoor use without checking UV resistance and sealing performance.

Best Practice: Match the IP rating to the operating environment (e.g., IP67 for wet/frequent washdown areas, IP65 for dusty indoor settings).

3. Overlooking Rod and Barrel Surface Treatments

The surface finish and treatment of the piston rod and cylinder barrel significantly affect performance and longevity. Pitfalls include:

- Choosing rods without proper plating (e.g., chrome-plated or stainless steel) in corrosive environments, leading to rust and pitting.

- Accepting cylinders with rough internal bore finishes that accelerate seal wear.

Best Practice: Specify hard chrome-plated or stainless steel rods for harsh environments. Confirm barrel surface treatments (e.g., honing, anodizing) meet industry standards.

4. Assuming All Seals Are Equal

Seal material and design directly impact temperature range, chemical resistance, and service life. Common issues:

- Using NBR (nitrile) seals in high-temperature applications (>80°C), causing hardening and cracking.

- Exposing seals to incompatible lubricants or chemicals, leading to swelling or degradation.

Best Practice: Verify seal material compatibility with operating temperature, air quality, and surrounding chemicals (e.g., use Viton® for high temps or aggressive media).

5. Neglecting Air Quality and Filtration

Even high-quality cylinders fail prematurely if supplied with contaminated or wet compressed air. Pitfalls:

- Skipping or undersizing air filtration (filter-regulator-lubricator units).

- Ignoring the need for proper air drying in humid environments.

Moisture and particulates accelerate internal wear and corrosion, negating the value of a high-IP-rated cylinder.

Best Practice: Implement proper air preparation with coalescing filters, dryers, and regulators. Maintain clean, dry air (per ISO 8573 standards).

6. Failing to Verify Compliance and Certifications

In regulated industries (e.g., food & beverage, pharmaceuticals, explosive atmospheres), uncertified components pose safety and compliance risks.

Pitfalls:

– Using non-food-grade lubricants or materials in hygienic applications.

– Installing standard cylinders in explosive environments without ATEX or IECEx certification.

Best Practice: Confirm certifications (e.g., FDA, ATEX, CE) match application requirements. Request documentation from suppliers.

By addressing these common pitfalls—particularly around material quality, IP ratings, and environmental compatibility—procurement teams can ensure reliable, long-lasting performance of pneumatic air cylinders.

Logistics & Compliance Guide for Air Cylinders (Pneumatic)

Overview

Pneumatic air cylinders are essential components in industrial automation, manufacturing, and mechanical systems. Proper logistics planning and adherence to compliance standards are critical to ensure safe transportation, regulatory compliance, and operational efficiency. This guide outlines key considerations for the international and domestic movement of pneumatic air cylinders, including packaging, shipping, customs, and regulatory requirements.

Packaging & Handling

Proper packaging protects air cylinders during transit and prevents damage to internal components. Follow these best practices:

– Seal Ports: Use protective caps or plugs on cylinder ports to prevent contamination and moisture ingress.

– Internal Protection: Ensure pistons are retracted and cylinders are stored with a small amount of lubricant to prevent internal corrosion.

– Cushioning: Wrap cylinders in anti-corrosion paper or VCI (Vapor Corrosion Inhibitor) film. Use foam, bubble wrap, or custom inserts to minimize movement in the shipping container.

– Outer Packaging: Use sturdy corrugated cardboard boxes or wooden crates for bulk or heavy-duty cylinders. Clearly label packages with “Fragile,” “This Side Up,” and handling instructions.

– Stacking: Avoid stacking heavy items on packed cylinders. If stacking is necessary, use skids and limit height per carrier guidelines.

Transportation Modes

Choose the appropriate transport method based on volume, urgency, and destination:

– Air Freight: Ideal for urgent, low-volume shipments. Subject to IATA Dangerous Goods Regulations if lubricants or compressed air are present. Most empty pneumatic cylinders are non-hazardous when properly prepared.

– Ocean Freight: Cost-effective for bulk shipments. Ensure protection against saltwater corrosion and humidity. Use desiccants in containers.

– Ground Transport: Suitable for domestic or regional delivery. Secure cylinders to prevent shifting; use straps or dunnage.

Customs & Documentation

Accurate documentation ensures smooth customs clearance:

– Commercial Invoice: Include detailed product description (e.g., “Pneumatic Air Cylinder, Double-Acting, Bore: 50mm, Stroke: 200mm”), HS Code, value, origin, and Incoterms® (e.g., FOB, DDP).

– Packing List: Specify item count, weights, dimensions, and packaging type.

– Certificate of Origin: May be required for preferential tariffs under trade agreements (e.g., USMCA, RCEP).

– HS Code Guidance: Common HS codes include:

– 8412.21.00 – Pneumatic pistons and cylinders

– 8481.80.00 – Other valves and cylinders for pneumatic systems (verify country-specific classifications)

– Import Licenses: Generally not required for standard air cylinders, but verify with local customs authorities.

Regulatory Compliance

Ensure compliance with regional and international standards:

– Pressure Equipment Directive (PED) 2014/68/EU: Applies to cylinders designed for pressures >0.5 bar in the EU. CE marking is mandatory. Verify if your cylinder falls under Article 4(3) exemptions (e.g., non-hazardous fluids, low volume).

– ASME Certification: Required in the U.S. for certain high-pressure applications. Most industrial pneumatic cylinders operate below ASME threshold and are exempt.

– REACH & RoHS (EU): Confirm materials (e.g., seals, coatings) comply with chemical restrictions. Provide Declaration of Conformity if requested.

– ATEX/IECEx: Required only if cylinders are used in explosive atmospheres. Standard industrial cylinders typically do not require certification unless explicitly rated.

Safety & Hazard Classification

- Non-Hazardous Classification: Empty pneumatic cylinders are generally not classified as dangerous goods.

- IATA/IMDG Compliance: If shipped with residual compressed air or flammable lubricants, classify accordingly. Most standard shipments are exempt under Special Provision A187 (IATA DGR 3.6).

- Material Safety Data Sheet (MSDS/SDS): Provide if lubricants or coatings are included or applied.

Import Duties & Taxes

- Tariff Rates: Vary by country. For example:

- U.S.: Typically duty-free under HTSUS 8412.21.00

- EU: 0% under CN code 8412.21.00 for most industrial cylinders

- VAT/GST: Apply local consumption tax upon import. Rate depends on destination country.

Best Practices Summary

- Verify product conformity with destination market regulations.

- Use tamper-evident, weather-resistant packaging for international shipping.

- Partner with freight forwarders experienced in industrial components.

- Maintain up-to-date technical documentation (drawings, compliance certificates).

- Label all units with part number, model, and country of origin.

Conclusion

Effective logistics and compliance management for pneumatic air cylinders minimize delays, reduce costs, and ensure product integrity. By adhering to packaging standards, understanding customs requirements, and verifying regulatory alignment, businesses can streamline global distribution and maintain customer satisfaction. Always consult local authorities or compliance experts for country-specific nuances.

Conclusion for Sourcing Pneumatic Air Circles:

Sourcing pneumatic air cylinders requires a strategic approach that balances performance requirements, cost-efficiency, reliability, and supplier credibility. Key factors such as cylinder type (single-acting or double-acting), bore size, stroke length, mounting style, material quality, and operating environment must be carefully evaluated to ensure optimal functionality within the intended application. Additionally, considering energy efficiency, maintenance needs, and compatibility with existing pneumatic systems enhances long-term operational effectiveness.

When selecting suppliers, prioritizing those with industry certifications, proven track records, technical support, and consistent quality control helps mitigate risks related to downtime and system failure. Exploring both local and global sourcing options can provide cost advantages, but should be weighed against lead times, logistics, and after-sales service.

In conclusion, effective sourcing of pneumatic air cylinders involves a comprehensive evaluation of technical specifications, supplier reliability, and total cost of ownership. By adopting a systematic and informed procurement strategy, organizations can secure high-performance components that contribute to improved automation, productivity, and system longevity in industrial applications.