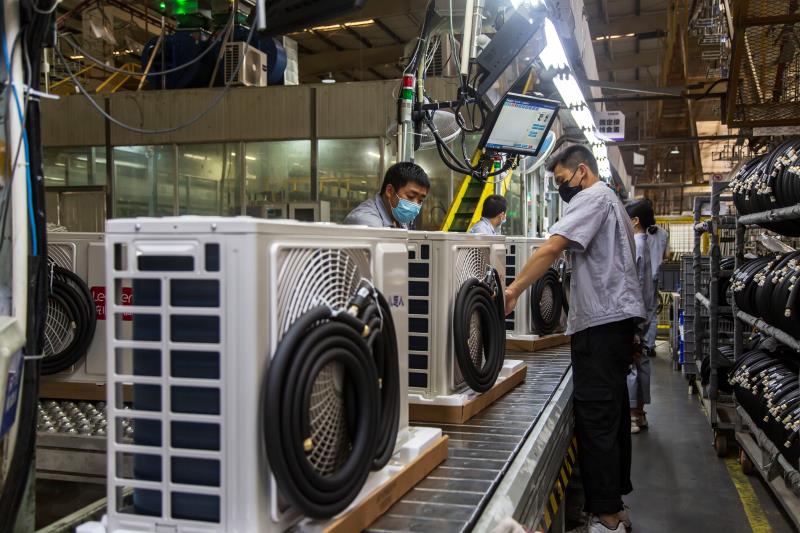

The global air conditioning tools market is experiencing steady expansion, driven by rising demand for HVAC maintenance, increasing adoption of energy-efficient cooling systems, and growing construction activities worldwide. According to Grand View Research, the global HVAC market was valued at USD 159.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2023 to 2030—directly influencing the demand for specialized air conditioning service tools. Similarly, Mordor Intelligence projects a CAGR of over 6.5% for the HVAC market through 2028, underpinned by technological advancements and stringent energy regulations. As refrigerant transitions and system complexity increase, technicians rely on high-precision tools for installation, diagnostics, and repairs. This surge in demand has elevated the role of manufacturers producing reliable, innovative AC tools—ranging from leak detectors and vacuum pumps to manifold gauges and charging scales. Below is a data-driven look at the top 9 air conditioning tools manufacturers leading innovation, quality, and market presence in this expanding sector.

Top 9 Air Conditioning Tools Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 HVAC Tools Manufacturer

Domain Est. 1998

Website: jbind.com

Key Highlights: JB Industries provides PT Conversion, Manifold Vacuum HVAC, and other products, built in the USA, predominantly in our factory in Aurora, IL….

#2 Nordyne

Domain Est. 1996

Website: nordyne.com

Key Highlights: As the most trusted worldwide HVAC manufacturer, Nordyne manufactures top-tier heating and cooling equipment that distributors, contractors, and customers love….

#3 Goodman: Air Conditioning and Heating Systems

Domain Est. 1997

Website: goodmanmfg.com

Key Highlights: Goodman Manufacturing offers a range of affordable air conditioning, packaged units, heat pumps and gas furnaces for residential heating and cooling needs….

#4 Friedrich Air Conditioning: Room Air Conditioning Expert

Domain Est. 1998

Website: friedrich.com

Key Highlights: Founded in 1883, Friedrich Air Conditioning Co. is a leading US manufacturer of premium room A/C and other home environment products….

#5 Bard Manufacturing

Domain Est. 1996

Website: bardhvac.com

Key Highlights: Bard offers high-quality commercial heating and cooling equipment to support a functional, comfortable environment….

#6 CPS Products

Domain Est. 1996

Website: cpsproducts.com

Key Highlights: CPS Products develops tools and equipment for HVAC/Refrigeration and Automotive systems. Find innovative solutions for professional service technicians….

#7 Lennox

Domain Est. 1997

Website: lennox.com

Key Highlights: Explore Lennox comfort and energy-efficient solutions for heating and cooling your space. Upgrade your home’s HVAC system with industry-leading solutions….

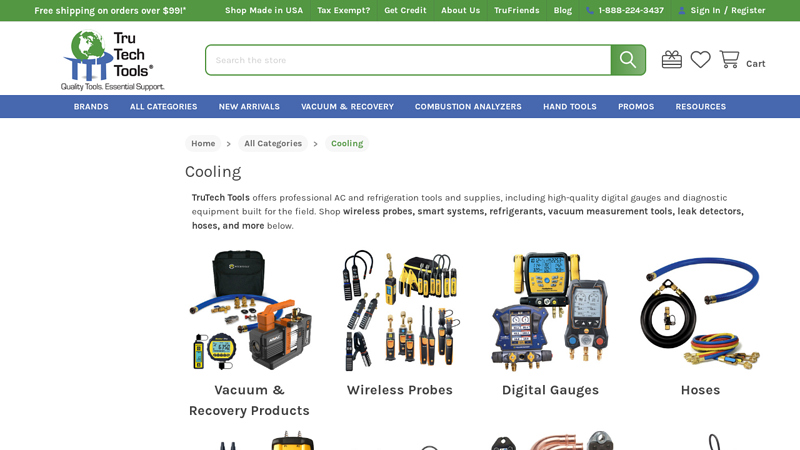

#8 A/C & Refrigeration Tools

Domain Est. 2007

#9 hilmor

Domain Est. 2009

Website: hilmor.com

Key Highlights: Discover hilmor HVAC tools built for professionals: durable, precise, and ergonomic solutions for bending, cutting, crimping, refrigerant handling, ……

Expert Sourcing Insights for Air Conditioning Tools

H2: 2026 Market Trends for Air Conditioning Tools

The air conditioning (AC) tools market is poised for significant transformation by 2026, driven by technological innovation, regulatory changes, and shifting consumer demands. This analysis explores the key trends expected to shape the industry over the coming years.

Growing Demand for Energy-Efficient and Eco-Friendly Tools

As global environmental regulations tighten—particularly those targeting refrigerants with high global warming potential (GWP), such as the phasedown of R-410A under the AIM Act in the U.S. and the EU’s F-Gas Regulation—AC technicians require updated tools compatible with next-generation refrigerants like R-32 and R-454B. This shift is accelerating demand for precision tools such as low-loss recovery machines, digital manifold gauges, and leak detectors calibrated for newer refrigerants. Manufacturers are responding by developing eco-conscious tools that minimize refrigerant emissions and improve system efficiency.

Integration of Smart Technology and IoT

By 2026, smart tools integrated with Internet of Things (IoT) technology are expected to become standard in the HVACR industry. Bluetooth-enabled digital manifolds, wireless refrigerant scales, and cloud-connected diagnostic tools allow technicians to streamline workflows, automatically log service data, and generate digital reports. These tools enhance accuracy, reduce human error, and support compliance with regulatory documentation requirements. OEMs like Fieldpiece, INFICON, and Ritchie Engineering are expanding their smart tool portfolios, signaling a broader industry shift toward digitization.

Expansion of Residential and Commercial Cooling Markets

Urbanization, rising temperatures due to climate change, and increasing disposable incomes—especially in emerging economies in Asia-Pacific, the Middle East, and Africa—are driving strong demand for air conditioning systems. This growth directly fuels the need for professional-grade AC tools. In countries like India, Indonesia, and Saudi Arabia, government-led cooling initiatives and building code updates are increasing HVAC installations, thereby boosting tool sales. The residential HVAC sector remains a key growth driver, with a parallel rise in demand for portable and easy-to-use diagnostic tools.

Technician Shortages and the Need for Training-Enabled Tools

The HVAC industry faces a global shortage of skilled technicians. To address this, tool manufacturers are focusing on user-friendly designs and tools with built-in training features. For example, some digital gauges now include guided workflows, error alerts, and augmented reality (AR) assistance via companion apps. These innovations lower the learning curve for new technicians and improve service consistency. By 2026, tools with embedded knowledge systems are likely to be a competitive differentiator in the market.

Rise of Rental and Shared Tool Platforms

With the high cost of advanced diagnostic equipment, small HVAC contractors and independent technicians are increasingly turning to tool rental services and shared platforms. Companies offering subscription-based access to premium tools—like high-accuracy vacuum pumps or spectrometry-based leak detectors—are gaining traction. This trend supports cost efficiency and promotes wider adoption of advanced technology without significant upfront investment, particularly in developing regions.

Consolidation and Innovation Among Tool Manufacturers

The AC tools market is witnessing increased consolidation, as larger industrial tool companies acquire specialized HVAC brands to expand their footprint. At the same time, startups are introducing innovative products such as AI-assisted diagnostic scanners and modular tool kits. R&D investments are focused on durability, miniaturization, and battery efficiency—especially for cordless tools, which are becoming essential for on-site service mobility.

Conclusion

By 2026, the air conditioning tools market will be defined by sustainability, digital integration, and accessibility. As regulations evolve and demand for cooling surges worldwide, tool manufacturers must continue to innovate to meet the needs of a changing workforce and a more environmentally conscious industry. The convergence of smart technology, eco-compliance, and user-centric design will shape the future of HVAC service tools, making them smarter, greener, and more efficient than ever before.

Common Pitfalls When Sourcing Air Conditioning Tools (Quality and IP)

Sourcing air conditioning tools—especially for professional or industrial use—requires careful consideration to avoid costly mistakes related to quality and intellectual property (IP). Below are key pitfalls to watch for:

Poor Tool Quality and Durability

Low-cost tools may appear attractive initially, but substandard materials and manufacturing often lead to premature failure, inaccurate performance, and safety risks. For example, refrigerant gauges with poorly calibrated sensors or leak-prone hoses can compromise system diagnostics and increase downtime. Always verify build quality, check for industry certifications (e.g., CE, UL), and read user reviews from technicians.

Lack of Compatibility with Modern Systems

Many newer HVAC systems use specific refrigerants (e.g., R-32, R-410A) and require tools rated for higher pressures and electronic integration. Sourcing outdated or generic tools can result in incompatibility, inefficient performance, or damage to sensitive equipment. Ensure tools are specified for current refrigerant types and system standards.

Counterfeit or Imitation Tools

The HVAC market is vulnerable to counterfeit versions of branded tools (e.g., Fieldpiece, Fluke, Bacharach). These copies may mimic appearance but fail to meet performance or safety standards. Counterfeits also pose IP risks—purchasing them may indirectly support infringement and expose your business to legal or reputational harm. Always source from authorized distributors.

Infringement of Intellectual Property

Using or distributing tools that replicate patented designs, software, or proprietary technology (e.g., digital manifold systems with protected algorithms) can lead to IP litigation. This is especially critical when sourcing from regions with weak IP enforcement. Verify that tools do not violate patents or trademarks to avoid legal exposure.

Inadequate Calibration and Measurement Accuracy

Precision is crucial in HVAC work. Tools with poor calibration—such as leak detectors or thermometers—can lead to incorrect diagnoses, system inefficiencies, or refrigerant overcharging. Look for tools with documented calibration standards and traceable certification (e.g., NIST).

Missing or Invalid Safety Certifications

Tools lacking proper safety certifications (e.g., IP ratings for dust/water resistance, electrical safety marks) may not be suitable for harsh job site conditions. Using uncertified tools increases the risk of accidents and may void insurance coverage or violate OSHA regulations.

Unreliable After-Sales Support and Warranty

Low-cost suppliers may offer little to no technical support, spare parts, or warranty coverage. When a critical tool fails, the absence of service can halt operations. Choose suppliers with proven customer support, accessible spare parts, and comprehensive warranties.

Conclusion

To avoid these pitfalls, conduct due diligence: verify supplier credentials, request product specifications and certifications, and prioritize reputable brands. Investing in high-quality, IP-compliant tools not only ensures long-term reliability but also protects your business from legal and operational risks.

Logistics & Compliance Guide for Air Conditioning Tools

Overview

This guide outlines the essential logistics and compliance considerations for the transportation, storage, and handling of air conditioning (AC) tools. These tools—ranging from refrigerant recovery machines and manifold gauges to vacuum pumps and leak detectors—are often subject to specific regulations due to their function, components, and potential environmental impact. Adherence to legal, safety, and logistical standards is critical for efficient operations and regulatory compliance.

Regulatory Compliance

Environmental Regulations

AC tools often interface with refrigerants, many of which are regulated under environmental laws such as the U.S. Environmental Protection Agency (EPA) Section 608 of the Clean Air Act. Ensure compliance by:

– Using only certified refrigerant recovery and recycling equipment.

– Properly maintaining records of refrigerant handling and disposal.

– Training personnel in EPA 608 certification or equivalent standards in other jurisdictions.

– Disposing of end-of-life tools containing refrigerant-bearing components through authorized channels.

International Compliance (e.g., F-Gas Regulation, Montreal Protocol)

For cross-border shipments:

– Verify refrigerant types against EU F-Gas Regulation or Kigali Amendment standards.

– Confirm tools do not contain banned or restricted substances.

– Comply with import/export restrictions on dual-use or ozone-depleting substances.

Electrical Safety Standards

Many AC tools are powered and must meet regional safety certifications:

– In the U.S.: UL or ETL certification.

– In the EU: CE marking per Low Voltage Directive and EMC Directive.

– In Canada: CSA certification.

Ensure tools are tested and labeled accordingly before distribution.

Packaging & Handling

Protective Packaging

- Use shock-resistant packaging with cushioning to protect sensitive components (e.g., gauges, sensors).

- Include moisture barriers for tools susceptible to corrosion or calibration drift.

- Clearly label packages with “Fragile,” “This Side Up,” and “Do Not Stack” where applicable.

Hazardous Components

- Tools containing residual refrigerant or pressurized components may be classified as hazardous goods.

- Follow IATA Dangerous Goods Regulations (for air transport) or IMDG Code (for sea) if applicable.

- Use UN-certified packaging for any shipment involving pressurized or refrigerant-containing tools.

Transportation & Shipping

Domestic Shipping

- Classify tools accurately under the appropriate freight class (NMFC codes) for LTL or parcel shipping.

- Use carriers experienced in handling technical or industrial equipment.

- Ensure proper insurance coverage for high-value tools.

International Shipping

- Prepare accurate commercial invoices, packing lists, and certificates of conformity.

- Include HS codes (e.g., 8414.90 for parts of AC units or 9025.19 for gauges) for customs clearance.

- Account for potential import duties and VAT.

- Use Incoterms (e.g., FOB, DDP) clearly defined in contracts.

Air Transport Restrictions

- Avoid shipping tools with residual refrigerant or pressurized systems via air freight unless compliant with IATA regulations.

- Vacuum pumps with oil must be drained or packaged to prevent leakage.

- Declare all lithium batteries (e.g., in digital leak detectors) per IATA Section II or Section IB as applicable.

Warehousing & Storage

Environmental Conditions

- Store tools in a dry, temperature-controlled environment to prevent condensation and corrosion.

- Avoid exposure to extreme heat, cold, or humidity, which can affect calibration and electronics.

Inventory Management

- Track tool calibration and maintenance schedules.

- Segregate tools containing hazardous residues from general inventory.

- Use barcode or RFID systems for efficient tracking and compliance audits.

Maintenance & Certification

Calibration Requirements

- Regularly calibrate precision tools (e.g., manifold gauges, digital thermometers).

- Maintain calibration logs for audit and compliance purposes.

- Follow manufacturer-recommended intervals or industry standards (e.g., ASHRAE guidelines).

Equipment Servicing

- Use authorized service centers for repairs involving refrigerant systems.

- Document all maintenance to support warranty claims and regulatory audits.

Training & Documentation

Personnel Training

- Train logistics and handling staff on proper procedures for packaging, labeling, and transporting AC tools.

- Provide safety training for handling tools with electrical or pressurized components.

Required Documentation

- Keep copies of:

- Product compliance certifications (CE, UL, CSA).

- EPA or local environmental compliance records.

- Shipping manifests and hazardous material declarations.

- Calibration and maintenance logs.

Conclusion

Proper logistics and compliance management for air conditioning tools ensures safety, legal adherence, and operational efficiency. By following this guide—covering environmental regulations, safe handling, accurate documentation, and appropriate shipping practices—businesses can reduce risk, avoid penalties, and maintain high standards across the supply chain.

In conclusion, sourcing air conditioning tools requires careful consideration of quality, reliability, cost-effectiveness, and supplier credibility. It is essential to select tools that meet industry standards and are compatible with various AC systems to ensure efficient installation, maintenance, and repair operations. Evaluating suppliers based on reputation, warranty offerings, technical support, and delivery timelines will help establish a dependable supply chain. Additionally, investing in durable, high-performance tools may yield long-term savings by reducing downtime and replacement costs. Ultimately, a strategic sourcing approach ensures technicians are well-equipped to deliver optimal service, enhancing customer satisfaction and operational efficiency in the HVAC industry.